The benchmark stock indices will continue its uptrend from the current levels, aided with a positive broader market momentum, according to analysts.

The markets continued its positive traction with broader market momentum being positive, leading to good opportunities in stock-specific trading, according to Ruchit Jain, lead research analyst at 5paisa.com.

On the index front, the Nifty continued its gradual up-move and is heading towards its previous highs. The immediate support base has shifted higher in the index to 22,430–22,370 range and till this support is intact, intraday dips are likely to get bought into, Jain said. "Hence, we continue with our positive stance on the index and advise traders to continue with a positive bias."

The Bank Nifty has seen a relative underperformance in the last few sessions, but here, too, the important supports are intact, according to Jain.

Higher bottom formation on intraday charts and positive consolidation on daily charts suggest strong possibility of further uptrend from the current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities. "For the trend-following traders now, 22,500 would act as a key support level. Above the same, it could rally till 22,700–22,735," Chouhan said.

On Wednesday, the Reserve Bank of India said it would pay Rs 2.1 lakh crore—the highest-ever surplus—as dividend to the Union government for financial year 2024. The US Federal Reserve's minutes showed a desire to hold interest rates higher for longer.

The GIFT Nifty was trading 13 points or 0.06% higher at 22,637 as of 06:35 a.m.

F&O Action

The Nifty May futures were up 0.27% to 22,657.95 at a premium of 60.15 points, while its open interest was down 1.23%. The Nifty Bank May futures was down 0.17% to 47,974.1 at a premium of 192.15 points, and its open interest was down 6%.

The open interest distribution for the Nifty May 23 series indicates that the 22,000 level is seeing the most put strikes, and call strikes of 23,000 have the maximum open interest.

For the Bank Nifty options' May 29 expiry, the maximum call open interest was at 48,000 and the maximum put open interest was at 48,000.

FII/DII Activity

Overseas investors in Indian equities remained net sellers on Wednesday for the third straight session.

Foreign portfolio investors offloaded stocks worth Rs 686 crore and domestic institutional investors remained net buyers for the second day and mopped up equities worth Rs 962 crore, according to provisional data from the National Stock Exchange.

Markets On Wednesday

India's benchmark stock indices ended the range-bound session higher, tracking gains in shares of Reliance Industries Ltd., Infosys Ltd., and Hindustan Unilever Ltd.

The NSE Nifty 50 ended 68.75 points, or 0.31%, higher at 22,597.80. It settled higher for the fifth consecutive session and recorded the longest winning streak since April 25. The S&P BSE Sensex closed 267.75 points up, or 0.36%, at 74,221.06.

During the last leg of trade, the Nifty rose 0.45% to 22,629.50, and the Sensex gained 0.48% to 74,307.79.

On the NSE, seven sectors advanced and five declined. The NSE Nifty Realty rose the most among peers, and the NSE Nifty Metal was the worst-performing sectoral index.

Broader markets ended on a mixed note. The S&P BSE Midcap ended 0.05% lower, while the S&P BSE Smallcap settled 0.18% higher.

On BSE, 15 sectors advanced and five declined. S&P BSE Realty was the top-performing sector, and S&P BSE Bankex was the top loser.

Major Stocks In News

FSN E-Commerce: The board approved the acquisition of the western wear and accessories business from Nykaa Fashion, approved the transfer of a 100% stake held in Iluminar Media to Nykaa Fashion and gave principal approval for the merger of Iluminar Media into Nykaa Fashion.

AllCargo Logistics: The company's arm, ECU Worldwide, acquired a 25% stake in Fair Trade for €2.9 million.

Jubilant Foodworks: The company approved a further investment of Rs 30 crore in the Bangladesh unit.

Global Cues

Stocks in the Asia Pacific region were trading mixed on Thursday after the US benchmarks fell on the Federal Reserve's desire to keep interest rates elevated for longer.

The Nikkei 225 was trading 154 points or 0.40% higher at 38,771, while the S&P ASX 200 was 82 points or 1.06% down at 7,764 as of 06:32 a.m. Meanwhile, South Korea's benchmark was down 0.39%.

While US equity fell after the release of the FOMC minutes, their futures rose following robust results from Nvidia Corp.

The S&P 500 fell 0.27%, and the Nasdaq Composite declined 0.18%, as of Wednesday. The Dow Jones Industrial Average was down by 0.51%.

Key Levels

US Dollar Index at 104.88

US 10-year bond yield at 4.43%

Brent crude down 0.31% at $81.65 per barrel

Nymex crude down 0.43% at $77.24 per barrel

Bitcoin was down 0.10% at $69,341.75

Rupee Update

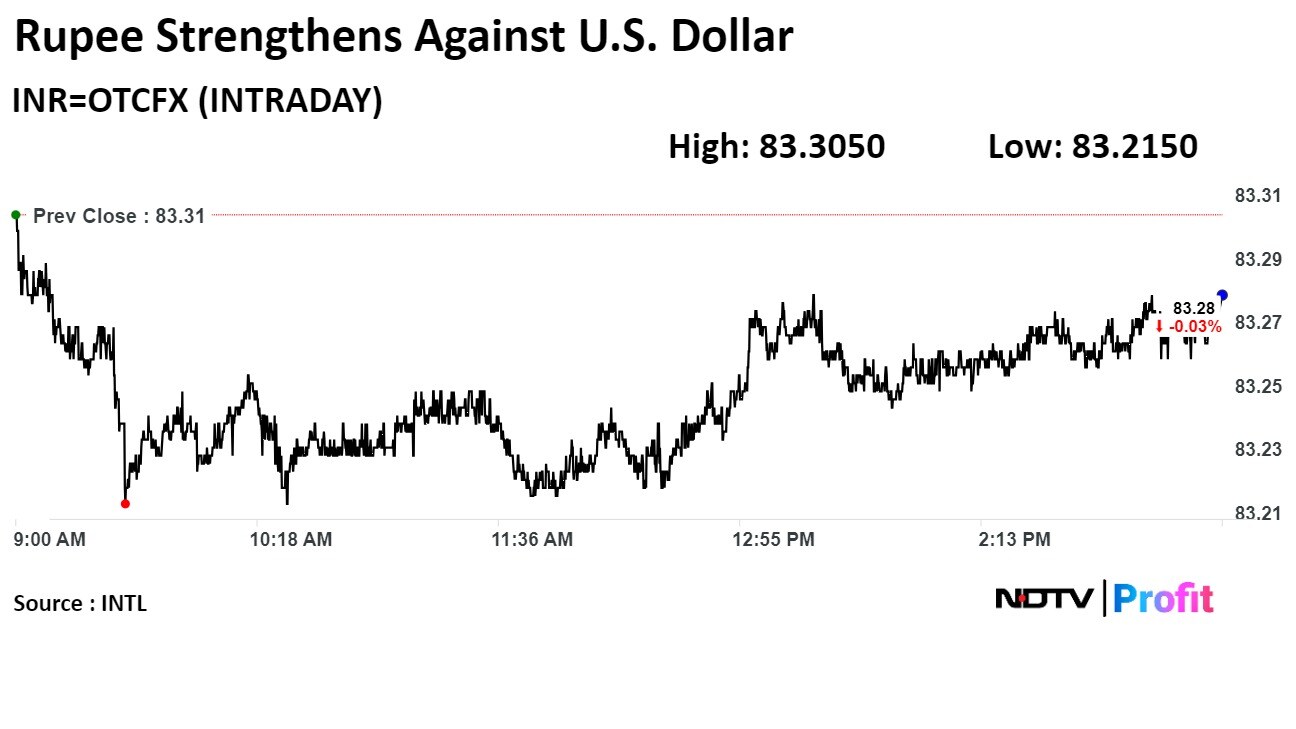

The Indian rupee closed stronger against the dollar on Wednesday on likely inflows into local stocks, even as market participants waited for the release of the minutes of the US Fed's latest meeting to give fresh direction to the market.

The local currency appreciated 3 paise to close at 83.28 against the US dollar, according to Bloomberg data. It had closed at 83.31 on Tuesday

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.