Shares of SpiceJet Ltd. rose on Monday, after the company announced that its founder and promoter Ajay Singh will convert warrants worth Rs 294.09 into shares. This move will increase the consolidated shareholding of the promoters in the company to 33.47% from the earlier 29.11%.

Singh will dispose up to 3.15 crore shares of the company and use the proceeds from the sale for warrant subscription, according to an exchange filing.

"Ajay Singh, promoter of the company, is disposing up to 3.15 crore equity shares of the company and utilise the proceeds to enable Spice Healthcare Private Limited to partially fund the balance of 75% of the amount at the time of allotment of the equity shares, pursuant to exercise of option to convert said warrants," according to the company statement.

A meeting of the board members will be held on or before March 18 to approve the allotment of equity shares after conversion of warrants, the statement said.

Singh had divested nearly 1% stake in the budget airline for Rs 52 crore through an open market transaction on Thursday.

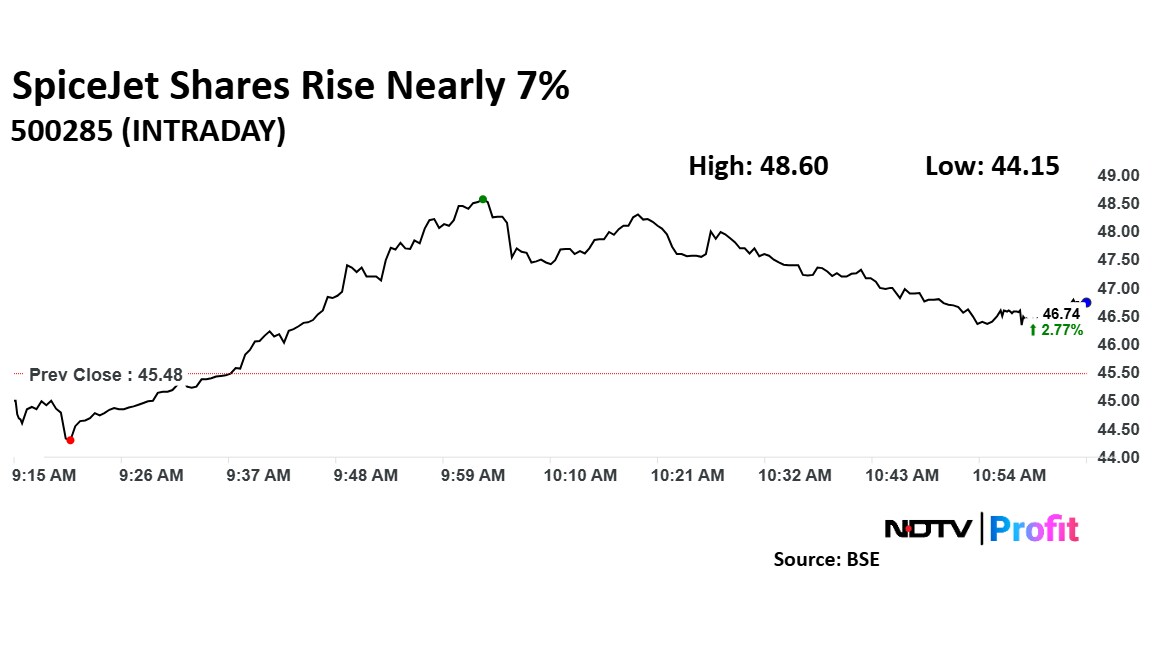

SpiceJet Share Price

Shares of SpiceJet rose as much as 6.86% to Rs 48.60 apiece, the highest level since March 13. It pared gains to trade 4.33% higher at Rs 47.45 apiece, as of 10:58 a.m. This compares to a 0.46% advance in the BSE Sensex.

The stock has fallen 22.11% in the last 12 months and 17.90% year-to-date. Total traded volume so far in the day stood at 18 times its 30-day average. The relative strength index was at 47.

Out of three analysts tracking the company, one maintains a 'buy' rating, one recommends a 'hold' and one suggests 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 21.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.