Indian equity benchmarks extended gains for the second consecutive trading session. The BSE Sensex closed more than 450 points higher to settle above 84,000 and the NSE Nifty 50 closed 0.7% higher to end above 25,860.

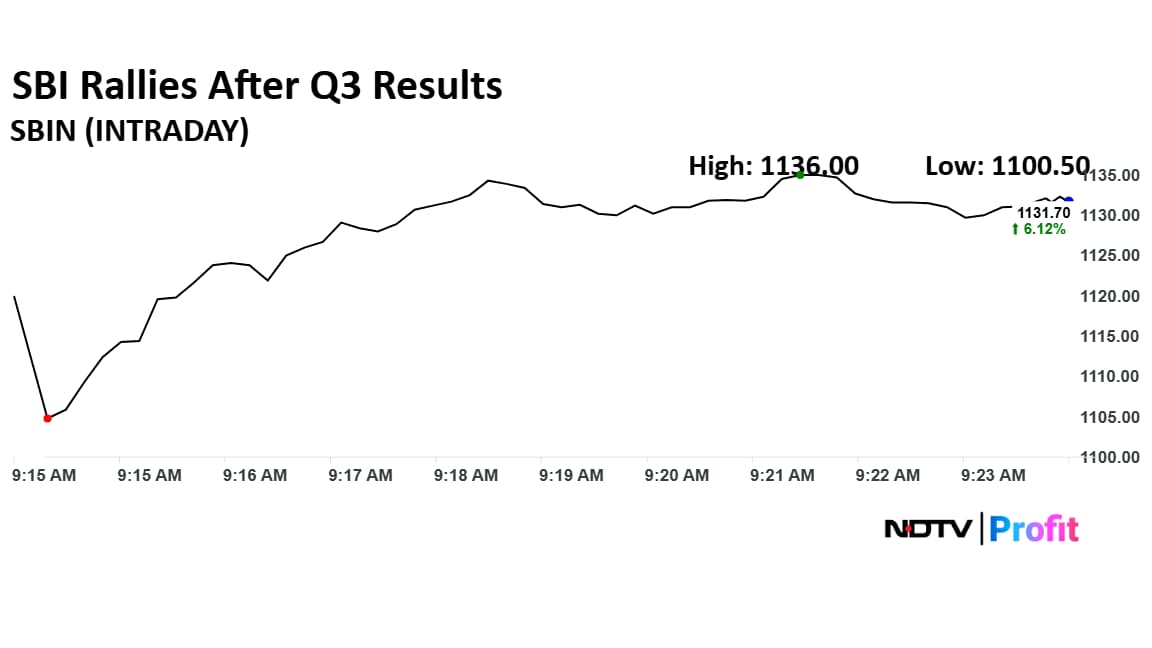

The gained in the indices were led by State Bank of India after the shares of country's largest lender surged to record high following Q3 upbeat and optimistic guidance.

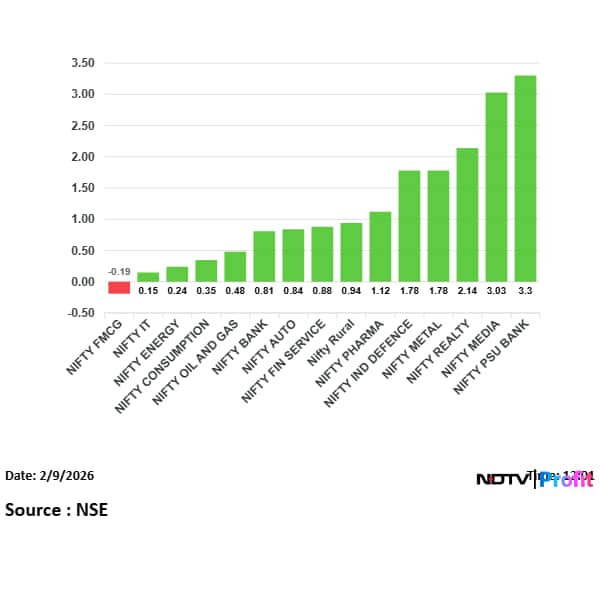

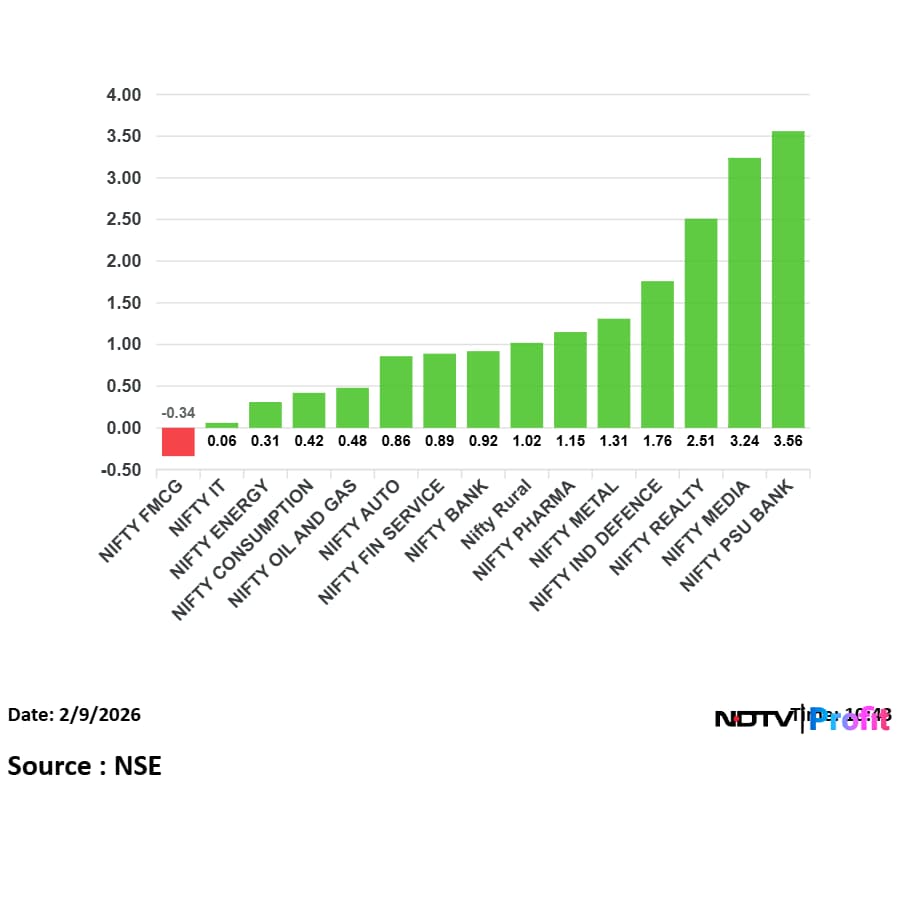

The market breadth tilted in favour of buyers. About 3,097 stocks advanced and 1,263 stocks declined on the BSE. All the sectoral gauges tracked by NSE ended higher, led by the NSE Nifty Media Index's 4.3% rally.

Indian equity benchmarks extended gains for the second consecutive trading session. The BSE Sensex closed more than 450 points higher to settle above 84,000 and the NSE Nifty 50 closed 0.7% higher to end above 25,860.

Long build-up

Short covering

Long unwinding

Short build-up

Vedanta Ltd.'s Chairman Anil Agarwal said India must scale up domestic oil, gas and mineral production to secure energy independence, warning that regulation and legal uncertainty are discouraging investment and slowing exploration.

In a post on X, the chairman said India imports about 90% of its oil and gas, leaving the country vulnerable during hostile geopolitical conditions. “There is no option but to raise our domestic production,” he said, adding that demand would keep rising for at least the next 20 years.

Tata & Sons Chairman N Chandrasekaran has expressed strong optimism about India's expanding trade landscape, saying recent free trade agreements with major global economies open up unprecedented opportunities for both Indian companies and overseas markets.

Speaking to NDTV's Sam Daniel on the sidelines of the Jaguar Land Rover project in Tamil Nadu's Ranipet district, Mr Chandrasekaran said trade agreements with the European Union, the UK, the UAE and the United States would be transformational for Indian industry. “I am extremely positive about the opportunities that lie ahead,” he said, adding that these agreements “open up the world market and open up the Indian market too.”

Sky Gold Q3 Highlights (Consolidated, YoY)

The new income tax rules have rationalised employee perquisites by revising thresholds for tax-free office meals, gifts received from employers, employer-provided educational facilities for employees' family members, and the use of motor vehicles provided by employers. These limits had remained unchanged for decades despite rising incomes and costs. Their revision seeks to align the taxation of salary benefits with current economic conditions and ensure a more accurate computation of taxable income.

Titan Co., Relaxo Footwears Ltd., Bata India Ltd., Tribhovandas Bhimji Zaveri Ltd., and Kalyan Jewellers Ltd. are some of the stocks from the export-facing industries that have good potential as a results of the India-United States trade deal, according to Rahul Arora, chief executive officer of Ashika Institutional Equities. He noted that textiles, jewellery, leather and footwear segments continue to grapple with high working capital requirements and debt-related issues.

However, he sees the jewellery space as a more attractive way to play the theme, citing companies such as Titan, Kalyan Jewellers and TBZ, which have relatively stronger profit-and-loss profiles and healthier cash flows.

Shares of Interglobe Aviation Ltd have bounced back to over 1.5% after the Ministry of Civil Aviation clarified that no such requirement of 'Indian CEOs' has been asked of Indian airline carriers. THe move came after the a media report, citing government government sources, stated that the Aviation Ministry has indicated to airlines the need for Indian CEOs at Indian carriers such as Air India and IndiGo.

The Minsitry of Civil Aviation has categorically denied the report. The share price jumped over 1.5% and is now trading at around Rs 4,962.30 apiece.

Man Industries Q3 Highlights (Consolidated, YoY)

Shares of Ugro Capital extended declines for the third consecutive trading session and fell as much as 9.7% to Rs 133.76.

Earlier in the day, the company's Founder and Managing Director Shachindra Nath spoke to NDTV Profit; here are the key highlights:

Trading volume was nearly 10 times its 20-day average, according to Bloomberg data.

Tata Sons Chairman N Chandrasekaran says:

| Symbol | LTP | %chng | New 52W/L price | Prev.Low | Prev. Low Date |

| ABSLLIQUID | 999.99 | 0 | 999.99 | 999.99 | 06-Feb-26 |

| APTUS | 264.5 | 2.08 | 256.3 | 257.15 | 21-Jan-26 |

| ASTRON | 4.02 | 2.29 | 3.82 | 3.9 | 04-Feb-26 |

| CLEDUCATE | 59.23 | 0.25 | 55.5 | 59.08 | 06-Feb-26 |

| DAMCAPITAL | 170.49 | 1.99 | 164.91 | 165.23 | 06-Feb-26 |

| DGCONTENT | 24.7 | 1.11 | 23.52 | 24 | 06-Feb-26 |

| DHRUV | 34.5 | -0.14 | 34 | 34 | 05-Feb-26 |

| FLEXITUFF | 9.77 | -0.81 | 9.2 | 9.36 | 05-Feb-26 |

| GMMPFAUDLR | 962.7 | -3.11 | 943.55 | 949.9 | 30-Jan-26 |

| GOCOLORS | 367.8 | -4.58 | 363.25 | 373.35 | 21-Jan-26 |

| GOKUL | 35 | 0.14 | 34.1 | 34.87 | 06-Feb-26 |

| KAMOPAINTS | 5.38 | -0.37 | 5.3 | 5.3 | 06-Feb-26 |

| KANSAINER | 212.46 | -0.88 | 212.25 | 213.5 | 06-Feb-26 |

| KEEPLEARN | 1.98 | -4.35 | 1.71 | 2.01 | 08-Dec-25 |

| NIPPOBATRY | 357 | -1.57 | 355 | 360.2 | 06-Feb-26 |

| ORIENTALTL | 7.38 | -0.54 | 6.71 | 6.91 | 02-Feb-26 |

| PALASHSECU | 96.5 | 1.34 | 93.2 | 94 | 06-Feb-26 |

| POLYMED | 1444.8 | 3.99 | 1370.3 | 1373 | 06-Feb-26 |

| PRUDMOULI | 18.57 | 3.4 | 17.7 | 17.7 | 05-Feb-26 |

| SHIVALIK | 295.5 | 3.56 | 277 | 282.3 | 06-Feb-26 |

| SML100CASE | 9.77 | 2.2 | 8.8 | 9.13 | 01-Feb-26 |

| SOLARA | 473.45 | 0.55 | 440.2 | 442.8 | 04-Mar-25 |

| TPLPLASTEH | 63.46 | 4.62 | 59.35 | 59.44 | 30-Jan-26 |

| UGROCAP | 135.55 | -8.51 | 133.76 | 139.12 | 27-Jan-26 |

| VIKASLIFE | 1.65 | 1.85 | 1.57 | 1.57 | 06-Feb-26 |

| VINDHYATEL | 1164.2 | -6.44 | 1128 | 1140.1 | 02-Feb-26 |

Alphabet-backed Aye Finance Ltd.'s Rs 1,010-crore initial public offering (IPO) opened for bidding on Monday. The non-financial banking company has fixed a price band of Rs 122-129 per share, valuing Aye Finance at Rs 3,184 crore at the upper end of the band. The issue will close on Feb. 11

Click here to check subscription status, latest GMP and more.

Shares of Tata Steel resumed gains ager Friday's blip. The stock rose as much as 4% to Rs 204.90 after the company announced its Q3 results post Friday's market hours.

Tata Steel Q3 (Cons, QoQ)

Shares of IFCI advanced for the fifth consecutive trading session and surged as much as 13.2%, the most in over eight months, to Rs 68.13.

Trading volume was almost quadruple its 20-day average, according to Bloomberg data. The scrip rallied over 17% in five trading sessions.

PSU Bank and Realty stocks have surged the most on the NSE.

The initial public offering of Fractal Analytics Ltd., a global enterprise AI and analytics firm, opened for bidding today. The mainboard issue will remain open for subscription until Feb. 11.

Fractal Analytics is widely recognised as one of India's first pure-play AI companies to hit the public markets.

The latest GMP signals that the shares are expected to list at a marginal premium of approximately 1.44% over the issue price.

Fractal Analytics IPO has been subscribed 2% as of 10:30 a.m.

In its latest note, Morgan Stanley has pointed out that there are significant headwinds for Suzlon Energy Ltd. going forward, particularly when it comes to new orders and execution. The brokerage has downgraded Suzlon from 'overweight' to 'equal-weight' while reducing the target price from Rs 78 to Rs 52.

The India-United States trade deal sealed last week will have a broadly positive impact on the country's growth and markets, according to brokerages. Bernstein expects market relief and sectoral benefits but remains neutral on equities. ICICI Securities expects zero tariffs on nearly half of India's US exports, reaffirming an optimistic CY26 Nifty outlook.

The average of analysts' consensus 12-month target for Nifty is placed at 29,752 points, indicating a 15% potential to the previous close, according to Bloomberg data.

Shares of Kalyan Jewellers were locked in 10% upper circuit at Rs 417.75 after the company announced its Q3 results after Friday's market hours.

Kalyan Jewellers Q3 (Cons, YoY)

Shares of Shipping Corporation of India rose as much as 14% to Rs 252.90. The stock halted its two-day losing streak.

Shares of State bank of India rallied over 6% after the country's largest lender announced its Q3 results on Saturday.

The yield on the 10-year note rose for the second consecutive trading session to trade two basis points higher at 6.76%

The Indian rupee traded a paisa lower at 90.67 during the opening trade against the US dollar.

The prices of gold and silver marginally rose at the start of this week. The price of silver rose by nearly Rs 3,000 to Rs 2.5 lakh per kg on Monday, while gold rose marginally to Rs 1.55 lakh per 10 grams, according to the India Bullions website.

Brent crude futures dropped 89 cents, or 1.31%, to $67.16 a barrel. US West Texas Intermediate declined 79 cents, or 1.24%, to $62.76 a barrel.

Shares of Suzlon will be in focus heading into trade on Monday after Morgan Stanley came out with an important note on the counter, notably downgrading its stance while considerably reducing the target price.

Should you buy, sell or hold on to Suzlon shares? Here's what Morgan Stanley said.

Suzlon Energy Ltd., State Bank of India, Tata Steel Ltd., and Kalyan Jeweller Ltd. are among companies that have drawn commentary from top brokerages on Monday. Analysts have tweaked share price targets and future outlook after some of these companies announced their December quarter results.

With market volatility and geopolitical uncertainties continuing to impact stock markets in 2026, Indian investors are increasingly turning to stocks that offer steady income. Dividend-paying stocks often catch the attention of investors, mostly those who look for stable returns amid market volatility.

So far in 2026, market data indicates, top 10 dividend-paying stocks largely belong to heavyweight companies from the metals and mining space.

Here are the top 10 dividend stocks to watch out for this month.

Shares of NBCC (India) will be in focus on Monday after the Supreme Court approved the completion of 16 stalled projects of Supertech by the company. The tentative cost of the project is Rs. 9,445 crore.

PFC said last week that the company acquired 52.6% in REC, to share detailed merger plan when finalised.

Kalyan Jewellers Q3 (Cons, YoY)

Tata Steel Q3 (Cons, QoQ)

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.