Good morning and welcome to this live coverage of RBI MPC meeting.

The Reserve Bank of India's six-member Monetary Policy Committee, led by Governor Sanjay Malhotra, has decided to keep the repo rate unchanged at 5.25%, just as markets expected.

The MPC retained a neutral policy stance. In its December policy, the MPC cut the repo rate by 25 basis points to 5.25%, taking the total rate cuts in 2025 to 125 basis points.

Watch Live Here:

"The hold at 5.25% was expected and signals a period of evaluation. While policy stability boosts housing sentiment, the real significance lies in how quickly banks pass on the previous 25-basis-point cut to borrowers to improve ground-level affordability," says Piyush Bothra, CFO and Co-Founder, Square Yards.

"The RBI’s pause at 5.25% aligns with supportive macro conditions and below-target inflation. Coupled with recent budget initiatives, this stability will drive real estate growth in industrial segments and Tier II/III cities. However, the full transmission of previous rate cuts to homebuyers remains critical for residential momentum," says Vimal Nadar, National Director & Head, Research at Colliers India.

"Focusing on effective transmission of rate cuts already taken and being encouraged by a healthy growth trajectory in the economy, RBI's MPC decided to keep repo rate unchanged while awaiting new GDP and CPI series. With inflation expected to rise hereon amid normalisation of food prices and adverse base effect, the scope for further rate cuts has shrunk. A shock to the growth-inflation balance would only propel another rate cut. For now, we expect a prolonged pause from the RBI," says Garima Kapoor, Deputy Head of Research and Economist at Elara Capital

Governor Sanjay Malhotra will address a press conference at noon.

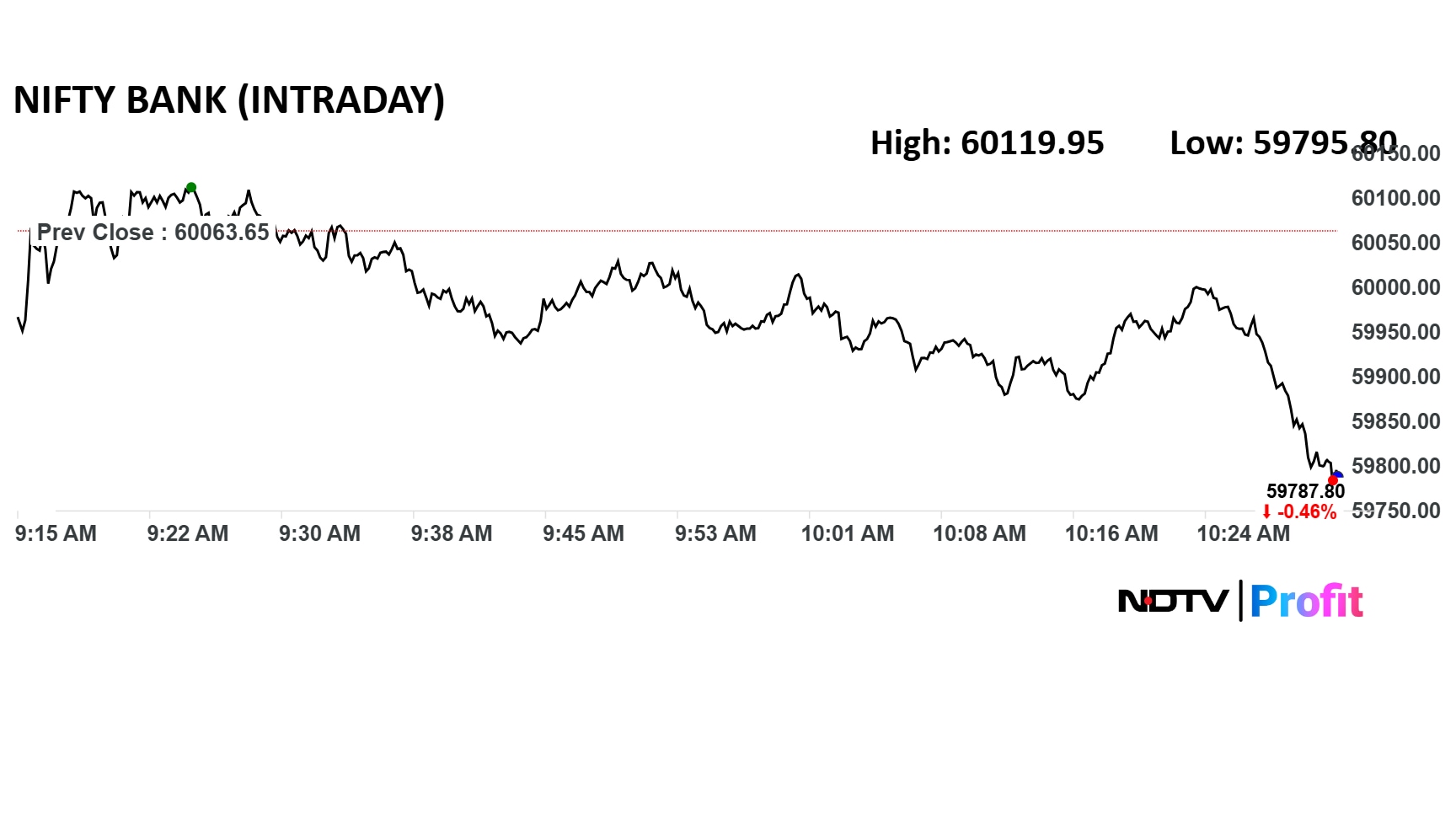

The Nifty Bank index went down after RBI did not announce any new liquidity measures.

Governor Malhotra did not spell out liquidity measures for bond markets as such, but assured the markets that RBI will meet liquidity needs on a pre-emptive basis.

The RBI will raise collateral free loans for MSMEs to Rs 20 lakh.

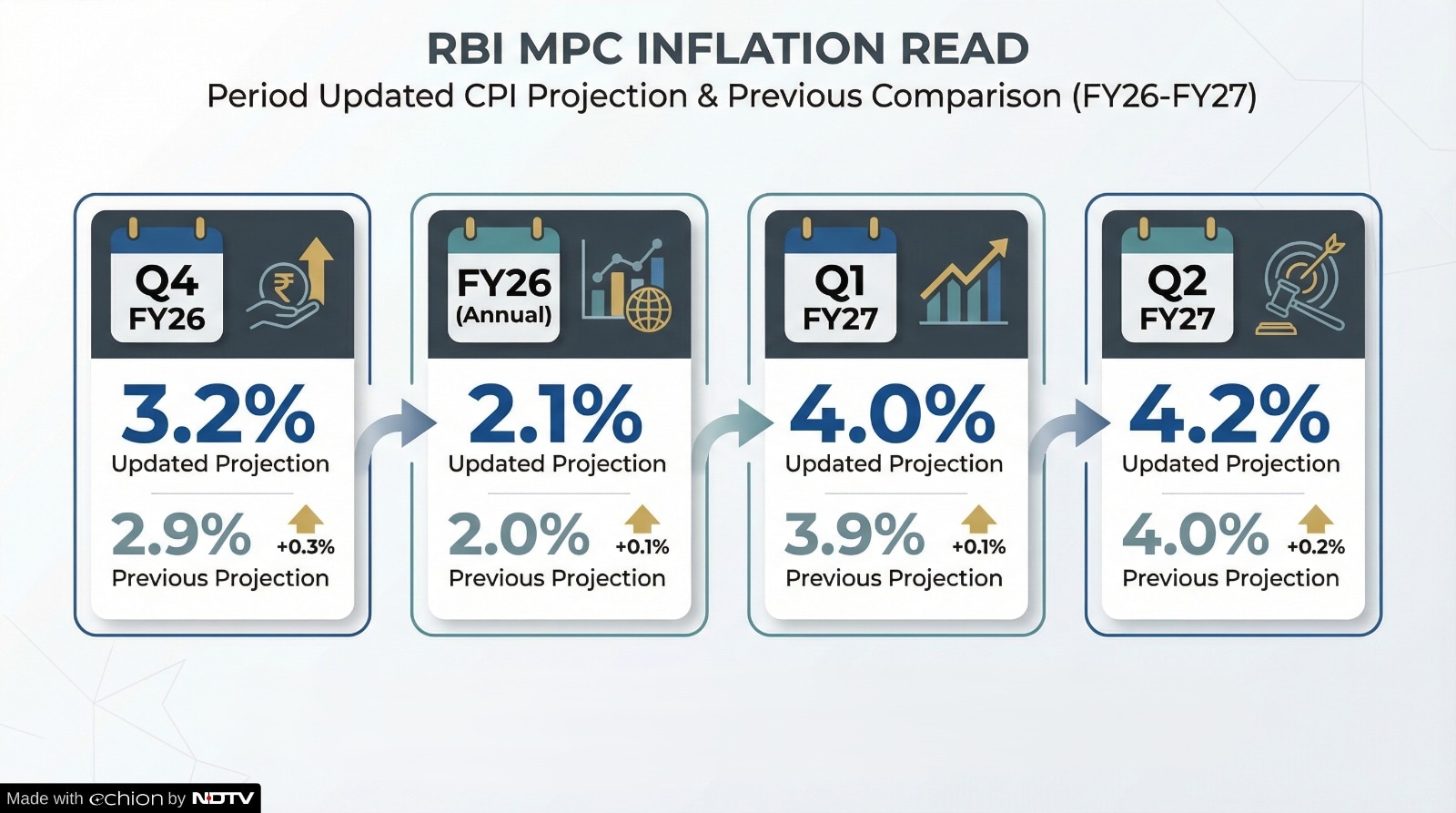

The RBI has not shared the CPI inflation estimate for fiscal 2027 as it awaits the revision of the base series and methodology expected later this month from the government.

RBI Governor Sanjay Malhotra said India continues to be an attractive FDI destination. The forex reserves stand at $723.8 billion as of January. The central bank is confident of meeting external financing needs

will be proactive in the liquidity management.

"Liquidity was at a surplus Rs 70,000 crore on a daily average basis since last meeting in December. The RBI undertook several durable liquidity augmenting measures," said RBI Governor Sanjay Malhotra.

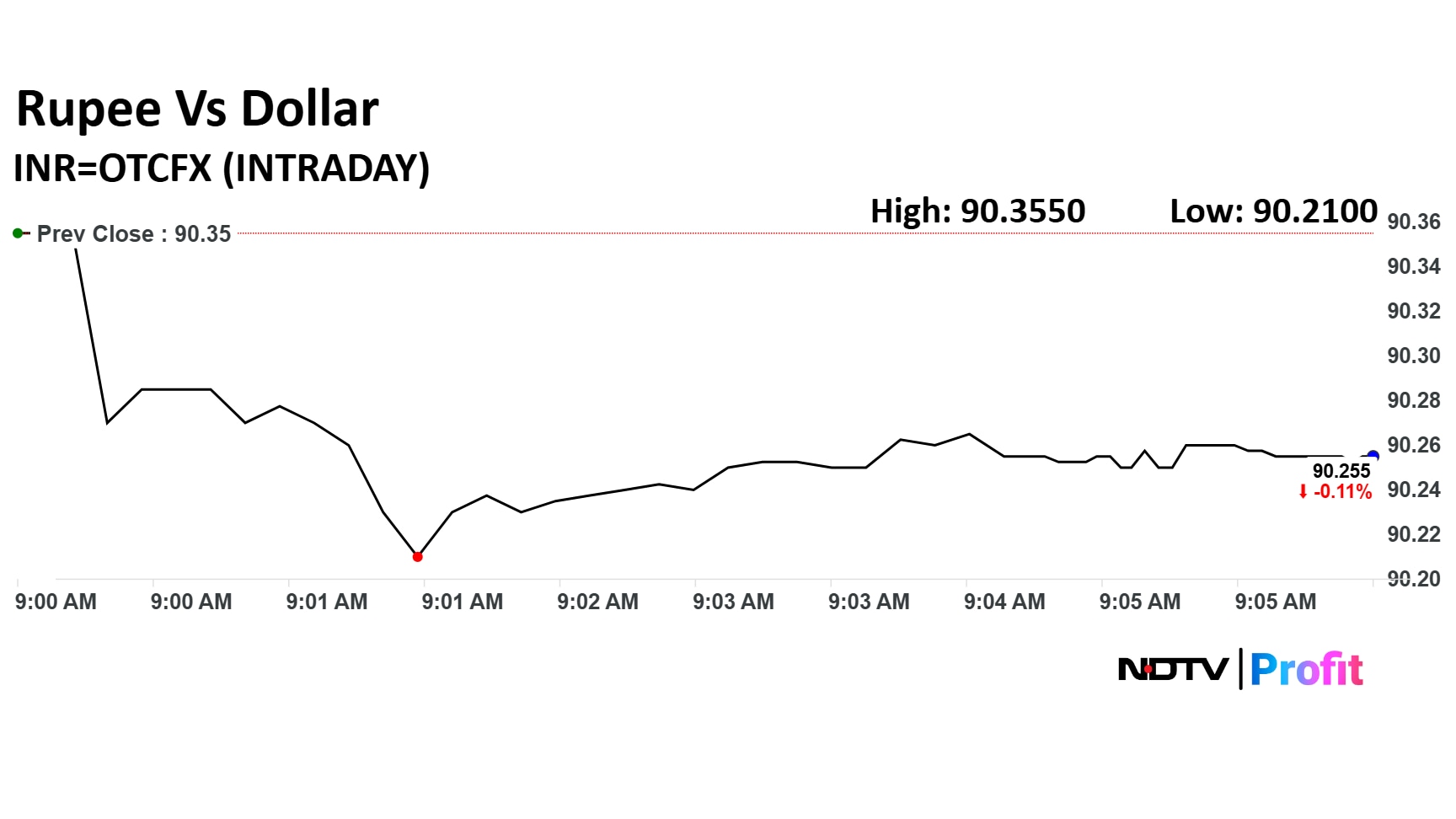

The rupee held on to slight gains as the RBI keeps rates on hold.

Yields on the benchmark 10-year bond rose 4 bps to 6.68%.

The 10-year bond yield rises 3bps to 6.68%.

The Reserve Bank of India's six-member Monetary Policy Committee, led by Governor Sanjay Malhotra, has decided to keep the repo rate unchanged at 5.25%, just as markets expected. The MPC retained a neutral policy stance.

In its December policy, the MPC cut the repo rate by 25 basis points to 5.25%, taking the total rate cuts in 2025 to 125 basis points.

Inflation is benign, growth is strong. He noted that trade deals with the European Union and United States shows promise.

Headline consumer inflation has averaged about 1.7% so far this financial year, driven largely by lower food prices. Forecasts point to inflation rising toward 3%–4% in the coming quarters, still within the central bank's 2%–6% band, even as underlying pressures remain contained. In its December policy, the RBI projected inflation at 2.0% for Q3 FY26 and 2.9% for Q4 FY26, rising to 3.9% in Q1 FY27—a steeper path than its October projection, when it had expected inflation to remain softer for longer.

Despite a cumulative 125-basis-point reduction in the repo rate since February 2025, economists say monetary transmission remains incomplete, limiting the effectiveness of additional rate cuts.

The RBI has already injected durable liquidity through a cash reserve ratio cut of about Rs 2.5 lakh crore, open market bond purchases of Rs 6.95 lakh crore and a foreign-exchange swap of roughly $25 billion. Even so, money-market rates, corporate bond spreads and wholesale deposit costs have remained elevated.

Madhavi Arora of Emkay Global said the central bank is likely to pause as weak transmission remains the binding constraint. “The easing cycle has been deep, but the pass-through to bond yields and credit markets has been limited, keeping financial conditions restrictive,” she said. Nuvama said system liquidity should improve over coming months as government cash balances and FX-related drains normalise, “reducing the need for further RBI liquidity infusion.”

Growth conditions continue to support a pause, economists said, even as momentum across sectors remains uneven. In its December policy, the RBI projected real GDP growth of 7.3% for FY26, slightly lower than earlier expectations for the second half of the year, while maintaining that domestic demand remains the key growth driver. For the second half of FY26, the central bank trimmed its growth outlook marginally from the October policy, citing global trade uncertainty and external headwinds.

India's economy is estimated to have grown 7.4% in FY26, with official projections pointing to growth of 6.8%–7.2% in FY27, supported primarily by domestic demand, according to the latest Economic Survey. Consumption and investment have posted steady gains so far this fiscal, cushioning activity amid global uncertainty.

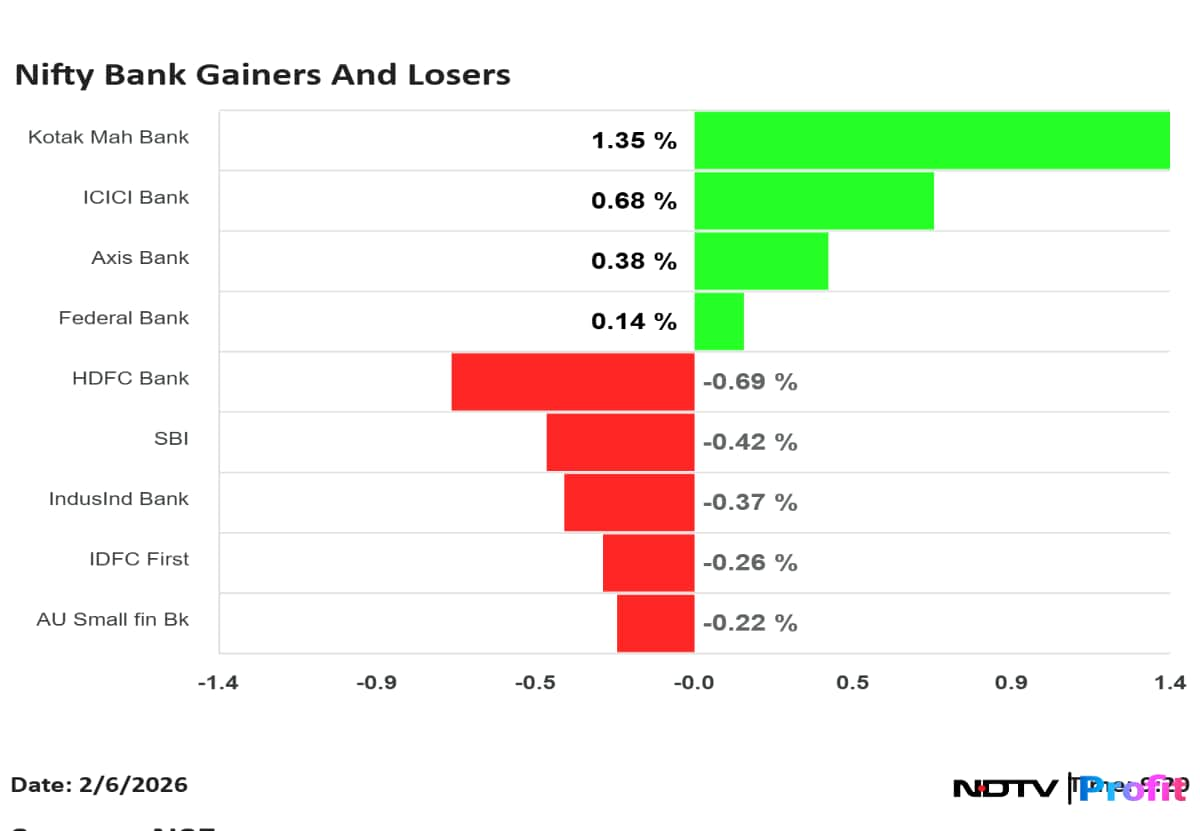

The Nifty Bank index opened 0.1% lower. Here are the top gainers and losers on the index:

The rupee is expected to depreciate 2% toward a year-end target of 92 against the US dollar, in contrast to the markets' more bearish estimates of 3-4% decline toward 93-94, according to analysts at multinational investment bank UBS.

The local currency saw a relief bounce following the announcement of the US-India trade deal earlier this week. While the rupee should stay supported in the short term, weak balance-of-payment dynamics point toward a managed pace of depreciation, analysts said in a note.

The yield on the 10-year government bond opened flat at 6.7% ahead of the RBI MPC decision.

The rupee opened 9 paise stronger at 90.27 against the US dollar, ahead of the RBI MPC decision.

The MPC meeting, which began on Wednesday, was days after the Union Budget and after India signed a trade agreement with the United States on Monday, under which Washington reduced tariffs on Indian goods to 18% from 25%, with certain products set to face zero tariffs. Economists say the deal could help stabilise capital flows and ease pressure on the rupee, reducing one of the external risks flagged by policymakers in recent months.

Economists do not expect major changes in growth or inflation forecasts. In December, the RBI raised its GDP growth projection for FY26 by 50 basis points to 7.3%. This was higher than its earlier estimate of 6.8%. The government's first advance estimates place real GDP growth at 7.4% for FY26.

With inflation within comfort range, the RBI had lowered its consumer price index (CPI) projection for 2025–26 to 2% from 2.6%. If the RBI keeps rates unchanged, loan and deposit rates are likely to stay stable. Interest rates linked to the external benchmark lending rate will also remain the same. Borrowers are unlikely to see immediate changes in their loan EMI restructure.

Viewers can watch the announcement live on the RBI's social media handles. The RBI Governor's press briefing can also be watched live on NDTV Profit. Audiences can follow the updates in real time and track key highlights on YouTube and other social media channels of the NDTV Network. Viewers can visit RBI's YouTube channel to watch the press conference at noon today.

The RBI MPC's three-day meeting to review the current monetary policy began on Wednesday, Feb. 4. The RBI Governor is set to announce the policy decision at 10 a.m. today. The Governor's press briefing will follow at noon.

The RBI is expected to keep its policy repo rate unchanged at 5.25% at its February monetary policy decision on Friday, as economists say inflation is set to firm from recent lows even as growth remains resilient and the transmission of earlier rate cuts continues to lag.

With inflation expected to firm but remain within the tolerance band, growth holding up and the effects of earlier easing still playing out, economists widely expect the RBI to maintain a wait-and-watch stance at its February meeting, keeping future moves contingent on incoming data. Thirty-four of 39 economists tracked by Bloomberg expect the Monetary Policy Committee to leave rates unchanged, while the remaining five forecast a 25-basis-point cut, according to the latest survey.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.