India's benchmark Nifty and Sensex ended higher for the day and the extended week on Friday, swimming through the Union Budget, India-US trade deal, Anthropic AI shock to IT and Reserve Bank of India repo rate policy.

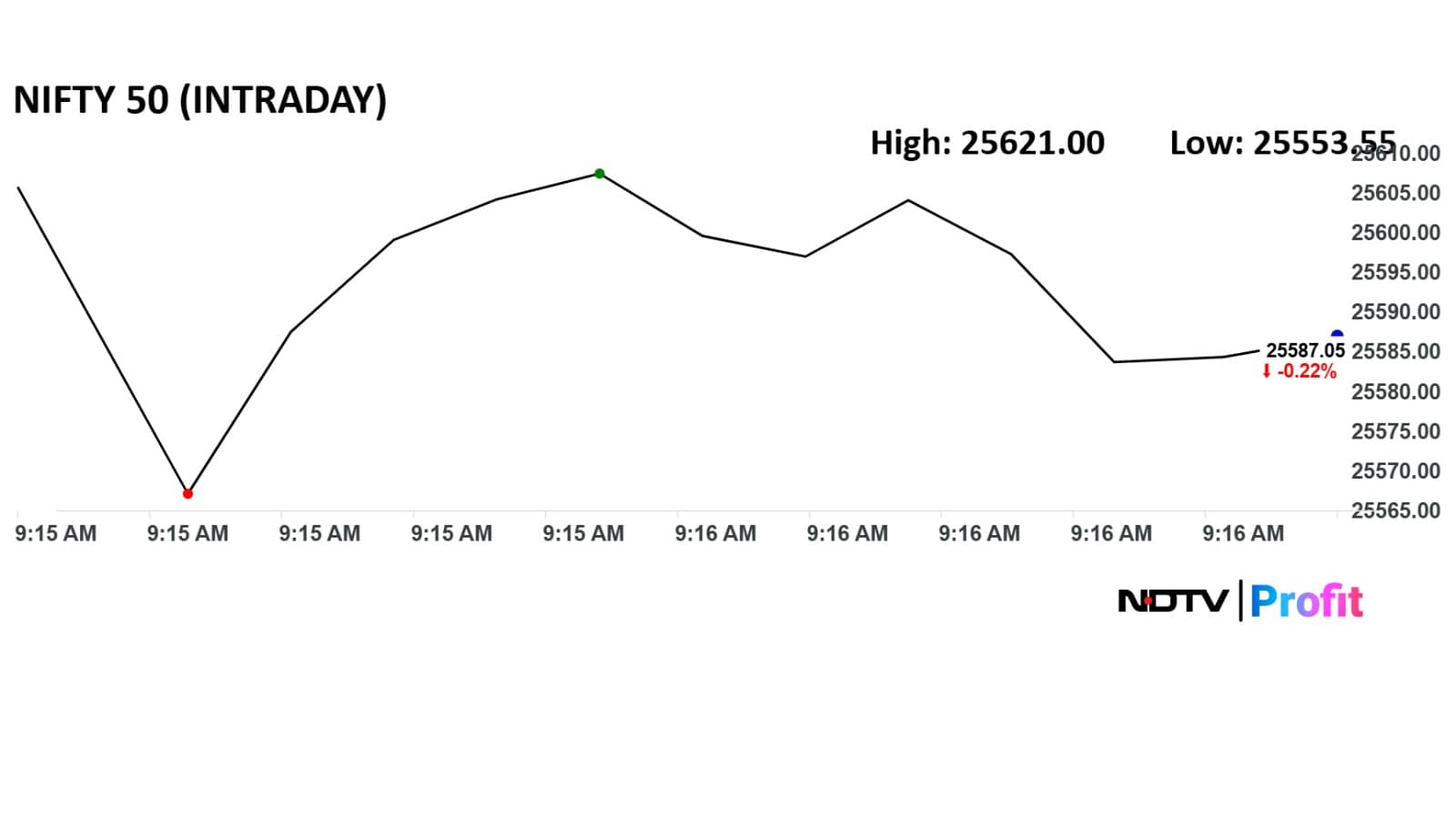

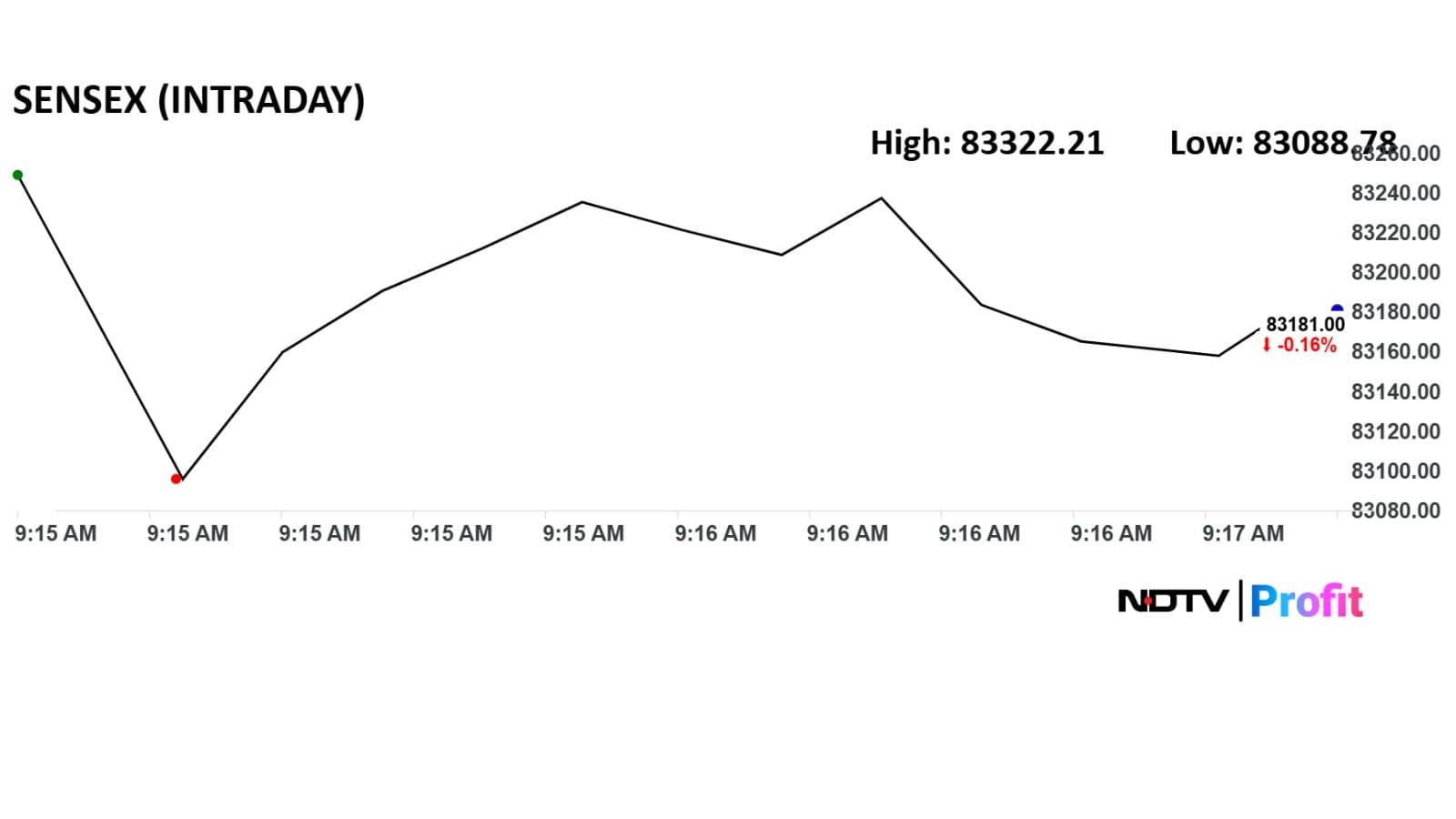

The Nifty ended 31 points or 0.1% higher at 25,674 while the BSE Sensex added 266 points or 0.3% to close at 83,580.

The rupee weakened 31 paise to settle at 90.66 per dollar. The decline was the sharpest in 10 days.

India's benchmark Nifty and Sensex ended higher for the day and the extended week on Friday, swimming through the Union Budget, India-US trade deal, Anthropic AI shock to IT and Reserve Bank of India repo rate policy.

The Nifty ended 31 points or 0.1% higher at 25,674 while the BSE Sensex added 266 points or 0.3% to close at 83,580.

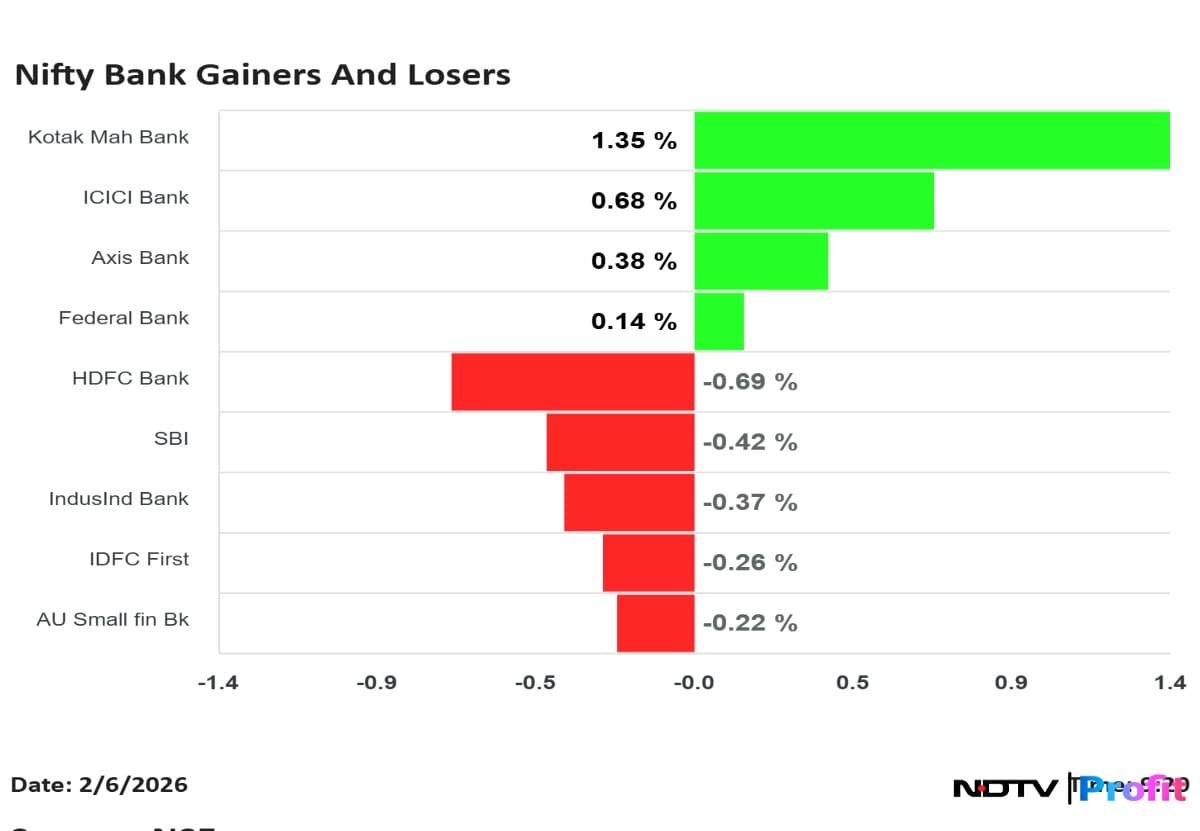

Broader markets underperformed the benchmark, with the Nifty Midcap 150 ending flat and the Nifty Smallcap 250 closing 0.29% lower. Among frontline stocks, ITC and Kotak Bank were the top gainers on the Nifty, lending support to the index.

The company's Saudi Arabia arm's JV bid was accepted by Diriyah Co. The bid price for construction project is SAR 717 Million.

Source: Exchange Filing

Cigarette stocks rose sharply in the trade after brokerage firm Nuvama noted that the tobacco firms are planning a price hike. The research firm said that the sector may have moved past the worst phase, with volumes next year not expected to post a double-digit decline.

The companies may roll out two to three staggered price increases in the next few months to offset the tax impact, Nuvama said in a note, adding that the tax hikes are unlikely to be withdrawn and it does not expect any significant tax increases in the next two years, which it said improves medium- to long-term visibility.

It also said some investors are looking beyond IT, citing AI disruption concerns, and are shifting to other defensives where valuations look more acceptable.

Here's what Nuvama had to say:

ITC

Godfrey Phillips

M&M said it will set up an auto and tractor manufacturing unit in Maharashtra, according to its exchange filing. The automaker said it will invest Rs 15,000 crore in a Nagpur manufacturing facility, adding that the production facility will start in 2028.

MRF (Q3, YoY)

Jubilant Pharmova (Q3, consolidated, YoY)

Ganesh Housing (Q3, consolidated, YoY)

Tarsons Products (Q3, consolidated, YoY)

BofA on RBI Policy

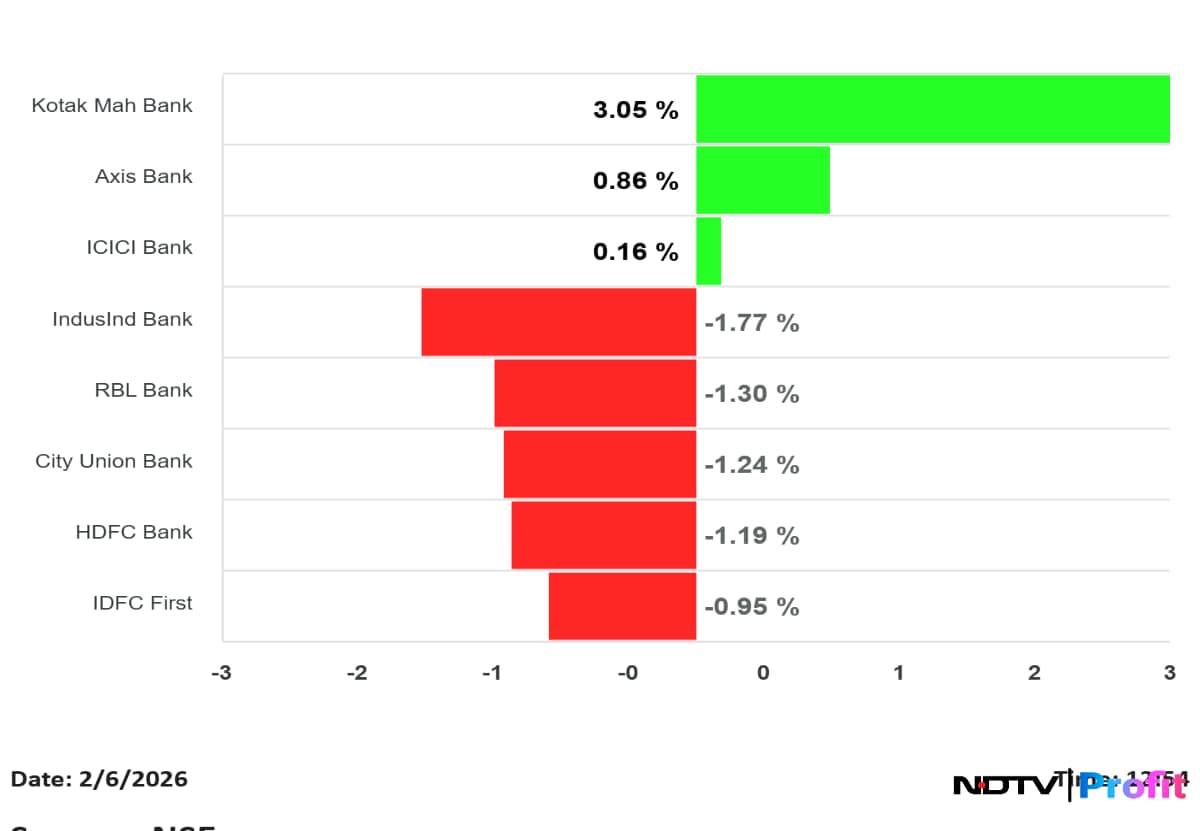

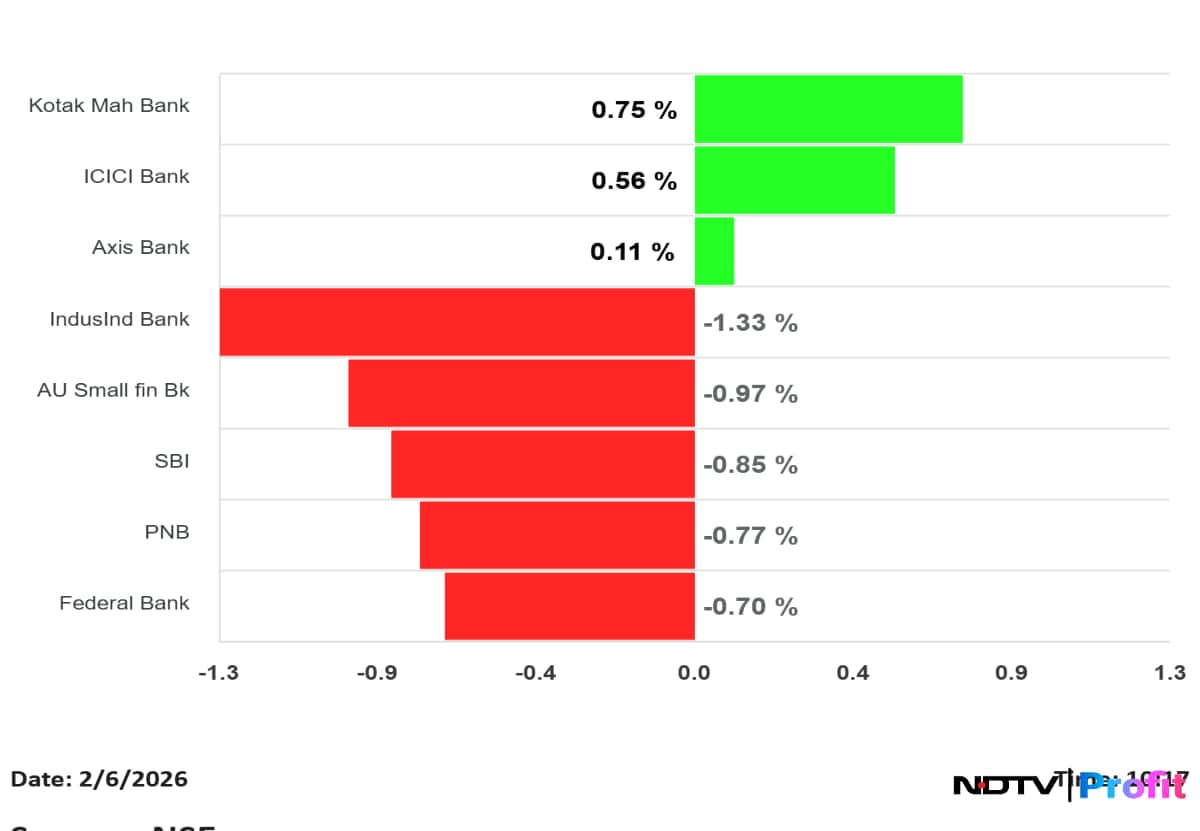

Most private bank stocks swings to loss

Nearly 20.5 lakh shares of Eternal changed hands in a large trade, according to Bloomberg data. Buyers and sellers were not known immediately.

Aditya Birla Fashion Q3 (Standalone, YoY)

Kennametal India Q3 (Standalone, QoQ)

JK Paper Q3 (Cons, YoY)

Shree Renuka Sugars Q3 (Cons, YoY)

Kaynes Tech Q3 (Cons, YoY)

Repco Home Finance Q3 (Cons, YoY)

Shreeji Shipping Q3 (Cons, YoY)

Goodyear India Q3 (Standalone, YoY)

Physicswallah Q3 (Cons, YoY)

The yield on the 10-year note rose as much as five basis points to 6.7%

The Indian rupee strengthened by 0.85% to 90.27 against the US dollar

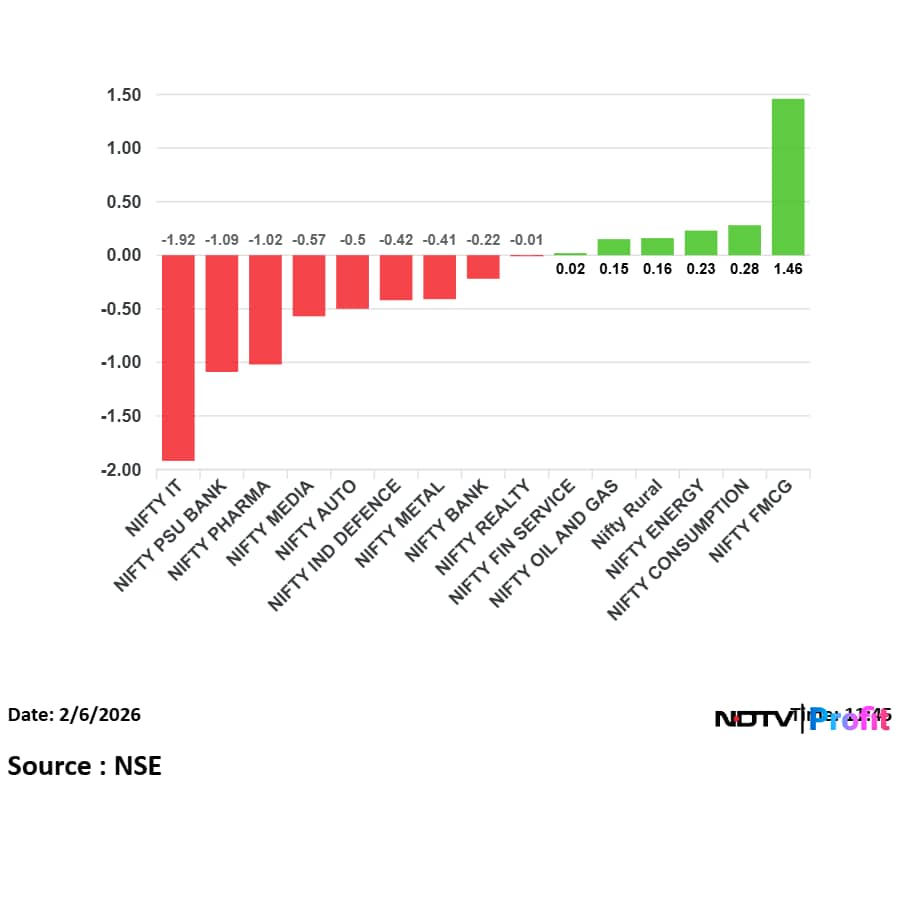

The NSE Nifty Bank Index extended declines after the RBI MPC keeps repo rates unchanged and retains 'neutral' stance

Sensex fell over 300 points and the Nifty traded below 25,550 after the RBI Monetary Policy Committee kept the benchmark repo rates unchanged at 5.25%.

RBI Monetary Policy Committee kept the benchmark repo rates unchanged at 5.25%.

RBI Governor Sanjay Malhotra begins MPC speech.

Berger Paints Q3 (Cons, YoY)

Nykaa Q3 (Cons, YoY)

Nilkamal Q3 (Cons, YoY)

Tata Motors PV Q3 (Cons, YoY)

Astral Q3 (Cons, YoY)

Bharti Airtel Q3 (Cons, QoQ)

LIC Q3 (Cons, YoY)

Bharti Hexacom Q3 (Standalone, QoQ)

Data Patterns Q3 (Standalone, YoY)

KNR Constructions Q3 (Cons, YoY)

Kaynes Tech Q3 (Cons, YoY)

Should you Buy, sell or hold Kaynes Tech? Click here to read experts' view on the stock.

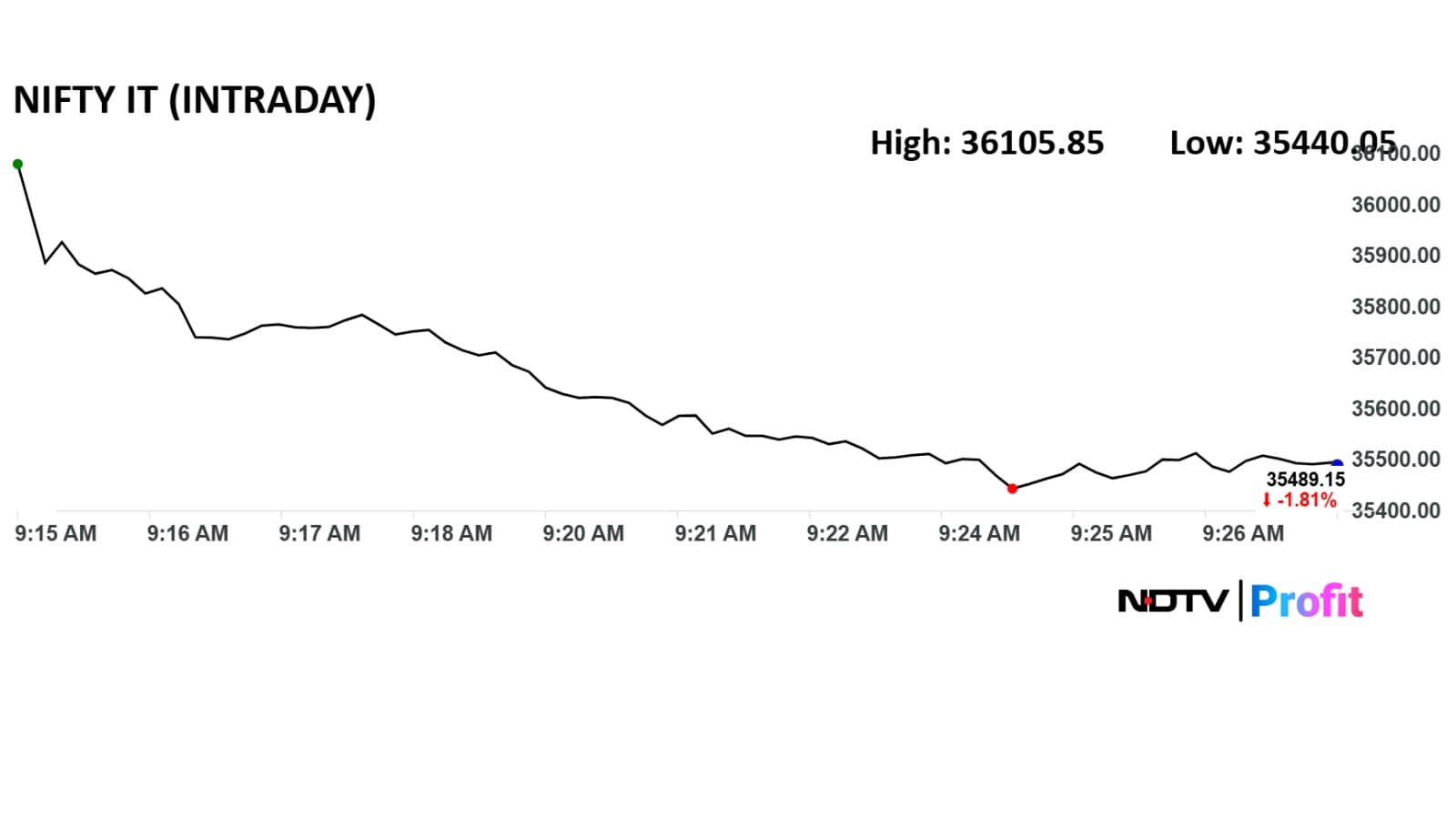

Shares of IT companies extended declines for the third consecutive trading session. The NSE Nifty IT Index have slumped 8% so far this week due to Anthropic shock.

Hero MotoCorp Q3 (Cons, YoY)

Minda Corp said on Thursday that it appointed Ajay Agarwal as the CFO.

India's benchmark indices, Nifty and Sensex, ended lower on Thursday, ending three days of advances. The Nifty 50 ended 133 points or 0.5% lower at 25.642 and the BSE Sensex tanked 506 points or 0.6% at 83,311. The broader market showed mixed performance with the Nifty Midcap 150 down 0.3% and Nifty Smallcap 250 down 1%.

Tata Motors PV Q3 (Cons, YoY)

Nykaa Q3 Results (Consolidated, YoY)

Wall Street benchmarks fell, and the Nasdaq 100 logged its steepest three-day drop since the sell-off in April.

Oil prices fell again as investors looked to planned Iran-US talks due later on Friday, which eased near-term worries about conflict and supply disruption.

Brent traded near $67 a barrel after sliding 2.8% on Thursday. West Texas Intermediate held below $63.

Futures dropped after US President Donald Trump said Iran was in talks. Prices later recovered some ground after Saudi Arabia cut prices for Asian buyers by less than expected, which traders took as a sign of steady demand.

Source: Bloomberg

Read the full preview here

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.