Transrail Lighting Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 82.49% at Rs 1,637 crore versus Rs 897 crore.

Ebitda at Rs 126.6 crore versus Rs 56.6 crore.

Ebitda margin up 142 basis points at 7.73% versus 6.3%.

Net profit at Rs 106 crore versus Rs 51.7 crore.

Automotive Axles Q1 FY26 Highlights (Consolidated, YoY)

Revenue down 0.61% at Rs 489 crore versus Rs 492 crore.

Ebitda down 2.04% at Rs 47.8 crore versus Rs 48.8 crore.

Ebitda margin down 14 basis points at 9.77% versus 9.91%.

Net profit up 5% at Rs 357 crore versus Rs 340 crore.

Updater Services Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 7.4% to Rs 700.00 crore versus Rs 652.00 crore

Net Profit up 13% to Rs 28.60 crore versus Rs 25.30 crore

Ebitda down 4% to Rs 39.20 crore versus Rs 40.70 crore

Margin at 5.6% versus 6.2%

Avalon Technologies Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 62.1% to Rs 323.30 crore versus Rs 199.40 crore

Net Profit at Rs 14.20 crore versus loss of Rs 2.30 crore

Ebitda at Rs 30.00 crore versus Rs 4.30 crore

Margin at 9.3% versus 2.2%

Lupin Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 11.9% to Rs 6,268.30 crore versus Rs 5,600.30 crore (Estimate: Rs 6,337.00 crore).

Net Profit up 52% to Rs 1,219.00 crore versus Rs 801.30 crore (Estimate: Rs 1,090.40 crore).

Ebitda up 39% to Rs 1,727.10 crore versus Rs 1,240.90 crore (Estimate: Rs 1,642.70 crore).

Margin at 27.6% versus 22.2% (Estimate: 25.92%).

Dalmia Bharat Sugar and Industries Q1 FY26 Highlights (Consolidated, YoY)

Revenue down 1.8% to Rs 942.87 crore versus Rs 960.26 crore

Net Profit down 30% to Rs 38.37 crore versus Rs 54.73 crore

Ebitda down 23% to Rs 85.59 crore versus Rs 111.20 crore

Margin at 9.1% versus 11.6%

Vaibhav Global Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 7.6% to Rs 813.73 crore versus Rs 756.00 crore

Net Profit up 36% to Rs 37.63 crore versus Rs 27.65 crore

Ebitda up 8% to Rs 61.53 crore versus Rs 56.78 crore

Margin at 7.6% versus 7.5%

Container Corp of India Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 2.4% to Rs 2,153.63 crore versus Rs 2,103.13 crore

Net Profit up 3% to Rs 266.54 crore versus Rs 258.17 crore

Ebitda down 2% to Rs 432.68 crore versus Rs 441.63 crore

Margin at 20.1% versus 21.0%

CCL Products (India) Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 36.5% to Rs 1,055.63 crore versus Rs 773.29 crore

Net Profit up 1% to Rs 72.44 crore versus Rs 71.47 crore

Ebitda up 22% to Rs 159.03 crore versus Rs 130.28 crore

Margin at 15.1% versus 16.8%

Sheela Foam Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 1.4% to Rs 821.41 crore versus Rs 809.76 crore

Net Profit down 84% to Rs 7.43 crore versus Rs 46.01 crore

Ebitda up 26% to Rs 75.45 crore versus Rs 59.85 crore

Margin at 9.2% versus 7.4%

Gujarat Gas Q1 FY26 Highlights (Standalone, QoQ)

Revenue down 5.2% to Rs 3,870.89 crore versus Rs 4,102.01 crore (Estimate: Rs 4,033.4 crore).

Net Profit up 14% to Rs 326.77 crore versus Rs 287.18 crore (Estimate: Rs 362.4 crore).

Ebitda up 16% to Rs 519.87 crore versus Rs 449.51 crore (Estimate: Rs 522.2 crore).

Margin at 13.4% versus 11.0% (Estimate: 12.94%).

Britannia Industries Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 8.8% to Rs 4,622.22 crore versus Rs 4,250.29 crore (Estimate: Rs 4,610.9 crore).

Net Profit up 3% to Rs 520.72 crore versus Rs 505.64 crore (Estimate: Rs 568.95 crore).

Ebitda flat at Rs 757.05 crore versus Rs 753.66 crore (Estimate: Rs 814.5 crore).

Margin at 16.4% versus 17.7% (Estimate: 17.67%).

EIH Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 8.9% to Rs 573.58 crore versus Rs 526.54 crore

Net Profit down 63% to Rs 33.86 crore versus Rs 92.19 crore

Ebitda up 19% to Rs 159.81 crore versus Rs 134.86 crore

Margin at 27.9% versus 25.6%

Centum Electronics Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 11.4% to Rs 273.40 crore versus Rs 245.40 crore

Net Profit at Rs 4.50 crore versus loss of Rs 3.80 crore

Ebitda up 46% to Rs 22.70 crore versus Rs 15.50 crore

Margin at 8.3% versus 6.3%

Care Ratings Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 19.0% to Rs 93.90 crore versus Rs 78.92 crore

Net Profit up 11% to Rs 72 lakh versus Rs 65 lakh

Ebitda up 27% to Rs 27.72 crore versus Rs 21.82 crore

Margin at 29.5% versus 27.6%

Elantas Beck India Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 9.7% to Rs 209.93 crore versus Rs 191.39 crore

Net Profit down 6% to Rs 39.28 crore versus Rs 41.84 crore

Ebitda up 2% to Rs 39.64 crore versus Rs 38.71 crore

Margin at 18.9% versus 20.2%

EPL Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 10.0% to Rs 1,107.90 crore versus Rs 1,007.40 crore

Net Profit up 56% to Rs 100.00 crore versus Rs 64.20 crore

Ebitda up 22% to Rs 226.80 crore versus Rs 185.80 crore

Margin at 20.5% versus 18.4%

Godawari Power and Ispat Q1 FY26 Highlights (Consolidated, YoY)

Revenue down 1.4% to Rs 1,323.25 crore versus Rs 1,342.48 crore

Net Profit down 25% to Rs 215.96 crore versus Rs 286.51 crore

Ebitda down 20% to Rs 324.37 crore versus Rs 407.63 crore

Margin at 24.5% versus 30.4%

Bharti Hexacom Q1 FY26 Highlights (Consolidated, QoQ)

Revenue down 1.1% to Rs 2,263.00 crore versus Rs 2,289.00 crore

Net Profit down 16% to Rs 391.60 crore versus Rs 468.40 crore

Ebitda down 1% to Rs 1,161.00 crore versus Rs 1,168.00 crore

Margin at 51.3% versus 51.0%

Torrent Power Q1 FY26 Highlights (Consolidated, YoY)

Revenue down 12.5% to Rs 7,906.37 crore versus Rs 9,033.73 crore

Net Profit down 25% to Rs 731.44 crore versus Rs 972.24 crore

Ebitda down 20% to Rs 1,483.06 crore versus Rs 1,857.93 crore

Margin at 18.8% versus 20.6%

NCC Q1 FY26 Highlights (Consolidated, YoY)

Revenue down 6.3% to Rs 5,178.99 crore versus Rs 5,527.98 crore

Net Profit down 8% to Rs 192.14 crore versus Rs 209.92 crore

Ebitda down 5% to Rs 456.12 crore versus Rs 477.91 crore

Margin at 8.8% versus 8.6%

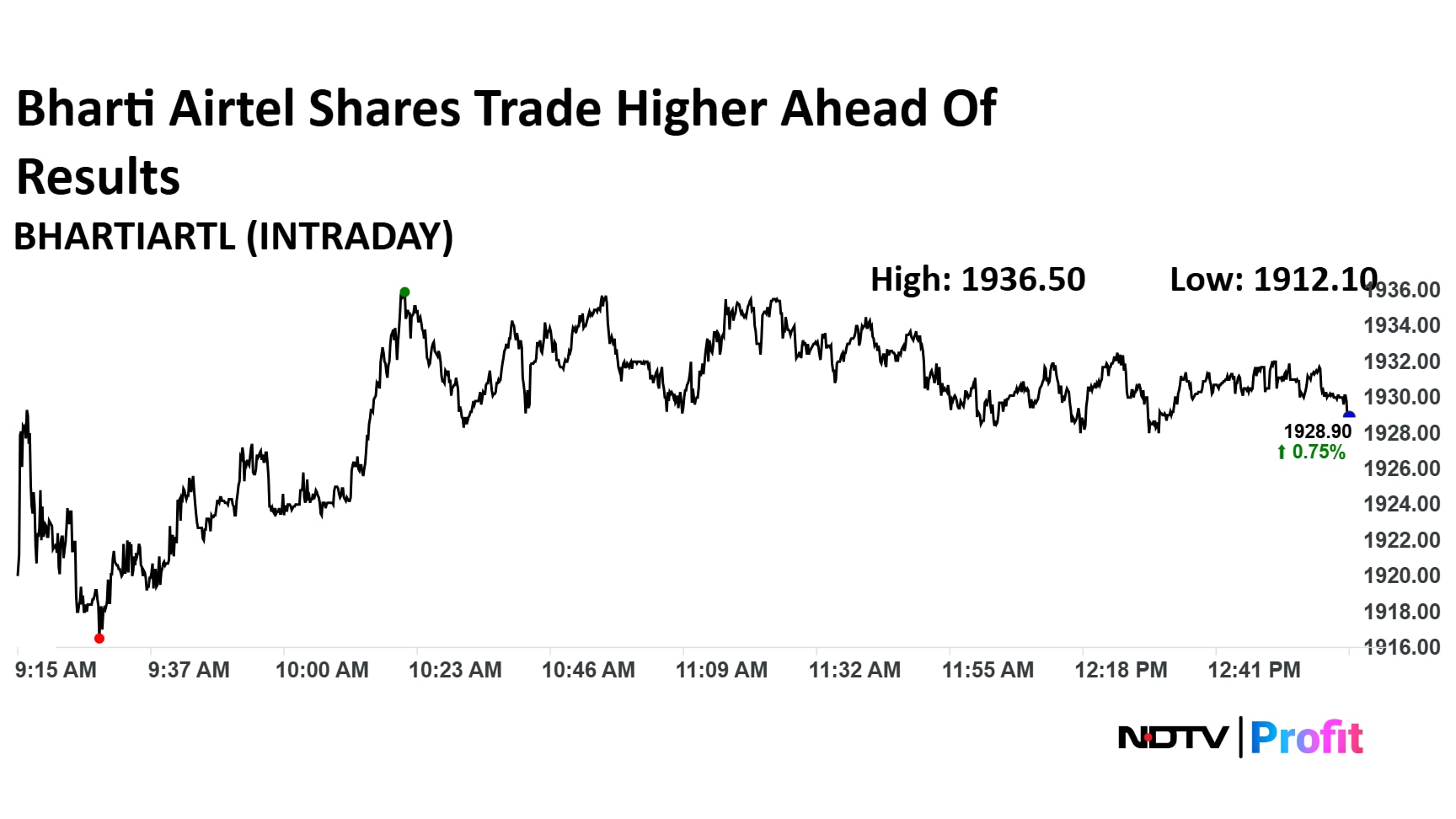

Bharti Airtel Q1 FY26 Highlights (Consolidated, QoQ)

Revenue up 3.3% to Rs 49,462.00 crore versus Rs 47,876.00 crore (Estimate: Rs 49,761.8 crore).

Net Profit down 52% to Rs 5,947.90 crore versus Rs 12,475.80 crore (Estimate: Rs 5,660.4 crore).

Ebitda up 3% to Rs 27,838.10 crore versus Rs 27,008.60 crore (Estimate: Rs 27,980 crore).

Margin at 56.3% versus 56.4% (Estimate: 56.23%).

Raymond Realty Q1 FY26 Highlights (Consolidated, YoY)

Revenue at Rs 374.35 crore versus Rs 129.68 crore

Net Profit at Rs 16.50 crore versus Rs 7.44 crore

Ebitda up 35% to Rs 23.68 crore versus Rs 17.52 crore

Margin at 6.3% versus 13.5%

Berger Paints Q1 FY26 Highlights (Consolidated, YoY)

Net profit down 11% at Rs 315 crore versus Rs 354 crore.

Revenue up 3.6% at Rs 3,201 crore versus Rs 3,091 crore.

Ebitda up 1.1% at Rs 528 crore versus Rs 522 crore.

Margin at 16.5% versus 16.9%.

Gland Pharma Q1 Highlights (Consolidated, YoY)

Revenue up 7.4% to Rs 1,505.60 crore versus Rs 1,401.70 crore (Estimate: Rs 1,530.50 crore).

Net Profit up 50% to Rs 215.40 crore versus Rs 143.70 crore (Estimate: Rs 215.50 crore).

Ebitda up 39% to Rs 367.60 crore versus Rs 264.30 crore (Estimate: Rs 368.00 crore).

Margin at 24.4% versus 18.9% (Estimate: 24.04%).

Gokaldas Exports Q1 Highlights (Consolidated, YoY)

Revenue up 2.5% to Rs 955.78 crore versus Rs 932.13 crore

Net Profit up 53% to Rs 41.47 crore versus Rs 27.17 crore

Ebitda up 30% to Rs 97.29 crore versus Rs 74.96 crore

Margin at 10.2% versus 8.0%

Jindal Saw Q1 Highlights (Consolidated, YoY)

Revenue down 17.3% to Rs 4,084.68 crore versus Rs 4,939.08 crore

Net Profit down 4% to Rs 424.04 crore versus Rs 441.06 crore

Ebitda down 20% to Rs 670.11 crore versus Rs 839.56 crore

Margin at 16.4% versus 17.0%

Tega Industries Q1 Highlights (Cons, YoY)

Revenue up 4.7% to Rs 356 crore versus Rs 340 crore.

Ebitda down 13.6% to Rs 55.4 crore versus Rs 64.1 crore.

Margin down to 15.6% versus 18.9%.

Net profit down 3.8% to Rs 35.3 crore versus Rs 36.7 crore.

Keystone Realtors Q1 Highlights (Cons, YoY)

Revenue down 35.3% to Rs 273 crore versus Rs 422 crore.

Ebitda down 68.2% to Rs 13.7 crore versus Rs 43.2 crore.

Margin down to 5% versus 10.2%.

Net profit down 43.8% to Rs 14.5 crore versus Rs 25.8 crore

Castrol India Earnings Key Highlights (QoQ)

Net Profit rose 4.5% to Rs 244 crore versus Rs 233 crore

Revenue rose 5.3% to Rs 1,497 crore versus Rs 1,422 crore

Ebitda rose 0.7% to Rs 350 crore versus Rs 347 crore

Margin at 23.4% versus 24.4%

The company will pay interim dividend of Rs 3.5 per share

Mtar Tech Earnings Key Highlights (Consolidated, YoY)

Net Profit surged 136.4% to Rs 10.8 crore versus Rs 4.4 crore

Revenue rose 22% to Rs 156.5 crore versus Rs 128 crore

Ebitda rose 71.5% to Rs 28.3 crore versus Rs 16.5 crore

Margin rose 520 basis points to 18.1% versus 12.9%

Eveready Industries Q1 Highlights (Cons, YoY)

Revenue up 7% to Rs 374 crore versus Rs 349 crore.

Ebitda up 7.9% to Rs 53.7 crore versus Rs 49.8 crore.

Margin up to 14.3% versus 14.2%.

Net profit up 3% to Rs 30.2 crore versus Rs 29.4 crore.

Financial year 2026 guidance maintained

Domestic ports revenue increased by 14% year-on-year to Rs 6,137 crore

International ports revenue increased 22% year-on-year to Rs 973 crore

Net debt/ Ebitda stood at 1.8x below ceiling level of 2.5x

Revenue expected to rise 16-22% to Rs 36,000-38,000 crore

Ebitda expected to rise 10%-16% to Rs 21,000-22,000 crore

Capex expected to be Rs 11,000-12,000 crore

Net debt/Ebitda to be maintained up to 2.5x

Gujarat Fluorochemicals Q1 Highlights (Cons, YoY)

Revenue up 8.9% to Rs 1,281 crore versus Rs 1,176 crore.

Ebitda up 31.3% to Rs 344 crore versus Rs 262 crore.

Margin up to 26.9% versus 22.3%.

Net profit up 70.4% to Rs 184 crore versus Rs 108 crore.

BLS International Q1 Highlights (Cons, YoY)

Revenue up 44.2% to Rs 711 crore versus Rs 493 crore

Ebitda up 53.4% to Rs 204 crore versus Rs 133 crore

Margin at 28.7% versus 27%

Net Profit up 49.8% to Rs 171 crore versus Rs 114 crore

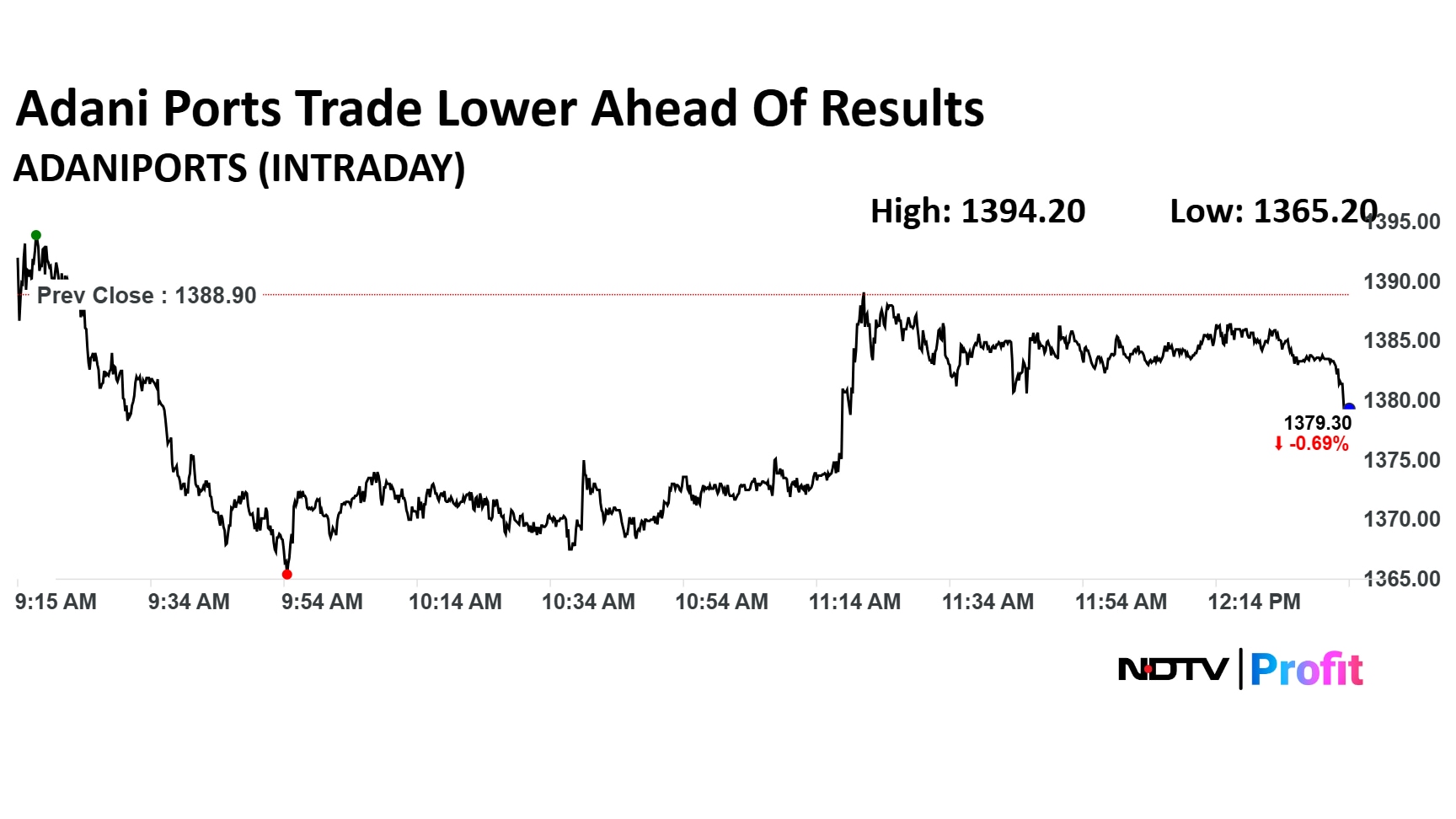

Adani Ports Q1 Highlights (Cons, YoY)

Revenue up 31.2% to Rs 9,126 crore versus Rs 6,956 crore

Ebitda up 29.5% to Rs 5,495 crore versus Rs 4,244 crore

Net Profit up 6.5% to Rs 3,315 crore versus Rs 3,113 crore

Electronics Mart Q1 Highlights (Cons, YoY)

Revenue down 9.7% to Rs 1,739 crore versus Rs 1,927 crores

Margin at 6.3% versus 8.3%

Ebitda down 31% at Rs 110 crore versus Rs 160 crore

Net Profit down 71.9% to Rs 21.6 crore versus Rs 77 crore

Exide Industries Q1 Highlights (Standalone, YoY)

Revenue up 4.6% at Rs 4,509 crore versus Rs 4,312 crore

Ebitda up 11% to Rs 547 crore versus Rs 493 crore

Margin at 12.1% versus 11.4%

Net profit up 14.7% to Rs 320 crore versus Rs 279 crore

Alembic Pharma Q1 Highlights (Cons, YoY)

Revenue up 9.5% to Rs 1,711 crore versus Rs 1,562 crore

Ebitda up 18.8% at Rs 281 crore versus Rs 237 crore

Margin at 16.4% against 15.2%

Net Profit up 14.6% to Rs 154 crore versus Rs 135 crore

The shares of Bharti Airtel was trading in the green as the telecom giant is set to post results today. The 0.80% gains compare to a 0.39% decline in the benchmark index Nifty 50.

The shares of Bharti Airtel was trading in the green as the telecom giant is set to post results today. The 0.80% gains compare to a 0.39% decline in the benchmark index Nifty 50.

The shares of Adani Ports were trading marginally lower ahead of the company posting first quarter results.

The shares of Adani Ports were trading marginally lower ahead of the company posting first quarter results.

Gujarat Gas is likely to report a net profit of Rs 362.40 crore and total revenue of Rs 4,033.40 crore for the first quarter, according to estimates. Its Ebitda is seen at Rs 522.20 crore, and margins are likely to be at 12.95%.

Britannia Industries is likely to report a net profit of Rs 568.95 crore and total revenue of Rs 4,610.90 crore for the first quarter, according to estimates. Its Ebitda is seen at Rs 814.50 crore, and margin is expected at 17.66%.

Anup Engineering Q1 Highlights (Cons, YoY)

Revenue up 20% to Rs 175 crore versus Rs 146 crore.

Ebitda up 22.2% to Rs 40.4 crore versus Rs 33 crore.

Margin up to 23% versus 22.6%.

Net profit up 9.3% to Rs 26.3 crore versus Rs 24 crore.

FMCG major Britannia Industries Ltd. is set to announce its financial results for the quarter ending June 2025 on Tuesday. Here's what analysts see in store for the quarter under review.

Britannia's growth in terms of revenue appears healthy to most analysts tracking the company. They predict higher pricing and volume growth to support the rise in topline. Earnings before tax, interest, depreciation and amortisation might also see a marginal increase but can be muted because of elevated raw material costs.

Read the full story below for analyst insights:

Bharti Airtel Ltd. is set to announce its financial results for the April-June quarter today. Brokerages expect ARPUs to improve marginally for the company.

The country's second largest telecom firm is likely to report a quarterly revenue of Rs 49,761.80 crore, according to consensus estimates of analysts tracked by Bloomberg. The margin is expected to come in at 56.2%.

Read the full story below for analyst insights:

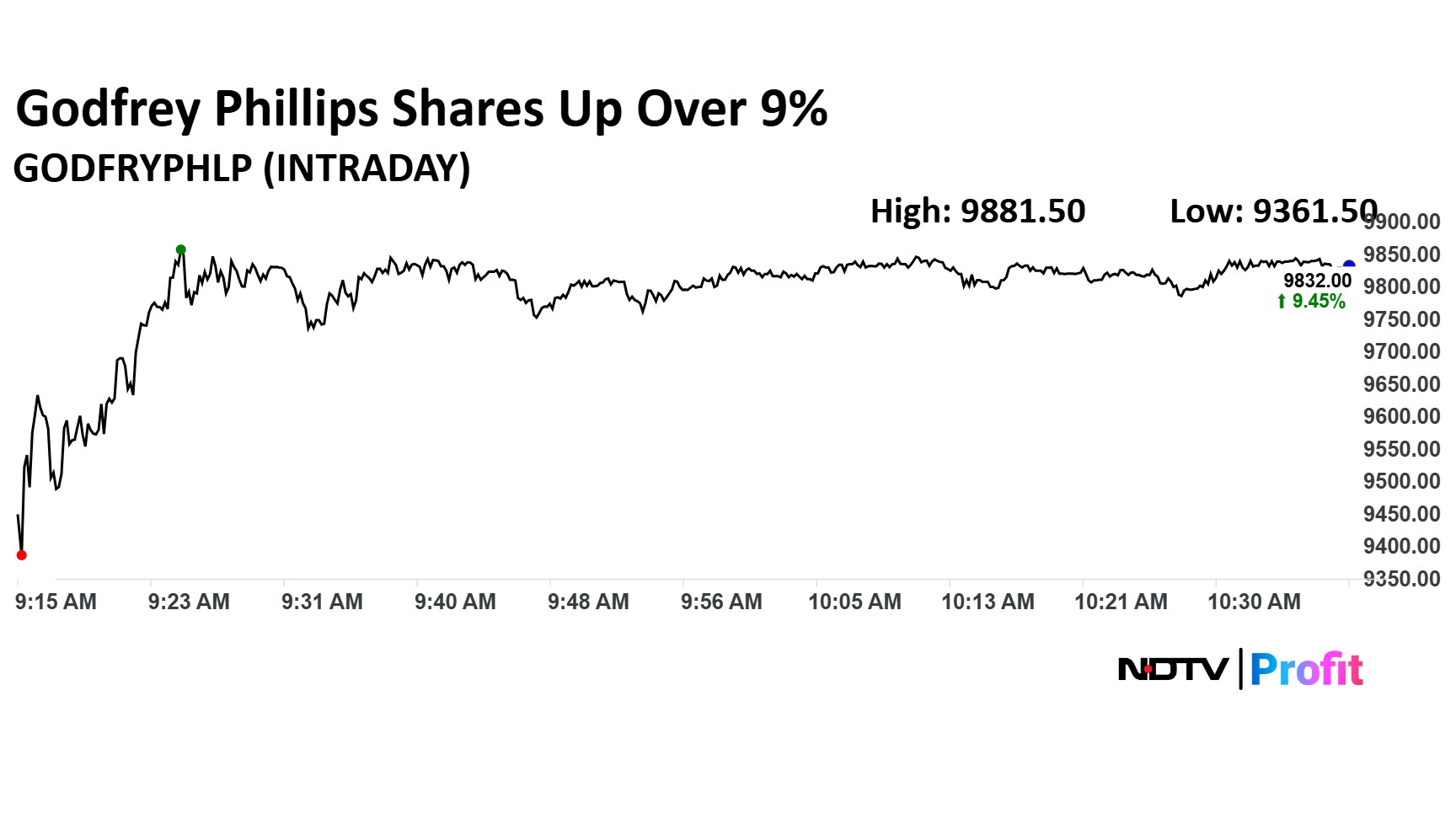

Godfrey Phillips shares rise 10% in trade so far after the company posted a revenue growth of 36% on Monday.

Godfrey Phillips shares rise 10% in trade so far after the company posted a revenue growth of 36% on Monday.

Bharti Airtel will also be reporting its results for the quarter on Tuesday. The company is likely to report a bottomline of Rs 155.80 crore and topline of Rs 1,737.00 crore for the first quarter, according to estimates. Its Ebitda is seen at Rs 274.00 crore, and margin is expected at 15.77%.

Adani Ports is likely to post net profit of Rs 2,929.90 crore and revenue of Rs 8,455 crore for the quarter ended June, according to a survey of analysts' estimates done by Bloomberg. Its earnings before interest, taxes, depreciation and amortisation is seen at Rs 5,012.60 crore, and margin is expected at 59.29%.

KPI Green Q1 Highlights (Cons, YoY)

Revenue up 73.3% to Rs 603 crore versus Rs 348 crore.

Ebitda up 58.3% to Rs 178 crore versus Rs 112 crore.

Margin down to 29.5% versus 32.3%.

Net profit up 68.4% to Rs 111 crore versus Rs 66.1 crore.

Approves raising up to Rs 700 crore via green bonds.

Hello and welcome to NDTV Profit's exclusive live coverage of the first-quarter earnings season. The financial landscape is buzzing today, as various players are set to announce their performance for the June quarter. The results will cover their financial performance for the April to June quarter.

Adani Ports and Special Economic Zone Ltd., Bharti Airtel Ltd. and Britannia Industries Ltd. are among the top names that will announce their earnings for the first quarter on Tuesday.

This is your front-row seat to the earnings action, so stay with us for real-time updates, analysis of the numbers, and all the key details that companies will be putting out through the day!

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.