Rupee strengthened 7 paise to close at 85.44 against US dollar

It ended at 85.51 a dollar on Wednesday

Source: Bloomberg

Europe: European Central Bank Monetary Policy Meeting — 5:00 p.m.

US: Weekly Unemployment Claims — 6:00 p.m.

US: Final Services PMI — 7:15 p.m.

US: Energy Information Administration Natural Gas Storage Report — 8:00 p.m.

US: Federal Reserve Governor Philip Jefferson at the Conference on Financial Intermediaries, Markets, and Monetary Policy, in Atlanta — 9:30 p.m

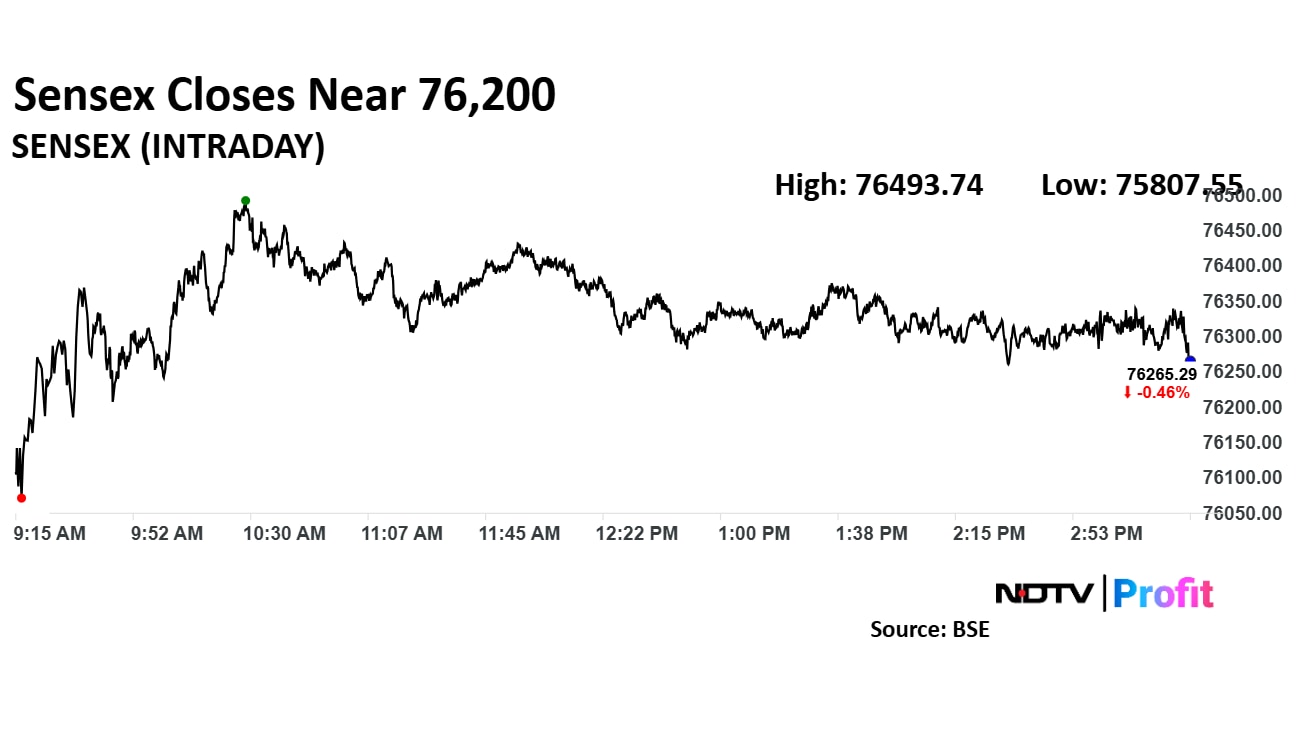

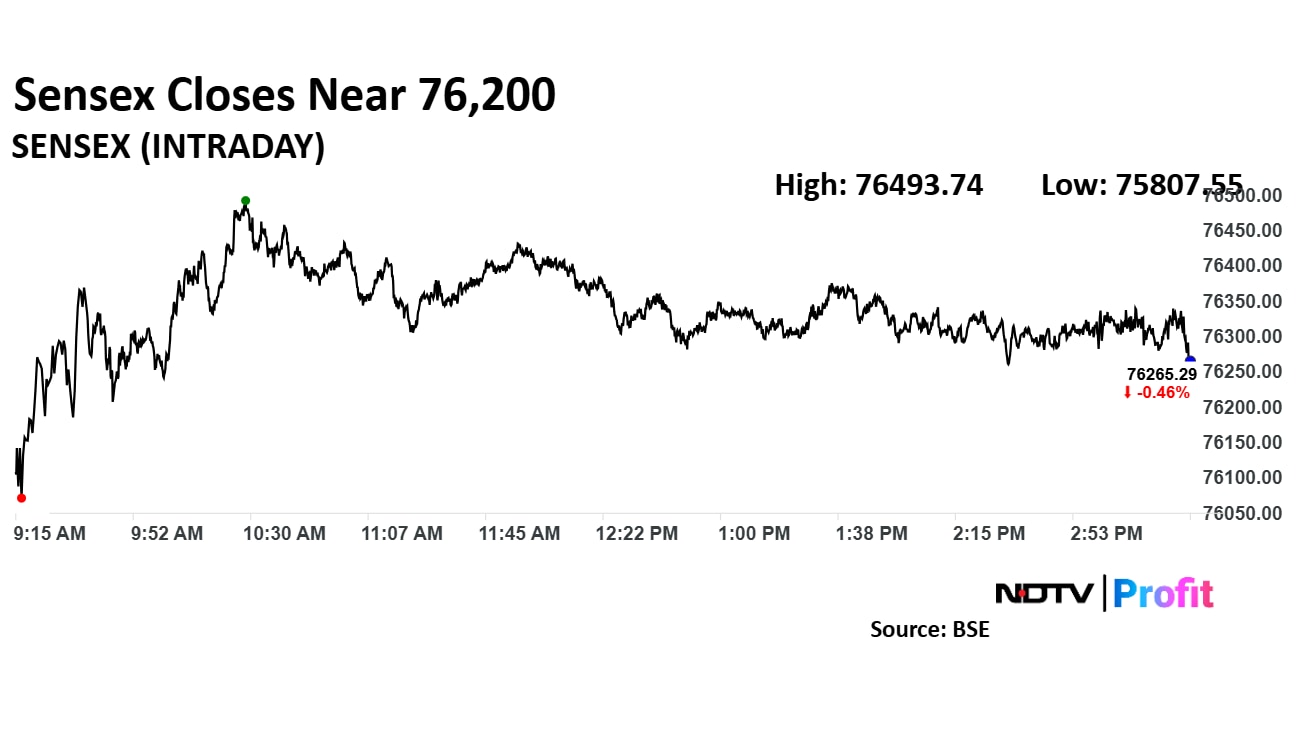

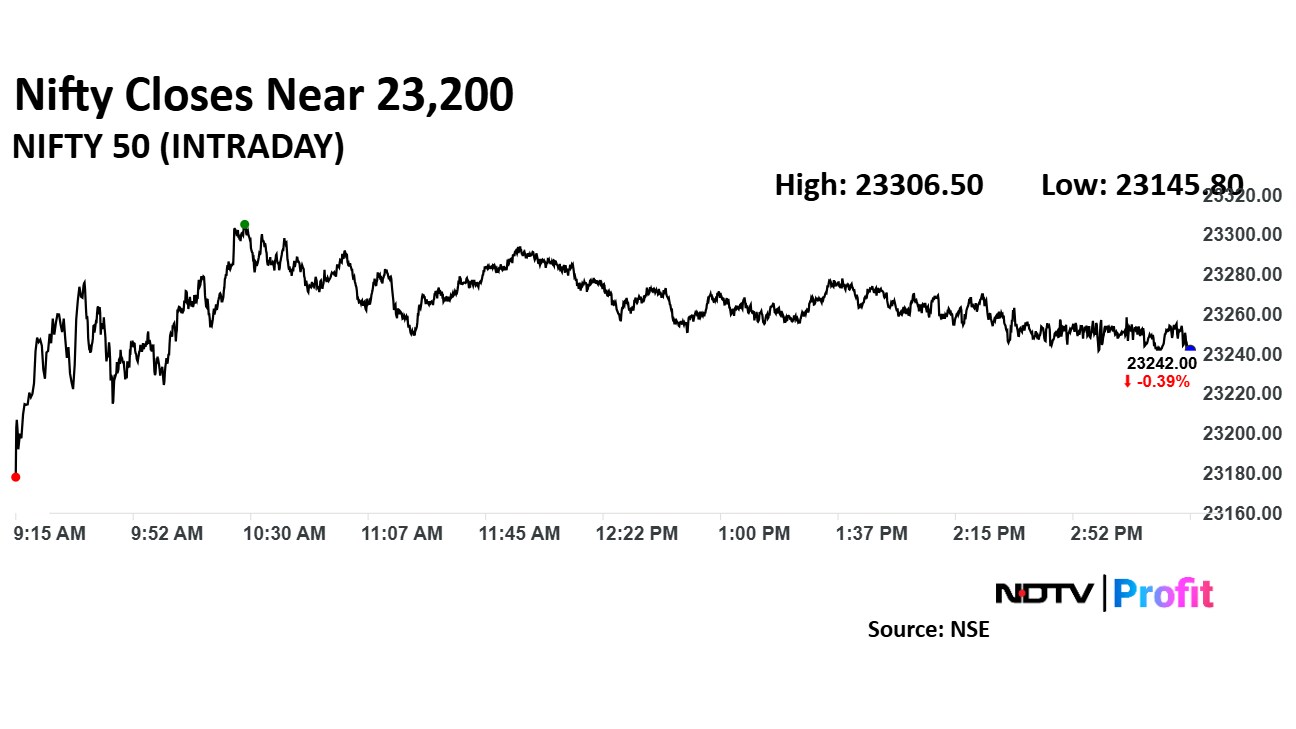

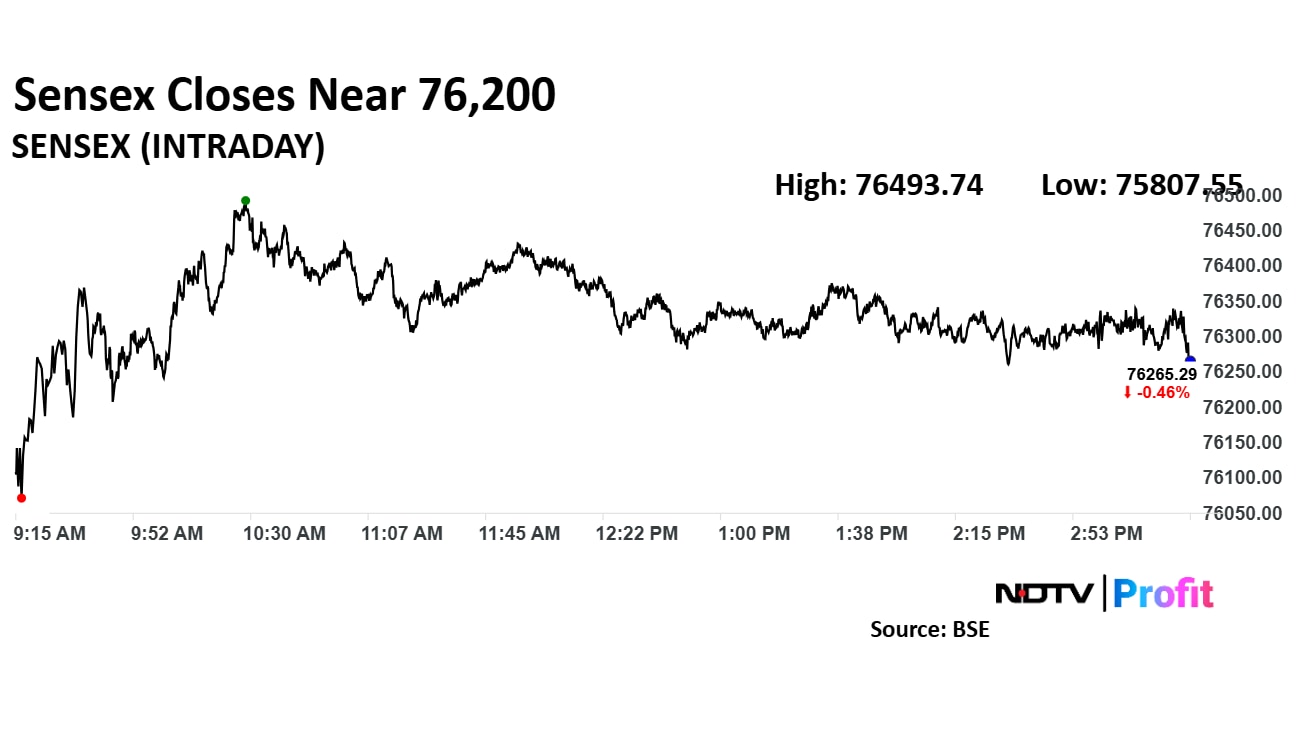

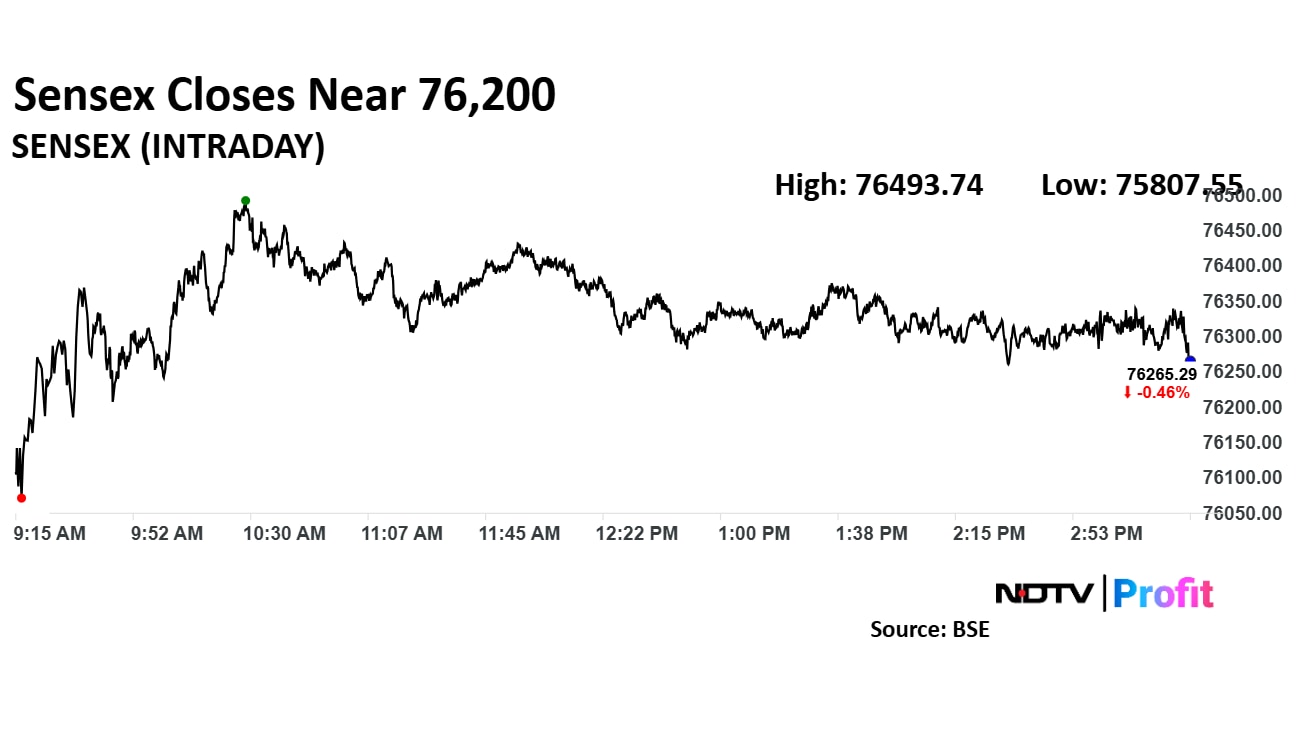

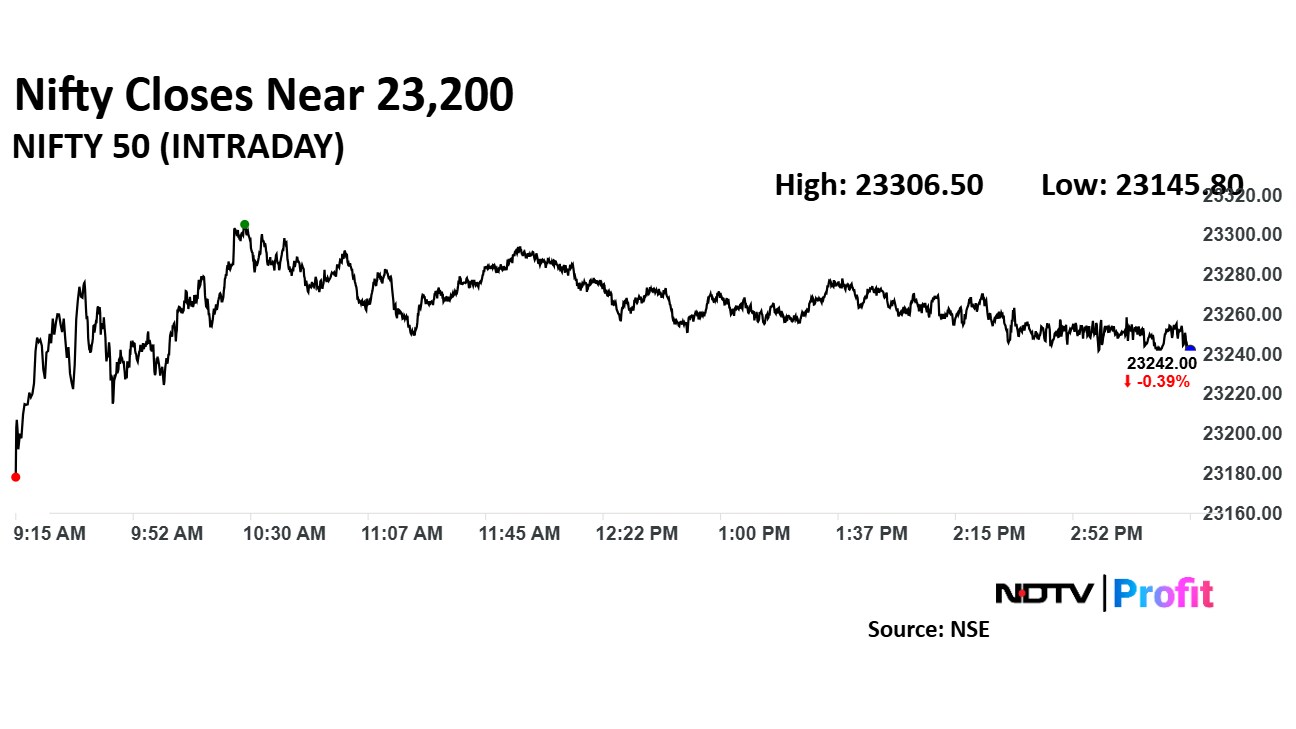

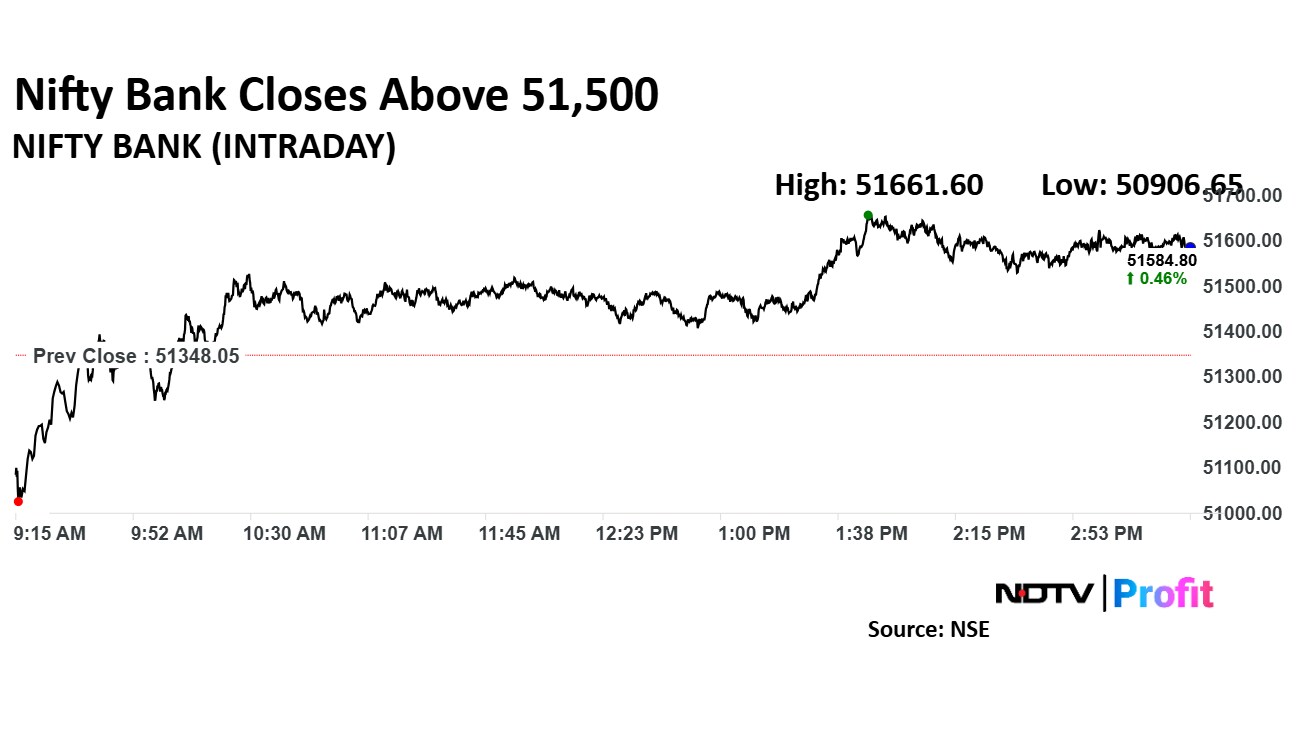

The Nifty 50 and Sensex ended lower as concerns over potential trade war dented risk-on sentiment

The Nifty 50 and Sensex ended 0.35% and 0.42% down, respectively.

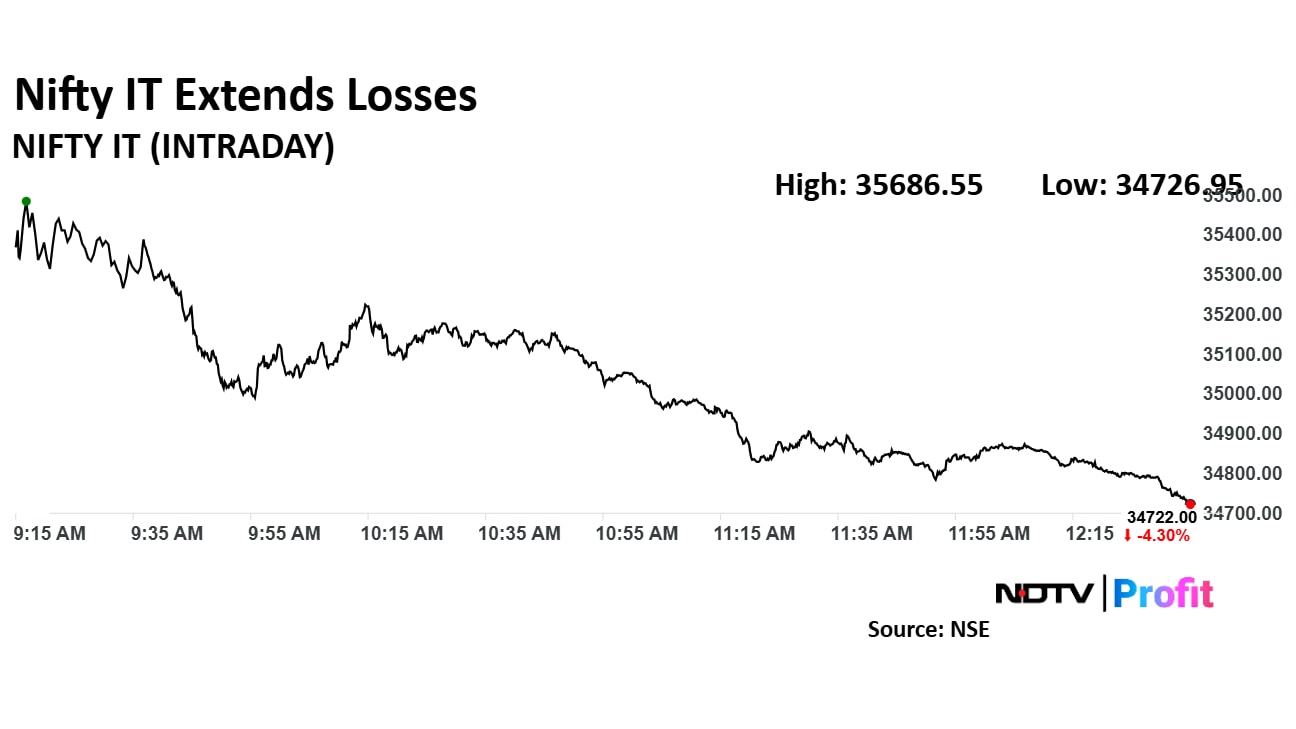

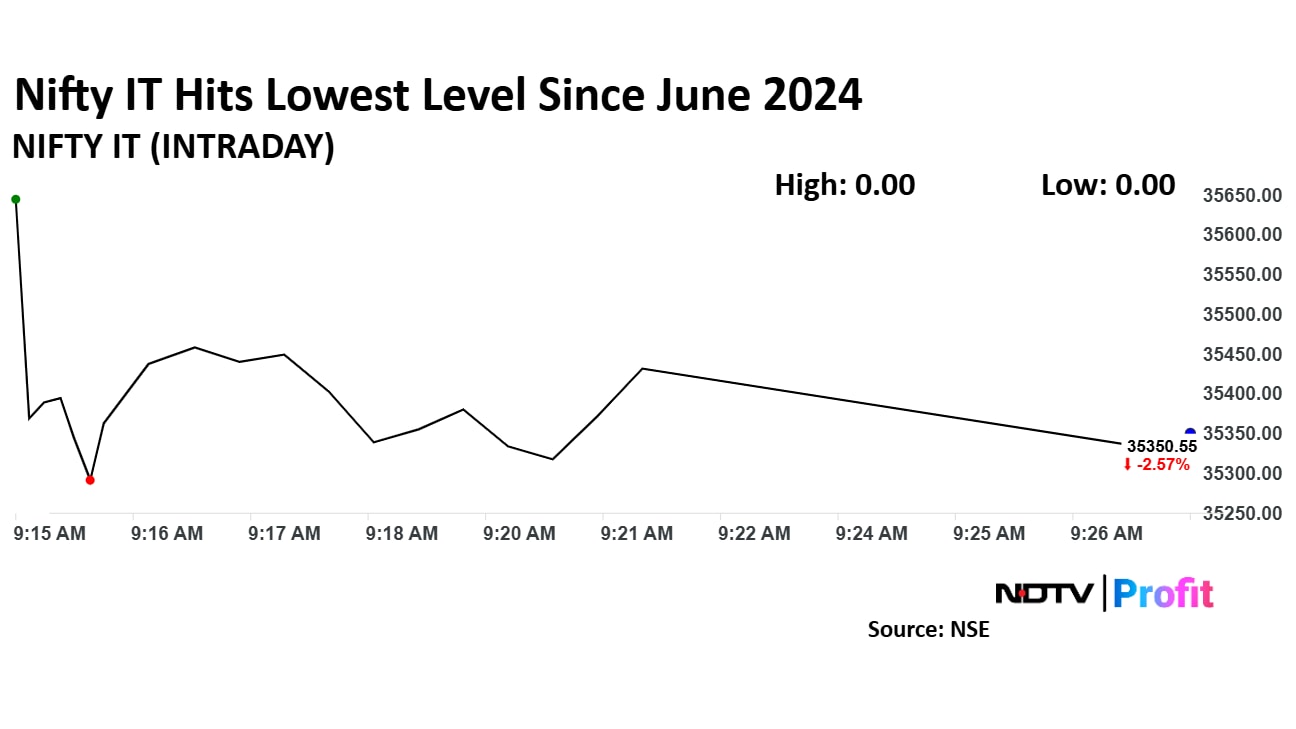

The NSE Nifty IT hit the lowest level since June 24. It ended 4.21% down.

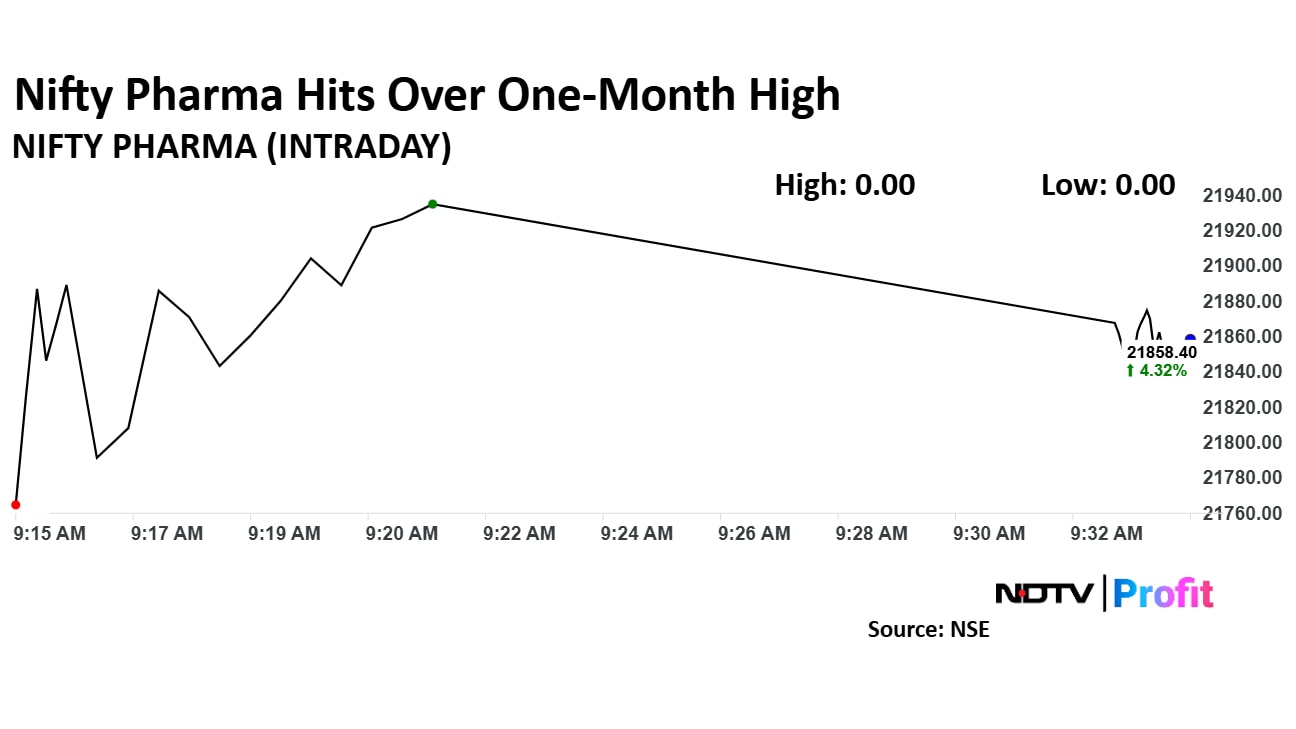

The NSE Nifty Pharma rose to over one-month high. It ended 2.25% higher.

The NSE Nifty Midcap 150 ended 0.20% higher.

The NSE Nifty Smallcap 250 ended 0.70% higher.

The Nifty 50 and Sensex ended lower as concerns over potential trade war dented risk-on sentiment

The Nifty 50 and Sensex ended 0.35% and 0.42% down, respectively.

The NSE Nifty IT hit the lowest level since June 24. It ended 4.21% down.

The NSE Nifty Pharma rose to over one-month high. It ended 2.25% higher.

The NSE Nifty Midcap 150 ended 0.20% higher.

The NSE Nifty Smallcap 250 ended 0.70% higher.

The Nifty 50 and Sensex ended lower as concerns over potential trade war dented risk-on sentiment

The Nifty 50 and Sensex ended 0.35% and 0.42% down, respectively.

The NSE Nifty IT hit the lowest level since June 24. It ended 4.21% down.

The NSE Nifty Pharma rose to over one-month high. It ended 2.25% higher.

The NSE Nifty Midcap 150 ended 0.20% higher.

The NSE Nifty Smallcap 250 ended 0.70% higher.

The Nifty 50 and Sensex ended lower as concerns over potential trade war dented risk-on sentiment

The Nifty 50 and Sensex ended 0.35% and 0.42% down, respectively.

The NSE Nifty IT hit the lowest level since June 24. It ended 4.21% down.

The NSE Nifty Pharma rose to over one-month high. It ended 2.25% higher.

The NSE Nifty Midcap 150 ended 0.20% higher.

The NSE Nifty Smallcap 250 ended 0.70% higher.

The Nifty 50 and Sensex ended lower as concerns over potential trade war dented risk-on sentiment

The Nifty 50 and Sensex ended 0.35% and 0.42% down, respectively.

The NSE Nifty IT hit the lowest level since June 24. It ended 4.21% down.

The NSE Nifty Pharma rose to over one-month high. It ended 2.25% higher.

The NSE Nifty Midcap 150 ended 0.20% higher.

The NSE Nifty Smallcap 250 ended 0.70% higher.

The Nifty 50 and Sensex ended lower as concerns over potential trade war dented risk-on sentiment

The Nifty 50 and Sensex ended 0.35% and 0.42% down, respectively.

The NSE Nifty IT hit the lowest level since June 24. It ended 4.21% down.

The NSE Nifty Pharma rose to over one-month high. It ended 2.25% higher.

The NSE Nifty Midcap 150 ended 0.20% higher.

The NSE Nifty Smallcap 250 ended 0.70% higher.

The Nifty 50 and Sensex ended lower as concerns over potential trade war dented risk-on sentiment

The Nifty 50 and Sensex ended 0.35% and 0.42% down, respectively.

The NSE Nifty IT hit the lowest level since June 24. It ended 4.21% down.

The NSE Nifty Pharma rose to over one-month high. It ended 2.25% higher.

The NSE Nifty Midcap 150 ended 0.20% higher.

The NSE Nifty Smallcap 250 ended 0.70% higher.

The Nifty 50 and Sensex ended lower as concerns over potential trade war dented risk-on sentiment

The Nifty 50 and Sensex ended 0.35% and 0.42% down, respectively.

The NSE Nifty IT hit the lowest level since June 24. It ended 4.21% down.

The NSE Nifty Pharma rose to over one-month high. It ended 2.25% higher.

The NSE Nifty Midcap 150 ended 0.20% higher.

The NSE Nifty Smallcap 250 ended 0.70% higher.

Shakti Pumps has received a significant order worth Rs 12 crore from the Maharashtra Energy Department. The order involves the supply of 445 solar water pumping systems, aimed at promoting sustainable irrigation practices in the region.

Markets across eurozone were trading losses after tension rose regarding potential trade war following US tariff imposition. European Union has vowed to retaliate to US Donald Trump's 20% tariff on bloc's exports.

The euro extends advance, rises over 1% to its highest level in six months

The dollar close to erasing all of its gains since early November

Domestic retail advances as On March 31 rises 19.4% to Rs 2.6 lakh crore.

Domestic advances as on March 31 up 13.7% to Rs 10.2 lakh crore.

Global Advances as on March 31 up 12.9% to Rs 12.3 lakh crore.

Domestic Deposits as of March 31 up 9.3% to Rs 12.4 lakh crore.

Global Deposits as of March 31 up 10.3% to Rs 14.7 lakh crore.

Global Business as on March 31 up 11.4% to Rs 27 lakh crore.

Expect To Maintain Double Digit Revenue Growth Momentum In financial year 2026.

Crude Oil Derivatives Remained Rangebound in the fourth quarter.

Copra & Vegetable Oil Prices Remained Firm at Peak Level in fourth quarter.

Consolidated Revenue Growth In financial year 2025 Likely To Be In Low Double Digits

Expect Marginal Operating Profit Growth fourth quarter.

International Business Had Mid-Teen Constant Currency Growth in the fourth quarter.

Fourth quarter Consolidated Revenue Growth Moved To High-Teens.

India Business Witnessed Sequential Uptick In Volume Growth In the fourth quarter.

Over 1.18 million shares of Mahindra Financial were traded via a block deal on Thursday. The share of Tata Steel fell as much as 1.92% to Rs 263.50 apiece.

E2E Networks Ltd. has announced the deployment of NVIDIA H200 clusters in Delhi NCR and Chennai, marking a significant milestone in India's AI revolution, the company said in an exchange filing.

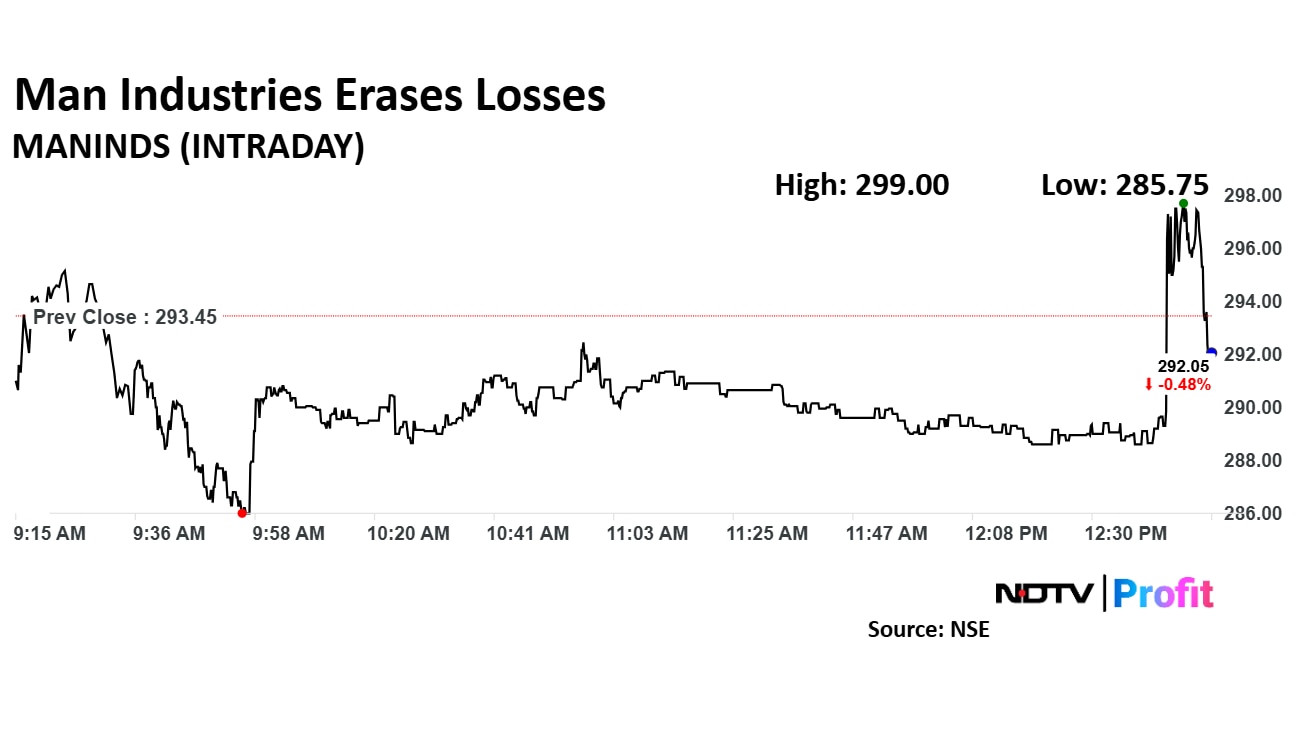

Man Industries Ltd. has announced its inclusion in Qatar Energy LNG's approved vendor list. This recognition enables the company to explore potential business opportunities with Qatar Energy LNG, a leading player in the global energy sector.

Man Industries Ltd. has announced its inclusion in Qatar Energy LNG's approved vendor list. This recognition enables the company to explore potential business opportunities with Qatar Energy LNG, a leading player in the global energy sector.

The NSE Nifty IT extended morning losses and continued to be the top loser sector on the NSE. The index fell as much as 4.32% to 34,717.55 so far today. It was trading 4.27% down at 34,735.30 as of 12:37 p.m., as compared to 0.26% decline in the NSE Nifty 50 index.

The NSE Nifty IT extended morning losses and continued to be the top loser sector on the NSE. The index fell as much as 4.32% to 34,717.55 so far today. It was trading 4.27% down at 34,735.30 as of 12:37 p.m., as compared to 0.26% decline in the NSE Nifty 50 index.

Amneal Pharmaceuticals, the marketing partner of Shilpa Medicare, has announced the launch of BORUZU (Bortezomib for Injection) in the US. This medication is approved for the treatment of multiple myeloma and mantle cell lymphoma.

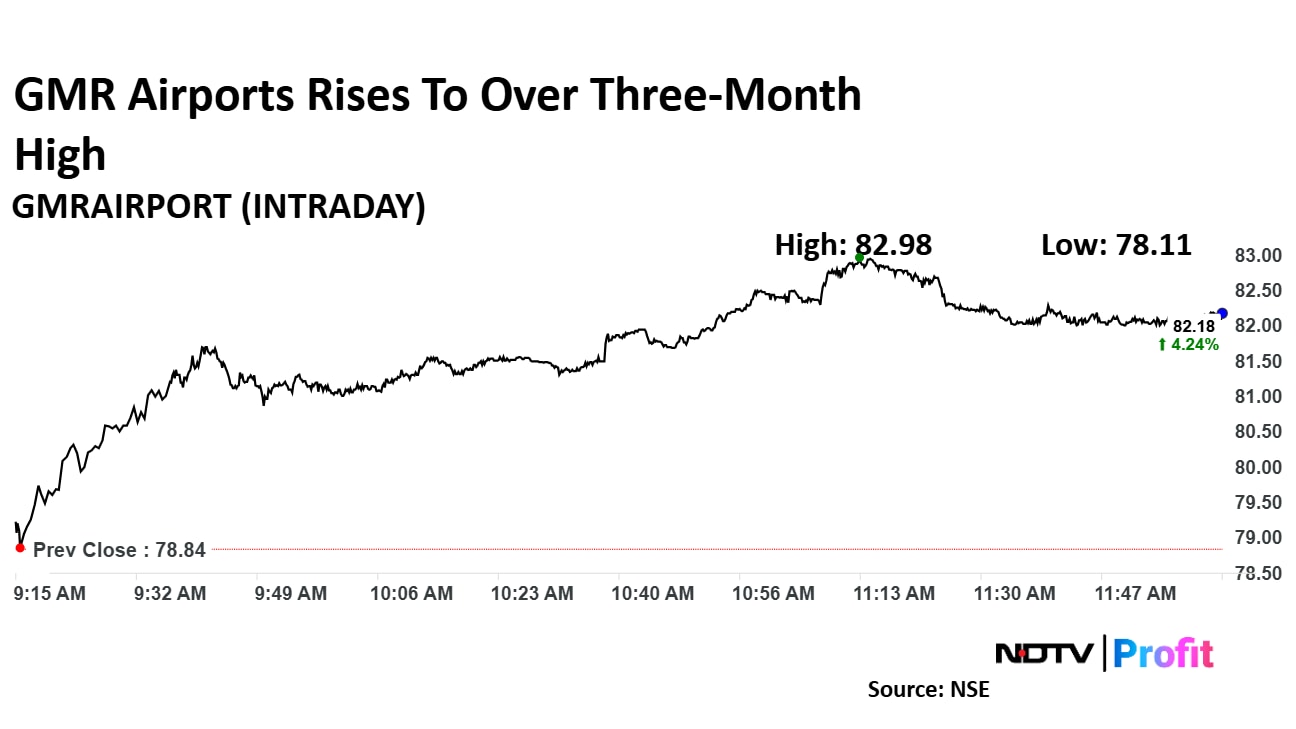

GMR Airports share price rose 5.25% to 82.98 apiece, the highest level since Dec 18, 2024. It was trading 4.13% higher at Rs 82.10 apiece as of 12:05 p.m., as compared to 0.20% decline in the NSE Nifty 50 index.

The share price rose as Citi Research initiated coverage on the company.

GMR Airports share price rose 5.25% to 82.98 apiece, the highest level since Dec 18, 2024. It was trading 4.13% higher at Rs 82.10 apiece as of 12:05 p.m., as compared to 0.20% decline in the NSE Nifty 50 index.

The share price rose as Citi Research initiated coverage on the company.

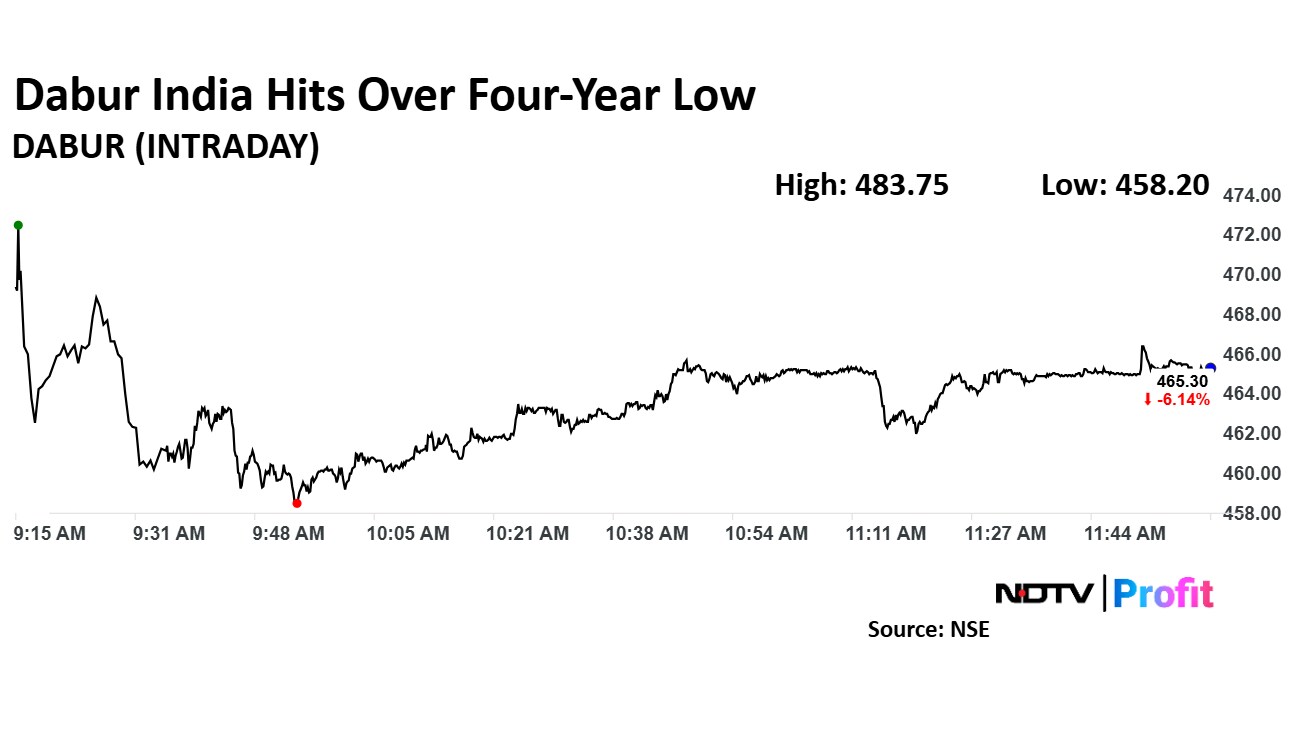

Dabur India Ltd. share price declined 7.57% to Rs 458.20 apiece, the lowest level since June 29, 2020. The stock price extended losses to fourth day. It was trading 6.16% down at Rs 465.20 apiece as of 12:02 p.m., as compared to 0.19% decline in the NSE Nifty 50 index.

Dabur India Ltd. share price declined 7.57% to Rs 458.20 apiece, the lowest level since June 29, 2020. The stock price extended losses to fourth day. It was trading 6.16% down at Rs 465.20 apiece as of 12:02 p.m., as compared to 0.19% decline in the NSE Nifty 50 index.

Network People Services Technologies has secured a significant order worth Rs 168 crore from Central Bank of India. The order involves the supply of sound boxes equipped with QR codes, aimed at enhancing customer convenience and accessibility.

With US automotive tariffs rising, India's EV sector has a prime opportunity to capture a larger share of the US market, especially in the budget car segment.

China's 2023 auto and component exports to the US stood at $17.99 billion, while India's were only $2.1 billion in 2024, highlighting the potential for growth.

To accelerate this, the government should enhance the PLI scheme by including more auto components, opening it to new players, and extending it by two years.

Source: Saurabh Agarwal, partner and automotive tax leader, EY India

Total business as on March 31 rose 22.7% at Rs 4.8 lakh crore (YoY)

Loans & advances as on March 31 rose 20.3% at Rs 2.4 lakh crore (YoY)

Customer deposits as on March 31 rose 25.2% at Rs 2.4 lakh crore (YoY)

CASA ratio as on March 31 was at 46.9% vs 47.7% (QoQ)

Source: Exchange filing

Asset Under Management as on March 31 rose 14.7% to Rs 35,550 crore (QoQ)

Liquidity as on March 31 stands at Rs 4,670 crore

Source: Exchange filing

Brightcom Group has received interim relief from the Telangana High Court in a matter involving petitioners Y Ramesh Reddy, Y Srinivasa Rao, and Vijay Kancharla. This relief provides temporary protection to the petitioners, allowing them to proceed without facing immediate adverse actions. The court's decision indicates that the petitioners' concerns warrant further consideration, and the case will likely proceed with additional hearings.

Parag Milk Foods' board has approved raising up to Rs 161 crore through a preferential issue of convertible warrants, according to an exchange filing.

US President Donald Trump announced a 26% tariff on Indian imports on Thursday, citing the country's higher tariff rates on American goods. The tariffs came into effect at midnight EST on Thursday, marking the move as one of the most aggressive in trade in recent history.

Read the full article here.

Shares of auto parts makers tumbled on Thursday after US President Donald Trump imposed a 25% tariff on foreign automakers. The tariff, which applies to components from May 3, is a response to alleged unfair trade practices by countries like India, Vietnam and more.

Read the full article here.

Vijay Kedia, an individual investor, believes that gold has become euphoric just like equities. He suggests not to buy the bullion at this price range.

According to Kedia investors should rejoice that the tariff on India is relatively low. Tariff are good moves for India. Bull market is longer while bear market is getting shorter. He expects markets to bottom out by June.

Kedia sees opportunities in power and ancillaries. Kedia will hold onto pharma stocks, he said in an interview to NDTV Profit.

US President Donald Trump's action on reciprocal tariffs could lead to reserve banks worldwide dumping the dollar in favour of alternatives, according to Deepak Shenoy, Founder and Chief Executive Officer of Capital Mind.

Read the full article here.

The NSE Nifty Pharma index rose on Thursday to hit over one-month high, driven by relief across the sector as it was excluded from US President Donald Trump's new tariffs. Meanwhile, Sun Pharmaceutical Industries, Dr. Reddy's Laboratories Ltd., and Cipla Ltd. were the top gainers in Nifty 50.

The NSE Nifty Pharma index rose on Thursday to hit over one-month high, driven by relief across the sector as it was excluded from US President Donald Trump's new tariffs. Meanwhile, Sun Pharmaceutical Industries, Dr. Reddy's Laboratories Ltd., and Cipla Ltd. were the top gainers in Nifty 50.

The NSE Nifty IT declines as much as 2.80% to 35,266.30, the lowest level since June 27. Infosys Ltd., and Tata Consultancy Services Ltd. weighed on the Nifty IT index.

The NSE Nifty IT declines as much as 2.80% to 35,266.30, the lowest level since June 27. Infosys Ltd., and Tata Consultancy Services Ltd. weighed on the Nifty IT index.

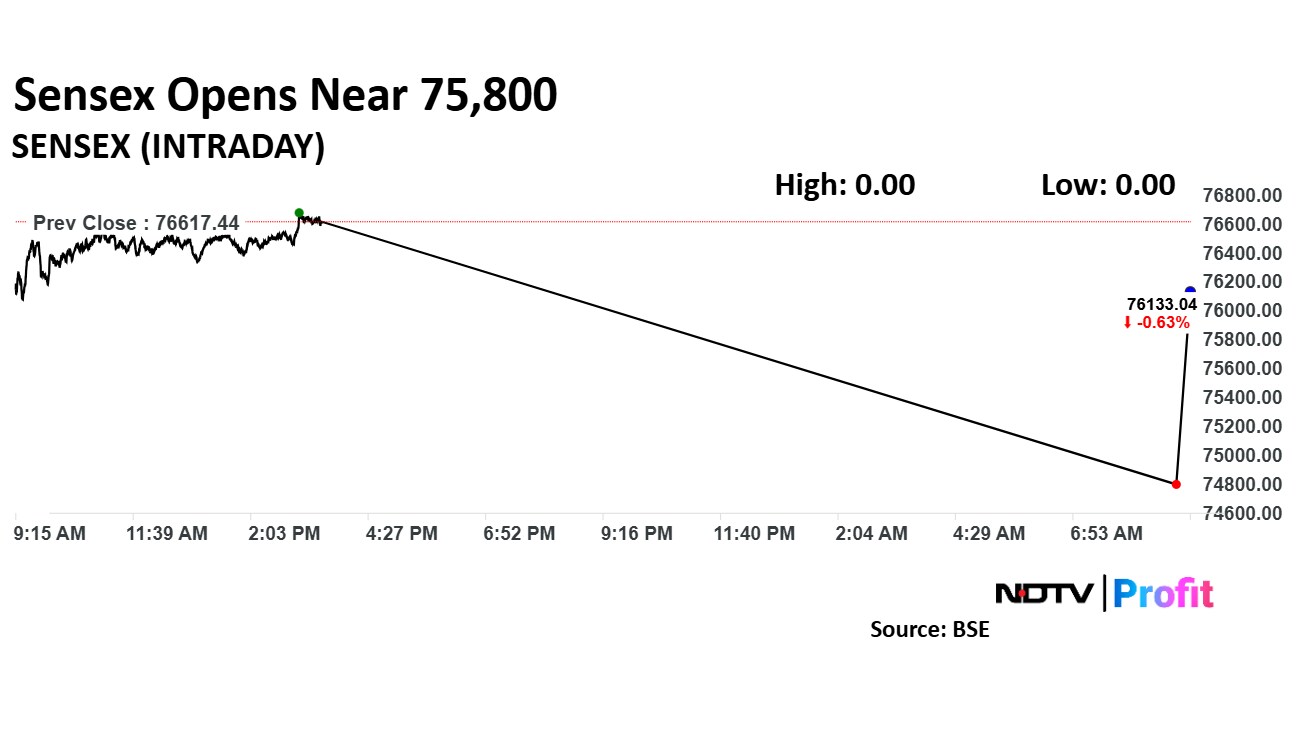

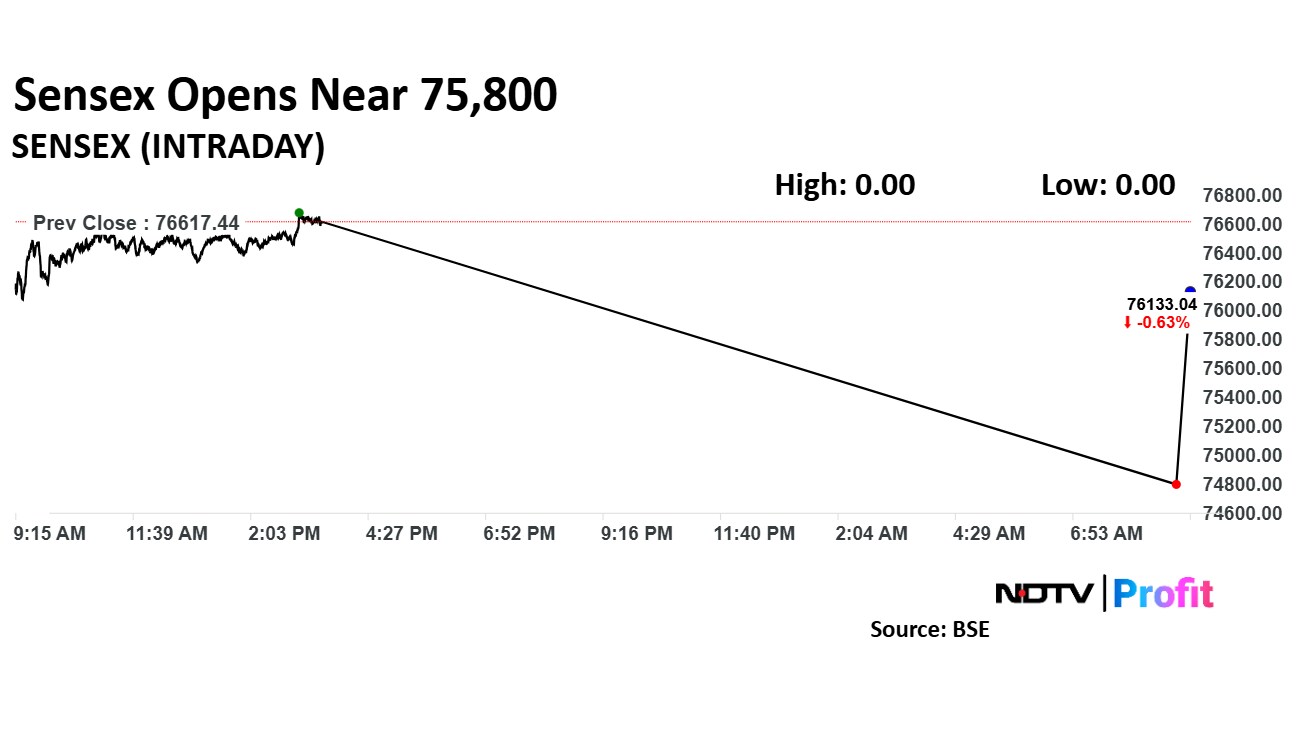

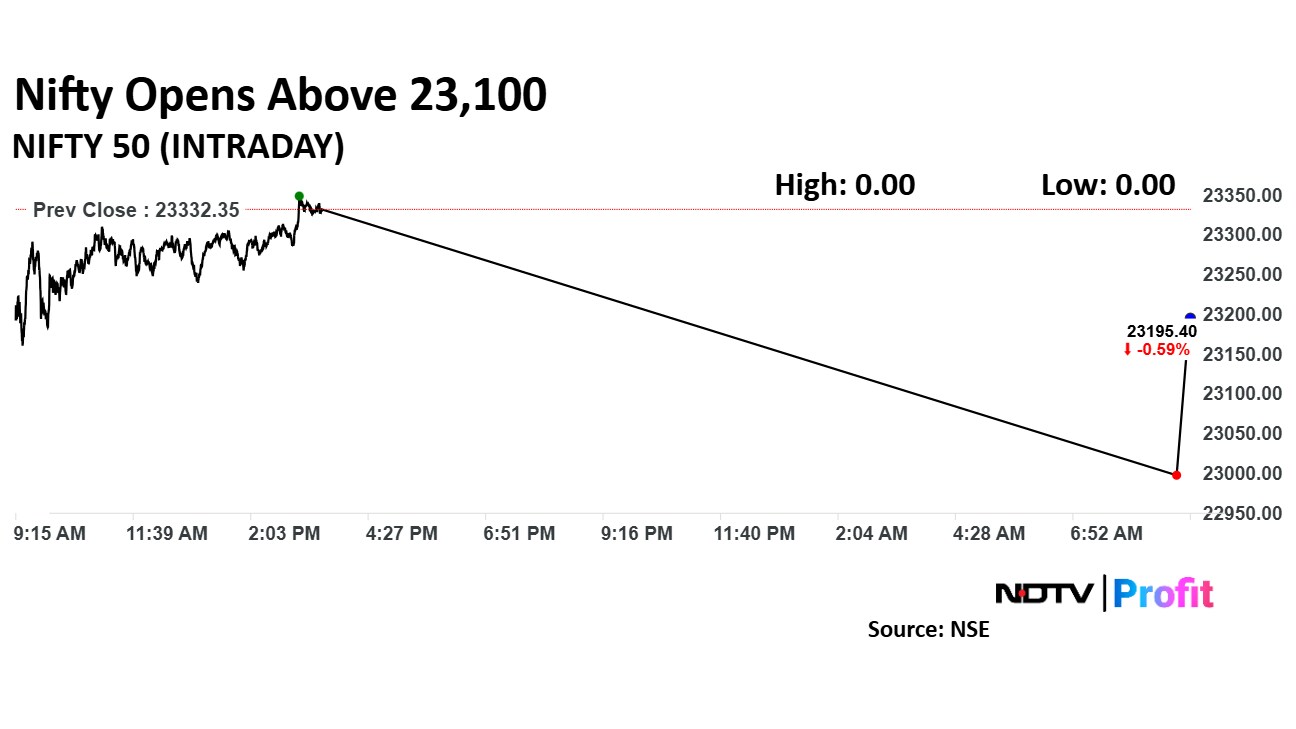

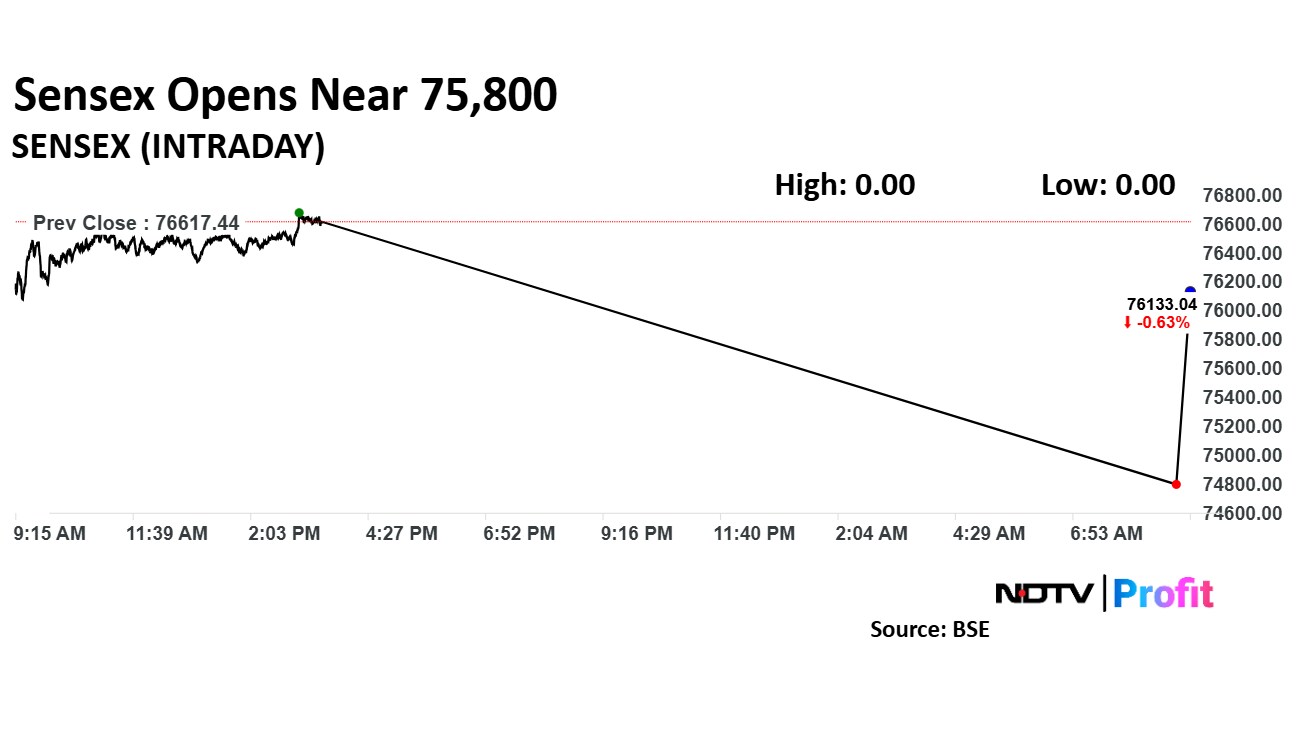

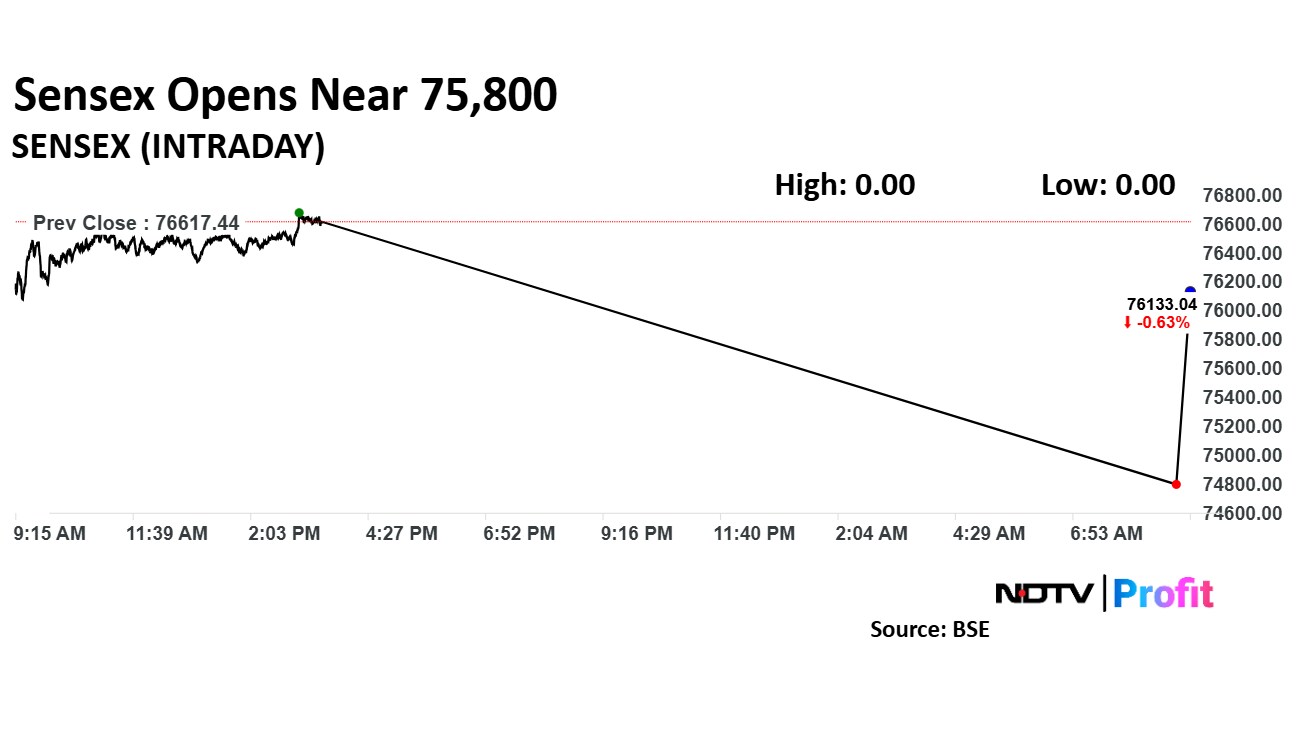

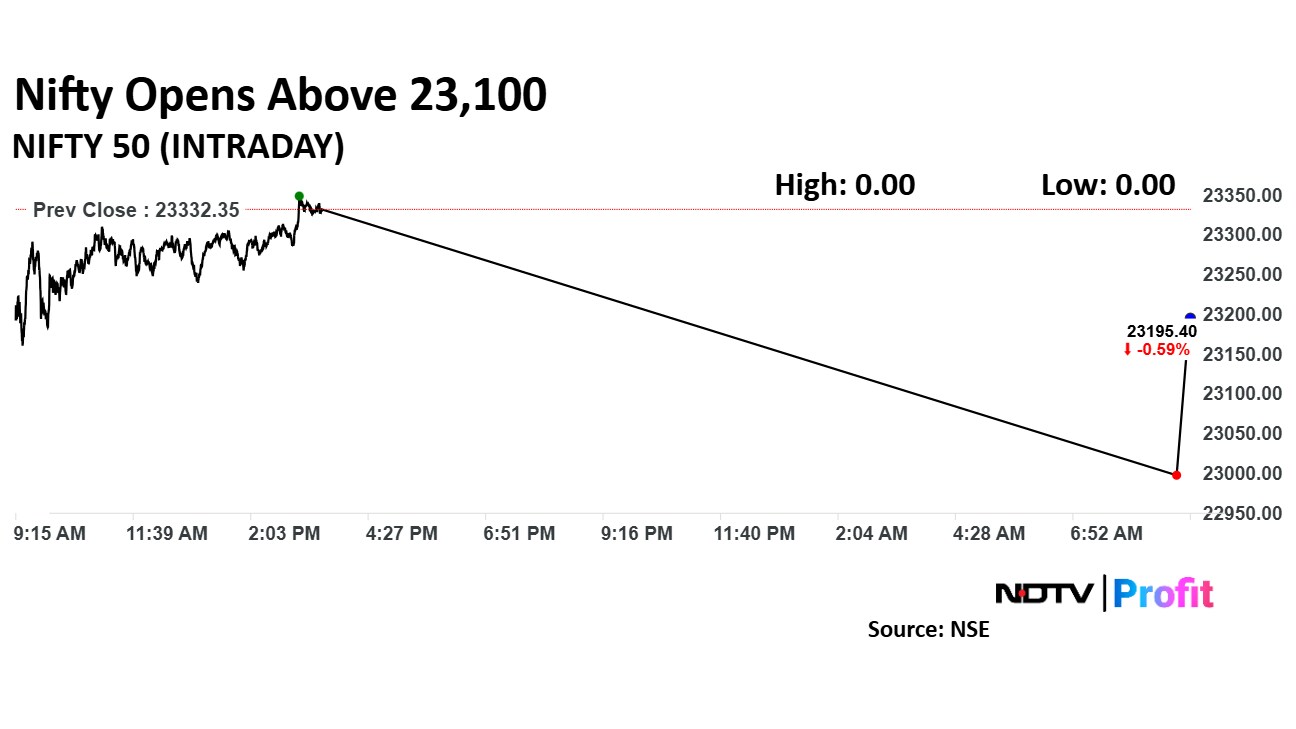

The NSE Nifty 50 and BSE Sensex opened lower on Thursday as the US President Donald Trump unveilved sweeping tariffs on its trading partner to curb the trade imbalances. Trump imposed 26% levy on Indian imports.

The Nifty 50 and Sensex were trading 0.45% and 0.55% down, respectively as of 9:21 a.m.

"From a technical standpoint, the Nifty formed an inside candlestick on the daily chart, indicating indecisiveness in market sentiment. A breakout above key levels could lead to a bullish movement in the near term. Immediate support levels are seen at 23,000 and 22,800, which could present potential buying opportunities, while resistance levels are observed at 23,500 and 23,700," said Hardik Matalia, derivative analyst, Choice Broking.

The NSE Nifty 50 and BSE Sensex opened lower on Thursday as the US President Donald Trump unveilved sweeping tariffs on its trading partner to curb the trade imbalances. Trump imposed 26% levy on Indian imports.

The Nifty 50 and Sensex were trading 0.45% and 0.55% down, respectively as of 9:21 a.m.

"From a technical standpoint, the Nifty formed an inside candlestick on the daily chart, indicating indecisiveness in market sentiment. A breakout above key levels could lead to a bullish movement in the near term. Immediate support levels are seen at 23,000 and 22,800, which could present potential buying opportunities, while resistance levels are observed at 23,500 and 23,700," said Hardik Matalia, derivative analyst, Choice Broking.

The NSE Nifty 50 and BSE Sensex opened lower on Thursday as the US President Donald Trump unveilved sweeping tariffs on its trading partner to curb the trade imbalances. Trump imposed 26% levy on Indian imports.

The Nifty 50 and Sensex were trading 0.45% and 0.55% down, respectively as of 9:21 a.m.

"From a technical standpoint, the Nifty formed an inside candlestick on the daily chart, indicating indecisiveness in market sentiment. A breakout above key levels could lead to a bullish movement in the near term. Immediate support levels are seen at 23,000 and 22,800, which could present potential buying opportunities, while resistance levels are observed at 23,500 and 23,700," said Hardik Matalia, derivative analyst, Choice Broking.

The NSE Nifty 50 and BSE Sensex opened lower on Thursday as the US President Donald Trump unveilved sweeping tariffs on its trading partner to curb the trade imbalances. Trump imposed 26% levy on Indian imports.

The Nifty 50 and Sensex were trading 0.45% and 0.55% down, respectively as of 9:21 a.m.

"From a technical standpoint, the Nifty formed an inside candlestick on the daily chart, indicating indecisiveness in market sentiment. A breakout above key levels could lead to a bullish movement in the near term. Immediate support levels are seen at 23,000 and 22,800, which could present potential buying opportunities, while resistance levels are observed at 23,500 and 23,700," said Hardik Matalia, derivative analyst, Choice Broking.

The NSE Nifty 50 and BSE Sensex opened lower on Thursday as the US President Donald Trump unveilved sweeping tariffs on its trading partner to curb the trade imbalances. Trump imposed 26% levy on Indian imports.

The Nifty 50 and Sensex were trading 0.45% and 0.55% down, respectively as of 9:21 a.m.

"From a technical standpoint, the Nifty formed an inside candlestick on the daily chart, indicating indecisiveness in market sentiment. A breakout above key levels could lead to a bullish movement in the near term. Immediate support levels are seen at 23,000 and 22,800, which could present potential buying opportunities, while resistance levels are observed at 23,500 and 23,700," said Hardik Matalia, derivative analyst, Choice Broking.

The NSE Nifty 50 and BSE Sensex opened lower on Thursday as the US President Donald Trump unveilved sweeping tariffs on its trading partner to curb the trade imbalances. Trump imposed 26% levy on Indian imports.

The Nifty 50 and Sensex were trading 0.45% and 0.55% down, respectively as of 9:21 a.m.

"From a technical standpoint, the Nifty formed an inside candlestick on the daily chart, indicating indecisiveness in market sentiment. A breakout above key levels could lead to a bullish movement in the near term. Immediate support levels are seen at 23,000 and 22,800, which could present potential buying opportunities, while resistance levels are observed at 23,500 and 23,700," said Hardik Matalia, derivative analyst, Choice Broking.

The NSE Nifty 50 and BSE Sensex opened lower on Thursday as the US President Donald Trump unveilved sweeping tariffs on its trading partner to curb the trade imbalances. Trump imposed 26% levy on Indian imports.

The Nifty 50 and Sensex were trading 0.45% and 0.55% down, respectively as of 9:21 a.m.

"From a technical standpoint, the Nifty formed an inside candlestick on the daily chart, indicating indecisiveness in market sentiment. A breakout above key levels could lead to a bullish movement in the near term. Immediate support levels are seen at 23,000 and 22,800, which could present potential buying opportunities, while resistance levels are observed at 23,500 and 23,700," said Hardik Matalia, derivative analyst, Choice Broking.

The NSE Nifty 50 and BSE Sensex opened lower on Thursday as the US President Donald Trump unveilved sweeping tariffs on its trading partner to curb the trade imbalances. Trump imposed 26% levy on Indian imports.

The Nifty 50 and Sensex were trading 0.45% and 0.55% down, respectively as of 9:21 a.m.

"From a technical standpoint, the Nifty formed an inside candlestick on the daily chart, indicating indecisiveness in market sentiment. A breakout above key levels could lead to a bullish movement in the near term. Immediate support levels are seen at 23,000 and 22,800, which could present potential buying opportunities, while resistance levels are observed at 23,500 and 23,700," said Hardik Matalia, derivative analyst, Choice Broking.

At pre-open, the NSE Nifty 50 was trading 182.05 points or 0.78% down at 23,150.30, and the BSE Sensex was trading 805.58 points or 1.05% down at 75,811.86.

The yield on the 10-year bond opened 2 basis points lower at 6.46%. It closed at 6.48% on Wednesday, according to data on Bloomberg.

Rupee weakened 24 paise to open at 85.75 against US dollar. It ended at 85.51 a dollar on Wednesday, according to data on Bloomberg.

Auto & auto parts subject to Section 232 tariffs at 25% not covered in latest order

Detailed list of auto components that will be subject to 25% auto tariff is awaited

ACMA says hopeful of a India-US trade deal that will be balanced for both nations

Note: The Automotive Component Manufacturers Association of India (ACMA) is the apex body representing the interest of India’s auto components industry

Quote

“ACMA is committed to engaging with all stakeholders to ensure the long-term interests of the Indian auto component industry.” — ACMA President Shradha Suri Marwah

Source: ACMA statement

CASA ratio at 29.2% compared 30.6%

Total deposits rose 10.7% at Rs 1.2 lakh crore

Gross advances rose 7.7% ar Rs 1.1 lakh crore

Source: Exchange filing

Growth concerns beginning to dominate inflation concerns

Expect Fed’s policy choices get complicated

Bigger channel of impact is overall global slowdown to hurt everyone

India Implications:

Around 18% of total goods exports to US, 2% of GDP

Direct impact of taiffs on India limited, indirect impact is large

Weak overall global growth is likely to weigh on India’s exports

2/3 of India’s topline linked to global growth directly or indirectly

BSE500 topline and exports have strong correlation, earnings cut risks loom large

Portfolio Allocation:

Investors should position for a global risk-off

Overweight:

Private banks, insurance

consumer, telecom, pharma

cement, chemicals, QSR

Underweight:

Industrials, metals, PSUs

Recently downgraded IT to underweight on high valuations

There is an absolutely exodus from the US in the last six weeks. Algorithm to calculate the tariff is sixth grade mathematics. It is a negotiating strategy but the price is so high that customer will likely walk away. Many countries will just walk away from the negotiating table, said Marko Papic, macro and geopolitical expert at BCA Research.

Almost every equity market has outperformed the US market. Papic believes that every equity market, including India, will outperform the US.

Formula for computation of the tariff is irrational. Tariff and US view is worse than the worst case scenario, said Ajay Bagga, a market expert.

Reciprocal, differential tariffs imposed on India. Common 10% baseline tariff to come into effect starting April 5, additional 16% reciprocal tariff to hit India starting April 10. Tariffs seen as a mixed bag for India, according to sources in the Ministry of Commerce.

Some sectors will get impacted, some might benefit as India might get competitive edge against nations like Vietnam, Indonesia. US President retains power to reduce tariffs for countries that negotiate or satisfy American concerns.

India ahead in this scenario, given that bilateral trade negotiations have already started. More elaborate statement, analysis by Commerce Ministry expected during the day

Crude oil prices declined over 2% early trade Thursday as the US imposed higher than expected tariffs on its trading partners to counter trade imbalances. US's protectionist trade policies threatens the present global trade ecosystem which may weigh on demand for crude oil.

China, world's second largest economy and one of the biggest consumer of crude oil now faces tariffs more than 50% from the US.

The brent crude was trading 2.45% down at $73.11 a barrel as of 7:38 a.m.

Gold prices hit record high on Thursday as investors seek comfort in the safe-haven asset while tensions rise about the future of global trade ecosystem after US unveiled tariff policy Wednesday.

The bullion rose as much as 1.07% to record high of $3,167.84 an ounce so far today. It was trading 0.56% higher at $3,151.74 an ounce.

Japan's benchmark the Nikkei 225 slumped over 4% and hit the lowest level since early August 2024. The KOSPI index fell nearly 3% and touched the lowest level since Jan 3. Markets in China and Australia also logged sharp losses.

US President Donald Trump imposed tariffs over 50% on China, 24% on Japan. Trump imposed 10% levy to all exports to the US, and additional tariffs on around 60 nations to deal with the large trade imbalances, Bloomberg reported.

The Nikkei 225 and KOSPI pared losses to trade 2.68% and 1.07% down, respectively. The CSI 300 was 0.16% down as of 7:37 a.m.

US stock futures tumbled after President Donald Trump unveiled sweeping tariff on trade partner countries. He imposed 10% tariff on all exports to the US, and different rates of additional tariff on trading partners on around 60 nations.

The Dow Jones Industrial and S&P 500 futures declined 1.88% and 2.79% down, respectively. The Nasdaq 100 futures fell 3.46% down.

On Wednesday, US markets closed higher on hopes that tariff policies will be less aggressive. The Dow Jones Industrial and S&P 500 ended 0.56% and 0.67% higher, respectively. The Nasdaq Composite ended 0.87% higher.

The GIFT Nifty was trading lower Thursday morning, which implied the benchmark indices may open in losses. US unveiled tariffs on Liberation Day which are higher than anticipated, which will affect global trade ecosystems significantly.

US President Donald Trump announced that a 10% levy will apply on all exports to the world's largest economy, and additional tariffs will apply on its largest trading partners. Trump announced 26% levy on Indian imports, 25% on automobile imports along with baseline tariffs.

The GIFT Nifty was trading 0.74% or 172.50 points lower at 23,050.00 as of 6:36 a.m.

HDFC Bank Ltd., IndusInd Bank Ltd., Bharat Electronics Ltd., MOIL Ltd., and Mahindra & Mahindra Financial Services share prices are in focus.

The benchmark equity indices snapped a two-day losing streak on Wednesday, tracking a rise in HDFC Bank Ltd.

The NSE Nifty 50 ended 166.65 points or 0.72% higher at 23,332.35, and the BSE Sensex closed 592.93 points or 0.78% up at 76,617.44.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.