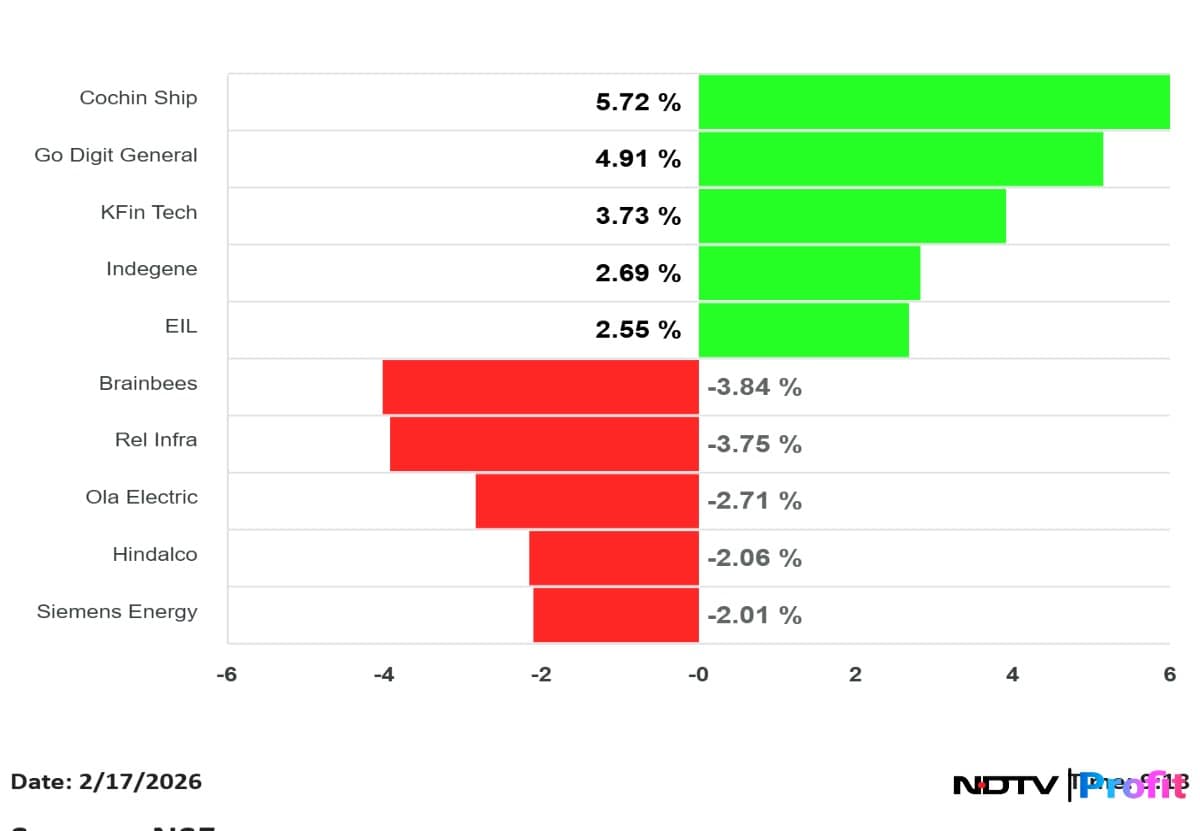

Indian equity benchmarks extended gains for the second consecutive trading session on Tuesday, led by the gains in Infosys and Larsen & Toubro Ltd. The NSE Nifty closed 0.2% or 42 points higher at 25,725 and the BSE Sensex ended 173.81 points higher at 83,450.96. The broader markets index, represented by the NSE Nifty 500 Index underperformed benchmark indices, led by the fall in EIL's 5% fall, followed by Groww's 4% decline.

Ten out of 15 sectoral gauges compiled by NSE ended higher, led by the NSE Nifty PSU Bank Index's 2.1% gains. The market breadth was tilted in favour of buyers. About 2,440 stocks advanced and 1,758 shares declined on BSE.

Elsewhere around the world, S&P 500 futures fell 0.2%, while Nasdaq 100 futures declined 0.5%; Dow futures were little changed. European shares opened flat, with the Stoxx Europe 600 little changed. In Asia, the MSCI Asia Pacific Index was little changed, and the MSCI Emerging Markets Index was also little changed.

Source: Bloomberg

Hindalco Industries Ltd. stock has received a downgrade from domestic brokerage InCred with a sharp target price cut, given a weakening outlook for aluminium prices and increased balance-sheet pressure from higher capital expenditure. The share price has fallen over 13% since hitting a life high of Rs 1,024.05 on Jan. 29. On a 12-month basis, Hindalco is up 45%.

Analysts have downgraded the stock to 'reduce' from 'add', with a new target price of Rs 631 from Rs 785 earlier.

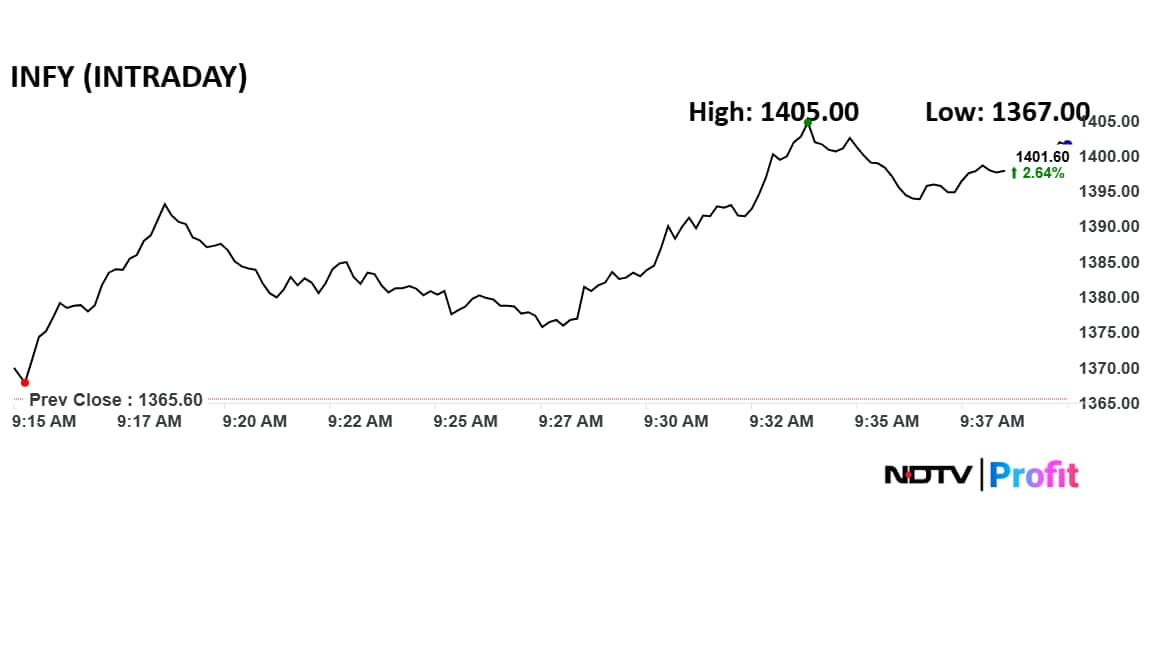

Infosys shares are set to close higher for the first time in 10 sessions after it announced a pact with Anthropic.

G R Infraprojects received an order worth Rs 1,898 crore in Madhya Pradesh from West Central Railway.

KNR Constructions received a letter of award for a road construction project in Chennai worth Rs 2,163 crore. The stock rose after the news.

The Nifty weekly futures and options contracts will expire today. The final hour of trade could be volatile.

Several PSU-linked counters show volume PCR below 0.40.

Key readings:

• IRFC – 0.21

• IDEA – 0.23

• DELHIVERY – 0.23

• OIL – 0.30

• NHPC – 0.29

• GMRAIRPORT – 0.38

Lowest OI-based PCR readings:

• TATAELXSI – 0.27

• SUZLON – 0.31

• MUTHOOTFIN – 0.33

• SHREECEM – 0.34

• RVNL – 0.34

• MAZDOCK – 0.35

Easy Trip Planners

Ola Electric

Engineers India

Texmaco Rail

Session volume data shows extreme call-heavy activity in several stocks.

Lowest volume-based PCR readings include:

• BAJAJHLDNG – 0.03

• TIINDIA – 0.07

• ADANIENSOL – 0.10

• SUPREMEIND – 0.08

• ZYDUSLIFE – 0.11

• MAZDOCK – 0.12

A volume PCR near zero indicates call volumes far exceed put volumes.

Major banking names remain below the 1 mark on OI-based PCR.

Key readings:

• HDFCBANK – 0.60

• ICICIBANK – 0.58

• AXISBANK – 0.54

• KOTAKBANK – 0.93

• SBIN – 1.05

• BANKBARODA – 0.59

• PNB – 0.53

Most banking counters show call open interest exceeding puts, with SBI as an exception above 1.

Volume-based PCR signals differ from OI positioning.

Highest volume-based PCR readings include:

• PIDILITIND – 1.63

• JSWSTEEL – 1.55

• HINDALCO – 1.46

• AMBER – 1.26

• SWIGGY – 1.22

These reflect higher put volumes relative to call volumes in the session.

Several stocks show sharply lower put–call ratios, reflecting higher call open interest.

The lowest OI-based PCR readings include:

• TATAELXSI – 0.25

• SUZLON – 0.31

• SHREECEM – 0.32

• MUTHOOTFIN – 0.33

• RVNL – 0.34

• BOSCHLTD – 0.35

A ratio well below 1 signals higher call positioning relative to puts.

The highest OI-based PCR readings include:

A ratio above 1 indicates put open interest exceeds call open interest in these stocks.

Sanjeev Bikhchandani told NDTV Profit that AI can disrupt existing systems but can also open new markets, and that shifting away from legacy systems will take time.

Key highlights from the conversation:

HSBC retained a Buy rating on Tata Motors Commercial Vehicles and raised its target price to Rs 534 from Rs 490, versus the last close of Rs 479.

Check prices in Mumbai, Delhi, Chennai, Bengaluru and other cities

The markets are expected to stay largely sideways with a slight positive bias, said Siddhartha Khemka, Head of Research (Wealth Management) at Motilal Oswal Financial Services, He said cues may come from Infosys’ AI-focused investor meet and the ongoing India AI Impact Summit, which he expects to influence IT and IT services stocks.

The upcoming Infosys AI-focused investor meet and the ongoing AI Impact Summit in Delhi are expected to provide direction for IT and IT services companies. Updates on enterprise AI adoption, monetisation, deal pipelines and regulatory outlook will be closely tracked, offering cues on demand trends and the broader growth outlook for the tech sector, which has underperformed in recent sessions.

Disclaimer: The views and opinions expressed by the investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

The figures shown are in thousands.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.