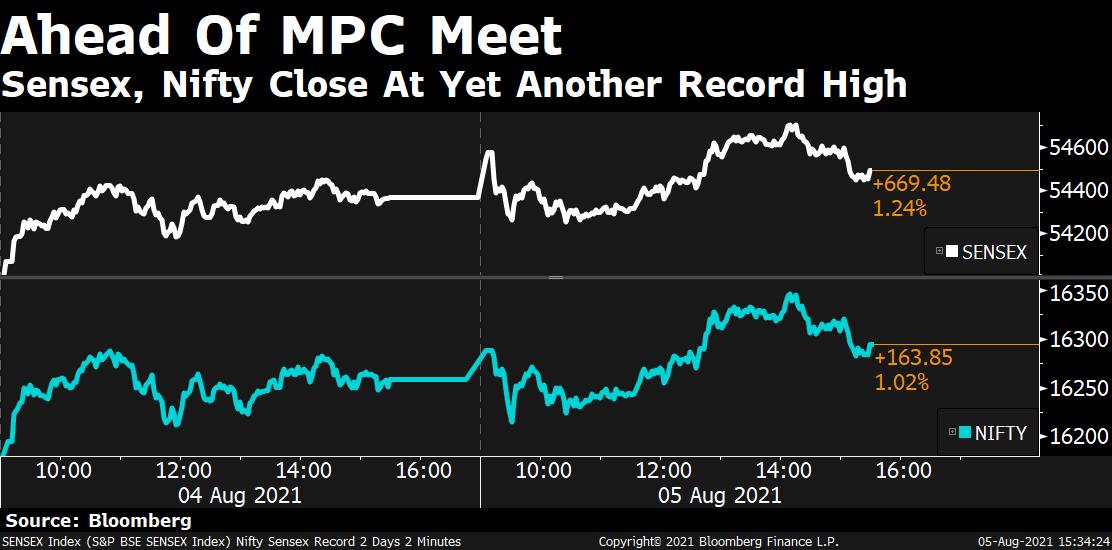

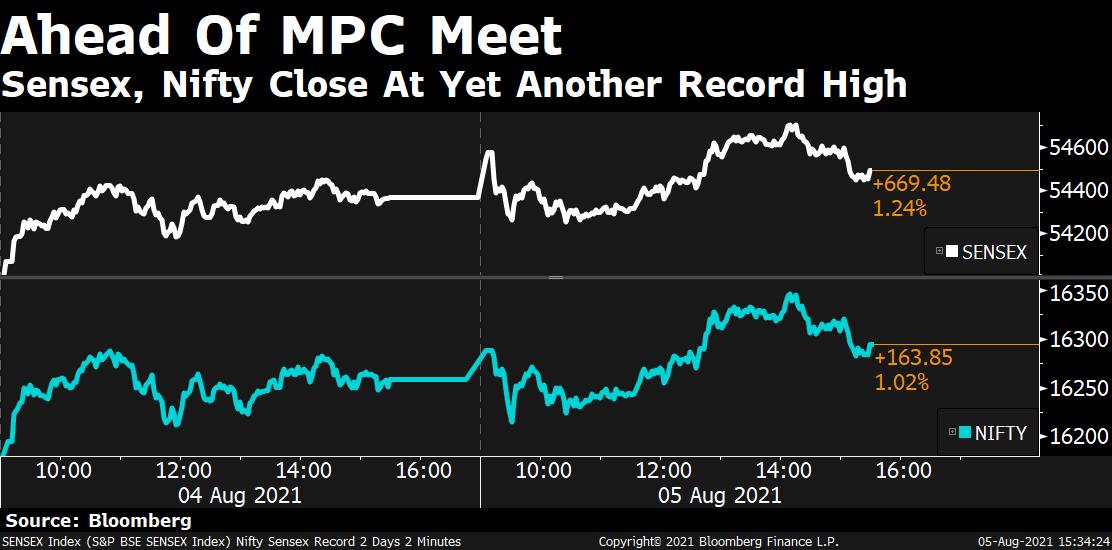

India's key equity benchmarks logged new highs for the third consecutive session ahead of RBI’s Monetary Policy Committee decision on Friday

The S&P BSE Sensex gained 0.23% to 54,492.84. The index touched a new peak of 54,717.24 in intraday trade. The NSE Nifty 50 Index rose 0.22% to 16,294.60. The 50-stock index touched a new high of 16,349.45 in intraday trade.

India's key equity benchmarks logged new highs for the third consecutive session ahead of RBI’s Monetary Policy Committee decision on Friday

The S&P BSE Sensex gained 0.23% to 54,492.84. The index touched a new peak of 54,717.24 in intraday trade. The NSE Nifty 50 Index rose 0.22% to 16,294.60. The 50-stock index touched a new high of 16,349.45 in intraday trade.

The broader markets underperformed their larger peers. The BSE MidCap remained almost unchanged while the BSE SmallCap declined nearly 0.5%. Ten out of the 19 sectoral indices compiled by the BSE Ltd. advanced, led by S&P BSE Telecom Index, up 3.5%

The market breadth was skewed in favour of bears. About 1,202 stocks advanced, 2,023 declined and 126 remained unchanged on the BSE.

India's key equity benchmarks logged new highs for the third consecutive session ahead of RBI’s Monetary Policy Committee decision on Friday

The S&P BSE Sensex gained 0.23% to 54,492.84. The index touched a new peak of 54,717.24 in intraday trade. The NSE Nifty 50 Index rose 0.22% to 16,294.60. The 50-stock index touched a new high of 16,349.45 in intraday trade.

India's key equity benchmarks logged new highs for the third consecutive session ahead of RBI’s Monetary Policy Committee decision on Friday

The S&P BSE Sensex gained 0.23% to 54,492.84. The index touched a new peak of 54,717.24 in intraday trade. The NSE Nifty 50 Index rose 0.22% to 16,294.60. The 50-stock index touched a new high of 16,349.45 in intraday trade.

The broader markets underperformed their larger peers. The BSE MidCap remained almost unchanged while the BSE SmallCap declined nearly 0.5%. Ten out of the 19 sectoral indices compiled by the BSE Ltd. advanced, led by S&P BSE Telecom Index, up 3.5%

The market breadth was skewed in favour of bears. About 1,202 stocks advanced, 2,023 declined and 126 remained unchanged on the BSE.

"Benchmark indices maintained their strong momentum, as both Nifty/Sensex registered fresh all-time highs of 16,349.45/54,717.24, respectively. After a sharp sideways movement intra-day, indices trimmed some gains in the last hour of trade. Technically, the larger texture of the market is positive and is likely to continue in the medium term. However, some profit booking at higher levels is not ruled out near 16,350-16,375 resistance levels. Trade setup suggests that the ideal strategy would be to add long positions near crucial supports. For the swing traders, 16,200 and 16,160 would be the key support level to watch out, and below the same the index would be vulnerable at 16,160 level," Shrikant Chouhan, Executive Vice President, Equity Technical Research, Kotak Securities wrote in a note.

Shares of Birla Corporation Ltd. gained 4.36% to Rs 1,424 apiece after reporting net income for the June quarter that exceeded the average analyst estimate.

June Quarter Earnings (Consolidated)

Net income at Rs 141.51 crore vs estimate of Rs 133 crore (Bloomberg Consensus)

Revenue at Rs 1,749.11 crore vs estimate of Rs 1,738 crore

Total costs at Rs 1,567.83 crore vs Rs 1,908.49 crore QoQ

Other income at Rs. 9.30 crore vs Rs 13.51 crore QoQ

All the 22 analysts tracking the company maintained ‘buy’ recommendation. The overall consensus price of analysts tracked by Bloomberg implied an upside of 1.5%.

Shares of GAIL Ltd. pared gains after reporting net income for the June quarter that missed the average analyst estimate.

First Quarter Results (Standalone)

Net profit at Rs 1,529.92 crore vs estimate of Rs 1,740 crore (Bloomberg Consensus)

Revenue at Rs 17,386.63 crore vs estimate of Rs 16,210 crore

Total expenses at Rs 15,530.48 crore vs 13,505.89 crore QoQ

Other income at Rs 197.58 crore vs Rs 568.41 crore QoQ

Of the 37 analysts tracking the company, 33 maintained ‘buy’ and 4 analysts maintained ‘hold’ recommendations. The overall consensus price of analysts tracked by Bloomberg implied an upside of 30.3%. Shares of GAIL India gained over 21% in 2021 so far.

Shares of Escorts Ltd. reversed losses and added 1.69% to Rs 1,255 apiece after reporting net income for the first quarter that beat the average analyst estimate.

June Quarter Results (Standalone)

Net income at Rs 185.20 crore vs estimate of Rs 170 crore (Bloomberg Consensus)

Revenue at Rs 1,671.49 crore vs estimate of Rs 1,620 crore

Total costs at Rs 1,472.57 crore vs Rs 1,898.83 crore QoQ

Ebitda at Rs 233.2 crore vs estimate of Rs 208 crore

Of the 25 analysts tracking the company,17 maintained ‘buy’, 5 maintained ‘hold’ and 3 analysts maintained ‘sell’ recommendations. The overall consensus price of analysts tracked by Bloomberg implied an upside of 10.7%.

Shares of Bharti Airtel Ltd. climbed 7.76% to a six month high of Rs 619 apiece. The rise comes amid the uncertainty over rival Vodafone Idea’s future.

Analysts see the ongoing consolidation in telecom industry, recent tariff hikes, industry-leading ARPU, resilient Africa business as positive triggers for the telecommunications services provider.

Of the 33 analysts tracking the company, 32 maintained ‘buy’ and 1 analyst maintained ‘hold’ recommendation. The overall consensus price of analysts tracked by Bloomberg implied an upside of 18.6%.

Shares of Bharti Airtel gained 20% in 2021 so far. The Relative Strength Index is 74 suggesting that the stock may be overbought.

Shares of Bharti Airtel Ltd. climbed 7.76% to a six month high of Rs 619 apiece. The rise comes amid the uncertainty over rival Vodafone Idea’s future.

Analysts see the ongoing consolidation in telecom industry, recent tariff hikes, industry-leading ARPU, resilient Africa business as positive triggers for the telecommunications services provider.

Of the 33 analysts tracking the company, 32 maintained ‘buy’ and 1 analyst maintained ‘hold’ recommendation. The overall consensus price of analysts tracked by Bloomberg implied an upside of 18.6%.

Shares of Bharti Airtel gained 20% in 2021 so far. The Relative Strength Index is 74 suggesting that the stock may be overbought.

Shares of Ipca Laboratories Ltd. gained 7.48% to Rs 2,244.15 apiece after reporting net income for the first quarter above average analyst estimate.

June Quarter Results

Net income at Rs. 306.67 crore vs estimate of Rs 253 crore (Bloomberg Consensus)

Revenue at 1,565.79 crore vs estimate of Rs 1,389 crore

Total costs at Rs 1,206.94 crore vs Rs 939.95 crore QoQ

Total income at Rs 1,586.80 crore vs Rs 1,134.58 crore QoQ

Of the 24 analysts tracking the company, 17 maintained ‘buy’, 6 maintained ‘hold’ and 1 analyst maintained ‘sell’ recommendation. The overall consensus price of analysts tracked by Bloomberg implied an upside of 5.3%.

Shares of Ipca Laboratories remained almost unchanged in 2021 so far compared to 13% for Nifty Pharma Index.

India's key equity benchmarks rose to new all-time highs amid steady regional trade led by telecom stocks while realty stocks declined.

The S&P BSE Sensex gained 0.31% to 54,537.64. The index touched a new peak of 54,638.36 in intraday trade. The NSE Nifty 50 Index rose 0.29% to 16,305.75. The 50-stock index touched a new high of 16,335.40 in intraday trade.

The broader markets underperformed the larger peers. The S&P BSE MidCap shed nearly 0.4% while the S&P BSE SmallCap declined over 0.6%. Thirteen out of the 19 sectoral indices compiled by the BSE Ltd. declined with S&P BSE Realty Index shedding 1.45%. On the flipside, S&P BSE Telecom index gained over 4%.

While Vodafone India shed over 20% in intraday trade after Kumar Mangalam Birla stepped down as non-executive chairman, Airtel gained nearly 7% to hit a new six-month high of Rs 614.

India's key equity benchmarks rose to new all-time highs amid steady regional trade led by telecom stocks while realty stocks declined.

The S&P BSE Sensex gained 0.31% to 54,537.64. The index touched a new peak of 54,638.36 in intraday trade. The NSE Nifty 50 Index rose 0.29% to 16,305.75. The 50-stock index touched a new high of 16,335.40 in intraday trade.

The broader markets underperformed the larger peers. The S&P BSE MidCap shed nearly 0.4% while the S&P BSE SmallCap declined over 0.6%. Thirteen out of the 19 sectoral indices compiled by the BSE Ltd. declined with S&P BSE Realty Index shedding 1.45%. On the flipside, S&P BSE Telecom index gained over 4%.

While Vodafone India shed over 20% in intraday trade after Kumar Mangalam Birla stepped down as non-executive chairman, Airtel gained nearly 7% to hit a new six-month high of Rs 614.

India's key equity benchmarks rose to new all-time highs amid steady regional trade led by telecom stocks while realty stocks declined.

The S&P BSE Sensex gained 0.31% to 54,537.64. The index touched a new peak of 54,638.36 in intraday trade. The NSE Nifty 50 Index rose 0.29% to 16,305.75. The 50-stock index touched a new high of 16,335.40 in intraday trade.

The broader markets underperformed the larger peers. The S&P BSE MidCap shed nearly 0.4% while the S&P BSE SmallCap declined over 0.6%. Thirteen out of the 19 sectoral indices compiled by the BSE Ltd. declined with S&P BSE Realty Index shedding 1.45%. On the flipside, S&P BSE Telecom index gained over 4%.

While Vodafone India shed over 20% in intraday trade after Kumar Mangalam Birla stepped down as non-executive chairman, Airtel gained nearly 7% to hit a new six-month high of Rs 614.

India's key equity benchmarks rose to new all-time highs amid steady regional trade led by telecom stocks while realty stocks declined.

The S&P BSE Sensex gained 0.31% to 54,537.64. The index touched a new peak of 54,638.36 in intraday trade. The NSE Nifty 50 Index rose 0.29% to 16,305.75. The 50-stock index touched a new high of 16,335.40 in intraday trade.

The broader markets underperformed the larger peers. The S&P BSE MidCap shed nearly 0.4% while the S&P BSE SmallCap declined over 0.6%. Thirteen out of the 19 sectoral indices compiled by the BSE Ltd. declined with S&P BSE Realty Index shedding 1.45%. On the flipside, S&P BSE Telecom index gained over 4%.

While Vodafone India shed over 20% in intraday trade after Kumar Mangalam Birla stepped down as non-executive chairman, Airtel gained nearly 7% to hit a new six-month high of Rs 614.

India's key equity benchmarks rose to new all-time highs amid steady regional trade led by telecom stocks while realty stocks declined.

The S&P BSE Sensex gained 0.31% to 54,537.64. The index touched a new peak of 54,638.36 in intraday trade. The NSE Nifty 50 Index rose 0.29% to 16,305.75. The 50-stock index touched a new high of 16,335.40 in intraday trade.

The broader markets underperformed the larger peers. The S&P BSE MidCap shed nearly 0.4% while the S&P BSE SmallCap declined over 0.6%. Thirteen out of the 19 sectoral indices compiled by the BSE Ltd. declined with S&P BSE Realty Index shedding 1.45%. On the flipside, S&P BSE Telecom index gained over 4%.

While Vodafone India shed over 20% in intraday trade after Kumar Mangalam Birla stepped down as non-executive chairman, Airtel gained nearly 7% to hit a new six-month high of Rs 614.

India's key equity benchmarks rose to new all-time highs amid steady regional trade led by telecom stocks while realty stocks declined.

The S&P BSE Sensex gained 0.31% to 54,537.64. The index touched a new peak of 54,638.36 in intraday trade. The NSE Nifty 50 Index rose 0.29% to 16,305.75. The 50-stock index touched a new high of 16,335.40 in intraday trade.

The broader markets underperformed the larger peers. The S&P BSE MidCap shed nearly 0.4% while the S&P BSE SmallCap declined over 0.6%. Thirteen out of the 19 sectoral indices compiled by the BSE Ltd. declined with S&P BSE Realty Index shedding 1.45%. On the flipside, S&P BSE Telecom index gained over 4%.

While Vodafone India shed over 20% in intraday trade after Kumar Mangalam Birla stepped down as non-executive chairman, Airtel gained nearly 7% to hit a new six-month high of Rs 614.

India's key equity benchmarks rose to new all-time highs amid steady regional trade led by telecom stocks while realty stocks declined.

The S&P BSE Sensex gained 0.31% to 54,537.64. The index touched a new peak of 54,638.36 in intraday trade. The NSE Nifty 50 Index rose 0.29% to 16,305.75. The 50-stock index touched a new high of 16,335.40 in intraday trade.

The broader markets underperformed the larger peers. The S&P BSE MidCap shed nearly 0.4% while the S&P BSE SmallCap declined over 0.6%. Thirteen out of the 19 sectoral indices compiled by the BSE Ltd. declined with S&P BSE Realty Index shedding 1.45%. On the flipside, S&P BSE Telecom index gained over 4%.

While Vodafone India shed over 20% in intraday trade after Kumar Mangalam Birla stepped down as non-executive chairman, Airtel gained nearly 7% to hit a new six-month high of Rs 614.

India's key equity benchmarks rose to new all-time highs amid steady regional trade led by telecom stocks while realty stocks declined.

The S&P BSE Sensex gained 0.31% to 54,537.64. The index touched a new peak of 54,638.36 in intraday trade. The NSE Nifty 50 Index rose 0.29% to 16,305.75. The 50-stock index touched a new high of 16,335.40 in intraday trade.

The broader markets underperformed the larger peers. The S&P BSE MidCap shed nearly 0.4% while the S&P BSE SmallCap declined over 0.6%. Thirteen out of the 19 sectoral indices compiled by the BSE Ltd. declined with S&P BSE Realty Index shedding 1.45%. On the flipside, S&P BSE Telecom index gained over 4%.

While Vodafone India shed over 20% in intraday trade after Kumar Mangalam Birla stepped down as non-executive chairman, Airtel gained nearly 7% to hit a new six-month high of Rs 614.

Shares of Borosil Renewables Ltd. gained 4.99% to Rs 317.70 apiece after the company reported June quarter numbers post market hours Wednesday.

Net profit and revenue declined sequentially in the June quarter. The company said that it will increase production capacity of its third furnace (SG-3), being installed at its manufacturing facility at Bharuch, Gujarat, from 500 MT to 550 MT per day. The proposed capacity is expected to be commissioned by July 2022.

June Quarter Results

Net profit at Rs. 39.62 crore vs Rs 66.87 crore QoQ

Revenue at Rs 136.13 crore vs Rs 193.98 crore QoQ

Total expenses at Rs 86.66 crore vs Rs 102.88 crore QoQ

Total income at Rs 142.51 crore vs Rs 196.90 crore QoQ

Shares of Borosil Renewables added 5.7% in 2021 so far compared to 14.8% gains for S&P BSE Sensex Index.

Shares of Metals and Minerals Trading Corporation Ltd. shed 4.96% to Rs 46 apiece after the company said that it may need to make significant provision in the accounts for 2020-21 due to a Supreme Court order.

In an exchange filing, MMTC said it is working out details of the Supreme Court order in MMTC vs Anglo American Metallurgical Coal Pty Ltd. Due to this, the annual accounts for FY21 may be delayed.

The company said is exploring all legal remedies and has informed the markets regulator SEBI of the situation.

Shares of Shipping Corporation of India Ltd. gained 3.59% to Rs 112.40 apiece after the board of directors approved the demerger of non-core assets into a new company.

The demerger is aimed at facilitating the government’s strategic disinvestment process of the company in an effective, efficient and rapid manner and also to unlock the value of the business assets, the company said in an exchange filing post market hours on Wednesday.

Shareholders will get 1 share in the new company for every share they held in the state-run shipping company. Shares of Shipping Corporation of India added over 25% in 2021 so far.

Retail investors led subscription in the four IPOs of Devyani International Ltd., Krsnaa Diagnostics Ltd., Exxaro Tiles Ltd. and Windlas Biotech Ltd. on the second day of the issues.

The offers of Exxaro Tiles and Windlas Biotech were subscribed 8.22 and 6.08 times, while Devyani International and Krsnaa Diagnostics were subscribed 5.18 and 4.08 times respectively at the time the Indian markets closed.

Follow the subscription updates live here:

Shares of Hindustan Petroleum Corporation Ltd. shed 3.58% to Rs 262.50 after reporting net income for the first quarter below the average analyst estimate.

June Quarter Results (Standalone)

Net profit at Rs 1,795 crore vs estimate of Rs 2,061.7 crore (Bloomberg consensus)

Revenue at Rs 72,443.4 crore vs estimate of Rs 73,830.3 crore

Other income at Rs 372 crore vs Rs 544.57 crore QoQ

Total expenses at Rs 75,560.66 crore vs Rs 81,679.61 crore QoQ

In an exchange filing, HPCL’s Chairman and Managing Director MK Surana said that the company expects to see further improvement in cracks and diesel demand by the end of this fiscal.

Of the 38 analysts tracking the company, 31 maintained ‘buy’ and 7 analysts maintained ‘hold’ recommendation. The overall consensus price of analysts tracked by Bloomberg implied an upside of 30.1%. Shares of HPCL added 31% in 2021 so far.

Shares of Sonata Software Ltd climbed 9.41% to a new record high of Rs 884.40 apiece after the company reported a sequential growth in net profit and revenue in the June quarter post market hours on Wednesday.

First Quarter Results (Consolidated)

Net profit at Rs 86.73 crore vs Rs 83.06 crore QoQ

Revenue at Rs 1,268.54 crore vs Rs 1,075.71 crore QoQ

Total costs at Rs 1,181.87 crore vs Rs 985.56 crore QoQ

Other income at Rs 28.15 crore vs Rs 18.92 crore QoQ

Of the 7 analysts tracking the company, 6 maintained ‘buy’ and 1 analyst maintained ‘sell’ recommendation. The overall consensus price of analysts tracked by Bloomberg implied a downside of 12%. Shares of Sonata Software gained nearly 115% in 2021 so far.

The Relative Strength index is 72, suggesting that the stock may be in overbought territory.

Shares of Sumitomo Chemical India Ltd. added 6.69% to hit a new record high of Rs 459.90 apiece. The company reported sequential growth in net income and revenue in the June quarter post market hours on Wednesday.

June Quarter Numbers

Net Income at Rs 105.75 crore vs Rs 54.1 crore QoQ

Revenue at Rs 782 crore vs Rs 534.3 crore QoQ

Total Expenses at Rs 645.1 crore vs Rs 477.54 crore QoQ

Other income at Rs. 5.43 crore vs Rs 4.67 crore QoQ

Of the 10 analysts tracking the company, 7 maintained ‘buy’ and 3 analysts maintained ‘hold’ recommendations. The overall consensus price of analysts tracked by Bloomberg implied a downside of 19.3%. Shares of Sumitomo Chemical India gained over 50% in 2021 so far.

Shares of Vodafone Idea Ltd. shed 20% to Rs. 4.80 apiece, lower than any close since May 18, 2020. The decline comes a day after Kumar Mangalam Birla stepped down as the chairman of the company.

In an exchange filling, Vodafone Idea said that its board accepted Birla’s request to down. The survival of Vodafone Idea is in doubt after the apex court rejected the plea of telecom operators to change the pending AGR dues.

Out of the 23 analysts tracking the company, 1 maintained ‘buy’, 6 maintained ‘hold’ and 16 analysts maintained ‘sell’ recommendation. The overall consensus price of analysts tracked by Bloomberg implied an upside of 31.6%.

Shares of Vodafone Idea shed over 50% in 2021 so far as compared to 14% gains for S&P BSE Telecom index. The relative strength index is 17 suggesting that the stock may be oversold.

SBI Life Insurance Co. had about 19 million shares change hands in a pre-market bunched trade, according to data compiled by Bloomberg.

Buyers, sellers were not immediately known

SBI Life shares were trading 1.4% higher, having gained as much as 3.4%

India's key equity benchmarks rose to new all-time highs amid steady regional trade as investors bet that Asia’s third-largest economy will keep the stimulus taps flowing to recover from a deadly wave of the coronavirus.

India's key equity benchmarks rose to new all-time highs amid steady regional trade as investors bet that Asia’s third-largest economy will keep the stimulus taps flowing to recover from a deadly wave of the coronavirus.

The S&P BSE Sensex was little changed at 54,336.59, after rising nearly 0.4% to a record high of 54,576.64. The NSE Nifty too gained by a similar magnitude to new high of 16,294.65, before paring all of its gains.

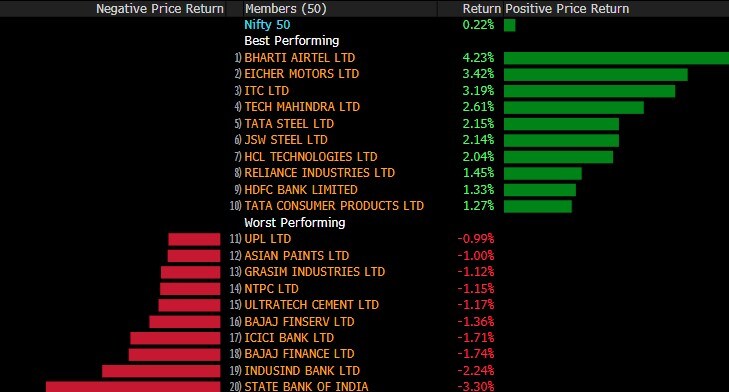

ICICI Bank Ltd. contributed the most to the index decline, decreasing 0.6%. IndusInd Bank Ltd. had the largest drop, falling 2.4%.

So far this week, the index rose 3%, heading for the biggest advance since the week ended May 23.

India's key equity benchmarks rose to new all-time highs amid steady regional trade as investors bet that Asia’s third-largest economy will keep the stimulus taps flowing to recover from a deadly wave of the coronavirus.

India's key equity benchmarks rose to new all-time highs amid steady regional trade as investors bet that Asia’s third-largest economy will keep the stimulus taps flowing to recover from a deadly wave of the coronavirus.

The S&P BSE Sensex was little changed at 54,336.59, after rising nearly 0.4% to a record high of 54,576.64. The NSE Nifty too gained by a similar magnitude to new high of 16,294.65, before paring all of its gains.

ICICI Bank Ltd. contributed the most to the index decline, decreasing 0.6%. IndusInd Bank Ltd. had the largest drop, falling 2.4%.

So far this week, the index rose 3%, heading for the biggest advance since the week ended May 23.

The broader markets underperformed their larger peers. The S&P BSE MidCap index fell 0.4% while the S&P BSE SmallCap was down nearly 1%. Fourteen of the 19 sectoral indices compiled by the BSE Ltd fell, led by the S&P BSE Realty index.

The market breadth was skewed in favour of the bears. About 1,897 stocks declined, 692 rose and 74 remained unchanged.

Earnings for Indian companies have been lackluster, with 21 of the 34 Nifty firms that have announced so far missing analyst estimates.

Bonds and the rupee could get a boost from easing crude oil prices ahead of the Indian central bank’s monetary policy review on Friday.

10-year yields little changed at 6.2% on Wednesday

“The upcoming policy will see the MPC re-emphasizing its commitment to keeping policy accommodative for the foreseeable future and maintaining comfortable liquidity,” Madhavi Arora, economist at Emkay Global Financial Service wrote in a note

Recent inflation surprises are unlikely to derail the RBI’s narrative that growth is still sub-par, especially with inflation ahead likely falling back to sub 6% - within its flexible target

We do not see any split in the voting pattern on the accommodative stance

We reckon the RBI will continue to strive to fix the artificially skewed yield curve and maintain its preference for curve flattening

The RBI may have to stretch GSAP/OMOs beyond Rs 4.5 lakh crore+ to manage the impending demand-supply mismatch

SBI Life Holder CA Emerald to sell 19 million shares: Terms

Windlas Biotech Ltd.’s Rs 401.5-crore issue was subscribed 3.18 times.

The Rs 1,213-crore initial public offering of Krsnaa Diagnostics was subscribed 1.98 times.

Exxaro Tiles Ltd.’s Rs 161-crore initial public offering was subscribed 4.67 times.

Devyani International Ltd.’s Rs 1,838-crore issue was subscribed 2.69 times.

Nuvoco Vistas sets price range for up to $674 million IPO at Rs 560-570/share, offer open Aug. 9-11

Chemplast Sanmar sets Rs 530-541 a share range for IPO

Aptus Value Housing Finance India IPO range set at Rs 346-353 a share

Asian stocks were steady Thursday as investors assessed mixed U.S. economic data and comments from a Federal Reserve official that the central bank is on course to taper stimulus support.

Equities edged up in Japan and Hong Kong and wavered in China, were Beijing’s regulatory curbs continue to dominate the agenda. The S&P 500 fell from a record overnight, led lower by energy shares, while the technology sector proved more resilient. U.S. contracts climbed in Asian trading.

India’s SGX Nifty 50 Index futures for Aug. delivery was little changed at 16,267 while MSCI Asia Pacific Index was 0.3% higher. NSE Nifty 50 Index rose 0.8% Wednesday to a 16,258.8.

Vice Chairman Richard Clarida said the Fed is on track for a liftoff in interest rates in 2023 and an announcement later this year on paring bond purchases. Clarida’s comments helped to cement money-market bets for an initial rate hike in early 2023. Treasury yields advanced and the dollar held a climb.

Oil steadied below $70 a barrel after a three-day slump exacerbated by the coronavirus resurgence.

Clarida painted an upbeat picture of the outlook while acknowledging that the rapid spread of the delta virus strain poses a downside risk. Global stocks remain close to all-time highs as investors assess the Fed outlook, robust earnings and the challenges to economic reopening from Covid-19. China’s regulatory crackdown on private industries also remains in focus.

Back home, Titan, Apollo Tyres, HPCL and Adani Total Gas may react as the companies reported quarterly results after the market closed on Wednesday. Cipla, GAIL India, Gujarat Gas, Adani Power and REC Ltd. are among companies scheduled to report earnings Thursday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.