No emerging market has been spared from the impact of the trade war, with sovereign and corporate dollar-denominated bonds of every country posting losses month to date.

Seven junk-rated sovereigns, led by Maldives, Sri Lanka, Gabon and Zambia, were down more than 10%, while the average loss on emerging-market sovereign dollar debt was 2.9% as of April 9, according to data compiled by Bloomberg. It's a similar picture for corporate debt, with every nation's credit in red, at an average 2.6% loss, erasing almost all 2025 gains.

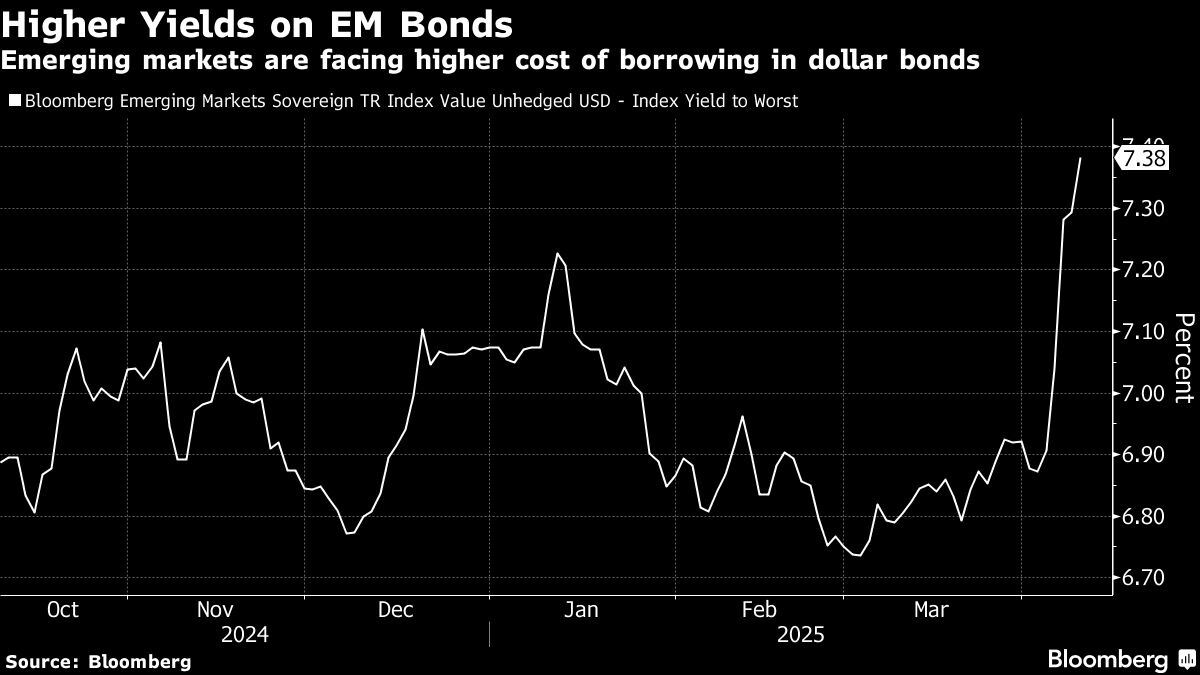

Even as stock markets surged after US President Donald Trump decided on Wednesday to pause some tariffs, EM sovereign dollar bonds ended the day with a 0.6% loss, signalling it will take more for investors to regain confidence as the focus shifts to assessing the impact of higher tariffs on inflation and the potential for long-lasting damage in trade links. Yields on EM sovereign dollar bonds reached 7.38%, the highest since August and 80 basis points higher than their five-year average.

Despite being the biggest target of Trump's tariff increases, China's sovereign dollar debt stayed resilient with only a 0.5% loss, making it one of the best performers for the month, data showed. Corporate bonds from Ukraine were the best performers for the year, with steelmaker Metinvest BV and poultry giant MHP SE retaining an average 7% gain even after this month's declines.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.