Torrent Pharmaceuticals Ltd. is making a strategic move with its acquisition of a controlling stake in JB Chemicals & Pharma, according to analysts. The shares of JB Pharma slipped 6.5% during early trade on Monday following the Torrent Pharma deal. While Torrent Pharma shares jumped by 4% in trade so far.

Analysts are of the opinion that the deal will usher in a new era of growth for the pharmaceutical giant. Both HSBC and Jefferies have maintained a 'buy' stance on Torrent Pharma. Torrent's past acquisitions have been focused on strengthening its presence in the Indian market, noted Jefferies.

Boost In India's Chronic Therapy Segments

HSBC, which has retained its 'buy' call on the counter with a target price of Rs 3,775, emphasised that the acquisition of JB Pharma, represents the "next leg of growth" for Torrent.

The brokerage expects this deal will significantly boost Torrent's presence in India's chronic therapy segments and open new avenues, such as ophthalmology. The acquisition is expected to enhance Torrent's international business by adding Contract Development and Manufacturing Organisation or CDMO capabilities.

Further, HSBC projects that the JB deal could be approximately 3% accretive to Torrent's financial year 2027 earnings per share. Analysts also believe that the company is well-positioned to fund the acquisition through internal accruals, potential QIP proceeds, and debt.

Entry Into Lozenges CDMO Operations For Exports

Jefferies also views the large-scale acquisition positively, reiterating its 'buy' rating for Torrent Pharma and setting a revised target price of Rs 3,740.

The brokerage firm notes that the transaction, executed in two phases, will strengthen Torrent's India portfolio and provide entry into lozenges CDMO operations for exports.

"Based on published FY25 financials, assuming no major divestment and Torrent is able to acquire a controlling stake, the combined entity would have revenue of Rs 154 billion and Ebitda of Rs 47.5 billion," according to Jefferies.

The analyst highlights that based on financials, Torrent's proven track record of successful acquisitions focused on strengthening its India market presence and being accretive to shareholders.

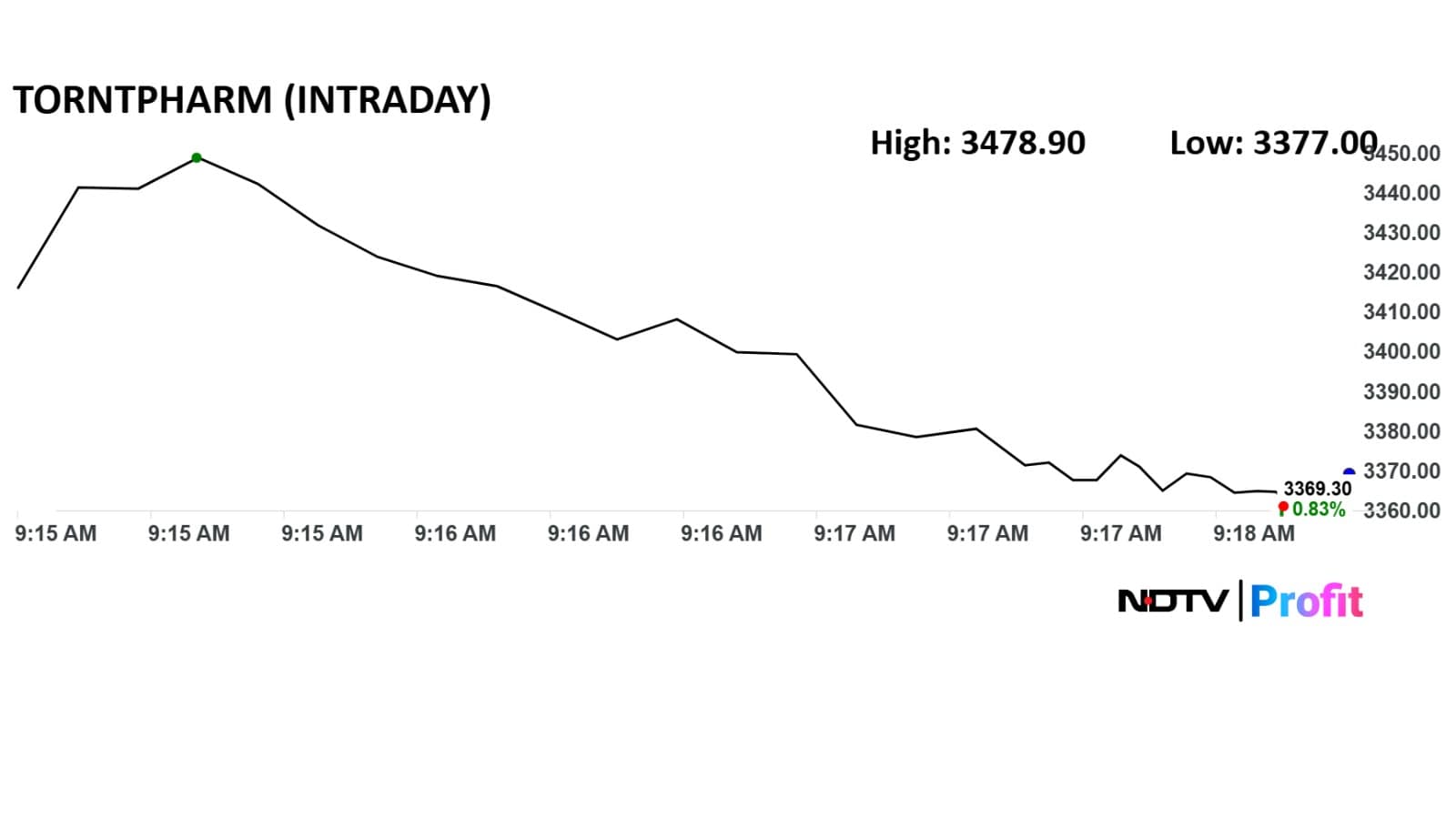

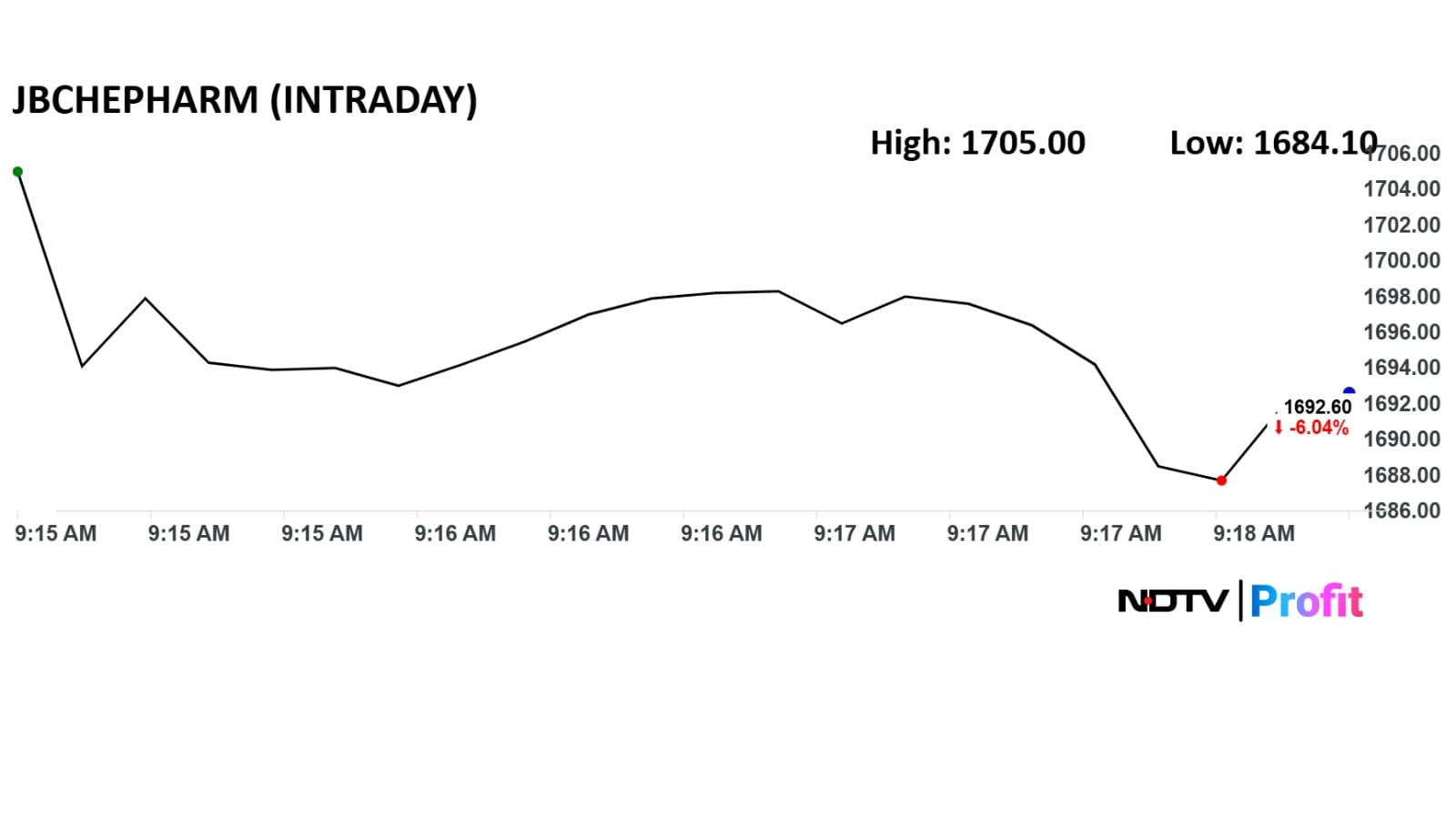

Torrent Pharma, JB Chemicals Share Price

The share price of Torrent Pharma marked gains of 4% during early trade on Monday, rising to Rs 3,478.9 apiece on NSE. The scrip was trading 0.57% higher at Rs 3,361 as of 9:28 a.m., compared to a 0.03% advance in the benchmark Nifty 50.

While the shares of JB Chemicals declined as much as 6.7% during trade to Rs 1,680.6. The scrip was trading 6.22% lower at Rs 1,688.1 apiece at 9:30 a.m., compared to a 0.07% decline in the Nifty 50.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.