Hello and welcome to our live coverage of Indian stock markets, where we track the day's trade after a US-India deal cut US reciprocal tariffs on Indian imports and early indicators pointed to a higher open. Indian equity benchmarks surges on Tuesday.

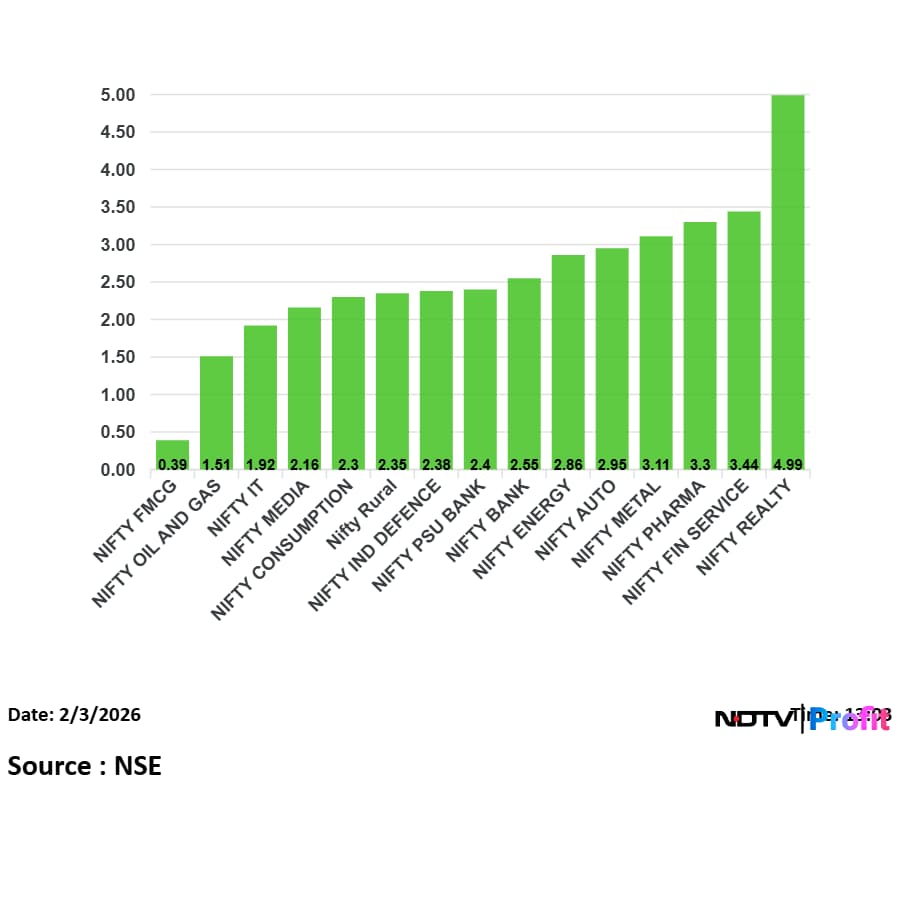

The Nifty 50 rose as much as 5% intraday. Markets are tracking the trade deal between India and the United States that lowers reciprocal tariffs on Indian imports to 18% from 25%. The change takes effect immediately. India had earlier faced total tariffs of 50%, including a 25% penalty linked to buying Russian oil. The US Embassy confirmed the overall tariff rate is now 18%

Track minute-by-minute updates on stock market coverage here.

And that's a wrap from us.

The Indian rupee strengthened further during the trade against the US dollar. The local currency appreciated as much as 1.46% to 90.18 against the greenback.

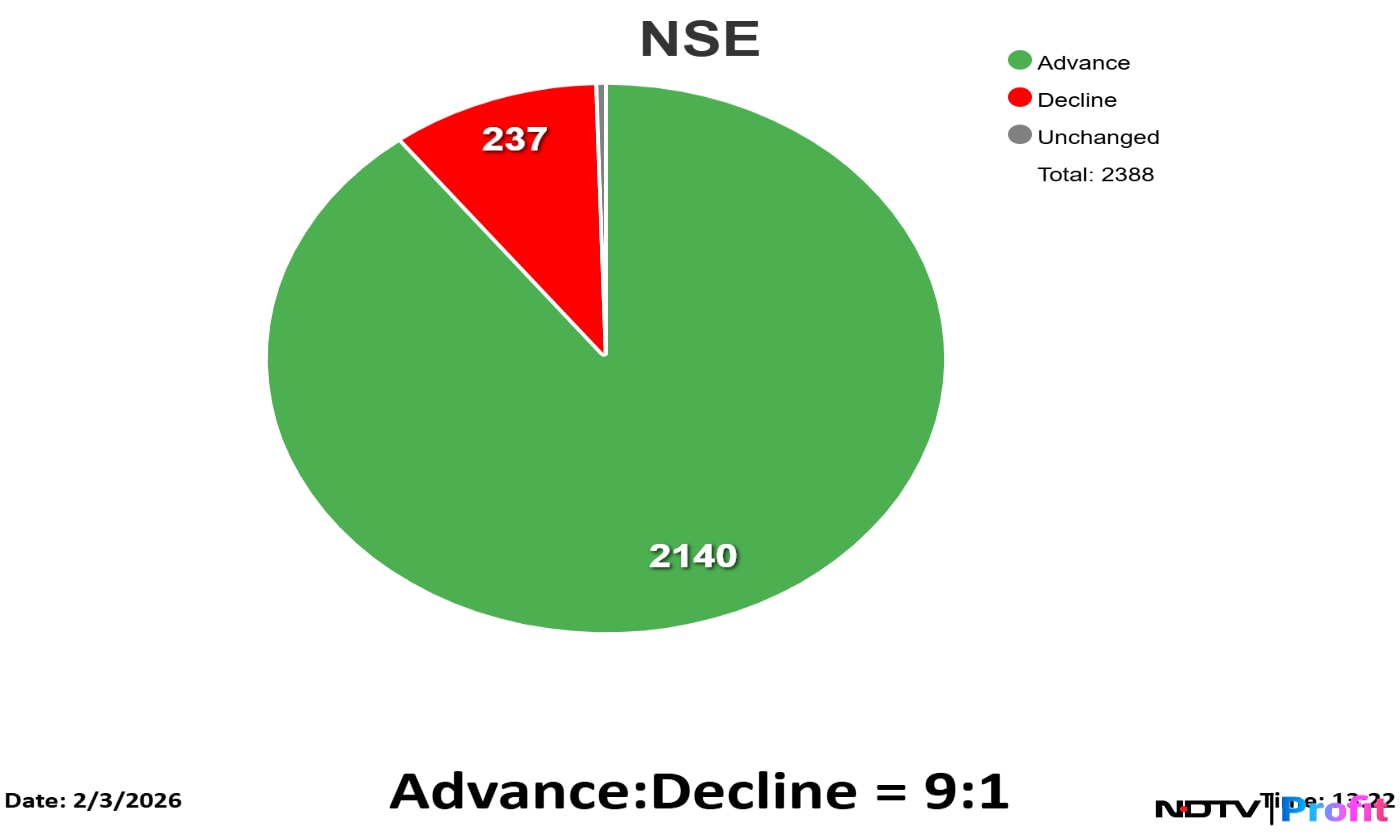

Nine out of every ten stock listed on the NSE is trading higher than its previous close, reflecting the broad based nature of Tuesday's market rally fueled by the India-US Trade deal.

Zerodha app glitched amid a sharp rally in Indian markets on Tuesday, following US President Donald Trump's announcement of a trade deal with India that cuts reciprocal tariffs on Indian imports to 18% from 25%. The issue was flagged by several Zerodha users with Redbox Global India taking to X to highlight major losses faced by several users as they couldn't complete their trades in time on the low-cost brokerage app.

Bitcoin remained under pressure on Tuesday, stalling after a brief rebound from a 10-month low as trader caution persisted in options activity. Trading was mostly flat by early afternoon in Singapore, with the original cryptocurrency hovering below $78,500 a day after bearish sentiment nearly pushed it to the lowest level since US President Donald Trump returned to the White House just over a year ago.

Source: Bloomberg

Over the past year, India–US trade negotiations moved through phases of tariff escalation, diplomatic outreach, and ultimately resolution. Beginning in early 2025, both sides launched talks to deepen trade ties even as the US imposed steep duties on Indian goods, prompting several rounds of high‑level meetings.

Read this infographic-led explainer for NDTV Profit, we break down what changed, why it matters, and how the agreement could impact markets, companies, and consumers on both sides.

Asian equities rebounded from their worst selloff in more than two months as a recovery in gold and silver helped steady markets after Monday’s volatility, while technology stocks rallied. The MSCI Asia Pacific Index rose 2.8%, marking its strongest session since April.

The gains are set to carry over into Europe and the US, with futures for the Nasdaq 100 Index rising 0.5% after AI bellwether Palantir Technologies Inc. posted a stronger-than-expected sales outlook.

Source: Bloomberg

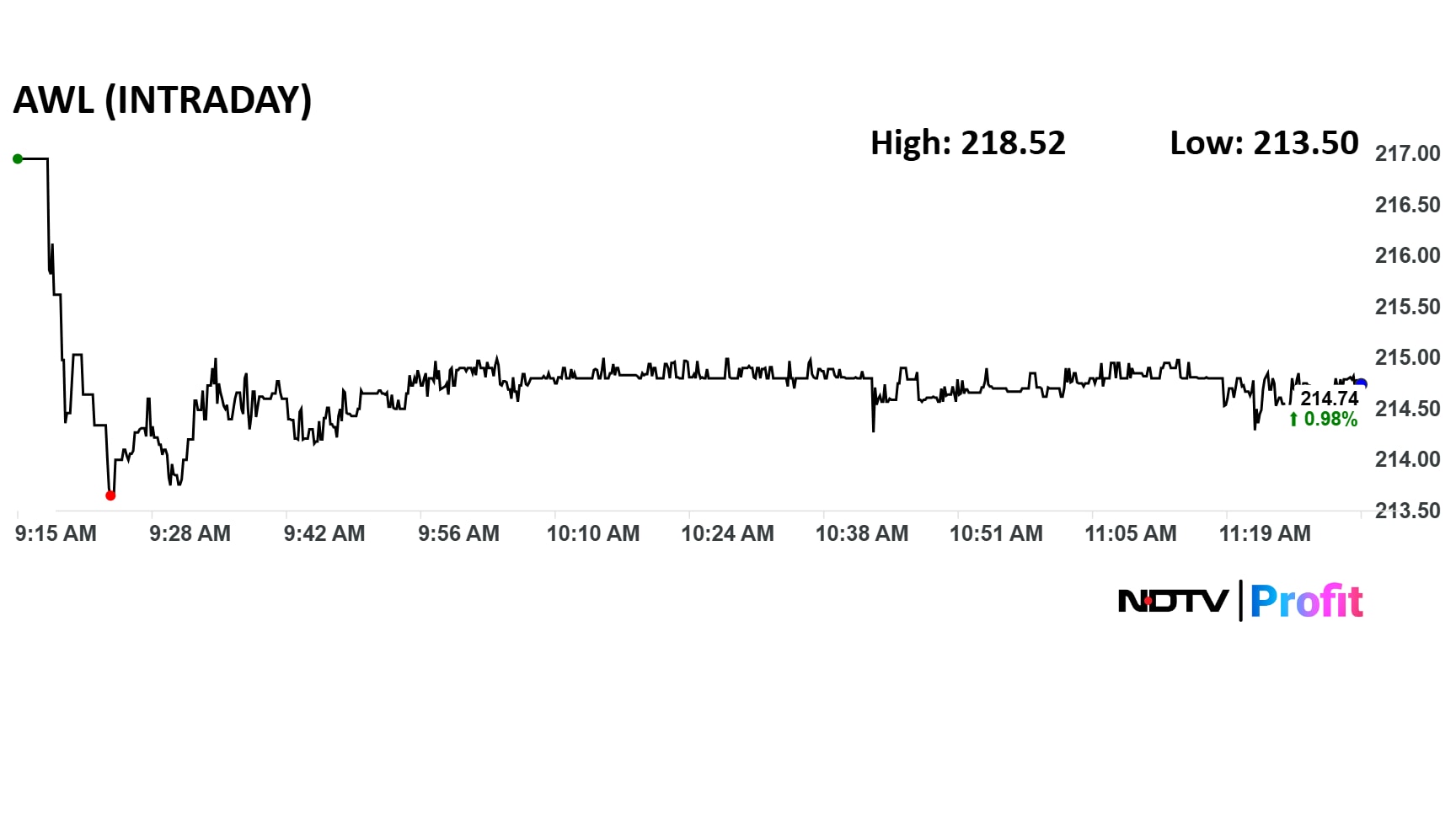

AWL Agri Business Q3 Results (Consolidated, YoY)

A market veteran said the deal has lifted sentiment after months of weak trading and portfolio losses. He said the move has prompted investors to return to the market.

Madhusudan Kela compared the moment to Diwali for markets. He said investors had missed a positive cue after a long correction and that the deal delivered a psychological boost. He said portfolios took a hit over the past 15 months and that the shift in mood could lead investors to buy when prices fall and re-enter positions.

Welspun Living

Trident

Eternal

IDFC First Bank

Source: Bloomberg

Shares of Central Depository Services Ltd. rose 9% to Rs 1,345. The stock had risen as much as 9.5% earlier in the day.

The scrip extended gains for the second consecutive trading session after announcing Q3 results during the weekend.

The textile and apparel industry has emerged as the biggest beneficiary of the US-India trade deal, with several stocks hitting upper circuits.

Shares of Gokaldas Exports jumped 20%, while Indo Count Industries, Kitex, Pearl Global, Himatsingka Seide, SP Apparels, and KPR Mill all rallied 20%, hitting their respective upper circuits. Trident also gained nearly 20% while Vardhman Textiles rose 18.06% in strong trade.

Spot gold climbed as much as 4.2% to above $4,855 an ounce. It had dropped 4.8% in the prior session after a fall on Friday that marked its biggest one-day decline in more than 10 years. Silver gained as much as 8.1% to trade above $85, after slipping 7% on Monday and logging a record intraday drop on Jan. 30.

Both metals hit fresh highs last month after a fast run-up that caught traders off guard.

With the tariff burden now lower, companies with significant exposure to the US are expected to see relief in margins, improved competitiveness, and better order visibility. Among Indian exporters, sectors such as textiles, seafood, auto ancillaries, chemicals, and select consumer companies are likely to be the key beneficiaries.

After a spell of suffering, India's trade deal with US will bring long-sought relief to the textiles and apparel sector. The sector will be the highest beneficiary for the landmark pact as US accounts for nearly 28% of India's total textile exports, making it the single largest destination for Indian textile manufacturers. Additionally, more than half of India's textile and apparel imports are linked to US cotton, highlighting the deep trade integration between the two countries.

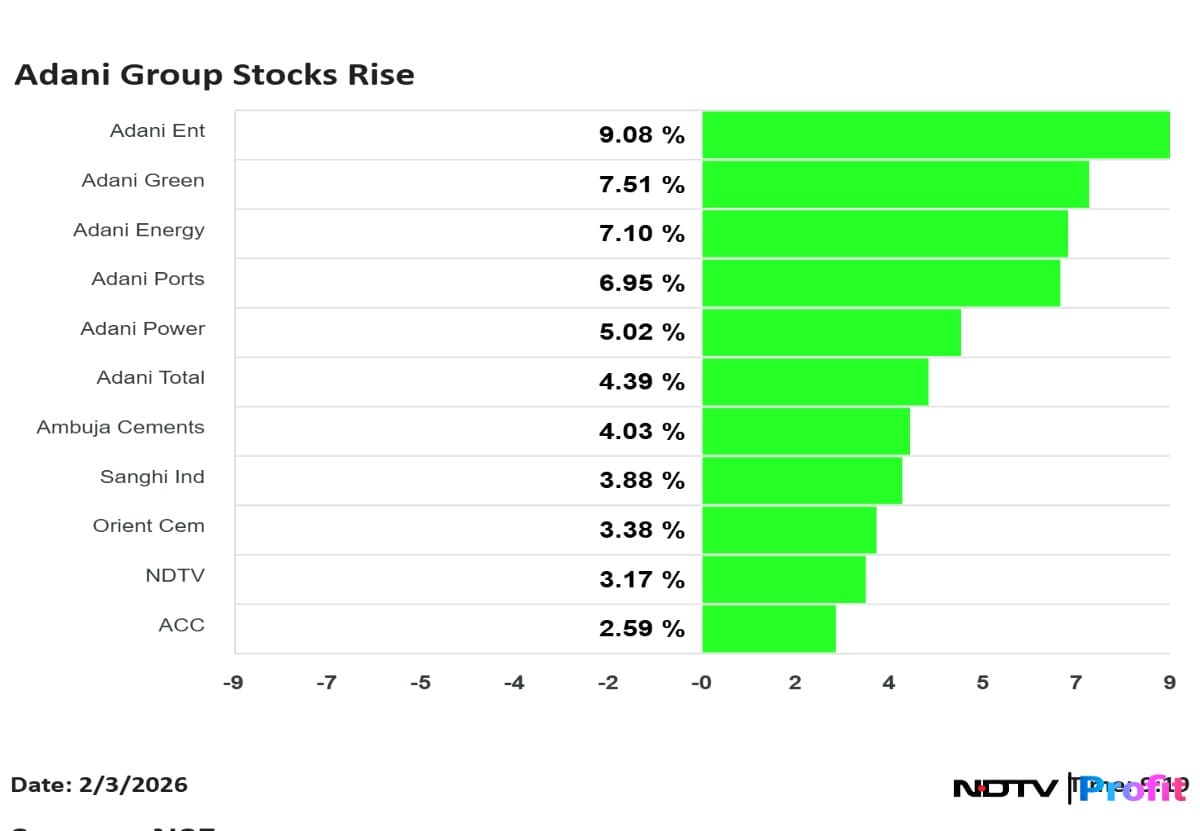

Shares of Adani Group companies rallied on Tuesday, led by Adani Enterprises' which was locked in 10% upper circuit. Shares of Adani Green Energy, Adani Energy Solutions and Adani ports and SEZ rose over 7% each.

ALSO READ: Adani Group Companies To Be A Key Beneficiary Of India-US Trade Deal, Says Jefferies

The Indian rupee strengthened on Wednesday, while the yield on the 10-year note declined after India and the United States agreed to a trade deal that cuts US reciprocal tariffs on Indian imports to 18% from 25%.

The local currency appreciated as much as 1.2% to 90.42 against the greenback. Meanwhile the yield on the 10-year note fell as much as five basis points to 5.71%

The GIFT Nifty surges over 1% or nearly 300 points to trade at 26,155.00 as of 8:46 am

Catch minute-by-minute updates on the latest developments on India-US tariff truce here.

Comprehensive Budget 2026 coverage, LIVE TV analysis, Stock Market and Industry reactions, Income Tax changes and Latest News on NDTV Profit.