Shares of Tata Steel Ltd., Steel Authority of India Ltd., JSW Steel Ltd. and Kalyani Steels Ltd., among others, declined during early trade on Monday, after reports of Indian steel mills looking to hike prices of flat products by Rs 1,000 per tonne this month.

Flat products usually contribute 50-70% of Indian steel mills' production volumes. A quick dip survey of sector watchers suggests that there could be a hike in long steel products as well.

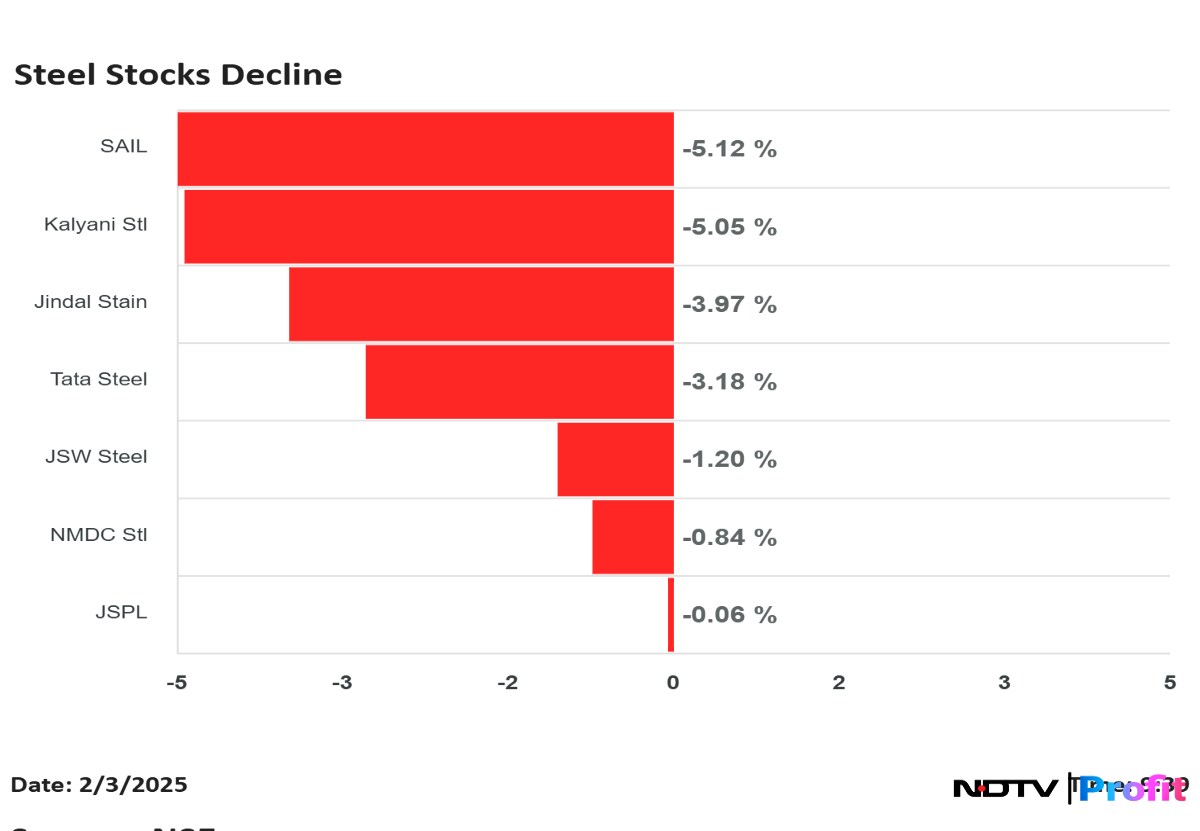

SAIL and Kalyani Steels tanked 5%, Jindal Stainless Ltd. fell 4.5%, while Tata Steel and Jindal Steel and Power Ltd. shed 3.3%.

JSW Steel lost 2.2% and NMDC Steel Ltd. fell 1.6%.

All listed Indian steel-makers make both flat and long steel products.

The hike indicates strong demand uptick in the domestic market. Steel prices have been subdued for the last several months due to cheaper import from China.

Companies are also expecting the imposition of safeguard duty by the government.

China's property crises over the last few years have depressed local steel demand, causing Chinese producers to direct their massive capacity to churn out exports.

India remained a net importer of steel from April to November period of the ongoing financial year, even as the industry faced price pressures, the Economic Survey 2024-25 said on Friday. The decline in the export of finished steel during FY25 was mainly driven by gaps between international and domestic prices, it noted.

The stainless steel industry has hailed the Union Budget 2025, saying the focus on infrastructure, manufacturing, and sustainability will push the sector's growth. Capital expenditure has been raised by 10% to Rs 11.2 lakh crore, besides measures to focus on manufacturing and MSMEs.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.