As the trading day concludes, we appreciate you following our real-time analysis, expert insights, and breaking stock market news.

Happy Gandhi Jayanthi and Dussera! Thank you and have a great evening

Rupee closed 9 paise stronger at 88.69 against the greenback, according to Bloomberg.

It closed at 88.78 a dollar on Tuesday.

Nifty trades above 24,800 mark, as RBI keeps Repo Rate unchanged at 5.5%

Nifty snaps 8-day losing streak, closes above 24,800 mark

Nifty Media gains over 3.5% for the day, emerges as the top gaining sector for the day

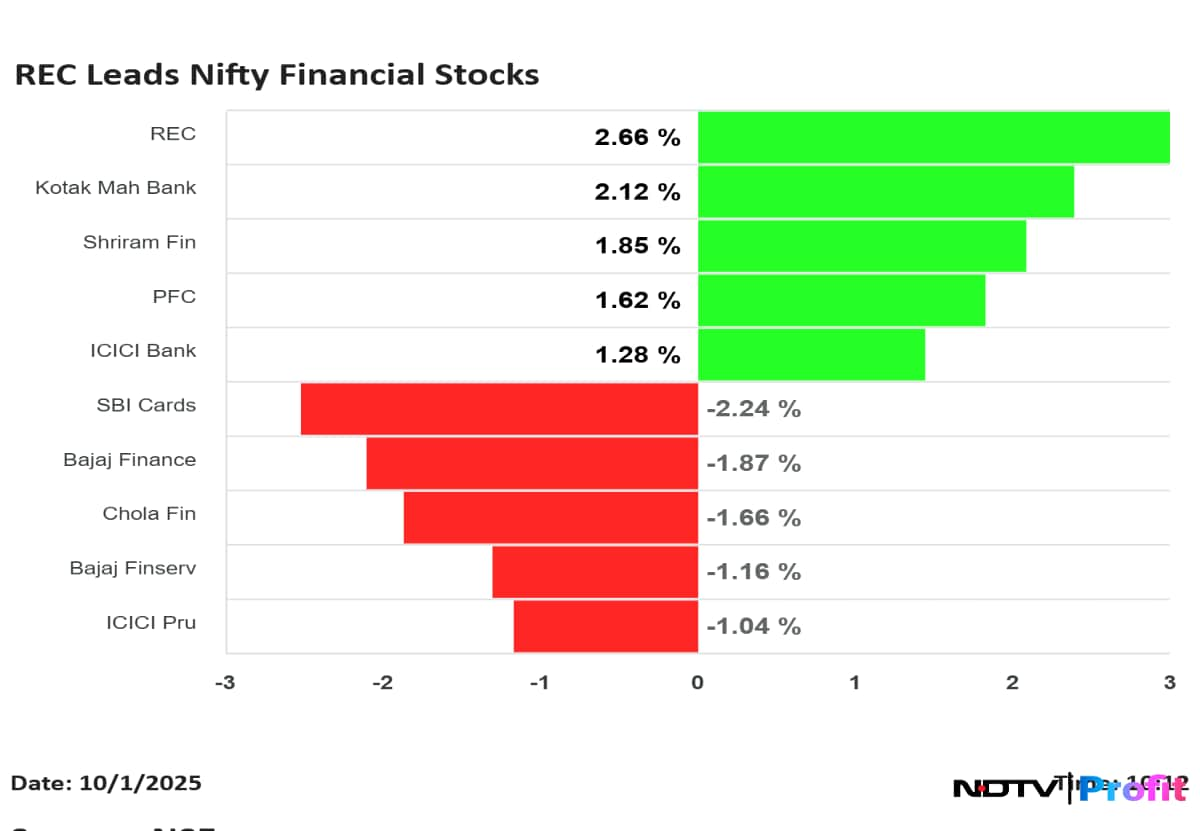

Nifty Financials lead the rally in Nifty

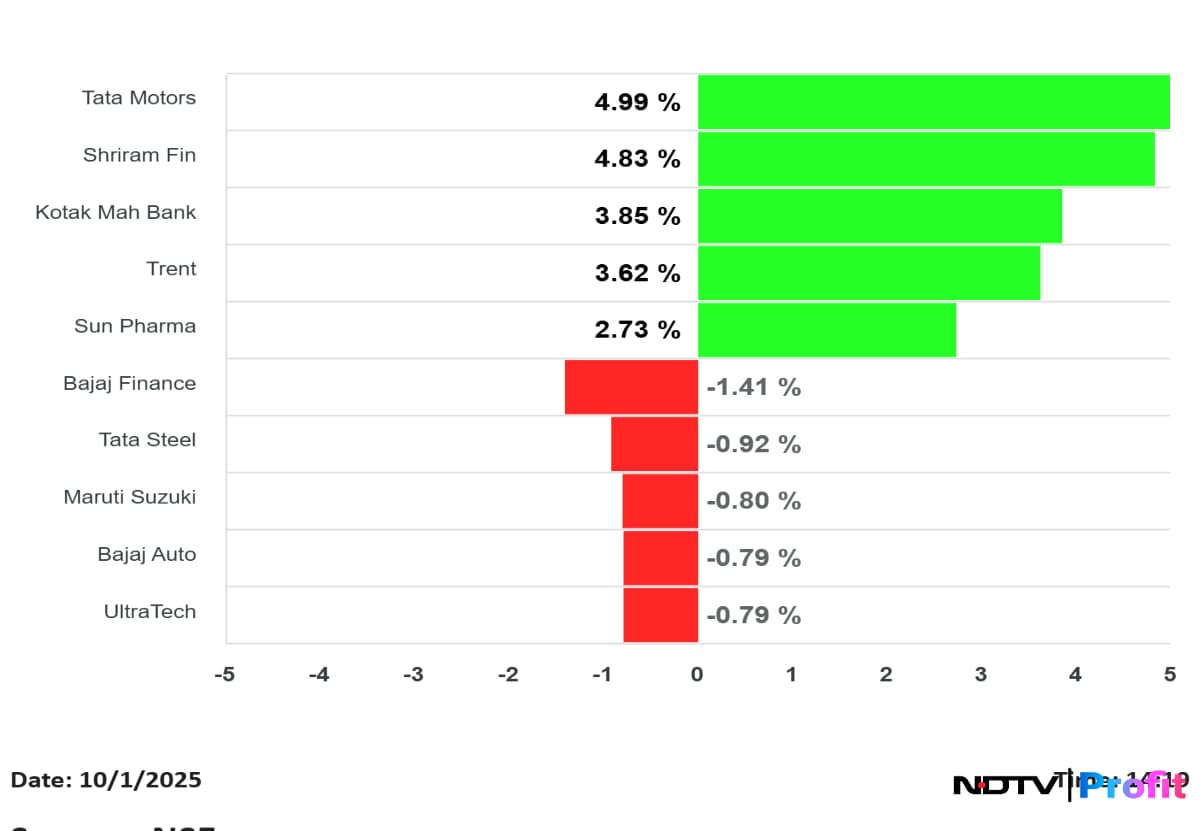

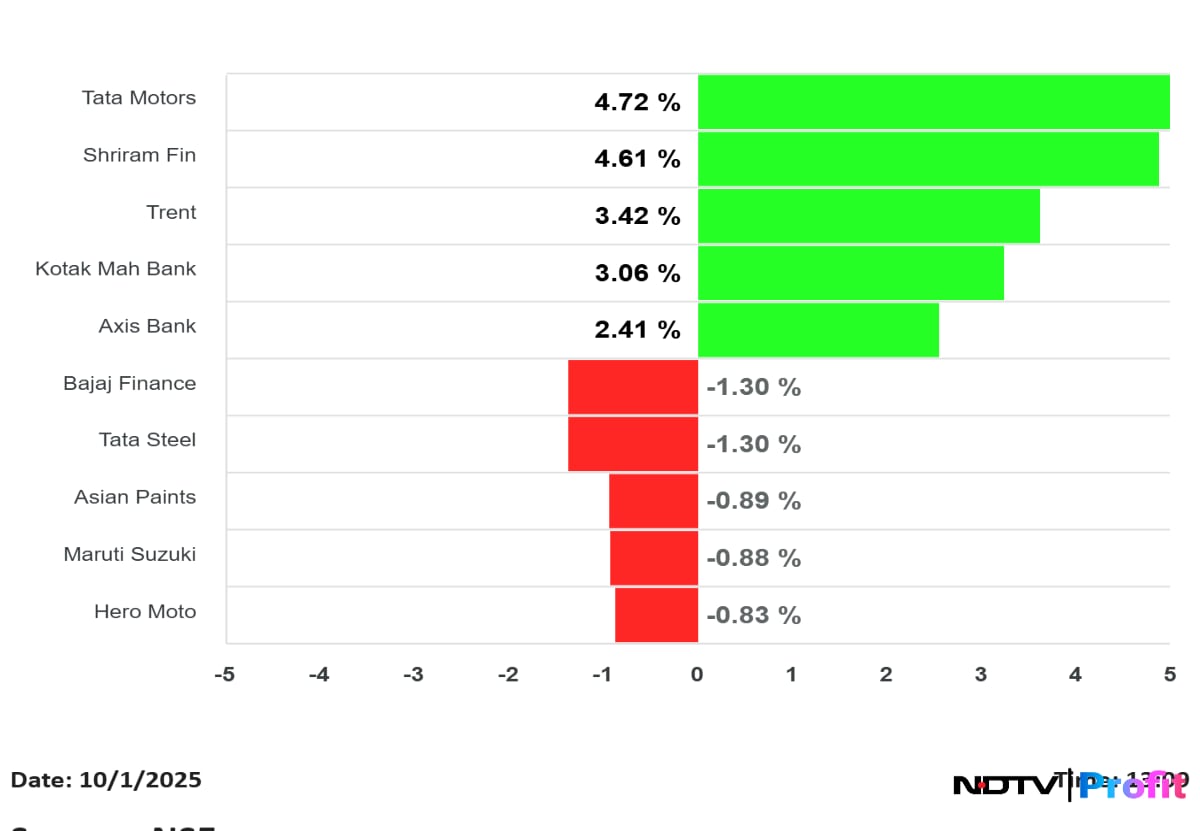

Tata Motors and Shriram Finance gains over 5%, emerges as the top gainers in Nifty

Shriram Finance and Kotak Mahindra Bank gains the most in Nifty Financials

Kotak Mahindra Bank and Axis Bank gain over 2% in trade

Nifty Bank and financials gains as RBI eases key curbs

Benchmarks slightly underperformed broader market indices

Nifty Midcap 150 gains for the 3 consecutive day

Nifty Smallcap 250 gains for the 2 consecutive day

All sectors gain in trade barring Nifty PSU Bank

Nifty Pharma snaps 7-day losing streak; gains over 1.4% for the day

Nifty Metal, Financial Services, Bank gains for the 3 consecutive day

Nifty IT snaps 8-day losing streak

Nifty Media snaps 6-day losing streak.

Nifty trades above 24,800 mark, as RBI keeps Repo Rate unchanged at 5.5%

Nifty snaps 8-day losing streak, closes above 24,800 mark

Nifty Media gains over 3.5% for the day, emerges as the top gaining sector for the day

Nifty Financials lead the rally in Nifty

Tata Motors and Shriram Finance gains over 5%, emerges as the top gainers in Nifty

Shriram Finance and Kotak Mahindra Bank gains the most in Nifty Financials

Kotak Mahindra Bank and Axis Bank gain over 2% in trade

Nifty Bank and financials gains as RBI eases key curbs

Benchmarks slightly underperformed broader market indices

Nifty Midcap 150 gains for the 3 consecutive day

Nifty Smallcap 250 gains for the 2 consecutive day

All sectors gain in trade barring Nifty PSU Bank

Nifty Pharma snaps 7-day losing streak; gains over 1.4% for the day

Nifty Metal, Financial Services, Bank gains for the 3 consecutive day

Nifty IT snaps 8-day losing streak

Nifty Media snaps 6-day losing streak.

In terms of volume buzz, counters that are seeing high volume are Tata Motors, Shariram Finance, ICICI Bank and HDFC Bank ahead of market close.

Ashok Leyland Sales Key Highlights (YoY)

Total Sales up 9% at 18,813 Units

Domestic Sales up 7% at 17,209 Units

Domestic M&HCV Sales up 3% at 10,499 Units

Total LCV Sales up 14% at 7,005 Units

The Reserve Bank of India on Wednesday announced a slew of measures to promote the internationalisation of the rupee. These include allowing foreigners to invest money stored in rupee vostro accounts in corporate bonds.

"We have been making steady progress in the use of Indian Rupee for international trade. Three measures are proposed in this regard," Governor Sanjay Malhotra said on Wednesday.

Nifty 50 as of 2:20 p.m. was trading above 24,800 with Tata Motors, Shriram Finance, Kotak Mahindra Bank and Trent leading gains.

The counters that have slipped into red are Bajaj Finance, Tata Steel, Maruti Suzuki and Bajaj Auto.

Nifty 50 as of 2:20 p.m. was trading above 24,800 with Tata Motors, Shriram Finance, Kotak Mahindra Bank and Trent leading gains.

The counters that have slipped into red are Bajaj Finance, Tata Steel, Maruti Suzuki and Bajaj Auto.

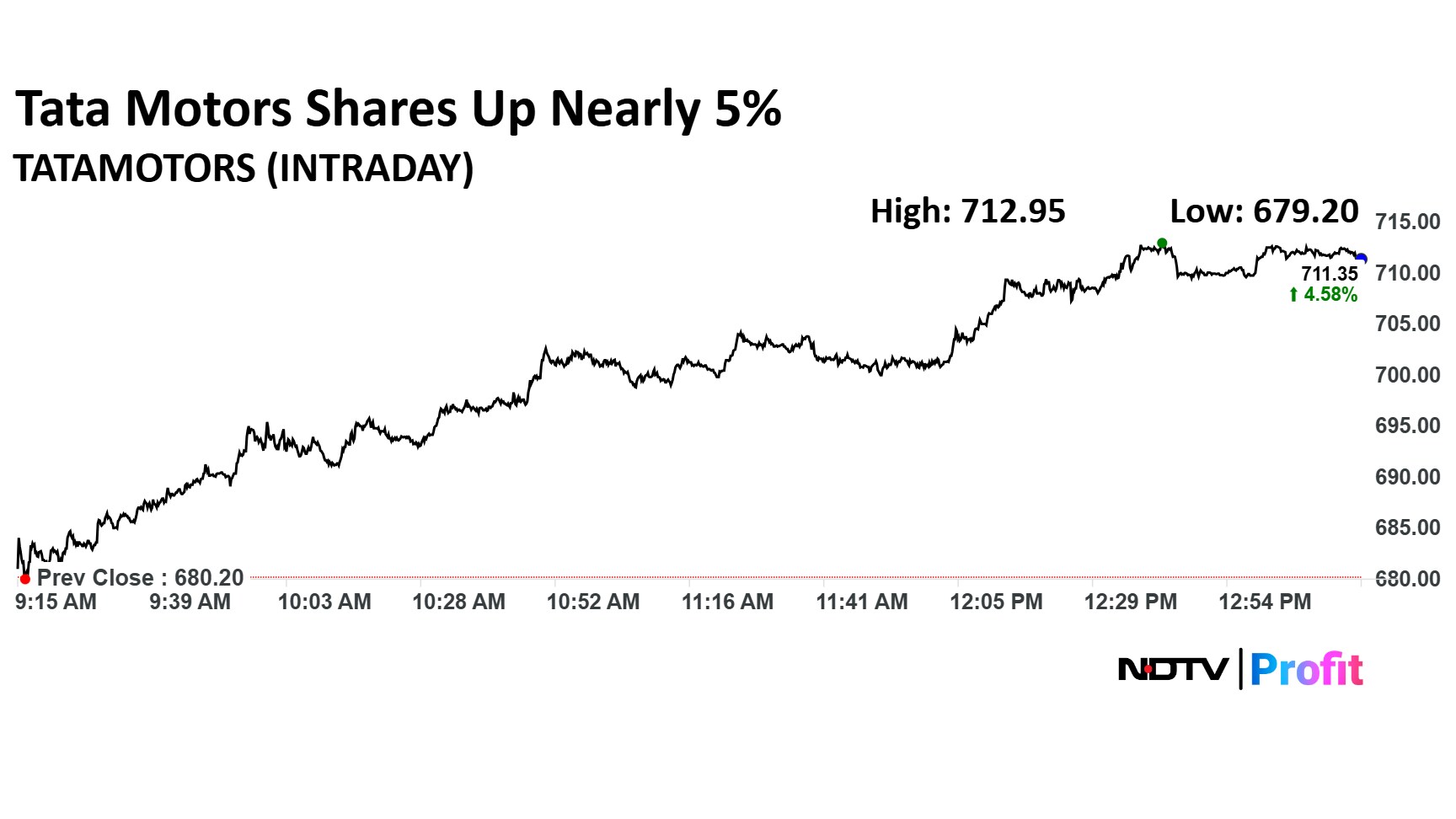

The shares of Tata Motors surged nearly 5% to Rs 712.9 apiece on the NSE during trade so far, after the company set the record date for the the demerger share issue on Oct. 14.

The company is set to allot one share of Tata Motors Ltd., commercial vehicles for every share held in company, according to an exchnage filing on Wednesday.

The shares of Tata Motors surged nearly 5% to Rs 712.9 apiece on the NSE during trade so far, after the company set the record date for the the demerger share issue on Oct. 14.

The company is set to allot one share of Tata Motors Ltd., commercial vehicles for every share held in company, according to an exchnage filing on Wednesday.

The Nifty 50 was trading 0.63% higher over the 24,700 levels at noon. The gains of the index was lead by Tata Motors, Shriram and Finance marking over 4% gains.

The index was held back by counters like Bajaj Finance, Tata Steel, Asian Paints and Maruti Suzuki trading in the red.

The Nifty 50 was trading 0.63% higher over the 24,700 levels at noon. The gains of the index was lead by Tata Motors, Shriram and Finance marking over 4% gains.

The index was held back by counters like Bajaj Finance, Tata Steel, Asian Paints and Maruti Suzuki trading in the red.

The RBI is looking is at the Indonesian Rupiah (IDR), United Arab Emirates Dirham (AED), among others to establish transparent reference rates for currencies of India’s major trading partners to facilitate rupee-based transactions, T Rabi Shankar, part time Member of Sixteenth Finance Commission and RBI Deputy Governor, said.

"The objective is to reduce crossing currencies to get rates. We have to work out ways to set a benchmark reference rate," he said.

Cross currency means a currency pair or transaction that does not involve the US dollar.

After Shriram Finance Ltd., MUFG has also denied any possibility of a stake sale in the company, in what was a direct response to media claims suggesting a 20% equity purchase from MUFG.

“With a view to prevent any misinformation and ensure full transparency, we hereby in good faith wish to clarify that the Company is not aware of any such potential majority stake sale of equity shares of the Company by any shareholder(s)," the company said in an exchange filing.

The Reserve Bank of India's Monetary Policy Committee kept the repo rate unchanged at 5.5% while maintaining a 'neutral' stance. During his speech, the RBI Governor Sanjay Malhotra also announced measures aimed at benefiting non-resident Indians (NRIs) via offering major incentives.

The RBI has introduced a series of measures that will ease cross-border trade and further expand the role of the Indian rupee in global trade. Most notably, the Governor promised to simplify regulations under the Foreign Exchange Management Act (FEMA).

Read more below:

The Reserve Bank of India has announced the proposal of a framework set to enable Indian banks to finance corporate acquisitions, a move that could reshape the landscape of deal-making in India. The announcement came as part of the central bank’s bi-monthly monetary policy statement, delivered by Governor Sanjay Malhotra.

Read the full details below:

Counters that are buzzing in terms of volume are names like Shriram Finance, Tata Motors, ICICI Bank, HDFC Bank, Tata Steel and ONGC.

Shriram Finance is up nearly 5% at Rs 646 apiece in the NSE, compared to the 0.79% advance in the Nifty 50 as of 12:16 p.m. Tata Motors also saw an uptick in trade after the company announced the record date for its demerger. With the stock price rising to over Rs 700.

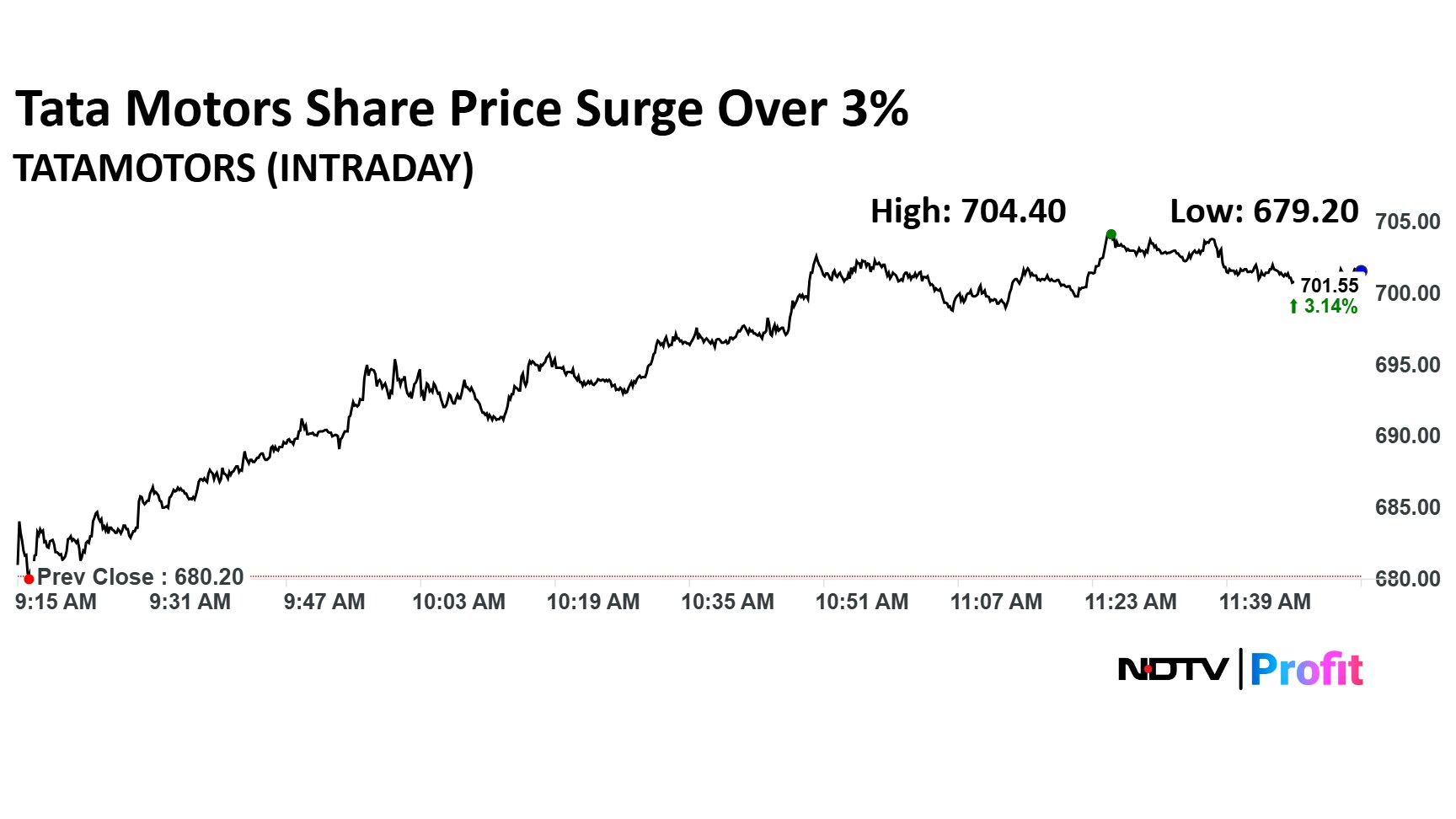

The shares of Tata Motors surged over 3% to Rs 701 apiece on the NSE after the company set the record date for the the demerger share issue on Oct. 14.

The company is set to allot one share of Tata Motors Ltd., commercial vehicles for every share held in company, according to an exchnage filing on Wednesday.

The shares of Tata Motors surged over 3% to Rs 701 apiece on the NSE after the company set the record date for the the demerger share issue on Oct. 14.

The company is set to allot one share of Tata Motors Ltd., commercial vehicles for every share held in company, according to an exchnage filing on Wednesday.

The Reserve Bank of India kept the repo rate unchanged at 5.5% in its latest Monetary Policy Meet. During his speech, RBI Governor Sanjay Malhotra also made a slew of announcements for ease of doing business and this propelled Dalal Street higher.

Reacting to the policy, industry veterans such as Keki Mistry, Dinesh Khara and Lalit Tyagi believe the policy goes well beyond just repo rates, highlighting the central bank's focus on growth.

Read the full story below:

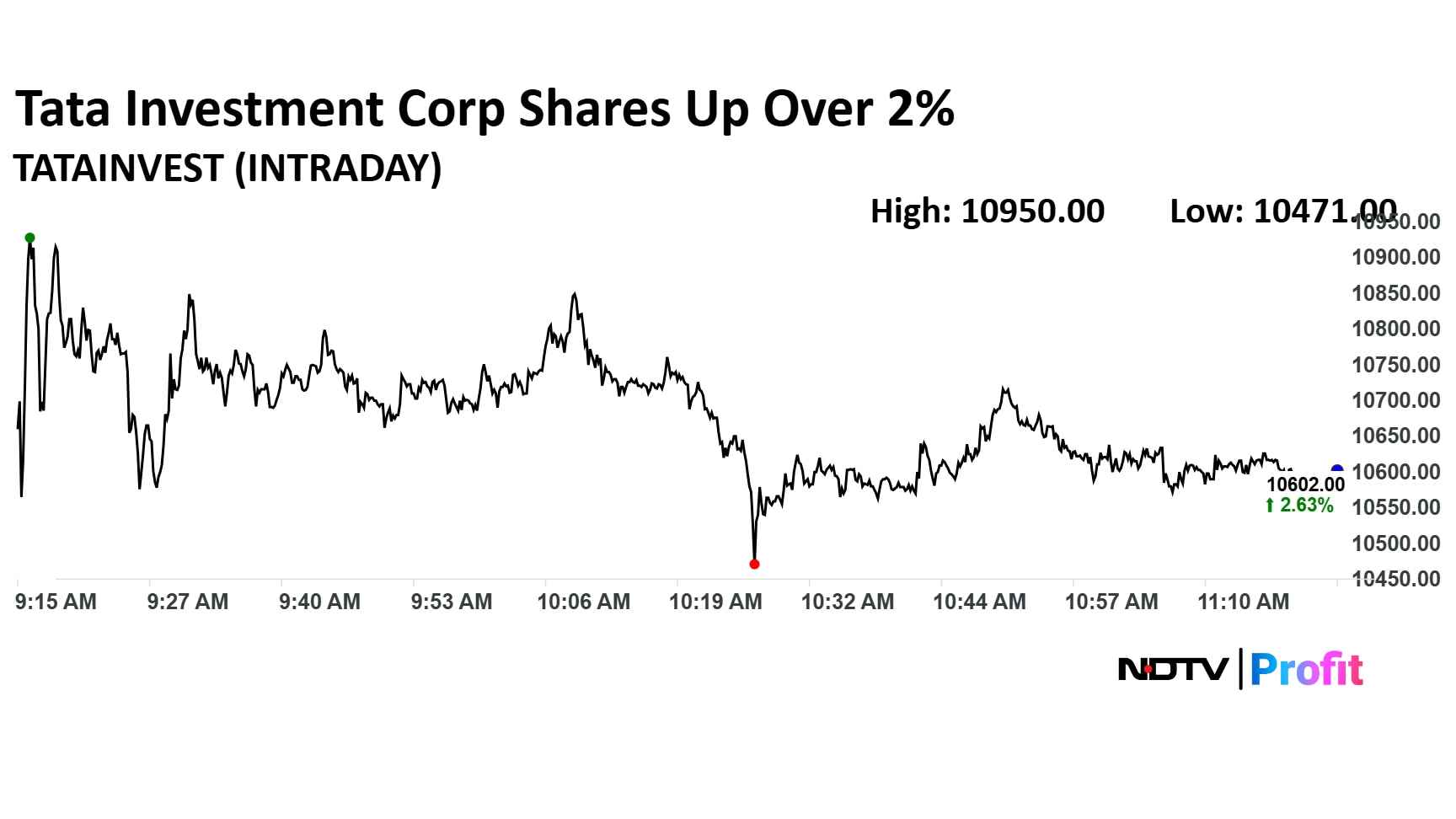

The shares of Tata Investments rose over 2% in trade, extending its winning streak. The scrip had risen over 14% this week.

The shares of Tata Investments rose over 2% in trade, extending its winning streak. The scrip had risen over 14% this week.

In what can be seen as a relief for HDFC Bank and HDB Financial Services Ltd., the Reserve Bank of India has removed the proposed regulatory restriction on business overlaps of bank and its group entities.

Read the full story below:

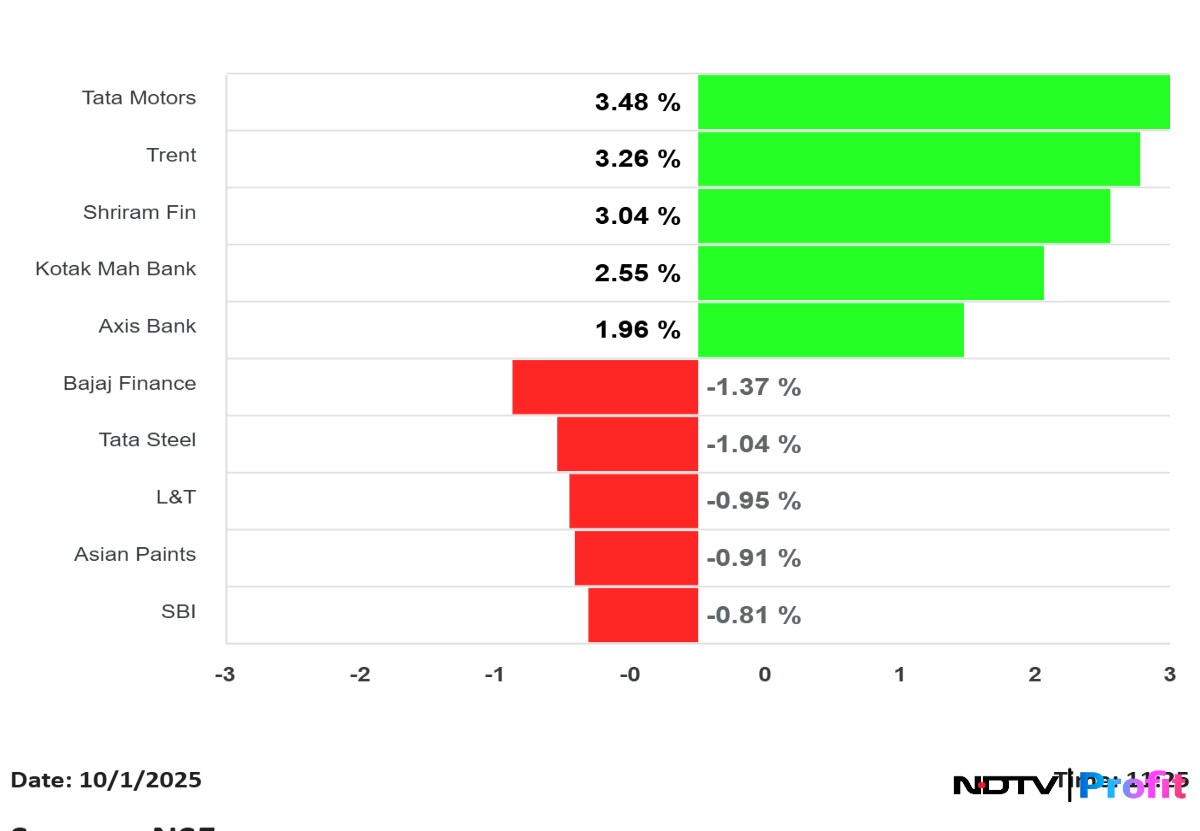

In the Nifty 50, the gains of 0.44% were led by Tata Motors, Trent and Shriram Finance that logged gains of over 3%. Tata Motors was trading 3.37% higher at Rs 702.9 as of 11:28 a.m. While Trent was trading 3.26% higher at Rs 4,830 apiece on the NSE.

Counters trading in the red were Bajaj Finance, Tata Steel and L&T along with SBI.

In the Nifty 50, the gains of 0.44% were led by Tata Motors, Trent and Shriram Finance that logged gains of over 3%. Tata Motors was trading 3.37% higher at Rs 702.9 as of 11:28 a.m. While Trent was trading 3.26% higher at Rs 4,830 apiece on the NSE.

Counters trading in the red were Bajaj Finance, Tata Steel and L&T along with SBI.

Auto companies including Bajaj Auto Ltd., Maruti Suzuki India Ltd., Hyundai Motor India Ltd., Tata Motors Ltd., Mahindra & Mahindra Ltd., Ola Electric Mobility Ltd., TVS Motor Company Ltd. among other companies will report their September auto sales data on Wednesday.

Catch all the real-time updates and auto sales numbers below:

The Reserve Bank of India's Monetary Policy Committee, led by RBI Governor Sanjay Malhotra, retained the benchmark repo rate at 5.5%, after front-loading the three rate cuts in February, April and June this year. However, the RBI revised the CPI inflation forecast downward while revising the GDP growth forecast upward.

Space for monetary action has opened up, Malhotra said, adding that the MPC considers it prudent to wait before beginning to cut rates further.

Read the full highlights below:

The shares of HDFC Bank rose over 1% in the day so far to Rs 961.4. The scrip was trading 0.98% higher at Rs 960 apiece on the NSE, while these gains compare a to 0.31% advance in the Nifty 50 as of 11:04 a.m.

The shares of HDFC Bank rose over 1% in the day so far to Rs 961.4. The scrip was trading 0.98% higher at Rs 960 apiece on the NSE, while these gains compare a to 0.31% advance in the Nifty 50 as of 11:04 a.m.

The government has kept the interest rates for all small savings schemes unchanged for the October to December 2025 quarter. This means that investors will continue to earn the same interest rates on schemes like the Public Provident Fund (PPF), Senior Citizens Savings Scheme (SCSS), National Savings Certificate (NSC), Kisan Vikas Patra (KVP) and Sukanya Samriddhi Yojana (SSY), among others.

As per the latest notification, the government has maintained the interest rates for key savings instruments, with the Public Provident Fund (PPF) offering 7.1%, while the National Savings Certificate yields 7.7%. Both the Senior Citizen Savings Scheme (SCSS) and Sukanya Samriddhi Yojana (SSY) deliver 8.2% returns. These small savings schemes are commonly referred to as post office schemes.

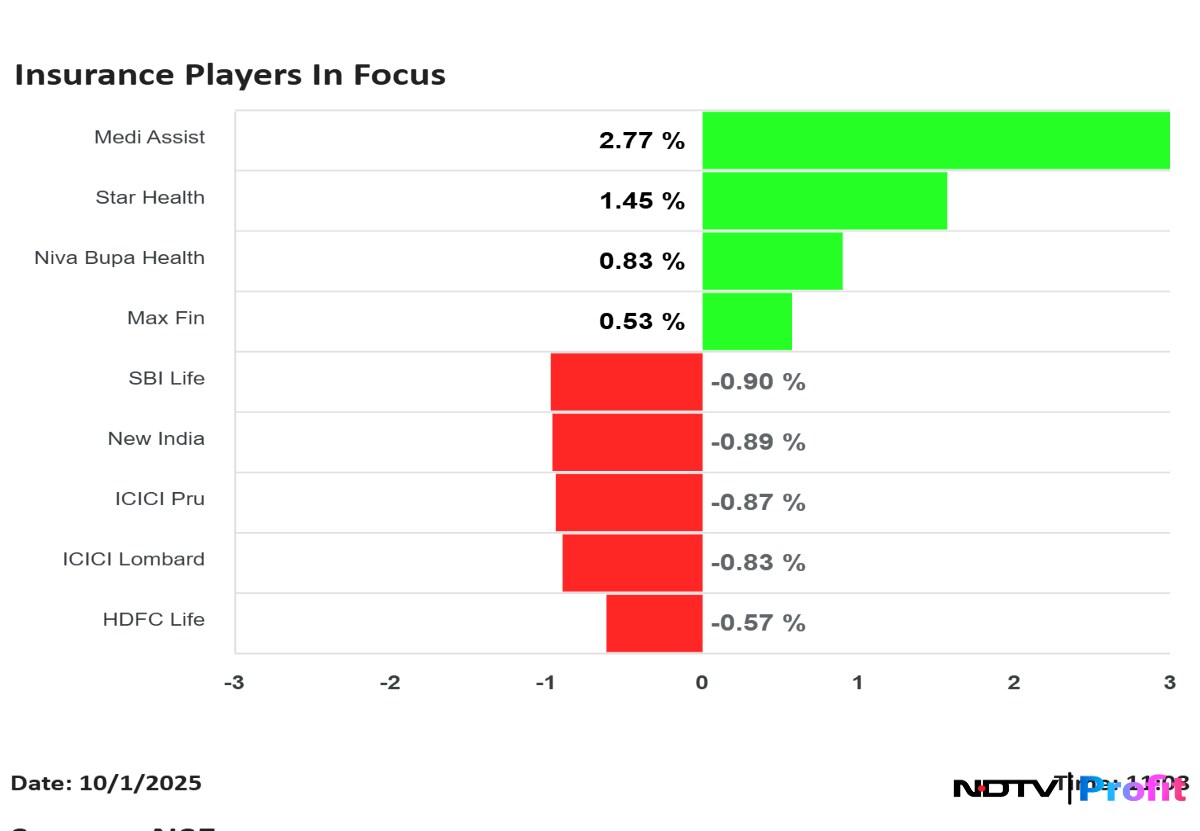

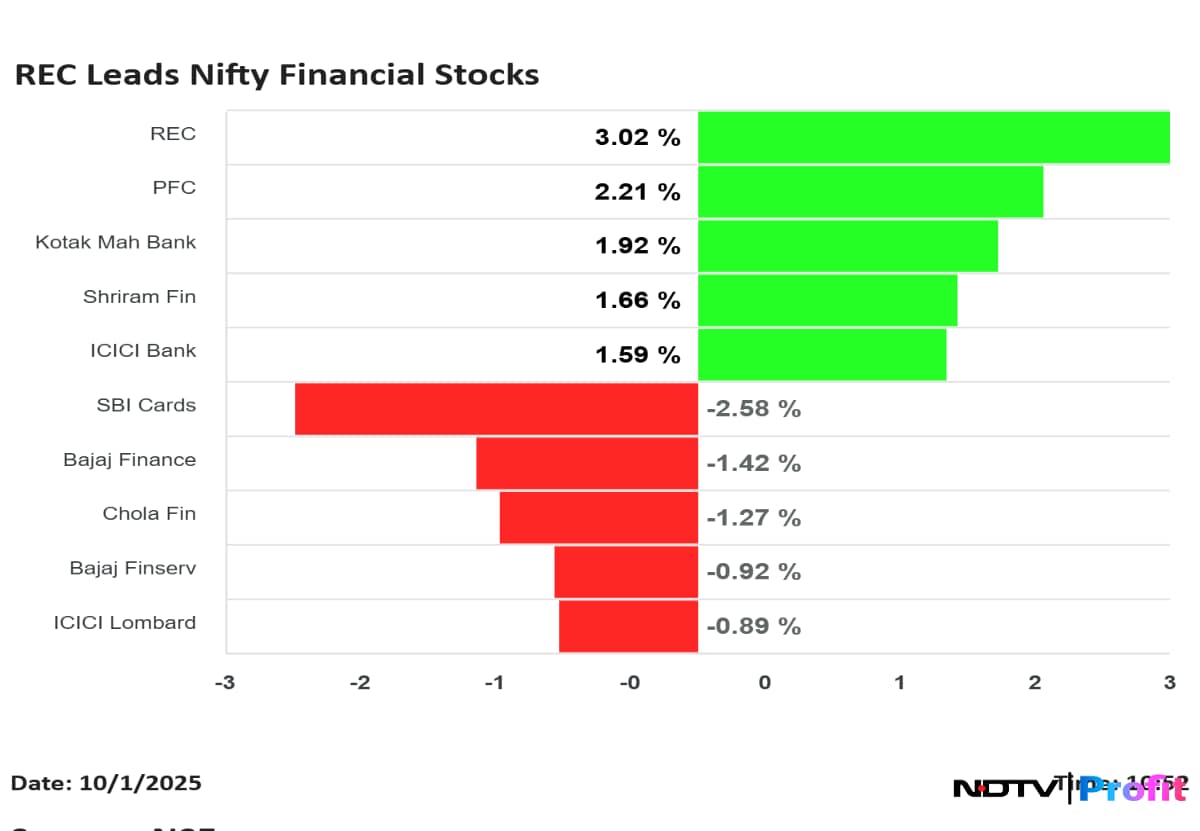

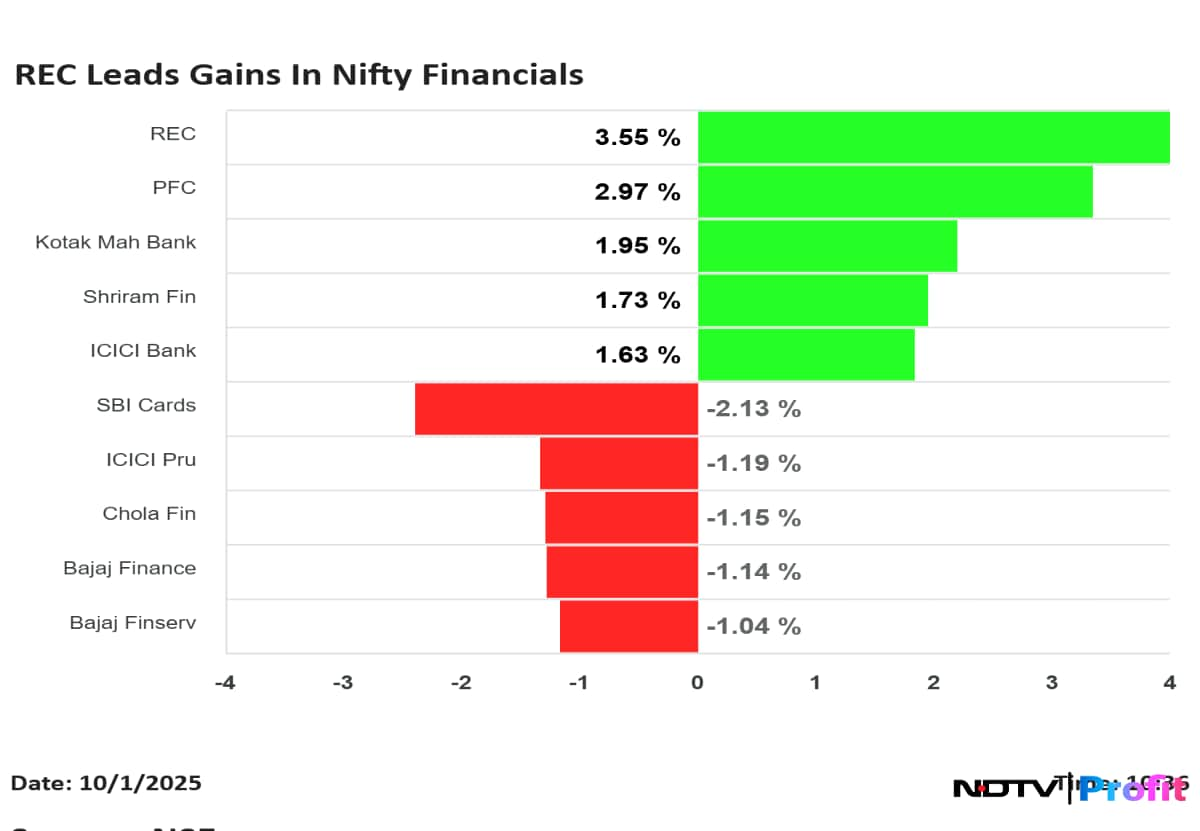

Nifty Finacials were trading in green with insurance players like REC, PFC leading the pack on the back of Malhotra's proposal during the MPC meet.

He said that the Central Bank is set to introduce risk based insurance premiums to incentive risk for banks.

Nifty Finacials were trading in green with insurance players like REC, PFC leading the pack on the back of Malhotra's proposal during the MPC meet.

He said that the Central Bank is set to introduce risk based insurance premiums to incentive risk for banks.

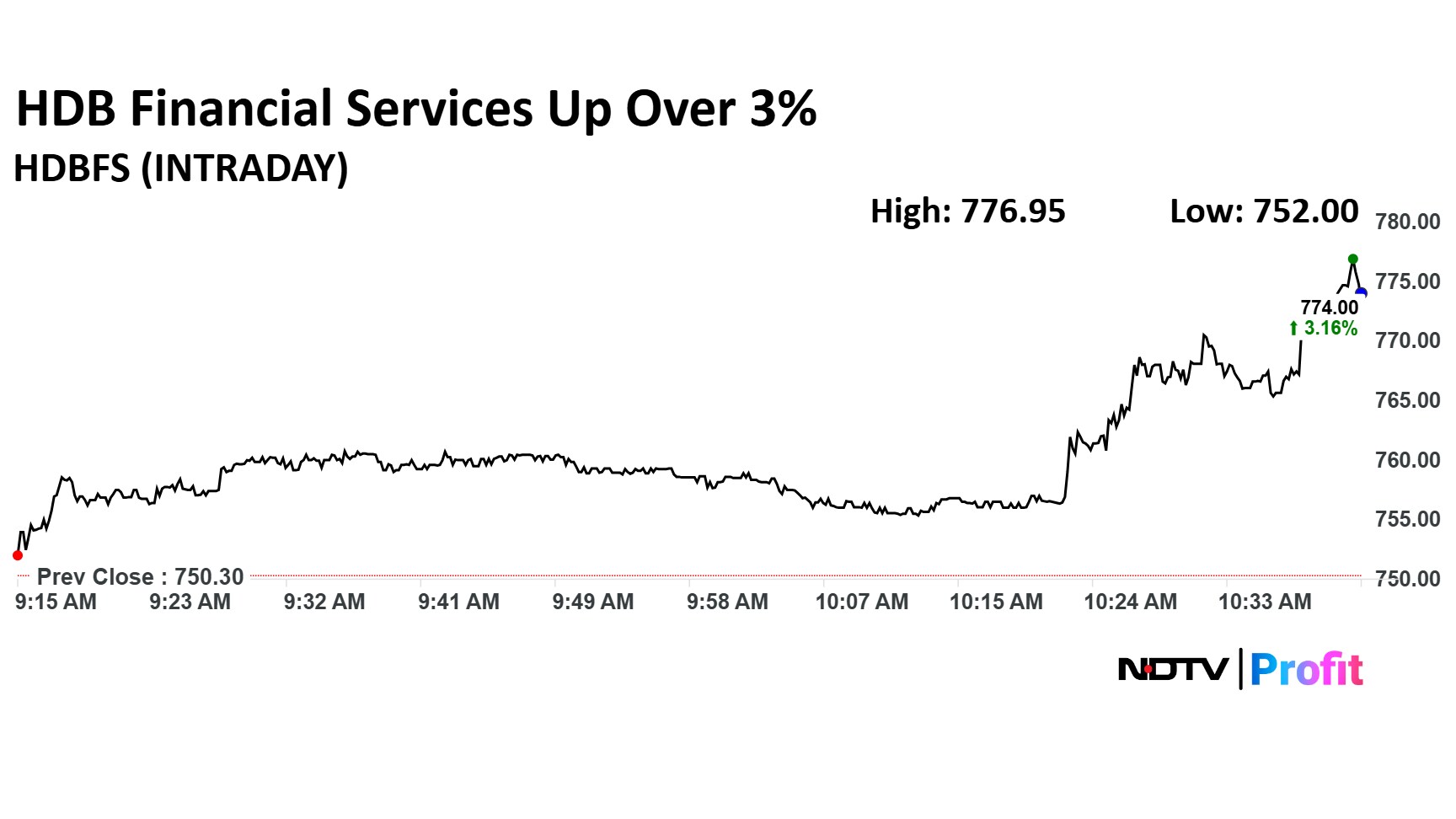

The shares of HDB Finacials Services surged nearly 4% after the RBI maintained the repo rate and kept the stance unchanged at neutral.

The shares of the scrip was trading 3.20% higehr at Rs 775.3 compared to the Nifty 50 trading 0.17% higher.

The shares of HDB Finacials Services surged nearly 4% after the RBI maintained the repo rate and kept the stance unchanged at neutral.

The shares of the scrip was trading 3.20% higehr at Rs 775.3 compared to the Nifty 50 trading 0.17% higher.

Names like REC, PFC, Kotak Mahindra Bank were trading in the gree. While counters like SBI Cards, ICICI Pru and Chola Finance were trading in the red.

Names like REC, PFC, Kotak Mahindra Bank were trading in the gree. While counters like SBI Cards, ICICI Pru and Chola Finance were trading in the red.

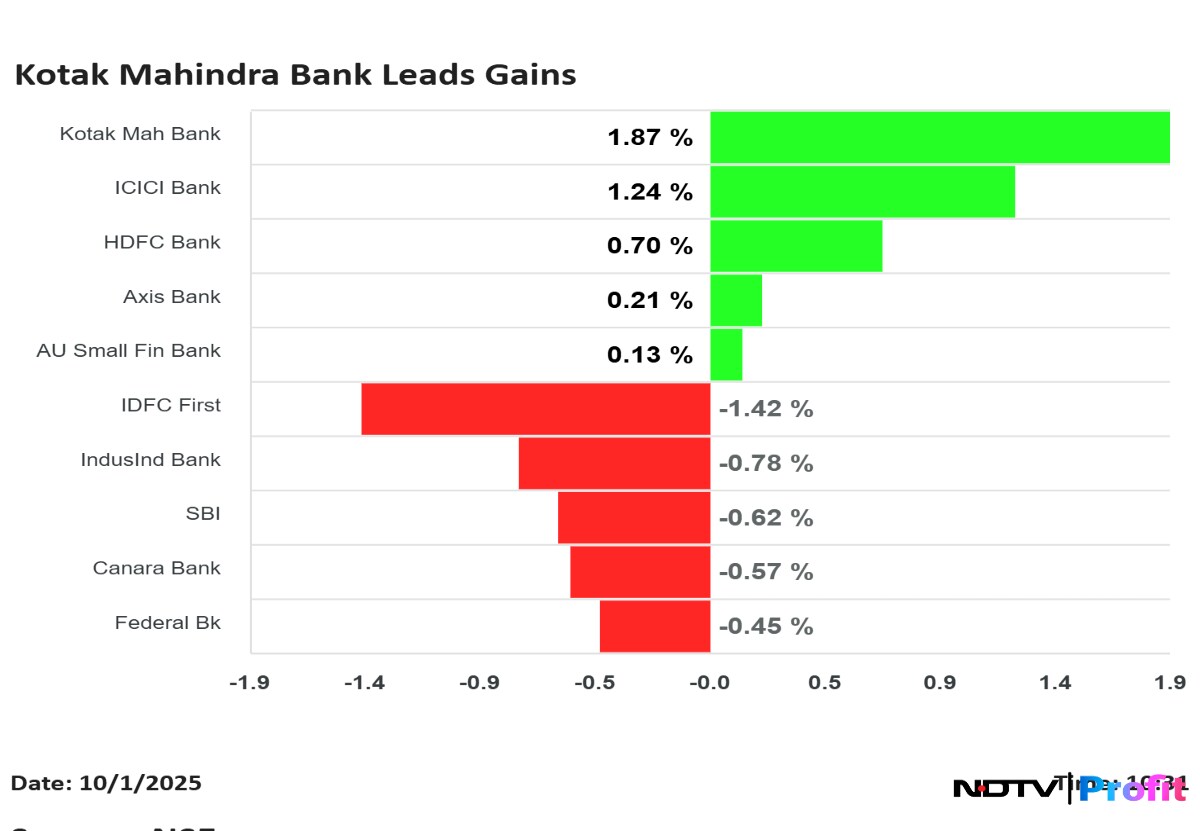

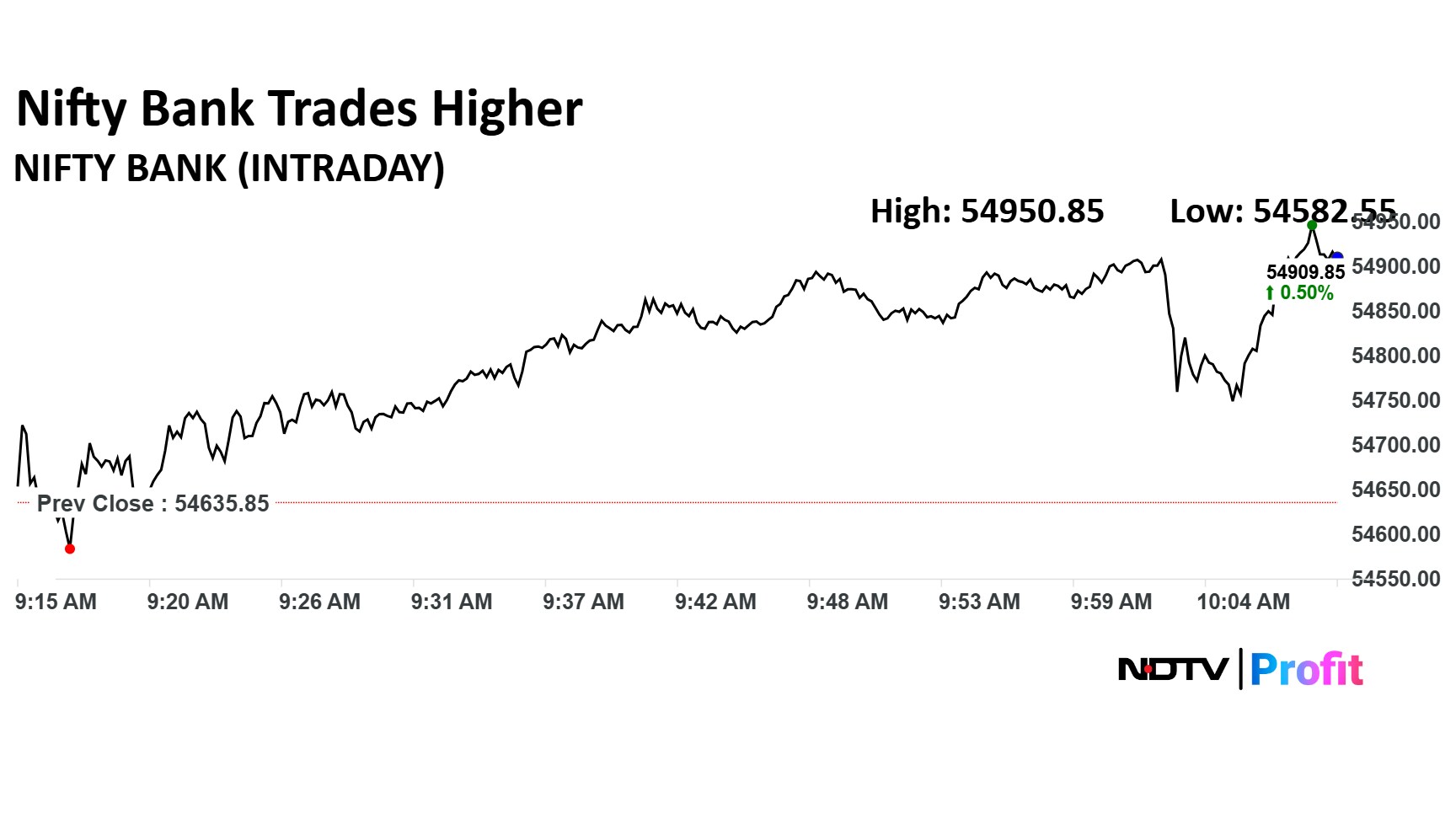

In the Nifty Bank pack, the gains were led by Kotak Mahindra Bank, as of 10:32 a.m. The bank marked nearly 2% gains followed by ICICI Bank and HDFC Bank.

Names like IDFC Bank, IndusInd Bank dragged the index, marking the deepest losses of the lot.

In the Nifty Bank pack, the gains were led by Kotak Mahindra Bank, as of 10:32 a.m. The bank marked nearly 2% gains followed by ICICI Bank and HDFC Bank.

Names like IDFC Bank, IndusInd Bank dragged the index, marking the deepest losses of the lot.

The RBI Governor said that the bank credit growth continues to be healthy despite lower from last year. He further proposed to introduce risk based insurance premiums to incentive risk for banks

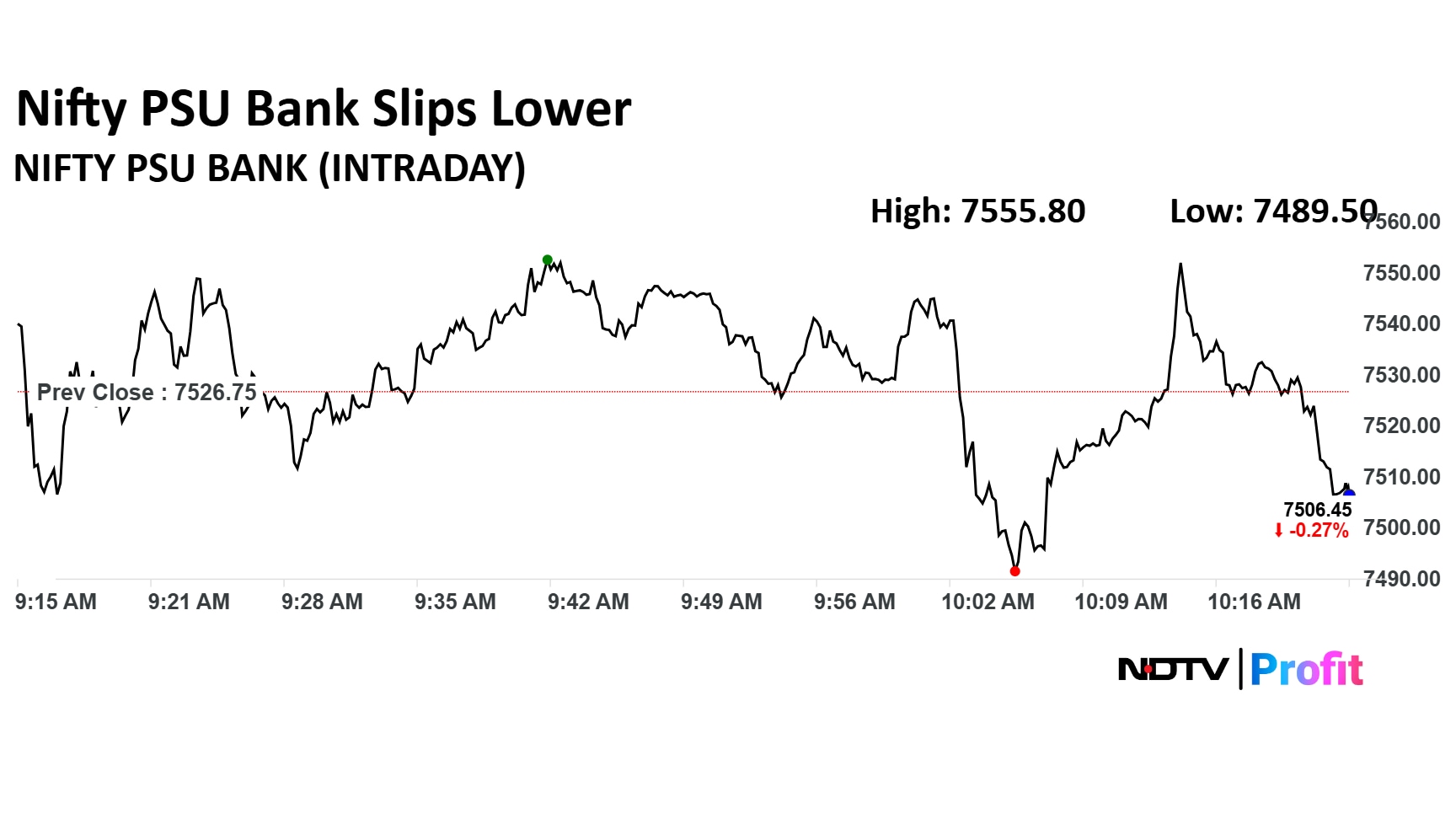

Nifty PSU Banks continued to trade in the red, declining less than 1%, the index underperformed the borader markets. The Nifty 50 was trading 0.19% higher as of 10:26 a.m.

Nifty PSU Banks continued to trade in the red, declining less than 1%, the index underperformed the borader markets. The Nifty 50 was trading 0.19% higher as of 10:26 a.m.

Policy Repo Rate: 5.50%

Standing Deposit Facility Rate: 5.25%

Marginal Standing Facility Rate: 5.75%

Bank Rate: 5.75%

The RBI Governor, Sanjay Malhotra said that the rupee has witnessed depreciation but the RBI is keeping a close on the volatility of rupee

"Money market trades remain stable. The moderation of outstanding loans is 0.55 basis points," he said.

The yield on the 10-year bond remains flat at 6.56%

Source: Bloomberg

Rupee at 88.76 after RBI MPC maintains the repo rate and neutral stance.

Rupee opened 2 paise stronger at 88.77 against the US Dollar.

It closed at 88.79 on Wednesday.

Source: Bloomberg

The names in financials continued to trade in the green with names like REC, Kotak Mahindra Bank, Shriram Finance leading the pack.

The names in financials continued to trade in the green with names like REC, Kotak Mahindra Bank, Shriram Finance leading the pack.

Nifty Bank traded nearly 1% higher after the RBI MPC announced that the repo rates will remain unchanged and their stance will be retained at neutral.

Nifty Bank traded nearly 1% higher after the RBI MPC announced that the repo rates will remain unchanged and their stance will be retained at neutral.

The Nifty 50 and Sensex holds its positive levels as the RBI Governor maintained the repo rates at 5.5% and retained its neutral stance.

The Nifty 50 and Sensex holds its positive levels as the RBI Governor maintained the repo rates at 5.5% and retained its neutral stance.

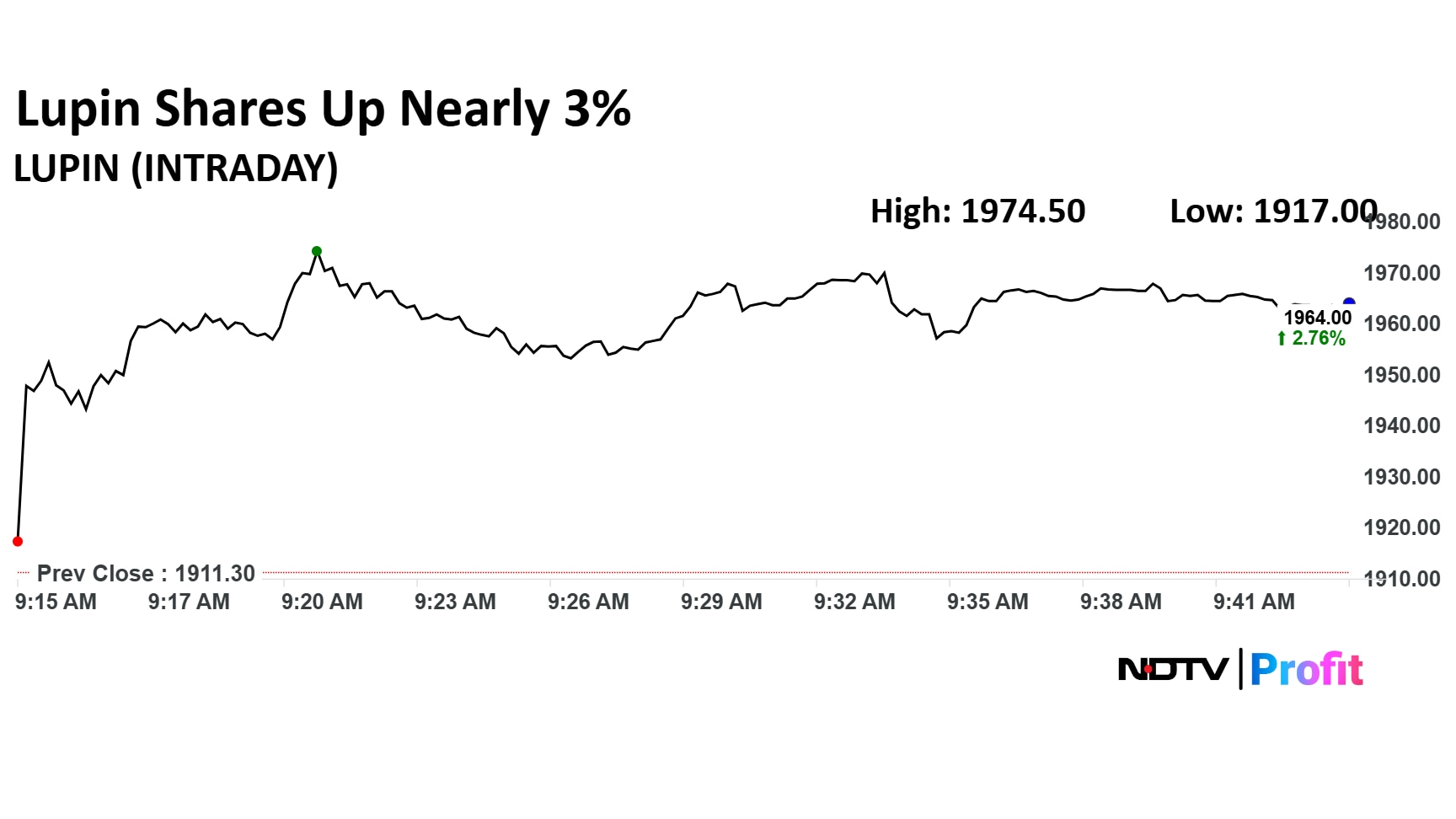

Despite US President Trump's 100% tariff coming into effect today, the pharma stocks are trading in the green with Lupin leading the gains.

Lupin is trading over 3% higher at Rs 1,917 apiece on the NSE, outperforming the Nifty 50. The benchmark index is trading 0.33% higher as of 9:50 a.m.

Despite US President Trump's 100% tariff coming into effect today, the pharma stocks are trading in the green with Lupin leading the gains.

Lupin is trading over 3% higher at Rs 1,917 apiece on the NSE, outperforming the Nifty 50. The benchmark index is trading 0.33% higher as of 9:50 a.m.

As the Reserve Bank of India’s Monetary Policy Committee (MPC) concludes its meeting today, and the broad expectation is that the central bank will keep the repo rate unchanged for the second consecutive time. RBI Governor Sanjay Malhotra will announce the committe'd decision at 10 am.

Catch all the live updates below:

The much-awaited demerger of Tata Motors is effective Wednesday, Oct. 1, with the auto giant set to split its commercial and passenger vehicle businesses.

The current entity, which is Tata Motors Ltd. will become the company's passenger vehicle arm, which will also house the company's electric vehicle operations and the Jaguar Land Rover business. It will be renamed Tata Motors Passenger Vehicles Ltd.

Read the full story below:

Nifty Pharma is in focus today as Trump's 100% tariff will take effect. The index was trading over 1% higher. Most of the names like Lupin and Sun Phrama were trading with over 2% gains.

Names like Granules India, Laurus Labs and Auro Pharma were also trading in the the green.

Nifty Pharma is in focus today as Trump's 100% tariff will take effect. The index was trading over 1% higher. Most of the names like Lupin and Sun Phrama were trading with over 2% gains.

Names like Granules India, Laurus Labs and Auro Pharma were also trading in the the green.

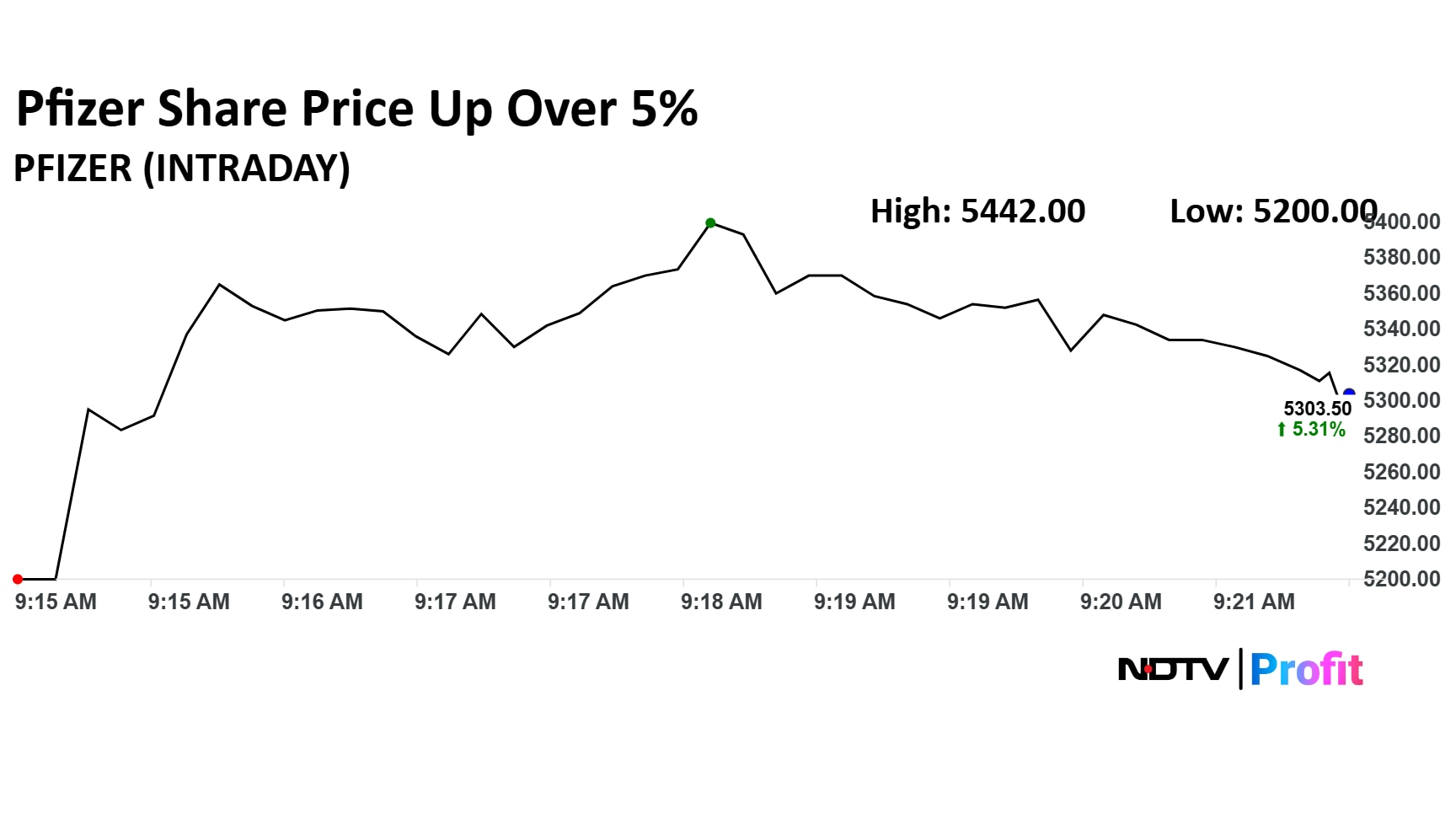

The shares of Pfizer rose over 5% during early trade on Wednesday to Rs 5,316 apiece on the NSE. These gains compare to a 0.10% advance in the Nifty 50 as of 9:24 a.m.

This surge in share price comes after Pfizer Inc., the US parent has secured a three-year reprieve from the tariffs on pharmaceutical imports imposed by US President Donald Trump.

The shares of Pfizer rose over 5% during early trade on Wednesday to Rs 5,316 apiece on the NSE. These gains compare to a 0.10% advance in the Nifty 50 as of 9:24 a.m.

This surge in share price comes after Pfizer Inc., the US parent has secured a three-year reprieve from the tariffs on pharmaceutical imports imposed by US President Donald Trump.

The Indian equity markets saw a mixed and tepid start ahead of the RBI's MPC meeting. The Nifty 50 opened above the 24,600 mark while Sensex saw a muted start.

Most of the sectoral indexes opened in the green with Nifty Pharma leading gains. Investors will be tracking Nifty Bank as the MPC decision is announced and the index has opened in red.

The Indian equity markets saw a mixed and tepid start ahead of the RBI's MPC meeting. The Nifty 50 opened above the 24,600 mark while Sensex saw a muted start.

Most of the sectoral indexes opened in the green with Nifty Pharma leading gains. Investors will be tracking Nifty Bank as the MPC decision is announced and the index has opened in red.

The yield on the 10-year bond opened flat at 6.56%

Source: Bloomberg

Rupee opened 2 paise stronger at 88.77 against the US Dollar.

It closed at 88.79 on Wednesday.

Source: Bloomberg

Shriram Finance Ltd. on Tuesday denied any possibility of a stake sale in the company, in what was a direct response to media claims suggesting a 20% equity purchase from MUFG.

“With a view to prevent any misinformation and ensure full transparency, we hereby in good faith wish to clarify that the Company is not aware of any such potential majority stake sale of equity shares of the Company by any shareholder(s)," the company said in an exchange filing.

CLSA has maintained its 'outperform' rating on Godrej Properties Ltd., raising its price target to Rs 2,850 from Rs 2,770, citing closing on a strong quarter and strong growth with improving cash flows and margin.

The brokerage believes that, the low profitability overhang is getting addressed with improving cash flows and thus margin outlook.

CLSA noted, GPL's stock trades at a EV/ cash Ebitda of 8.4 times, compared to 12-18 times for Oberoi and Lodha, which the brokerage believes is unwarranted.

Read the full story below:

Nifty October Futures down by 0.09% to 24,778 at a premium of 167 points.

Nifty October futures open interest up by 22%

Nifty Options 7 October Expiry: Maximum Call open interest at 25,000 and Maximum Put open interest at 24600

Securities in Ban Period: Sammaan Cap

Nifty October Futures down by 0.09% to 24,778 at a premium of 167 points.

Nifty October futures open interest up by 22%

Nifty Options 7 October Expiry: Maximum Call open interest at 25,000 and Maximum Put open interest at 24600

Securities in Ban Period: Sammaan Cap

Gold prices today were trading at a new high of levels above the Rs 1,17,000 mark, ahead of the Reserve Bank of India's MPC.

The Central Bank is broadly expected to maintain the status and gold ahead of the decision has prices surged to a fresh high of Rs 1,17,350 per 10 gm, according to the India Bullion Co. The price surged by nearly Rs 1,000 compared to Rs 1,16,410 on Tuesday.

Read full story to check rates across India:

West Texas Intermediate crude fell 0.14% to $62.46 per barrel.

Spot gold was up 0.16% to $3,865 an ounce.

Overnight in the U.S., major indices eked out gains despite looming political risk. The Dow Jones rose about 0.2% to close at a record high, while the S&P 500 added roughly 0.4% and the Nasdaq Composite gained around 0.3%.

The mood was bolstered by easing fears of a damaging government shutdown.

Today, all eyes will be on the Reserve Bank of India's Monetary Policy Committee as it is expected to retain the benchmark lending rate at 5.5%.

The Central Bank is set to announce its decision today. There are also expectations of further rate cuts down the line. Out of the 37 economists polled by Bloomberg, 11 expect a status quo, while the rest expect a 25 basis point cut. The repo rate is currently at 5.5%.

Good morning! Welcome to NDTV Profit's live coverage of the Indian equity markets. Here we bring you real-time updates, sharp analyst insights, top stock picks, and all the market-moving news you need. Stay tuned and stay ahead of the curve.

The GIFT Nifty was trading near 24,600 early Wednesday. The futures contract based on the benchmark Nifty 50 fell 0.31% at 24,611 as of 6:24 a.m. indicating a negative start for the Indian markets. The Nifty had ended in red for the eighth consecutive session on Tuesday, largely unchanged, after a volatile and choppy trade driven by monthly F&O expiry.

At the close, the Sensex slipped 97.32 points, or 0.12%, to 80,267.62, while the Nifty fell 23.80 points, or 0.10%, to 24,611.10. The Nifty rose as much as 0.39% during the day to 24,731.80, while the Sensex was also up 0.39% to 80,201.15.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.