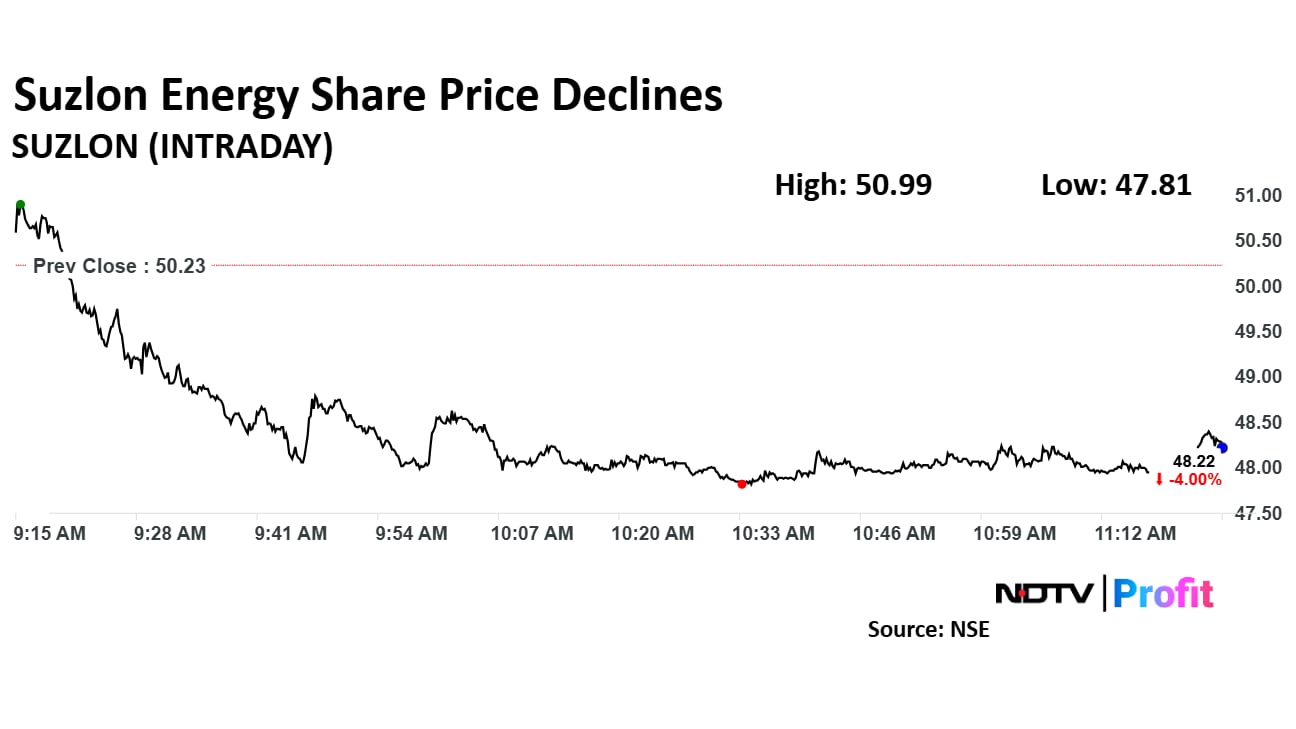

Suzlon Energy Ltd.'s share price declined to over seven-month low in Tuesday's session. The company is set to release its earnings for the third quarter later today.

According to Bloomberg's consensus estimate, Suzlon Energy is expected to report Rs 350 crore consolidated net profit for the October-December period of the financial year 2025. Its revenue is expected to come at Rs 2,855 crore. The operating profit is estimated to have risen to Rs 431 crore during the third quarter. Margins may have risen to 15.16%.

In the preceding quarter, Suzlon Energy had reported an year-on-year increase of 96% in the net profit to Rs 200.60 crore versus Rs 102.29 crore.

Suzlon Energy Q2 Results Key Highlights (Consolidated, YoY)

Revenue up 48.0% to Rs 2,103.38 crore versus Rs 1,421.43 crore.

Net profit up 96% to Rs 200.60 crore versus Rs 102.29 crore.

Ebitda up 31% to Rs 294.18 crore versus Rs 225.04 crore.

Margin at 14.0% versus 15.8%

Suzlon Energy said in an exchange filing that there was no trigger for the significant movement in the stock price in Monday's session. Suzlon Energy's stock price has been declining for the last six days.

Suzlon Energy share price declined 4.82% to Rs 47.81 apiece, the lowest level since June 11, 2024. However, it recovered slightly later to trade 2.89% lower at Rs 48.78 apiece as of 11:49 a.m. as compared to 0.80% advance in the NSE Nifty 50 index.

The stock rose 12.79% in 12 months. Total traded volume so far in the day stood at 1.9 times its 30-day average. The relative strength index was at 25.93.

Out of six analysts tracking the company, four maintain a 'buy' rating and two recommend a 'hold,', according to Bloomberg data. The average 12-month consensus price target implies an upside of 57.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.