Indian shares climbed higher tracking positive trade in global equity markets on hopes that the ECB will prolong the bank's 80 billion euros ($86 billion) a month of bond purchases beyond March.

The S&P BSE Sensex gained 1.2 percent to 26,555, its biggest intraday gain since November 25. While the NSE Nifty too advanced 1.2 percent to 8,204. The market breadth was firmly in favour of the buyers with 1220 advances, 210 declines and 425 stocks remaining unchanged.

Here are the stocks that are moving the market for the day:

Tata Steel

Shares of the steel maker rose 3 percent to Rs 424 after Tata Steel U.K. reached an agreement with trade unions to keep production going at the Port Talbot plan in Wales and other steelworks in the U.K. for at least five years.

In return, Tata Steel will replace the expensive salary pension scheme with a defined contribution scheme. The company will also continue to invest in its U.K. business to enhance the competitive position of Tata Steel U.K. in the European steel industry, , the company said in a media statement.

There is much more work to be done to make Tata Steel U.K. more financially sustainable, but I am confident that all stakeholders will do all they can to try to ensure that the company will be able to achieve its plan in the coming months and years.Koushik Chatterjee, group CEO and executive director, European business, Tata Steel.

5 year commitment.https://t.co/fceQ5qzy0g

Jet Airways

Shares of the aviation company rose 1.7 percent to Rs 375. The carrier, part-owned by Etihad Airways PJSC, is seeking to raise about $300 million to fund expansion on international routes, people with knowledge of the matter told Bloomberg.

Discussions on the fundraising are at a preliminary stage, and there's no certainty they will result in a transaction, Bloomberg reported quoting the unnamed source.

Read the full report HERE

Divi's Laboratories

The pharma firm dropped as much as 6.2 percent to Rs 1,088 after it received a Form 483 from the U.S. Food and Drug Administration regarding an inspection at its Vishakhapatnam Unit II.

The U.S. FDA pointed made five observations after the inspection, which Divi Labs will respond to within the stipulated time, it said in a statement to the exchanges.

A Form 483 is issued when the drug regulator finds conditions, during the inspection, that may violate their norms.

Crompton Greaves

The company fell as much as 8.5 percent to Rs 60 after it decided to terminate the share purchase agreement with Pauwels Spaco for Crompton Greaves' power business in Europe, North America and Indonesia.

The company wishes to inform that certain conditions precedents to the SPA, continue to remain unfulfilled and the fulfillment of the same is beyond the reasonable control of the parties in the multinational geography/product line international power business of the company. After review of the situation, the parties to the sale have decided not to further pursue the completion of the SPA consequently stands terminated.Crompton Greaves' statement to the exchanges.Crompton Greaves will continue to explore options for the sale of its international power business, the company added in the exchange filing.

Polaris

The financial technology service provider fell 6.9 percent to Rs 151 after its promoter, Virtusa Consulting Services, put up 1.86 percent of it stake on sale. The sale offer for non retailers will open up on December 8 while that for retailers will open up on December 9, the company said in a statement.

The floor price has been fixed at Rs 130, the company added.

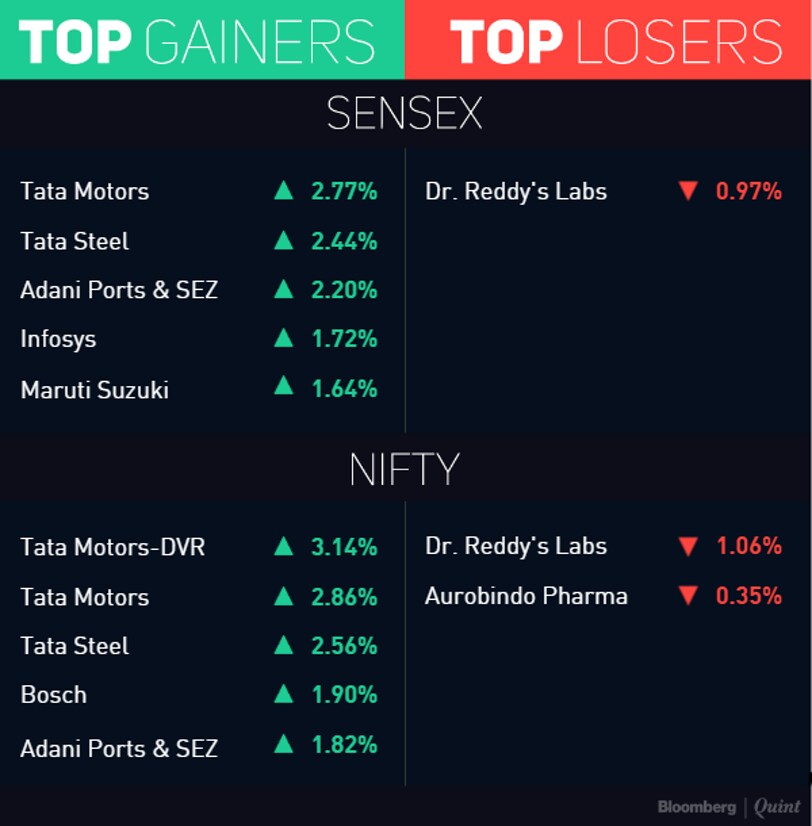

Sensex, Nifty: Movers & Shakers

Here are the best and worst performers of the BSE Sensex and the NSE Nifty.

For live updates on the market, click here!

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.