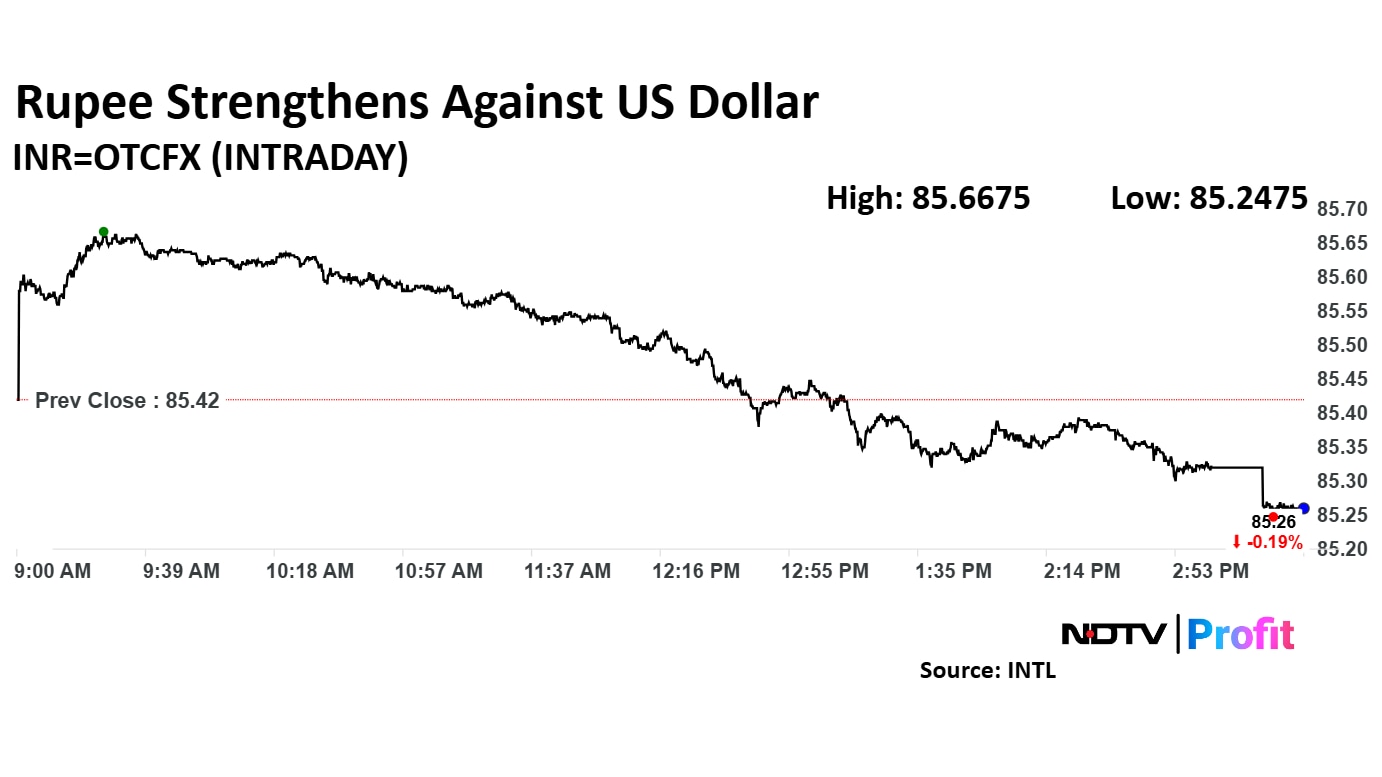

Rupee closed 15 paise stronger at 85.27 against US dollar

It closed at 85.42 a dollar on Wednesday

Source: Bloomberg

Rupee closed 15 paise stronger at 85.27 against US dollar

It closed at 85.42 a dollar on Wednesday

Source: Bloomberg

The NSE Nifty 50 and BSE Sensex ended 0.34% and 0.39% down, respectively.

IndusInd Bank Ltd., UltraTech Cement Ltd., and Grasim Industries Ltd. rose the most.

Hindustan Unilever Ltd., Bharti Airtel Ltd., and Eicher Motors Ltd. declined the most.

The NSE Nifty Realty declined the most, and the NSE Nifty Pharma rose the most.

The NSE Nifty Midcap 150 ended 0.17% down at 20,194.40

The NSE Nifty Smallcap 250 ended 0.05% down at 15,915.25

The NSE Nifty 50 and BSE Sensex ended 0.34% and 0.39% down, respectively.

IndusInd Bank Ltd., UltraTech Cement Ltd., and Grasim Industries Ltd. rose the most.

Hindustan Unilever Ltd., Bharti Airtel Ltd., and Eicher Motors Ltd. declined the most.

The NSE Nifty Realty declined the most, and the NSE Nifty Pharma rose the most.

The NSE Nifty Midcap 150 ended 0.17% down at 20,194.40

The NSE Nifty Smallcap 250 ended 0.05% down at 15,915.25

Revenue at Rs 5,991.67 crore NDTV Profit estimate Of Rs 5,904 crore.

Ebitda at Rs 755 crore versus NDTV Profit estimate Of Rs 760 crore.

Margin at 12.6% versus NDTV Profit estimate of 12.8%.

Profit at Rs 751 crore versus NDTV Profit estimate of Rs 503 crore.

Announces dividend of Rs 7.5 per share.

Most markets in the eurozone decline Thursday as European investors assess several corporate's performance for fourth quarter. German shoe-maker Adidas, BNP Paribas SA, Nestle SA, and Unilever PLC released their results.

French lender BNP Paribas SA reported decline in net income in line with expectation. Adidas's sales beat sales estimate, while Unilever PLC reported better than expected sales.

The Euro Stoxx 50 and CAC 40 were trading 0.74% and 0.60% down, respectively. The DAX was trading 0.71% down as of 2:49 p.m.

Maintain Overweight with a target price of Rs 6,500

The gift that keeps on giving

Growth momentum not at risk

Aiming for 100 basis points margin expansion in FY26

Commentary on the FY26 outlook was optimistic as it feels confident of maintaining the growth momentum

Remains one of our high-conviction Overweights

The Nifty 50 fell as much as 0.37% to hit a low of 24,239.45 on Thursday, while the Sensex fell 0.4% to an intraday low of 79,793.21.

The indices are set to close in the red and break their gaining streak from the past seven sessions.

Supreme Industries Q4 Highlights (Consolidated, YoY)

Revenue up 0.6% to Rs 3,027.07 crore versus Rs 3,007.89 crore

Ebitda down 15% to Rs 416.27 crore versus Rs 490.67 crore

Ebitda margins contracted to 13.8% versus 16.3%

Net profit down 17% to Rs 293.94 crore versus Rs 354.82 crore

The company announced a dividend of Rs 24 per share, for the financial year ended March 31, 2025.

Honasa Consumer has promoted Avinash Dhagat to the position of Chief Supply Chain Officer.

Eternal has clarified that Rakesh Ranjan has not resigned and continues to be part of the company's leadership team.

Morepen Laboratories has launched four new products: Ticapen, UdoFix, LycoMore, and Acifix.

Le Travenues Technology Ltd. AbhiBus has partnered with Chennai Super Kings as the official bus travel partner for the 2025 T20 season.

Ircon International has had the contract value for tunnel systems revised to Rs 203 crore from Rs 144 crore by Indian Railways.

NTPC Green Energy will consider borrowing up to ₹5,000 crore during FY26 in its upcoming board meeting on April 29, the company said in an exchange filing.

Nestle India Q4 Highlights (Standalone, YoY)

Revenue up 4.5% to Rs 5,503.80 crore versus Rs 5,267.50 crore

Ebitda up 3% to Rs 1,388.90 crore versus Rs 1,350.00 crore

Ebitda margins contracted to 25.2% versus 25.6%

Net profit down 4% to Rs 1,204.50 crore versus Rs 1,250.50 crore

Board recommended final dividend of Rs 10 per share

Nestle India Q4 Highlights (Standalone, YoY)

Revenue up 4.5% to Rs 5,503.80 crore versus Rs 5,267.50 crore

Ebitda up 3% to Rs 1,388.90 crore versus Rs 1,350.00 crore

Ebitda margins contracted to 25.2% versus 25.6%

Net profit down 4% to Rs 1,204.50 crore versus Rs 1,250.50 crore

Board recommended final dividend of Rs 10 per share

The scrip declined 1.66% to Rs 2,393 apiece. However, Nestle India share price erased losses shortly.

For faster updates on fourth quarter earning click here.

Vascon Engineers has received a Letter of Intent worth ₹85.43 crore from Yucca Promoters LLP for constructing a commercial building in Pune.

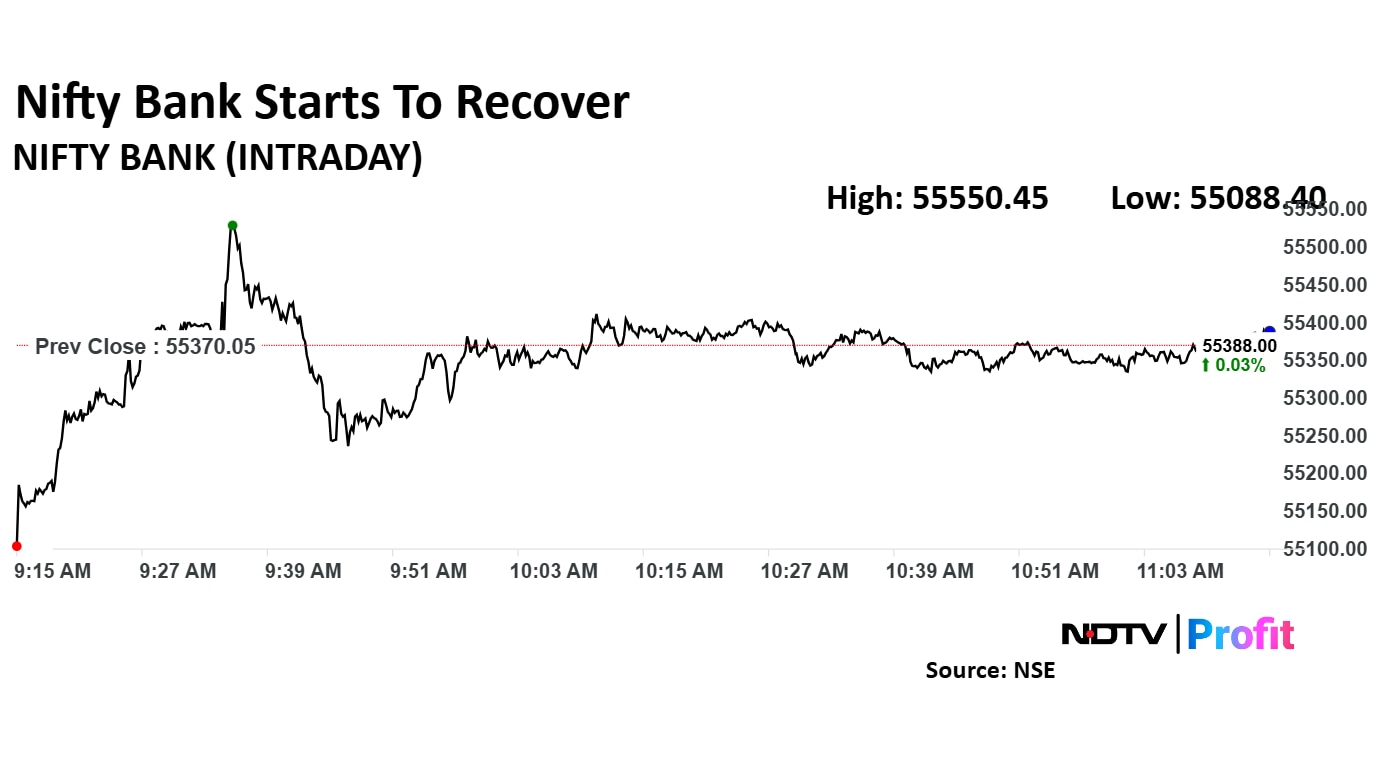

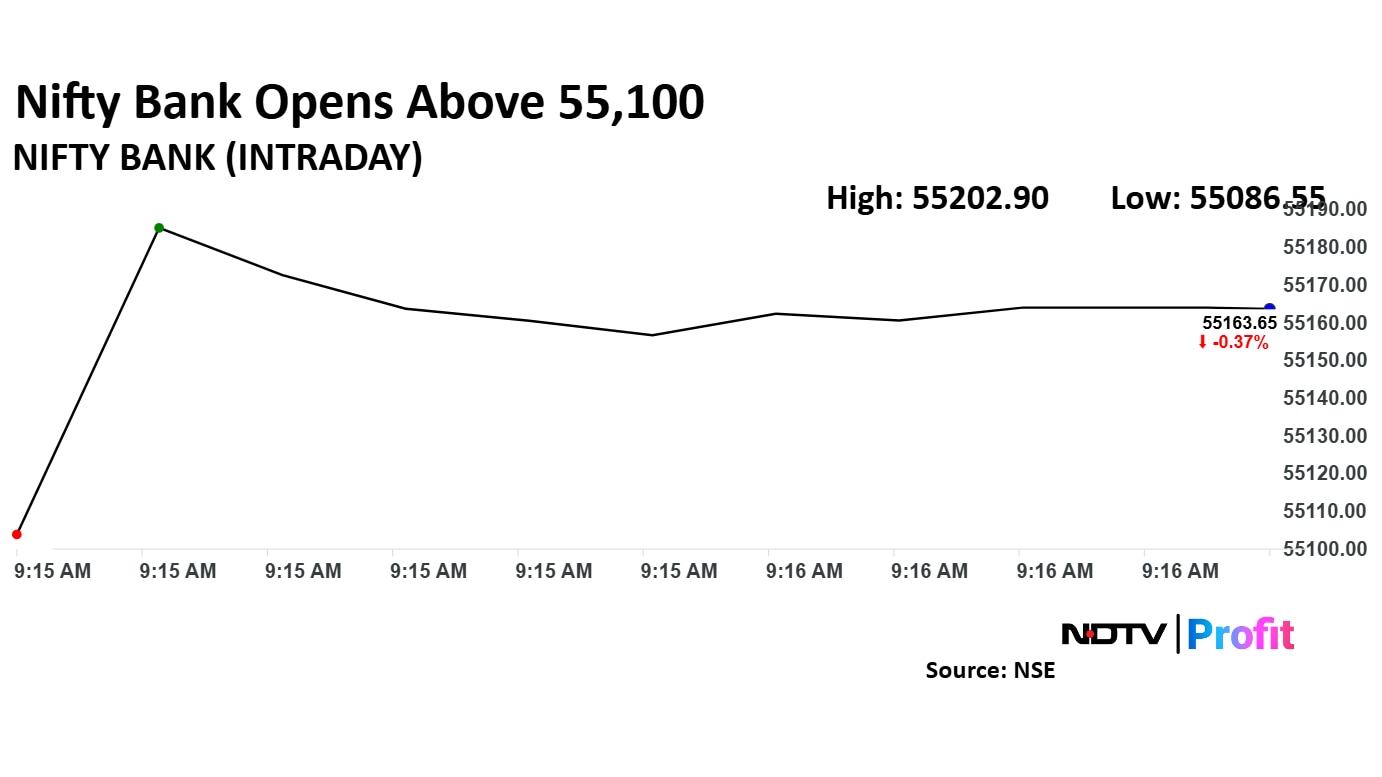

The NSE Nifty Bank reversed losses from previous session as IndusInd Bank Ltd. and Federal Bank Ltd. share prices lead. The index snapped a three-day record rally on Wednesday and opened in loss Thursday.

The index declined as much as 0.51% to the day's low of 55,088.40 so far today. The index was trading flat at 55,365.50 as of 11:19 a.m.

The NSE Nifty Bank reversed losses from previous session as IndusInd Bank Ltd. and Federal Bank Ltd. share prices lead. The index snapped a three-day record rally on Wednesday and opened in loss Thursday.

The index declined as much as 0.51% to the day's low of 55,088.40 so far today. The index was trading flat at 55,365.50 as of 11:19 a.m.

Lupin has received US FDA approval for Tolvaptan Tablets, a medication used to slow kidney function decline in adults with certain kidney diseases.

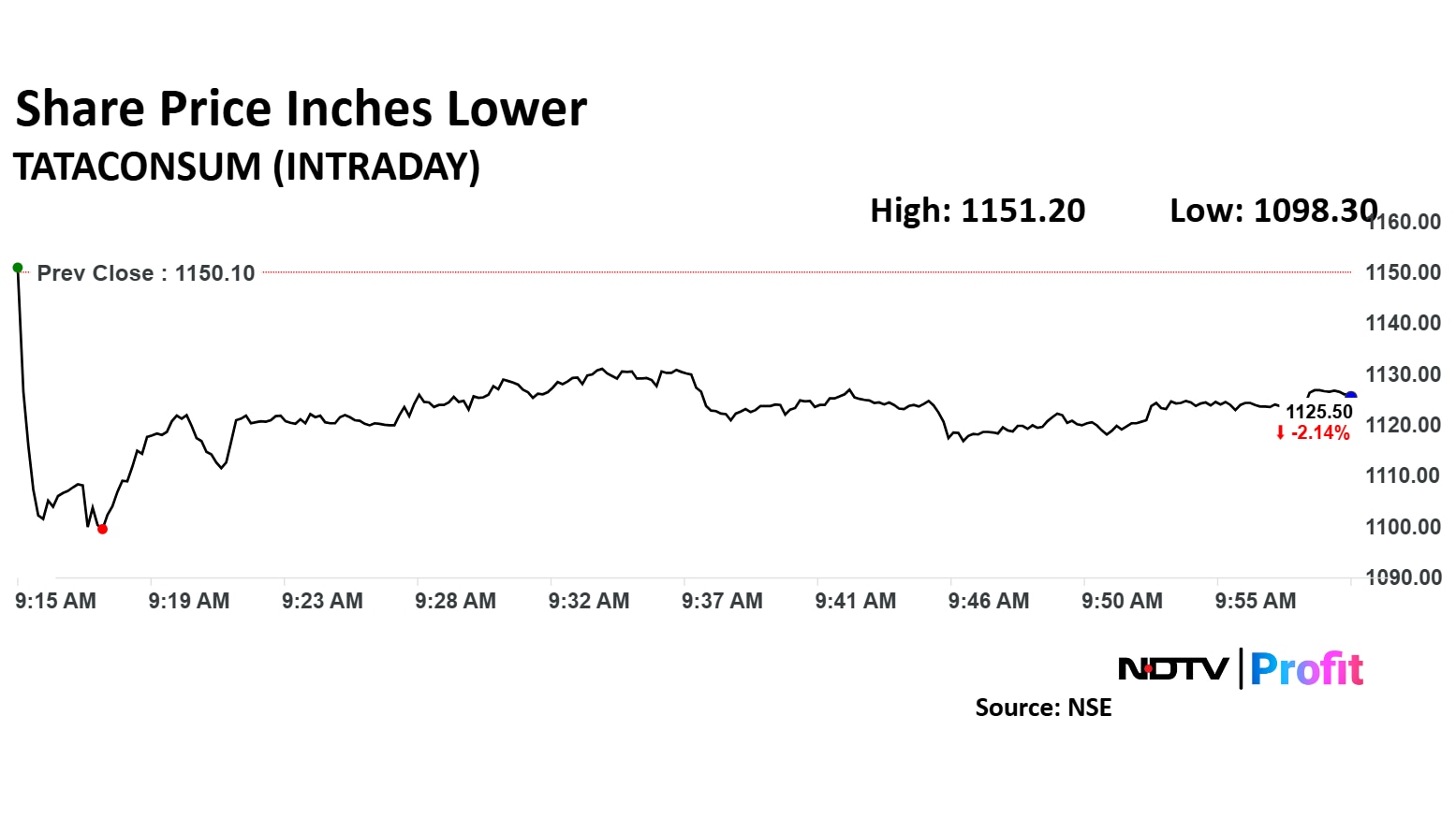

Tata Consumer Products Ltd.'s shares fell over 4% on Thursday as its fourth quarter margins took a beating due to higher tea costs. This, even as the company reported a jump in its net profit.

Tata Consumer Products Ltd.'s shares fell over 4% on Thursday as its fourth quarter margins took a beating due to higher tea costs. This, even as the company reported a jump in its net profit.

Axiscades Technologies Ltd. has appointed Anurag Sharma as CEO of its ADD-Solution division to drive European growth and lead software-driven engineering innovation.

Aurionpro Solutions' subsidiary, AryaXAI, has launched AI Alignment Labs in Paris and Mumbai to accelerate research in artificial intelligence, focusing on developing aligned AI solutions.

Revenue up 2.4% to Rs 15,214 crore versus Rs 14,857 crore

Ebitda up 1% to Rs 3,466 crore versus Rs 3,435 crore

Ebitda margins contracted to 22.8% versus 23.1%

Net profit up 4% to Rs 2,493 crore versus Rs 2,406 crore

Revenue up 2.4% to Rs 15,214 crore versus Rs 14,857 crore

Ebitda up 1% to Rs 3,466 crore versus Rs 3,435 crore

Ebitda margins contracted to 22.8% versus 23.1%

Net profit up 4% to Rs 2,493 crore versus Rs 2,406 crore

For faster updates on fourth quarter earning click here.

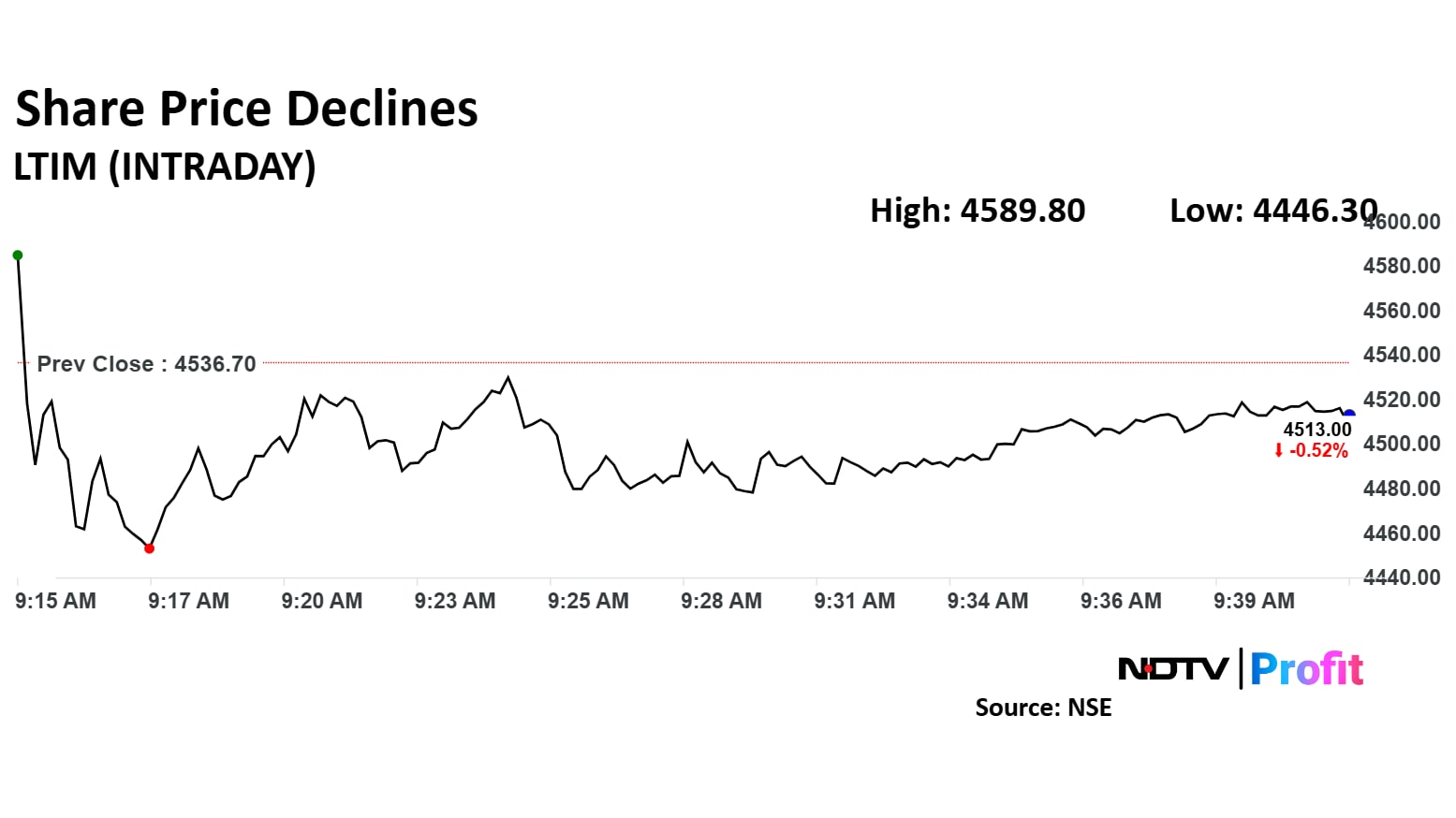

LTIMindtree Ltd. share price declined nearly 2% after reporting its fourth-quarter earning report.

The share price declined despite the company posting an increase in net profit. Moreover, the company's board of directors also recommended a final dividend of Rs 45 per share.

LTIMindtree Ltd. share price declined nearly 2% after reporting its fourth-quarter earning report.

The share price declined despite the company posting an increase in net profit. Moreover, the company's board of directors also recommended a final dividend of Rs 45 per share.

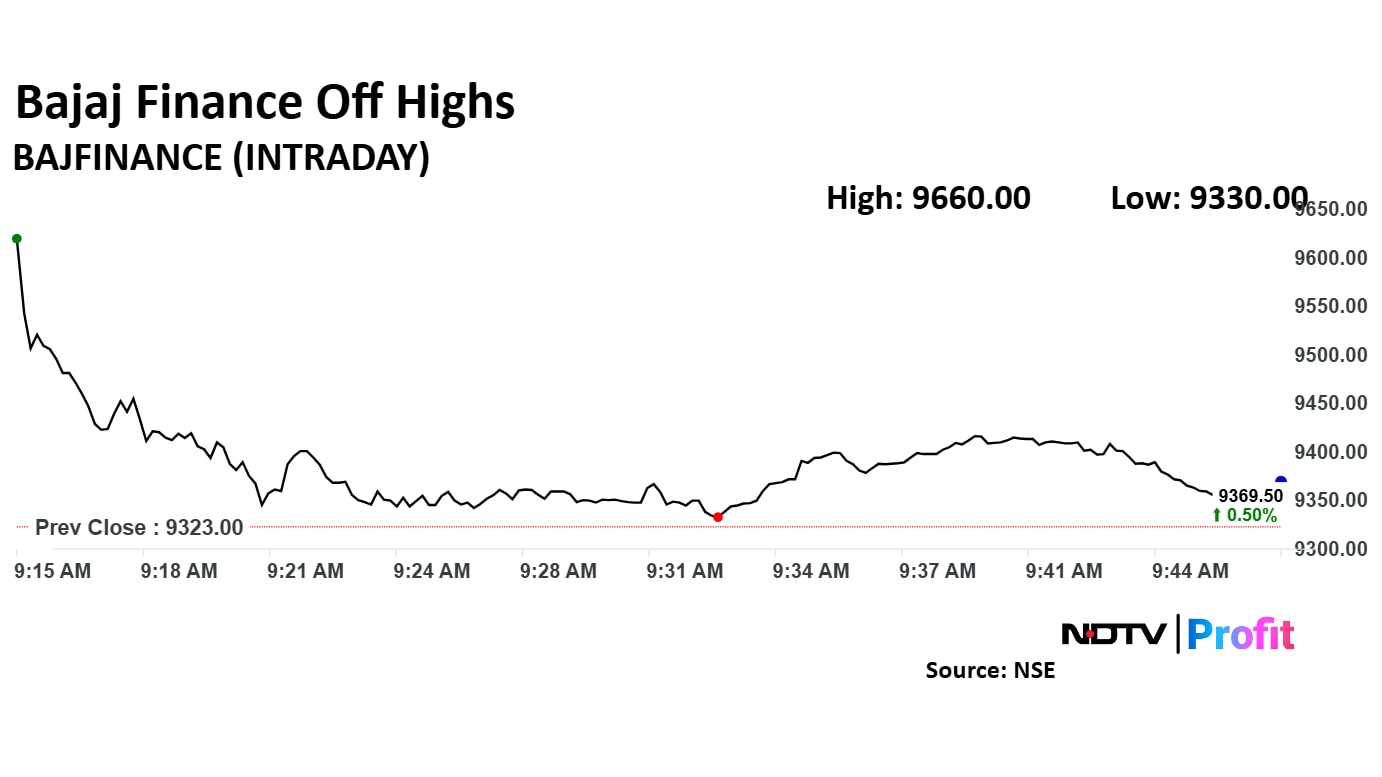

The shares of Bajaj Finance Ltd. rose to hit a new life high after it announced that the board of directors will consider proposals for a stock split and bonus issue of shares during a meeting on April 29.

The shares of Bajaj Finance rose as much as 3.61% to Rs 9,660 apiece to hit a fresh life high.

The shares of Bajaj Finance Ltd. rose to hit a new life high after it announced that the board of directors will consider proposals for a stock split and bonus issue of shares during a meeting on April 29.

The shares of Bajaj Finance rose as much as 3.61% to Rs 9,660 apiece to hit a fresh life high.

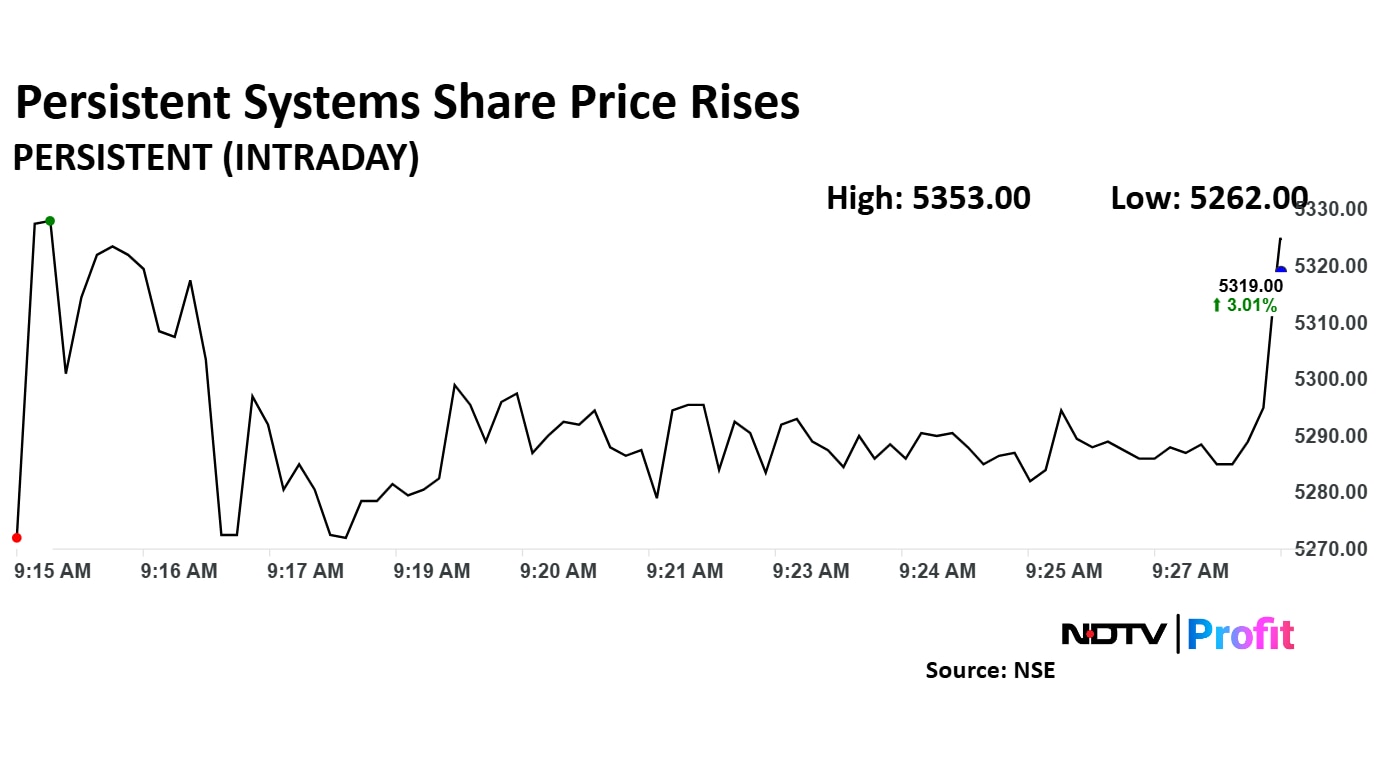

Persistent Systems Ltd. saw a 3.67% rise in its share price on Thursday following the announcement of its fourth-quarter earnings.

Persistent Systems Ltd. saw a 3.67% rise in its share price on Thursday following the announcement of its fourth-quarter earnings.

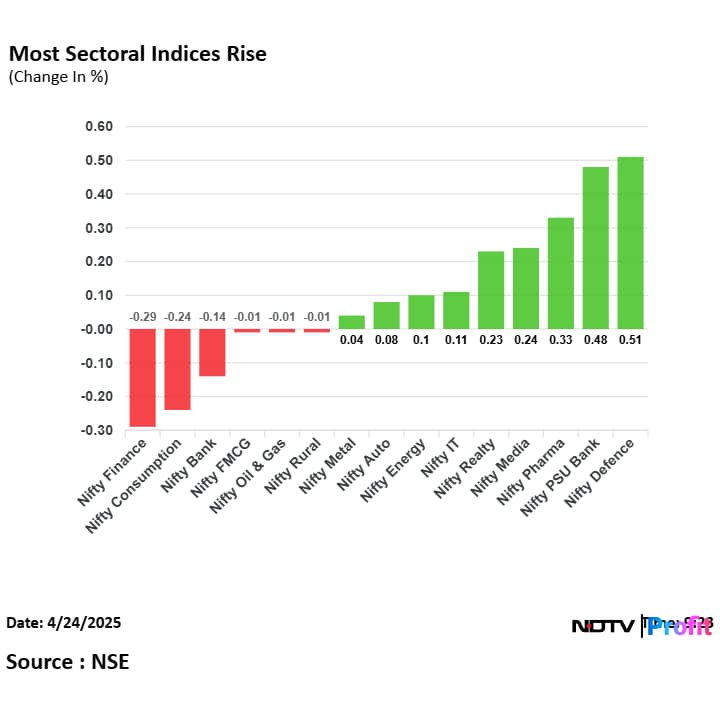

Out of 15 sectoral indices on National Stock Exchange, three declined, three remained flat, and nine sectoral indices advanced. The NSE Nifty Defense was leading in gains, while the NSE Nifty Finance declined the most.

Out of 15 sectoral indices on National Stock Exchange, three declined, three remained flat, and nine sectoral indices advanced. The NSE Nifty Defense was leading in gains, while the NSE Nifty Finance declined the most.

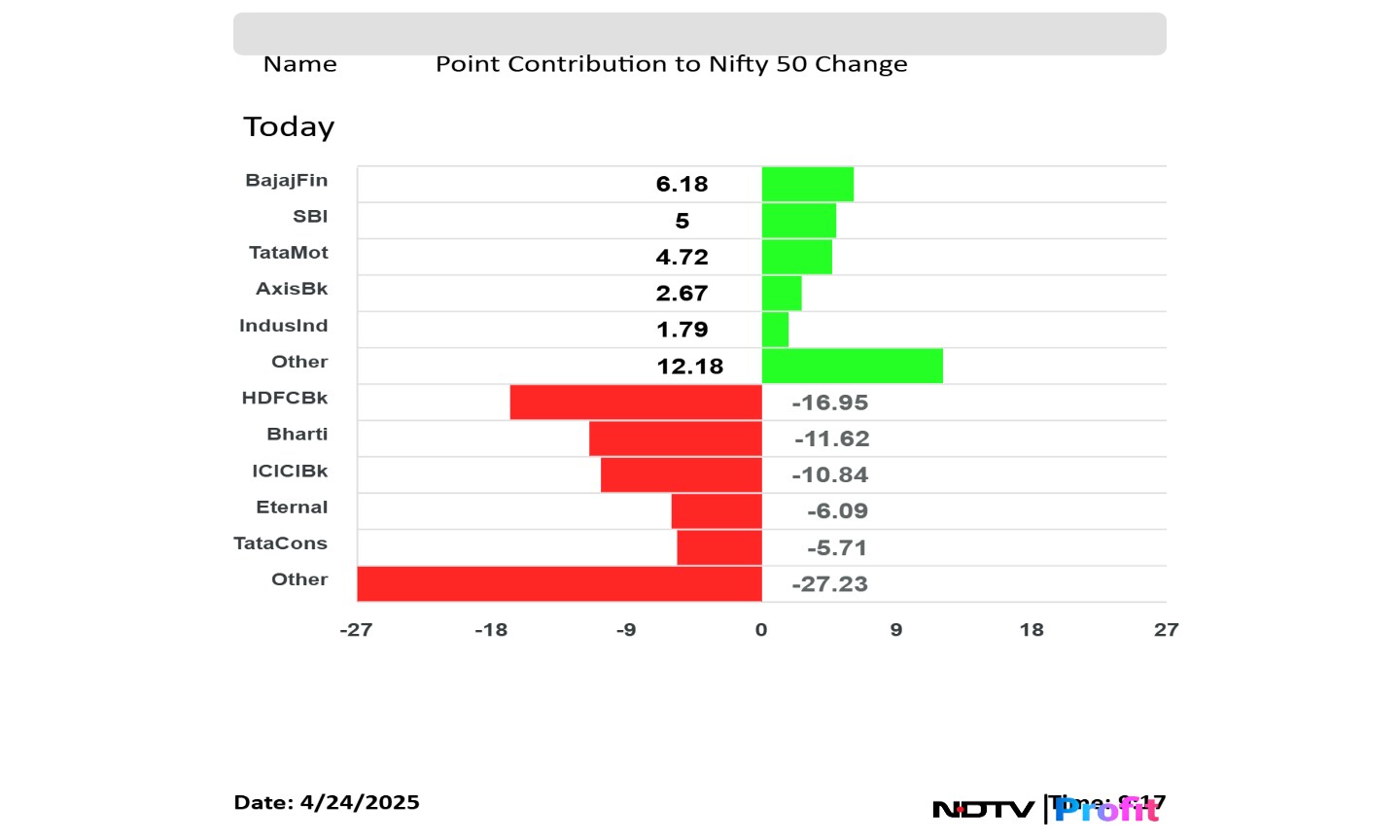

HDFC Bank Ltd., Bharti Airtel Ltd., ICICI Bank Ltd., Eternal Ltd., and Tata Consumer Products Ltd. weighed on the Nifty 50 index.

Bajaj Finance Ltd., State Bank of India, Tata Motors Ltd., Axis Bank Ltd., IndusInd Bank Ltd. added to the Nifty 50 index.

HDFC Bank Ltd., Bharti Airtel Ltd., ICICI Bank Ltd., Eternal Ltd., and Tata Consumer Products Ltd. weighed on the Nifty 50 index.

Bajaj Finance Ltd., State Bank of India, Tata Motors Ltd., Axis Bank Ltd., IndusInd Bank Ltd. added to the Nifty 50 index.

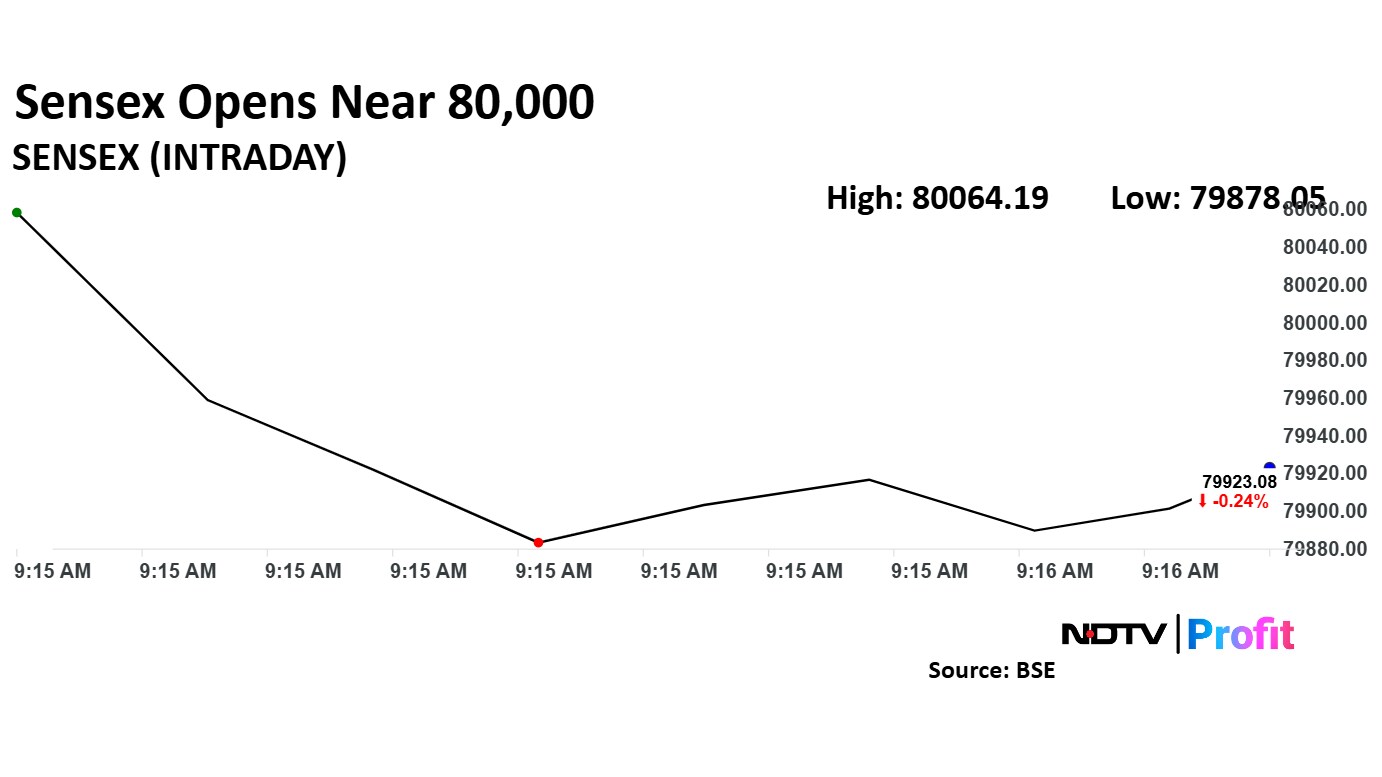

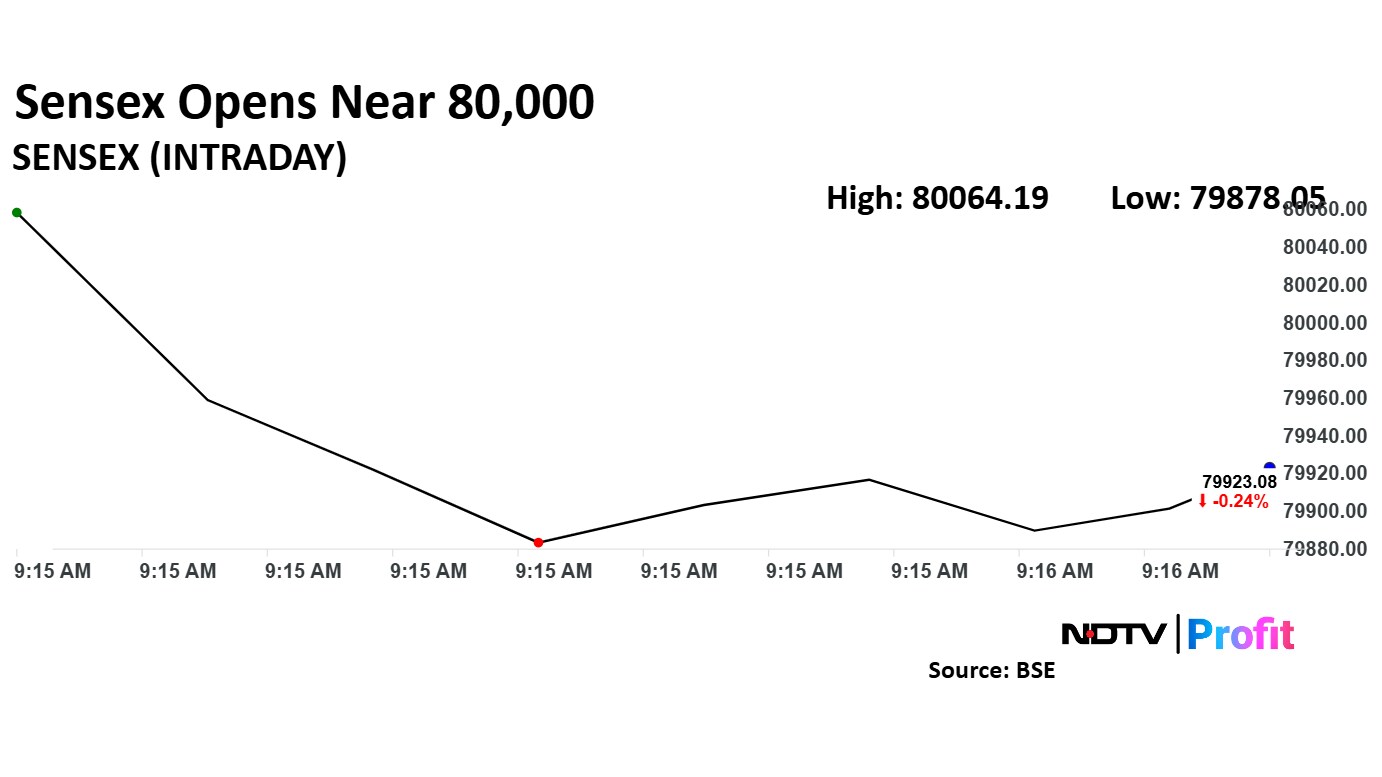

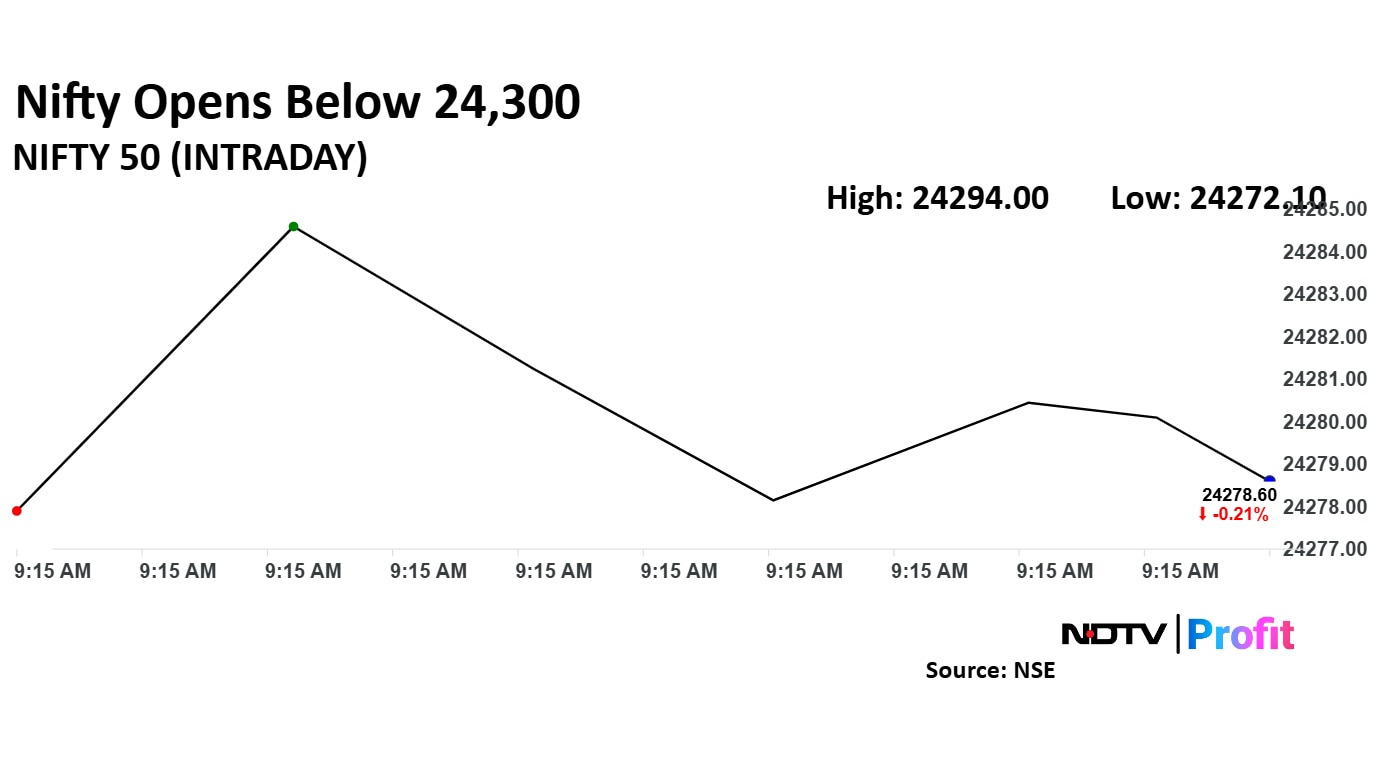

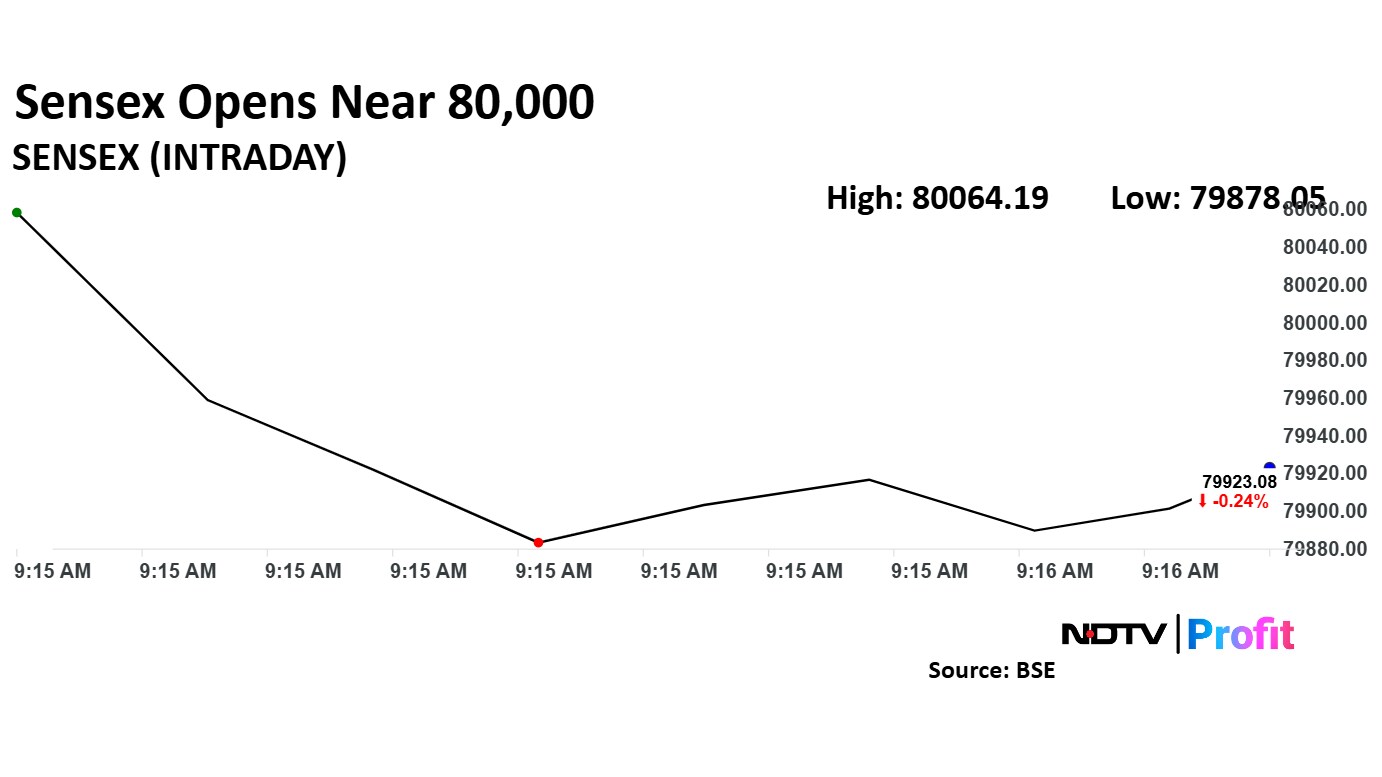

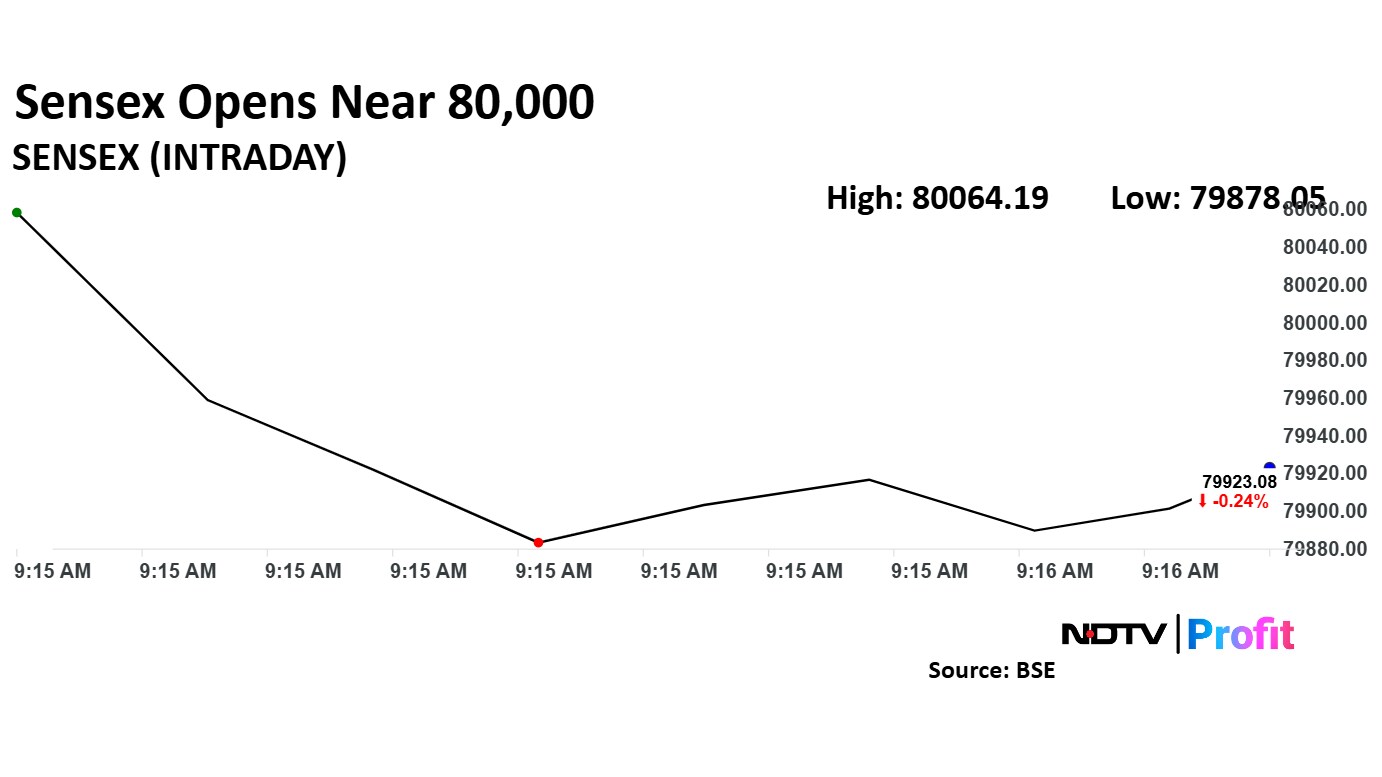

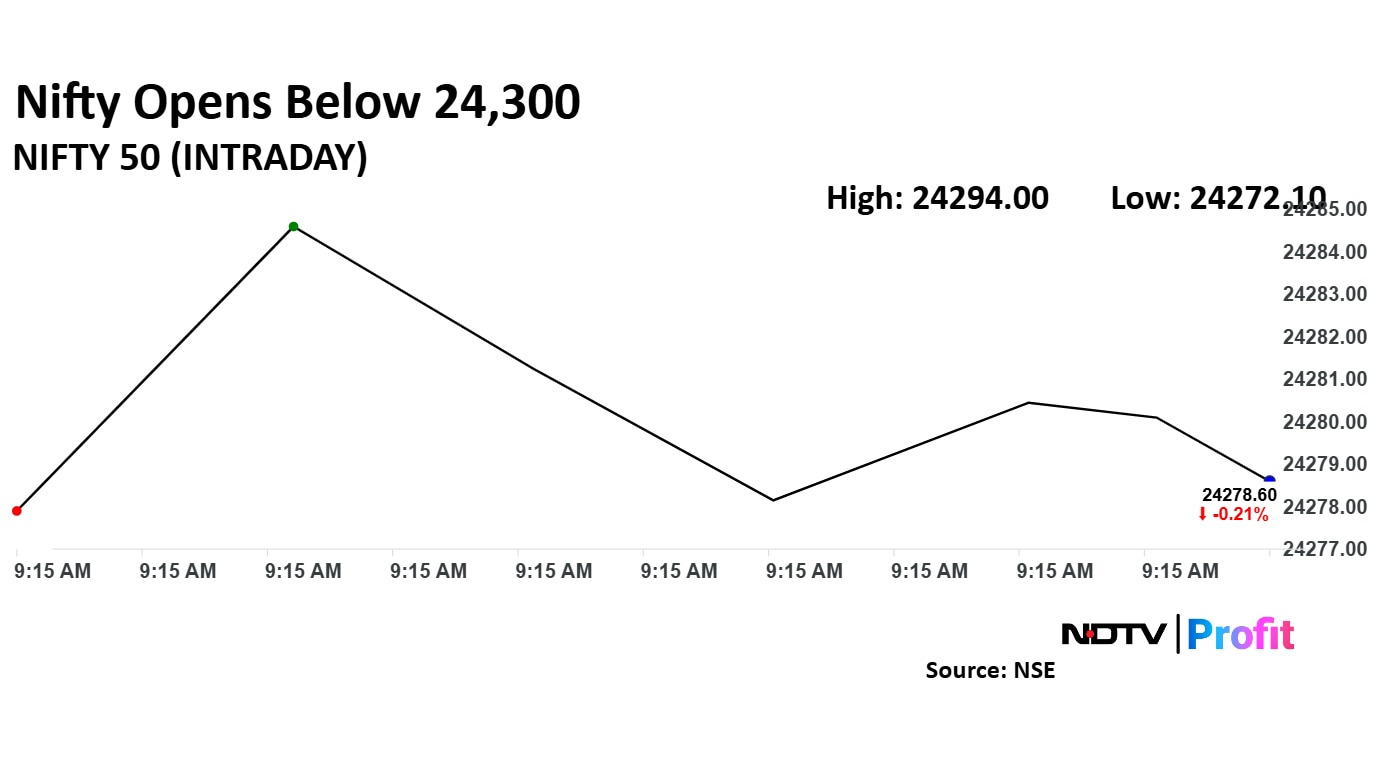

The NSE Nifty 50 and BSE Sensex snapped a seven-day winning streak at open on Thursday as HDFC Bank Ltd. share price dragged. The Nifty 50 and Sensex were trading 0.18% and 0.16% down, respectively as of 9:19 a.m.

"Immediate resistance for the Nifty is seen at 24,545, which happens to be a 61.8% retracement of the entire fall from 26,277(the All-Time High) to 21,743(the 7th April 2025 Low). Support for the Nifty has shifted upwards to 24,072," said Devarsh Vakil, head, prime research at HDFC Securities

The NSE Nifty 50 and BSE Sensex snapped a seven-day winning streak at open on Thursday as HDFC Bank Ltd. share price dragged. The Nifty 50 and Sensex were trading 0.18% and 0.16% down, respectively as of 9:19 a.m.

"Immediate resistance for the Nifty is seen at 24,545, which happens to be a 61.8% retracement of the entire fall from 26,277(the All-Time High) to 21,743(the 7th April 2025 Low). Support for the Nifty has shifted upwards to 24,072," said Devarsh Vakil, head, prime research at HDFC Securities

The NSE Nifty 50 and BSE Sensex snapped a seven-day winning streak at open on Thursday as HDFC Bank Ltd. share price dragged. The Nifty 50 and Sensex were trading 0.18% and 0.16% down, respectively as of 9:19 a.m.

"Immediate resistance for the Nifty is seen at 24,545, which happens to be a 61.8% retracement of the entire fall from 26,277(the All-Time High) to 21,743(the 7th April 2025 Low). Support for the Nifty has shifted upwards to 24,072," said Devarsh Vakil, head, prime research at HDFC Securities

The NSE Nifty 50 and BSE Sensex snapped a seven-day winning streak at open on Thursday as HDFC Bank Ltd. share price dragged. The Nifty 50 and Sensex were trading 0.18% and 0.16% down, respectively as of 9:19 a.m.

"Immediate resistance for the Nifty is seen at 24,545, which happens to be a 61.8% retracement of the entire fall from 26,277(the All-Time High) to 21,743(the 7th April 2025 Low). Support for the Nifty has shifted upwards to 24,072," said Devarsh Vakil, head, prime research at HDFC Securities

The NSE Nifty 50 and BSE Sensex snapped a seven-day winning streak at open on Thursday as HDFC Bank Ltd. share price dragged. The Nifty 50 and Sensex were trading 0.18% and 0.16% down, respectively as of 9:19 a.m.

"Immediate resistance for the Nifty is seen at 24,545, which happens to be a 61.8% retracement of the entire fall from 26,277(the All-Time High) to 21,743(the 7th April 2025 Low). Support for the Nifty has shifted upwards to 24,072," said Devarsh Vakil, head, prime research at HDFC Securities

The NSE Nifty 50 and BSE Sensex snapped a seven-day winning streak at open on Thursday as HDFC Bank Ltd. share price dragged. The Nifty 50 and Sensex were trading 0.18% and 0.16% down, respectively as of 9:19 a.m.

"Immediate resistance for the Nifty is seen at 24,545, which happens to be a 61.8% retracement of the entire fall from 26,277(the All-Time High) to 21,743(the 7th April 2025 Low). Support for the Nifty has shifted upwards to 24,072," said Devarsh Vakil, head, prime research at HDFC Securities

The NSE Nifty 50 and BSE Sensex snapped a seven-day winning streak at open on Thursday as HDFC Bank Ltd. share price dragged. The Nifty 50 and Sensex were trading 0.18% and 0.16% down, respectively as of 9:19 a.m.

"Immediate resistance for the Nifty is seen at 24,545, which happens to be a 61.8% retracement of the entire fall from 26,277(the All-Time High) to 21,743(the 7th April 2025 Low). Support for the Nifty has shifted upwards to 24,072," said Devarsh Vakil, head, prime research at HDFC Securities

The NSE Nifty 50 and BSE Sensex snapped a seven-day winning streak at open on Thursday as HDFC Bank Ltd. share price dragged. The Nifty 50 and Sensex were trading 0.18% and 0.16% down, respectively as of 9:19 a.m.

"Immediate resistance for the Nifty is seen at 24,545, which happens to be a 61.8% retracement of the entire fall from 26,277(the All-Time High) to 21,743(the 7th April 2025 Low). Support for the Nifty has shifted upwards to 24,072," said Devarsh Vakil, head, prime research at HDFC Securities

At pre-open, the NSE Nifty 50 was trading 0.46% higher at 24,277.90, and the BSE Sensex was trading 0.58% higher at 80,058.43.

Rupee opened 18 paise weaker at 85.60 against US dollar

It closed at 85.42 a dollar on Wednesday

Source: Bloomberg

The yield on the 10-year bond opened flat at 6.32%

Source: Bloomberg

Healthcare vertical pressure for the industry could emanate opportunities for us

Currently Healthcare smaller share for us vs industry

Upgrade India to Neutral from Underweight; still prefer China over India

China remains our key overweight market

Positive on the Indian market for four reasons:

expect a consumption-led recovery in FY26 and FY27

lower oil prices aid GDP growth and help in lower inflation

India looks better placed than its Asian peers to weather US tariffs impact and a global growth slowdown

valuations are reasonable

Prefer financials, consumption, auto; cautious on industrials, IT and pharma

Expect 8% upside in Nifty 50; one year target of 26,000

Samhi Hotels has partnered with GIC for a hotel investment platform with a planned investment of up to $300 million. The partnership will start with 5 hotels owned by SAMHI, valued at approximately Rs 2,200 crore.

Jefferies has downgraded Waaree Energies Ltd. from 'hold' to 'underperform', despite a strong fourth quarter performance and positive financial year 2026 guidance. The downgrade follows a sharp 25% rally in the stock over the past month.

Read the full article here.

Gold prices rebounded from the steepest decline in five months as the US President Donald Trump signaled that the final tariff on China will likely be less than 145%. He also clarified that he has no intention to fire Fed Chair Jerome Powell.

The Bloomberg spot gold was trading 1.96% higher at $3,352.81 an ounce.

Most markets in the Asia-Pacific region were trading higher Thursday morning as risk sentiments among investors continued to recover amid less fears about US and China trade relationships.

The Nikkei 225 and S&P ASX 200 were trading 0.96% and 0.65% higher, respectively as of 7:54 a.m.

Meanwhile, investors logged losses in South Korea after data from the Bank of Korea showed GDP contracted 0.2% in the first quarter sequentially. Economists expected the economy to grow 0.1% in the first quarter.

The KOSPI was trading 0.54% down at 2,511.88 as of 7:58 a.m.

US share indices extended rally Wednesday as optimism over a possible pause in the tension between US and China continued to support risk-sentiments among traders.

The Dow Jones Industrial Average and S&P 500 ended 1.07% and 1.67% higher, respectively. The Nasdaq Composite ended 2.50% higher.

The GIFT Nifty was trading flat early trade Thursday, which implied a flat open for the Nifty 50. LTIMindtree Ltd., Bajaj Housing Finance Ltd., Rallis India Ltd., Dalmia Bharat Ltd., and Can Fin Homes Ltd. share prices may react in Thursday's session.

The GIFT Nifty was trading flat at 24,260.50 as of 6:56 a.m.

The NSE Nifty 50 and BSE Sensex extended their gaining streak to seventh day and finished at the highest level since mid December 2024. The rally in the benchmark indices got support from a surge in technology stocks. Infosys Ltd., HCLTech Ltd., and Tata Consultancy Services Ltd.'s share prices contributed the most to gains in the Nifty 50.

The Nifty 50 ended 115.10 points or 0.48% higher at 24,282.35, and the Sensex ended 520.90 points, or 0.65% up at 80,116.49.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.