Brokerage firm Morgan Stanley has initiated coverage on Swiggy Ltd. with an 'overweight' rating, citing improving execution in food delivery, aggressive investments in quick commerce, and a favourable valuation discount to the market leader, Eternal Ltd. (Zomato).

Morgan Stanley's price target for Swiggy is Rs 405, implying a 22% upside from current levels. The brokerage expects Swiggy's food delivery business to grow at a 15.8% CAGR from fiscal 2025 to 2029, and its quick commerce gross order value to grow at a 63% CAGR over the same period.

Swiggy is projected to reach adjusted Ebitda break-even by fiscal 2028. In food delivery, the adjusted Ebitda margin is expected to improve from 2% in fiscal 2025 to 4.8% by fiscal 2028.

Morgan Stanley values Swiggy's food delivery at nearly 52% of Eternal's corresponding business and estimates Swiggy lags by two years on adjusted Ebitda and 15% in market share. Quick commerce is valued at 25% of Eternal's, with at least a three-year Ebitda lag.

India's quick commerce total addressable market is now estimated at $57 billion by 2030, up from $42 billion, with Swiggy expected to hold a 22% share.

Morgan Stanley flagged weaker execution, higher-than-expected quick comm investments, and regulatory challenges related to gig workers or FDI in retail as risks.

Swiggy has recently made several senior hires and has improved food delivery margins by narrowing the profit-per-order gap with Zomato from Rs 12 in the March quarter of fiscal 2024 to Rs 6 in that of fiscal 2025. The company is also seeing momentum in its 10-minute food service, which now accounts for 12% of orders.

Morgan Stanley ranks Eternal higher than Swiggy due to stronger leadership in both food delivery and QC, better unit economics, and a more robust balance sheet. Nonetheless, it expects both players to benefit from a duopoly structure and large, expanding addressable markets.

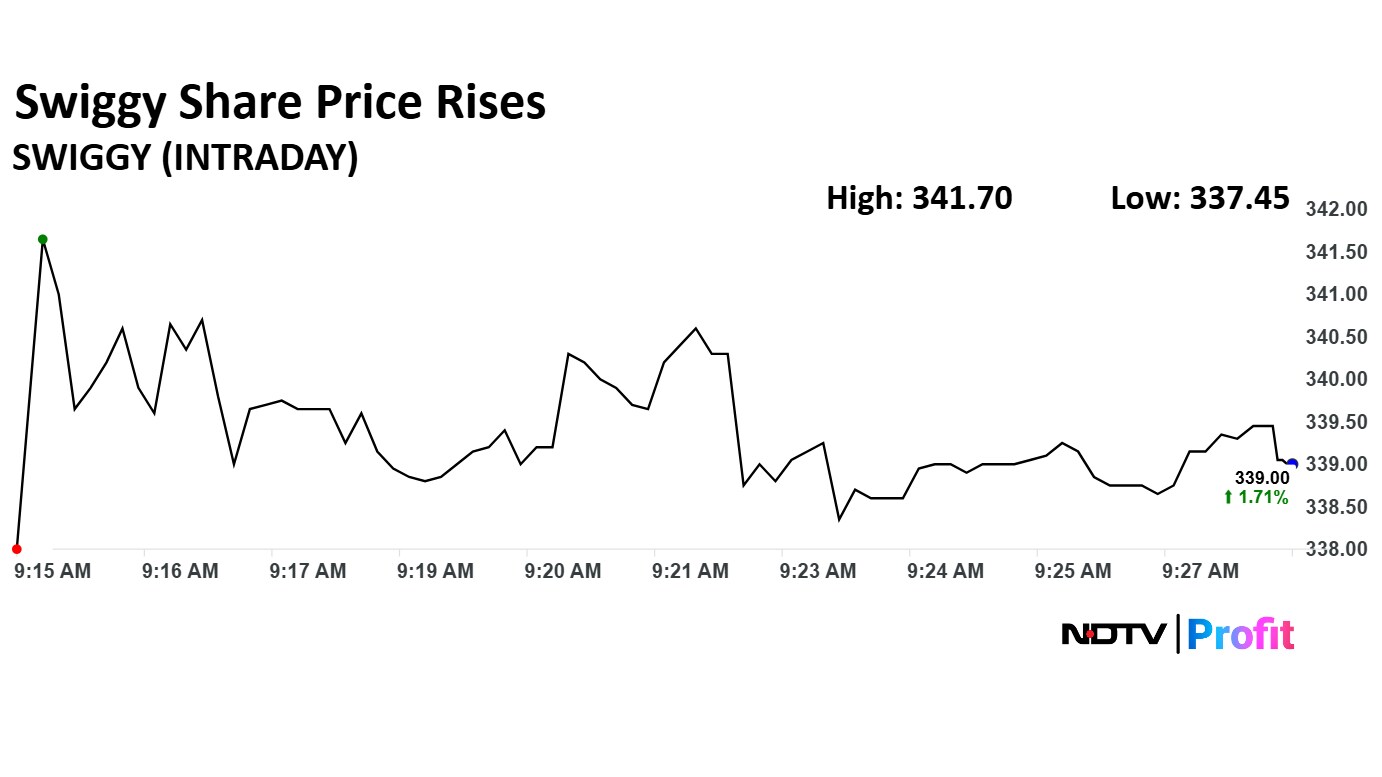

Swiggy Share Price Today

The scrip rose as much as 2.52% to Rs 341.70 apiece, the highest level since May 6. It pared gains to trade 1.95% higher at Rs 338.60 apiece, as of 09:39 a.m. This compares to a 0.14% decline in the NSE Nifty 50 Index.

It has fallen 25.64% since listing. The relative strength index was at 58.54.

Out of 21 analysts tracking the company, 15 maintain a 'buy' rating, three recommend a 'hold,' and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 22.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.