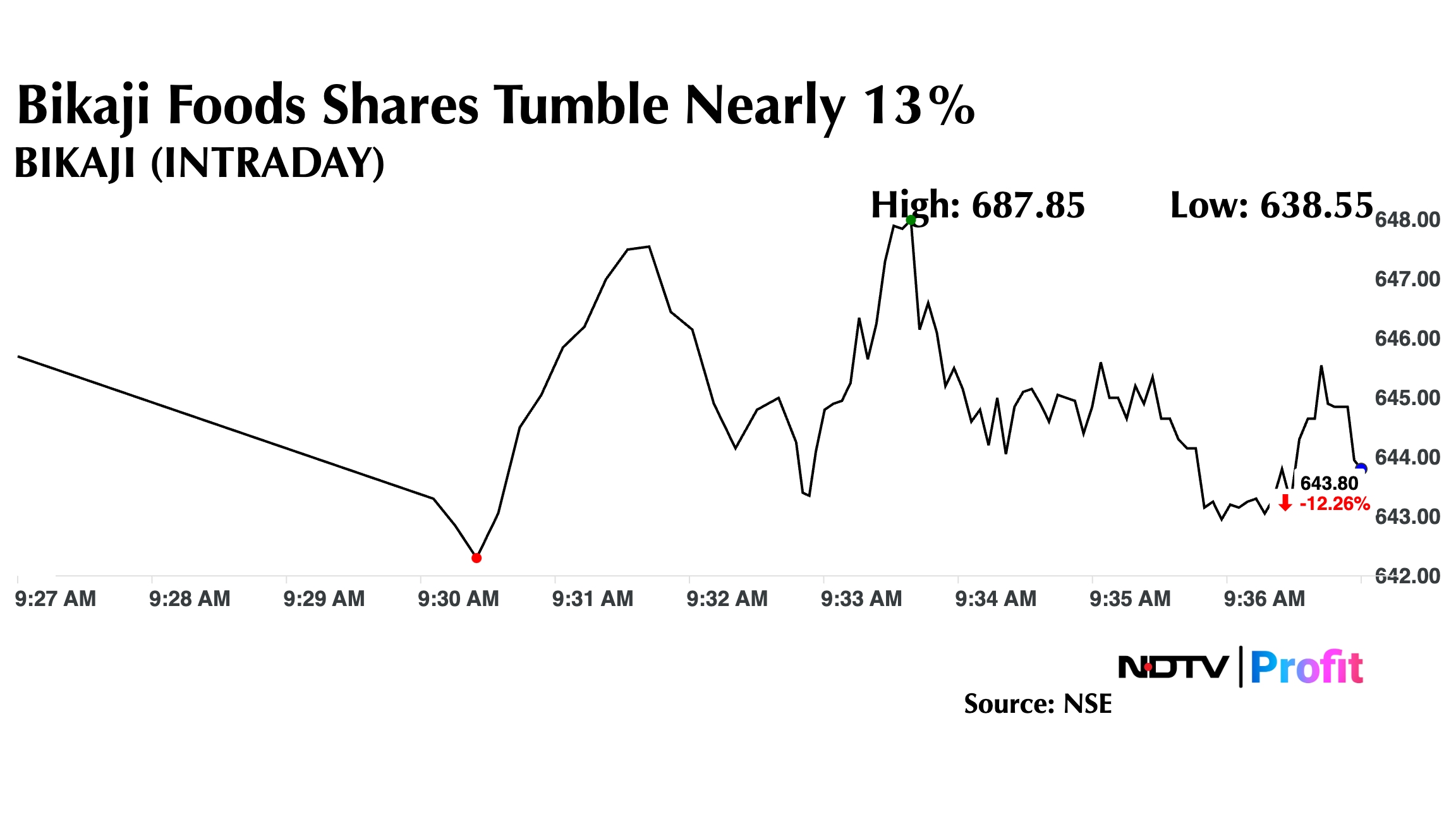

Shares of Bikaji Foods International Ltd. tumbled nearly 13% to the lowest since November 2022 on Friday as net profit dipped 39% in the third quarter of the current fiscal, missing analysts' estimates.

The savoury foods and sweet maker posted a profit of Rs 28.6 crore in the quarter ended Dec. 31, 2024, as compared to Rs 46.6 crore in the same period last fiscal, according to an exchange filing on Thursday. Analysts tracked by Bloomberg had a consensus estimate of Rs 49 crore.

The ethnic snacks segment posted an 11% growth in revenue, constituting around 62.1% to the overall revenue, while the papad revenue rose 9.6%, accounting for approximately 6% of the total revenue share.

Packaged sweets saw a revenue growth of 11%, constituting around 18.1% of the overall revenue. The western snacks division noted a flat revenue growth, representing 6.8% of the total revenue.

For the nine months of fiscal year 2025, revenue from operations grew 17% to Rs 2,008.2 crore, accompanied by a volume growth of 10.9%.

The scrip fell as much as 12.97% to Rs 638.5 apiece as soon as the market opened. It pared losses to trade 12.2% lower at Rs 645 apiece, as of 09:31 a.m. This compares to a flat NSE Nifty 50 Index.

It has risen 14.80% in the last 12 months. Total traded volume so far in the day stood at 0.67 times its 30-day average. The relative strength index was at 46.36.

All the six analysts tracking the company maintain a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analysts' price targets implies a potential upside of 38%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.