Overseas investors turned net sellers of Indian equities on Wednesday.

Foreign portfolio investors offloaded stocks worth Rs 666.3 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors remained net sellers and sold equities worth Rs 862.9 crore, the NSE data showed.

India received the highest-ever foreign portfolio inflows in 2023 and surpassed emerging market peers, amid global volatility and valuation concerns.

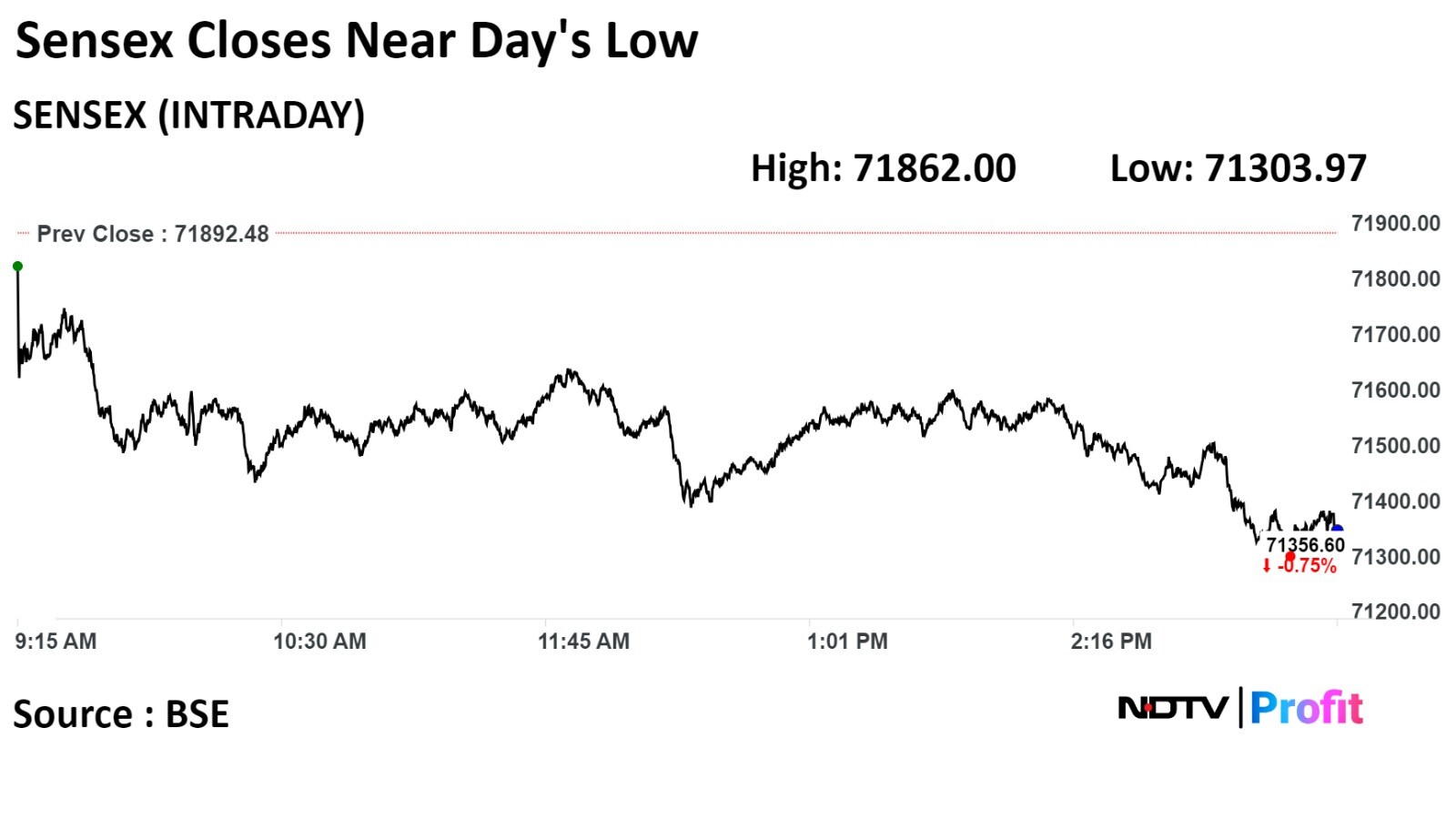

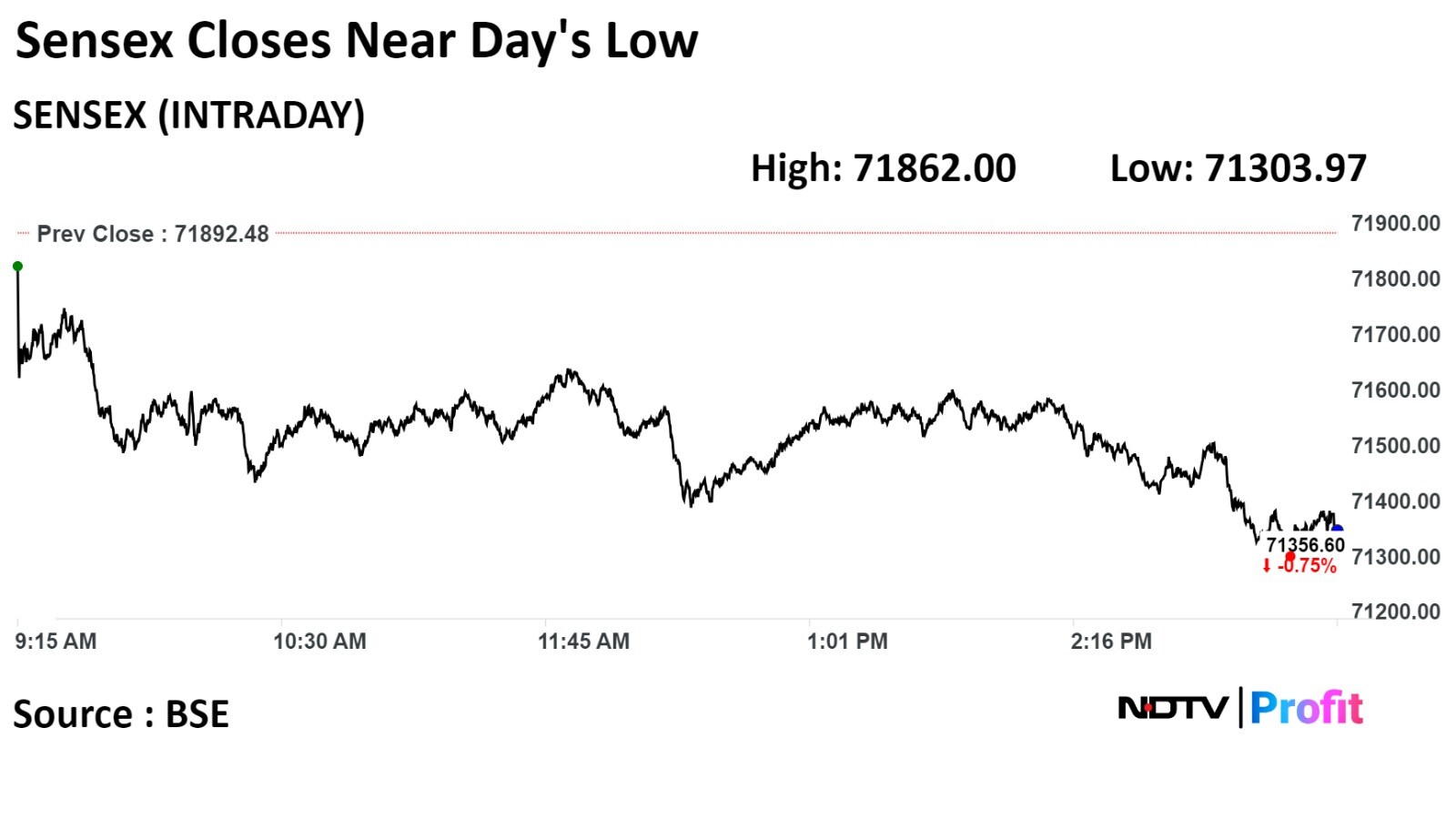

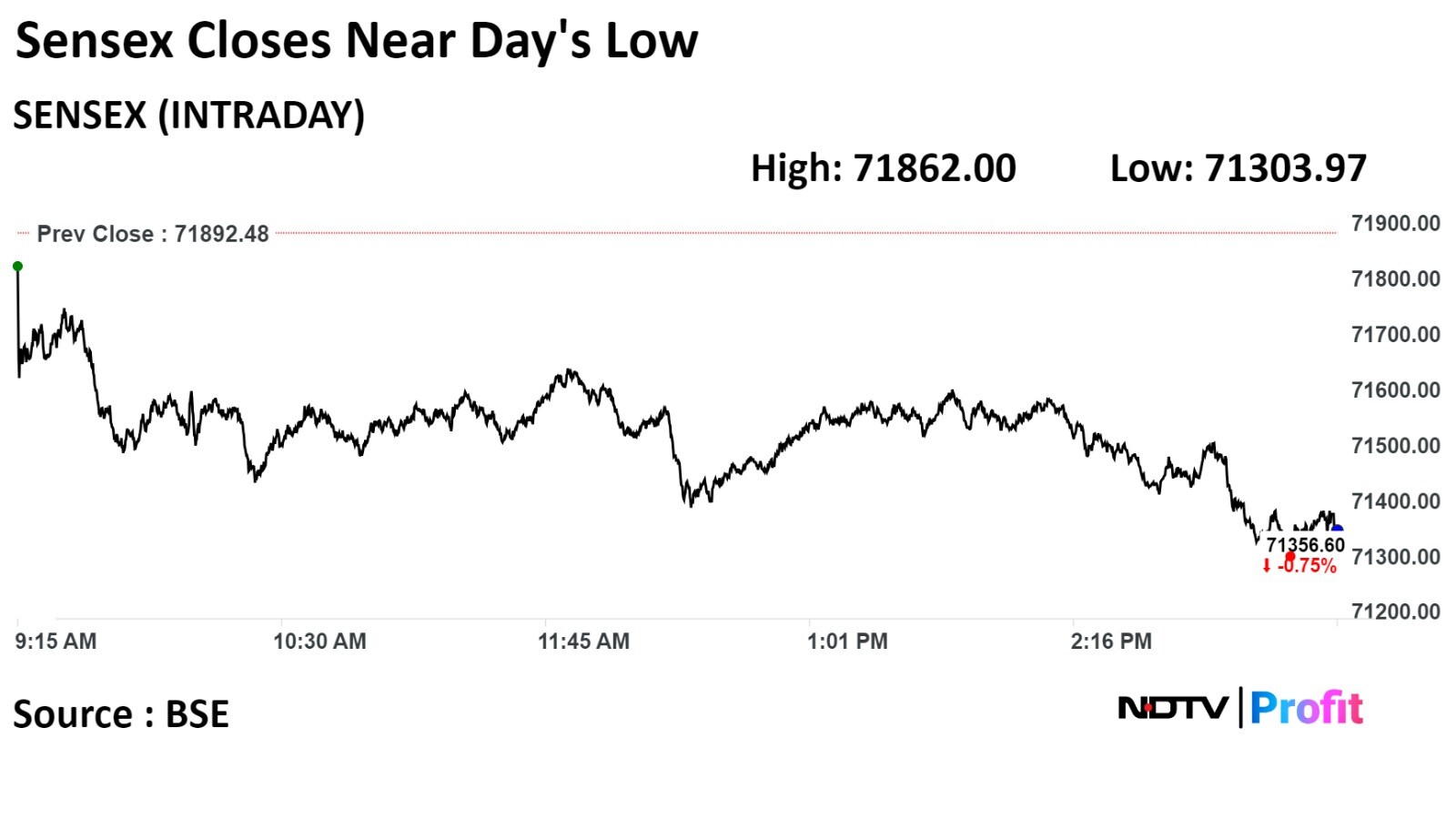

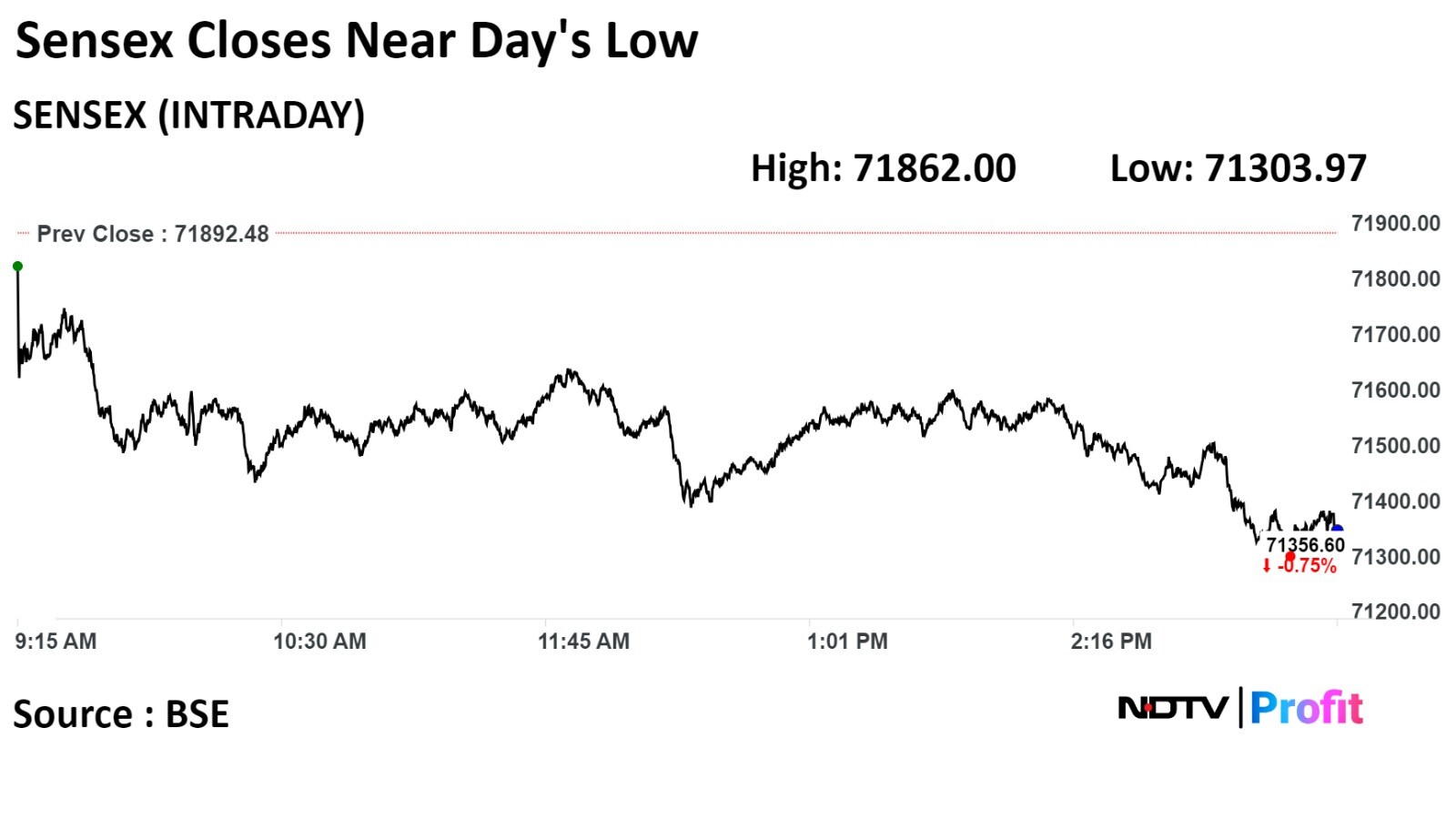

The BSE Sensex ended 0.75%, or 535.88 points, lower at 71,356.60, while the NSE Nifty 50 declined 0.69%, or 148.45 points, to close at 21,517.35.

The yield on the 10-year bond closed flat at 7.22% on Wednesday.

Source: Bloomberg

Adani Group stocks added as much as Rs 1.18 lakh crore in investor wealth, taking their total market capitalisation to Rs 15.62 lakh crore, intraday.

At 3:30, the shares added Rs 63,703 crore in market value taking the capitalisation to Rs 15.08 lakh crore.

The local currency strengthened 3 paise to close at 83.29 against the U.S dollar on Wednesday.

It closed at 83.32 on Tuesday.

Source: Bloomberg

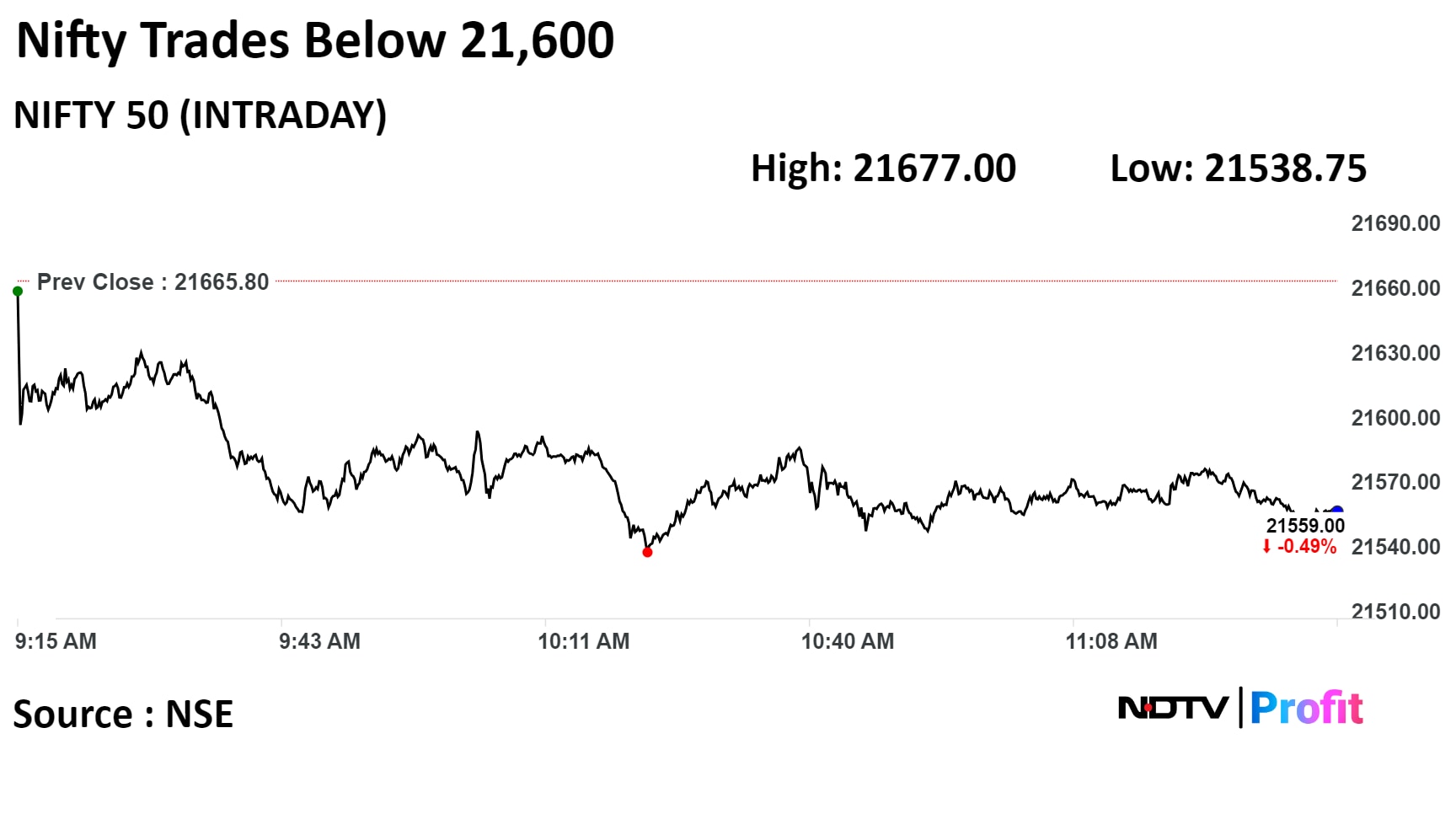

India's benchmark stock indices ended lower for a second day in a row on Wednesday as HDFC Bank Ltd, Infosys Ltd, and Reliance Industries Ltd weighed.

The BSE Sensex ended 0.75% or 535.88 points down at 71,356.60, while the NSE Nifty 50 settled 0.69% or 148.45 points down at 21,517.35.

Intraday, the benchmark S&P BSE Sensex declined 0.82% 0r 588.51 points to 71,303.97, while the NSE Nifty 50 fell 0.76% or 165.45 points to 21,500.35

India's benchmark stock indices ended lower for a second day in a row on Wednesday as HDFC Bank Ltd, Infosys Ltd, and Reliance Industries Ltd weighed.

The BSE Sensex ended 0.75% or 535.88 points down at 71,356.60, while the NSE Nifty 50 settled 0.69% or 148.45 points down at 21,517.35.

Intraday, the benchmark S&P BSE Sensex declined 0.82% 0r 588.51 points to 71,303.97, while the NSE Nifty 50 fell 0.76% or 165.45 points to 21,500.35

India's benchmark stock indices ended lower for a second day in a row on Wednesday as HDFC Bank Ltd, Infosys Ltd, and Reliance Industries Ltd weighed.

The BSE Sensex ended 0.75% or 535.88 points down at 71,356.60, while the NSE Nifty 50 settled 0.69% or 148.45 points down at 21,517.35.

Intraday, the benchmark S&P BSE Sensex declined 0.82% 0r 588.51 points to 71,303.97, while the NSE Nifty 50 fell 0.76% or 165.45 points to 21,500.35

India's benchmark stock indices ended lower for a second day in a row on Wednesday as HDFC Bank Ltd, Infosys Ltd, and Reliance Industries Ltd weighed.

The BSE Sensex ended 0.75% or 535.88 points down at 71,356.60, while the NSE Nifty 50 settled 0.69% or 148.45 points down at 21,517.35.

Intraday, the benchmark S&P BSE Sensex declined 0.82% 0r 588.51 points to 71,303.97, while the NSE Nifty 50 fell 0.76% or 165.45 points to 21,500.35

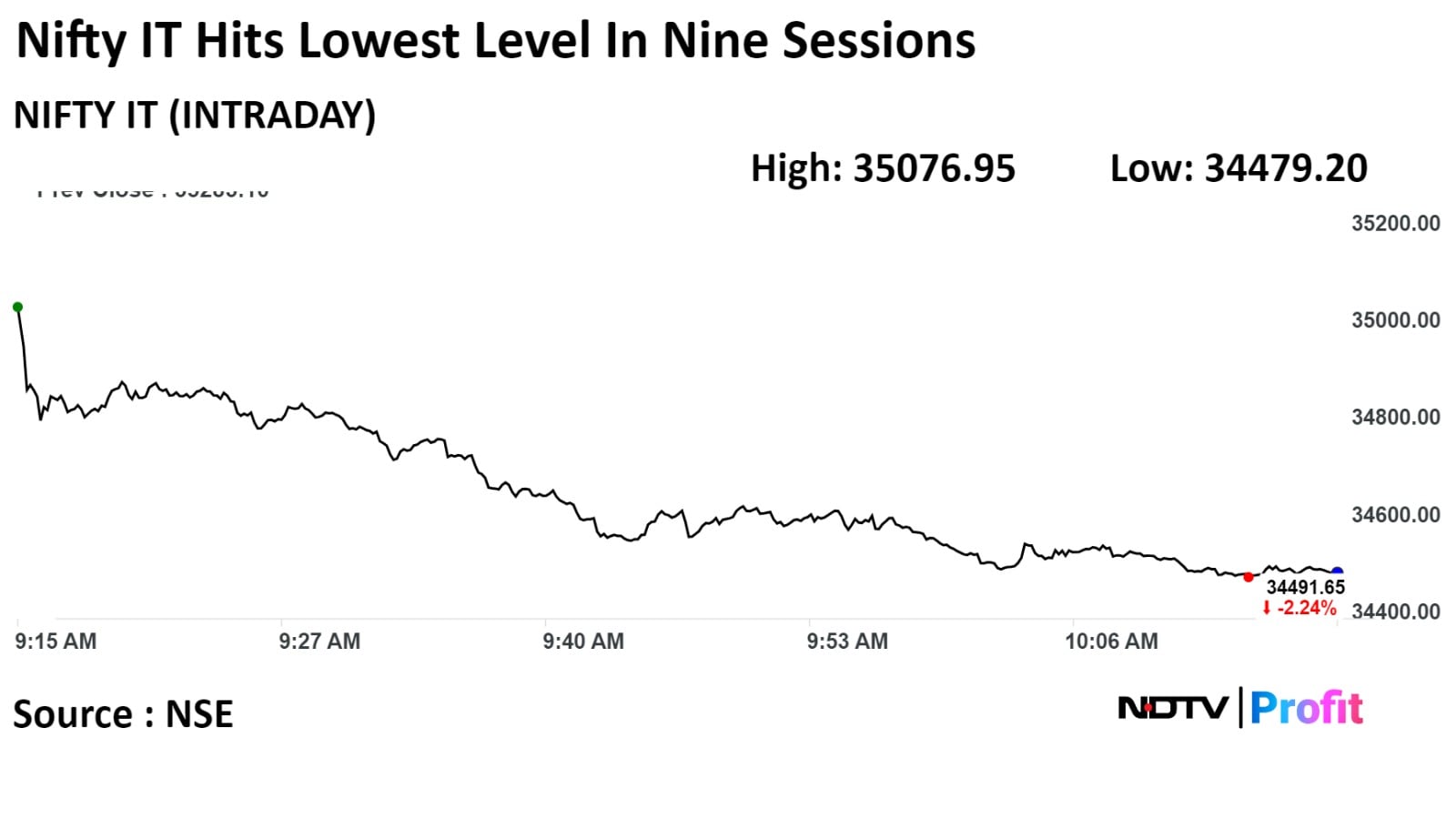

"On last Wednesday, the benchmark indices continued profit booking, the nifty ends 148 points lower while the Sensex was down by 536 points. Among Sectors, despite weak momentum Reality and PSU Banks outperformed, both indices rallied over 1 percent. Whereas IT index was the top looser, shed over 2 percent. Technically, post-muted opening the nifty/Sensex breached the important support level of 21600/71500 and post breakdown it intensified selling pressure," said Shrikant Chouhan, head, equity research at Kotak Securities

"We are of the view that, as long as the index is trading below 21600/71500 the weak sentiment is likely to continue. Below the same, market could slip till 21450-21400/71000-70900. On the flip side, technical bounce back possible only after dismissal of 21600/71500. Above 21600/71500 the market could move up till 21650- 21680/71750-71950. For traders, the current market texture is volatile hence; level based trading would be the ideal strategy for the day traders," he added

India's benchmark stock indices ended lower for a second day in a row on Wednesday as HDFC Bank Ltd, Infosys Ltd, and Reliance Industries Ltd weighed.

The BSE Sensex ended 0.75% or 535.88 points down at 71,356.60, while the NSE Nifty 50 settled 0.69% or 148.45 points down at 21,517.35.

Intraday, the benchmark S&P BSE Sensex declined 0.82% 0r 588.51 points to 71,303.97, while the NSE Nifty 50 fell 0.76% or 165.45 points to 21,500.35

India's benchmark stock indices ended lower for a second day in a row on Wednesday as HDFC Bank Ltd, Infosys Ltd, and Reliance Industries Ltd weighed.

The BSE Sensex ended 0.75% or 535.88 points down at 71,356.60, while the NSE Nifty 50 settled 0.69% or 148.45 points down at 21,517.35.

Intraday, the benchmark S&P BSE Sensex declined 0.82% 0r 588.51 points to 71,303.97, while the NSE Nifty 50 fell 0.76% or 165.45 points to 21,500.35

India's benchmark stock indices ended lower for a second day in a row on Wednesday as HDFC Bank Ltd, Infosys Ltd, and Reliance Industries Ltd weighed.

The BSE Sensex ended 0.75% or 535.88 points down at 71,356.60, while the NSE Nifty 50 settled 0.69% or 148.45 points down at 21,517.35.

Intraday, the benchmark S&P BSE Sensex declined 0.82% 0r 588.51 points to 71,303.97, while the NSE Nifty 50 fell 0.76% or 165.45 points to 21,500.35

India's benchmark stock indices ended lower for a second day in a row on Wednesday as HDFC Bank Ltd, Infosys Ltd, and Reliance Industries Ltd weighed.

The BSE Sensex ended 0.75% or 535.88 points down at 71,356.60, while the NSE Nifty 50 settled 0.69% or 148.45 points down at 21,517.35.

Intraday, the benchmark S&P BSE Sensex declined 0.82% 0r 588.51 points to 71,303.97, while the NSE Nifty 50 fell 0.76% or 165.45 points to 21,500.35

"On last Wednesday, the benchmark indices continued profit booking, the nifty ends 148 points lower while the Sensex was down by 536 points. Among Sectors, despite weak momentum Reality and PSU Banks outperformed, both indices rallied over 1 percent. Whereas IT index was the top looser, shed over 2 percent. Technically, post-muted opening the nifty/Sensex breached the important support level of 21600/71500 and post breakdown it intensified selling pressure," said Shrikant Chouhan, head, equity research at Kotak Securities

"We are of the view that, as long as the index is trading below 21600/71500 the weak sentiment is likely to continue. Below the same, market could slip till 21450-21400/71000-70900. On the flip side, technical bounce back possible only after dismissal of 21600/71500. Above 21600/71500 the market could move up till 21650- 21680/71750-71950. For traders, the current market texture is volatile hence; level based trading would be the ideal strategy for the day traders," he added

HDFC Bank Ltd, Infosys Ltd, Reliance Industries Ltd, Tata Consultancy Services Ltd, and Hindalco Industries weighed on indices.

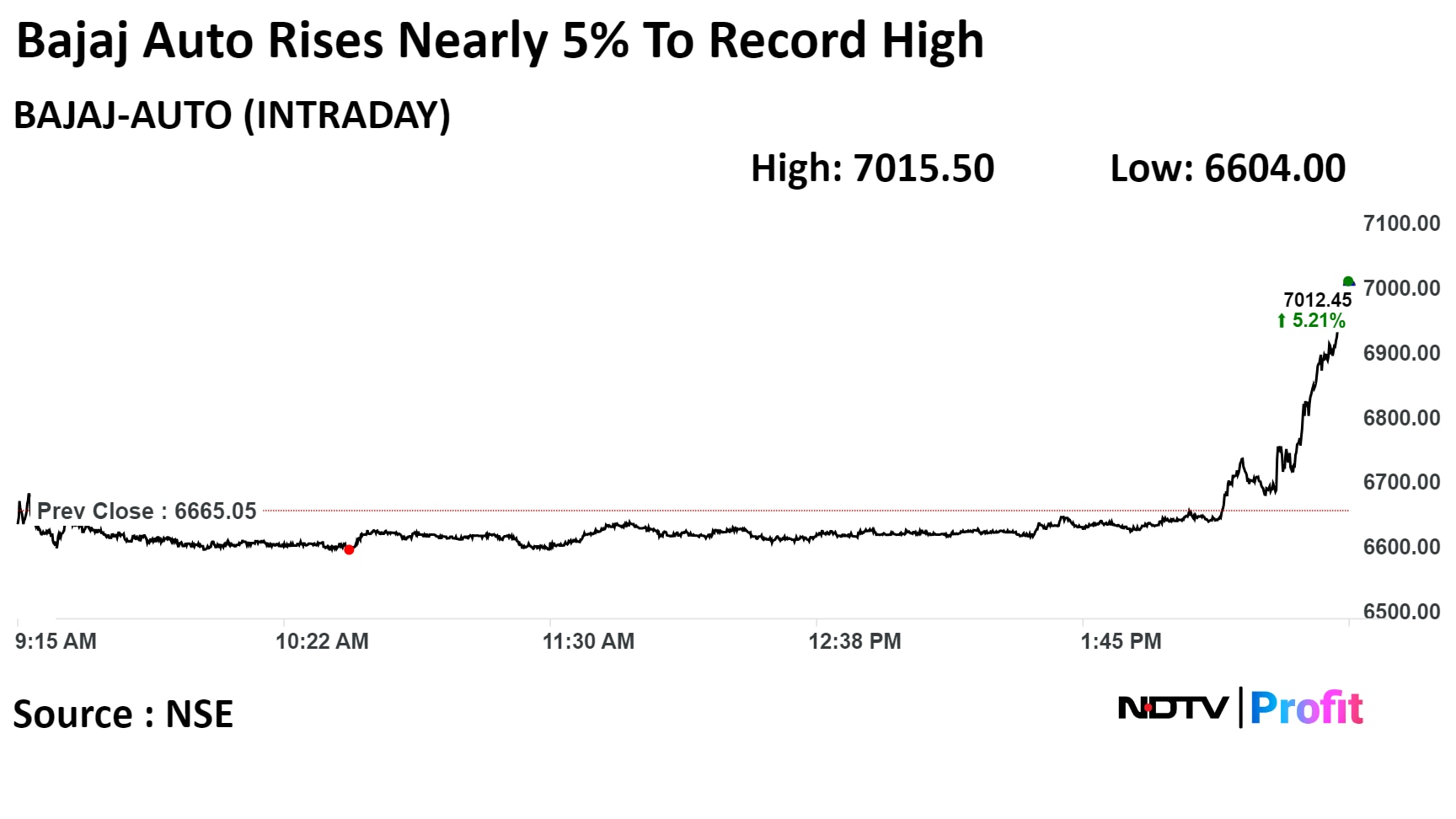

ITC Ltd, Bajaj Auto Ltd, Bharti Airtel Ltd, Adani Enterprises Ltd and IndusInd Bank added positively to the indices.

The broader markets outperformed benchmark indices. The S&P BSE Smallcap Index rose 0.30%, whereas S&P BSE MidCap Index was 0.20% higher. Around six out of 20 sectors compiled by BSE declined, while 14 sectors advanced. S&P BSE Metal and IT sectors declined the most among sectoral indices.

Sectoral indices ended on a mixed note on NSE. Around five sectoral indices declined with the Nifty IT emerging as the top loser, while six sectors advanced, and one remained little unchanged out of 12 sectors.

The market breadth was skewed in favour of the buyers. About 2201 stocks advanced, 1635 stocks declined, and 109 remained unchanged on the BSE.

ITC Ltd had 52.6 lakh shares changed hands in a large trade

The company's 0.04% equity changed hands at Rs 477.95 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Scrips of Bajaj Auto Ltd surged nearly 5% on Wednesday as it may take buyback of shares into consideration on Jan 8, according to exchange filing.

Scrips of Bajaj Auto Ltd surged nearly 5% on Wednesday as it may take buyback of shares into consideration on Jan 8, according to exchange filing.

Bajaj Auto Ltd is to consider buyback of shares on Jan 8

Source: Exchange Filing

PTC Industries approved issuing 2.35 lakh preferential shares worth Rs Rs 141.24 crore

Issue price for shares set at Rs 6,000 apiece

Source: Exchange filing

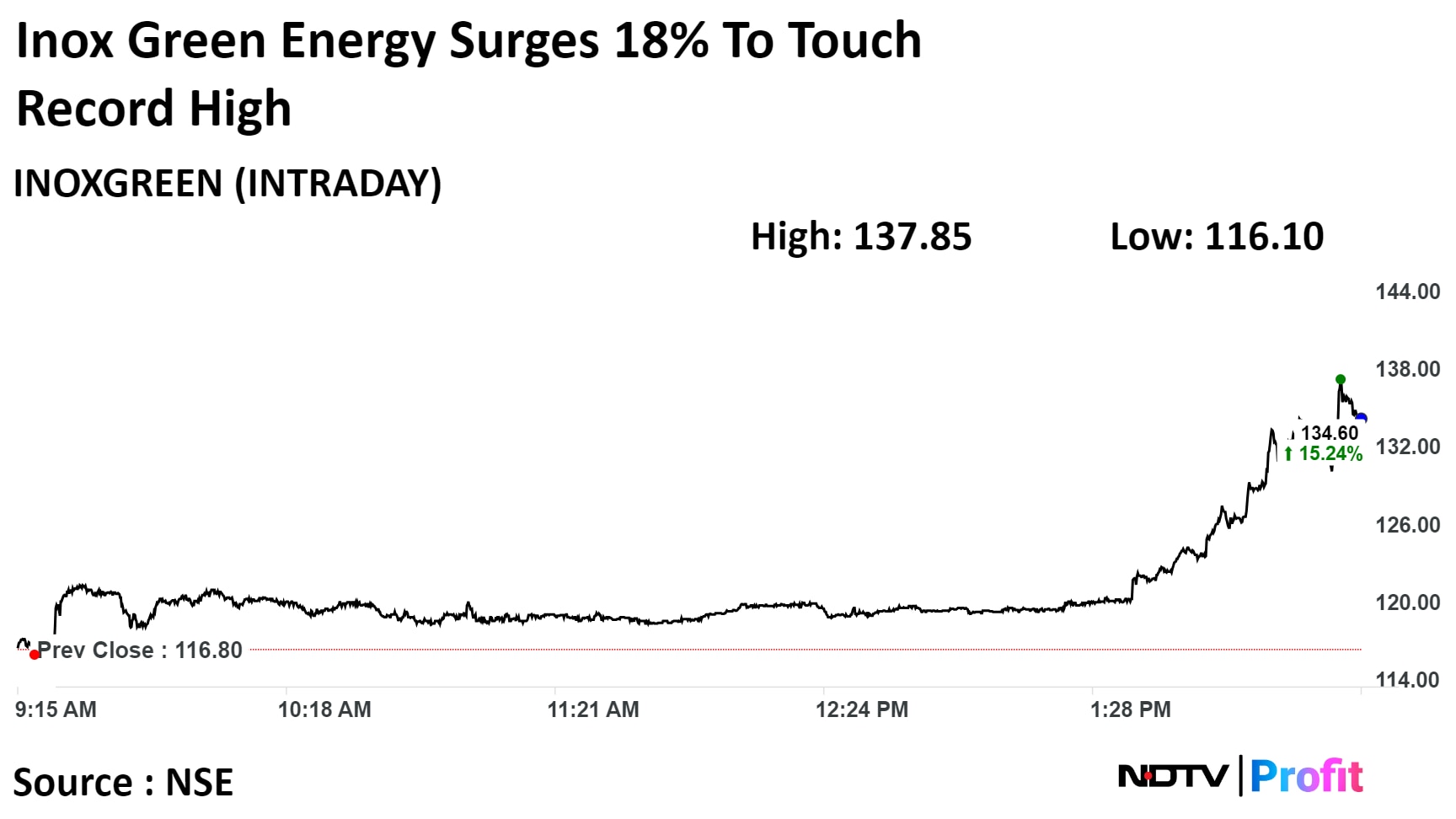

Inox Green Energy Services Ltd surged 18.02% to Rs 137.85, the highest level since it was listed on the exchanges on Nov 23, 2022. The scrip was trading 15.33% higher at Rs 134.70 as of 02:36 p.m. This compares to 0.58% decline on NSE Nifty 50 index.

It has risen 188.54% on a year-to-date basis. Total traded volume so far in the day stood at 1.7 times its 30-day average. The relative strength index was at 80.61, which implied the stock is overbought.

Inox Green Energy Services Ltd surged 18.02% to Rs 137.85, the highest level since it was listed on the exchanges on Nov 23, 2022. The scrip was trading 15.33% higher at Rs 134.70 as of 02:36 p.m. This compares to 0.58% decline on NSE Nifty 50 index.

It has risen 188.54% on a year-to-date basis. Total traded volume so far in the day stood at 1.7 times its 30-day average. The relative strength index was at 80.61, which implied the stock is overbought.

Grasim Industries' paper-manufacturing join venture in Canada stops pulp operations due to prevailing market conditions

Source: Exchange filing

Adani Total Gas Ltd signed a MoU with Shigan Quantum Technologies for collaboration in decarbonisation

MoU to explore retrofitting ICE engines to run on alternate fuels like CNG and LNG

Partners to also explore other applications like stationary engines, locomotives & marine equipment

Source: Exchange filing

Most markets in Europe were trading higher on Wednesday as investors await the unemployment data from Germany, Spain, and minutes of the U.S. Federal Reserve's December policy meeting later today.

Most markets in Europe were trading higher on Wednesday as investors await the unemployment data from Germany, Spain, and minutes of the U.S. Federal Reserve's December policy meeting later today.

Delhi High Court, Jan 3: Directed 3 Vivo-India executives, who were given bail in December for money laundering, not to leave the country.

Executives must submit an undertaking regarding the directive.

REC signs MoU with RVNL to finance up to `35,000 cr for infra projects over the next 5 years

Projects to include multi-modal logistics hubs rail infra projects, road, port, & metro projects

Source: Twitter

Samvardhana Motherson International Ltd had 63.5 lakh shares changed hands in a large trade

The company's 0.1% equity changed hands at Rs 61.35 apiece

Buyers and sellers not known immediately

Source: Bloomberg

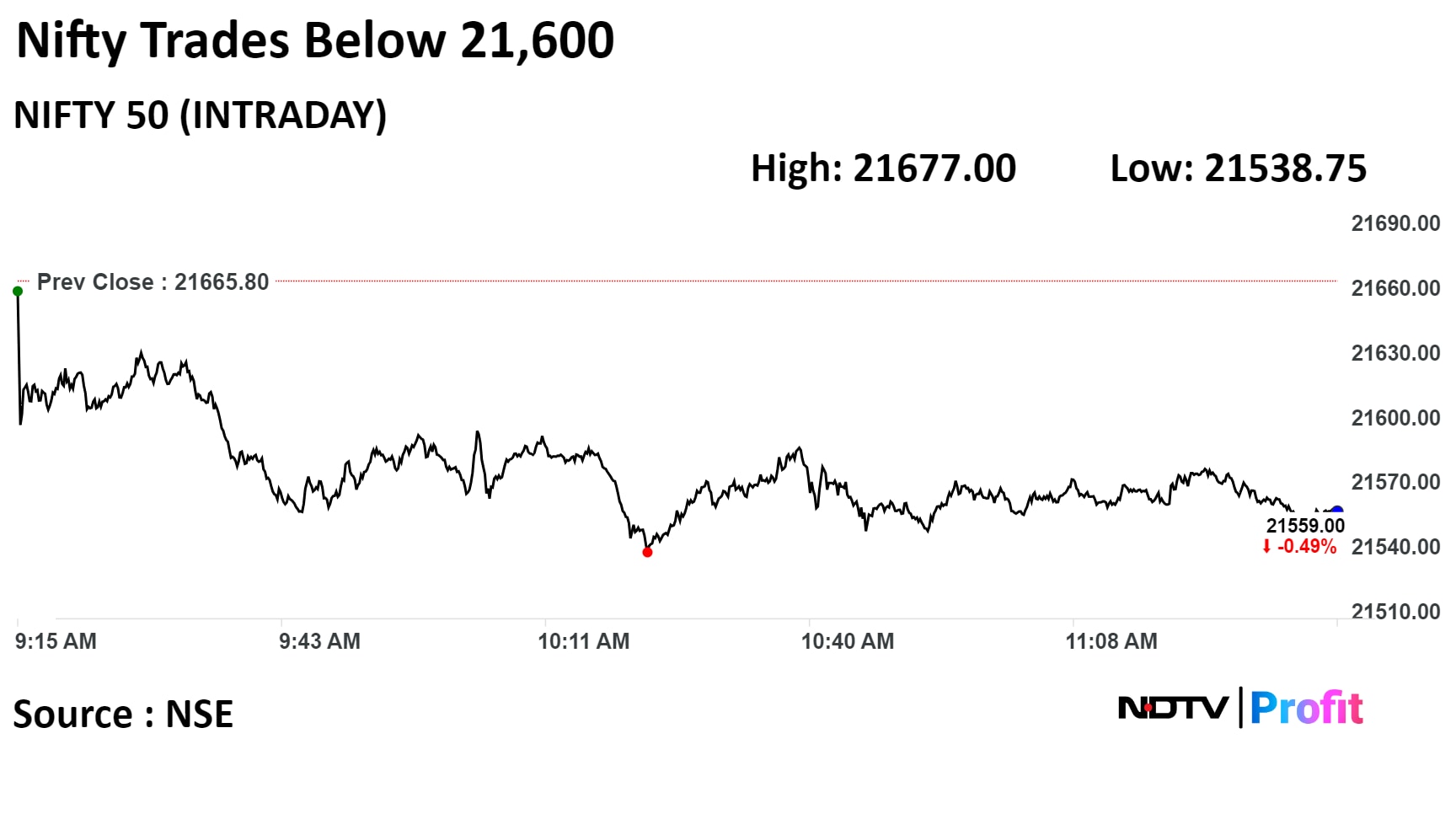

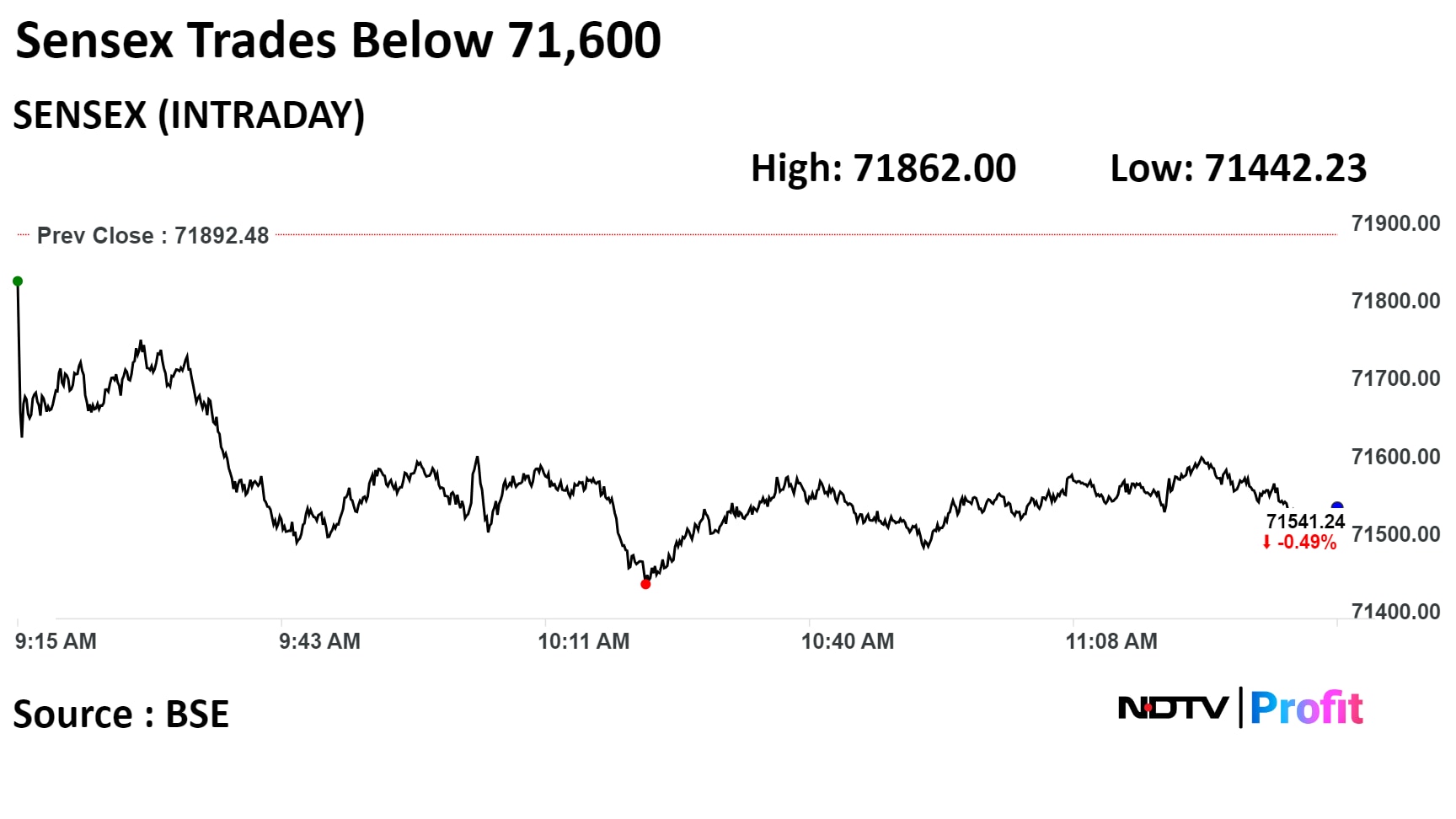

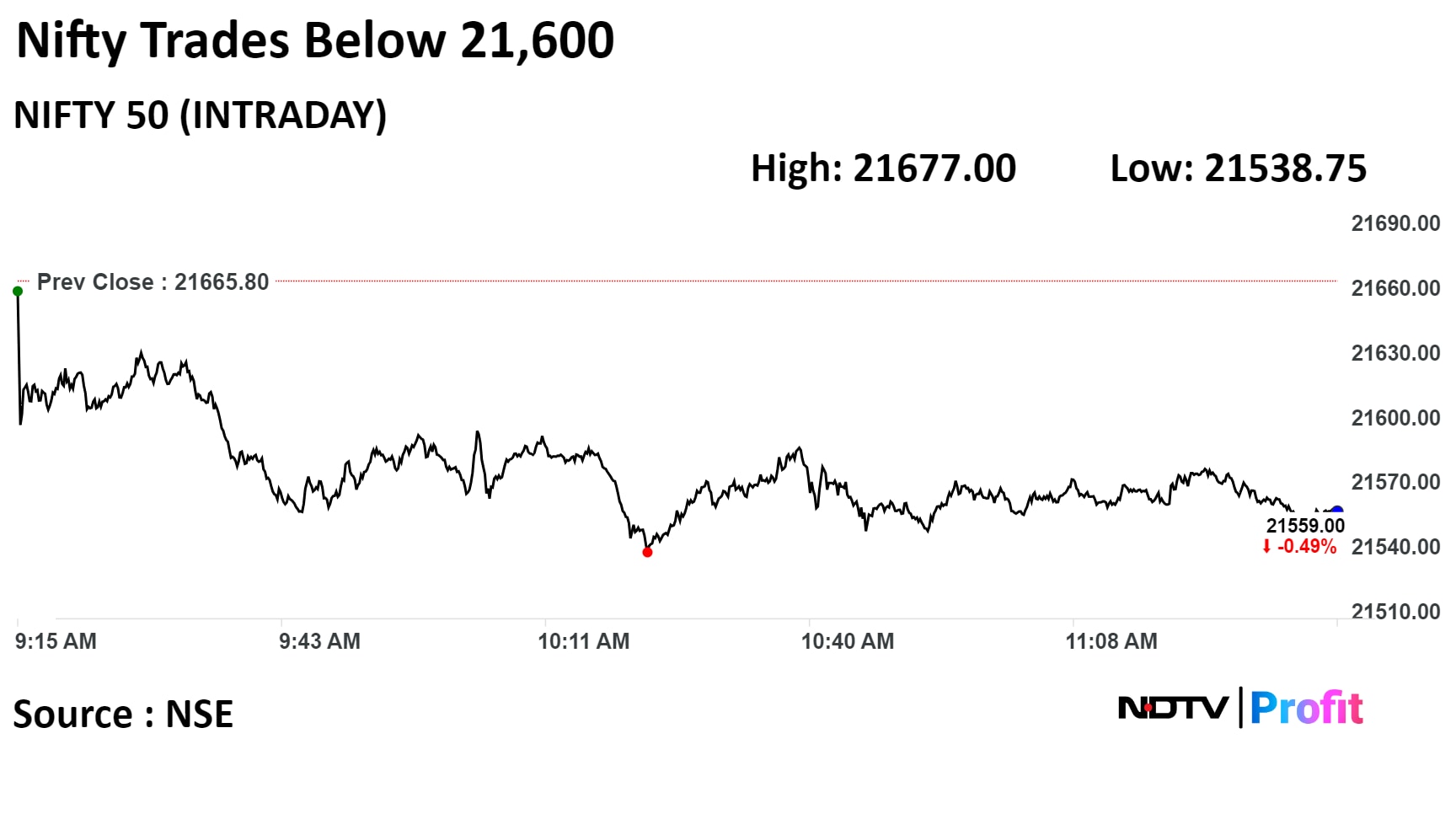

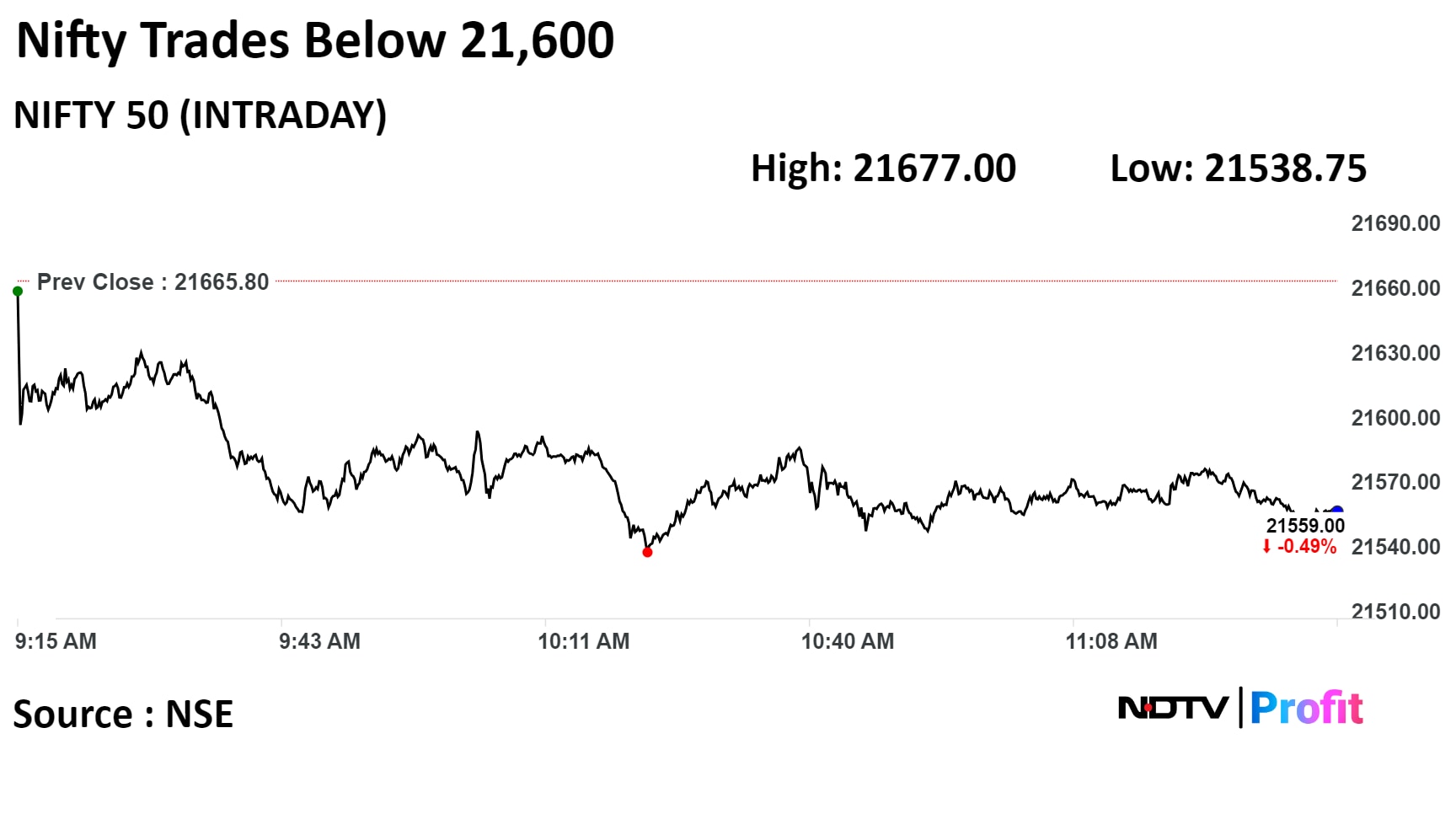

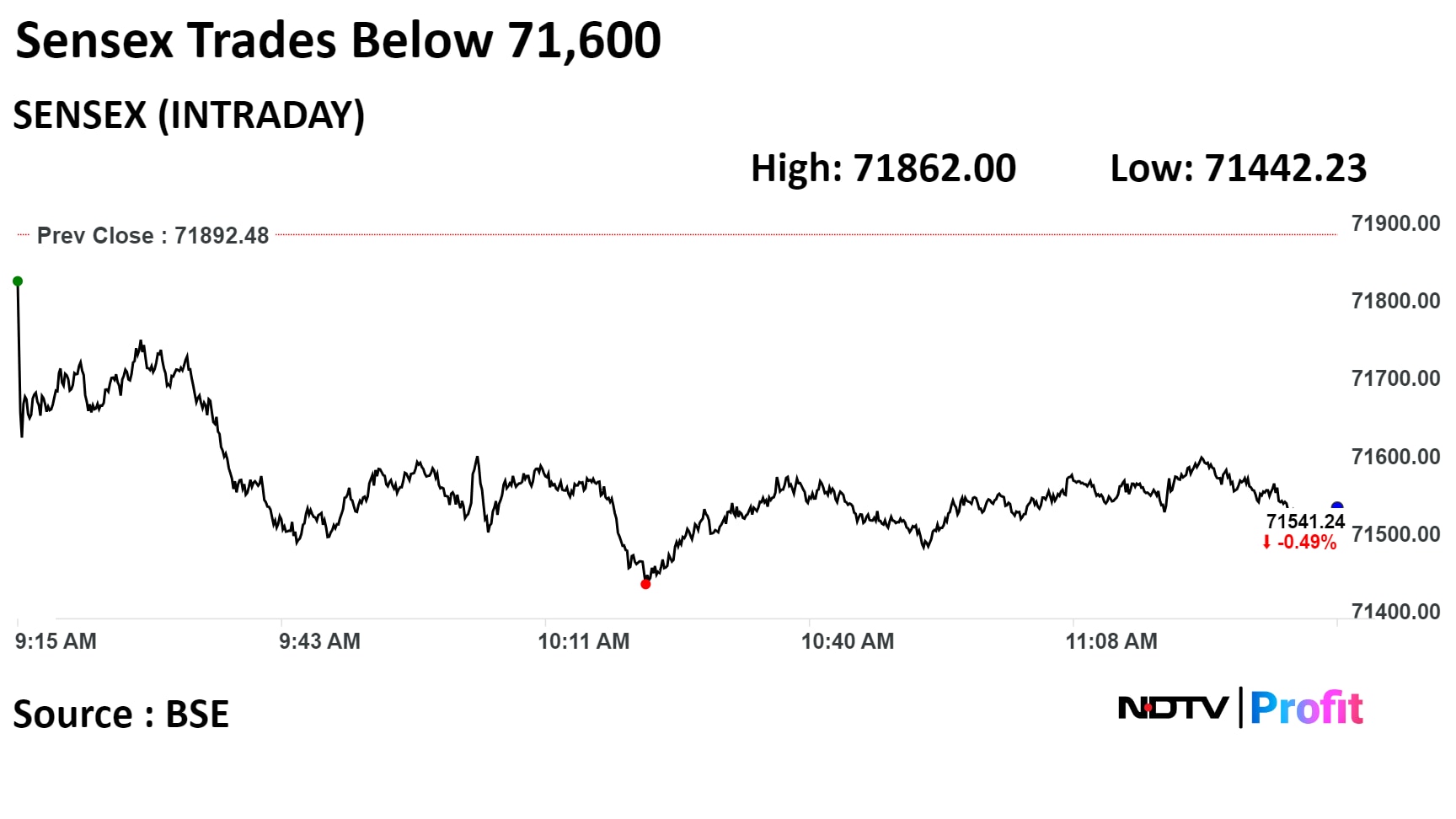

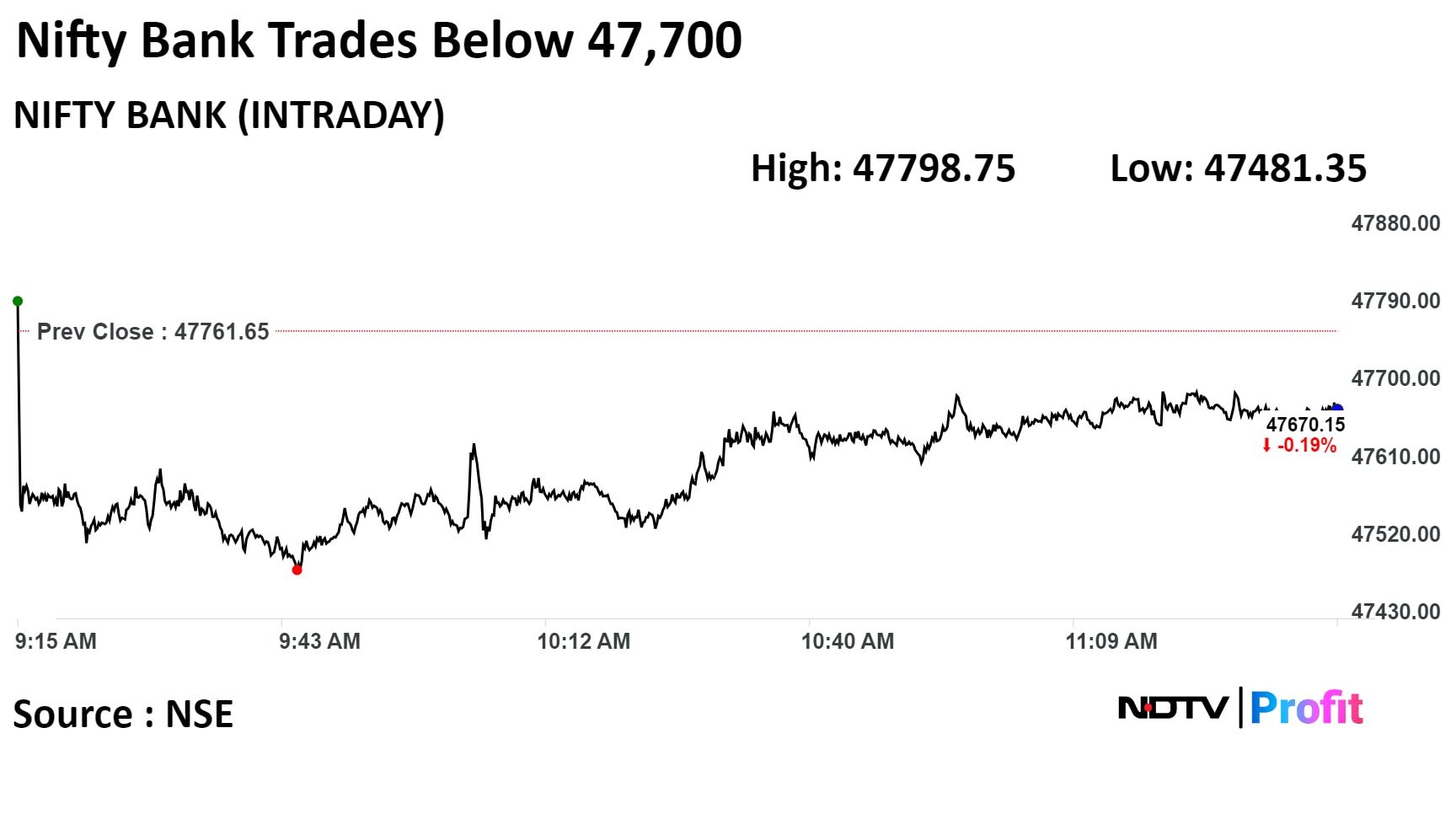

India's benchmark indices extended their decline through midday on Wednesday, mirroring a similar trend across global peers. Information technology and banking stocks led to the losses.

The NSE Nifty 50 hit a five-day low of 21,538.75, and the S&P BSE Sensex fell to a six-day low of 71,442.23 so far in the day.

At 11:39 a.m., the Nifty 50 was 101.70 points, or 0.47%, lower at 21,564.10, while the Sensex declined 342.02 points, or 0.48%, to 71,550.46.

Today, the domestic market followed the subdued trend observed in global counterparts, initiating the day with a lower opening, said Shrey Jain, founder and chief executive at SAS Online. "Initiating the session with a gap down opening around 21,650, Nifty is poised for potential selling pressure at higher levels throughout the day."

India's benchmark indices extended their decline through midday on Wednesday, mirroring a similar trend across global peers. Information technology and banking stocks led to the losses.

The NSE Nifty 50 hit a five-day low of 21,538.75, and the S&P BSE Sensex fell to a six-day low of 71,442.23 so far in the day.

At 11:39 a.m., the Nifty 50 was 101.70 points, or 0.47%, lower at 21,564.10, while the Sensex declined 342.02 points, or 0.48%, to 71,550.46.

Today, the domestic market followed the subdued trend observed in global counterparts, initiating the day with a lower opening, said Shrey Jain, founder and chief executive at SAS Online. "Initiating the session with a gap down opening around 21,650, Nifty is poised for potential selling pressure at higher levels throughout the day."

India's benchmark indices extended their decline through midday on Wednesday, mirroring a similar trend across global peers. Information technology and banking stocks led to the losses.

The NSE Nifty 50 hit a five-day low of 21,538.75, and the S&P BSE Sensex fell to a six-day low of 71,442.23 so far in the day.

At 11:39 a.m., the Nifty 50 was 101.70 points, or 0.47%, lower at 21,564.10, while the Sensex declined 342.02 points, or 0.48%, to 71,550.46.

Today, the domestic market followed the subdued trend observed in global counterparts, initiating the day with a lower opening, said Shrey Jain, founder and chief executive at SAS Online. "Initiating the session with a gap down opening around 21,650, Nifty is poised for potential selling pressure at higher levels throughout the day."

India's benchmark indices extended their decline through midday on Wednesday, mirroring a similar trend across global peers. Information technology and banking stocks led to the losses.

The NSE Nifty 50 hit a five-day low of 21,538.75, and the S&P BSE Sensex fell to a six-day low of 71,442.23 so far in the day.

At 11:39 a.m., the Nifty 50 was 101.70 points, or 0.47%, lower at 21,564.10, while the Sensex declined 342.02 points, or 0.48%, to 71,550.46.

Today, the domestic market followed the subdued trend observed in global counterparts, initiating the day with a lower opening, said Shrey Jain, founder and chief executive at SAS Online. "Initiating the session with a gap down opening around 21,650, Nifty is poised for potential selling pressure at higher levels throughout the day."

India's benchmark indices extended their decline through midday on Wednesday, mirroring a similar trend across global peers. Information technology and banking stocks led to the losses.

The NSE Nifty 50 hit a five-day low of 21,538.75, and the S&P BSE Sensex fell to a six-day low of 71,442.23 so far in the day.

At 11:39 a.m., the Nifty 50 was 101.70 points, or 0.47%, lower at 21,564.10, while the Sensex declined 342.02 points, or 0.48%, to 71,550.46.

Today, the domestic market followed the subdued trend observed in global counterparts, initiating the day with a lower opening, said Shrey Jain, founder and chief executive at SAS Online. "Initiating the session with a gap down opening around 21,650, Nifty is poised for potential selling pressure at higher levels throughout the day."

India's benchmark indices extended their decline through midday on Wednesday, mirroring a similar trend across global peers. Information technology and banking stocks led to the losses.

The NSE Nifty 50 hit a five-day low of 21,538.75, and the S&P BSE Sensex fell to a six-day low of 71,442.23 so far in the day.

At 11:39 a.m., the Nifty 50 was 101.70 points, or 0.47%, lower at 21,564.10, while the Sensex declined 342.02 points, or 0.48%, to 71,550.46.

Today, the domestic market followed the subdued trend observed in global counterparts, initiating the day with a lower opening, said Shrey Jain, founder and chief executive at SAS Online. "Initiating the session with a gap down opening around 21,650, Nifty is poised for potential selling pressure at higher levels throughout the day."

India's benchmark indices extended their decline through midday on Wednesday, mirroring a similar trend across global peers. Information technology and banking stocks led to the losses.

The NSE Nifty 50 hit a five-day low of 21,538.75, and the S&P BSE Sensex fell to a six-day low of 71,442.23 so far in the day.

At 11:39 a.m., the Nifty 50 was 101.70 points, or 0.47%, lower at 21,564.10, while the Sensex declined 342.02 points, or 0.48%, to 71,550.46.

Today, the domestic market followed the subdued trend observed in global counterparts, initiating the day with a lower opening, said Shrey Jain, founder and chief executive at SAS Online. "Initiating the session with a gap down opening around 21,650, Nifty is poised for potential selling pressure at higher levels throughout the day."

India's benchmark indices extended their decline through midday on Wednesday, mirroring a similar trend across global peers. Information technology and banking stocks led to the losses.

The NSE Nifty 50 hit a five-day low of 21,538.75, and the S&P BSE Sensex fell to a six-day low of 71,442.23 so far in the day.

At 11:39 a.m., the Nifty 50 was 101.70 points, or 0.47%, lower at 21,564.10, while the Sensex declined 342.02 points, or 0.48%, to 71,550.46.

Today, the domestic market followed the subdued trend observed in global counterparts, initiating the day with a lower opening, said Shrey Jain, founder and chief executive at SAS Online. "Initiating the session with a gap down opening around 21,650, Nifty is poised for potential selling pressure at higher levels throughout the day."

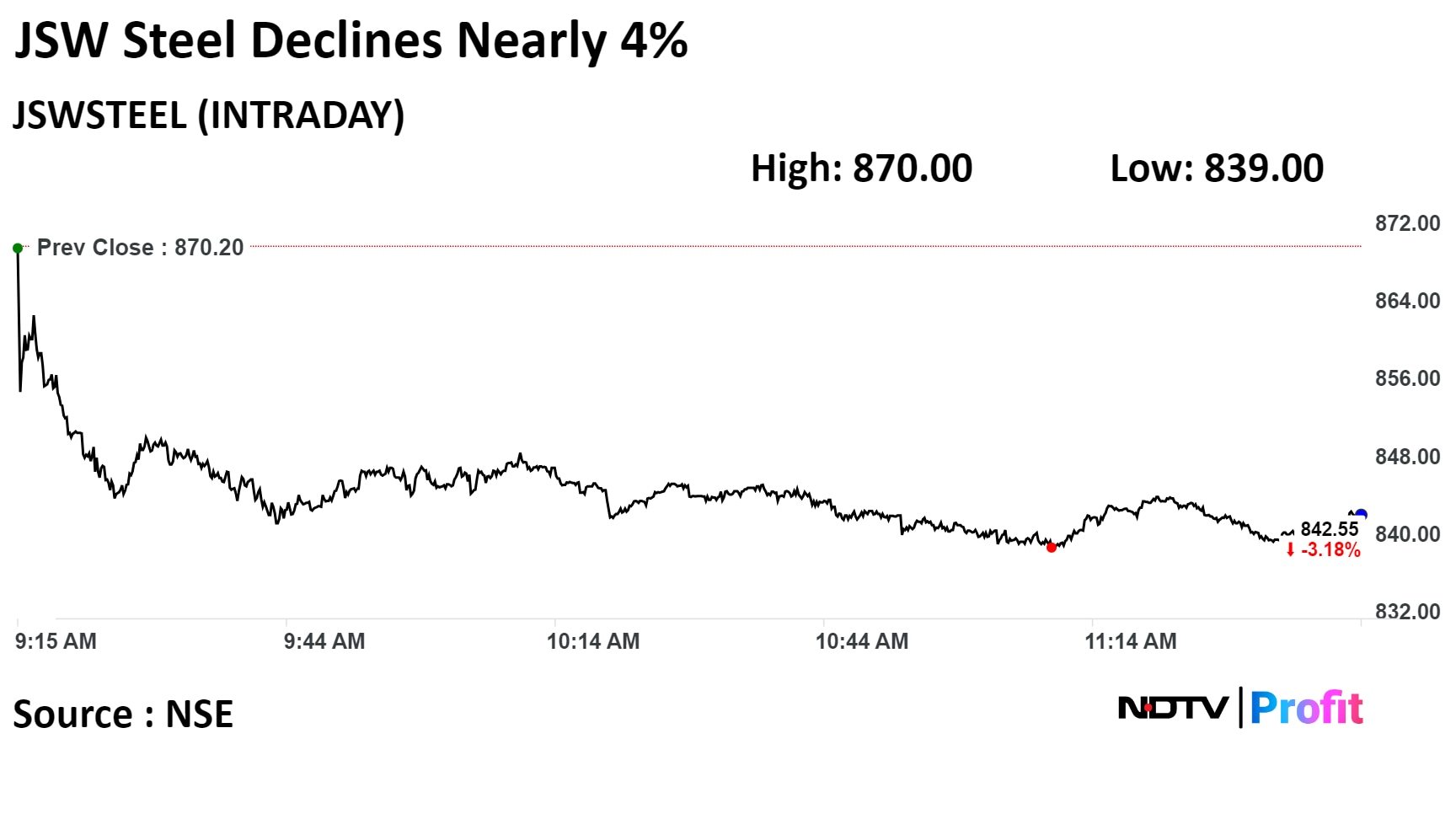

Shares of HDFC Bank Ltd., Infosys Ltd., Tata Consultancy Services Ltd., JSW Steel Ltd., and Hindalco Industries Ltd. dragged the indices.

While those of ITC Ltd., Bharti Airtel Ltd., State Bank Of India, Adani Enterprises Ltd., and Axis Bank cushioned the fall.

Sectoral indices were mixed with Nifty PSU Bank gaining over 1%. Nifty IT lost the most by over 2% and Nifty Metal fell 1.4%.

The broader markets outperformed with the BSE MidCap trading 0.30% higher and BSE SmallCap gainig 0.32% through midday on Wednesday.

Fifteen out of the 20 sectors compiled by the BSE advanced, while five declined.

The market breadth was skewed in favour of the buyers. As many as 2,065 stocks advanced, 1,610 declined and 138 remained unchanged on the BSE.

LTIMindtree Ltd said to the exchanges it has launched Farmers Edge Innovation Lab in Mumbai

Source: Exchange Filing

Central Ban Of India had 10 lakh shares changed hands in a large trade

The lender has 0.01% equity changed hands at Rs 52.45 apiece

Buyers and sellers not known immediately

Source: Bloomberg

ONGC Videsh is in talks with PDVSA to recover accrued dividend

PDVSA San Cristobal project owes $600 mn in dividend

Talks with PDVSA is on dividend include oil as payment

Alert: PDVSA stands for Petroleos de Venezuela SA

Source: Bloomberg

Shares of JSW Steel Ltd declined as much as 3.59% to Rs 839.00 on Wednesday, the lowest level since Dec 21, 2023. It was trading 3.9% lower at Rs 842.40 as of 11:50 a.m. This compares to 0.38% decline on NSE Nifty 50 index.

It has risen 9.70% on a year-to-date basis. Total traded volume so far in the day stood at 2.4 times its 30-day average. The relative strength index was at 50.75.

Out of 31 analysts tracking the company, 11 maintain a 'buy' rating, 11 recommend a 'hold,' and nine suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside/upside of -6.0%.

Shares of JSW Steel Ltd declined as much as 3.59% to Rs 839.00 on Wednesday, the lowest level since Dec 21, 2023. It was trading 3.9% lower at Rs 842.40 as of 11:50 a.m. This compares to 0.38% decline on NSE Nifty 50 index.

It has risen 9.70% on a year-to-date basis. Total traded volume so far in the day stood at 2.4 times its 30-day average. The relative strength index was at 50.75.

Out of 31 analysts tracking the company, 11 maintain a 'buy' rating, 11 recommend a 'hold,' and nine suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside/upside of -6.0%.

GAIL and TruAlt Bioenergy announced $72 mn investment via CBG JV

JV to set up 10 plants aiming at over 33 mn kg CBG production

Alert: CBG stands for Compressed Bio Gas

Source: Exchange Filing

Vodafone Idea Ltd's chief Regulatory & Corporate Affairs Officer P. Balaji resigns with effect from Jan 10

Source: Exchange Filing

All Adani Group stocks advanced as the Supreme Court today disposed the petition on Adani-Hindenburg case.

Adani Group stocks added as much as Rs 1.18 crore in investor wealth, taking their total market capitalisation to Rs 15.62 lakh crore, intraday.

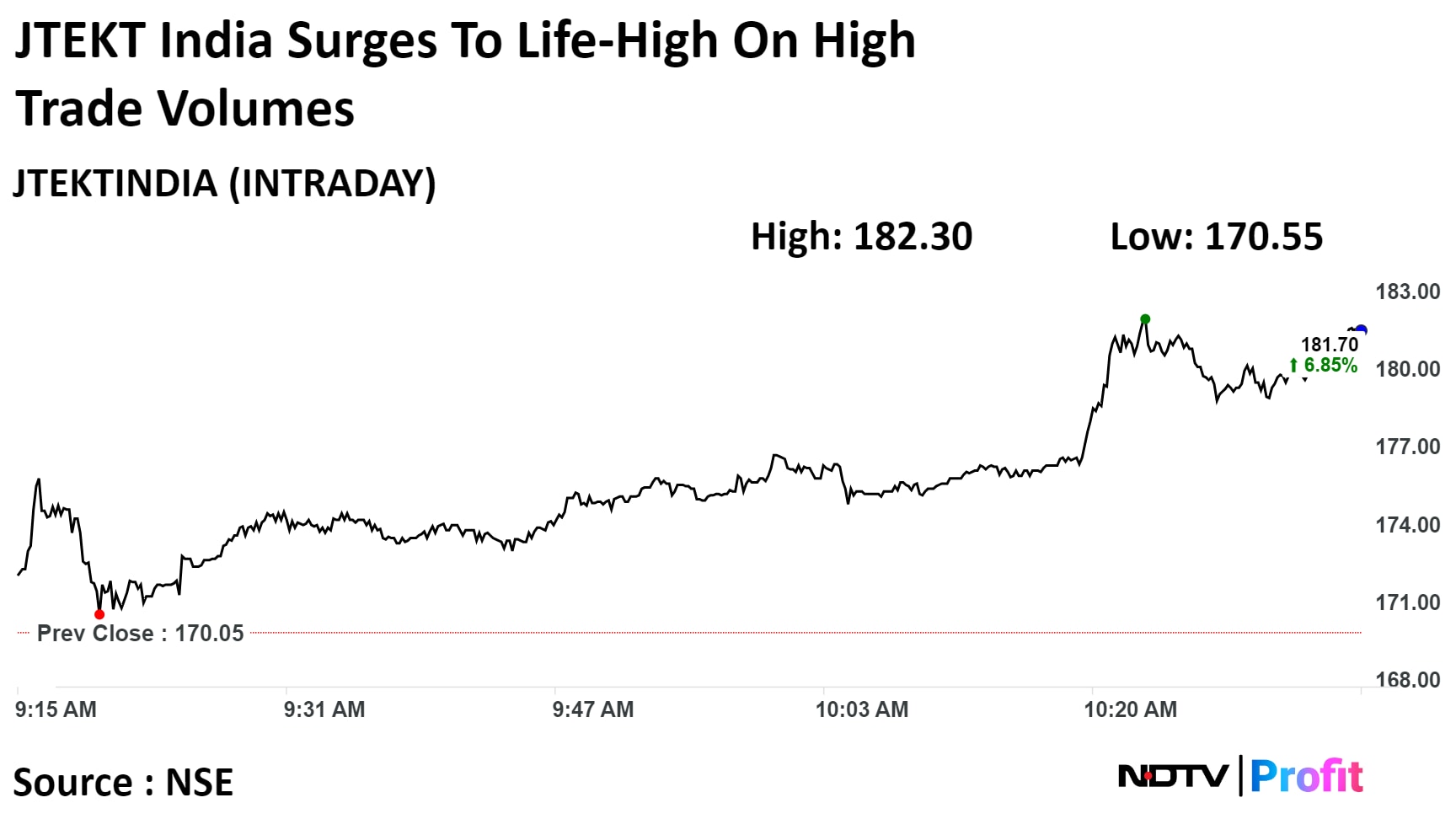

Shares of the JTEKT India Ltd jumped over 7% to record high on Wednesday on high trade volumes. The script's total traded volume so far in the day stood at 4.6 times its 30-day average.

Shares of the JTEKT India Ltd jumped over 7% to record high on Wednesday on high trade volumes. The script's total traded volume so far in the day stood at 4.6 times its 30-day average.

JTEKT India Ltd rose as much as 7.20% to Rs 182.30 apiece, the highest level since it was listed on BSE on May 25, 1988. It pared gains to trade 5.79% higher at Rs 180.85 apiece, as of 10:39 a.m. This compares to a 0.36% decline in the NSE Nifty 50 Index.

It has risen 24.66% on a year-to-date basis.The relative strength index was at 82.29, which implied the stock is overbought.

One analyst tracking the company mainted 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an downside of 8.3%

BoFa Securities maintained 'Buy' on Reliance Industries Ltd at Rs 2,850 target

Peak 5G capex now behind in telecom segment, management focusing on monetization

Telco to see market share gains and tariff hikes

Jio Platforms to see strong net adds on 4G

Retail to see opportunities across formats, business in investment mode

Return on invested capital in Retail unlikely to improve

Expects Reliance Retail to deepen omni-channel presence in grocery, fashion, cosmetics, pharmacy

Visibility by management on potential IPOs to be major catalyst

FDC at 13.82x its 30 day average

Unichem Laboratories at 3.86x its 30 day average

Alok Industries at 3.65x its 30 day average

Zf Commercial Vehicle Control Systems at 2.67x its 30 day average

Maintain 'Reduce' on Gujarat Gas at Rs 440 target, on expensive valuations

Maintains 'Buy' on Gujarat State Petronet with Rs 335 target

Reiterate 'Buy' on Petronet LNG at Rs 245 target, QatarGas contract renewal to be material positive trigger

Gujarat State Petronet, Gujarat Gas, Petronet LNG tend to benefit from lower rates

No major disruptions seen with near-to-medium term supply outlook looking comfortable

Gujarat State's volumes to see fillip from power, refinery sectors

Gujarat Gas spreads likely to improve as propane remains steady in Jan’24

Petronet LNG tolling volumes to see uptick, with higher demand for spot gas

Unclear China outlook poses risk to propane prices

ITC Ltd's Nakul Anand ceased to be whole-time director effective today

Anand ceased to be whole-time director as its term got over

Source: Exchange Filing

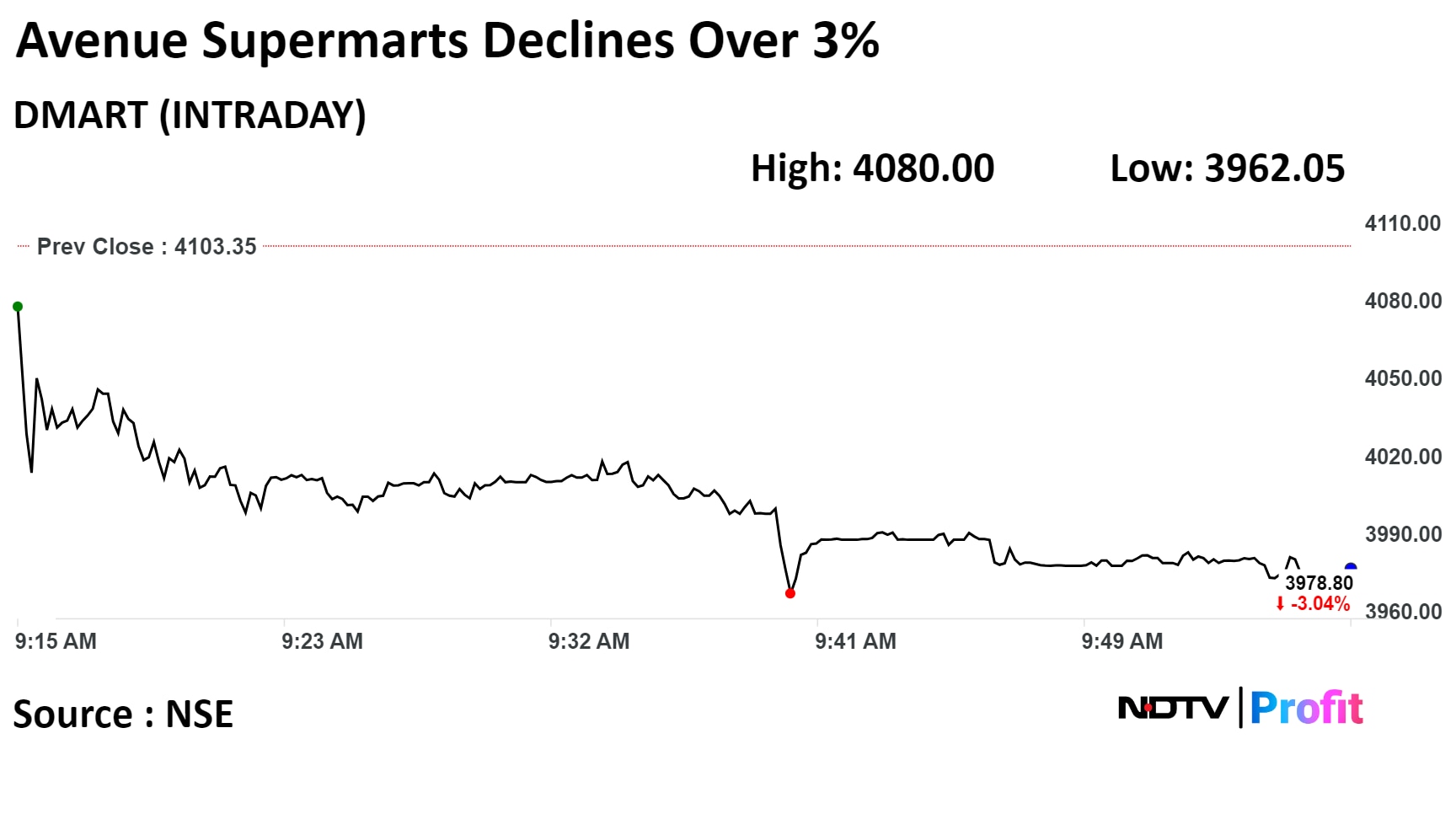

Shares of Avenue Supermarts Ltd declined as much as 3.44% on Wednesday as Citi Research said the company's is likely to remain weak in third quarter of current fiscal year due to slow store growth in smaller towns.

The brokerage maintained 'Sell' rating on Avenue Supermarts Ltd at the target price of Rs 3,100.

The brokerage said the company's revenue per sq ft remains impacted by inferior product mix, new store additions in smaller towns

Citi Research also remained cautious at the current valuation given risks around store additions

Shares of Avenue Supermarts Ltd declined as much as 3.44% on Wednesday as Citi Research said the company's is likely to remain weak in third quarter of current fiscal year due to slow store growth in smaller towns.

The brokerage maintained 'Sell' rating on Avenue Supermarts Ltd at the target price of Rs 3,100.

The brokerage said the company's revenue per sq ft remains impacted by inferior product mix, new store additions in smaller towns

Citi Research also remained cautious at the current valuation given risks around store additions

Shares of Avenue Supermarts fell 3.44%, the lowest since Dec. 29, 2023, before paring some loss to trade 3.25% at 10:02 a.m. This compares to 0.38% fall in NSE Nifty 50.

The stock has fallen 2.27% year-to-date. Total traded volume so far in the day stood at 5.2 times its 30-day average. The relative strength index was at 49.50.

Of the 25 analysts tracking the company, 11 maintain a 'buy' rating, six recommend a 'hold,' and eight suggest a 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 0.8%.

SBI raised $500 million 3 year loan at 80 bps over SOFR

SBI raised $500 million 5 year loan at 100 bps over SOFR

Loan entirely underwritten by HSBC

Funds raised to meet long term growth and liability management requirements

Funds raised through SBI's GIFT city branch

SBI had last raised $500 million in 2022 through a syndicated loan

Alert: SOFR is secured overnight financing rate

Source: People in the know to NDTV Profit

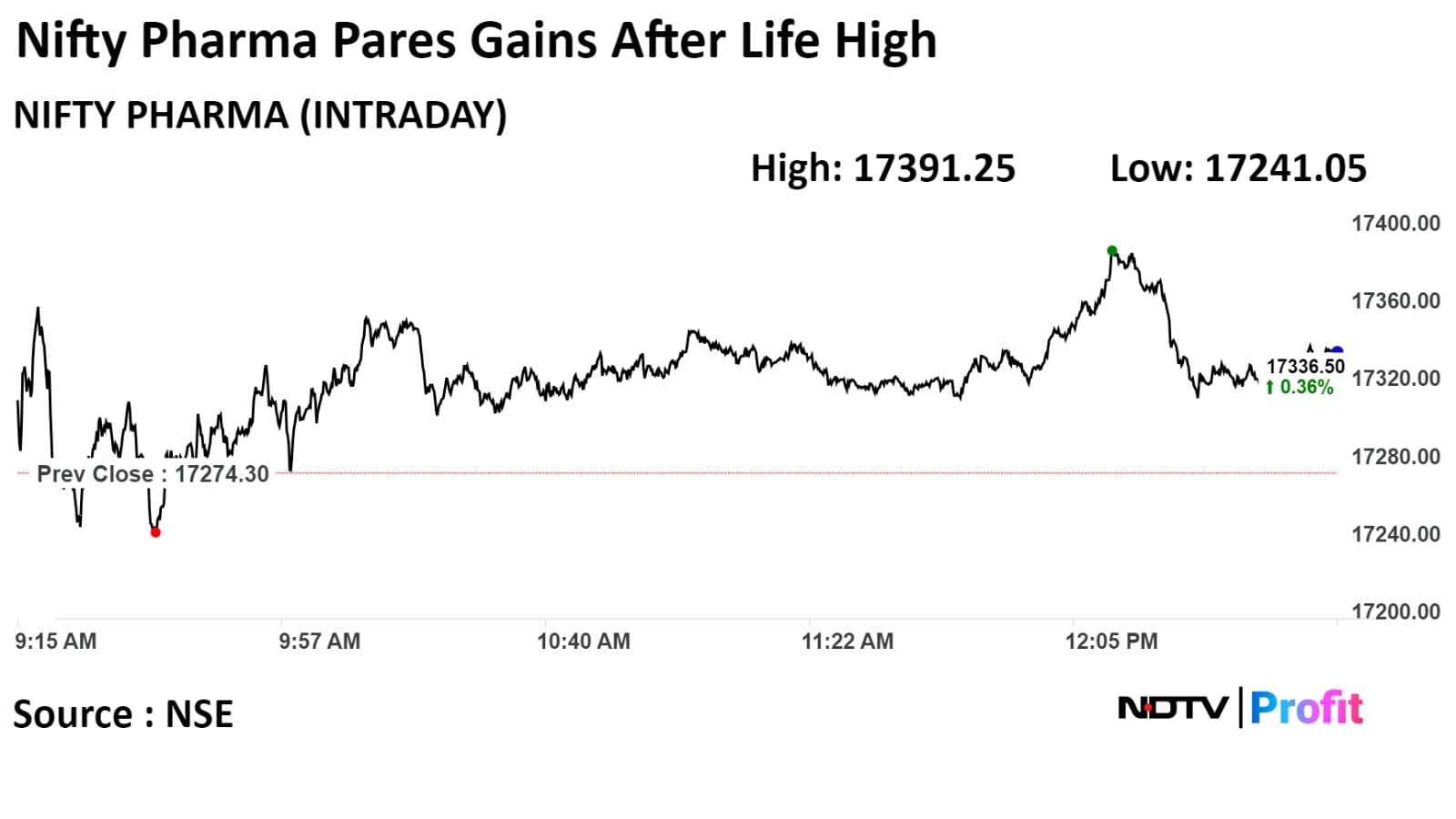

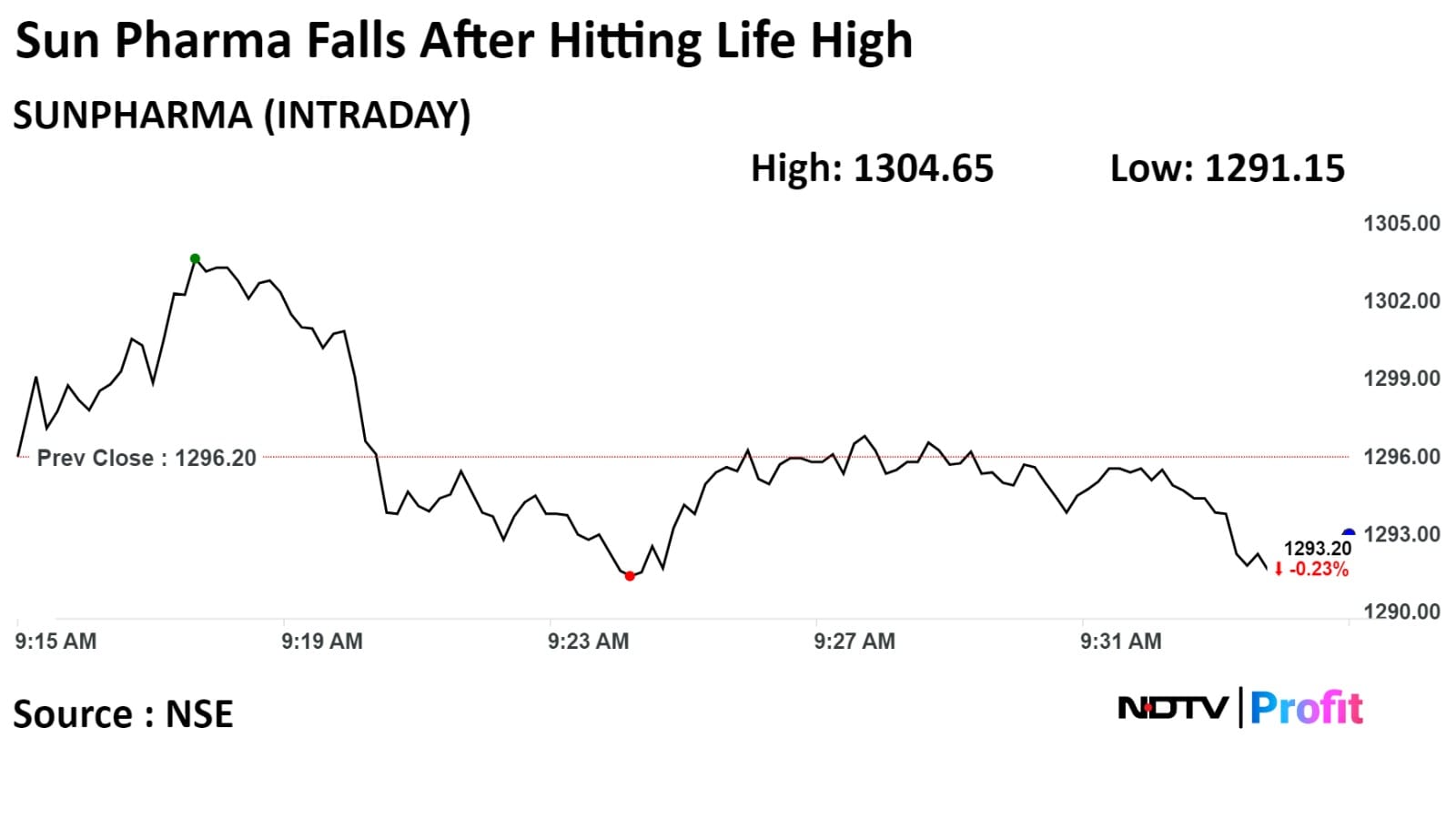

Shares of Sun Pharmaceutical Industries Ltd. rose to hit its lifetime high after the company announced that it has acquired 100% of shares of Libra Merger Ltd., a company incorporated in Israel, for consolidation of business in Israel.

Shares of Sun Pharmaceutical Industries Ltd. rose to hit its lifetime high after the company announced that it has acquired 100% of shares of Libra Merger Ltd., a company incorporated in Israel, for consolidation of business in Israel.

Sun Pharma's stock rose 0.65% during the day to Rs 1,304.65 apiece on the NSE. It was trading 0.25% higher at Rs 1,299.40 apiece, compared to a 0.4% decline in the benchmark Nifty 50 as of 10:07 a.m.

The total traded volume so far in the day stood at 1.5 times its 30-day average. The relative strength index was at 76.7, indicating that the stock may be overbought.

Thirty-seven out of the 40 analysts tracking the company have a 'buy' rating on the stock, two recommend a 'hold' and one suggests a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 1.7%.

Indian Overseas Bank's 11 lakh shares changed hands in a large trade

The lender's 0.01% equity changed hands at Rs 43.85 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Adani Group stocks surged in early trading on Wednesday ahead of the verdict in the short selling case. They added as much as Rs 89,592.06 crore in investor wealth to take the conglomerate's total market capitalisation to Rs 15.34 lakh crore

As of 9:21 a.m., the group's shares had added Rs 65,476 crore in market value at a capitalisation to Rs 15.09 lakh crore.

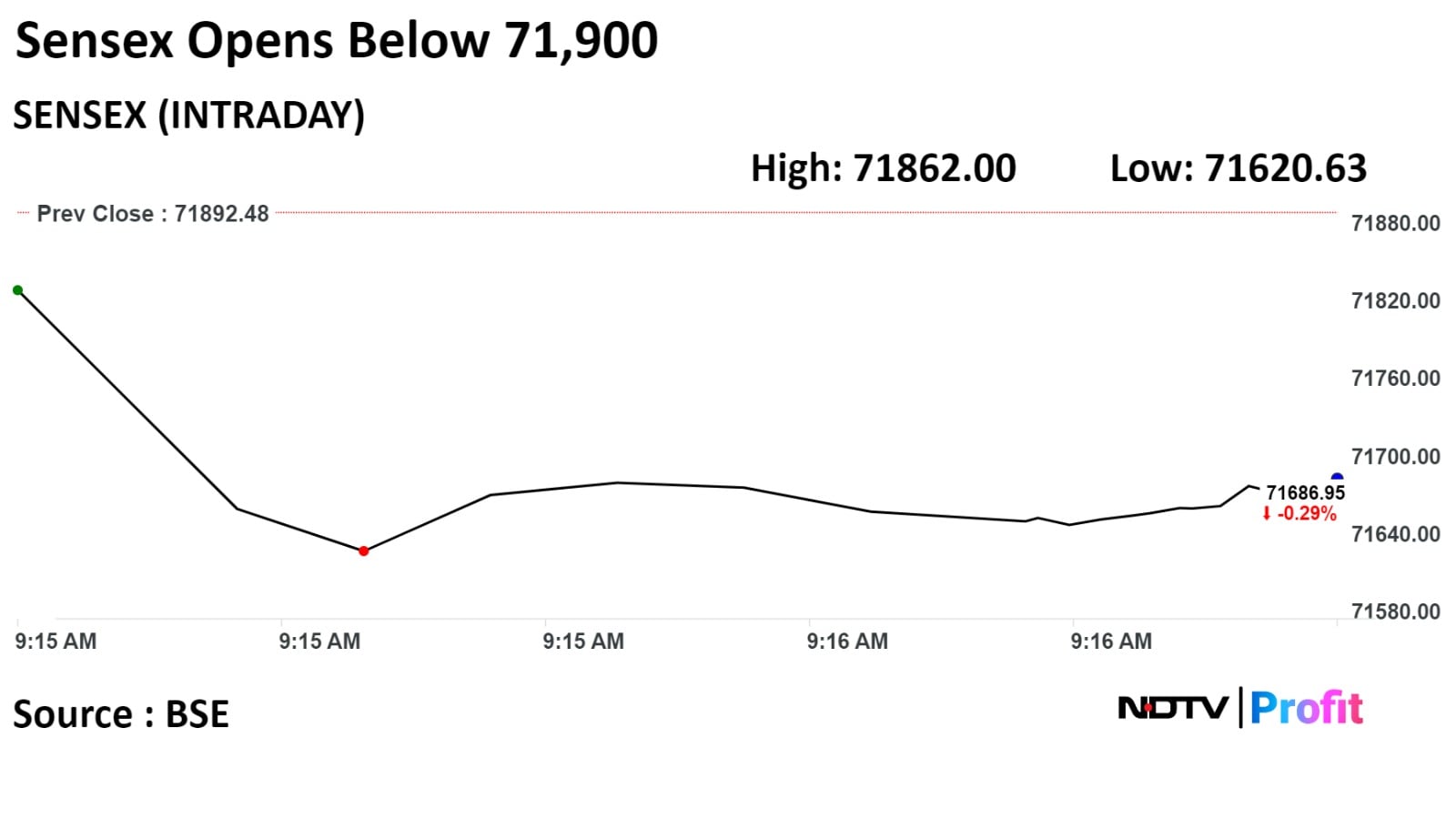

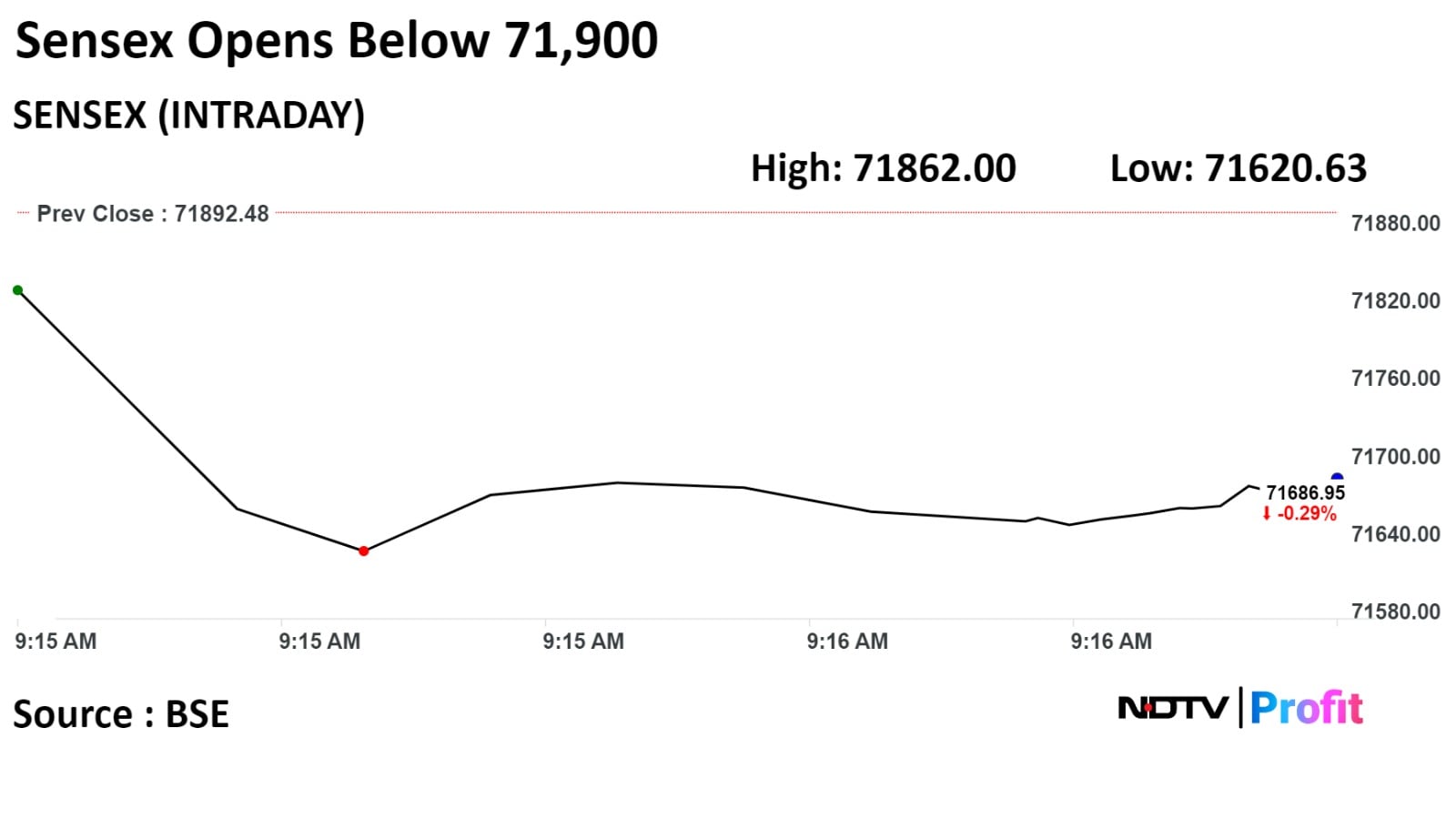

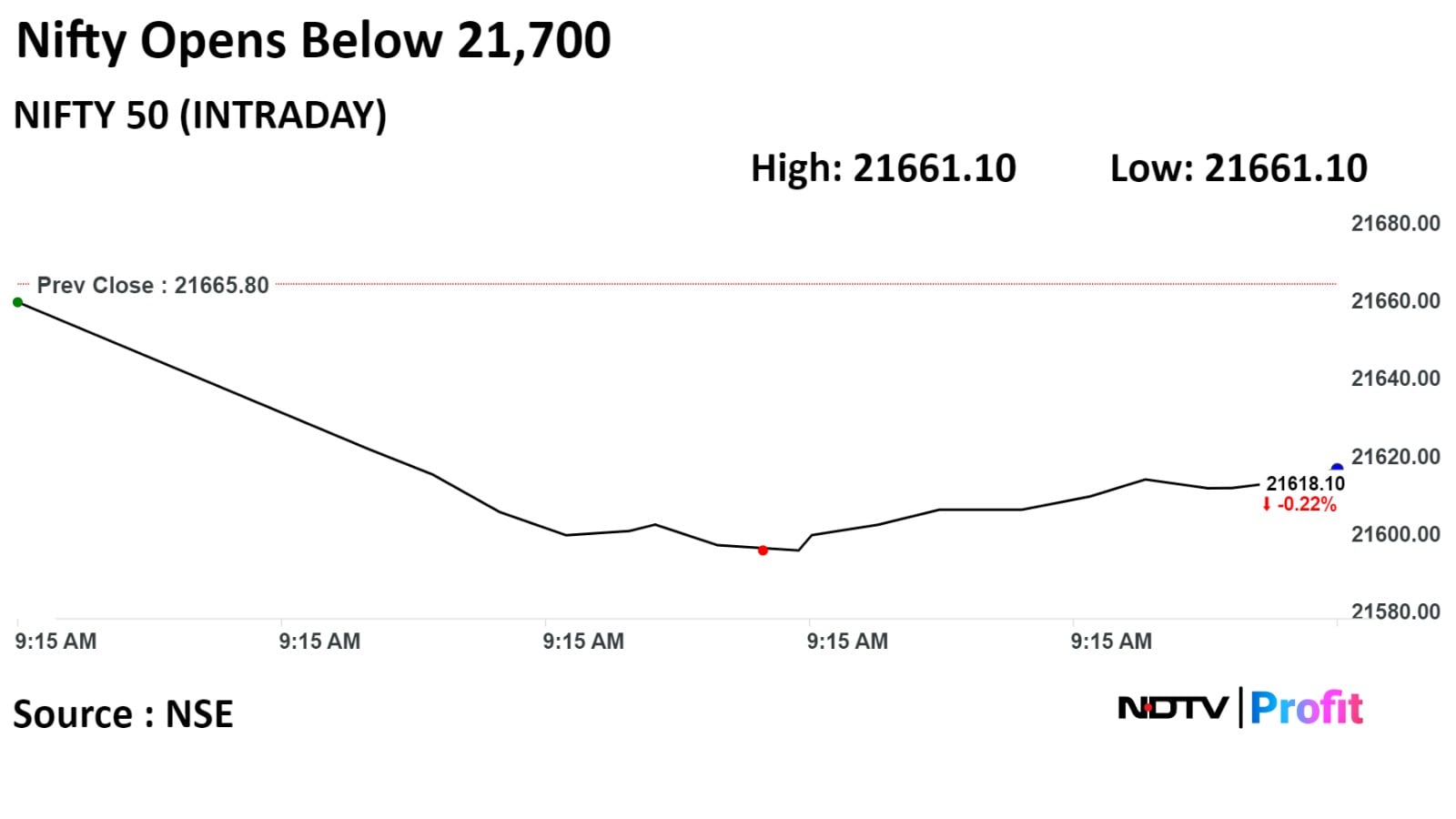

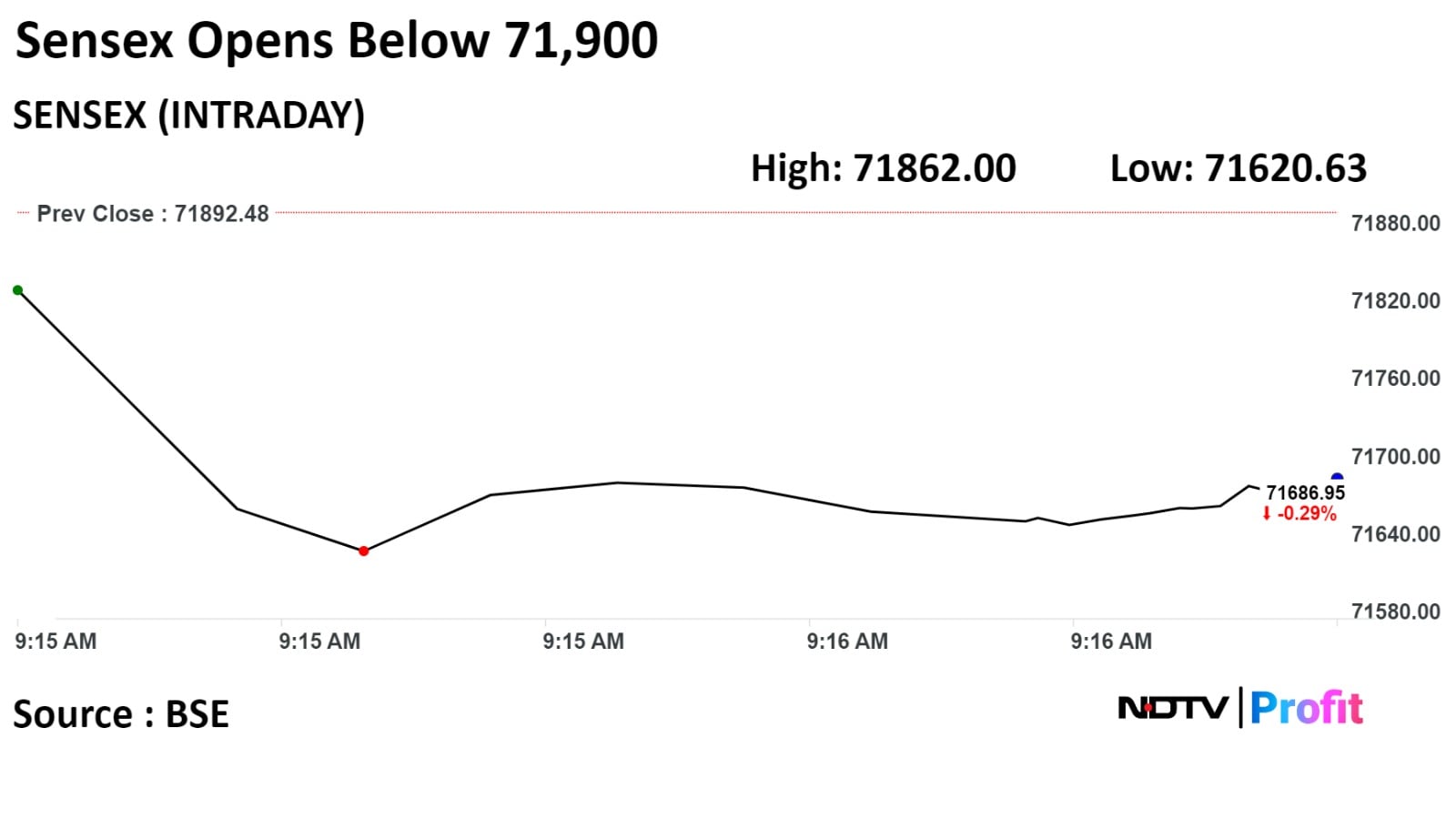

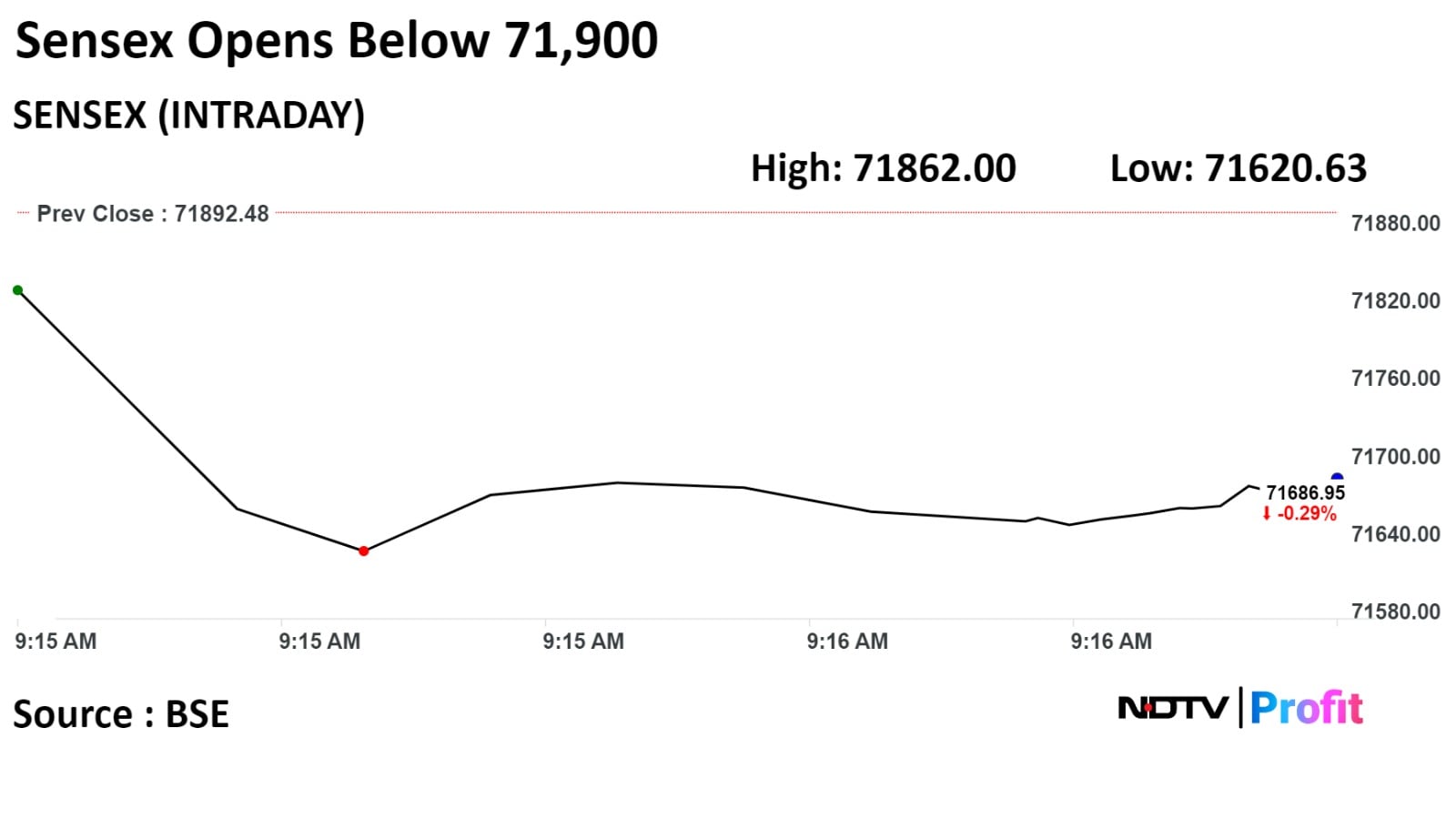

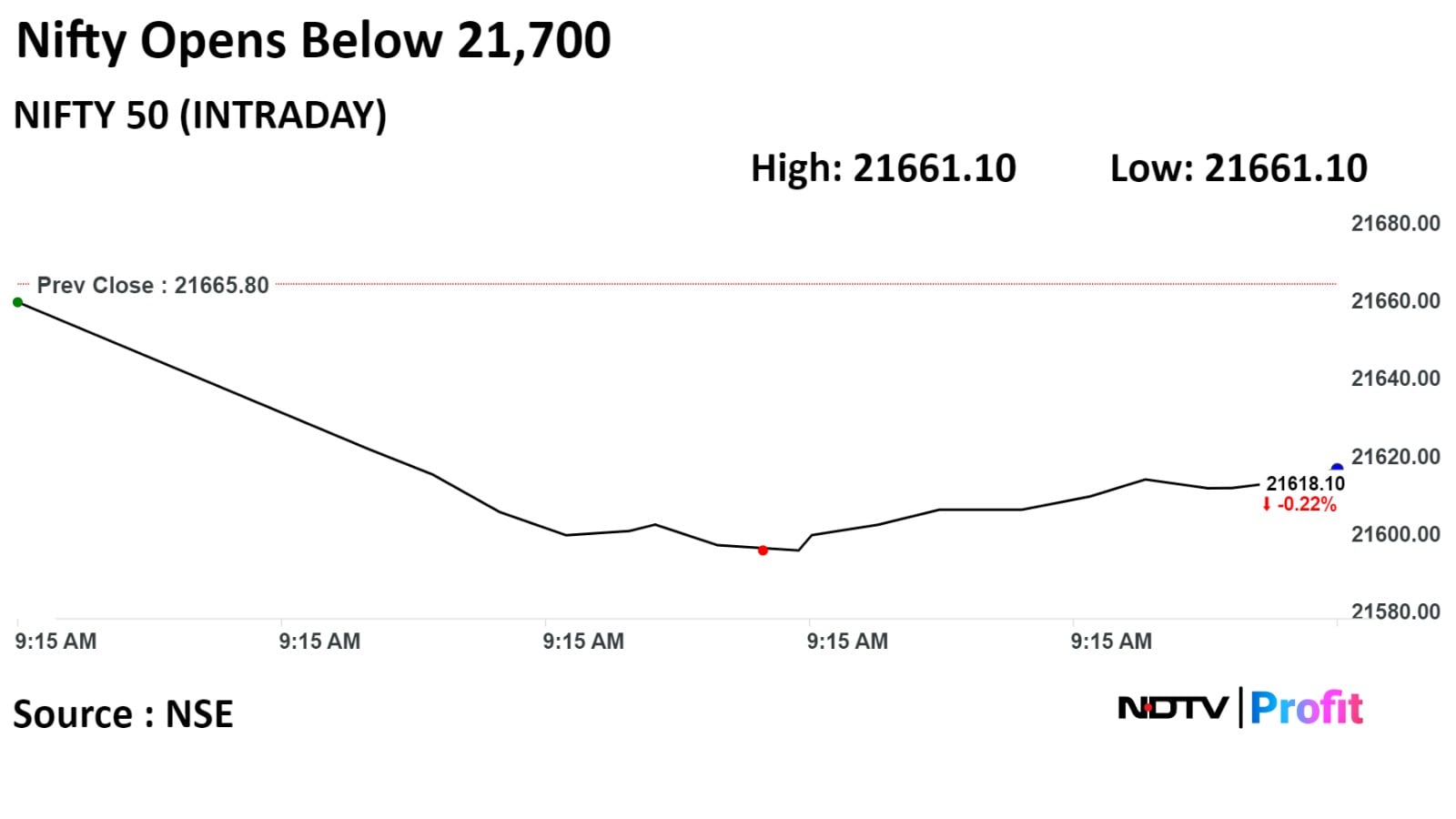

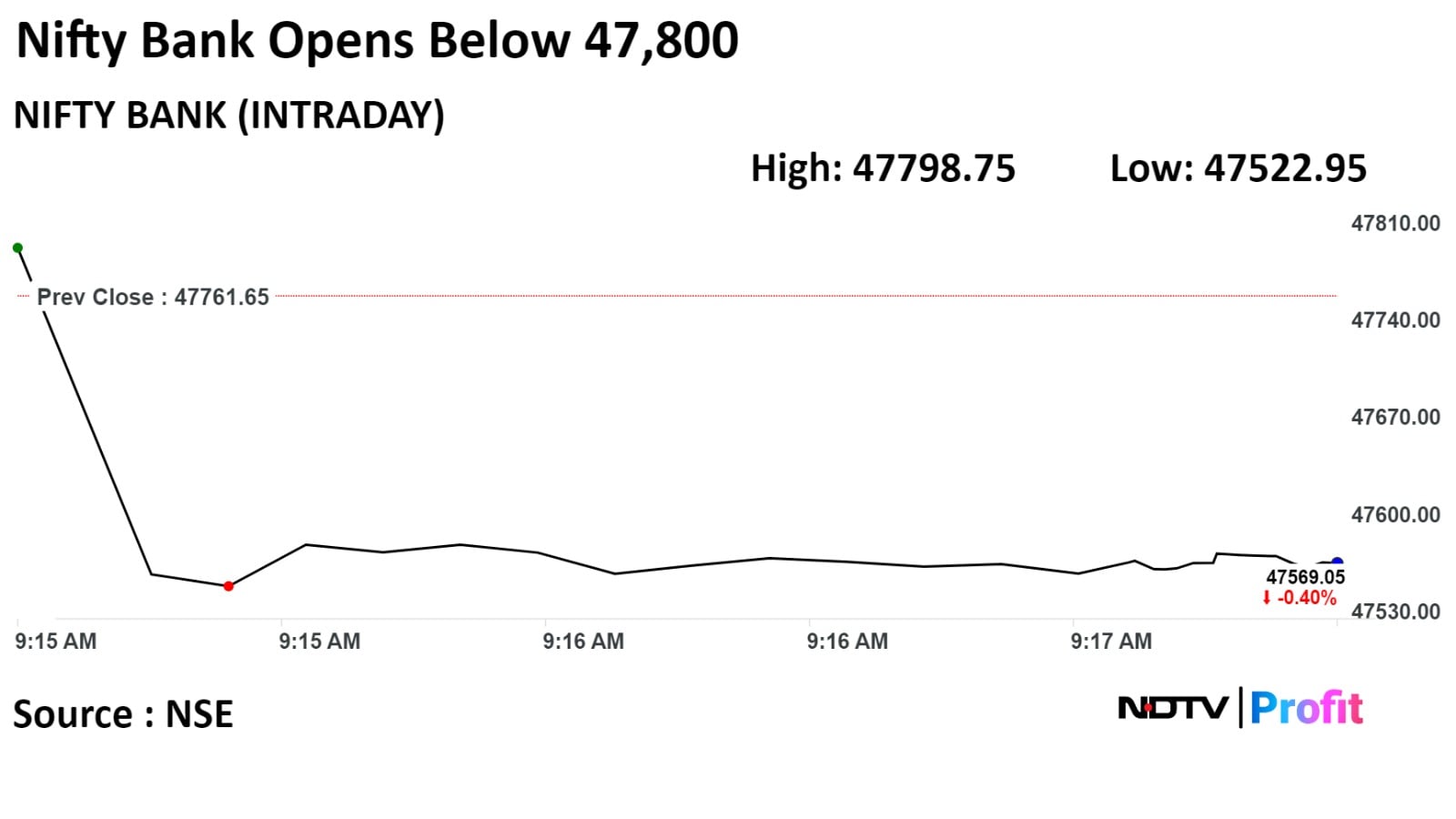

India's benchmark indices opened lower on Wednesday as ICICI Bank Ltd, Infosys Ltd weighed.

Benchmark indices also declined tracking losses on its Asian peers.

As of 09:17 a.m., the BSE Sensex was 0.30% or 225.60 points down at 71,677.01, while the NSE Nifty 50 declined 0.27% or 53,85 points to 21,615.

"Technically, on daily charts, the index has formed a bearish candle and on intraday charts, it has formed double top formation, which is largely negative. For the traders now, 21760/72300 would act as a key level to watch out. Above the same, the market could rally till 21800 -21850/72500-72650. On the flip side, below 21760/72300 weak sentiment is likely to continue. Below which, the market could continue the correction formation till 21550-21500/71600-71450," Amol Athawale, vice president, technical research at Kotak Securities Ltd

India's benchmark indices opened lower on Wednesday as ICICI Bank Ltd, Infosys Ltd weighed.

Benchmark indices also declined tracking losses on its Asian peers.

As of 09:17 a.m., the BSE Sensex was 0.30% or 225.60 points down at 71,677.01, while the NSE Nifty 50 declined 0.27% or 53,85 points to 21,615.

"Technically, on daily charts, the index has formed a bearish candle and on intraday charts, it has formed double top formation, which is largely negative. For the traders now, 21760/72300 would act as a key level to watch out. Above the same, the market could rally till 21800 -21850/72500-72650. On the flip side, below 21760/72300 weak sentiment is likely to continue. Below which, the market could continue the correction formation till 21550-21500/71600-71450," Amol Athawale, vice president, technical research at Kotak Securities Ltd

India's benchmark indices opened lower on Wednesday as ICICI Bank Ltd, Infosys Ltd weighed.

Benchmark indices also declined tracking losses on its Asian peers.

As of 09:17 a.m., the BSE Sensex was 0.30% or 225.60 points down at 71,677.01, while the NSE Nifty 50 declined 0.27% or 53,85 points to 21,615.

"Technically, on daily charts, the index has formed a bearish candle and on intraday charts, it has formed double top formation, which is largely negative. For the traders now, 21760/72300 would act as a key level to watch out. Above the same, the market could rally till 21800 -21850/72500-72650. On the flip side, below 21760/72300 weak sentiment is likely to continue. Below which, the market could continue the correction formation till 21550-21500/71600-71450," Amol Athawale, vice president, technical research at Kotak Securities Ltd

India's benchmark indices opened lower on Wednesday as ICICI Bank Ltd, Infosys Ltd weighed.

Benchmark indices also declined tracking losses on its Asian peers.

As of 09:17 a.m., the BSE Sensex was 0.30% or 225.60 points down at 71,677.01, while the NSE Nifty 50 declined 0.27% or 53,85 points to 21,615.

"Technically, on daily charts, the index has formed a bearish candle and on intraday charts, it has formed double top formation, which is largely negative. For the traders now, 21760/72300 would act as a key level to watch out. Above the same, the market could rally till 21800 -21850/72500-72650. On the flip side, below 21760/72300 weak sentiment is likely to continue. Below which, the market could continue the correction formation till 21550-21500/71600-71450," Amol Athawale, vice president, technical research at Kotak Securities Ltd

India's benchmark indices opened lower on Wednesday as ICICI Bank Ltd, Infosys Ltd weighed.

Benchmark indices also declined tracking losses on its Asian peers.

As of 09:17 a.m., the BSE Sensex was 0.30% or 225.60 points down at 71,677.01, while the NSE Nifty 50 declined 0.27% or 53,85 points to 21,615.

"Technically, on daily charts, the index has formed a bearish candle and on intraday charts, it has formed double top formation, which is largely negative. For the traders now, 21760/72300 would act as a key level to watch out. Above the same, the market could rally till 21800 -21850/72500-72650. On the flip side, below 21760/72300 weak sentiment is likely to continue. Below which, the market could continue the correction formation till 21550-21500/71600-71450," Amol Athawale, vice president, technical research at Kotak Securities Ltd

India's benchmark indices opened lower on Wednesday as ICICI Bank Ltd, Infosys Ltd weighed.

Benchmark indices also declined tracking losses on its Asian peers.

As of 09:17 a.m., the BSE Sensex was 0.30% or 225.60 points down at 71,677.01, while the NSE Nifty 50 declined 0.27% or 53,85 points to 21,615.

"Technically, on daily charts, the index has formed a bearish candle and on intraday charts, it has formed double top formation, which is largely negative. For the traders now, 21760/72300 would act as a key level to watch out. Above the same, the market could rally till 21800 -21850/72500-72650. On the flip side, below 21760/72300 weak sentiment is likely to continue. Below which, the market could continue the correction formation till 21550-21500/71600-71450," Amol Athawale, vice president, technical research at Kotak Securities Ltd

India's benchmark indices opened lower on Wednesday as ICICI Bank Ltd, Infosys Ltd weighed.

Benchmark indices also declined tracking losses on its Asian peers.

As of 09:17 a.m., the BSE Sensex was 0.30% or 225.60 points down at 71,677.01, while the NSE Nifty 50 declined 0.27% or 53,85 points to 21,615.

"Technically, on daily charts, the index has formed a bearish candle and on intraday charts, it has formed double top formation, which is largely negative. For the traders now, 21760/72300 would act as a key level to watch out. Above the same, the market could rally till 21800 -21850/72500-72650. On the flip side, below 21760/72300 weak sentiment is likely to continue. Below which, the market could continue the correction formation till 21550-21500/71600-71450," Amol Athawale, vice president, technical research at Kotak Securities Ltd

India's benchmark indices opened lower on Wednesday as ICICI Bank Ltd, Infosys Ltd weighed.

Benchmark indices also declined tracking losses on its Asian peers.

As of 09:17 a.m., the BSE Sensex was 0.30% or 225.60 points down at 71,677.01, while the NSE Nifty 50 declined 0.27% or 53,85 points to 21,615.

"Technically, on daily charts, the index has formed a bearish candle and on intraday charts, it has formed double top formation, which is largely negative. For the traders now, 21760/72300 would act as a key level to watch out. Above the same, the market could rally till 21800 -21850/72500-72650. On the flip side, below 21760/72300 weak sentiment is likely to continue. Below which, the market could continue the correction formation till 21550-21500/71600-71450," Amol Athawale, vice president, technical research at Kotak Securities Ltd

Infosys Ltd, Tata Consultancy Services Ltd, ICICI Bank Ltd, JSW Steel Ltd, and HDFC Bank Ltd weighed on the indices.

Reliance Industries Ltd, ITC Ltd, Adani Enterprises Ltd, Adani Ports and Special Economic Zones Ltd, Bajaj Finserv Ltd, added positively to the indices.

On NSE, eight stocks declined out of 13 sectors, while four gained. Nifty IT and Nifty metal declined the most.

Broader markets outperformed benchmark indices. The S&P BSE Smallcap Index rose 0.11%, whereas S&P BSE MidCap Index was 0.25% lower.

Around 14 out of 20 sectors compiled by BSE declined, while six advanced. S&P BSE Metal declined the most among sectoral indices.

The market breadth was skewed in the favour of buyers. Around 1806 stocks rose, 1051 stocks declined, while 110 remained unchanged.

Glenmark Pharmaceuticals Ltd Introduced anti-diabetic drug Liraglutide

The company will sell Liraglutide under brand name 'Lirafit'

Alert: Liraglutide is indicated for improving glycemic control

Source: Exchange Filing

At pre-open, the NSE Nifty 50 was 0.09% or 19.15 points higher at 21,684.95, while the BSE Sensex was 0.08% or 59.86 points lower at 71.832.62.

The yield on the 10-year bond opened flat at 7.20% on Wednesday.

Source: Bloomberg

-The local currency opened flat at 83.31 against the U.S dollar on Wednesday.

Source: Bloomberg

Maintains 'Sell' rating on JSW Energy, Tata Power due to stretched valuations

Resilient earnings expected for regulated power utilities

Expect 4.5-5.5% CAGR in India's power demand

Medium-term sector drivers: Rising chance of peak power deficits, sustained improvement seen in DISCOM AT&C losses and payment situation

Role of energy storage systems to become pivotal

Valuations not as attractive as earlier, but still remain reasonable

Gensol Engineering Ltd received an order worth Rs 138.72 crore for Solar Power Project by SEML in Chhattisgarh

Source: Exchange Filing

U.S. Dollar Index at 102.15

U.S. 10-year bond yield at 3.93%

Brent crude down 0.07% at $75.84 per barrel

Nymex crude flat at $70.38 per barrel

GIFT Nifty was at 21,680 as of 07:18 a.m.

Bitcoin was up 0.26% at $45,244.94

Maintains 'buy' rating on 8 out of 10 coverage stocks, except Cummins and BHEL

Larsen & Toubro Ltd , Siemens Ltd, Thermax Ltd, and KEI industries Ltd were the top picks

Expects operating leverage surprise to continue in 2024

Expects upcoming budget signaling govt capex cycle slowdown is potential negative

Believes capex cycle remains in favour of industrial stocks

The brokerage maintains 'equal-weight' with a price target of Rs 285

Mahindra & Mahindra Financial Services' disbursements softer than expected; Gross Stage 3 asset declined

Downside risks to AUM growth remain, project 15% growth in Q4

Sees limited upside on muted ROE, downside risks to earnings forecasts

Emkay Global upgraded L&T Finance Holdings to 'buy' with revised target price of Rs 190 apiece.

Rural, two-wheeler and farm equipment segments provide cross-selling and upselling opportunities

Strong margins and provision buffer give comfort in sustainable profitable growth

Expects business achieving consolidated RoA of 3% in FY26E

Price band revised from 5% to 20%: Bajel Projects.

Ex/record AGM: SpiceJet.

Moved into a short-term ASM framework: Kalyani Steels.

Moved out of short-term ASM framework: Navkar Corp, Salasar Techno Engineering.

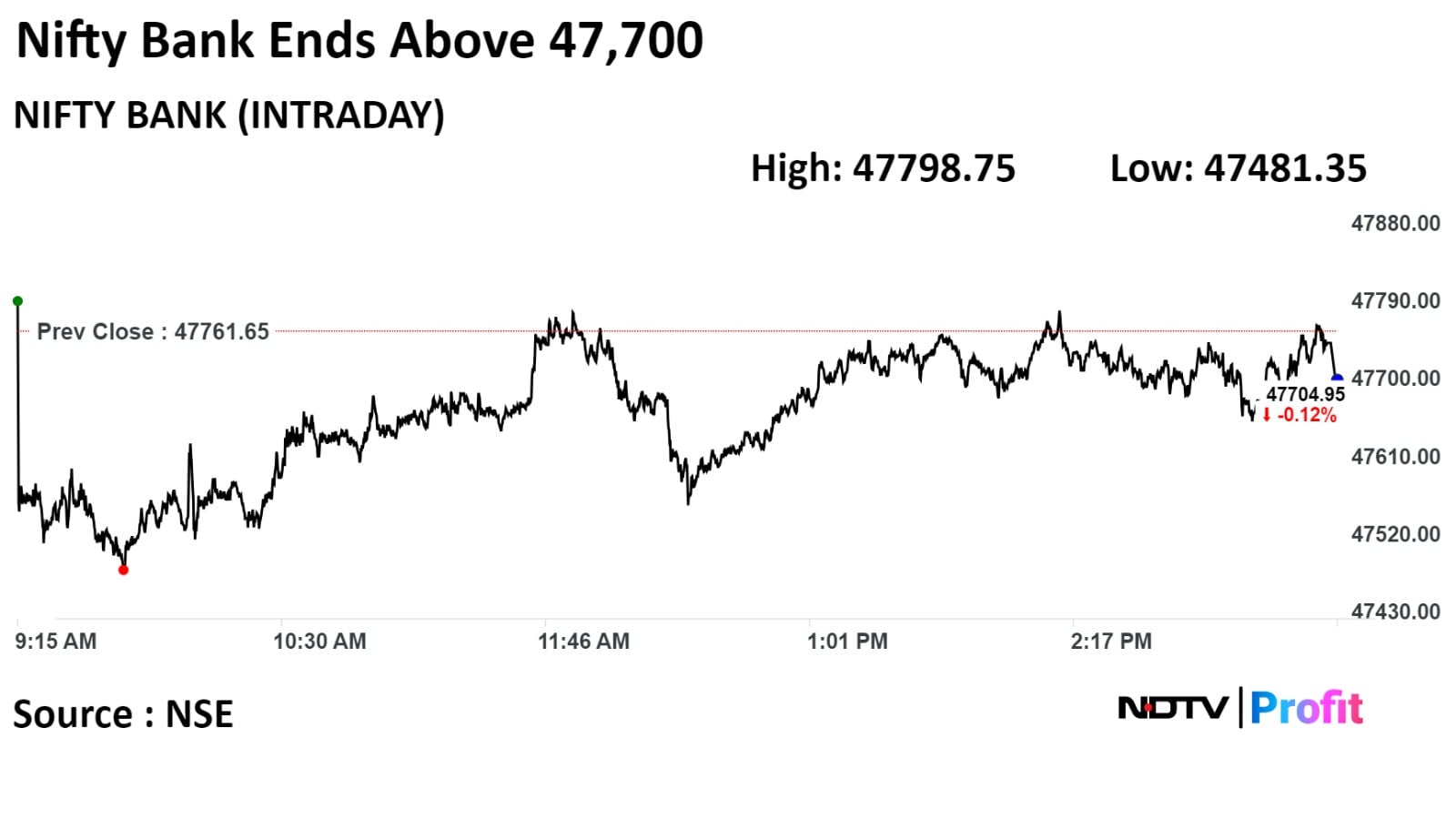

Nifty January futures down by 0.62% to 21,754 at a premium of 88.2 points.

Nifty January futures open interest up by 2.8%.

Nifty Bank January futures down by 1.35% to 47,882.55 at a premium of 120.9 points.

Nifty Bank January futures open interest up by 12.3%.

Nifty Options Jan 4 Expiry: Maximum Call open interest at 21,800 and Maximum Put open interest at 21,000.

Bank Nifty Options 3 Jan Expiry: Maximum Call Open Interest at 48,000 and Maximum Put open interest at 47,000.

Securities in the ban period: Balrampur Chini Mills, Delta Corp, Hindustan Copper, Indian Energy Exchange, SAIL, Zee Entertainment.

Mahindra Lifespaces: To meet investors and analysts on Feb. 5.

Sky Gold: To meet investors and analysts on Jan. 9.

Vishnu Chemicals: To meet investors and analysts on Jan. 4.

Globus Spirits: To meet investors and analysts on Jan. 8.

ASK Automotive: To meet investors and analysts on Jan. 5.

Advanced Enzymes: To meet investors and analysts on Jan. 9.

Hindustan Petroleum Corp: To meet investors and analysts on Jan. 11.

Sterlite Technologies: To meet investors and analysts on Jan. 8.

ADF Foods: To meet investors and analysts on Jan. 5.

VST Industries: DSP Mutual Fund sold 2.5 lakh shares (1.61%), HDFC Mutual Fund sold 2 lakh shares (1.29%) while Radhakishan Shivkishan Damani bought 2.22 lakh shares (1.44%), SBI Mutual Fund bought 2.25 lakh shares (1.45%) at Rs 3,390 apiece.

Strides Pharma Science: Amansa Holding bought 18.17 lakh shares (2%) at Rs 659.61 apiece.

PDS: Malabar India Fund bought 10 lakh shares (0.76%) at Rs 505.17 apiece.

NCC: Promoter group Alluri SanjithRaju bought 10,000 shares on Dec. 29.

Divis Laboratories: Promoter group DIVI Madhusudana Rao sold 5,000 shares on Dec. 29.

Medplus Health Services: Promoter Agilemed Investments created a pledge for 17.33 lakh shares on Dec. 20 and Madhukar Gangadi Reddy created a pledge of 19.21 lakh shares on Dec. 20.

Adani Group Stocks: The Supreme Court will pronounce its judgement in the Adani Group-Hindenburg Research case on Wednesday.

Maruti Suzuki: The company recorded total production at 1.21 lakh units, down 2.9% YoY, and passenger car production at 64,802 units, down 3.7% YoY. The auto manufacturer's mini and compact car production stood at 63,855 units, down 23.8% YoY.

Hero MotoCorp: The company recorded vehicle sales at 393,952 units, down 0.1% YoY and motorcycle sales at 354,658 units, down 0.6% YoY. The company's exports stood at 16,110 units, up 25.7% YoY.

Exide Industries: The company will increase its corporate guarantee to Exide Energy Solutions by Rs 1,000 crore. The corporate guarantee limit will be increased from Rs 2,000 crore to Rs 3,000 crore.

Mahindra and Mahindra Financial Services: The company recorded an overall disbursement of Rs 4,900 crore, up 5% YoY for December, and business assets of Rs 96,850 crore, up 25% YoY.

Coal India: The company recorded coal production at 532 MT during April-Dec 2023, up 11% YoY, and non-regulated sector consumers hit a record high of 98 MT during April-Dec 2023.

Mahindra EPC Irrigation: The company received four orders worth Rs 13.34 crore from the office of the Assistant Engineer of the Water Users Association for the supply of pressurised micro irrigation systems.

Yes Bank: The lender recorded loans and advances at Rs 2.17 lakh crore, up 11.9% YoY, and deposits at Rs 2.41 lakh crore, up 13.2% YoY. The lender's CASA ratio stood at 29.7% vs. 29.9%.

Vedanta: The company's unit, BALCO, received a tax demand worth Rs 23 crore.

Affle India: The company will buy a 9.03% stake in Explurger for Rs 37.3 crore to enrich its vertical reach to the relevant users by using the AI-powered social media app of Explurger.

CSB Bank: The company recorded total deposits of Rs 27,344 crore, up 20.65%, and gross advances of Rs 22,863 crore, up 22.59%. The bank's CASA stood at Rs 7,509 crore, up 5.39%.

Archean Chemical Industries: The company unit incorporated its subsidiary, SiCSem.

Shyam Metallics and Energy: The company opened its qualified institutional placement to raise up to Rs 3,600 crore. It set a floor price for QIP at Rs 597.63 per share, which indicates a discount of 7.06% to the current market price.

Bank of Maharashtra: The company recorded total business at Rs 4.35 lakh crore, up 18.92%, and Q3 gross advances at Rs 1.89 lakh crore, up 20.28% YoY. The lender's Q3 total deposits stood at Rs 2.46 lakh crore, up 17.9% YoY.

Arihant Superstructures: The company added a new plotted development project in Navi Mumbai, spread across 118 acres. The project is being acquired partly on an outright basis and partly in a joint-venture transaction. The total development potential is estimated at 2 million sq. ft.

Natco Pharma: The company announced that DASH Pharmaceuticals has officially transitioned to Natco Pharma USA. All products marketed by DASH Pharmaceuticals will transition to the Natco Pharma USA label.

Marico: The High Court of Bombay approved the dissolution of Halite Personal Care India, a wholly-owned subsidiary of the company.

Avenue Supermarts: The company recorded standalone revenue at Rs 13,247 crore, up 17.2% YoY, and the number of stores at 341 as of Dec. 31.

Life Insurance Corp.: The company received a tax demand of Rs 117 crore from Telangana tax authorities for FY17.

Brigade Enterprise: The company acquired an additional 4.53% stake in BCV Developers. Accordingly, the shareholding of the company has increased from 62.51% to 67.04% in BCV Developers.

MOIL: The company recorded a production volume of 1.85 lakh MT, up 31% YoY for December, and sales of 11.01 lakh MT, up 40% YoY from April to December.

Sun Pharmaceutical Industries: The pharma giant acquired a 100% stake in Israel's Libra Merger. Acquisition to facilitate consolidation of the company’s business in Israel.

Hindustan Zinc: The company recorded mined metal production at 2.71 lakh metric tonnes, up 7% YoY, and refined metal production at 2.59 lakh metric tonnes, up 1% YoY.

Jubilant Foodworks: The company acquired a 6.32% stake in O2 Renewable to buy up to 4.51 MW of renewable power. The aggregate cost of acquisition is Rs 2.67 crore.

Jubilant Pharmova: The company acquired a 19.89% stake in O2 Renewable for the purchase of renewable energy power (electricity) generated from the captive generating plant for Rs 8.43 crore.

Rail Vikas Nigam: The company has signed a MoU with REC for mutual benefits by way of RVNL presenting bankable projects with assured or projected sources of revenue.

Birlasoft: The company appointed Manjunath Kygonahally as the chief executive officer of the rest of the world region, effective January 2.

Rama Steel Tubes: The company recorded a Q3 sales volume of 46,919.80 tonnes, up 31% QoQ.

GVK Power and Infrastructure: The Competition Commission of India approved the proposed acquisition of GVK Power by Punjab State Power Corp.

Stock indices in Asia declined Wednesday, tracking losses on Wall Street, as market participants' hope for a rate cut by the U.S. Federal Reserve dampened, pushing Treasury yields higher.

The S&P/ASX 200 was down 1.07% at 7,546.30, while the KOSPI in South Korea declined 1.86% to 2,620.26 as of 7:08 a.m.

Financial markets in Japan are closed until Thursday.

U.S. stocks and Treasury notes dropped as traders trimmed their bets on interest rate cuts, Bloomberg reported.

The S&P 500 index and Nasdaq Composite fell by 0.57% and 1.63%, respectively, on Tuesday. The Dow Jones Industrial Average rose by 0.07%.

Brent crude was trading 0.01% higher at $75.90 a barrel. Gold was up 0.13% to $2,061.72 an ounce.

GIFT Nifty was 0.09%, or 12 points lower, at 21,681 as of 8:10 a.m.

India's benchmark stock indices closed lower on Tuesday as information technology and banking stocks declined amid a lack of fresh triggers. The Nifty ended 76.10 points, or 0.35%, lower at 21,665.80, while the Sensex fell 379.46 points, or 0.53%, to close at 71,892.48.

Overseas investors became net buyers of Indian equities on Tuesday. Foreign portfolio investors bought stocks worth Rs 1,602.2 crore, while domestic institutional investors turned net sellers and sold equities worth Rs 1,959 crore, the NSE data showed.

The Indian rupee weakened 8 paise to close at Rs 83.32 against the U.S. dollar on Tuesday.

Stock indices in Asia declined Wednesday, tracking losses on Wall Street, as market participants' hope for a rate cut by the U.S. Federal Reserve dampened, pushing Treasury yields higher.

The S&P/ASX 200 was down 1.07% at 7,546.30, while the KOSPI in South Korea declined 1.86% to 2,620.26 as of 7:08 a.m.

Financial markets in Japan are closed until Thursday.

U.S. stocks and Treasury notes dropped as traders trimmed their bets on interest rate cuts, Bloomberg reported.

The S&P 500 index and Nasdaq Composite fell by 0.57% and 1.63%, respectively, on Tuesday. The Dow Jones Industrial Average rose by 0.07%.

Brent crude was trading 0.01% higher at $75.90 a barrel. Gold was up 0.13% to $2,061.72 an ounce.

GIFT Nifty was 0.09%, or 12 points lower, at 21,681 as of 8:10 a.m.

India's benchmark stock indices closed lower on Tuesday as information technology and banking stocks declined amid a lack of fresh triggers. The Nifty ended 76.10 points, or 0.35%, lower at 21,665.80, while the Sensex fell 379.46 points, or 0.53%, to close at 71,892.48.

Overseas investors became net buyers of Indian equities on Tuesday. Foreign portfolio investors bought stocks worth Rs 1,602.2 crore, while domestic institutional investors turned net sellers and sold equities worth Rs 1,959 crore, the NSE data showed.

The Indian rupee weakened 8 paise to close at Rs 83.32 against the U.S. dollar on Tuesday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.