Adani Power Ltd.'s consolidated net profit rose 7% in the third quarter of the current financial year. Shares of the company surged as much as 6% subsequently.

The Adani Group company posted a consolidated bottom-line of Rs 2,940.07 crore for the quarter ended December, according to an exchange filing on Wednesday.

The company's revenue climbed 5.2% year-on-year to Rs 13,671.18 crore. Operating income, or earnings before interest, taxes, depreciation and amortisation, increased by 8% to Rs 5,022.92 crore. Ebitda margin expanded to 36.7% from 35.8%.

Adani Power Q3 Highlights (Consolidated, YoY)

Revenue up 5.2% to Rs 13,671.18 crore versus Rs 12,991.44 crore.

Ebitda up 8% to Rs 5,022.92 crore versus Rs 4,645.34 crore.

Margin at 36.7% versus 35.8%.

Net profit up 7% to Rs 2,940.07 crore versus Rs 2,737.96 crore.

The company increased its fundraising limit via non-convertible debentures to Rs 11,000 crore. The board also approved raising up to Rs 5,000 crore via QIP.

“Adani Power is well on its way to achieve its generation capacity target of 30+ GW by 2030, with rapid progress in under-construction projects, secure supply chain, and successful bids for long term PPA tie-ups," said SB Khyalia, CEO of Adani Power.

We are taking steps ranging from backward integration into mining to improve our competitiveness and digitalisation of our operations to enhance our future-readiness, he added.

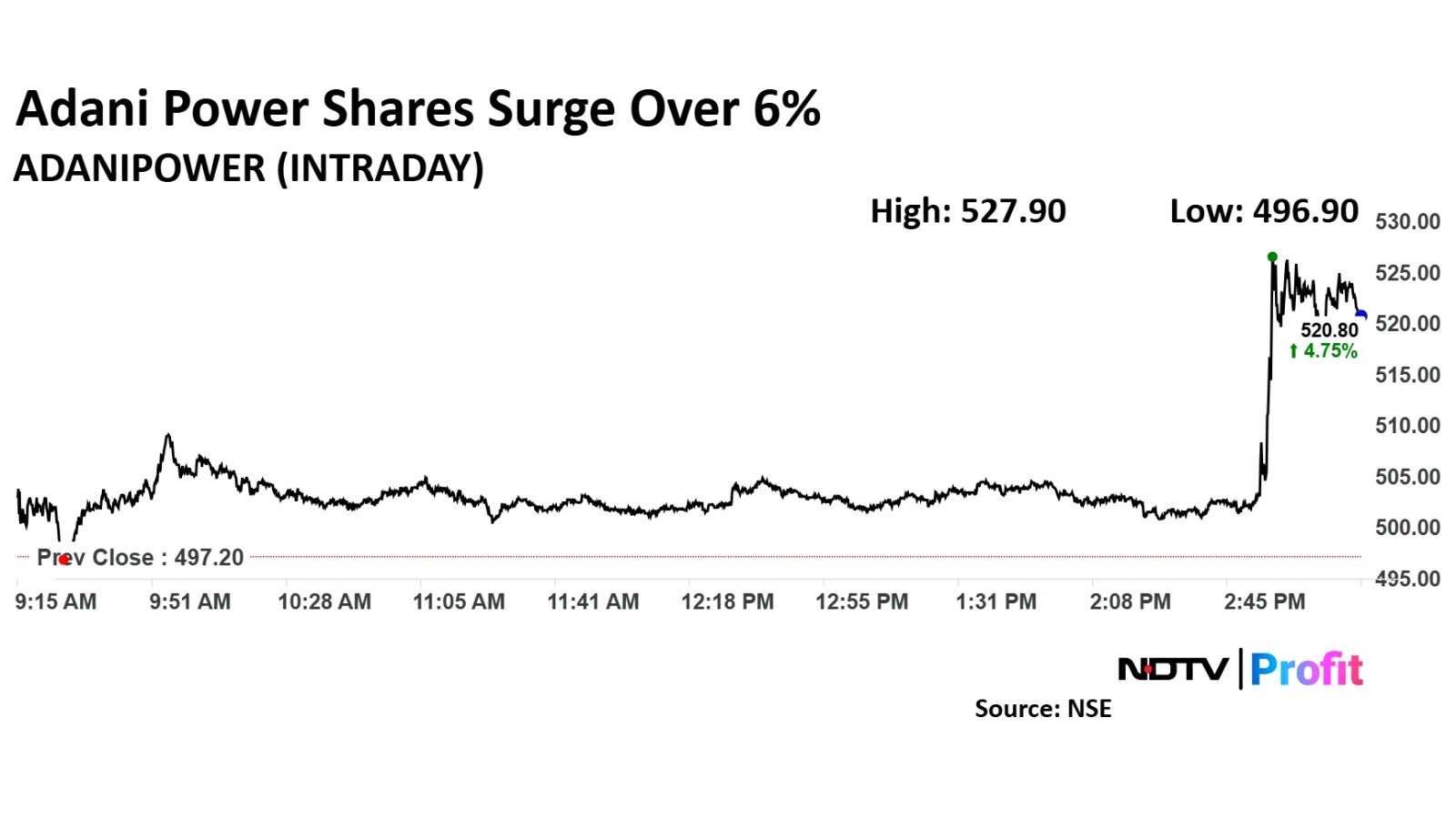

Adani Power Share Price Today

Adani Power stock rose as much as 6.17% during the day to Rs 527.90 apiece on the NSE. It was trading 4.86% higher at Rs 521.35 apiece, compared to an 0.87% advance in the benchmark Nifty 50 as of 3:15 p.m.

It has fallen 8.16% in the last 12 months. The total traded volume so far in the day stood at 0.8 times its 30-day average. The relative strength index was at 50.66. The one analyst tracking the stock has a 'buy' rating on it.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.