ICICI Bank Q2 Update: ICICI Bank announced on Saturday, Sept. 20 that it will consider and approve its July-September quarter results for fiscal 2025-26 (Q2FY26) on Oct. 18, 2025. India's second-largest private banking lender said in a regulatory filing to the stock exchanges that its board meeting to consider the second quarter results of current fiscal will be held on Oct. 18.

"In view of the above and pursuant to the provisions of SEBI (Prohibition of Insider Trading) Regulations, 2015 read with ICICI Bank Code on Prohibition of Insider Trading, the Trading Window for dealing in the securities of the Bank will remain closed for all Designated Persons of the Bank (including Directors) and their immediate relatives from Oct. 1 to Oct. 20, 2025," said the private sector bank.

ICICI Bank Q1 Results 2025

Strong loan growth, a rise in net interest income and largely stable asset quality helped ICICI Bank Ltd.'s June quarter earnings. The private sector bank's standalone net profit stood at Rs 12,768.21 crore, up 15% year-on-year, exceeding consensus analysts estimates compiled by Bloomberg of Rs 11,770 crore.

Net interest income rose 11% over the year to Rs 21,635 crore. The net interest margin of the bank stood at 4.34% in the June quarter compared with 4.41% in quarter ended March and 4.36% in the year ago period.

The bank's asset quality was largely stable, with the gross non-performing assets ratio flat at 1.67%. However, the net NPA ratio rose slightly to 0.41% from 0.39% in the prior quarter. The gross NPA additions rose to Rs 6,245 crore from Rs 5,142 crore in the March quarter.

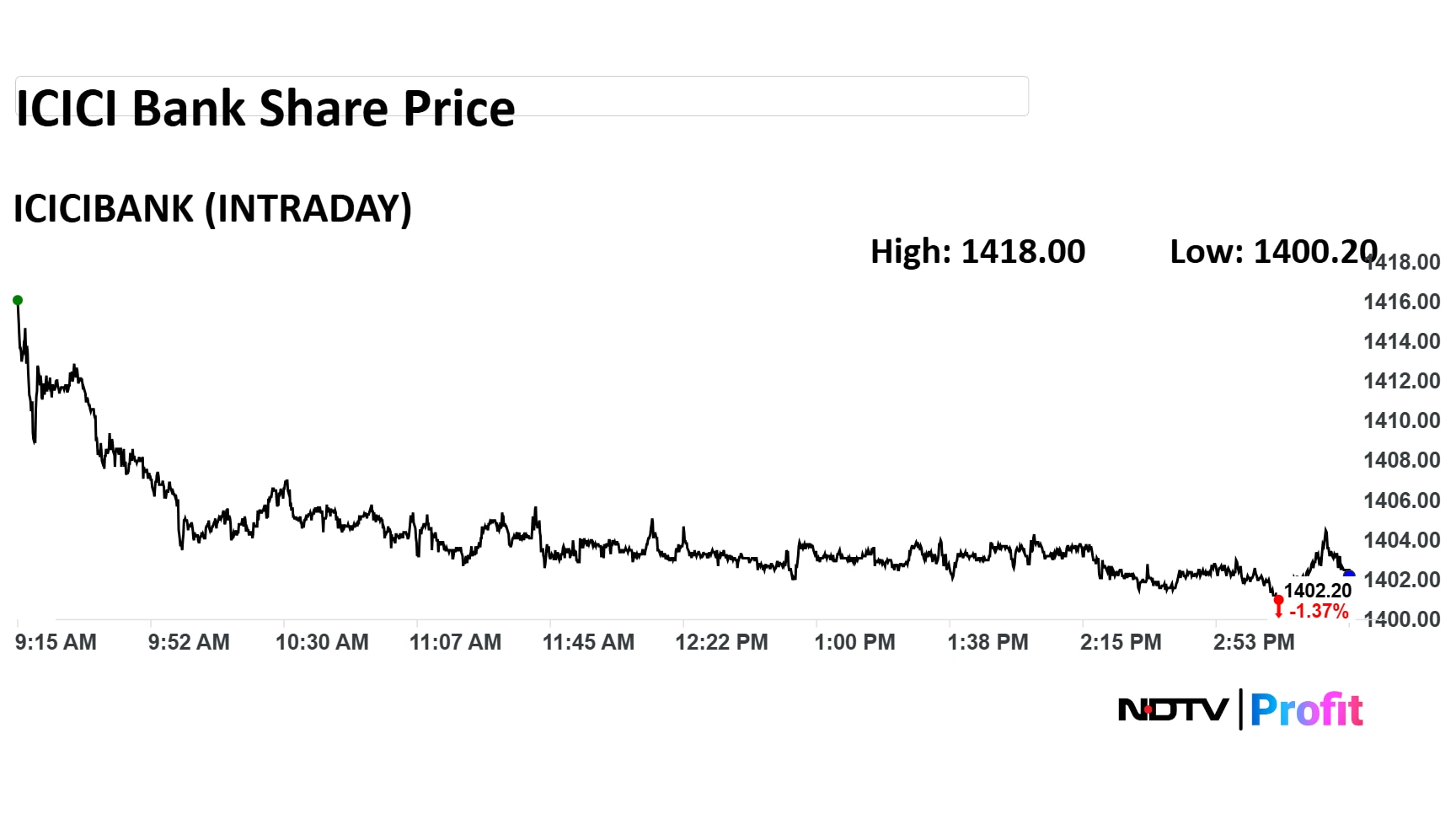

ICICI Bank Share Price Trend

On Friday, shares of ICICI Bank settled 1.37% lower at Rs 1,402.40 apiece on the BSE. Shares of the private bank have gained 6.8% in the last six months. On a year-to-date basis, the stock has risen 9.41% and 8.48% in one year. The relative strength index was 52.43. As of Sept. 20, the private bank commands a market cap of Rs 10,01,654.46 crore.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.