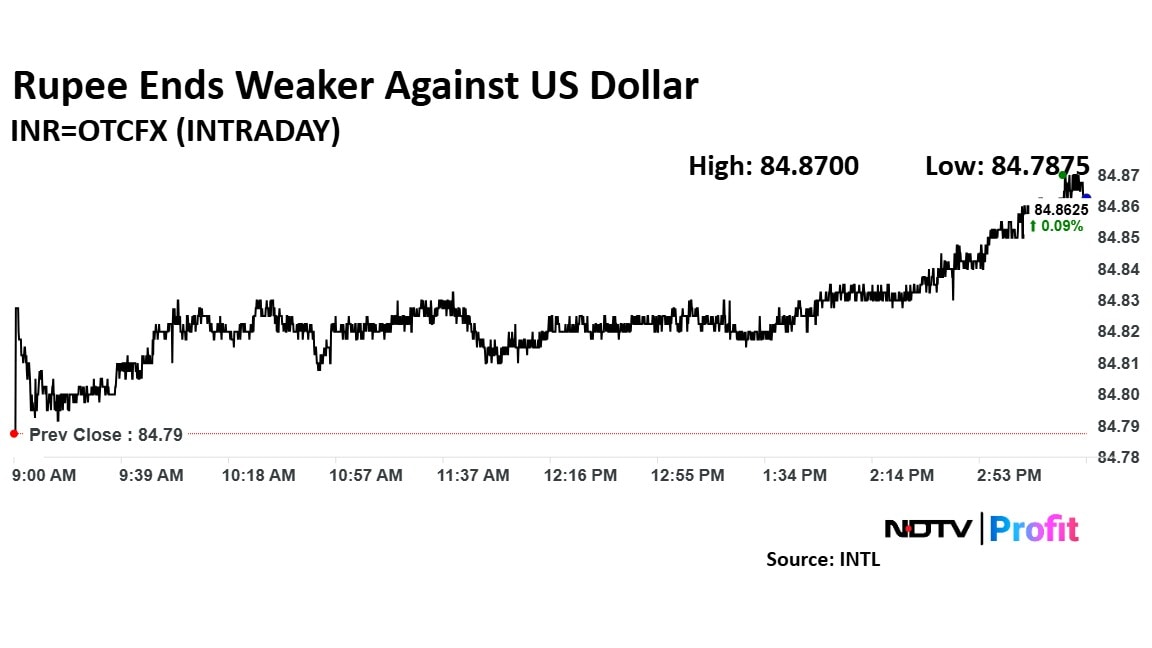

The Indian rupee closed weaker on Monday ahead of major central banks' rate decisions this week. The currency weakened by 8 paise to close at 84.87 against the US Dollar. It had closed at 84.79 on Friday.

The US Dollar Index was down 0.13% at 106.8620. While the Brent crude was down 0.60% at $73.89 per barrel.

The depreciation that the currency faced was attributed to the Reserve Bank of India's announcement of leadership transition, according to Amit Pabari, managing director of CR Forex Advisors.

With Shaktikanta Das being replaced by the incoming Sanjay Malhotra, the shift initially introduced a wave of uncertainty, though markets quickly adjusted, he said. Given this context, the RBI kept a close eye on banking system liquidity and opted for a buy-sell swap to provide much-needed support to the Rupee.

"Additionally, Foreign Institutional Investors turning net buyers in December, following significant outflows in the past two months, is expected to lend further stability to the domestic currency," he said.

A host of central banks will be announcing their monetary policy decisions this week. The US Federal Reserve, Bank of Japan, and central banks in Pakistan, Thailand, and Indonesia will reveal their stances on benchmark lending rates, signaling their future rate trajectories.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.