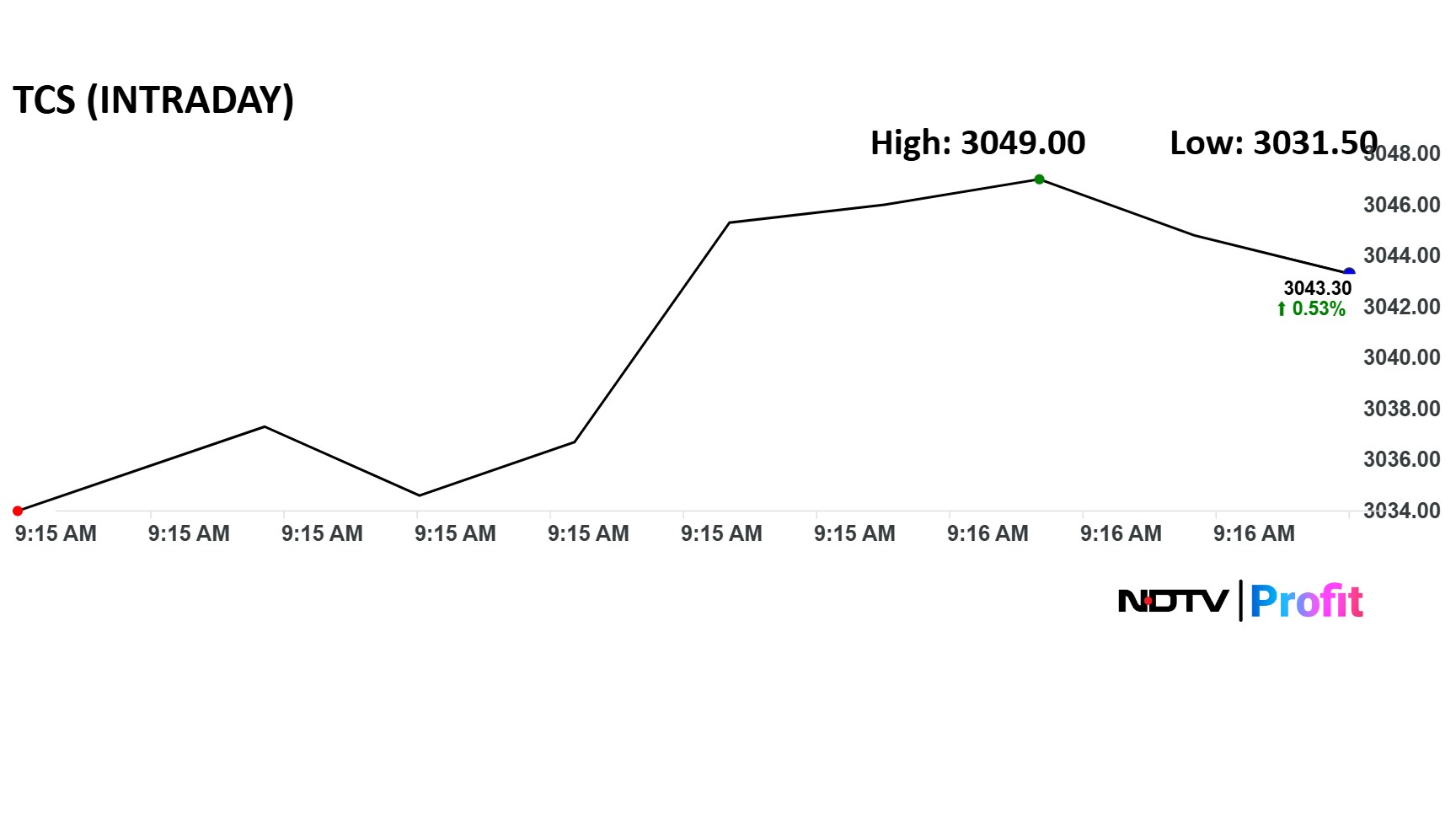

Tata Consultancy Services Ltd. share price opened marginally higher on Thursday, ahead of the second-quarter financial results. The stock rose as much as 0.7% during early trade.

The Q2 results will be announced after market hours. The company has cancelled its scheduled press conference as the day coincides with the death anniversary of Ratan Tata, the former Chairman of Tata Sons and a towering figure in the Tata Group.

While the press event has been scrapped, the company's analyst call, where the financial performance and management commentary are shared is set to proceed as planned.

The TCS Q2 results are highly anticipated, as they will provide a key indicator of demand in the global IT sector.

The US government's $1,000,000 fee on new H1-B visa applications have also come as a shock for India's software and IT services exporters. TCS is one of the largest H-1B visa recipients among Indian IT companies, making the fee increase a key factor in its cost structure.

Investors will also be eyeing any recovery in discretionary spending in the IT giant, particularly from the US and European markets. Further, the focus is also set to be on how it is managing ongoing challenges in specialised staffing and cautious client spending.

TCS is expected to report a revenue increase of 3% to Rs 65,206 crore from Rs 63,437 crore in the previous quarter, according to analysts consensus estimates tracked By Bloomberg. Meanwhile, profit is projected to decline 1% to Rs 12,568 crore from Rs 12,760 crore.

TCS shares have fallen 29% in the last 12 months and 26% on a year-to-date basis.

Thirty-two out of the 51 analysts tracking xx have a 'buy' rating on the stock, 13 recommend a 'hold' and six suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets is Rs 3,541, which implies a potential upside of 17%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.