Zee Entertainment Enterprises Ltd.'s share price dropped 6.24%, a day after shareholders voted against a proposal to raise Rs 2,237 crore by issuing warrants to the company's promoters.

The resolution failed as the number of votes in favour was less than three times the number of votes against it.

Specifically, there were 32.47 crore (59.5%) in support of the resolution, while 22.09 crore voters (40.5%) opposed it. Most warrants were slated to be issued to a Mauritian promoter, with ousted board member Punit Goenka listed among the ultimate beneficiaries. Approval would have meant funds from Sunbright Mauritius Investments Ltd. and Altilis Technologies Pvt. Documents indicated that Sunbright was set to subscribe to over 99% of the warrants, which would have converted to a 14.92% stake in the company.

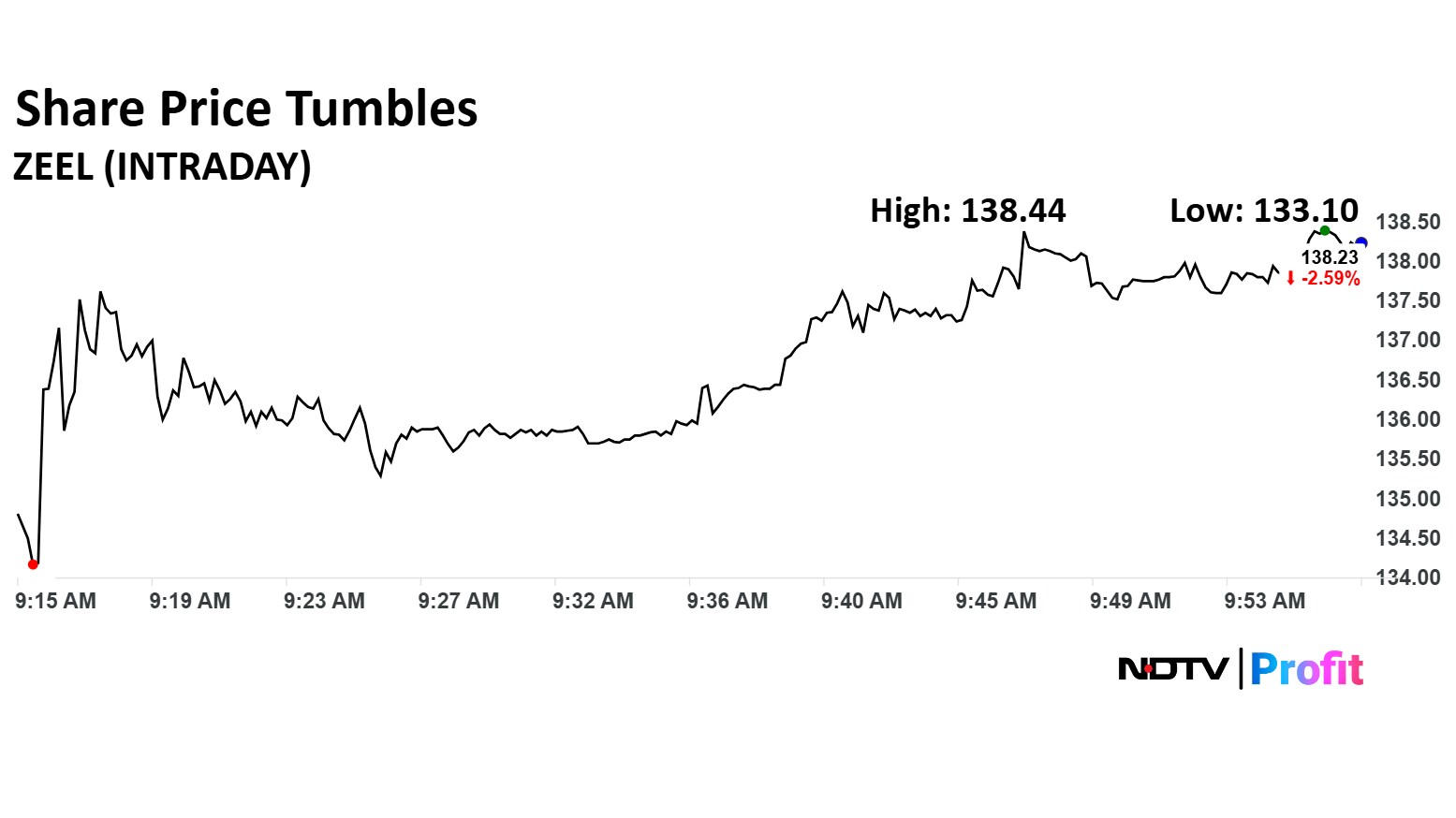

Zee Share Price

The scrip fell as much as 6.20% to Rs 133.10 apiece. It pared losses to trade 2.67% lower at Rs 138.11 apiece, as of 09:54 a.m. This compares to a 0.27% decline in the NSE Nifty 50.

It has fallen 6.24% in the last 12 months. Total traded volume so far in the day stood at 3.2 times its 30-day average. The relative strength index was at 49.

Out of 20 analysts tracking the company, 11 maintain a 'buy' rating, four recommend a 'hold' and five suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 8.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.