Yes Bank's share price gained 1.82% on Wednesday after the bank's board approved a plan to raise Rs 16,000 crore through a combination of debt and equity issuances.

The private lender aims to raise Rs 7,500 crore via equity and Rs 8,500 crore through eligible debt securities in Indian or foreign currency, subject to shareholder and regulatory approvals.

This fundraising initiative follows the bank's recent announcement on May 9 that Sumitomo Mitsui Banking Corporation would acquire a 20% stake from existing shareholders, including State Bank of India and other Indian lenders such as HDFC Bank, ICICI Bank, Kotak Mahindra Bank, Axis Bank, IDFC First Bank, Federal Bank, and Bandhan Bank. These lenders had participated in Yes Bank's restructuring plan in 2020.

SBI will divest its 13.19% stake in Yes Bank for approximately Rs 8,890 crore, while other lenders will collectively sell a 6.81% stake to SMBC, bringing SMBC's total investment in Yes Bank to around Rs 13,484 crore.

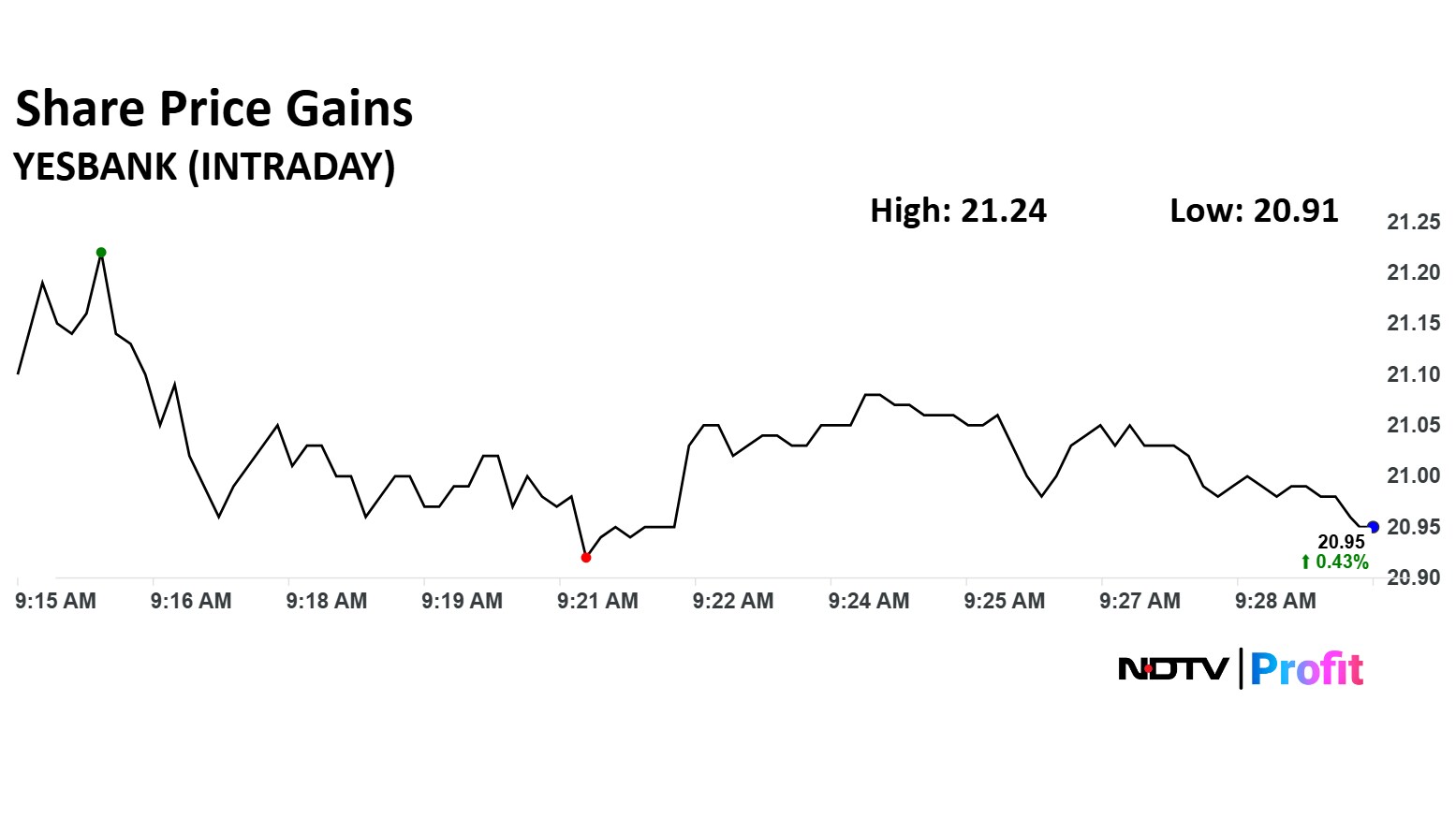

Yes Bank Share Price Today

The scrip rose as much as 1.82% to Rs 21.24 apiece. It pared gains to trade 0.67% higher at Rs 21 apiece, as of 09:27 a.m. This compares to a 0.26% advance in the NSE Nifty 50.

It has fallen 3.89% in the last 12 months. The relative strength index was at 54.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.