The shares of Techno Electric And Engineering Ltd. rose nearly 13% to hit a four-month high after a jump in net profit in the quarter ended March.

Techno Electric reported a 73.7% year-on-year rise in net profit to Rs 135 crore for the quarter ended March, compared to Rs 77.5 crore in the same quarter of the previous fiscal year, according to its stock exchange notification.

Revenue increased by 85.6% year-on-year for the three months ended March, reaching Rs 816 crore. Operating income, or earnings before interest, taxes, depreciation, and amortisation, more than doubled year-on-year to Rs 126.7 crore. The Ebitda margin expanded 230 points to 15.5%.

Techno Electric on Tuesday also announced a dividend of Rs 9 per equity share for the fourth quarter of fiscal 2024-25. The company announced distribution of Rs 104.66 crore to shareholders in the fourth quarter of this fiscal.

In comparison, the company had issued a final dividend of Rs 7 apiece on Sept. 13, 2024, and a dividend of Rs 6 on Sept. 15, 2023.

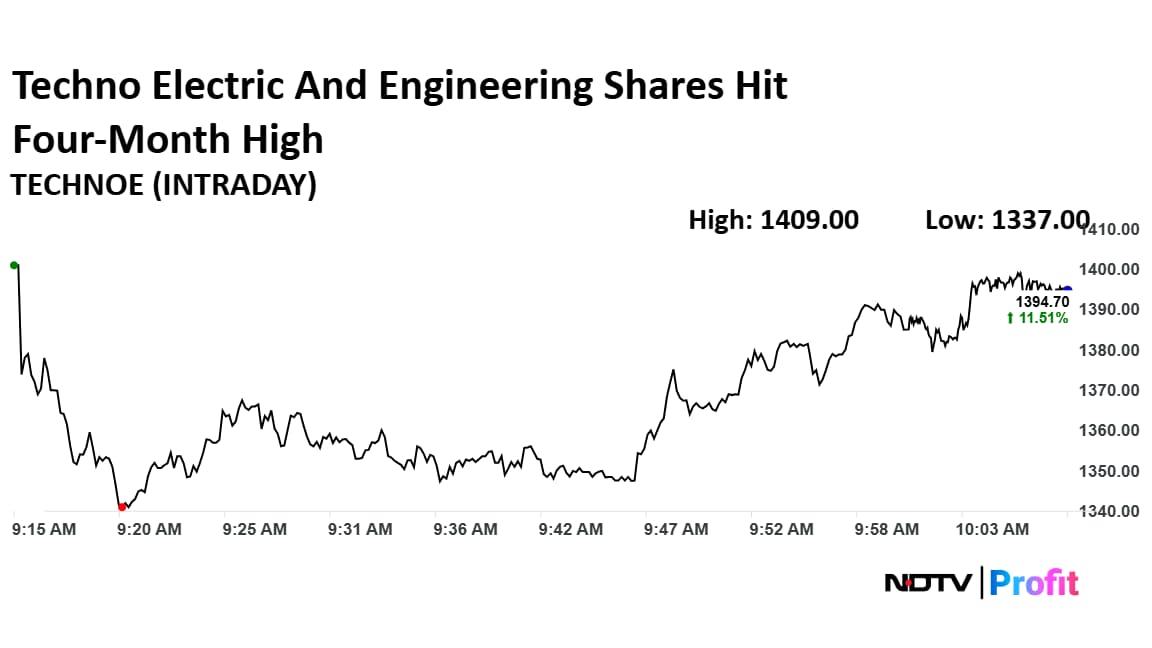

Techno Electric And Engineering Share Price Rises

Techno Electric's stock rose as much as 12.66% during the day to Rs 1,409 apiece on the NSE, the highest level since Jan. 13, 2024. It was trading 10.98% higher at Rs 1,388 apiece compared to a 0.20% decline in the benchmark Nifty 50 at 10:00 a.m.

The share price has risen 29.83% in the last 12 months and fallen 11.66% on a year-to-date basis. The total traded volume so far in the day stood at 21 times its 30-day average. The relative strength index was at 72, implying the stock may be overbought.

All four analysts tracking Techno have a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 12.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.