Indian Oil Corp. reported a decline in both profitability and operating income in the first quarter of the financial year 2026.

Standalone net profit for the quarter ended June 31, 2025, fell 21.7% to Rs 5,689 crore, compared to Rs 7,265 crore in the preceding quarter, according to financial results released on Thursday.

The Average Gross Refining Margin — the difference between the cost of crude oil and the price of refined products like petrol and diesel — in the first quarter was $2.15 per barrel, compared to $6.39 in the year-ago period. The estimate was $5.63.

Indian Oil Q1 Result Highlights (Standalone, QoQ)

Revenue down 1% to Rs 1.93 lakh crore versus Rs 1.95 lakh crore (Bloomberg estimate: Rs 1.79 lakh crore)

Ebitda down 7.1% to Rs 12,607 crore versus Rs 13,572 crore (estimate: Rs 15,559 crore)

Margin at 6.5% versus 7% (Estimate: 7.91%)

Net Profit down 21.7% to Rs 5,689 crore versus Rs 7,265 crore (estimate: Rs 7,292 crore)

Income from petrochemicals and gas segments fell, while petroleum products rose marginally.

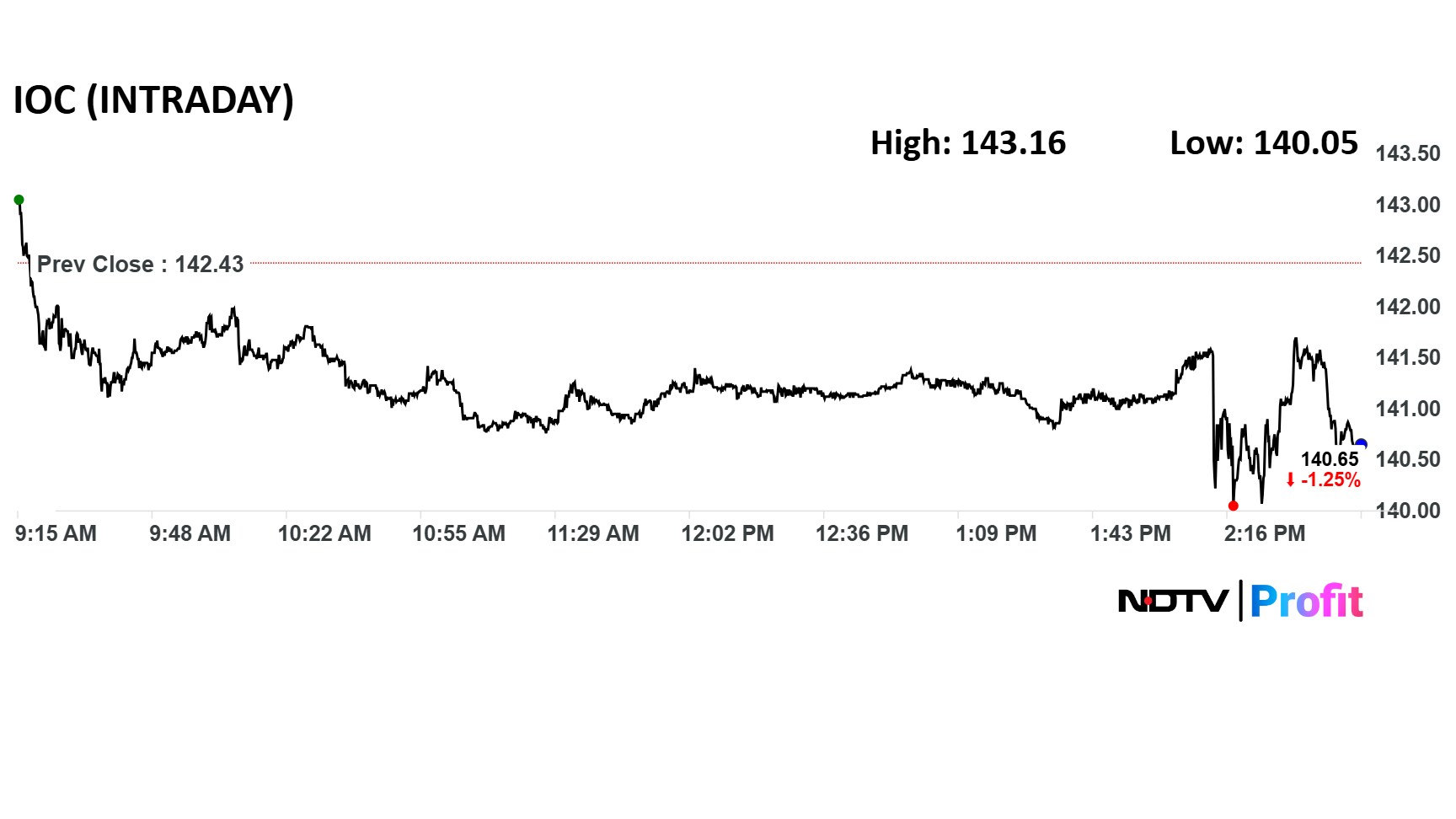

Indian Oil Shares Down

Shares of Indian Oil slipped as much as 1.7% to Rs 140 apiece after the results. The benchmark Nifty was up 0.14%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.