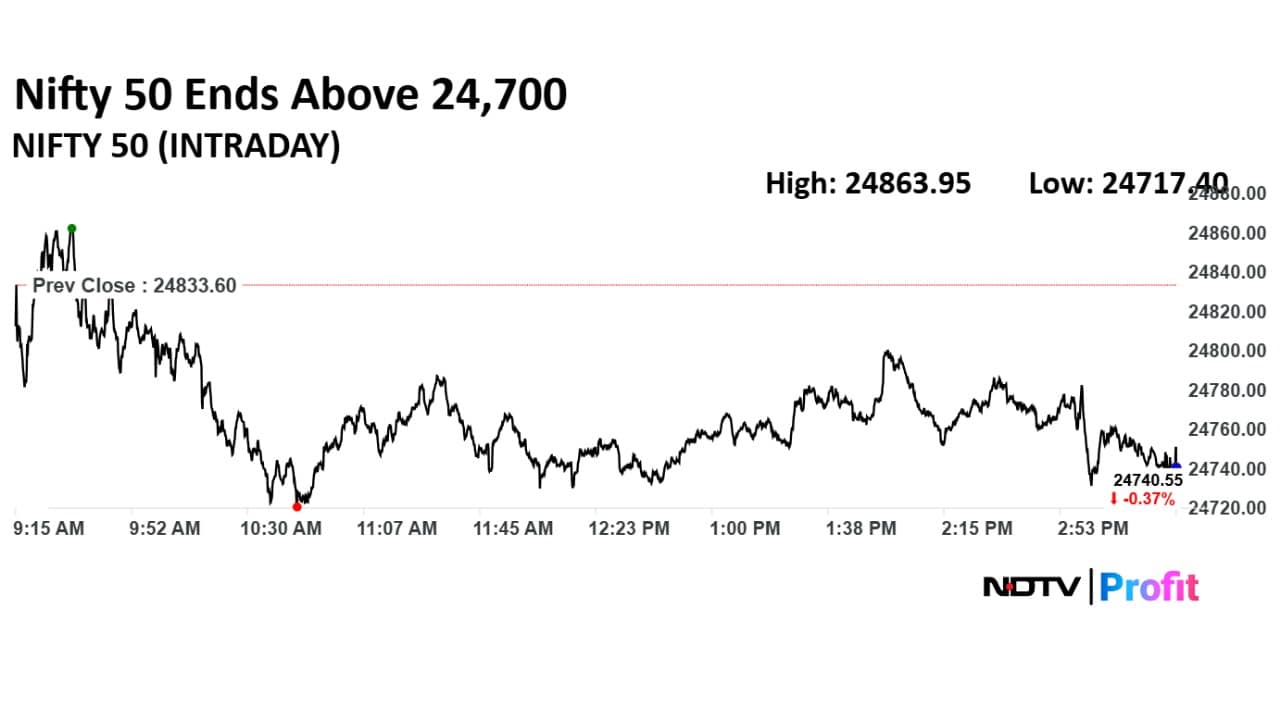

The NSE Nifty 50 found its key support at its 20-day simple moving average of 24,650, while 25,000 is a key resistance area, according to Amol Athawale of Kotak Securities.

"On the upside, a successful breakout above 25,000 could push the market towards 25,250. On the other hand, a breach of 24,650 could change the sentiment," the technical research analyst said.

Below the breach of 24,650, the market is likely to retest the levels of 24,450, according to the analyst. Athawale said further upside may continue, potentially lifting the index up to 25,500.

On the weekly chart, the index formed a small bear candle, which mostly remained enclosed inside previous week price range, signalling consolidation amid stock-specific action, analysts from Bajaj Broking Research said.

Bajaj Broking Research's analysts identified the key short-term support at 24,400-24,500 levels.

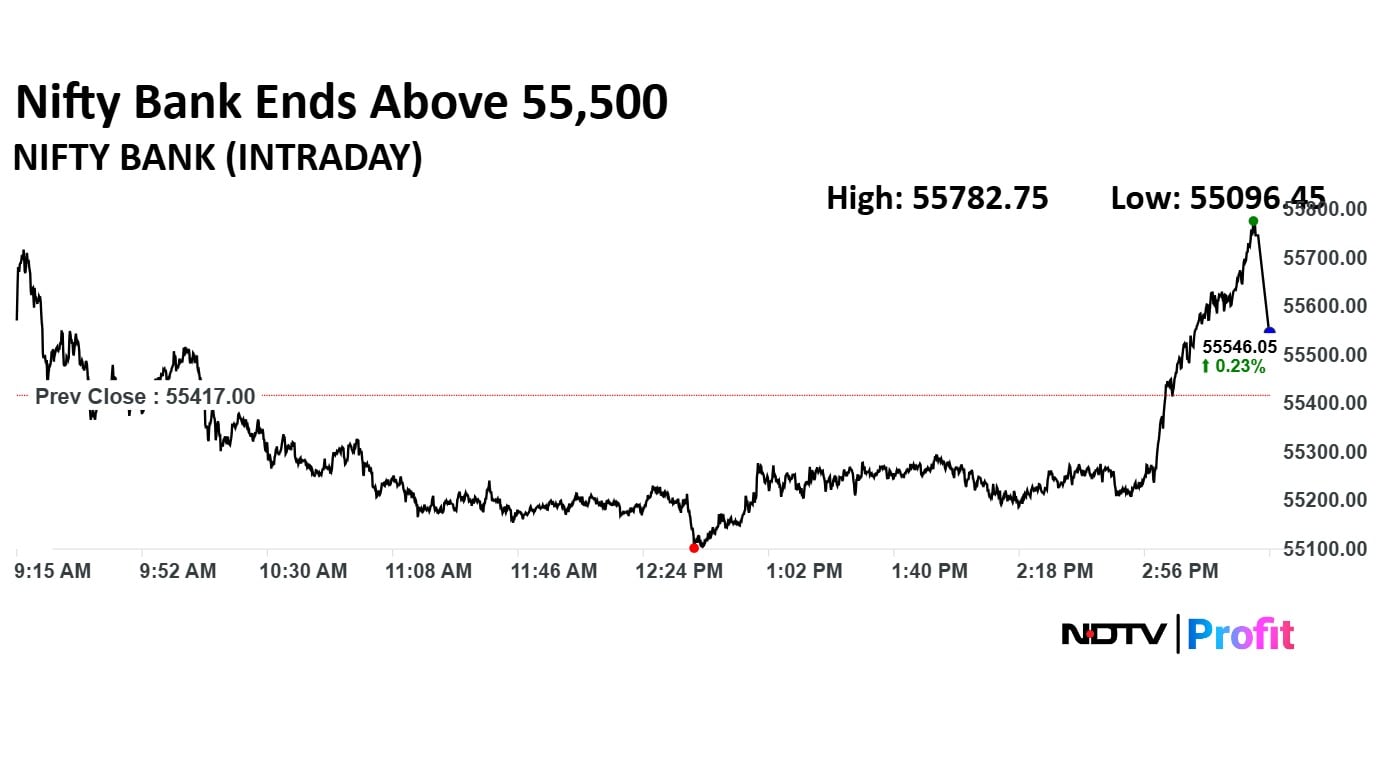

The Bank Nifty is currently testing the upper band of the last five weeks consolidation range placed around 55,800-56,000 levels, which was identified as key resistance levels by the analysts. Immediate support is placed at 54,800 levels, while the short-term support is seen at 54,000-53,500.

For Bank Nifty, the higher bottom support is placed at 55,000, according to Athawale.

If it breaks above this level the uptrend wave is likely to continue towards 56,500–57,000, he stated. "However, below 55,000, the uptrend would become vulnerable. In that case, we could see a correction down to 54,500–54,200," Athawale said.

Market Recap

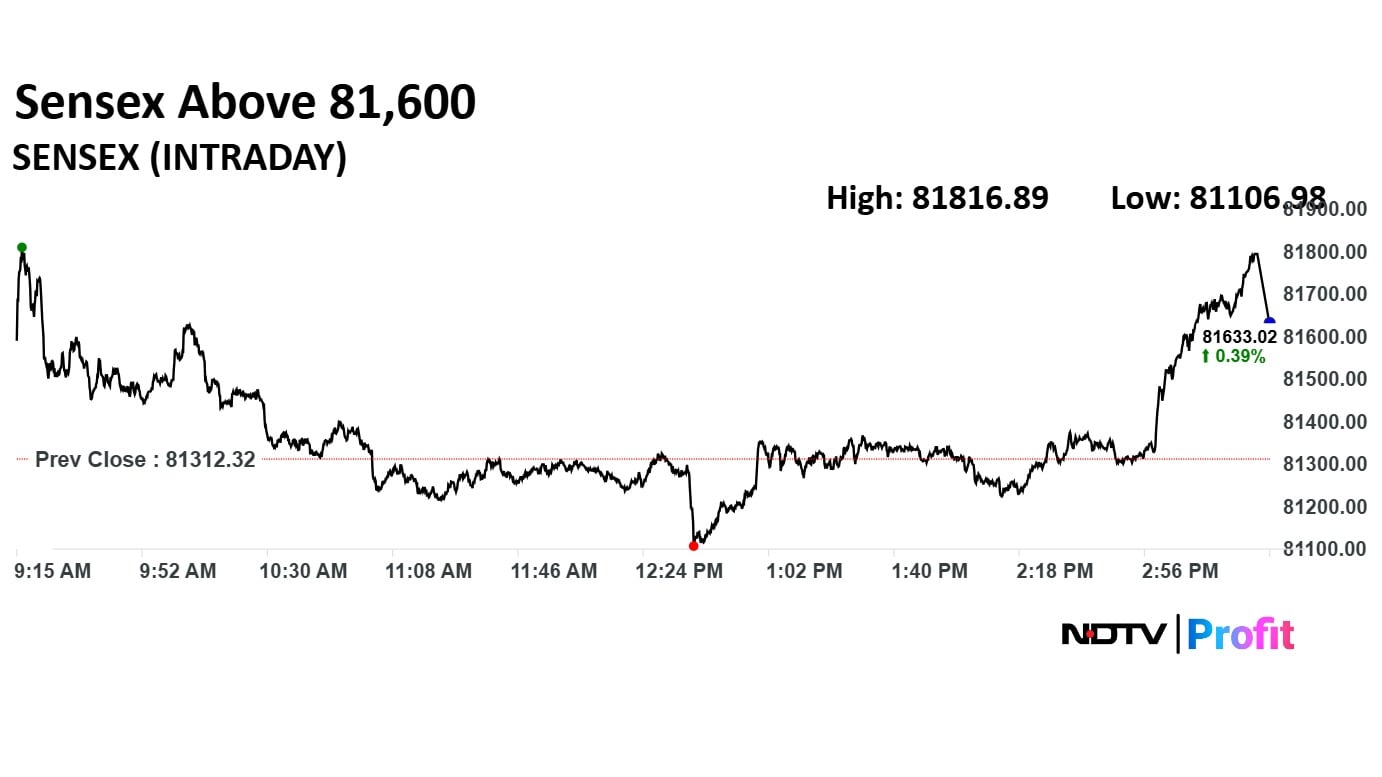

The benchmark equity indices closed lower on Friday, marking the second week of losses. The NSE Nifty 50 ended 82.9 points or 0.33% lower at 24,750.7 and BSE Sensex ended 182.01 points or 0.22% lower at 81,451.01.

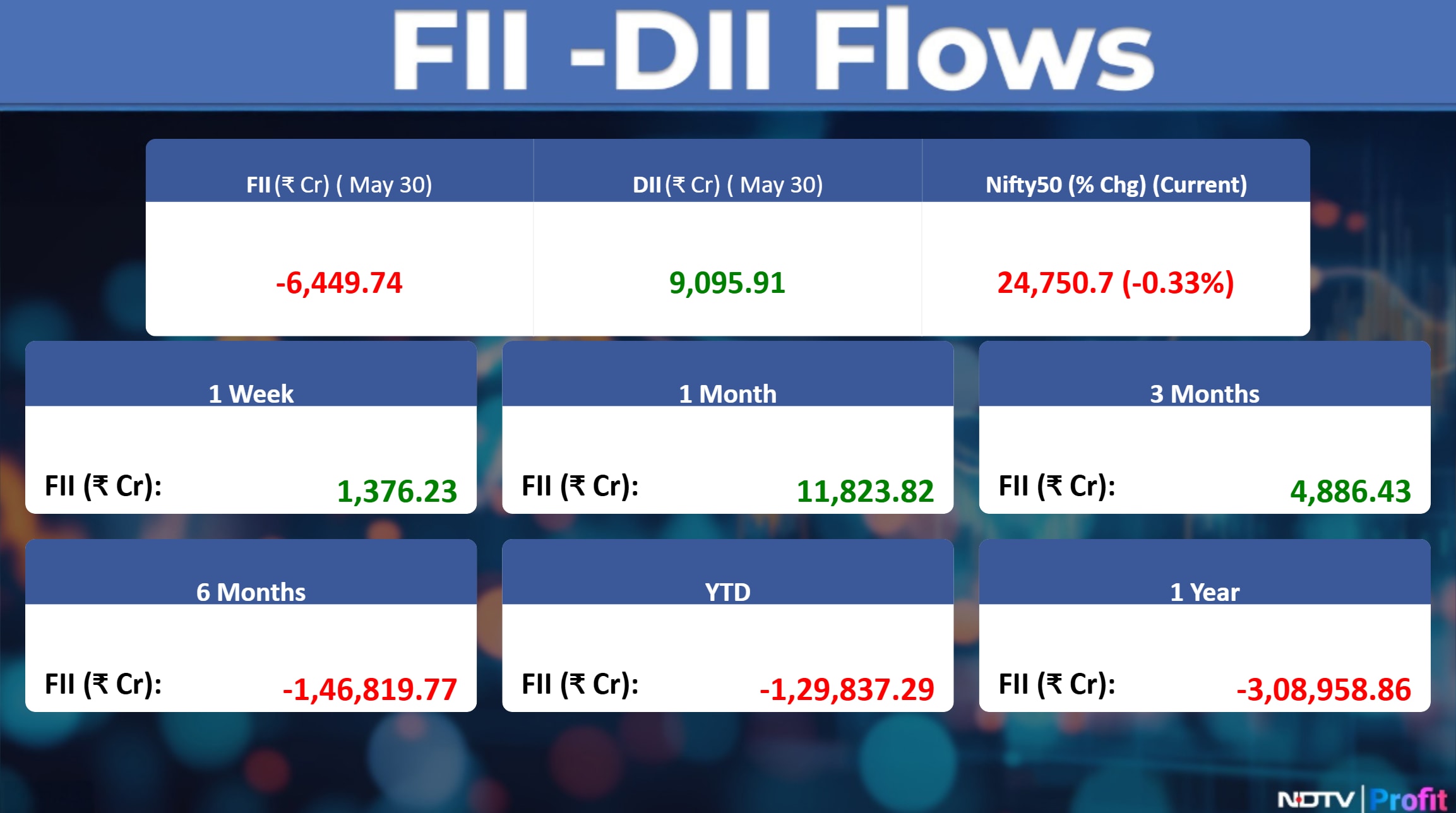

FII/DII

Foreign portfolio investors turned net sellers of Indian equities on Friday after fifth sessions, selling up stocks worth Rs 6,449.7 crore, according to the provisional data from the National Stock Exchange.

Domestic institutional investors stayed net buyers for the ninth straight session as they bought equities worth Rs 9,095.9 crore, the data showed.

In the month of May, the overseas investors have net bought shares worth Rs 19,860 crore.

F&O Cues

Nifty May Futures down by 0.36% to 24,852 at a premium of 102 points.

Nifty May futures open interest up by 2.65%.

Nifty Options June 6 Expiry: Maximum Call open interest at 26,800 and Maximum Put open interest at 24,000.

Securities in ban period: Manappuram.

Major Stocks In News

Infosys: Infosys BPM, the business process management arm of Infosys, announced the launch of AI agents for invoice processing within its flagship Infosys Accounts Payable on Cloud solution.

Indian Oil Corp: The company has finalised the levelized cost of hydrogen (LCoH)* for setting up a 10,000 tonnes per annum green hydrogen generation unit at its Panipat refinery and petrochemical complex. This marks company's entry into the green hydrogen space with India's largest-ever green hydrogen project to date. The project will start commissioning by December 2027. The green hydrogen produced will replace fossil-derived hydrogen in refinery operations, resulting in substantial reduction in carbon emissions.

Adani Energy Solutions: The company received Rs 1,660 crore inter-state transmission project in Maharashtra. The project will evacuate green power from Maharashtra's Raigad region. The company to build 3,000 Mega Volt-Amperes of substations capacity. The company's transmission orderbook now stands at Rs 61,600 crore.

Vedanta: The board approved Issuance of non-convertible debentures worth Rs 5,000 crore on private placement basis.

Currency Recap

The Indian rupee opened 16 paise stronger at 85.37 against the US dollar on Friday, in comparison to its previous close of 85.53 on Thursday snapping its three-day decline. This slight depreciation comes amid various global and domestic economic factors influencing the currency markets.

Disclaimer: The views and opinions expressed by the investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.