The live blog has ended.

The RBI Monetary Policy Committee on Wednesday kept the repo rate unchanged at 5.5%. It also maintained the stance 'neutral'.

Inflation forecast was lowered and GDP forecast kept the same as in July.

Governor Sanjay Malhotra said the central bank will await more macro data to guage the impact of trade and other uncertainities on the Indian economy.

"The current pause reflects a calibrated, data-driven approach. With easing already frontloaded in the last policy, it seems MPC is preserving room for future rate action (if any)," as per Dolat Research.

RBI Governor Sanjay Malhotra said he is hopeful of an amicable solution to the India-US trade talks.

"We took various steps to support growth beyond monetary policy. Let us wait for two months and see how the economy fares. We will now be found wanting in doing whatever it takes," he said.

The RBI currently is not worried about the non-performing assets in the banking sector, Governor Sanjay Malhotra said. He said the sharp rise in unsecured loans has been reduced.

India's GDP growth forecasts by the RBI have factored in the global risks, Governor Sanjay Malhotra said.

"As of now, we don't have sufficient data to revise our GDP forecasts."

The central bank estimates 6.5% growth in FY26, the same as in its July release.

RBI holds repo rate steady, @GovSMalhotra says impact of 100 bps rate cut in previous MPCs is still percolating down in the economy.

— NDTV Profit (@NDTVProfitIndia) August 6, 2025

Here's @Vishwanath4389 with the key takeaways.

Read: https://t.co/bY1vLQmSoO pic.twitter.com/21CtAWUhp7

"New investments were tepid, but seeing some revival in demand. Liquidity position is comfortable, and will further increase after CRR cuts come into effect. Banks will see some NIM compression due to loan repricing. Typically, the lag between repricing in loans and deposits is of two quarters There will be some support from CRR cut, but not enough to counter the NIM compression," added Ashwini Tiwari, managing director of SBI speaking to NDTV Profit.

"Banks not asking borrowers to go to market, short term rates are lower than bank rates. Cash surplus in corporates is large, a rate cut would not have made too much of an impact on consumer demand. Deposit transmission is not a straight linkage with the policy rate. Goal is to give depositors a fair rate versus market," said Ashwini Tiwari, managing director of SBI told NDTV Profit.

"A 25 bps rate cut this time could have been negative for the banking sector as asset prices will come down, loan rates will come down but deposit rates will take time. So banks would not transmit to incremental lending," said Jaideep Iyer, Head of Strategy, RBL Bank.

Devang Shah, head of fixed income at Axis Mutual Fund, said the RBI is nearing the end of the rate cut cycle and may have 25-50 bps reduction more. But a repo of 4% is highly unlikely and the benchmark may be in the 5-5.5% range.

"The RBI is at a wait-and-watch mode and will see how some of the earlier monetary easing transmits into the system. The macro data is mixed," said Sakshi Gupta, Principal Economist at HDFC Bank.

"Both external and internal economic indicators do not support the 'pause case'. Having done a large rate cut since February, could you wait for some more data, probably yes," said Maneesh Dangi, Founder, Macro Mosaic Investing and Research.

#RBI's GDP growth projections remain unchanged, but is there going to be an impact of tariff uncertainty in next policy?

— NDTV Profit (@NDTVProfitIndia) August 6, 2025

Here's what Maneesh Dangi expects. @notarandomwalk @TamannaInamdar

Watch live: https://t.co/8DXVdwEJN6

Read #RBIPolicy updates: https://t.co/63wnwM91Jm pic.twitter.com/a6mYdccIH6

RBI Governor Sanjay Malhotra said as the CRR cut comes into effect starting September, liquidity conditions will be supported further.

"In the credit market, the weighted average lending rate of scheduled commercial banks declined by 71 bps. On outstanding rupee loans, there was 39 bps reduction between Feb and June in the weighted average lending rate. Going ahead, the RBI will remain nimble and flexible in liquidity management," he said.

Rupee advanced 12 paise to 87.68 against US Dollar. It opened at 87.72 a dollar on Wednesday.

The yield on the benchmark 10-year government bond rose 3 basis points to 6.36%.

"As of Aug 1 forex reserves stood at $688.9 bln, sufficient to cover more than 11 months of merchandise imports," RBI Governor Sanjay Malhotra said.

Real GDP growth for FY26 is projected at 6.5%.

Q1 GDP growth seen at 6.5%, Q2 at 6.7%, Q3 at 6.6% and Q4 at 6.3%.

Q1 FY27 GDP growth seen at 6.6%.

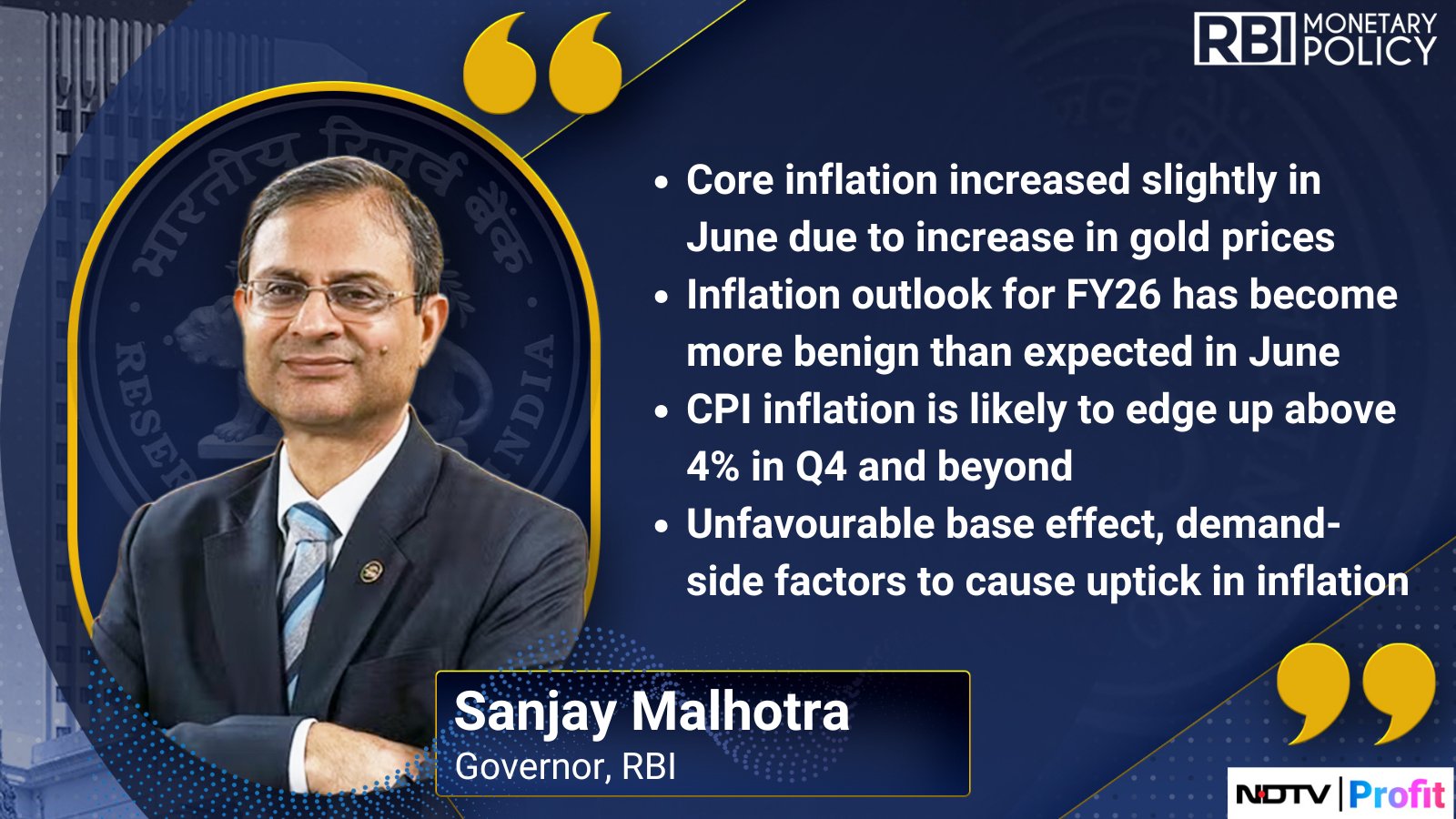

Inflation outlook for FY26 has become more benign than expected in June.

FY26 inflation seen at 3.1%

CPI inflation in Q2 seen at 2.1%, Q3 at 3.1%, and Q4 at 4.4%

CPI inflation in Q1 FY27 seen at 4.9%

RBI Governor Sanjay Malhotra said domestic growth is holding up, broadly evolving along lines of the central bank's assessment.

"Some high-frequency indicators showed mixed signals. Rural consumption is showing revival. Fixed investment supported by buoyant government capex is supporting economic activity. Steady monsoon is supporting Kharif sowing, bolstering reservoir levels," he said.

Malhotra said services activity remains steady but growth in the industrial sector remained subdued and uneven. "Manufacturing PMI remained elevated in Q1, but IIP showed moderation. Supportive monetary, regulatory, fiscal policy should boost demand," he said.

"Headline inflation is lower because of volatile food prices. Inflation projected to go up from last quarter of current financial year," RBI Governor Sanjay Malhotra said.

"Headline inflation is lower because of volatile food prices. Inflation projected to go up from last quarter of current financial year," RBI Governor Sanjay Malhotra said.

#RBIPolicy | #Inflation outlook for FY25-26 has become more benign than expected in June, says @RBI Governor Sanjay Malhotra.

— NDTV Profit (@NDTVProfitIndia) August 6, 2025

Read LIVE updates: https://t.co/KjdqxBSYBp pic.twitter.com/8YnmXaJ1Uc

"The RBI took decisive, forward looking measures to support growth. MPC voted unanimously to keep policy rate unchanged. Repo rate kept at 5.5%. MPC decided to continue with neutral stance," said Governor Malhotra

No surprises!

The RBI Monetary Policy Commitee has decided to unnanimously keep the repo rate unchanged at 5.5%, Governor Sanjay Malhotra said.

RBI Governor Sanjay Malhotra said the monsoon season has been progressing well. "The economy is approaching the festive season, which brings buoyancy in economic activity. Geopolitical uncertainties have somewhat abated."

Ahead of the RBI MPC meeting, SBI Research predicted another 25 basis point rate cut.

In its report titled ‘Prelude to MPC Meeting: August 4-6, 2025,’ SBI Research highlighted that key economic trends, from tariff revisions to GDP growth, inflation projections for FY27 and even the festive demand cycle in FY26, are all being addressed early.

The report added that in the current environment, delaying action could be counterproductive, stating, “No point in committing a Type 2 error today by not cutting rates in August, as inflation will continue to remain range-bound even in FY27.”

The RBI can utilise some space to support growth as inflation is seen to be muted and US tariffs can impact economy negatively, said Samiran Chakraborty, Chief Economist - India at Citibank.

He also said the RBI should not wait till the October meeting to cut rates because the festive season is much earlier this year.

The RBI Governor’s speech can be watched live on the central bank’s YouTube channel. It will also be available live on the social media accounts of the RBI, including X and Facebook.

The RBI Governor's speech will also be broadcast live on the NDTV Profit TV channel from 10 a.m. onwards. You can also follow real-time updates on the website's live blog or check the NDTV Profit YouTube channel for updates. The post MPC press conference will begin at noon on August 6.

The Nifty 50 and BSE Sensex opened flat on Wednesday, ahead of the RBI MPC decision. The Nifty remained above 24,600 while the Sensex stood at nearly 80,700.

The Reserve Bank of India is expected to keep repo rate steady at 5.50% in the ongoing policy meeting despite there being enough room for the central bank to reduce more, said Rahul Bajoria, head, India and ASEAN Economic Research, BofA Global Research.

The RBI's Monetary Policy Committee is scheduled to announce policy meeting outcome on Wednesday.

"I will look for a dovish guidance from the central bank and promise of not acting now. And continue to watch data to understand what can be done in two-three meetings," he said.

The yield on the benchmark 10-year government bond opened flat at 6.33%.

Source: Cogencis

The Rupee opened 8 paise stronger at 87.72 against the US Dollar, ahead of the RBI MPC decision on the repo rate.

Source: Cogencis

There is scope for the RBI to keep the repo rate on hold, according to Lakshmi Iyer, CEO-Investment and Strategy at Kotak Alternate Asset Managers.

She said India currently has the highest real interest rates (rate net of inflation) amongst peers. "The RBI is the lone star illuminating the markets. It is going to be a wait and watch on what RBI does. The globe looking at India from a monetary stance perspective," Iyer told NDTV Profit.

The analyst is not expecting any more liquidity measures since Cash Reserve Ratio cuts announced in the July meeting are yet to manifest.

Will the RBI cut the benchmark lending rate in its August review?

Listen to what NDTV Profit's Banking Editor, Vishwanath Nair, is hearing from experts. He will get us all the important highlights from today's RBI announcement.

#RBIPolicy: Will the #RBI MPC cut rates? @Vishwanath4389, present at @RBI headquarters, brings you the latest updates on RBI Policy decision

— NDTV Profit (@NDTVProfitIndia) August 6, 2025

Catch the live coverage only on NDTV Profit today, 10 am onwards. pic.twitter.com/35SSPzQxcY

The Reserve Bank of India's Monetary Policy Committee will announce its decision on the repo rate on Wednesday amid heightened trade tensions. A poll of economists by Bloomberg has projected that the rates would be held steady.

In its June policy meeting, the RBI delivered a 50 basis points, or 0.5%, reduction on the repo rate.

The repo rate decision will come out at 10:00 a.m. and Governor Sanjay Malhotra will address a media briefing at noon.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.