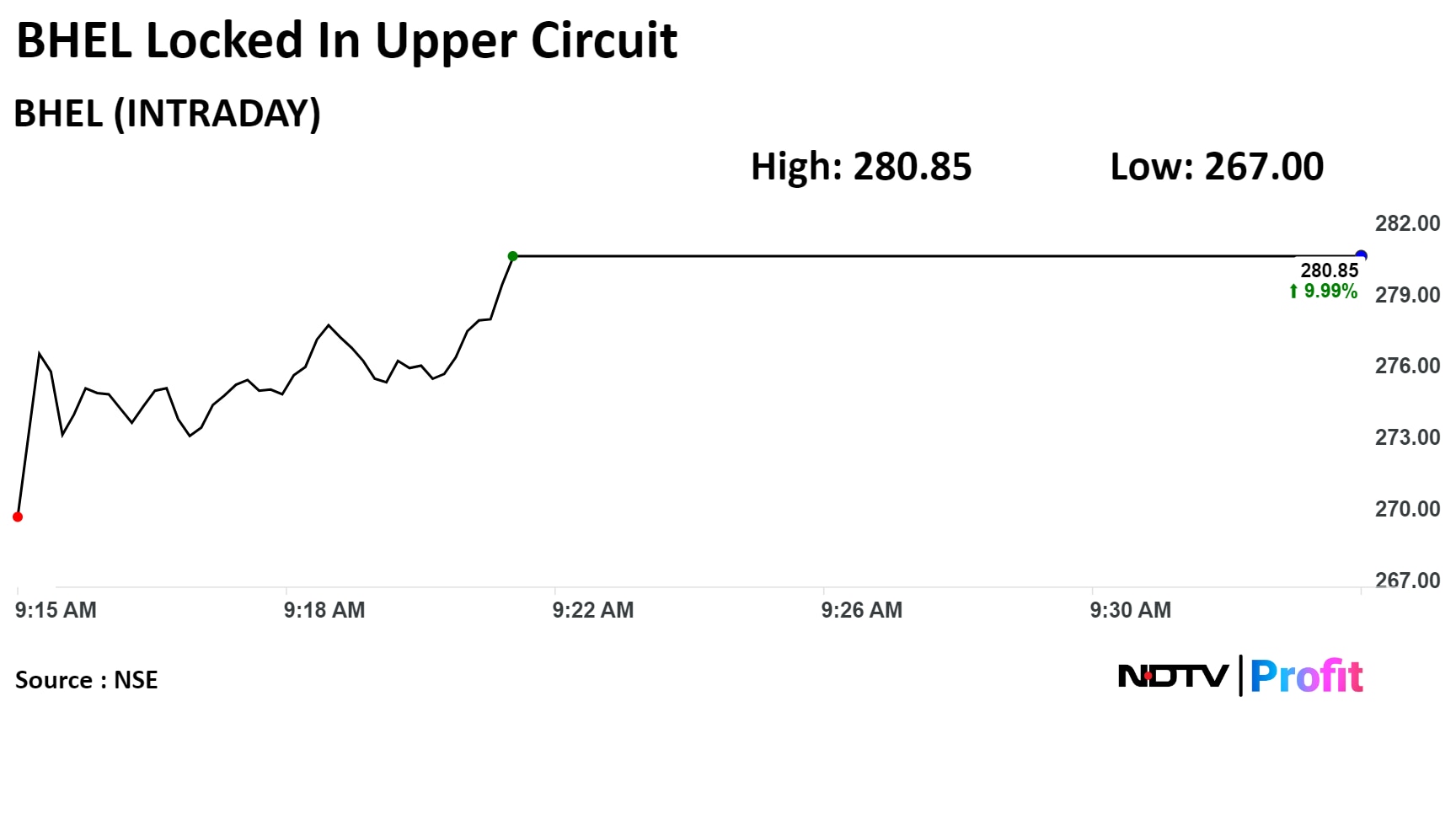

Shares of Bharat Heavy Electricals Ltd. hit upper circuit of 10% on Thursday, after it received two orders to set up two 800-MW thermal power plants each in Chhattisgarh's Raipur and Uttar Pradesh's Mirzapur phase-1. The upper circuit for the stock now stands at 15% and at the time of publishing the stock is up 12%.

Adani Power Ltd. awarded the company an order to set up two plants in Raipur, while its subsidiary Mirzapur Thermal Energy (UP) Pvt. gave the order for Mirzapur. Both the orders are for a broad consideration of Rs 3,500 crore each, according to exchange filings.

The contracts involve supply of equipment, including boilers, turbines, generators and supervision of erection and commissioning.

For both the orders, the supply of the first unit is expected to take up to 35 months and the second unit is expected to take 41 months, the filings said.

Shares of the company rose as much as 14.24% to the highest level since June 4, before paring gains to trade 13.45% higher at Rs 289.10 apiece, as of 10:00 a.m. This compares to a 0.59% advance in the NSE Nifty 50.

The stock has risen 48.72% year-to-date and has risen 228.07% in the last 12 months. Total traded volume so far in the day stood at 1.26 times its 30-day average. The relative strength index was at 50.58.

Out of 19 analysts tracking the company, five maintain a 'buy' rating, three recommend a 'hold,' and 11 suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 21.4%.

Disclaimer: NDTV Profit is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.