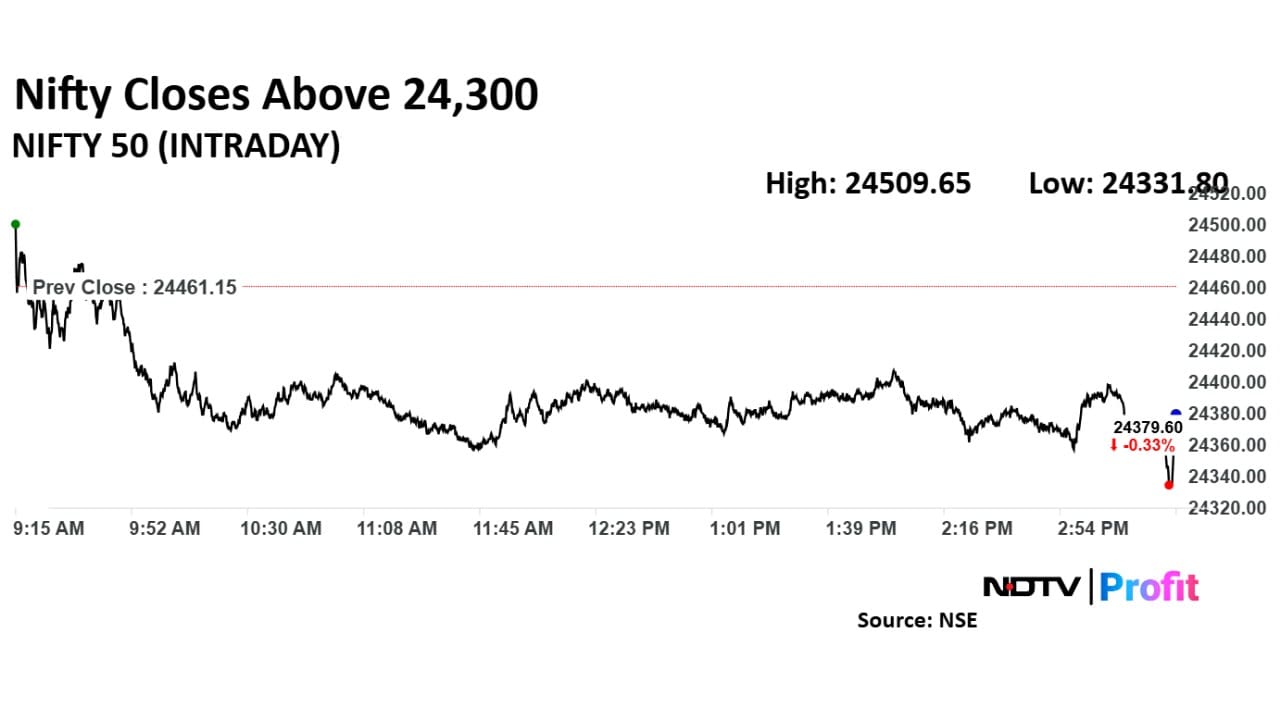

The NSE Nifty 50 finds immediate resistance at 24,590 after the markets closed with most sectors ending lower, according to Hrishikesh Yedve, technical and derivatives research analyst at Asit C. Mehta Investment Interrmediates Ltd.

The Nifty formed a bearish engulfing candle on the daily charts, which indicated weakness. The Nifty found support near the 200-day simple moving average, which is at 24,050 levels, according to Yedve. "A sustained move below 24,300 could pull the index towards the 24,200–24,050 zone."

The weak sentiment is likely to continue as long as the Nifty trades below the resistance level of 24,500, according to Shrikant Chouhan, head of equity research at Kotak Securities said. "On the lower side, the market could retest the level of 24,250."

"Further downside may also continue, which could drag the index down to 24,175. On the other side, a dismissal of 24,500 could push the market up to 24,580–24,625," he added.

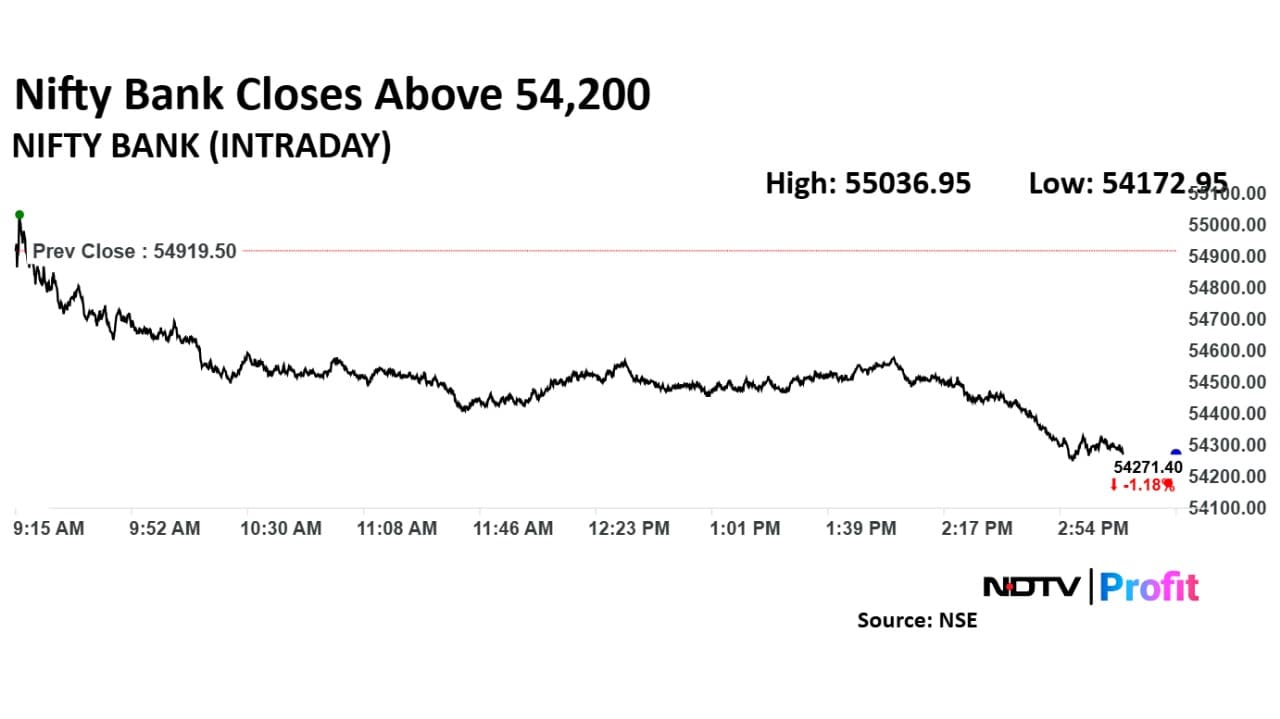

The Bank Nifty has formed a red candle, reflecting weakness after opening flat and seeing continued selling pressure. It finds immediate resistance at 55,000, followed by 56,000, according to Yedve.

The analyst found key support to be at 53,890 levels. Yedve recommends a sell-on-rise strategy to investors till it remains below 56,000 levels.

Market Recap

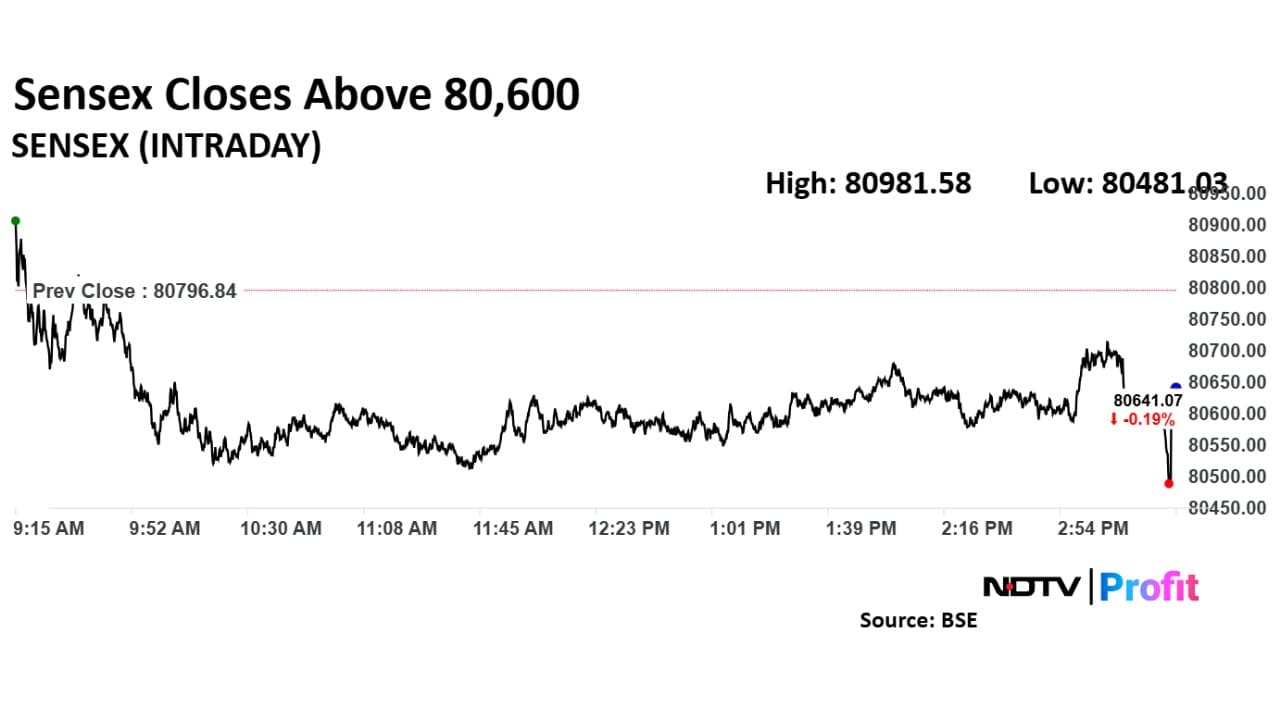

India's benchmark indices snapped two-day gaining streak to end lower on Tuesday.

The NSE Nifty 50 closed 81.55 points or 0.33% lower at 24,379.60, while the BSE Sensex ended 155.77 points or 0.19% down at 80,641.07. Intraday, the Nifty fell as much as 0.53% to 24,331.80, while the Sensex dipped 0.39% to 80,481.03.

FII/DII Activity

Foreign portfolio investors stayed net buyers of Indian equities for the 14th straight session on Tuesday, as they bought stocks worth Rs 3,794.5 crore.

Domestic institutional investors turned net sellers after being net buyers for the six consecutive session, they offloaded equities worth Rs 1,397.68 crore, according to provisional data from the National Stock Exchange.

Global Cues

Markets in Australia and South Korea advanced Wednesday as news of first trade negotiation between US and China lifted investors' risk sentiment. US Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer will hold talks with Chinese counter parts in Switzerland this week, Bloomberg reported.

This will be the first official meet between the two largest economy since President Donald Trump imposed protectionist trade policies.

The S&P ASX 200 and KOSPI were trading 0.24% and 0.62% higher, respectively. Meanwhile, the Nikkei 225 declined 0.06% as of 6:44 a.m.

On Tuesday, the Dow Jones Industrial Average and S&P 500 ended 0.95% and 0.77% down, respectively. The Nasdaq Composite ended 0.87% down.

The brent crude was trading 0.77% higher at $62.63 a barrel. The dollar index was trading 0.31% higher at 99.55, and the Bloomberg spot gold was trading 1.56% down at 3,378.29.

F&O Cues

Nifty May Futures down by 0.56% to 24,415 at a premium of 36 points.

Nifty May futures open interest up by 0.06%.

Nifty Options May 8 Expiry: Maximum call open interest at 24,500 and maximum put open interest at 24,000.

Put-Call ratio at 0.73, with highest change in Call open interest at 24,400.

Securities in ban period: CDSL, RBL Bank, Manappuram Finance.

Major Stocks In The News

Prestige Estates: Prestige City residential project sees sales of over Rs 3,000 crore across 1,200 units within a week of launch.

Tamilnad Mercantile Bank: The company revised Marginal Cost of Funds based Lending Rate to 9.5% from 9.6% effective May 7.

Gujarat Mineral Development Corp.: The company signed a Long-Term Supply agreement with City Gold Pipes for Supply of Limestone to get supply of 150 MT limestone over a period of 40 years from Kutch.

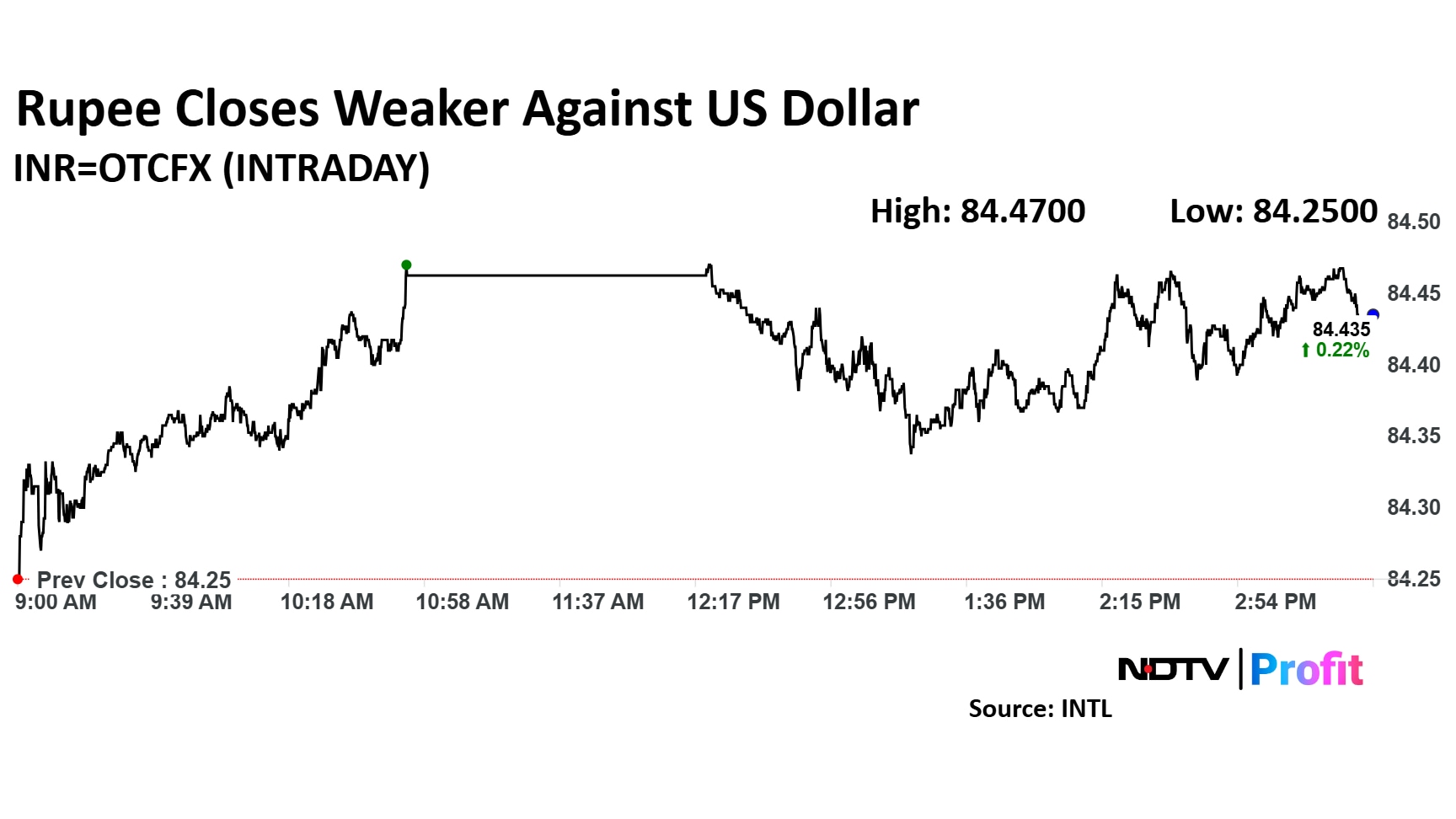

Currency Market

The Indian rupee closed 19 paise weaker at 84.44 against the US dollar on Tuesday, according to Bloomberg data.

Disclaimer: The views and opinions expressed by the investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.