GR Infraprojects Q1 Highlights (Consolidated, YoY)

Revenue down 2.1% to Rs 1,987.78 crore versus Rs 2,030.00 crore

Net Profit up 57% to Rs 244.00 crore versus Rs 155.00 crore

Ebitda up 8% to Rs 398.12 crore versus Rs 367.80 crore

Margin at 20.0% versus 18.1%

LIC Housing Finance Q1 Highlights (Standalone, YoY)

Net interest income up 22% to Rs 2065.8 crore versus Rs 1691.9 crore

Net Profit down 0.6% to Rs 1,359.92 crore versus Rs 1,367.96 crore

HealthCare Global Enterprises Q1 Highlights (Consolidated, YoY)

Revenue up 16.6% to Rs 611.80 crore versus Rs 524.60 crore

Net Profit down 61% to Rs 4.75 crore versus Rs 12.10 crore

Ebitda up 18% to Rs 106.45 crore versus Rs 89.91 crore

Margin at 17.4% versus 17.1%

Baazar Style Retail Q1 Highlights (Consolidated, YoY)

Revenue up 37% to Rs 377.85 crore versus Rs 275.79 crore

Net Profit at Rs 2.05 crore versus loss of Rs 0.42 crore

Ebitda up 39% to Rs 58.20 crore versus Rs 41.88 crore

Margin at 15.4% versus 15.2%

Multi Commodity Exchange of India Q1 Highlights (Consolidated, QoQ)

Revenue up 28.1% to Rs 373.21 crore versus Rs 291.33 crore (Estimate: Rs 389.13 crore).

Net Profit up 50% to Rs 203.19 crore versus Rs 135.46 crore (Estimate: Rs 200.57 crore).

Ebitda up 51% to Rs 241.66 crore versus Rs 160.19 crore (Estimate: Rs 267.73 crore).

Margin at 64.8% versus 55% (Estimate: 68.8%).

Approves share split in 1:5 ratio

Narayana Hrudayalaya Q1 Highlights (Consolidated, YoY)

Revenue up 15.4% to Rs 1,507 crore versus Rs 1,306 crore

Net Profit down 2.3% to Rs 197 crore versus Rs 201 crore

Ebitda up 11.4% to Rs 337 crore versus Rs 302 crore

Margin at 22.4% versus 23.1%

Shakti Pumps India Q1 Highlights (Consolidated, YoY)

Revenue up 9.7% to Rs 622.50 crore versus Rs 567.65 crore

Net Profit up 5% to Rs 96.83 crore versus Rs 92.66 crore

Ebitda up 6% to Rs 143.57 crore versus Rs 135.95 crore

Margin at 23.1% versus 23.9%

PC Jeweller Q1 Highlights (Consolidated, YoY)

Revenue up 80.7% to Rs 724.91 crore versus Rs 401.15 crore

Net Profit up 4% to Rs 161.93 crore versus Rs 156.06 crore

Ebitda up 147% to Rs 127.31 crore versus Rs 51.57 crore

Margin at 17.6% versus 12.9%

Alivus Life Sciences Q1 Highlights (Consolidated, YoY)

Revenue up 2.2% to Rs 601.80 crore versus Rs 588.60 crore

Net Profit up 9% to Rs 121.50 crore versus Rs 111.40 crore

Ebitda up 8% to Rs 172.20 crore versus Rs 159.40 crore

Margin at 28.6% versus 27.1%

JK Lakshmi Cement Q1 Highlights (Consolidated, YoY)

Revenue up 11.3% to Rs 1,741 crore versus Rs 1,564 crore.

Net Profit at Rs 150 crore versus Rs 56.9 crore.

Ebitda up 39.9% to Rs 311 crore versus Rs 222 crore.

Margin at 17.9% versus 14.2%.

Ramkrishna Forgings Q1 Highlights (Standalone, YoY)

Revenue up 5.7% to Rs 936.69 crore versus Rs 886.34 crore.

Net Profit down 49% to Rs 21.51 crore versus Rs 42.52 crore.

Ebitda down 8% to Rs 134.76 crore versus Rs 147.05 crore.

Margin at 14.4% versus 16.6%.

ITC Q1 Highlights (Standalone, YoY)

Revenue up 20.6% to Rs 19,749.91 crore versus Rs 16,374.02 crore.

Net Profit down 0.1% to Rs 4,912.36 crore versus Rs 4,917.45 crore.

Ebitda up 3% to Rs 6,261.27 crore versus Rs 6,086.77 crore.

Margin at 31.7% versus 37.2%.

Jupiter Life Line Highlights (Consolidated, YoY)

Revenue up 20.5% to Rs 347.63 crore versus Rs 288.58 crore.

Net Profit down 1% to Rs 43.84 crore versus Rs 44.47 crore.

Ebitda up 20% to Rs 78.13 crore versus Rs 65.31 crore.

Margin at 22.5% versus 22.6%

Delhivery Q1 Highlights (Consolidated, YoY)

Revenue up 5.6% to Rs 2,294.00 crore versus Rs 2,172.30 crore.

Net Profit up 67% to Rs 91.05 crore versus Rs 54.36 crore.

Ebitda up 53% to Rs 148.82 crore versus Rs 97.06 crore.

Margin at 6.5% versus 4.5%

Honeywell Automation India Q1 Highlights (YoY)

Revenue up 23.2% to Rs 1,183.00 crore versus Rs 960.00 crore

Net Profit down 9% to Rs 125.00 crore versus Rs 137.00 crore

Ebitda down 8% to Rs 141.30 crore versus Rs 153.40 crore

Margin at 11.9% versus 16.0%

Tata Power Q1 Highlights (Consolidated, YoY)

Revenue up 4.3% to Rs 18,035.07 crore versus Rs 17,293.62 crore (Estimate: Rs 17,865.52 crore).

Net Profit up 9% to Rs 1,059.86 crore versus Rs 970.91 crore (Estimate: Rs 1,021.87 crore).

Ebitda up 15% to Rs 4,139.01 crore versus Rs 3,586.66 crore (Estimate: Rs 3,530.28 crore).

Margin at 22.9% versus 20.7% (Estimate: 19.8%).

Aditya Vision Q1 Highlights (YoY)

Revenue up 5.8% at Rs 940 crore versus Rs 889 crore.

Ebitda up 5.4% at Rs 89.7 crore versus Rs 85.1 crore.

Margin at 9.5% versus 9.6%.

Net Profit up 3.9% at Rs 55.2 crore versus Rs 53.1 crore.

Safari Industries Q1 Highlights (Consolidated, YoY)

Revenue up 17.3% at Rs 528 crore versus Rs 450 crore.

Ebitda up 20.4% at Rs 79.3 crore versus Rs 65.9 crore.

Margin at 15% versus 14.6%.

Net Profit up 13.7% at Rs 50.5 crore versus Rs 44.4 crore.

Safari Industries Q1 Highlights (Consolidated, YoY)

Revenue up 17.3% at Rs 528 crore versus Rs 450 crore.

Ebitda up 20.4% at Rs 79.3 crore versus Rs 65.9 crore.

Margin at 15% versus 14.6%.

Net Profit up 13.7% at Rs 50.5 crore versus Rs 44.4 crore.

Steel Strips Q1 Highlights (Consolidated, YoY)

Revenue up 15.8% at Rs 1,187 crore versus Rs 1,025 crore.

Ebitda up 7.5% at Rs 122 crore versus Rs 113 crore.

Margin at 10.2% versus 11.0%.

Net Profit up 15.8% at Rs 47.2 crore versus Rs 40.8 crore.

UPL Q1 Highlights (Consolidated, YoY)

Revenue up 1.6% at Rs 9,216 crore versus Rs 9,067 crore.

Ebitda up 13.7% at Rs 1,303 crore versus Rs 1,146 crore.

Margin at 14.1% versus 12.6%.

Net Loss of Rs 88 crore versus a loss of Rs 384 crore.

Graphite India Q1 Highlights (Consolidated, YoY)

Revenue down 8.7% to Rs 665 crore versus Rs 728 crore.

Ebitda down 61.9% to Rs 43 crore versus Rs 113 crore.

Margin at 6.5% versus 15.5%.

Net profit down 43.5% to Rs 134 crore versus Rs 237 crore.

Capri Global Q1 Highlights (YoY)

Calculated NII up 38% at Rs 349 crore versus Rs 252 crore.

Impairments up 63.8% at Rs 63 crore versus Rs 38.5 crore.

Net Profit at Rs 150 crore versus Rs 62.2 crore.

Tube Investments Q1 Highlights (Consolidated, YoY)

Revenue up 16% at Rs 5,309 crore versus Rs 4,578 crore.

Ebitda up 2.8% at Rs 546 crore versus Rs 531 crore.

Margin at 10.3% versus 11.6%.

Net Profit down 12.3% at Rs 199 crore versus Rs 227 crore.

P&G Health Q1 Highlights (YoY)

Revenue up 19.3% at Rs 339 crore versus Rs 284 crore.

Ebitda up 87.2% at Rs 90.3 crore versus Rs 48.3 crore.

Margin at 26.7% versus 17%.

Net Profit at Rs 66.2 crore versus Rs 16.8 crore.

Go Fashion Q1 Highlights (YoY)

Revenue up 1.2% at Rs 223 crore versus Rs 220 crore.

Ebitda down 4.8% at Rs 68.7 crore versus Rs 72.1 crore.

Margin at 30.8% versus 32.8%.

Net Profit down 22.3% at Rs 22.3 crore versus Rs 28.6 crore.

Dhanuka Agritech Q1 Highlights (YoY)

Revenue up 7% at Rs 528 crore versus Rs 494 crore.

Ebitda up 16% at Rs 83.2 crore versus Rs 71.7 crore.

Margin at 15.7% versus 14.5%.

Net Profit up 13.5% at Rs 55.5 crore versus Rs 48.9 crore.

Transformers & Rectifiers Q1 Highlights (Consolidated, YoY)

Revenue up 64.4% at Rs 529 crore versus Rs 322 crore.

Ebitda at Rs 88.2 crore versus Rs 42.2 crore.

Margin at 16.7% versus 13.1%.

Net Profit at Rs 67.4 crore versus Rs 20 crore.

Ratnamani Metals Q1 Highlights (Consolidated, QoQ)

Revenue down 32.9% at Rs 1,152 crore versus Rs 1,715 crore.

Ebitda down 37.7% at Rs 188 crore versus Rs 302 crore.

Margin at 16.3% versus 17.6%.

Net Profit down 36.4% at Rs 132 crore versus Rs 207 crore.

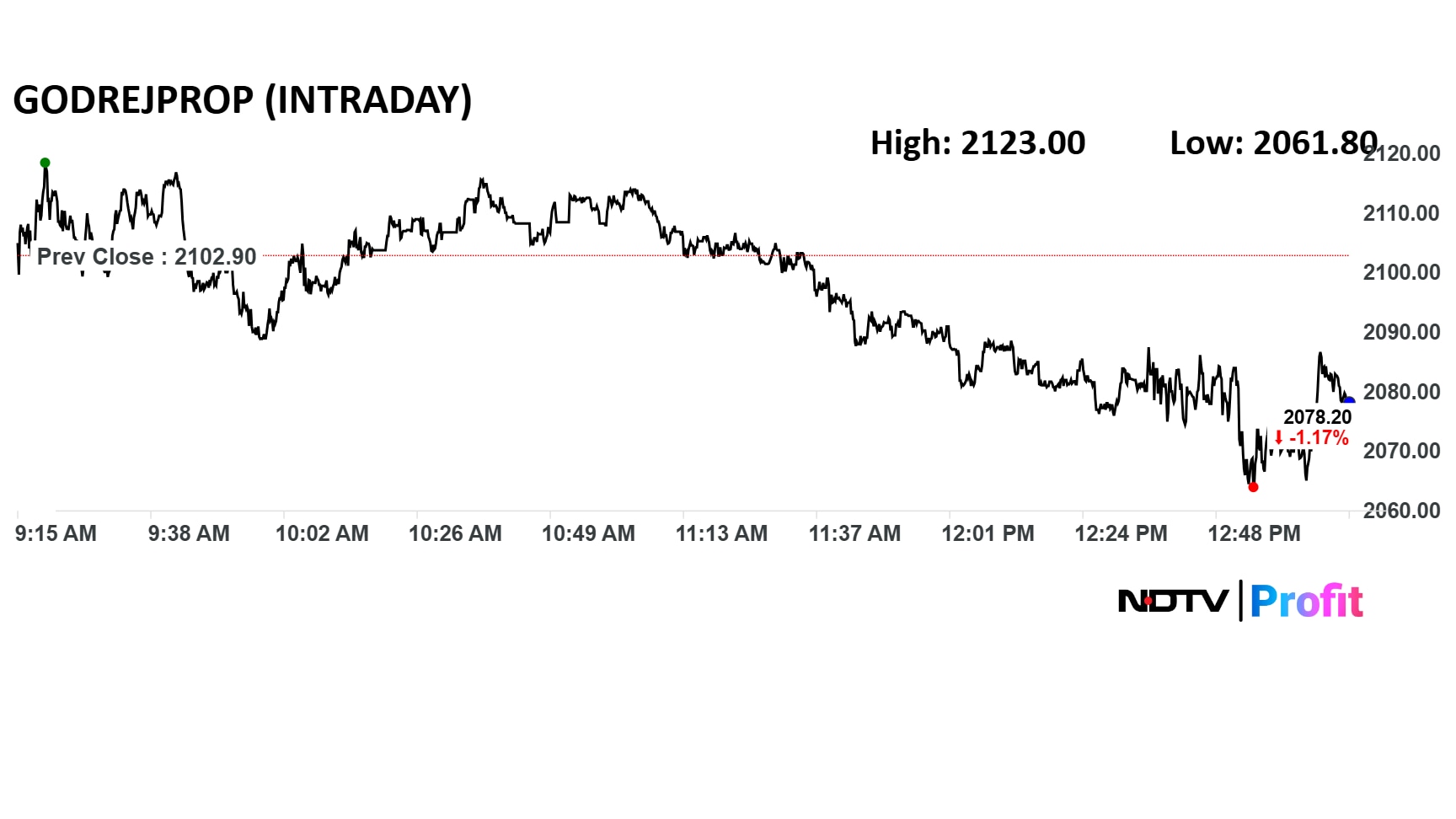

Godrej Properties Q1 FY26 (Consolidated, YoY)

Revenue down 41% to Rs 435 crore versus Rs 739 crore

Ebitda loss of Rs 243 crore versus loss of Rs 125 crore

Net profit down 12.5% at Rs 205 crore versus Rs 182 crore

GSK Pharma Q1 FY26 (Consolidated, YoY)

Revenue down 1.2% at Rs 805 crore versus Rs 815 crore

Ebitda up 8.96% at Rs 251.2 crore versus Rs 230.54 crore

Margin at 31.19% versus 28.29%

Net profit up 12.45% at Rs 205 crore versus Rs 182.3 crore

Adani Power Ltd.'s board on Friday approved a plan for a stock split in the ratio of 1:5, according to an exchange filing. Each fully paid-up equity share having a face value of Rs 10 will be divided into five equity shares having a face value of Rs 2, subject to approval of the shareholders of the company, the filing said.

The stock split will be Adani Power's first-ever corporate action.

The record date for determining the eligible shareholders will be announced after the shareholders' approval. The company will issue a separate notification for the same.

Adani Power Q1 FY26 (Consolidated, QoQ)

Revenue down 0.9% at Rs 14,109 crore versus Rs 14,237 crore

EBITDA up 18.1% a Rs 5,685 crore versus Rs 4,813 crore

Margin at 40.3% versus 33.8%

Net Profit up 27.2% at Rs 3,305 crore versus Rs 2,599 crore

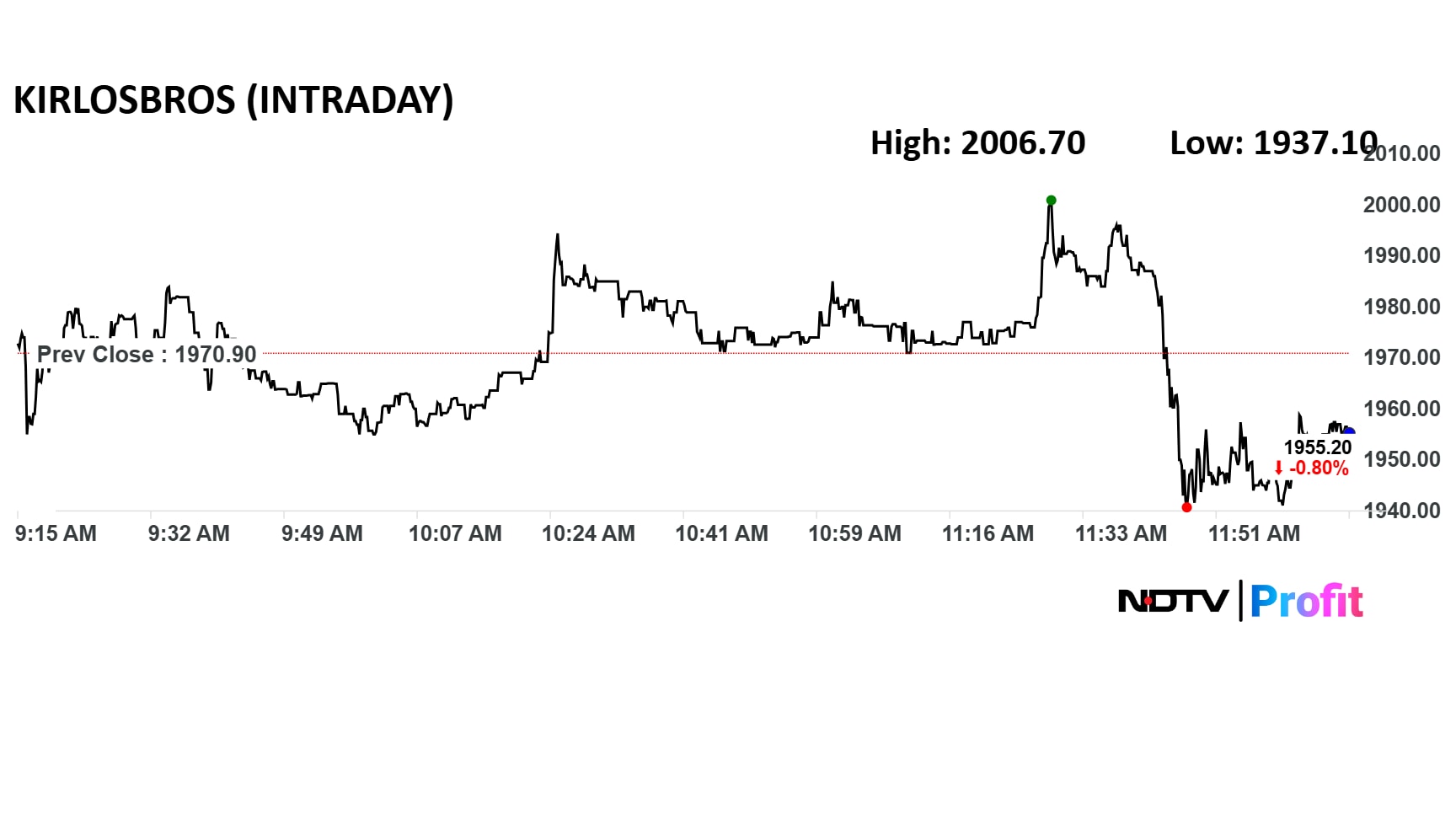

Kirloskar Brothers Q1 FY26 (Consolidated, YoY)

Revenue down 5% at Rs 979 crore versus Rs 1,031 crore

Ebitda flat at Rs 112 crore

Margin at 11.4% versus 10.8%

Net profit up 2.5% at Rs 66.7 crore versus Rs 65.1 crore

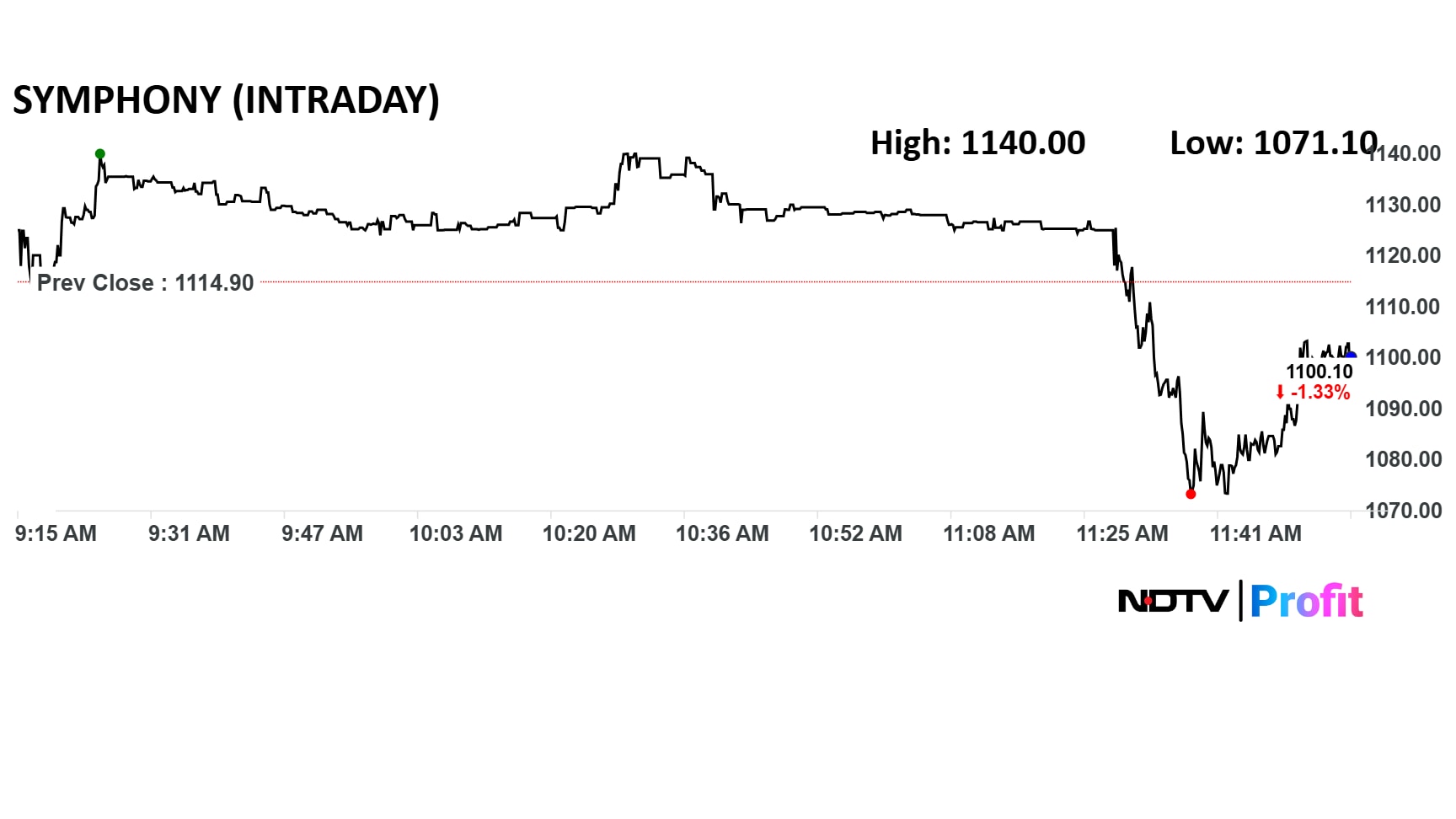

Symphony Q1 FY26 Highlights (Consolidated, YoY)

Revenue down 36.1% at Rs 251 crore versus Rs 393 crore

Ebitda down 70.1% at Rs 26 crore versus Rs 87 crore

Margin at 10.4% versus 22.1%

Net Profit down 52.3% at Rs 42 crore versus Rs 88 crore.

Symphony Q1 FY26 Highlights (Consolidated, YoY)

Revenue down 36.1% at Rs 251 crore versus Rs 393 crore

Ebitda down 70.1% at Rs 26 crore versus Rs 87 crore

Margin at 10.4% versus 22.1%

Net Profit down 52.3% at Rs 42 crore versus Rs 88 crore.

ITC Ltd. shares traded higher early in the session on Friday ahead of the first quarter financial results due today. The stock gained 1.8% intraday and added the most points to the benchmark Nifty 50 after Reliance Industries Ltd.

The street expects the FMCG giant to report good revenue growth even as operating margins are likely to be under pressure.

ITC is likely to clock net profit at Rs 5,084.86 crore and revenue of Rs 18,261.19 crore for the quarter ended June, according to a survey of analysts' estimates done by Bloomberg.

MCX will also be reporting its results for the quarter on Thursday. The company is likely to report a net profit of Rs 200.57 crore and revenue of Rs 389.13 crore for the first quarter, according to estimates.

Here are the earnings estimates of major companies that are scheduled to announce their results on Friday:

Hello and welcome to NDTV Profit's exclusive live coverage of the first-quarter earnings season. The financial landscape is buzzing today, as various players are set to announce their performance for the June quarter. The results will cover their financial performance for the April to June quarter.

ITC Ltd., Multi Commodity Exchange of India Ltd. and Adani Power Ltd. are among the top names that will announce their earnings for the first quarter on Friday.

This is your front-row seat to the earnings action, so stay with us for real-time updates, analysis of the numbers, and all the key details that companies will be putting out through the day!

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.