Almost all tyremakers beat earnings estimates as volumes rose on higher truck sales. That's reflecting on their stocks as well.

Shares of Apollo Tyres Ltd. gained about 15 percent from their February lows, MRF Ltd. has gained around 9 percent and CEAT has just started to rebound from its lows.

Anti-loading rules pushed up commercial vehicle sales, increasing demand for tyres. Volumes rising for most companies in the quarter ended December. Higher customs duty (15 percent from 10 percent earlier) and a continuing anti-dumping duty on cheaper imports from China also provided tailwinds to the domestic tyre industry.

“We believe the high-margin truck tyre business is yielding rich dividends for the tyre majors in the commercial vehicle sector,” said Ashwin Patil, auto analyst at brokerage LKP Securities. He said demand for upgrading fleet by some of the major clients of truckmakers, the government's infrastructure and a bullish outlook on mining sector will continue a strong growth in truck tyre business.

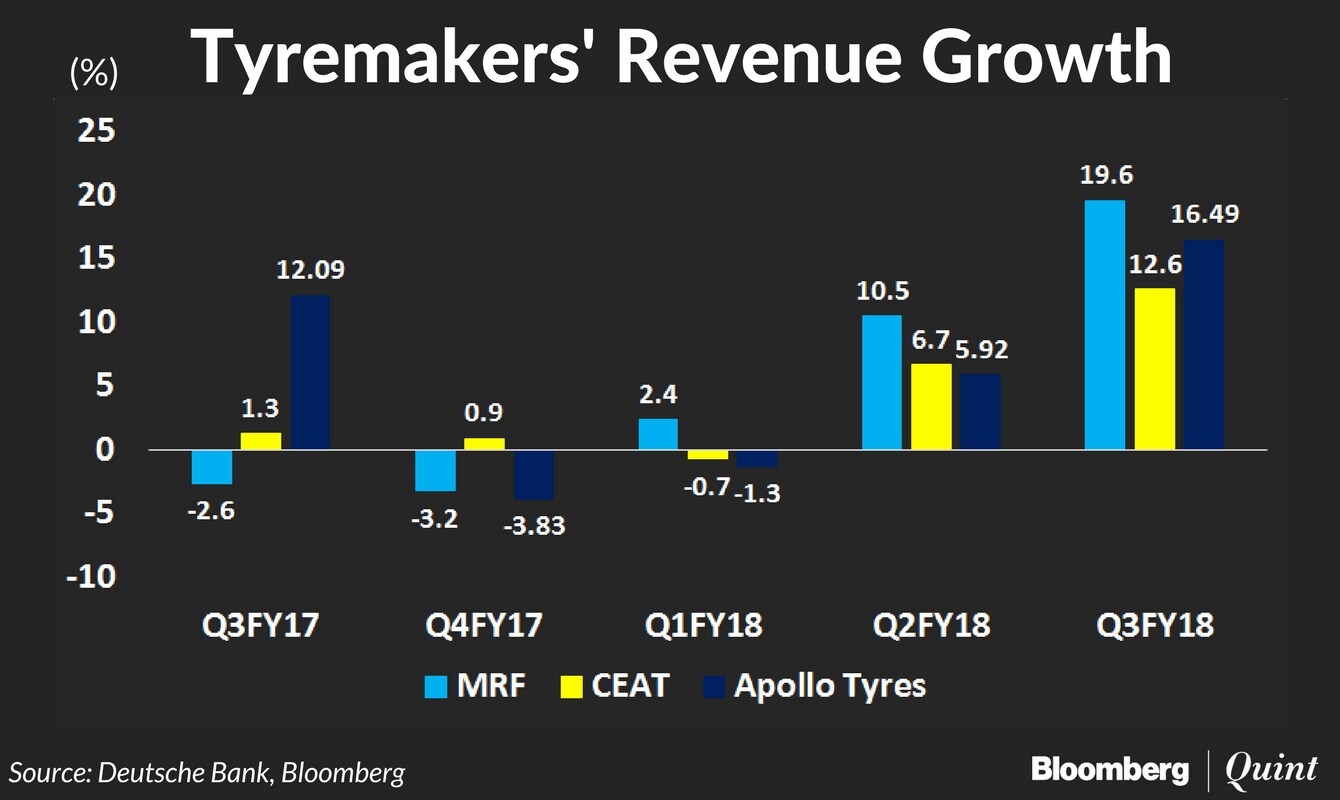

Apollo Tyres' standalone business reported its highest volume growth in at least 12 quarters and CEAT's volumes rose in double-digits after five quarters. MRF's sold 19 percent more tyres during the quarter, continuing with the double-digit growth in the three months ended September.

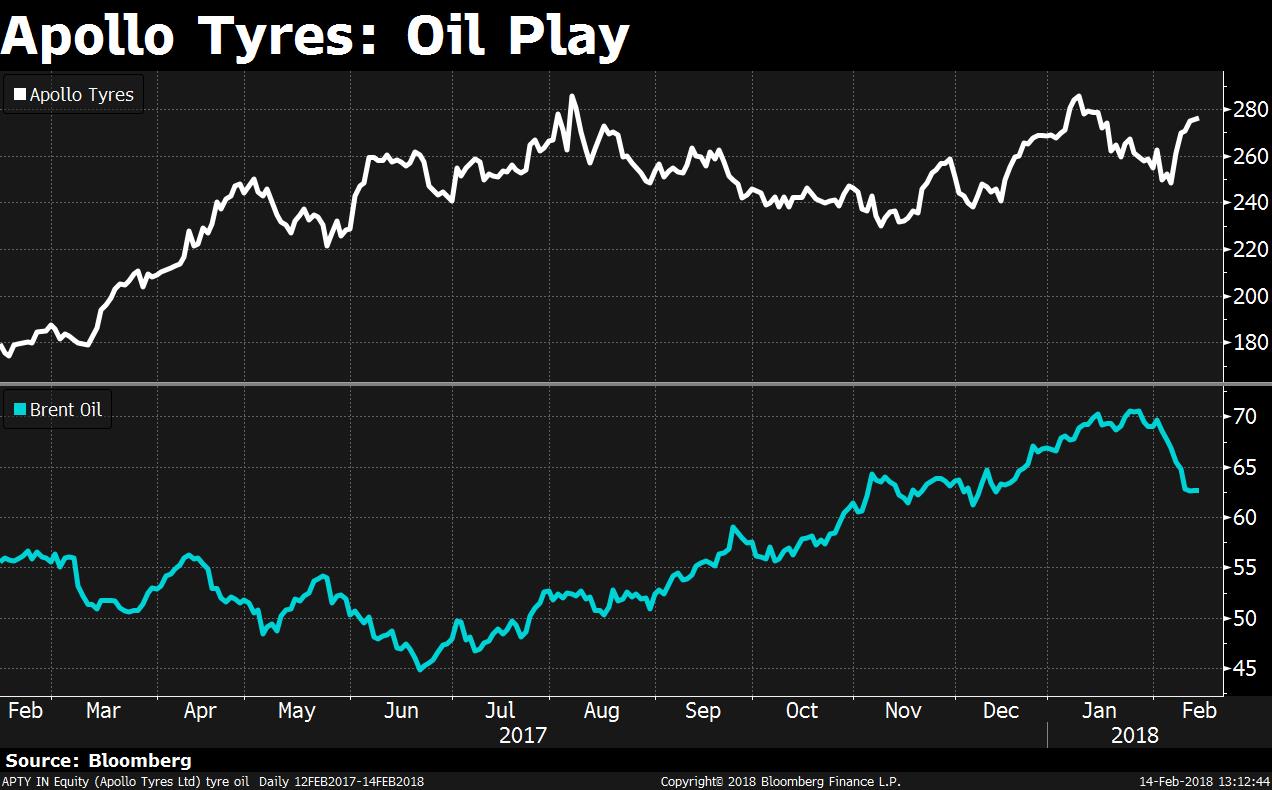

Earlier price hikes also aided the earnings with a lag, with operating margins at their highest in four quarter for all tyremakers. While rubber prices remain soft, the pullback in oil prices should shore up the sentiment. There's a negative correlation between crude and the stock prices of tyre companies (see chart).

A recovery in volumes and margins could attract investors to tyre stocks that have hardly given much returns in the last six months. Moreover, better performance provides room to increase prices, if needed. Crude prices remain a risk.

A possible implementation of the cash-for-clunkers scheme will also aid truckmakers, said Patil. "Benign outlook on rubber prices by tyremakers may provide the necessary jump in profitability."

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.