(Bloomberg) -- SoftBank Group Corp. shares surged for a third day on the explosive rally of its Arm Holdings Plc., the chip designer that has almost doubled in value since making the case last week for how it will benefit from the artificial intelligence boom.

SoftBank's stock climbed as much as 11% on Tuesday, to the highest level since May of 2021. SoftBank held onto a stake of about 90% in Arm as it took the company public last year.

Arm's shares rose 29% on Monday, pushing its gains to more than 90% since it reported financial results on Feb. 7. The company is expanding beyond its traditional base in smartphone technology into new markets like artificial intelligence applications, lifting its outlook.

“There is no doubt that Arm is a high growth stock and that it deserves a premium valuation,” Victor Galliano, an independent analyst, wrote in a note published on Smartkarma. “This is compounded by it being an AI play, adding to its credentials with growth investors.”

SoftBank founder Masayoshi Son has pledged to explore ways to use Arm's chip designs as he pursues AI-related investments. The Tokyo-based company also reported financial results last week, logging its first profit after four quarters of losses.

SoftBank has been trying to recover from a series of misplaced startup bets, and Son can now point to Arm as an example of his risk-taking paying off. Arm is becoming the crown jewel among his holdings, much like Chinese e-commerce pioneer Alibaba Group Holding Ltd. did in the past.

“Our main concern is that it now appears to be a ‘growth at any price' stock, and that this can be de-railed by an earnings disappointment,” Galliano wrote in the note. SoftBank's growing reliance on Arm is a risk as “we believe that its super-premium valuations are unsustainable.”

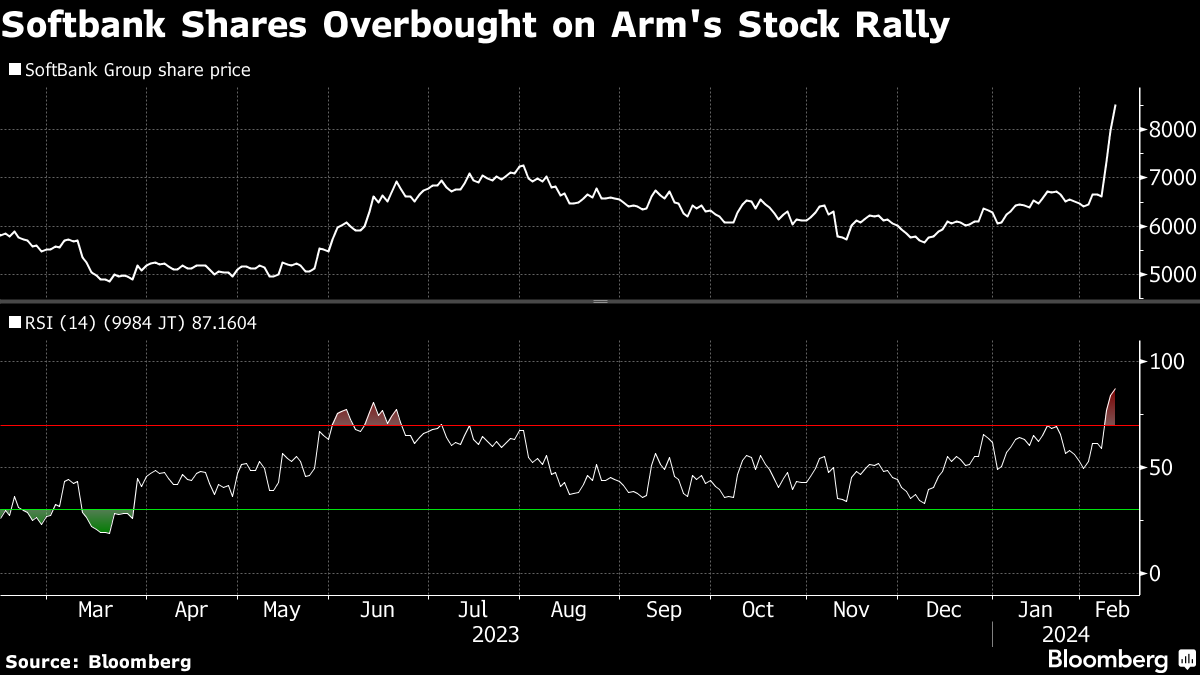

By at least one metric, SoftBank's valuation may be getting ahead of itself. Technical traders track what's known as a stock's relative strength by measuring the pace of recent price changes, suggesting whether a stock is overbought or oversold. SoftBank's 14-day relative strength index is hovering far above the key 70 mark, a sign traders sometimes interpret as an indication for a correction

Arm has already far surpassed SoftBank in terms of market value, even though the Japanese company holds such a large share of the company's equity. Arm's market valuation is now about $153 billion, while SoftBank's is about $85 billion including Tuesday's rally.

“The pace of new investments has not accelerated,” Kirk Boodry, an analyst at Astris Advisory, wrote in a note last week. “We have mixed feelings in this as SoftBank has a high cash balance and investors would like to see money being put to work.”

--With assistance from Takahiko Hyuga, Kurt Schussler and Winnie Hsu.

(Updates to add analyst comments)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.