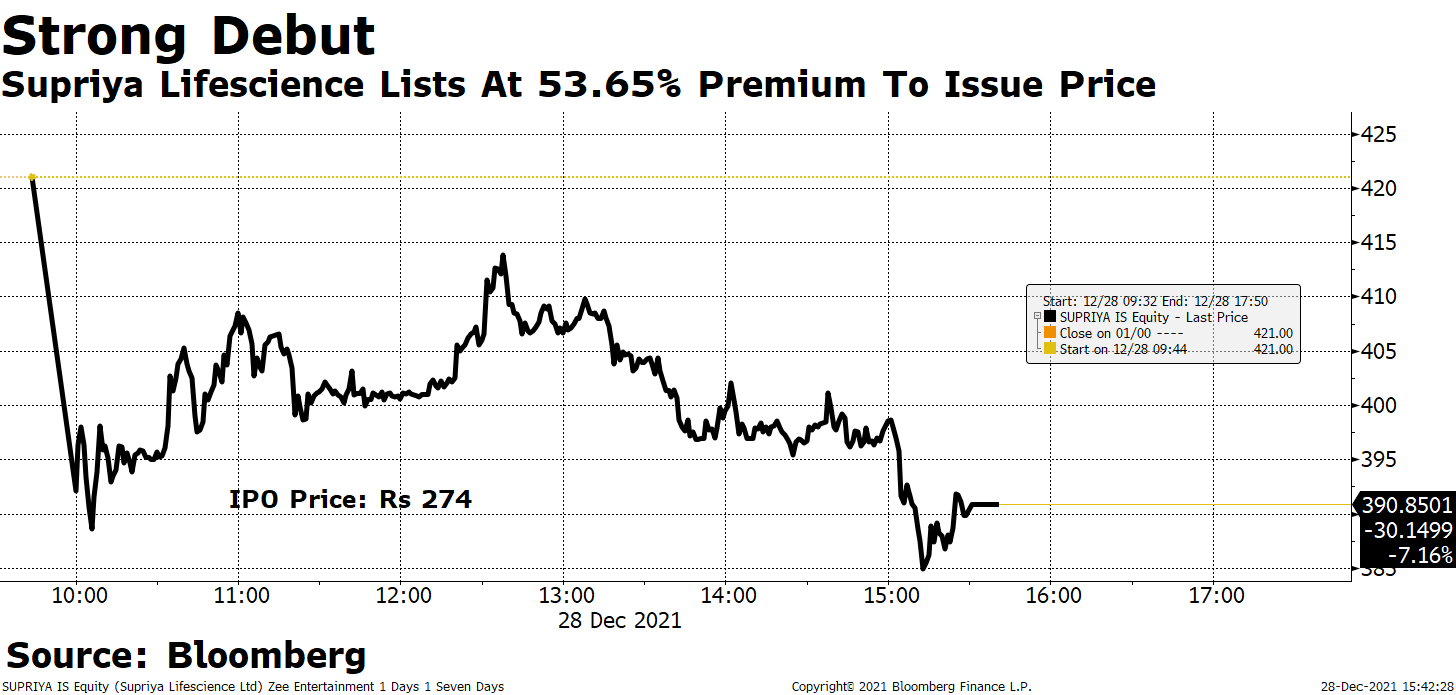

Shares of Supriya Lifescience Ltd. surged on market debut after investors piled into its initial public offering.

The bulk drugmaker and supplier's stock listed at an intraday high of Rs 421 apiece, a 53.65% premium to its IPO price of Rs 274, on the National Stock Exchange. The stock closed at Rs 389.70, up 42% over the issue price.

The IPO—which comprised a fresh issue worth Rs 200 crore and an offer for sale of up to Rs 500 crore—was subscribed 71.47 times.

Supriya Lifescience manufactures and supplies active pharmaceutical ingredients. Some of its customers include Syntec Do Brasil LTDA., American International Chemical Inc. and AT Planejamento E Desenbolvimento De Negocios Ltda, Suan Farma Inc., Acme Generics LLP., Akum Drugs Ltd. and Mankind Pharma Ltd. The company offers niche products of 38 APIs on diverse therapeutic segments.

Research Reports On Supriya Lifescience

Supriya Lifescience IPO - Focused Player In Key, Niche Active Pharma Ingredients: ICICI Direct

Supriya Lifescience IPO - Investment Rationale, Financials, Risks, Concerns: Motilal Oswal

Supriya Lifescience IPO - Valuations, Strengths, Key Strategies, Risks: Anand Rathi

Watch BloombergQuint's IPO Adda With Supriya Lifescience's Management

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.