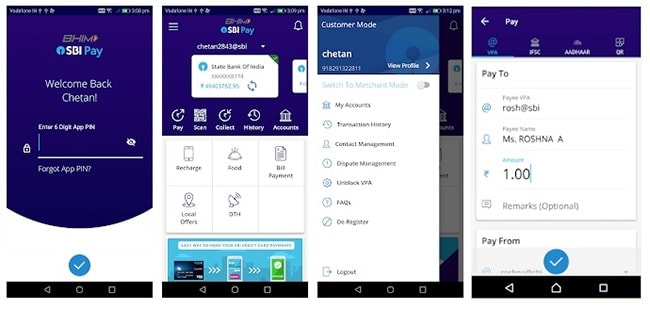

SBI or State Bank of India offers a mobile app that lets users transfer funds using a virtual payment address or a bank account along with the IFSC code. This was said by the country's largest bank on microblogging site Twitter. Called BHIM SBI Pay, the mobile app is based on the Unified Payments Interface or UPI, a system that enables transfer of funds between accounts of different banks into a single mobile application. In order to send or request funds using the BHIM SBI Pay app, the user has to make sure that his or her mobile number is linked to the bank account and he or she is in possession of the debit card linked to the account.

https://t.co/GT1KjkKshb

iOS: https://t.co/dSCH04zGsRpic.twitter.com/w7R2oQazBkState Bank of India (@TheOfficialSBI) June 1, 2018Here are 10 things to know about mobile app BHIM SBI Pay:

1. Money transfer limit of BHIM SBI Pay2. Additional functions of BHIM SBI Pay3. Mode of transfer via BHIM SBI Pay4. Who can use BHIM SBI Pay5. Virtual Payment Address under BHIM SBI Pay6. How many accounts can be linked with BHIM SBI Payand fin tech Tapzo allows UPI payments to 63,000 merchants across India? Have you signed up yet? pic.twitter.com/hA5mNCqW2aState Bank of India (@TheOfficialSBI) June 5, 2018

7. Lost mobile phone8. Reversal of payment9. How to change default account10. How to transfer (send or receive) money via BHIM SBI PayEssential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.