Hinduja Global Q1 FY26 Highlights (Consolidated, YoY)

Revenue down 3.3% to Rs 1,056 crore versus Rs 1,092 crore.

Ebitda rises 71.6% to Rs 28.7 crore versus Rs 16.7 crore.

Margin at 2.7% versus 1.5%.

Net Profit down 89.5% at Rs 17.4 crore versus Rs 166 crore.

SKF Q1 FY26 Highlights (Consolidated, YoY)

Revenue rises 6.4% to Rs 1,283 crore versus Rs 1,206 crore.

Ebitda files 13.6% to Rs 167.3 crore versus Rs 194 crore.

Margin at 13% versus 16%

Net profit declines 25.6% to Rs 118 crore versus Rs 159 crore.

Rain Industries Q1 FY26 Highlights (Consolidated, YoY)

Revenue rises 7.5% to Rs 4,401 crore versus Rs 4,094 crore.

Ebitda up 88.8% at Rs 658 crore versus Rs 349 crore.

Margin at 15% versus 8.5%.

Net profit at Rs 60.7 crore versus loss of Rs 77.9 crore.

Protean eGov Technologies Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 7.3% to Rs 210.84 crore versus Rs 196.54 crore.

Net Profit up 13% to Rs 23.85 crore versus Rs 21.09 crore.

Ebitda up 9% to Rs 16.41 crore versus Rs 15.11 crore.

Margin at 7.8% versus 7.7%.

Raymond Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 16.6% to Rs 524.29 crore versus Rs 449.81 crore.

Net Profit down 9% to Rs 20.62 crore versus Rs 22.62 crore.

Ebitda up 25% to Rs 56.28 crore versus Rs 44.88 crore.

Margin at 10.7% versus 10.0%.

Fortis Healthcare Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 16.6% to Rs 2,166.72 crore versus Rs 1,858.90 crore.

Net Profit up 57% to Rs 260.28 crore versus Rs 165.96 crore.

Ebitda up 43% to Rs 490.67 crore versus Rs 342.52 crore.

Margin at 22.6% versus 18.4%.

Bajaj Holdings Q1 FY26 Highlights (Consolidated, YoY)

Total income at Rs 338 crore versus Rs 148 crore.

Net profit at Rs 3,487 crore versus Rs 1,610 crore.

The surge in profit was from the sale of shares in Bajaj Finserv.

Balmer Lawrie Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 6.7% to Rs 680.66 crore versus Rs 638.16 crore.

Net Profit up 8% to Rs 68.93 crore versus Rs 63.83 crore.

Ebitda up 30% to Rs 83.18 crore versus Rs 63.93 crore.

Margin at 12.2% versus 10.0%

Gopal Snacks Q1 FY26 Highlights (Consolidated, YoY)

Revenue down 9.1% to Rs 322.17 crore versus Rs 354.32 crore.

Net Profit down 90% to Rs 2.52 crore versus Rs 24.30 crore.

Ebitda down 16% to Rs 107.42 crore versus Rs 128.44 crore.

Margin at 33.3% versus 36.2%.

Raymond Lifestyle Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 17.2% to Rs 1,430.43 crore versus Rs 1,220.12 crore.

Net loss at Rs 19.82 crore versus loss of Rs 23.21 crore.

Ebitda up 29% to Rs 77.00 crore versus Rs 59.72 crore.

Margin at 5.4% versus 4.9%.

Datamatics Global Services Q1 FY26 Highlights (Consolidated, QoQ)

Revenue down 6.0% to Rs 467.56 crore versus Rs 497.15 crore

Net Profit up 12% to Rs 50.38 crore versus Rs 44.86 crore

Ebit up 3% to Rs 56.43 crore versus Rs 54.54 crore

Margin at 12.1% versus 11.0%

Numbers in line with estimates

Q1 saw weak sales with 10% fall in sales YoY

New ABS regulation starting 2026 could impact margins

Company invested 510 crores in Euler Motors this quarter

Management commentary on demand will be key in conference call scheduled at 10:30 am tomorrow

VIP Industries Q1 FY26 Highlights (Consolidated, YoY)

Revenue down 12.1% to Rs 561.43 crore versus Rs 638.89 crore

Net loss at Rs 13.10 crore versus profit of Rs 4.04 crore

Ebitda down 50% to Rs 24.65 crore versus Rs 49.31 crore

Margin at 4.4% versus 7.7%

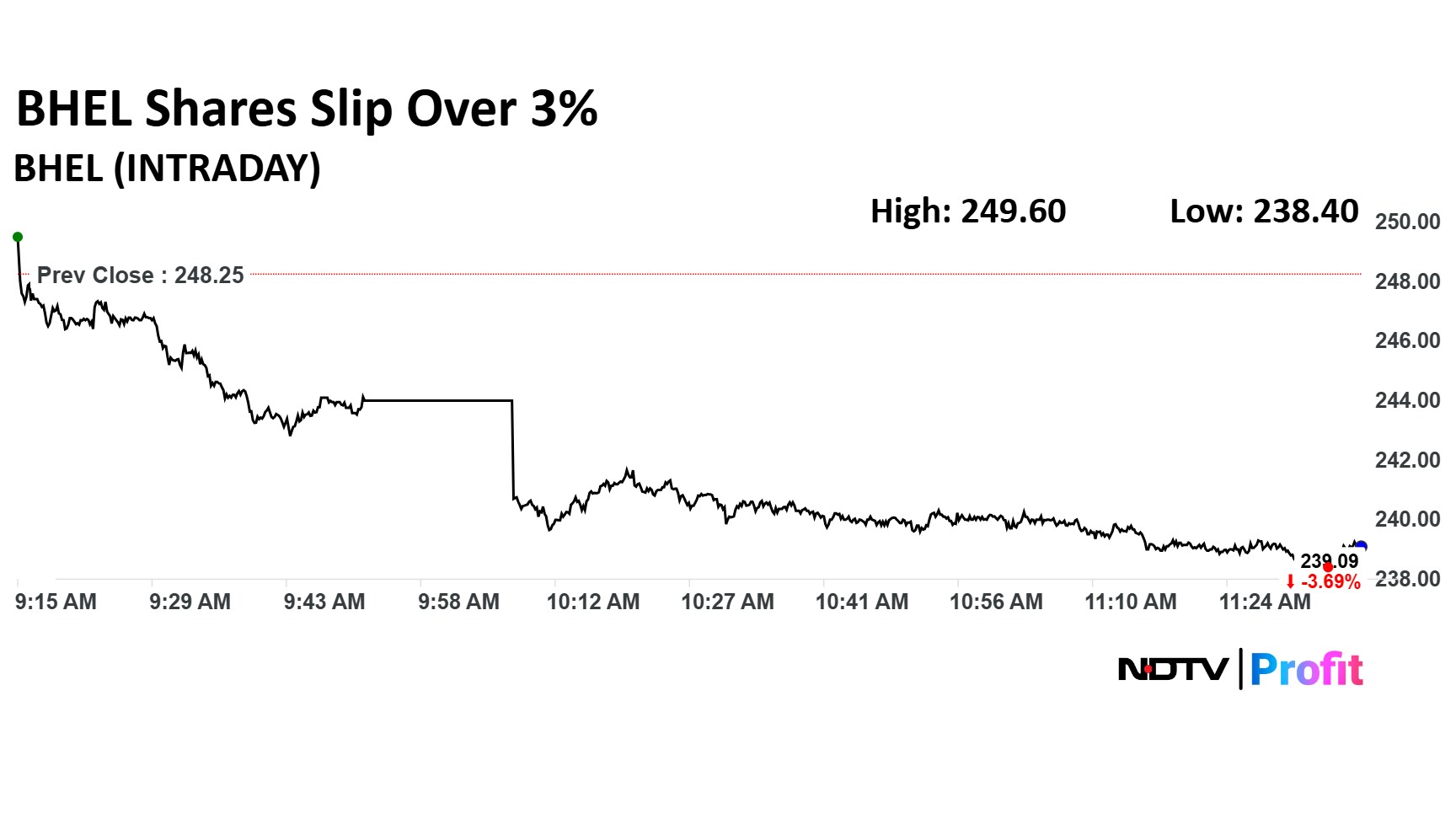

BHEL Q1 FY26 Highlights (Consolidated, YoY)

Revenue flat at Rs 5,486.91 crore versus Rs 5,484.92 crore.

Net loss at Rs 455.50 crore versus Rs 211.40 crore.

Ebitda loss at Rs 537.14 crore versus Rs 169.35 crore.

Ircon International Q1 FY26 Highlights (Consolidated, YoY)

Revenue down 21.9% to Rs 1,786.29 crore versus Rs 2,287.13 crore.

Net Profit down 27% to Rs 164.56 crore versus Rs 224.02 crore.

Ebitda down 20% to Rs 199.90 crore versus Rs 250.51 crore.

Margin at 11.2% versus 11.0%.

Sula Vineyards Q1 FY26 Highlights (Consolidated, YoY)

Revenue down 9.3% to Rs 109.64 crore versus Rs 120.93 crore.

Net Profit down 87% to Rs 1.94 crore versus Rs 14.63 crore.

Ebitda down 46% to Rs 18.30 crore versus Rs 33.96 crore.

Margin at 16.7% versus 28.1%.

Hero MotoCorp Q1 FY26 Highlights (Standalone, YoY)

Revenue down 5.6% to Rs 9,578.86 crore versus Rs 10,143.73 crore.

Net Profit flat at Rs 1,125.70 crore versus Rs 1,122.63 crore.

Ebitda down 5% to Rs 1,381.71 crore versus Rs 1,459.75 crore.

Margin flat at 14.4%.

Trent Q1 FY26 Highlights (Standalone, YoY)

Revenue up 19.8% to Rs 4,781.25 crore versus Rs 3,991.74 crore.

Net Profit up 24% to Rs 422.59 crore versus Rs 342.15 crore.

Ebitda up 37% to Rs 837.73 crore versus Rs 611.20 crore.

Margin at 17.5% versus 15.3%

Kirloskar Oil Engines Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 8.1% to Rs 1,763.80 crore versus Rs 1,631.87 crore.

Net Profit down 11% to Rs 141.88 crore versus Rs 159.30 crore.

Ebitda up 1% to Rs 326.67 crore versus Rs 324.64 crore.

Margin at 18.5% versus 19.9%.

Bajaj Auto Q1 FY26 Conference Call

Speaker: Mr. Rakesh Sharma – Executive Director

Achieved highest ever retails in Exports outside of Nigeria.

Dominar and Pulsar continued to enrich mix with Pulsar going 21.

Top 30 overseas markets account for 70% emerging market opportunity.

LATAM and Asia on growth part.

Nigeria trading environment remains uncertain and we need to avoid building stock here.

Global tariff issue has not had any issue here.

Domestic motorcycles in first quarter was flattish YoY.

125cc continued to perform better than 100cc segment.

Our approach was continue to differentiate in segments .

We lost 2% market share qoq in 100cc segment.

Strategic focus remains in 125cc – we lost market share in Q3, early Q4 – pricing measures were initiated in Q4 and had some 3% market share improvement in first quarter.

Overall market share in 125 cc now at 15%.

MM Forgings Q1 FY26 Highlights (Consolidated, YoY)

Revenue down 5.4% to Rs 361.64 crore versus Rs 382.19 crore.

Net Profit down 36% to Rs 19.19 crore versus Rs 30.11 crore.

Ebitda down 13% to Rs 63.31 crore versus Rs 73.12 crore.

Margin at 17.5% versus 19.1%.

Gujarat Narmada Valley Fertilizers Q1 FY26 Highlights (Consolidated, YoY)

Revenue down 20.8% to Rs 1,601 crore versus Rs 2,021 crore.

Net Profit down 30% to Rs 83 crore versus Rs 118 crore.

Ebitda down 80% to Rs 31 crore versus Rs 153 crore.

Margin at 1.9% versus 7.6%.

Prince Pipes And Fittings Q1 FY26 Highlights (YoY)

Revenue down 4.0% to Rs 580.42 crore versus Rs 604.47 crore.

Ebitda down 32% to Rs 39.57 crore versus Rs 58.30 crore.

Margin at 6.8% versus 9.6%.

Net Profit down 80% to Rs 4.82 crore versus Rs 24.68 crore.

Lumax Industries Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 20.5% to Rs 922.52 crore versus Rs 765.79 crore.

Net Profit up 6% to Rs 36.19 crore versus Rs 34.18 crore.

Ebitda up 42% to Rs 81.81 crore versus Rs 57.75 crore.

Margin at 8.9% versus 7.5%.

HUDCO Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 34.2% to Rs 2,937.31 crore versus Rs 2,188.35 crore.

Net Profit up 13% to Rs 630.23 crore versus Rs 557.75 crore.

NII rises 33.4% to Rs 948 crore versus Rs 711 crore.

Impairment loss of Rs 103 crore versus loss of Rs 18.7 crore.

Jindal Stainless Q1 FY26 Highlights (Consolidated, QoQ)

Revenue flat at Rs 10,207.14 crore.

Net Profit up 21% to Rs 714.16 crore versus Rs 590.99 crore.

Ebitda up 23% to Rs 1,309.80 crore versus Rs 1,060.88 crore.

Margin at 12.8% versus 10.4%.

Sanghvi Movers Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 81.5% to Rs 273.36 crore versus Rs 150.61 crore.

Net Profit up 24% to Rs 50.26 crore versus Rs 40.49 crore.

Ebitda up 34% to Rs 99.55 crore versus Rs 74.33 crore.

Margin at 36.4% versus 49.4%.

Electrosteel Castings Q1 FY26 Highlights (Consolidated, QoQ)

Revenue down 8.4% to Rs 1,557.69 crore versus Rs 1,700.68 crore.

Net Profit down 47% to Rs 89.05 crore versus Rs 168.31 crore.

Ebitda up 7% to Rs 170.25 crore versus Rs 159.60 crore.

Margin at 10.9% versus 9.4%.

Blue Star Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 4.1% to Rs 2,982.25 crore versus Rs 2,865.37 crore.

Net Profit down 28% to Rs 120.96 crore versus Rs 168.84 crore.

Ebitda down 16% to Rs 199.99 crore versus Rs 237.83 crore.

Margin at 6.7% versus 8.3%.

Godrej Agrovet Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 11.2% to Rs 2,614.17 crore versus Rs 2,350.75 crore.

Net Profit up 19% to Rs 160.52 crore versus Rs 135.15 crore.

Ebitda up 19% to Rs 269.56 crore versus Rs 226.13 crore.

Margin at 10.3% versus 9.6%.

RITES Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 0.8% to Rs 489.74 crore versus Rs 485.76 crore.

Net Profit up 1% to Rs 80.10 crore versus Rs 79.02 crore.

Ebitda up 8% to Rs 114.15 crore versus Rs 105.78 crore.

Margin at 23.3% versus 21.8%.

Board to pay interim dividend of Rs 1.3 per share.

Welspun Enterprises Q1 FY26 Highlights (Consolidated, YoY)

Revenue down 9.1% to Rs 845.05 crore versus Rs 929.96 crore.

Net Profit down 1% to Rs 103.33 crore versus Rs 104.44 crore.

Ebitda up 12% to Rs 182.18 crore versus Rs 162.99 crore.

Margin at 21.6% versus 17.5%.

KPR Mill Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 9.7% to Rs 1,766.27 crore versus Rs 1,609.66 crore.

Net Profit up 5% to Rs 212.70 crore versus Rs 203.31 crore.

Ebitda down 1% to Rs 310.25 crore versus Rs 314.74 crore.

Margin at 17.6% versus 19.6%.

Krishna Institute of Medical Sciences Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 26.6% to Rs 871.60 crore versus Rs 688.40 crore.

Net Profit down 9% to Rs 78.60 crore versus Rs 86.60 crore.

Ebitda up 7% to Rs 192.60 crore versus Rs 179.40 crore.

Margin at 22.1% versus 26.1%.

Morepen Labs Q1 FY26 Highlights (Consolidated, YoY)

Revenue down 6.6% at Rs 425 crore versus Rs 455 crore

EBITDA down 53.2% at Rs 24.2 crore versus Rs 51.6 crore

Margin at 5.7% versus 11.3%

Net Profit down 65.5% at Rs 4.1 crore versus Rs 11.9 crore

The board approved special dividend of Rs 10 per share. It also approved bonus issue of one equity share for every one held.

Pidilite Industries Q1 FY26 Highlights (Consolidated, YoY)

Net Profit up 18.6% at Rs 672 crore versus Rs 567 crore

Revenue up 10.5% at Rs 3,753 crore versus Rs 3,395 crore

EBITDA up 15.8% at Rs 941 crore versus Rs 813 crore

Margin At 25% versus 23.9%

Bayer CropScience Q1 Highlights (YoY)

Revenue up 17.4% to Rs 1,915 crore versus Rs 1,631 crore.

Ebitda up 11% to Rs 348 crore versus Rs 314 crore.

Margin down to 18.2% versus 19.3%.

Net profit up 9.6% to Rs 279 crore versus Rs 254 crore.

Hero MotoCorp is likely to report a net profit of Rs 1,062.90 crore and total revenue of Rs 9,796.90 crore for the first quarter, according to estimates. Its Ebitda is seen at Rs 1,373.10 crore, and margin is expected at 14.02%.

PVR Inox Q1 Highlights (Cons, YoY)

Revenue up 23.4% at Rs 1,469 crore versus Rs 1,191 crore

Ebitda up 58% at Rs 397 crore versus Rs 252 crore

Margin at 27% versus 21.1%

Net Loss of Rs 54 crore versus loss of Rs 179 crore

After posting first quarter results, the company is se to pay a dividend of Rs 3.70 per share.

Bharat Forge Q1 Highlights (Cons, YoY)

Revenue down 4.8% to Rs 3,909 crore versus Rs 4,106 crore.

Ebitda down 9.2% to Rs 673 crore versus Rs 741 crore.

Margin down to 17.2% versus 18%.

net profit up 62.6% to Rs 284 crore versus Rs 175 crore.

PFC Q1 Highlights (Cons, YoY)

Net Profit up 25% to Rs 8,981 crore versus Rs 7,182 crore.

Calculated NII up 22.7% to Rs 11,054 crore versus Rs 9,006 crore.

Harsha Engineers Q1 Highlights (Cons, YoY)

Revenue up 6.4% to Rs 365 crore versus Rs 343 crore.

Ebitda up 0.5% to Rs 55.4 crore versus Rs 55.2 crore.

Margin down to 15.2% versus 16%.

Net profit up 5.2% to Rs 37.9 crore versus Rs 36 crore.

UNO Minda Q1 highlights (Cons, YoY)

Revenue up 17.6% to Rs 4,489 crore versus Rs 3,818 crore.

Ebitda up 33.2% to Rs 543 crore versus Rs 408 crore

Margin at 12% versus 10.7%

Net Profit up 46.5% to Rs 291 crore versus Rs 198 crore

Sundram Clayton Q1 Highlights (YoY)

Revenue down 12% to Rs 512 crore versus Rs 580 crore.

Ebitda rose 66% to Rs 16.2 crore versus Rs 9.8 crore.

Margin at 3.2% versus 1.8%.

Net Loss of Rs 57.8 crore versus loss of Rs 55.9 crore

Cera Sanitary Q1 Highlights (Cons, YoY)

Revenue up 5.4% to Rs 422 crore versus Rs 401 crore.

Margin at 13% versus 14.5%.

Ebitda contracted 5.1% to Rs 55 crore versus Rs 58 crore.

Net Profit down 1% to Rs 46.6 crore versus Rs 47 crore.

VRL Logistics Q1 Highlights (YoY)

Revenue up 2.4% to Rs 744 crore versus Rs 727 crore.

Ebitda up 74.5% to Rs 152 crore versis Rs 86.9 crore.

Margin At 20.4% verSus 11.9%.

Net Profit rose to Rs 50 crore versus Rs 13.4 crore

Bajaj Auto Q1 Highlights (Standalone, YoY)

Revenue up 5.5% to Rs 12,584.45 crore versus Rs 11,928.02 crore.

Ebitda up 2.8% to Rs 2,481.77 crore versus Rs 2,415.26 crore.

Margin at 19.7% versus 20.2%.

Net profit up 5.4% to Rs 2,095.98 crore versus Rs 1,988.34 crore.

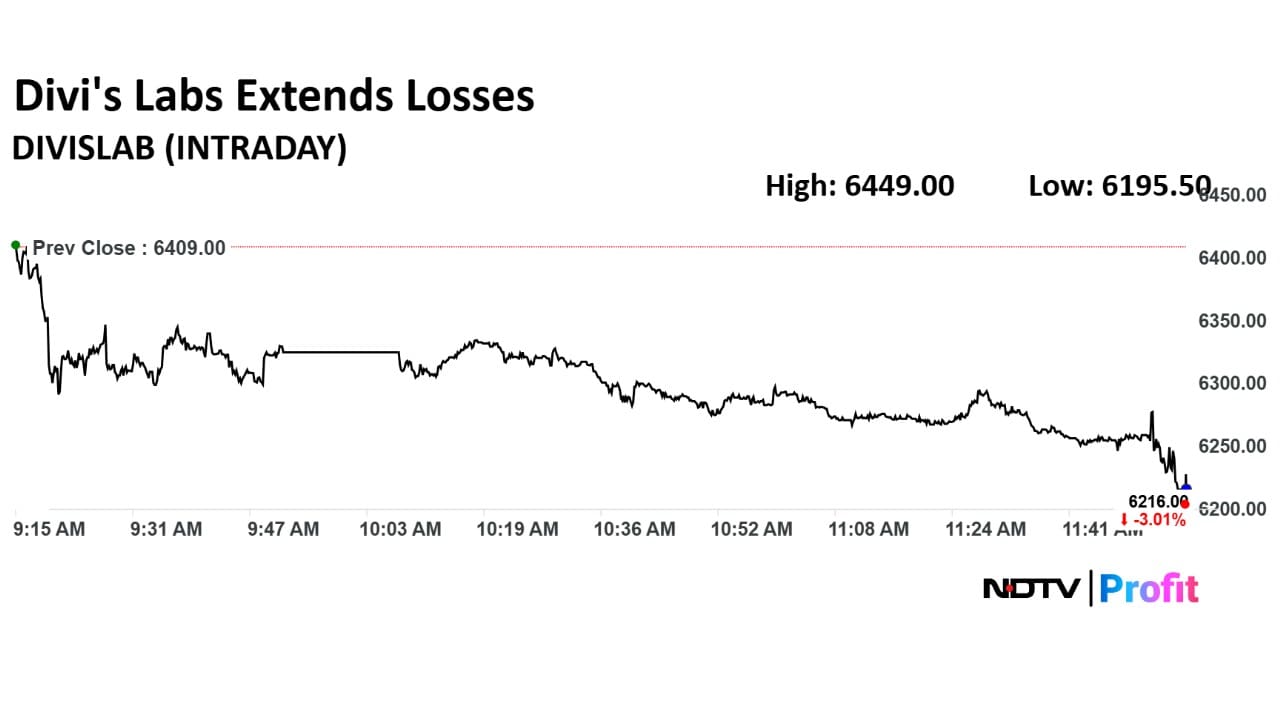

Divi's Labs share prices remained lower after the Q1 results. Both benchmarks Nifty and Sensex are also down.

Divi's Labs share prices remained lower after the Q1 results. Both benchmarks Nifty and Sensex are also down.

Divi's Laboratories Q1FY26 Highlights (Consolidated, YoY)

Revenue up 13.8% at Rs 2,410 crore versus Rs 2,118 crore

EBITDA up 17.2% at Rs 729 crore versus Rs 622 crore

Margin at 30.2% versus 29.4%

Net Profit up 26.7% at Rs 545 crore versus Rs 430 crore

Ahead of posting results, BHEL is the counter that marked the deepest losses among the pack of companies that are set to declare their first quarter results. The scrip was down over 3% trading at Rs 239, compared to a 0.36% decline in the benchmark index Nifty 50.

Ahead of posting results, BHEL is the counter that marked the deepest losses among the pack of companies that are set to declare their first quarter results. The scrip was down over 3% trading at Rs 239, compared to a 0.36% decline in the benchmark index Nifty 50.

The shares of the Nifty 50 company were trading in the green ahead of posting results. The shares were trading at Rs 5,356, about 0.73% higher. These gains compared to a 0.38% decline in the Nifty 50.

The shares of the Nifty 50 company were trading in the green ahead of posting results. The shares were trading at Rs 5,356, about 0.73% higher. These gains compared to a 0.38% decline in the Nifty 50.

Britannia Q1 Concall Highlights

Most price hikes are now done with

Revenue growth to be higher than volume growth because of inflation

Transaction growth with customers has been at 12%

Volume momentum will come back

Volume versus value growth delta will be between 6-8% in next 3 quarters

Britannia Q1 Concall Highlights

Improved relative market share versus organized players

The quarter gone by has been stable in terms of commodities

Both urban and rural growths on a positive trajectory

Registered double digit growth in rural markets in the first quarter

Registered high single digit growth in urban markets in first quarter

Sustain Margins while being competitive against regional players

E-commerce doing well with 4% share in overall business

Bajaj Auto is likely to post net profit of Rs 2,012.30 crore and revenue of Rs 12,283.40 crore for the quarter ended June, according to a survey of analysts' estimates done by Bloomberg. Its earnings before interest, taxes, depreciation and amortisation is seen at Rs 2,429.40 crore, and margin is expected at 19.78%.

Trent Ltd., Bajaj Auto, Raymond, Hero MotoCorp, BHEL and others are among the top names that will announce their earnings for the first quarter on Wednesday.

This is your front-row seat to the earnings action, so stay with us for real-time updates, analysis of the numbers, and all the key details that companies will be putting out through the day!

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.