This week on Startup Street, a look at the credit guarantee scheme for startups which was announced in 2016 but is still in the “planning” phase; India is seeking feedback on how to rank states on ease of starting new businesses; and Kerala becomes home to the country's largest startup complex. Here's what went on:

Empty Promise?

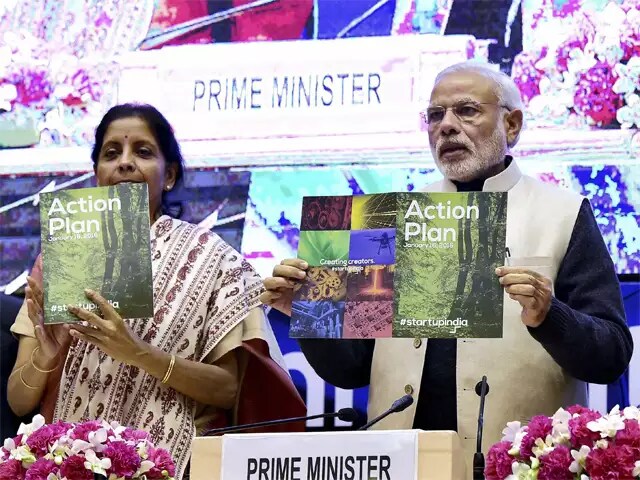

Prime Minister Narendra Modi's credit guarantee fund for startups that will allow them to take loans up to Rs 5 crore without any collateral is yet to be rolled out, three years after it was announced.

Aimed at improving access to capital for startups, the fund was to provide 80 percent risk cover for the collateral-free credit given by banks. Modi had announced the scheme as part of the Startup India Action Plan in January 2016.

In July 2017, the government said it was still formulating the fund with a corpus of Rs 2,000 crore under the Department of Industrial Policy and Promotion.

Last week, Minister of State for Commerce and Industry CR Chaudhary informed the Lok Sabha in a written reply that the government is still “planning” to set up a Credit Guarantee Fund. “The scheme has yet to be made operational.”

BloombergQuint has yet to receive a response on queries emailed to secretary, DIPP.

Startups in India have been raising funds at a record pace now. Since 2014, they mopped up more than $38 billion, according to Inc42's The State of The Indian Startup Ecosystem report. But most of it was cornered by large, established privately held companies and funding was led by global investors, private equity and venture capital funds and angel investors.

Modi's another scheme announced in 2016, the Fund of Funds for Startups, also saw new ventures get only a fraction of what was originally planned. The fund, which had a corpus of Rs 10,000 crore, had only released Rs 600 crore till March 2018 to the Small Industries Development Bank of India, according to another written reply in Parliament. As of December 2018, 176 startups were covered under the fund.

That comes when the government faces criticism for the “draconian” angel tax. Over the last few months, over 150 startups received notices from the Income Tax Department asking them to clear dues on angel funding.

The move threatens to cripple the startup ecosystem where angel funding is an essential part, particularly for early-stage startups. Writing for BloombergQuint, TV Mohandas Pai, chairman of Manipal Global Education, had said, “If this continues to be the state of affairs, the angel funding ecosystem, which has seen a decline of 48.5 percent, from 653 investors in 2016 to 343 in 2018, will ultimately dry up.”

DIPP Seeks Feedback On Startup Ranking For States

The Department of Industrial Policy and Promotion is seeking views of stakeholders on the draft methodology it uses to rank states based on the measures they've taken to promote startups.

“We have drafted the methodology for states startup ranking 2019 with suggested pillars, action points and proposed weight for feedback. DIPP is seeking inputs on the proposed methodology,” Startup India said in a tweet.

.@DIPPGOI is seeking your inputs on the proposed methodology for #StatesStartupRanking2019. Find the draft document at https://t.co/AxKzRynuR2, & mail your suggestions at startup.india@gov.in. (5/5)

The draft discussion document has listed five broad principles for ranking. It wants more emphasis to be given on feedback from actual beneficiaries. The framework will be designed to inspire states so that they can target newer and higher goals. Different yardsticks may be used for evaluating states with mature startup ecosystems.

A total of 27 states and three union territories participated in the last year's ranking exercise. Gujarat topped the list in 2018.

India's Largest Startup Complex Opens Today

Kerala will become home to India's largest integrated startup complex.

Chief Minister Pinarayi Vijayan will inaugurate the innovation hub, set up by the Kerala Startup Mission, in Kochi. Established over an area of 1.8 lakh square feet, the complex aims to provide quality infrastructure for incubation and acceleration of startups, a statement by the nodal agency said.

⚡️ “Integrated Startup Complex in Kochi, Kerala”https://t.co/oC7ZlMuTxg

The Centre will also house a “Maker Village” BRINC, the country's first international accelerator for hardware startups; BRIC, an incubator dedicated to developing solutions for cancer diagnosis care; and a centre of excellence set up by gaming engine developer Unity and Cera Sanitaryware Ltd.

Once fully developed into a full-fledged campus with over half-a-million square feet built-up area, the hub would become the largest work-live-play space exclusively dedicated to startups in the country, the statement added.

Over 100 startups in various stages of growth are already operating in the three incubators functioning within the facility.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.