Benchmarks close lower for second day in a row

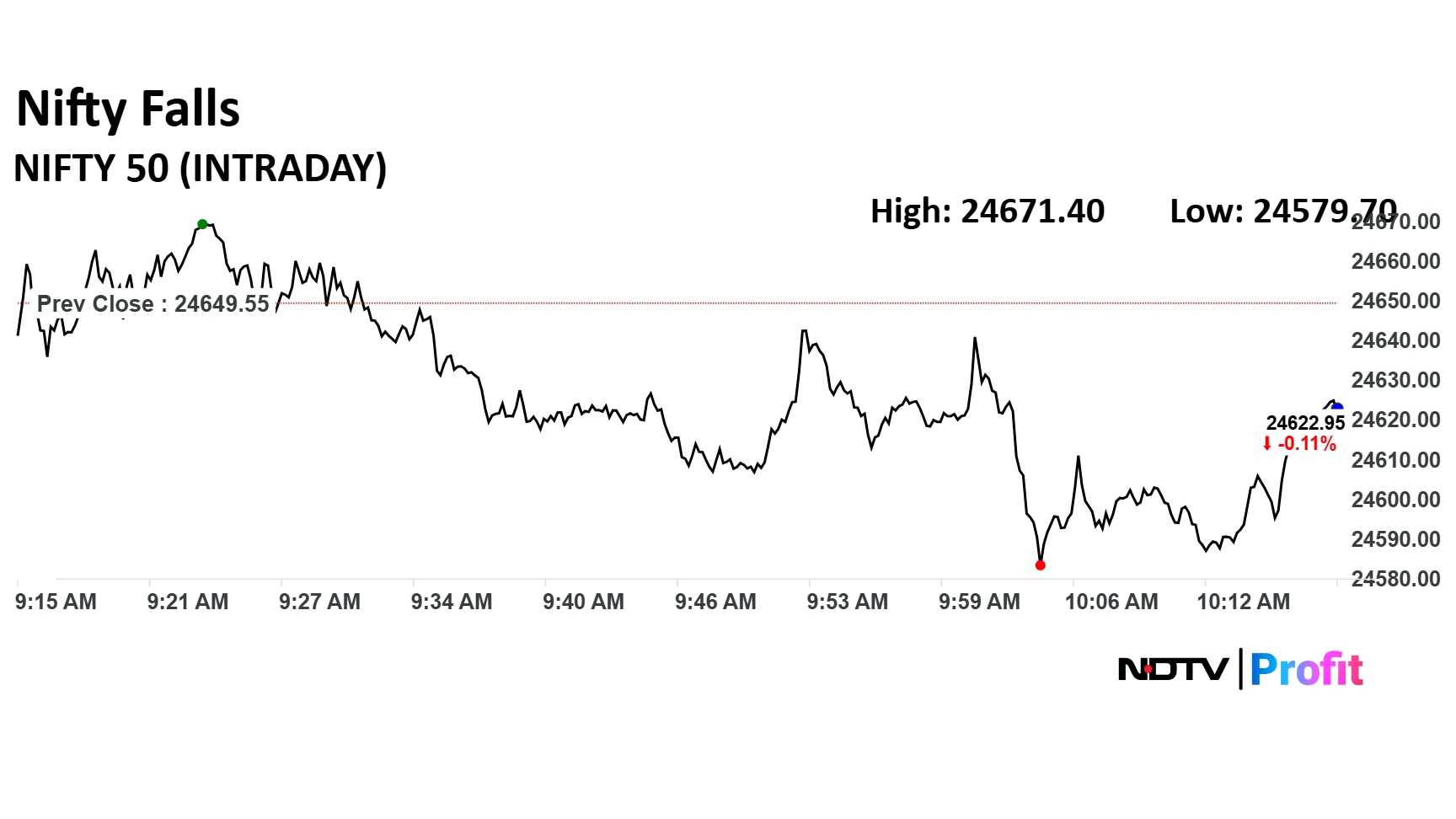

Nifty falls second day in a row; Wipro, Sun Pharma top laggards

Benchmarks end near day's low, fall second day in a row

Broader market indices underperform benchmarks

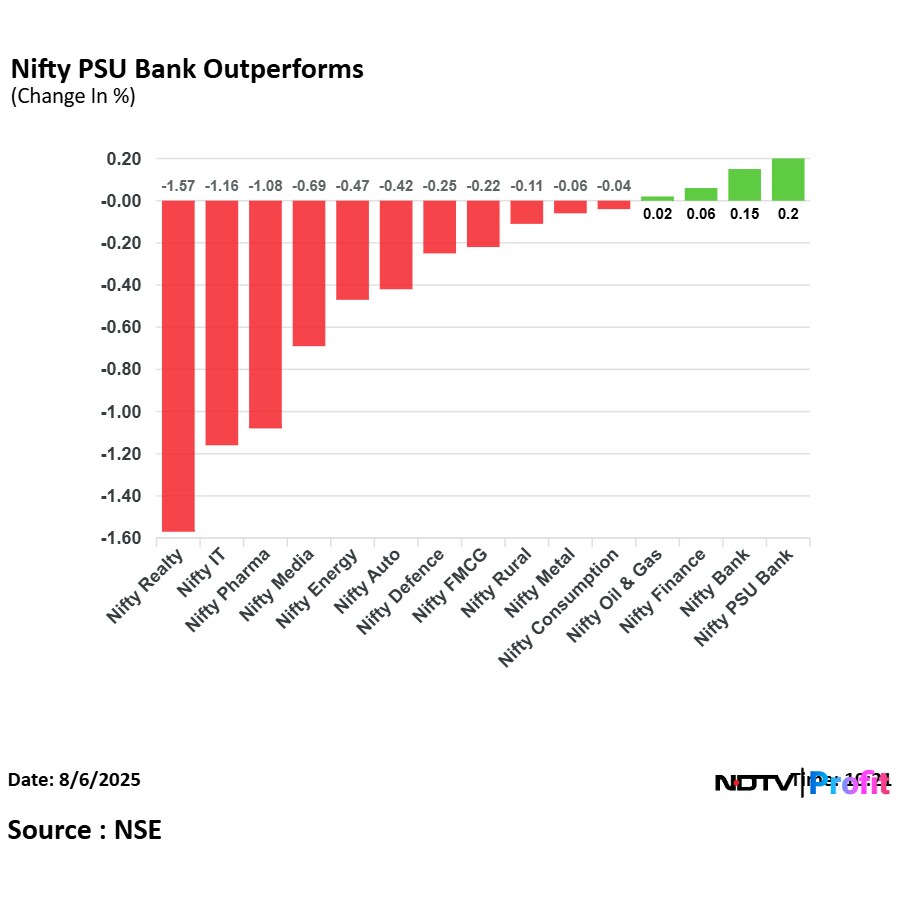

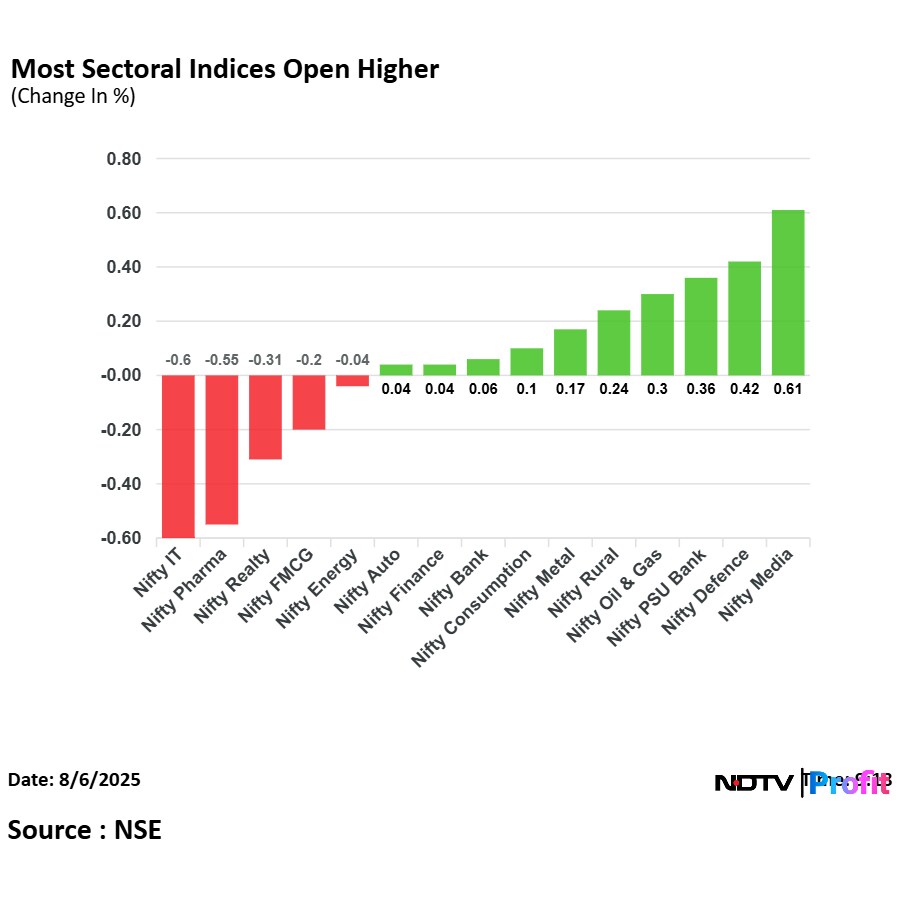

Most sectoral indices close in red

Nifty Bank, Nifty PSU Bank only sectoral gainers

Nifty Pharma worst performing sector as Trump tariff threat looms

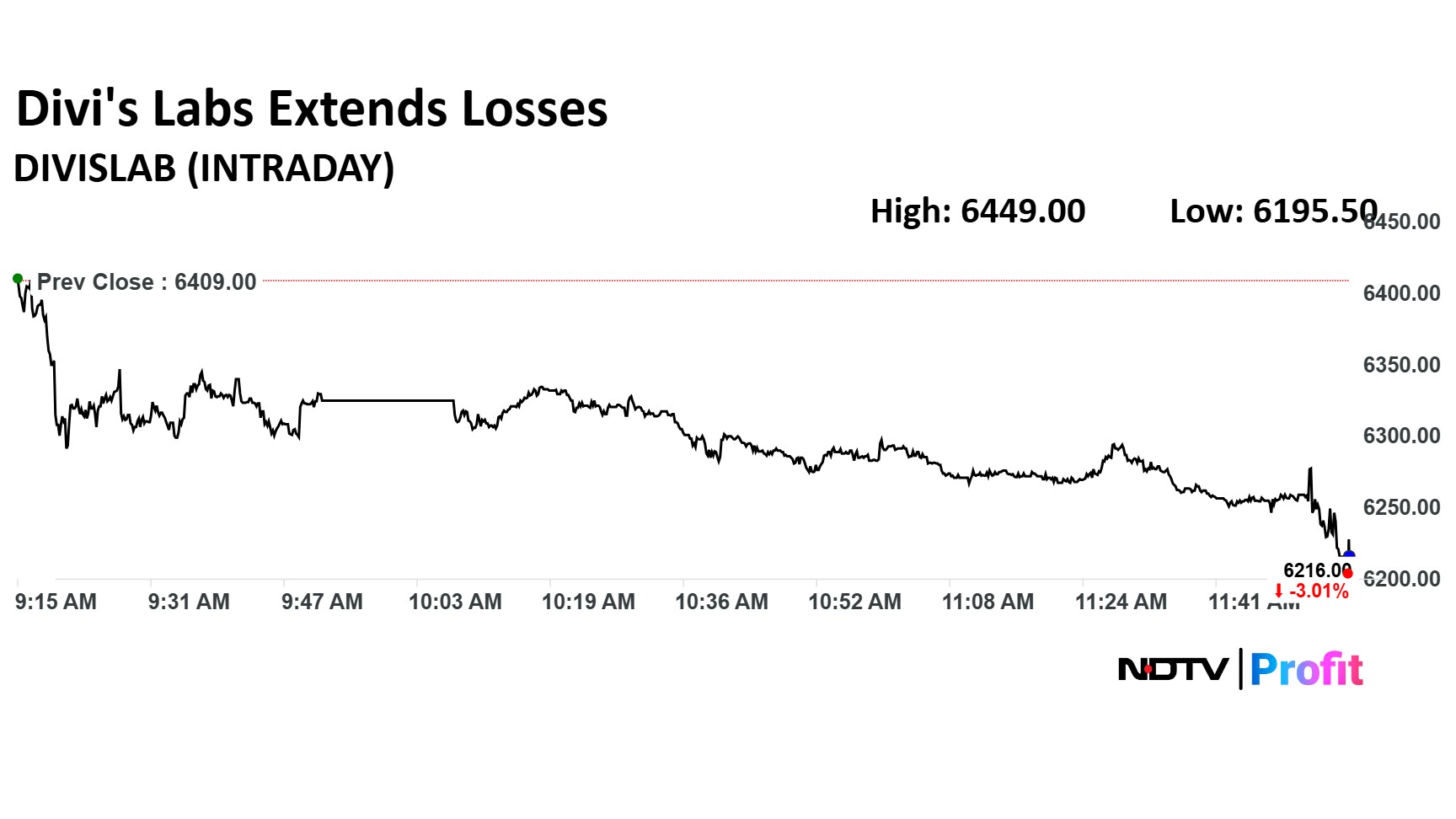

Nifty Pharma falls second day in a row dragged by Divi's Lab, Ajanta Pharma

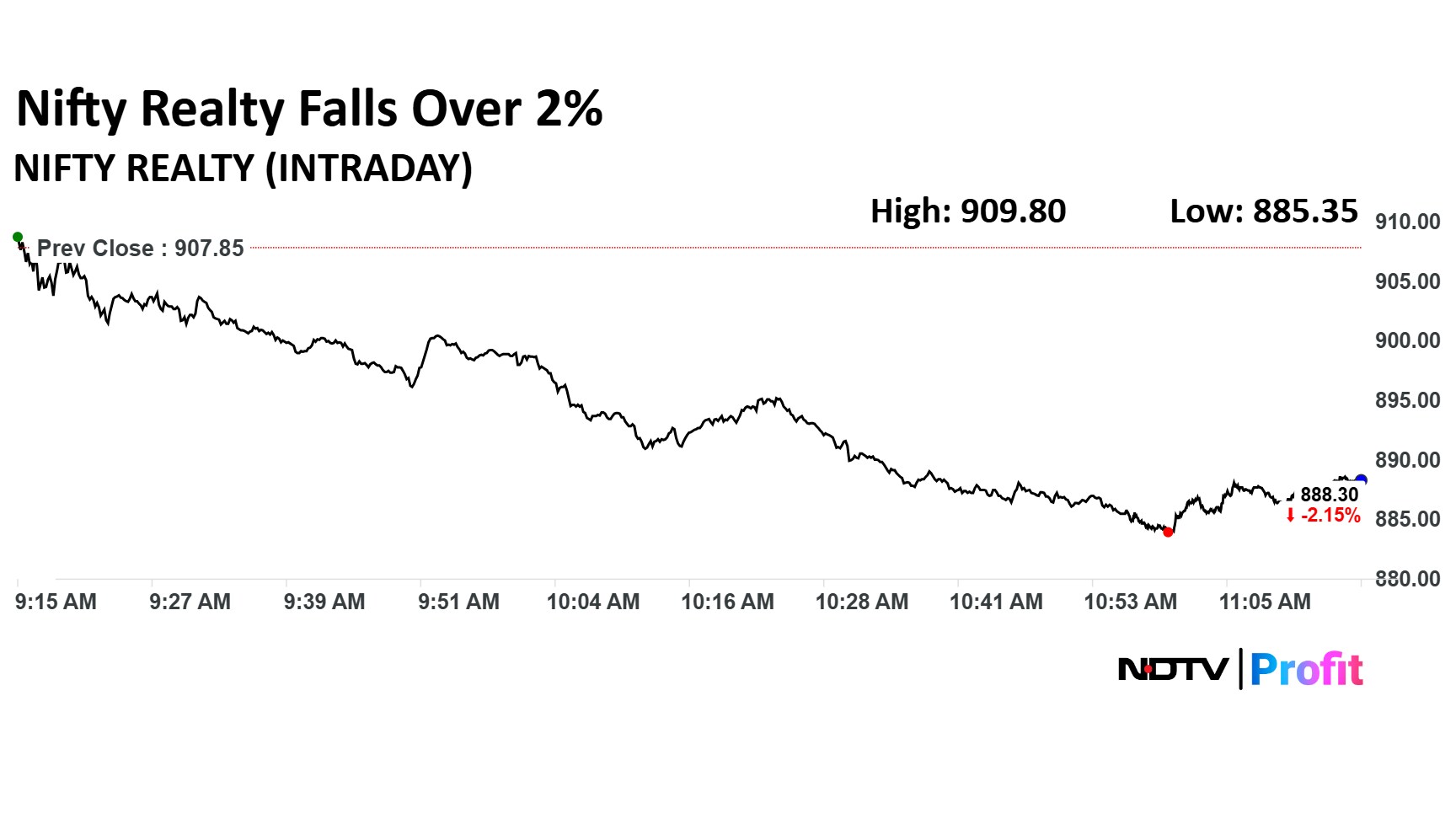

Nifty IT, Pharma, Realty fall second day in a row

Nifty FMCG falls third day in a row dragged by Britannia, Balrampur Chini

Benchmarks close lower for second day in a row

Nifty falls second day in a row; Wipro, Sun Pharma top laggards

Benchmarks end near day's low, fall second day in a row

Broader market indices underperform benchmarks

Most sectoral indices close in red

Nifty Bank, Nifty PSU Bank only sectoral gainers

Nifty Pharma worst performing sector as Trump tariff threat looms

Nifty Pharma falls second day in a row dragged by Divi's Lab, Ajanta Pharma

Nifty IT, Pharma, Realty fall second day in a row

Nifty FMCG falls third day in a row dragged by Britannia, Balrampur Chini

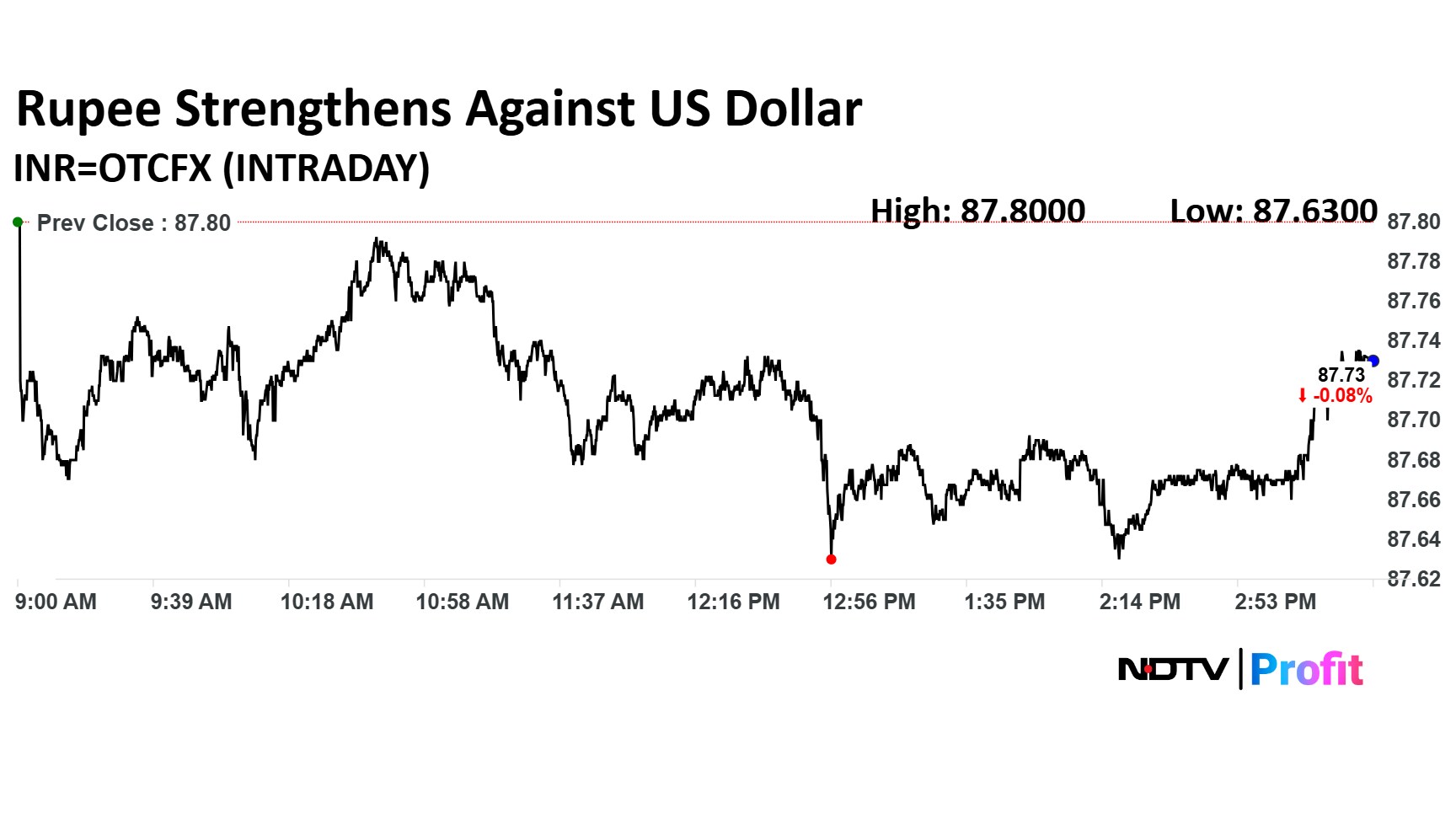

Rupee close 7 paise stronger at 87.73 against US Dollar

It closed at 87.80 a dollar on Tuesday

Source: Cogencis

Rupee close 7 paise stronger at 87.73 against US Dollar

It closed at 87.80 a dollar on Tuesday

Source: Cogencis

Securities and Exchange Board of India Chairman Tuhin Kanta Pandey today clarified that no formal communication has taken place with the Finance Ministry regarding a proposal to reduce Securities Transaction Tax on cash market transactions—a move that could encourage greater investor participation and ease the surge in options trading volumes.

Infosys Ltd. has inaugurated a center for advanced for artificial intelligence, cybersecurity, and space technology at Hubballi Development Centre.

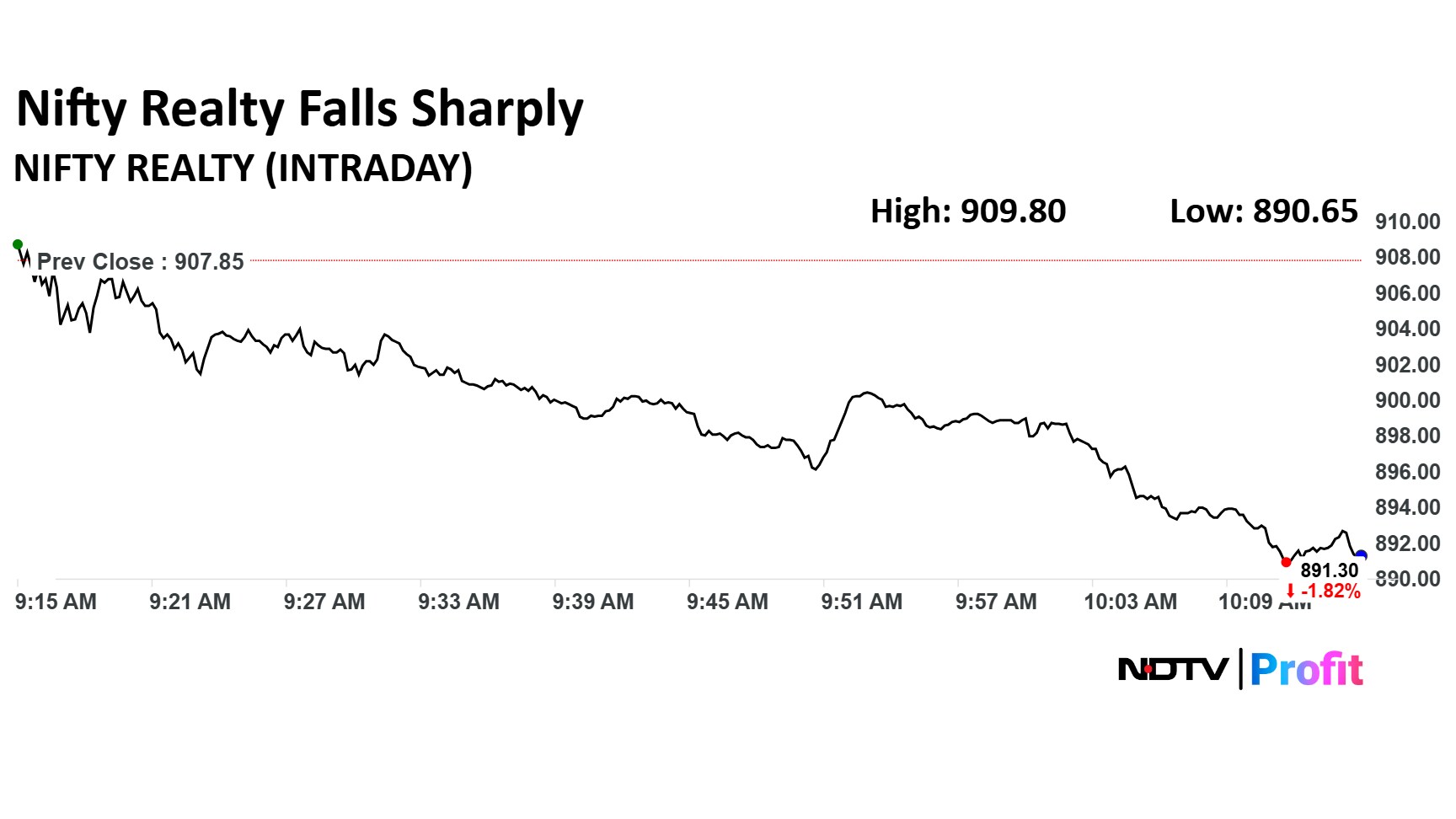

DLF Ltd., Prestige Estates Projects Ltd., and Godrej Properties Ltd shares weighed on the NSE Nifty Realty index. The index extended losses and became the worst performer after the Reserve Bank of India kept the benchmark repo rate unchanged at 5.5%, in line with expectations.

DLF Ltd., Prestige Estates Projects Ltd., and Godrej Properties Ltd shares weighed on the NSE Nifty Realty index. The index extended losses and became the worst performer after the Reserve Bank of India kept the benchmark repo rate unchanged at 5.5%, in line with expectations.

Nifty Bank, which was trading 0.27% higher ahead of the announcement of the Reserve Bank of India's policy meet outcome, gave up gains to trade 0.24% lower as the central bank decided to keep the repo rate unchanged at 5.5% and maintain the stance neutral.

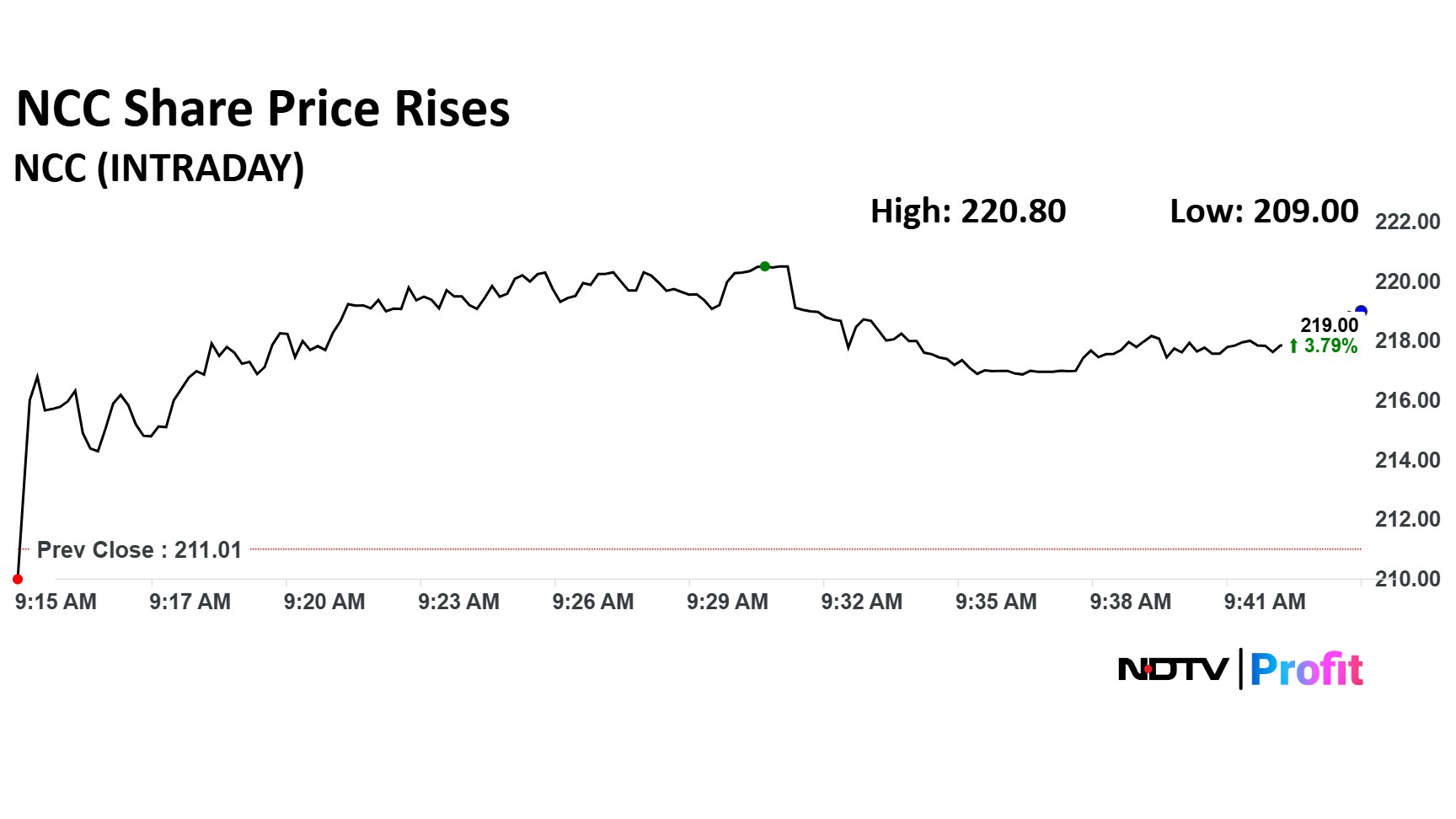

NCC Ltd. share price snapped a five-day losing streak in Wednesday's session despite posting bleak results for April–June. The company has maintained healthy order inflows in the first quarter and is confident in making a slow recovery on the back of a strong order book.

The Enforcement Directorate questioned Anil Ambani's top aides including Amitabh Jhunjhunwala and Sateesh Seth on Wednesday in connection to the alleged loan fraud case linked to Reliance Group entities, sources told NDTV Profit.

Both Jhunjhunwala and Seth appeared at the federal agency's headquarters in New Delhi and the questioning was underway, said the sources mentioned above.

Pidilite Industries Q1 FY26 Highlights (Consolidated, YoY)

Net Profit up 18.6% at Rs 672 crore versus Rs 567 crore

Revenue up 10.5% at Rs 3,753 crore versus Rs 3,395 crore

EBITDA up 15.8% at Rs 941 crore versus Rs 813 crore

Margin At 25% versus 23.9%

Global Index provider MSCI is expected to announce major changes to its standard and small-cap indices, with several companies poised for inclusion and exclusion.

As per data from Nuvama, notable inclusions in the MSCI Standard Index are Vishal Mega Mart and Swiggy, with estimated inflows of $287 million and $285 million, respectively. Similarly, Hitachi Energy and Waaree Energies are also likely to join the index. Meanwhile, on the flip side, Sona BLW Precision Forgings and Thermax are expected to be excluded.

NDTV Profit India has been tracking the action in the top dealing rooms of India’s financial capital, and this edition of ‘Heard On The Street’ provides you with buzzing action on stocks like Pidilite, Piramal Pharma, Adani Energy, Coforge and IIFL Finance.

Heard On The Street provides readers with what well-informed investors, especially HNIs, FIIs, DIIs, and mutual funds, are buying and selling in the stock market. It also tracks the latest unconfirmed/unverified chatter around stocks and/or sectors.

The information technology shares witnessed the highest FPI outflows in more than three years during the previous month, according to data compiled by NDTV profit with the information available on National Securities and Depositories Ltd.

The overseas investors pulled out $2.3 billion in IT stocks in July, according to NSDL data. That's the highest outflow since March 2022. The sharp pullback came as the NSE Nifty IT Index declined over 9% in July, underperforming the benchmark Nifty 50, which fell 2.9% during the same period.

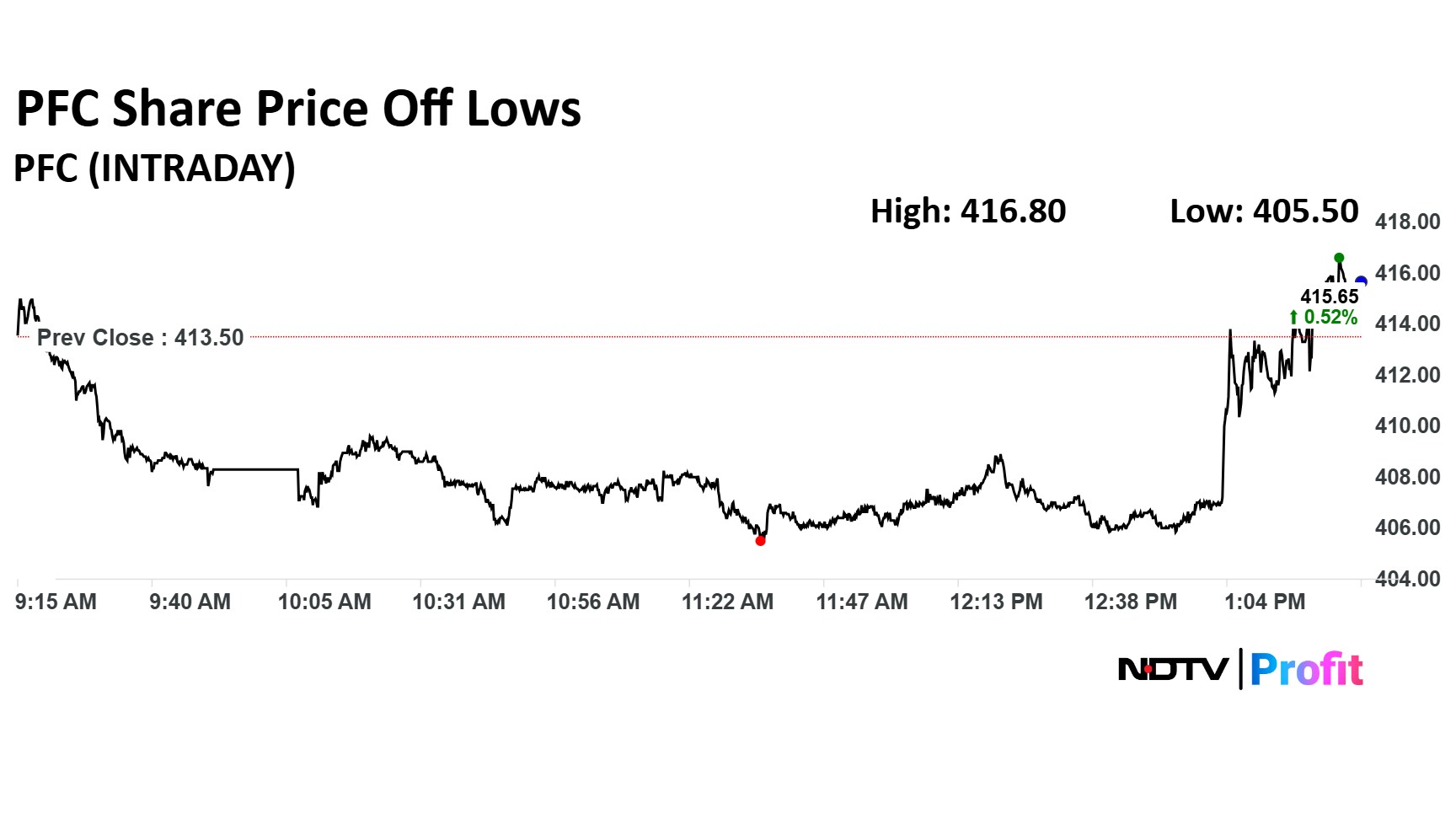

Power Finance Corp share price erased losses after it reported an increase net profit for the first quarter.

Power Finance Corp share price erased losses after it reported an increase net profit for the first quarter.

Long-short ratio at 8:92, which means only 8% of FII bets are long on Nifty 50. It shows that FIIs are excessively short on Indian markets

The long-short ratio is lowest since March 2023. In the past 10 years, this is only the second time the number has fallen this low.

Earlier, we were at this low in March 22, 2023. Post that the Nifty 50 gained around 17% over a period of 4 months. Even Nifty RSI has fallen below 40

Past instance show that there have been gains in benchmark whenever RSI has fallen below 40.

Vodafone Idea Ltd. received GST demand of Rs 21 crore including penalty from Bihar Tax Body, the exchange filing said.

Motilal Oswal Financial Services Ltd. has approved allotment of 50,000 non-convertible debentures aggregating up to Rs 500 crore.

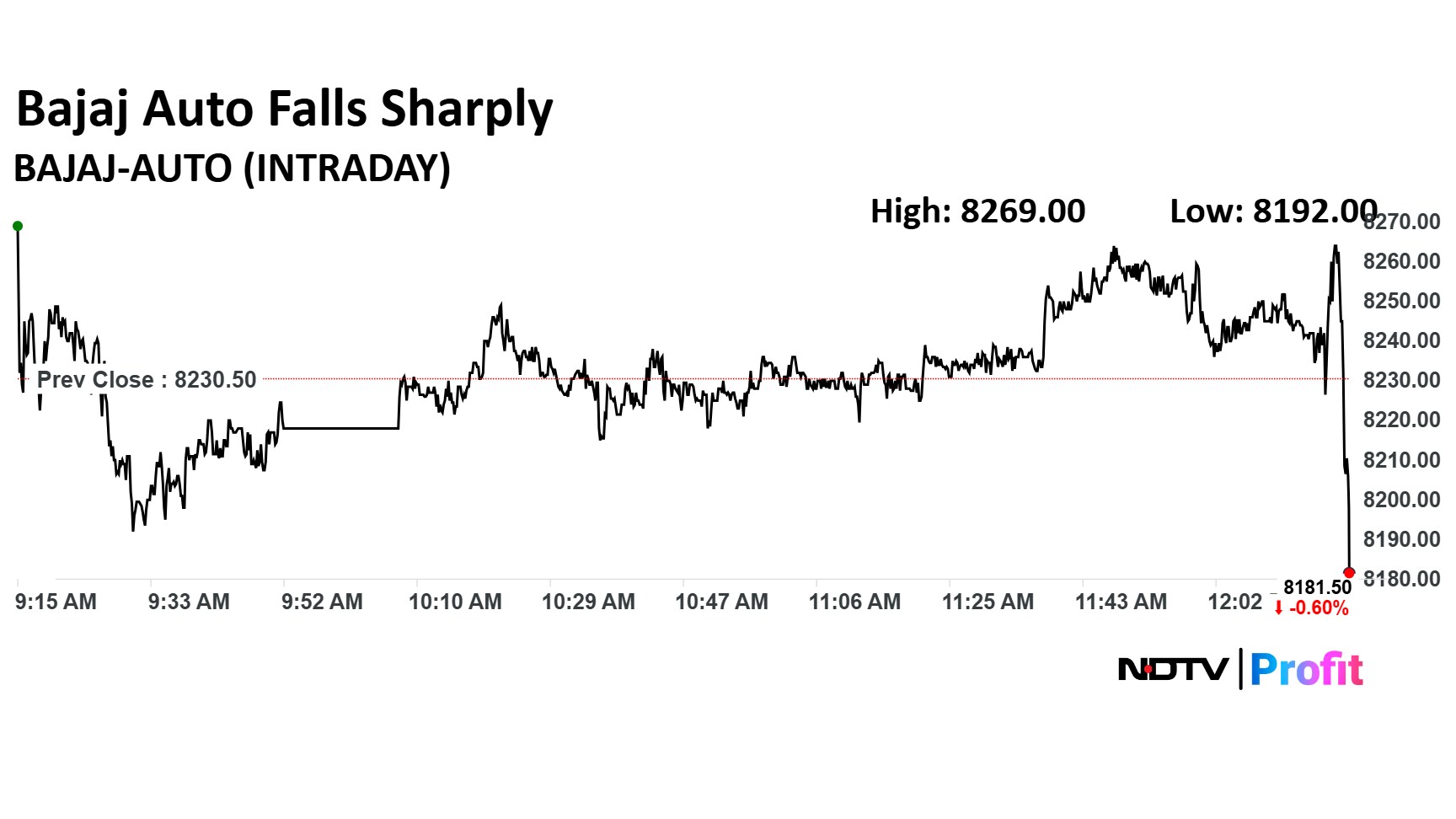

Bajaj Auto Q1 Highlights (Standalone, YoY)

Revenue up 5.5% to Rs 12,584.45 crore versus Rs 11,928.02 crore.

Ebitda up 2.8% to Rs 2,481.77 crore versus Rs 2,415.26 crore.

Margin at 19.7% versus 20.2%.

Net profit up 5.4% to Rs 2,095.98 crore versus Rs 1,988.34 crore.

Bajaj Auto Q1 Highlights (Standalone, YoY)

Revenue up 5.5% to Rs 12,584.45 crore versus Rs 11,928.02 crore.

Ebitda up 2.8% to Rs 2,481.77 crore versus Rs 2,415.26 crore.

Margin at 19.7% versus 20.2%.

Net profit up 5.4% to Rs 2,095.98 crore versus Rs 1,988.34 crore.

Holding the rates was on expected lines, especially since the RBI had front-loaded a 50 basis points rate cut in the last monetary policy. The focus now shifts to the transmission of these rate cuts, said Sadaf Sayeed, CEO, Muthoot Microfin.

So far, out of the 100 bps cut since the new Governor took charge, only 55 bps has been passed on. The remaining transmission is critical to ensure that the benefits reach consumers. Effective transmission will support credit growth, which in turn will boost consumption and contribute to overall GDP growth, Sayeed said.

Divi's Laboratories Q1FY26 Highlights (Consolidated, YoY)

Revenue up 13.8% at Rs 2,410 crore versus Rs 2,118 crore

EBITDA up 17.2% at Rs 729 crore versus Rs 622 crore

Margin At 30.2% Vs 29.4% (Cons, YoY)

Net Profit up 26.7% at Rs 545 crore versus Rs 430 crore

Track live updates on first-quarter earnings here.

Divi's Laboratories Q1FY26 Highlights (Consolidated, YoY)

Revenue up 13.8% at Rs 2,410 crore versus Rs 2,118 crore

EBITDA up 17.2% at Rs 729 crore versus Rs 622 crore

Margin At 30.2% Vs 29.4% (Cons, YoY)

Net Profit up 26.7% at Rs 545 crore versus Rs 430 crore

Track live updates on first-quarter earnings here.

Steel Exchange of India is in pact with Vizag Profiles Logistics and Hind Terminals. They will develop general cargo terminals and multi-modal logistics park in Vasakhapatnam, the company said in a exchange filing.

Reliance Securities sees that the rupee may remain in the range of 87.00–88.20 a dollar. The brokerage even expects a possibility of rupee hitting record low.

"The Indian rupee edged up to 87.77 per dollar after the Reserve Bank of India (RBI) kept its benchmark policy rate unchanged, in line with market expectations, and maintained a neutral policy stance," Jigar Trivedi, a senior research analyst at Reliance Securities

This decision comes on the heels of a surprise 50-basis-points rate cut in June, indicating that the central bank may be taking a wait-and-watch approach amid evolving global uncertainties. RBI Governor Sanjay Malhotra highlighted continued pressures in global trade but reiterated that India’s economic fundamentals remain strong, he said.

Allied Digital Services Ltd. signed a five-year contract for Rs 420 crore order with European Pharmaceutical company. The pact is to transform digital workplace for over 1.2 lakh employees, the company said in the exchange filing.

The Reserve Bank of India is in a 'wait and watch' mode, as it is looking at how the previous monetary policies will transmit into the system, said Sakshi Gupta, principal economist at HDFC Bank.

Gupta's reaction comes as the RBI's Monetary Policy Committee on Wednesday kept the benchmark repo rate unchanged. The country's central bank also maintained its 'neutral' stance.

That said, markets are still pricing in a possible 25-basis-point cut in October, especially if the U.S. Fed begins its easing cycle in September and the impact of U.S. tariffs on Indian growth becomes clearer. A stable domestic rate environment, coupled with potential Fed cuts, could widen the India–U.S. yield spread, making Indian G-secs more attractive to FPIs. For fixed-income investors, the setup remains constructive, said Vineet Agrawal, Co-founder of Jiraaf.

GTPL Hathway Ltd. has completed acquisition of balance 49% stake in arm GTPL Vision Services, the company said in the exchange filing.

The NSE Nifty Realty index emerged as the worst performing index after the Reserve Bank of India stood pat on its view on interest rate and stance.

The NSE Nifty Realty index emerged as the worst performing index after the Reserve Bank of India stood pat on its view on interest rate and stance.

On National Stock Exchange, three sectors were trading with gains compared to 10 sectoral indices declining. Two sectoral indices traded flat.

The NSE Nifty PSU Bank rose the most. Union Bank Ltd. and Central Bank of India rose the most.

On National Stock Exchange, three sectors were trading with gains compared to 10 sectoral indices declining. Two sectoral indices traded flat.

The NSE Nifty PSU Bank rose the most. Union Bank Ltd. and Central Bank of India rose the most.

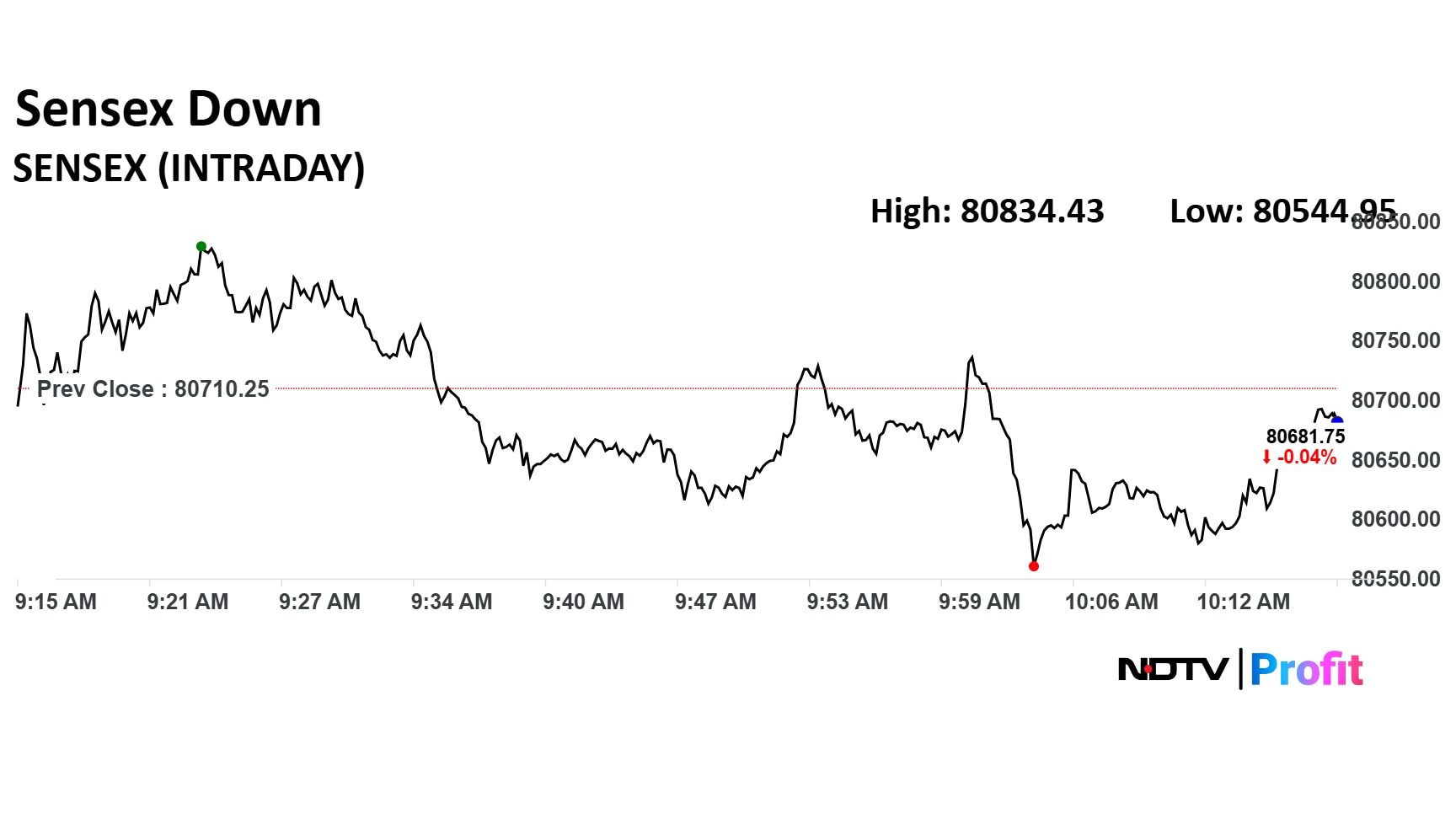

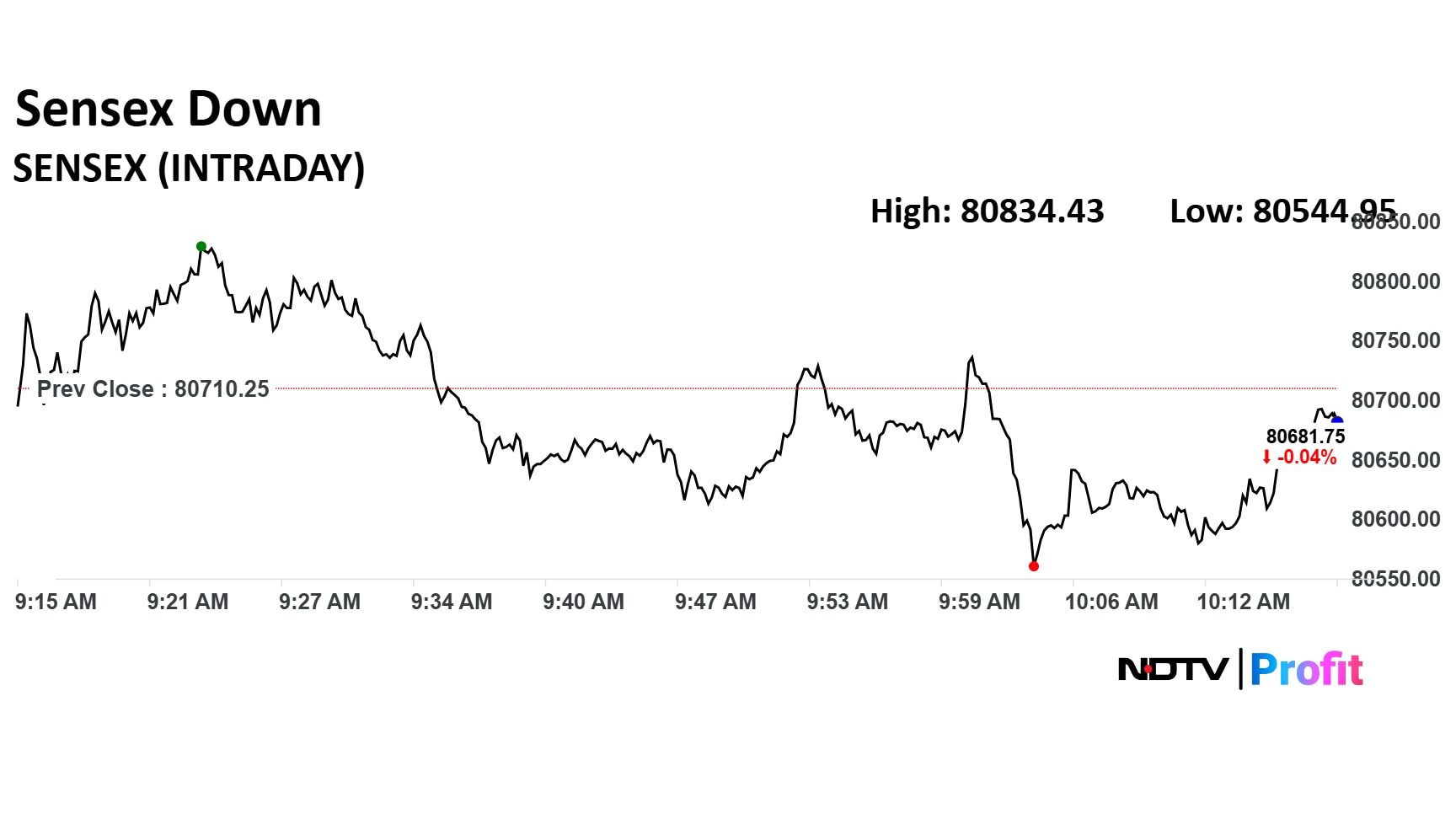

The NSE Nifty 50 and BSE Sensex fell after the Reserve Bank of India kept the benchmark repo rate unchanged at 5.5%. The central bank also maintained its neutral stance.

The NSE Nifty 50 and BSE Sensex fell after the Reserve Bank of India kept the benchmark repo rate unchanged at 5.5%. The central bank also maintained its neutral stance.

The NSE Nifty 50 and BSE Sensex fell after the Reserve Bank of India kept the benchmark repo rate unchanged at 5.5%. The central bank also maintained its neutral stance.

The NSE Nifty 50 and BSE Sensex fell after the Reserve Bank of India kept the benchmark repo rate unchanged at 5.5%. The central bank also maintained its neutral stance.

Rupee advanced 12 paise to 87.68 against US Dollar

It opened at 87.72 a dollar on Wednesday

It closed at 87.80 a dollar on Tuesday.

Source: Cogencis

The yield on 6.33%, 2035 bond rose 3 basis points to 6.36%

It closed at 6.33% on Tuesday

Source: Cogencis

NCC Ltd. share price snapped a five-day losing streak in Wednesday's session despite posting bleak results for April–June. The company has maintained a healthy order inflows in the first quarter and is confident to make slow recovery on the back of strong order book.

NCC Ltd. share price snapped a five-day losing streak in Wednesday's session despite posting bleak results for April–June. The company has maintained a healthy order inflows in the first quarter and is confident to make slow recovery on the back of strong order book.

On National Stock Exchange Ltd., eight sectoral indices advanced, three remained flat, and four declined.

On National Stock Exchange Ltd., eight sectoral indices advanced, three remained flat, and four declined.

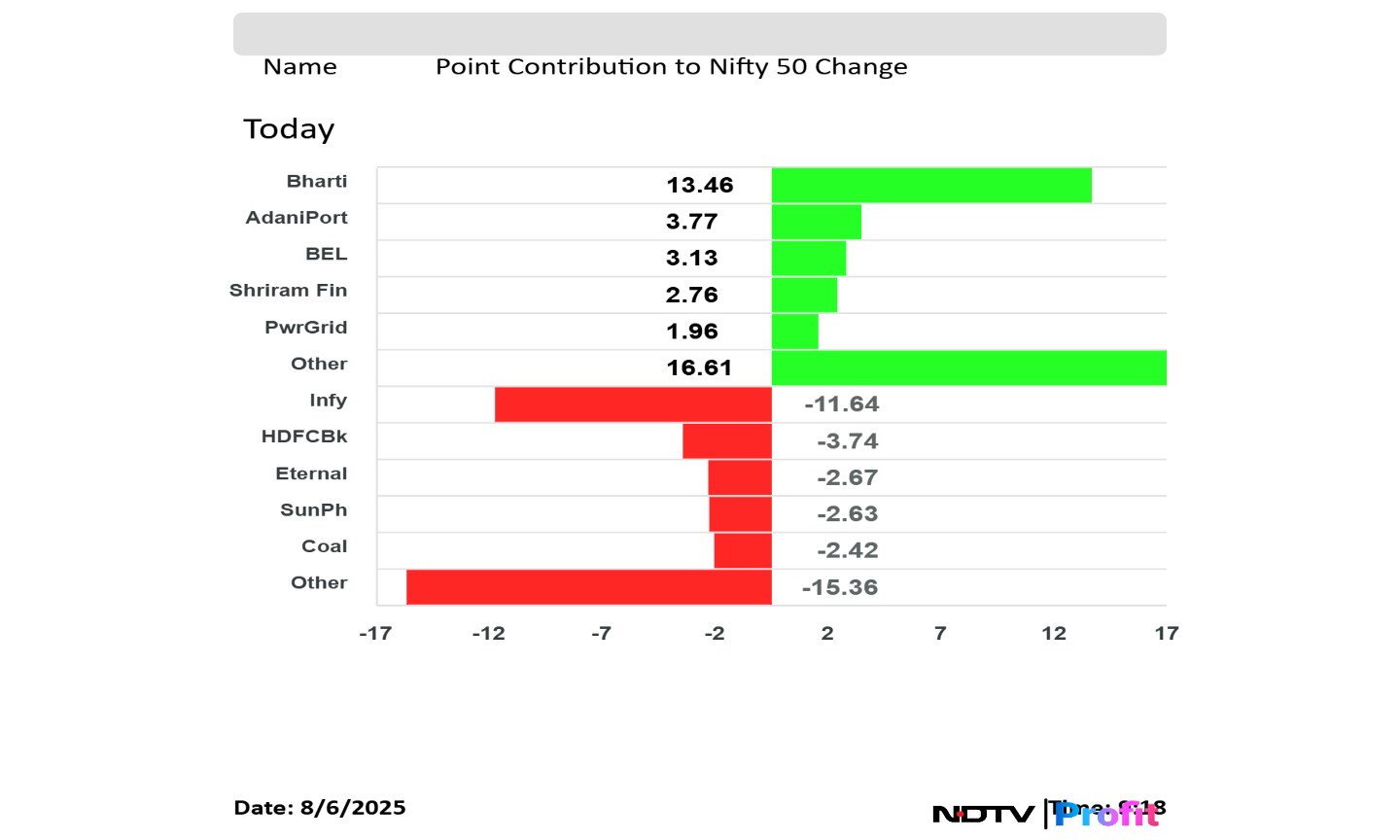

Bharti Airtel Ltd., Adani Ports And Special Economic Zone Ltd., Bharat Electronics Ltd., Shriram Finance Ltd., and Power Grid Corp added to the NSE Nifty 50 index.

Infosys Ltd., HDFC Bank Ltd., Eternal Ltd., Sun Pharmaceutical Industries Ltd., and Coal India Ltd. weighed on the NSE Nifty 50 index.

Bharti Airtel Ltd., Adani Ports And Special Economic Zone Ltd., Bharat Electronics Ltd., Shriram Finance Ltd., and Power Grid Corp added to the NSE Nifty 50 index.

Infosys Ltd., HDFC Bank Ltd., Eternal Ltd., Sun Pharmaceutical Industries Ltd., and Coal India Ltd. weighed on the NSE Nifty 50 index.

The NSE Nifty 50 and BSE Sensex opened on a muted note with positive bias as Bharti Airtel Ltd. led. The indices were trading 0.03% and 0.06% higher, respectively as of 9:20 a.m.

The NSE Nifty 50 and BSE Sensex opened on a muted note with positive bias as Bharti Airtel Ltd. led. The indices were trading 0.03% and 0.06% higher, respectively as of 9:20 a.m.

JSW Energy Ltd. started operations at second 80 megawatt unit of Kutehr hydroelectric power plant in Himachal Pradesh, the company said in the exchange filing.

The 10-year bond yield opened flat at 6.33%

Source: Cogencis

Rupee opened 8 paise stronger at 87.72 against US Dollar

It closed at 87.80 a dollar on Tuesday.

Source: Cogencis

Three big negatives cloud Wednesday’s market mood: President Trump’s threat to impose tariffs on chip and pharma imports is likely to keep pharma stocks under pressure; his fresh salvo indicating a steep tariff hike within 24 hours and calling India an unfavourable trade partner adds to the gloom; and Wall Street’s weakness after the ISM Services PMI showed a surprise slowdown, rising price pressures, and further job losses. All eyes now shift to the Reserve Bank of India Monetary Policy Committee meet, where the Street will be watching for cues on repo rate, inflation, and growth amidst this tariff turbulence, said Prashanth Tapse, a senior vice president, research, Mehta Equities.

Brokerages are divided in their views on Gland Pharma Ltd., post first quarter of fiscal 2025-26. Jefferies has upgraded its rating to 'hold' from 'underperform' and hiked the target price to Rs 1,950 from Rs 1,350. Meanwhile, Citi has maintained a 'sell' rating, with a target price at Rs 1,680.

Jefferies upgradeed Gland Pharma to hold, as it believe earnings downcycle for the company is behind and in next 1-2 years can benefit from the generic GLP driven tailwinds. "Our FY26-27 EPS moves up by 2-5% on higher growth and margin profile. We value Gland at 25 times Sept. 27 EPS with our price target," it added.

Bajaj Auto Ltd., Hero MotoCorp Ltd., Jindal Stainless Ltd. and Trent Ltd. are among the top names that will announce their earnings for the first quarter on Wednesday.

Bajaj Auto is likely to post net profit of Rs 2,012.30 crore and revenue of Rs 12,283.40 crore for the quarter ended June, according to a survey of analysts' estimates done by Bloomberg. Its earnings before interest, taxes, depreciation and amortisation is seen at Rs 2,429.40 crore, and margin is expected at 19.78%.

Bluestone Jewellery set the price band at Rs 492–517 for its initial public offer.

The much-awaited initial public offering (IPO) of National Securities Depository Ltd. (NSDL), which closed on August 1, was subscribed 41 times on the third and final day of bidding. The NSDL IPO share allotment status was finalised on Monday, August 4.

The mainboard issue, which opened on July 30, received bids for more than 144.03 crore shares against 3.51 crore shares on offer.

Asia-Pacific markets were trading on a mixed note on Wednesday amid fresh tariff threats from the US President Donald Trump. He said that he will announce tariffs on pharmaceutical, and semiconductors.

The Nikkei 225 and S&P ASX 200 were trading 0.44% and 0.55% higher, respectively as of 7:40 a.m. The CSI 300 and Hang Seng were trading 0.01% and 0.20% down, respectively as of 7:41 a.m.

The Dow Jones Industrial Average and S&P 500 futures rose in Asia-Pacific session. On Tuesday, US stocks ended with losses as US ISM services purchasing manager index data softened, further putting light on the economic slow down.

The Dow Jones Industrial Average and S&P 500 futures were trading 0.11% and 0.10% higher, respectively as of 7:35 a.m. The Nasdaq 100 futures fell 0.02%.

The GIFT Nifty was trading 0.10% or 25 points higher at 24,662.50 as of 6:41 a.m., which implied a higher open for the benchmark NSE Nifty 50 index.

Bharti Airtel Ltd., Amber Enterprises Ltd., Container Corp of India, Torrent Power Ltd., and Britannia Industries Ltd. shares in focus in Wednesday's session. Bank and financial services' stocks will also get attention today as the Reserve Bank of India's rate-setting panel is expected to release its policy decision.

The Indian equity benchmark indices closed lower after a day of closing in the green, as Adani Ports, Reliance, Infosys along with others weighed on the index. The NSE Nifty 50 benchmark ended 73 points, or 0.30% down at 24,649, and the 30-stock BSE Sensex ended 308 points, or 0.38% lower at 80,710.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.