Nifty ends below 24,700 mark.

Nifty Midcap 150 end lower for the day, drag by BSE and Timken India.

Nifty smallcap 250 end lower for the day, drag by Triveni Turbine and Ino India.

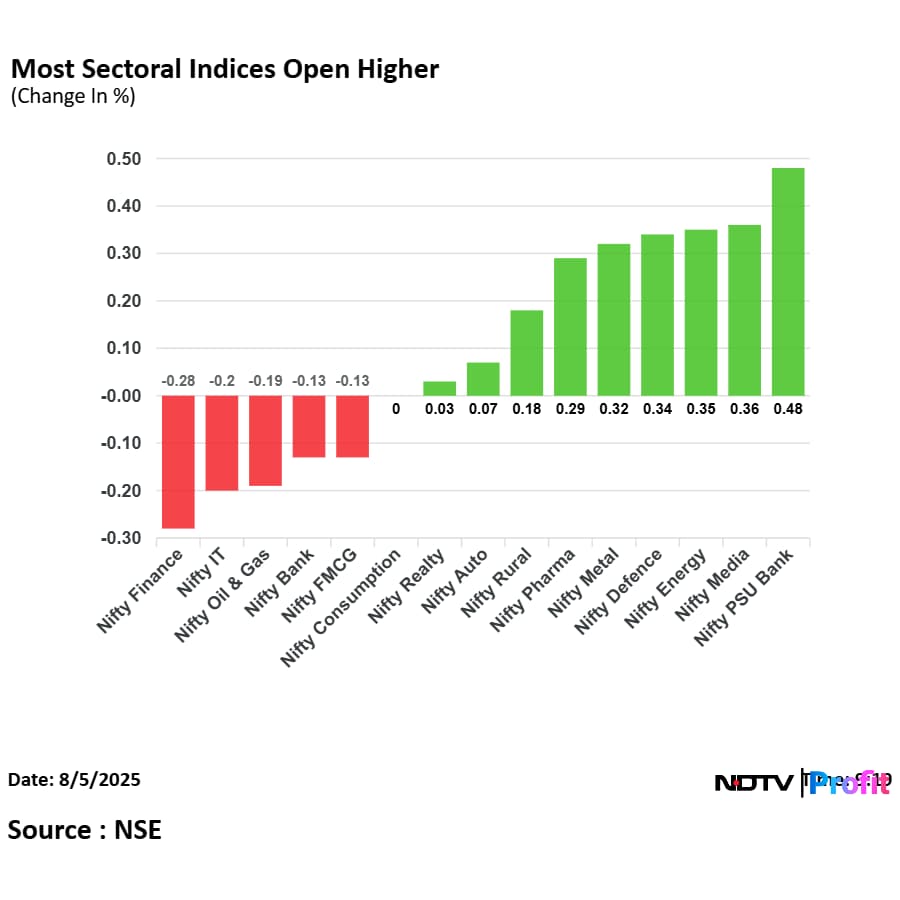

Nifty Oil and Gas emerges the top losing sector for the day, drag by MGL and Petronet.

All sectoral Indices lose in Trade Barring Nifty Auto and Metal.

Nifty Auto and Metal gains higher for the 2nd consecutive day.

Nifty Financial Services fell for the 4th consecutive day.

Nifty FMCG fell for the 2nd consecutive day.

IndusInd Bank emerges as top gainer in Nifty after company announces Rajiv Anand appointed as MD and CEO.

Nifty ends below 24,700 mark.

Nifty Midcap 150 end lower for the day, drag by BSE and Timken India.

Nifty smallcap 250 end lower for the day, drag by Triveni Turbine and Ino India.

Nifty Oil and Gas emerges the top losing sector for the day, drag by MGL and Petronet.

All sectoral Indices lose in Trade Barring Nifty Auto and Metal.

Nifty Auto and Metal gains higher for the 2nd consecutive day.

Nifty Financial Services fell for the 4th consecutive day.

Nifty FMCG fell for the 2nd consecutive day.

IndusInd Bank emerges as top gainer in Nifty after company announces Rajiv Anand appointed as MD and CEO.

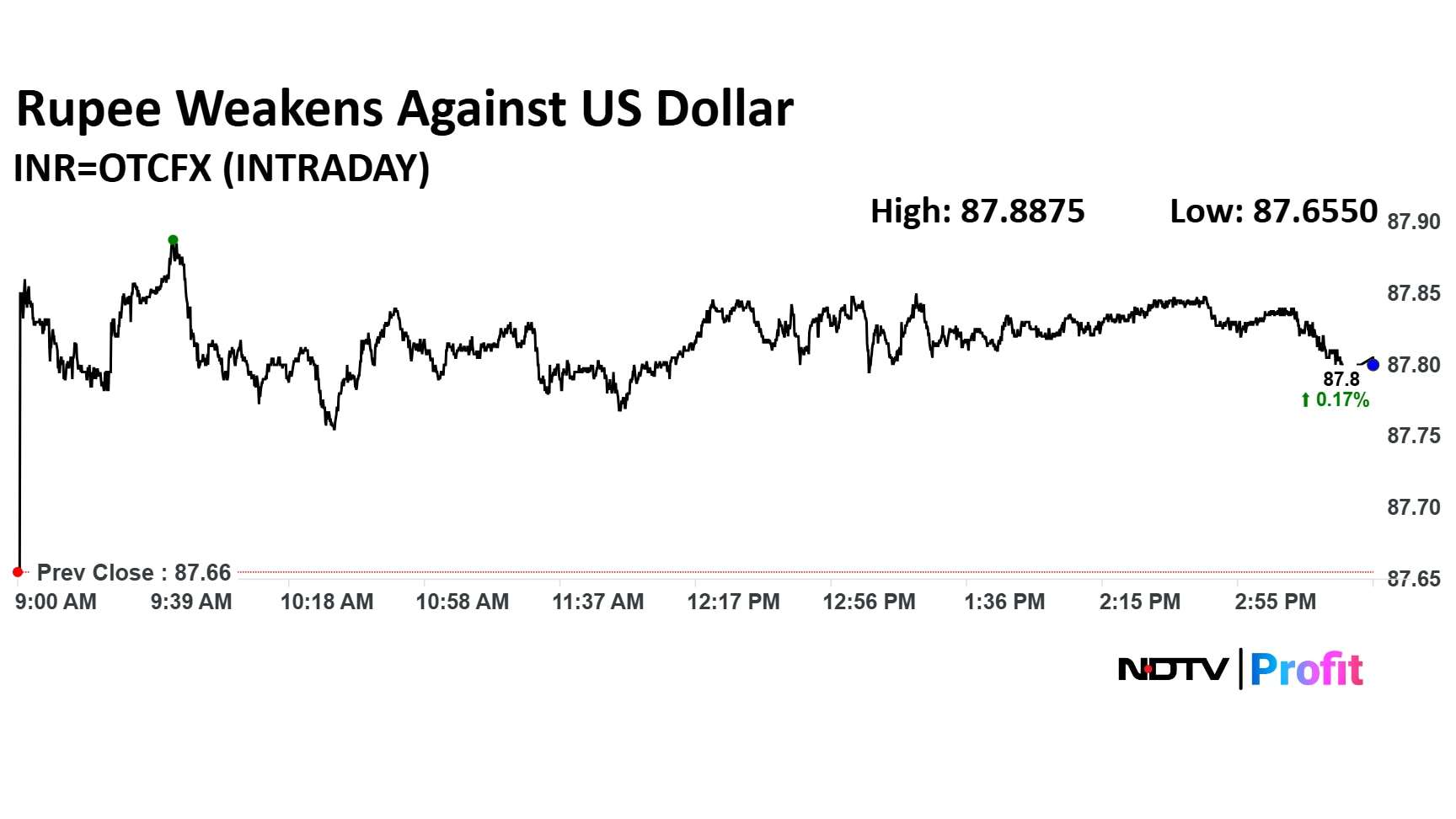

Rupee closed 14 paise weaker at 87.80 against US Dollar

It closed at 87.66 a dollar on Monday.

Source: Cogencis

Rupee closed 14 paise weaker at 87.80 against US Dollar

It closed at 87.66 a dollar on Monday.

Source: Cogencis

Castrol India Earnings Key Highlights (QoQ)

Net Profit rose 4.5% to Rs 244 crore versus Rs 233 crore

Revenue rose 5.3% to Rs 1,497 crore versus Rs 1,422 crore

Ebitda rose 0.7% to Rs 350 crore versus Rs 347 crore

Margin at 23.4% versus 24.4%

The company will pay interim dividend of Rs 3.5 per share

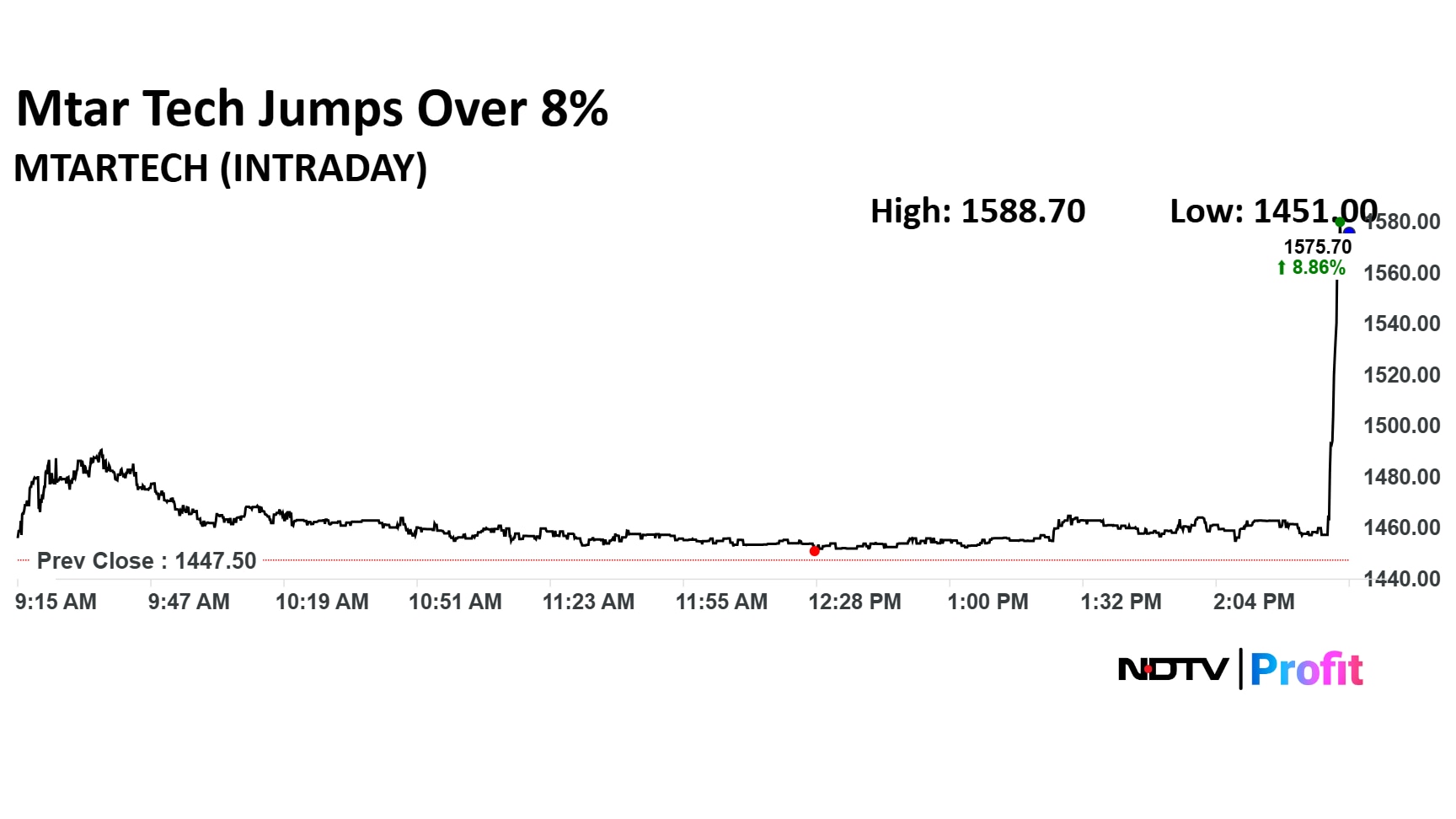

Mtar Tech Earnings Key Highlights (Consolidated, YoY)

Net Profit surged 136.4% to Rs 10.8 crore versus Rs 4.4 crore

Revenue rose 22% to Rs 156.5 crore versus Rs 128 crore

Ebitda rose 71.5% to Rs 28.3 crore versus Rs 16.5 crore

Margin rose 520 basis points to 18.1% versus 12.9%

Mtar Tech Earnings Key Highlights (Consolidated, YoY)

Net Profit surged 136.4% to Rs 10.8 crore versus Rs 4.4 crore

Revenue rose 22% to Rs 156.5 crore versus Rs 128 crore

Ebitda rose 71.5% to Rs 28.3 crore versus Rs 16.5 crore

Margin rose 520 basis points to 18.1% versus 12.9%

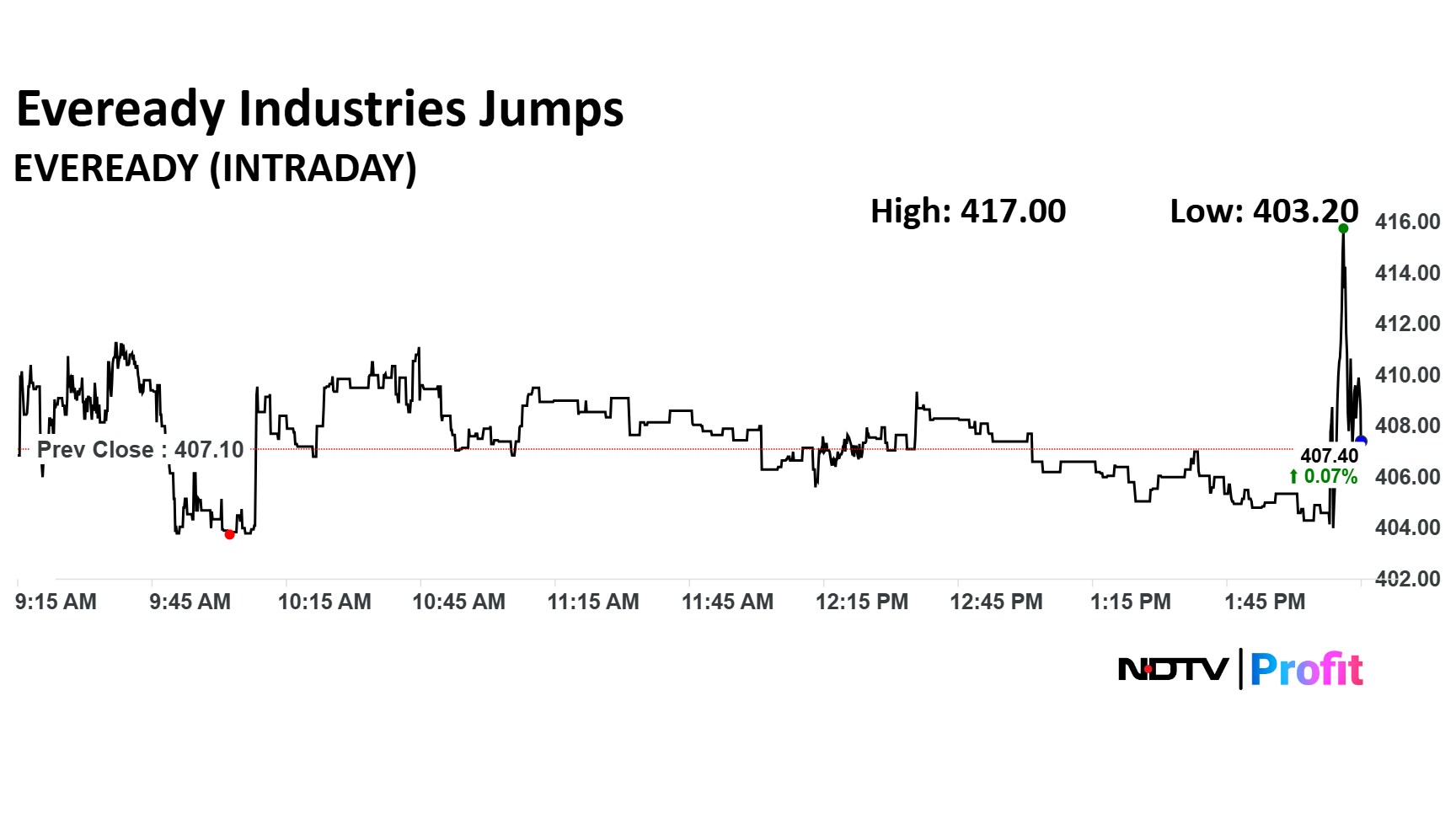

Eveready Industries Q1 Highlights (Cons, YoY)

Revenue up 7% to Rs 374 crore versus Rs 349 crore.

Ebitda up 7.9% to Rs 53.7 crore versus Rs 49.8 crore.

Margin up to 14.3% versus 14.2%.

Net profit up 3% to Rs 30.2 crore versus Rs 29.4 crore.

Eveready Industries Q1 Highlights (Cons, YoY)

Revenue up 7% to Rs 374 crore versus Rs 349 crore.

Ebitda up 7.9% to Rs 53.7 crore versus Rs 49.8 crore.

Margin up to 14.3% versus 14.2%.

Net profit up 3% to Rs 30.2 crore versus Rs 29.4 crore.

The Securities and Exchange Board of India (SEBI) is actively considering steps to reduce the surging volumes in options trading and shift focus back to the cash market, people in the know told NDTV Profit.

A key committee of the regulator is scheduled to meet on August 19 to discuss a set of measures aimed at this objective, Profit was told.

Adani Ports Q1 Highlights (Cons, YoY)

Revenue up 31.2% to Rs 9,126 crore versus Rs 6,956 crore

Ebitda up 29.5% to Rs 5,495 crore versus Rs 4,244 crore

Net Profit up 6.5% to Rs 3,315 crore versus Rs 3,113 crore

Texmaco Rail And Engineering received an order worth Rs 73 crore order from central railway, the company said in the exchange filing.

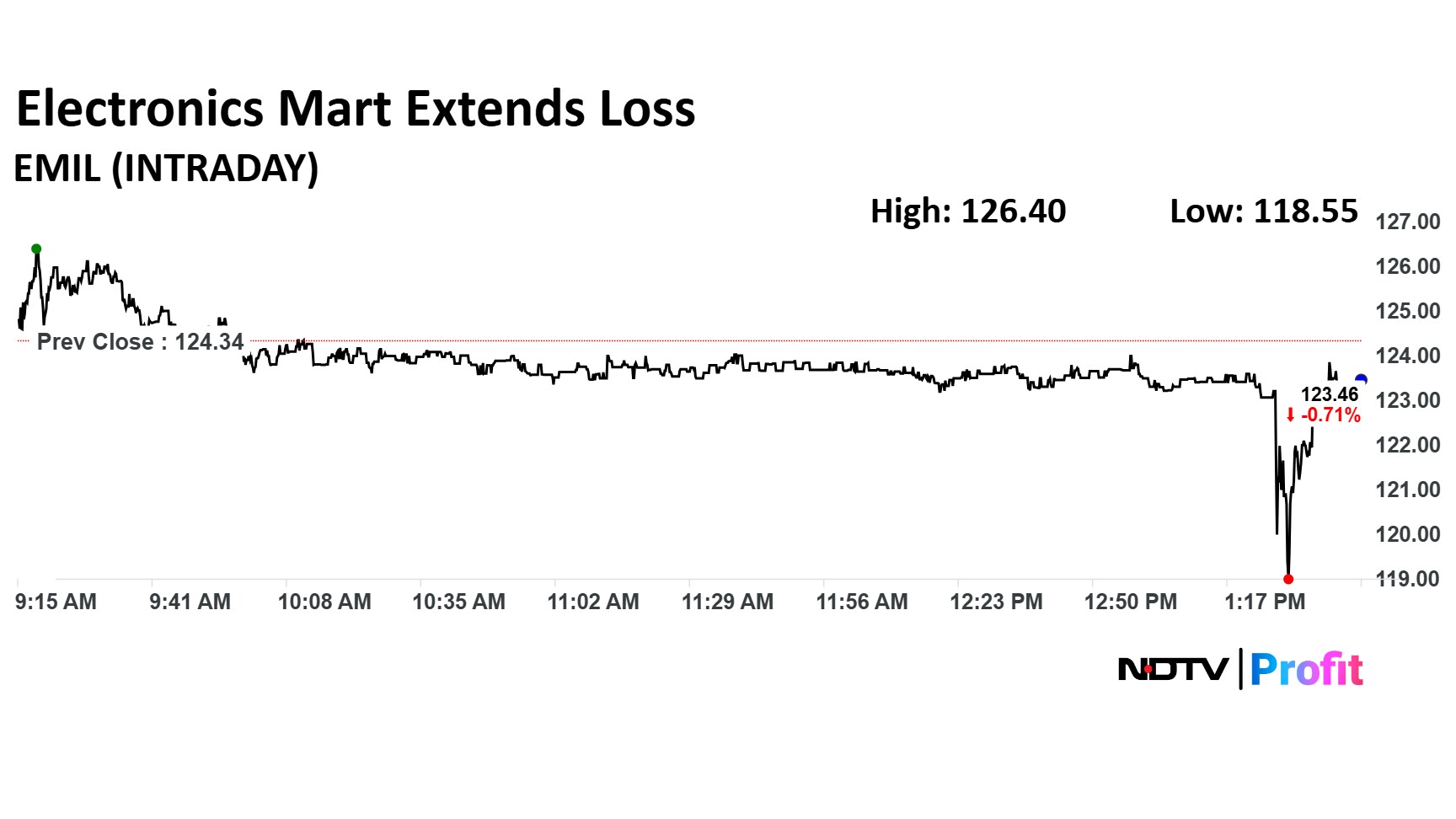

Electronics Mart Q1 Highlights (Cons, YoY)

Revenue down 9.7% to Rs 1,739 crore versus Rs 1,927 crores

Margin at 6.3% versus 8.3%

Ebitda down 31% at Rs 110 crore versus Rs 160 crore

Net Profit down 71.9% to Rs 21.6 crore versus Rs 77 crore

Electronics Mart Q1 Highlights (Cons, YoY)

Revenue down 9.7% to Rs 1,739 crore versus Rs 1,927 crores

Margin at 6.3% versus 8.3%

Ebitda down 31% at Rs 110 crore versus Rs 160 crore

Net Profit down 71.9% to Rs 21.6 crore versus Rs 77 crore

BSE Ltd.'s share price dropped 5% in Tuesday's session without any fundamental trigger. General weakness across markets due to tariff uncertainty weighed on the stock exchanges' stock.

BSE Ltd.'s share price dropped 5% in Tuesday's session without any fundamental trigger. General weakness across markets due to tariff uncertainty weighed on the stock exchanges' stock.

Dixon Technologies is in master services pact with Tech Mahindra Ltd. Tech Mahindra to provide automation and smart factory services to company, the exchange filing said.

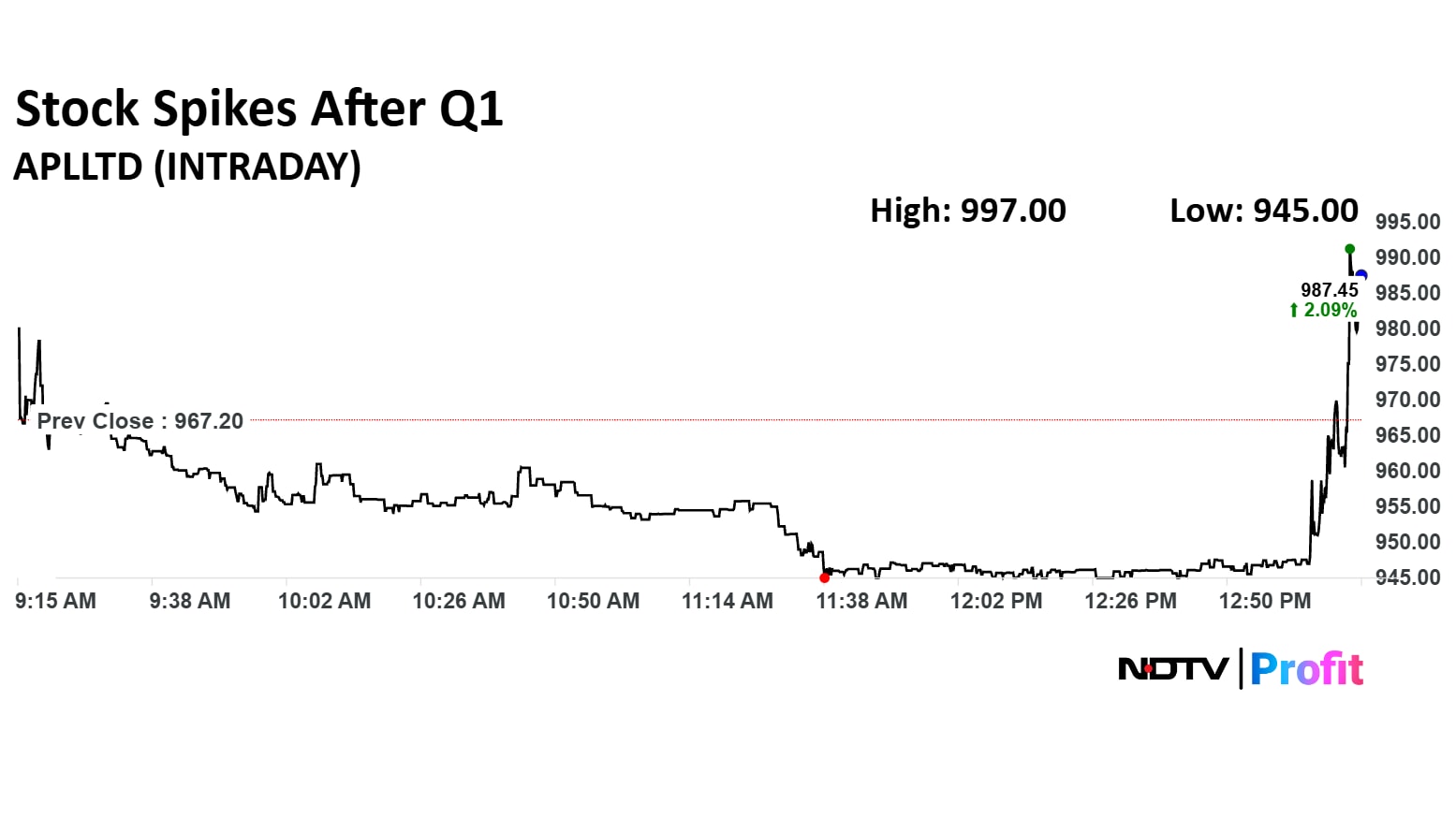

Alembic Pharma Q1 Highlights (Cons, YoY)

Revenue up 9.5% to Rs 1,711 crore versus Rs 1,562 crore

Ebitda up 18.8% at Rs 281 crore versus Rs 237 crore

Margin at 16.4% against 15.2%

Net Profit up 14.6% to Rs 154 crore versus Rs 135 crore

Alembic Pharma Q1 Highlights (Cons, YoY)

Revenue up 9.5% to Rs 1,711 crore versus Rs 1,562 crore

Ebitda up 18.8% at Rs 281 crore versus Rs 237 crore

Margin at 16.4% against 15.2%

Net Profit up 14.6% to Rs 154 crore versus Rs 135 crore

In an exchange filing on Tuesday, Hazoor Multi Projects disclosed their acquisition of Quippo Oil & Gas Infra through competitive Swiss challenge bidding proces.

Anant Raj Ltd. expanded data center business. It now targets revenue of Rs 1,200 crore by financial year 2027.

The mainboard initial public offering of Knowledge Realty Trust Ltd., has opened on Tuesday, Aug.5 and run till Aug.7. The price band for the Rs 4,800-crore REIT has been fixed between Rs 95 and Rs 100 per unit. This IPO is entirely a fresh issuance of units by Knowledge Realty Trust.

Knowledge Realty Trust, sponsored by realty firm Sattva Group and Blackstone, on Monday garnered Rs 1,620 crore from anchor investors ahead of its REIT public issue opening for public subscription.

Aurionpro Solutions Ltd. has approved to acquire entire stake in InfrariskSG Pte for $2 million, the company said in the exchange filing.

Computer Age Management Services Ltd. introduced artificial intelligence fabric 'CAMSAi' for capital markets and banking and financial services institutes, the company said in the exchange filing.

Bharat Heavy Electricals Ltd.'s share price spiked nearly 3% after the company received coverage initiation from UBS.

The brokerage noted that there is thermal reviving and remunerative growth ahead for the company. It also noted that the company's net profit is expected to rise eight times by FY28E.

The scrip rose as much as 2.87% to Rs 248.37 apiece. It pared gains to trade 1.51% higher at Rs 245.07 apiece, as of 10:37 a.m.

NBCC (India) Ltd.'s unit Lokpal of India received order worth in the range of Rs 25.4 crore – Rs 103 crore. Order value for repair works modified due to technical reasons, the company said in the exchange filing.

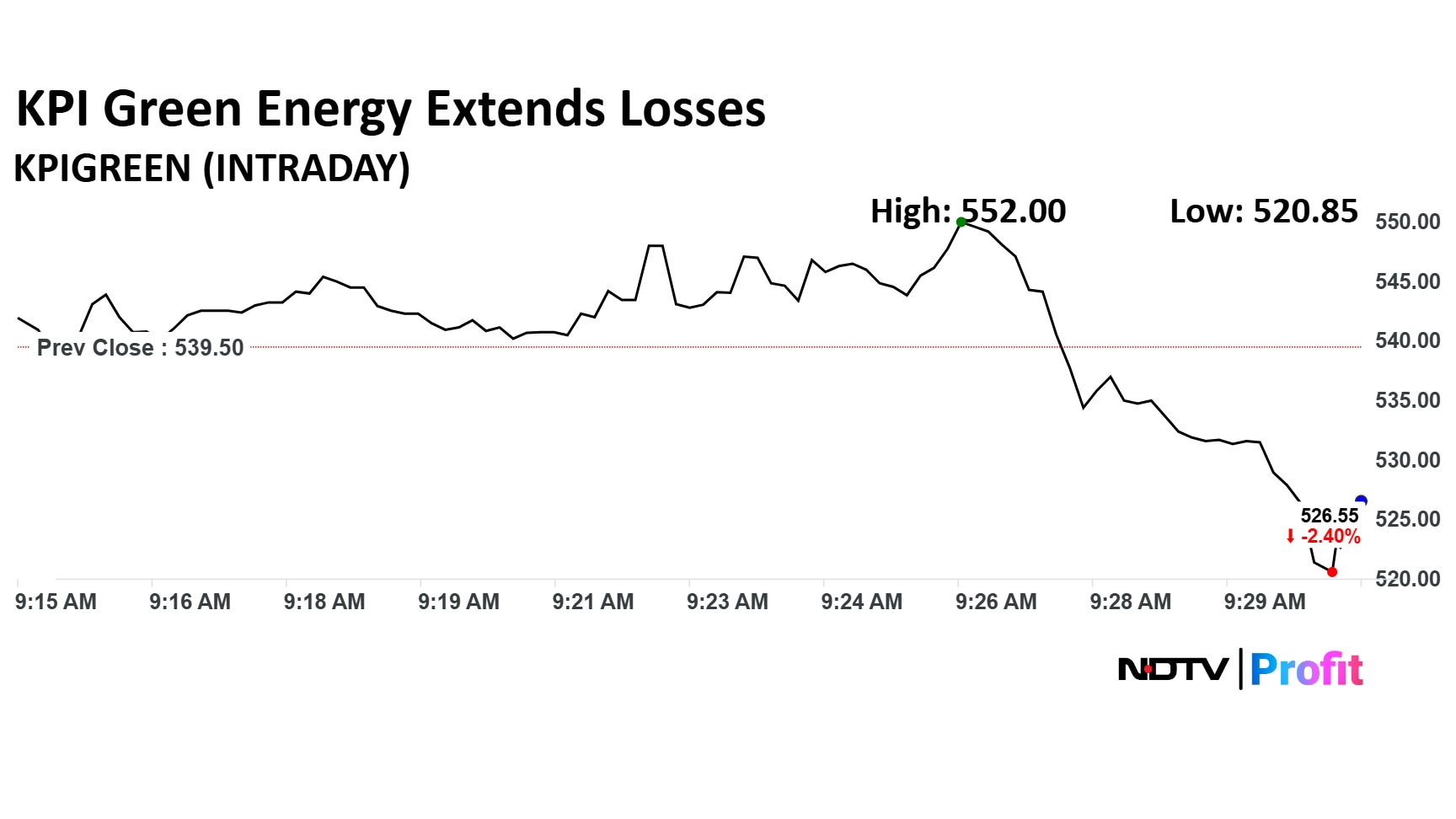

KPI Green Q1 Highlights (Cons, YoY)

Revenue up 73.3% to Rs 603 crore versus Rs 348 crore.

Ebitda up 58.3% to Rs 178 crore versus Rs 112 crore.

Margin down to 29.5% versus 32.3%.

Net profit up 68.4% to Rs 111 crore versus Rs 66.1 crore.

Approves raising up to Rs 700 crore via green bonds.

Track live updates on Q1 earnings here.

KPI Green Q1 Highlights (Cons, YoY)

Revenue up 73.3% to Rs 603 crore versus Rs 348 crore.

Ebitda up 58.3% to Rs 178 crore versus Rs 112 crore.

Margin down to 29.5% versus 32.3%.

Net profit up 68.4% to Rs 111 crore versus Rs 66.1 crore.

Approves raising up to Rs 700 crore via green bonds.

Track live updates on Q1 earnings here.

Bharti Airtel Ltd. is set to announce its financial results for the April-June quarter on Tuesday. Brokerages expect ARPUs to improve marginally for the company.

The country's second largest telecom firm is likely to report a quarterly revenue of Rs 49,761.80 crore, according to consensus estimates of analysts tracked by Bloomberg. The margin is expected to come in at 56.2%.

Reliance Power Ltd.'s share price plummeted by 5%, hitting the lower circuit limit on Tuesday, as Reliance Group Chairman Anil Ambani is set to appear before probe agency Enforcement Directorate today for questioning in connection with an alleged Rs 17,000 crore worth bank loan fraud-linked money laundering case. The stock has continued to remain in lower circuit for the the third consecutive day, as per Bloomberg.

Track live updates on Anil Ambani Group stocks here.

Veranda Learning Learning Solutions's board approved merger between two of its subsidiary. The two subsidiaries are Veranda K-12 Learning Solutions Pvt. Ltd. and Veranda Administrative Learning Solutions Pvt. Ltd.

Laxmi India Finance Ltd. made a lacklustre debut at the Street with a 10.47% discount over its issue price. On the National Stock Exchange, the stock started trading at Rs 141.08 apiece, compared to the issue price of Rs 137.52 at 10:00 a.m., at a discount of 12.9%. On BSE, the scrip started trading at Rs 136 apiece, compared to the issue price of 158, at a discount of 12.9%.

Aditya Infotech Ltd. listed at over 50% premium. The scrip started trading at Rs 1,015 apiece on the NSE and Rs 1,018 on the BSE. The IPO price was Rs 675 apiece.

UBS has initiated coverage on multiple industrial and infrastructure power Original Equipment Manufacturers with a buy rating. The brokerage believes that OEMs are expected to see significant growth given UBS sees profits will increase 3.7 times from FY20-25 to FY25-30 and established leaders will see a 45% Compound Annual Growth Rate in profits.

The report suggests that there is room for creating value for stakeholders, and the advantage lies with existing market leaders.

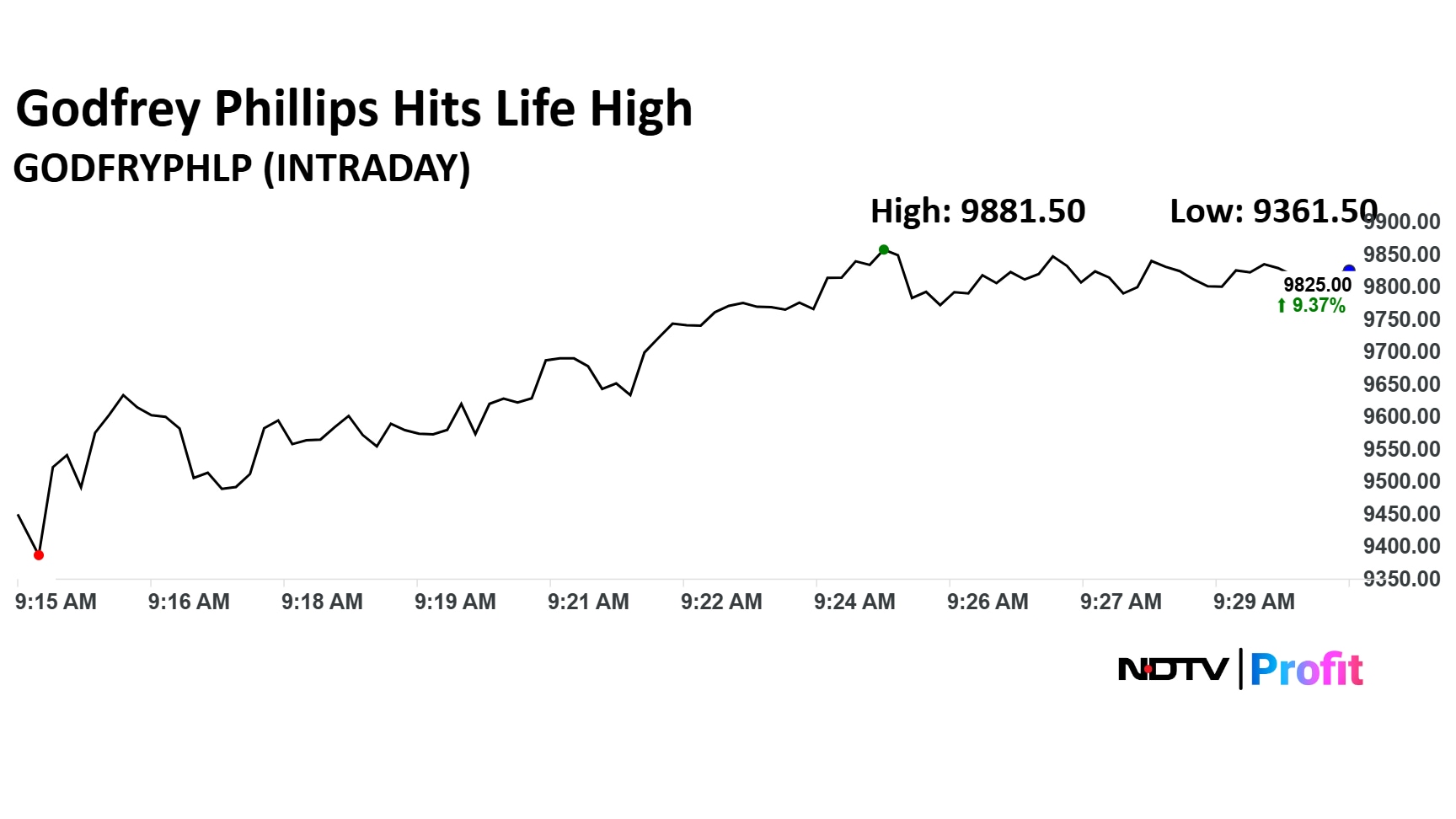

Godfrey Phillips India Ltd. share price hit a record high in Tuesday's session as the company's net profit increased during April–June period.

Godfrey Phillips India Ltd. share price hit a record high in Tuesday's session as the company's net profit increased during April–June period.

On National Stock Exchange, eight sectoral indices advanced, five declined, and two remained flat out of 15 sectoral indices.

On National Stock Exchange, eight sectoral indices advanced, five declined, and two remained flat out of 15 sectoral indices.

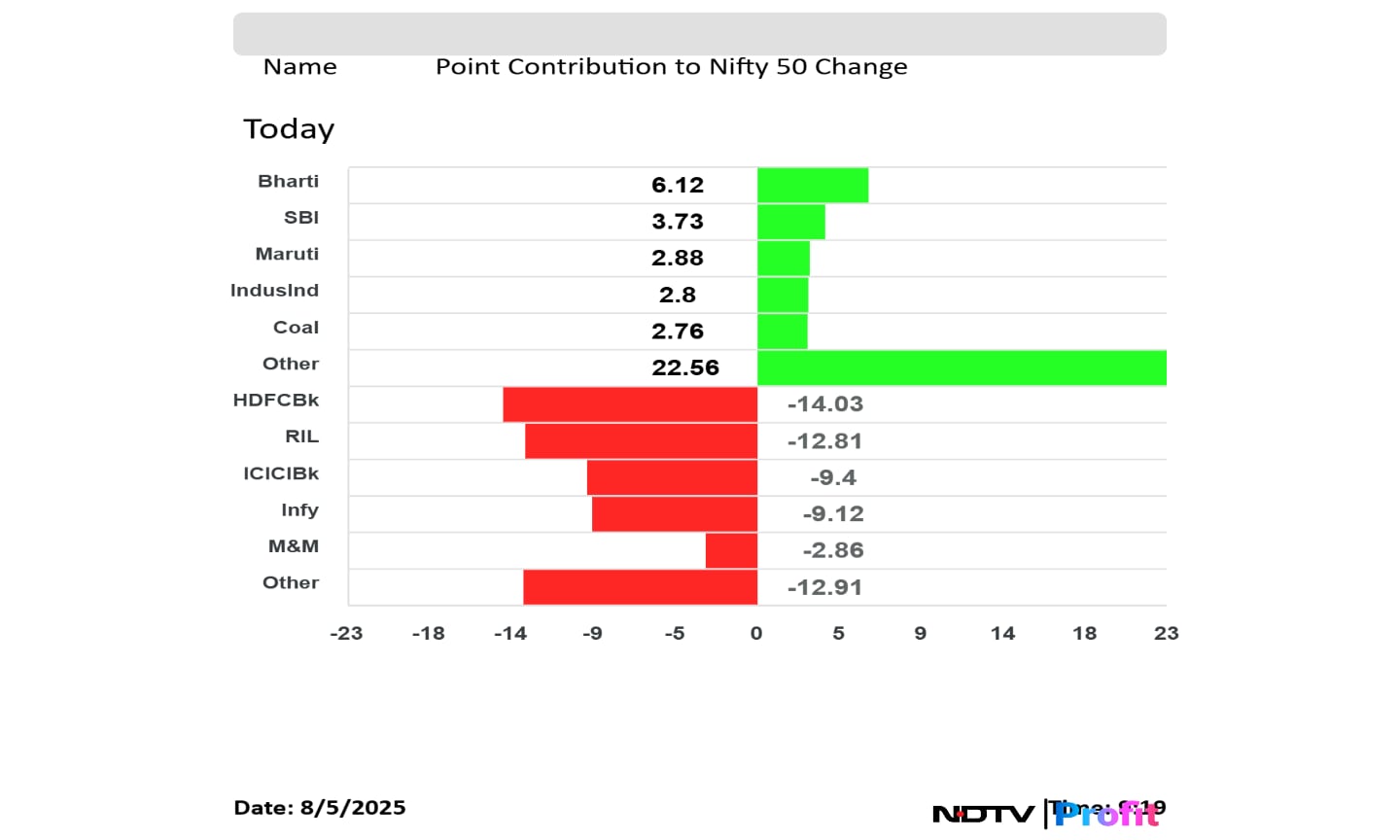

HDFC Bank Ltd., Reliance Industries Ltd., ICICI Bank Ltd., Infosys Ltd., and Mahindra & Mahindra Ltd. weighed on the NSE Nifty 50 index.

Bharti Airtel Ltd., State Bank of India, Maruti Suzuki India Ltd., IndusInd Bank Ltd., and Coal India Ltd. limited losses in the index.

HDFC Bank Ltd., Reliance Industries Ltd., ICICI Bank Ltd., Infosys Ltd., and Mahindra & Mahindra Ltd. weighed on the NSE Nifty 50 index.

Bharti Airtel Ltd., State Bank of India, Maruti Suzuki India Ltd., IndusInd Bank Ltd., and Coal India Ltd. limited losses in the index.

The NSE Nifty 50 and BSE Sensex declined shortly after a muted open as HDFC Bank Ltd. and Reliance Industries Ltd. shares weighed. The indices were trading 0.12% and 0.18% down, respectively as of 9:23 a.m.

The NSE Nifty 50 and BSE Sensex declined shortly after a muted open as HDFC Bank Ltd. and Reliance Industries Ltd. shares weighed. The indices were trading 0.12% and 0.18% down, respectively as of 9:23 a.m.

The 10-year bond yield opened flat at 6.38%

Source: Cogencis

Rupee opened 19 paise weaker at 87.85 against US Dollar

It closed at 87.66 a dollar on Monday.

Source: Cogencis

Stock market regulator—Securities and Exchange Board of India—is currently exploring forming a special division that will be responsible for looking into market manipulation instances of high-frequency trading firms, according to people familiar with the matter.

The immediate function of this team would be to look into Jane Street entities and would later expand to any such instances in the future.

Raitel Corp Gets Letter Of Intent From Bihar Electronics Development Corp, the company said in the exchange filing.

July client base rose 1.8% to 3.3 crore

July orders rose 7% to 12.3 crore

July average daily orders fall 2.3% to 53.5 lakh

July average daily orders fall 2.3% to 53.5 lakh

July gross client acquisitions rose 17% to 6.4 lakh

July gross client acquisitions rose 17% to 6.4 lakh

Engineering and technology major ABB India is navigating a temporary slowdown in its large-scale industrial projects segment, according to the company’s Managing Director (MD), Sanjeev Sharma.

However, the company is confident of maintaining PAT margins within the guided range of 12% to 15% in CY25, provided revenue off-take remains strong and external factors like Quality Control Orders (QCOs) do not pose significant challenges, as per CFO TK Sridhar.

Shares of Coal India Ltd., Kirloskar Industries Ltd., Blue Dart Express Ltd. and 16 other companies will be of interest on Tuesday, as it marks the last session for investors to buy shares to qualify for receiving the dividend before the stock goes ex/record-date.

Oil prices consolidated in Asia-Pacific market hours after three-day slump as traders take a step back to assess impact of imminent penalty on India's Russian supplies.

US President Donald Trump said that he would raise tariffs on India substantially because of its oil imports from Russia.

The brent October future contract was trading 0.10% down at $68.69 a barrel as of 7:53 a.m.

Markets in most Asia–Pacific markets were trading higher on Tuesday, as overnight gains on Wall Street supported.

South Korea's benchmark index KOSPI and Australia's S&P ASX 200 were trading 1.58% and 1.08% higher, respectively as of 7:37 a.m.

The Nikkei 225 rebounded in Tuesday's session. It was trading 0.53% higher as of 7:37 a.m.

US futures were trading higher on Tuesday in Asia-Pacific market hours as market participants increased bets on rate cuts as early as September from the US Federal Reserve.

In a surprise move, Fed Governor Adriana Kugler has resigned, which opened more room for new officials joining the central bank. President Donald Trump has said a number of times to replace Chair Jerome Powell while demanded rate cuts.

The Dow Jones Industrial Average and S&P 500 futures were trading 0.14% and 0.18% higher, respectively as of 7:28 a.m.

The GIFT Nifty was trading 0.07% or 16.50 points higher at 24,723 as of 6:37 a.m., which implied a higher open for the NSE Nifty 50 index.

Traders may keep an eye on Aurobindo Pharma Ltd., Delta Corp Ltd., Siemens Energy Ltd., and Sona BLW Precision Forgings Ltd. share prices will likely to move significantly because of the first-quarter results released Monday post market hours.

The Indian equity benchmark indices closed higher snapping a two-day slump, as Hero Moto, Tata Steel stocks led gains.

The NSE Nifty 50 ended 157 points, or 0.64% up at 24,722, and the 30-stock BSE Sensex ended 418 points, or 0.52% higher at 81,018. The NSE Nifty Bank closed flat at 55,619.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.