The NSE Nifty 50's key resistance areas will likely be in the 24,250–24,350 range, while 24,100 and 24,000 will act as key support zones, according to analysts.

The index is currently testing the immediate resistance area of 24,200–24,300. A sustained move above 24,300 can pave the way for further upside towards 24,550 and then towards December 2024 high of 24,850 in the upcoming weeks, according to Bajaj Broking.

The current market texture is bullish but overbought. Hence, a range-bound activity is likely to continue in the near future, according to Shrikant Chouhan, head of equity research at Kotak Securities.

For day traders, 24,100 and 24,000 will act as key support zones, while 24,250–24,350 can serve as key resistance areas for the bulls, Chouhan said. "However, if the index falls below 24,000, sentiment could change. Traders may prefer to exit their long positions below this level," he added.

"With the daily stochastic entering overbought territory after a sharp 1,800-point rally in the past six sessions, some consolidation at higher levels cannot be ruled out. Hence, failure to move above 24,300 can lead some consolidation in the range of 24,300–23,800," Bajaj broking shared.

The Bank Nifty, which settled on a bullish note, continues to trade above its breakout level of 54,470 and has formed a green candle with a long upper shadow, indicating selling pressure at higher levels, according to Hrishikesh Yedve, technical and derivatives research analyst at Asit C Mehta Investment Interrmediates Ltd.

Yedve added that 56,000 would act as a stiff resistance, while 54,470 remains a crucial support zone. He advised short-term traders to book profits near 56,000 and look to re-enter on dips.

Market Recap

The benchmark equity indices rose for the sixth session in a row on Tuesday and recorded the best winning streak in nearly a month as sharp gains in financial services stocks supported the rally.

The NSE Nifty 50 ended 41.70 points or 0.17% higher at 24,167.25 and the BSE Sensex closed 187.09 points or 0.24% up at 79,595.59. During the session, the Nifty rose 0.35% to the day's high of 24,242.6 and the Sensex gained 0.52% to 79,842.3.

FII/DII Activity

Foreign portfolio investors continued to maintain their buying streak of Indian equities on Tuesday for the fifth straight session as they acquired stocks worth Rs 1,290.4 crore.

Domestic institutional investors turned net sellers after a day's net buying, as they sold equities worth Rs 885.6 crore, according to provisional data from the National Stock Exchange.

F&O Action

Nifty April Futures up by 0.12% to 24,164 at a premium of 0.1 points.

Nifty April futures open interest down by 20%.

Nifty Options April 24 Expiry: Maximum call open interest at 25,500 and maximum put open interest at 23,000.

Put-Call ratio at 1.0, with highest change in Put open interest at 24,000.

Securities in ban period: Manappuram Finance, RBL Bank.

Major Stocks In The News

Bharti Airtel: Bharti Hexacom, a subsidiary of the company, entered into an agreement with Adani Data Networks. Under this agreement, Bharti Hexacom will acquire 400 MHz of spectrum in the 26 GHz band from Adani Data Networks.

IndusInd Bank: The internal audit department of the bank is currently reviewing its microfinance portfolio in response to certain concerns raised. To aid in this process, the bank has engaged EY to assist the internal audit team. EY's role is to provide assistance to the internal audit and does not involve conducting a forensic audit.

Ashoka Buildcon: The firm received a letter of acceptance worth Rs 569 crore from Central Railway for a gauge conversion project in Maharashtra.

Bank of India: The bank is to consider fundraising through bonds on April 30.

Currency Market

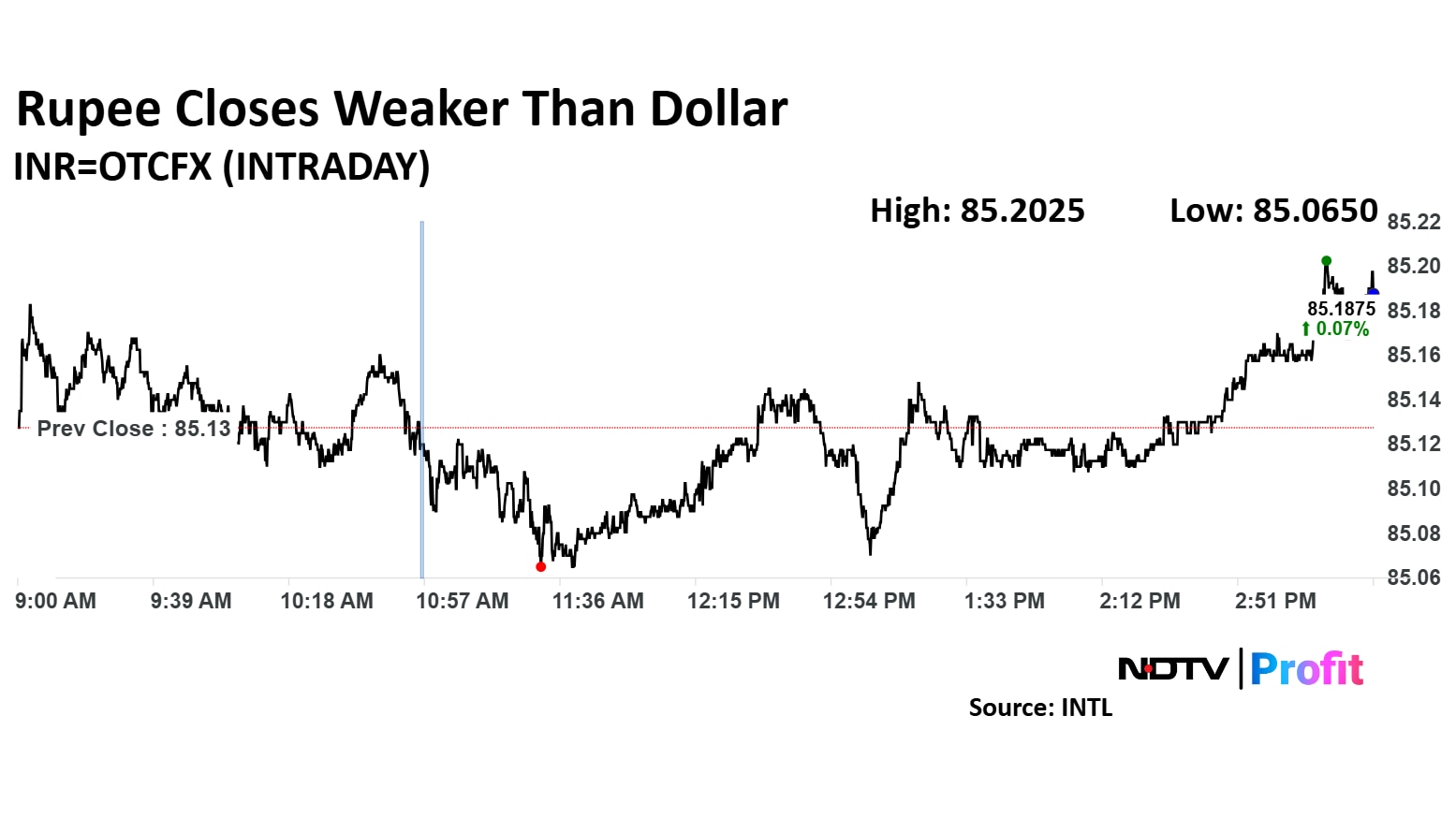

The rupee closed lower on Tuesday, snapping a five-day winning streak, as rising crude oil prices and a recovery in the dollar index weighed on sentiment.

The local unit settled at 85.20 against the US dollar, down 7 paise from its previous close of 85.13. Earlier in the day, it had opened flat at the same level.

Disclaimer: The views and opinions expressed by the investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Global Cues

Markets in Japan, South Korea, and Australia advanced on Wednesday as risk-sentiment got a boost from first positive comment from US President Donald Trump about China since the trade war began. The Nikkei 225 and KOSPI were trading 1.85% and 1.19% higher, respectively. The S&P ASX 200 was trading 1.84% higher.

On Tuesday, share indices on Wall Street rebounded as concerns about the US Federal Reserve's independence allayed after Trump said that he has no intention to fire Chair Jerome Powell.

The Dow Jones Industrial Average and S&P 500 ended 2.66% and 2.51% higher, respectively. The Nasdaq Composite ended 2.34% higher.

The dollar index was trading 0.34% higher at 99.26. The Bloomberg spot gold was trading 0.30% down at $3,370.43 an ounce as of 7:01 a.m.

The brent crude was trading 0.86% higher at $68.02 a barrel as of 7:02 a.m.

The GIFT Nifty was trading 0.72% or 66.50 points higher at 23,375.00 as of 7:01 a.m.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.