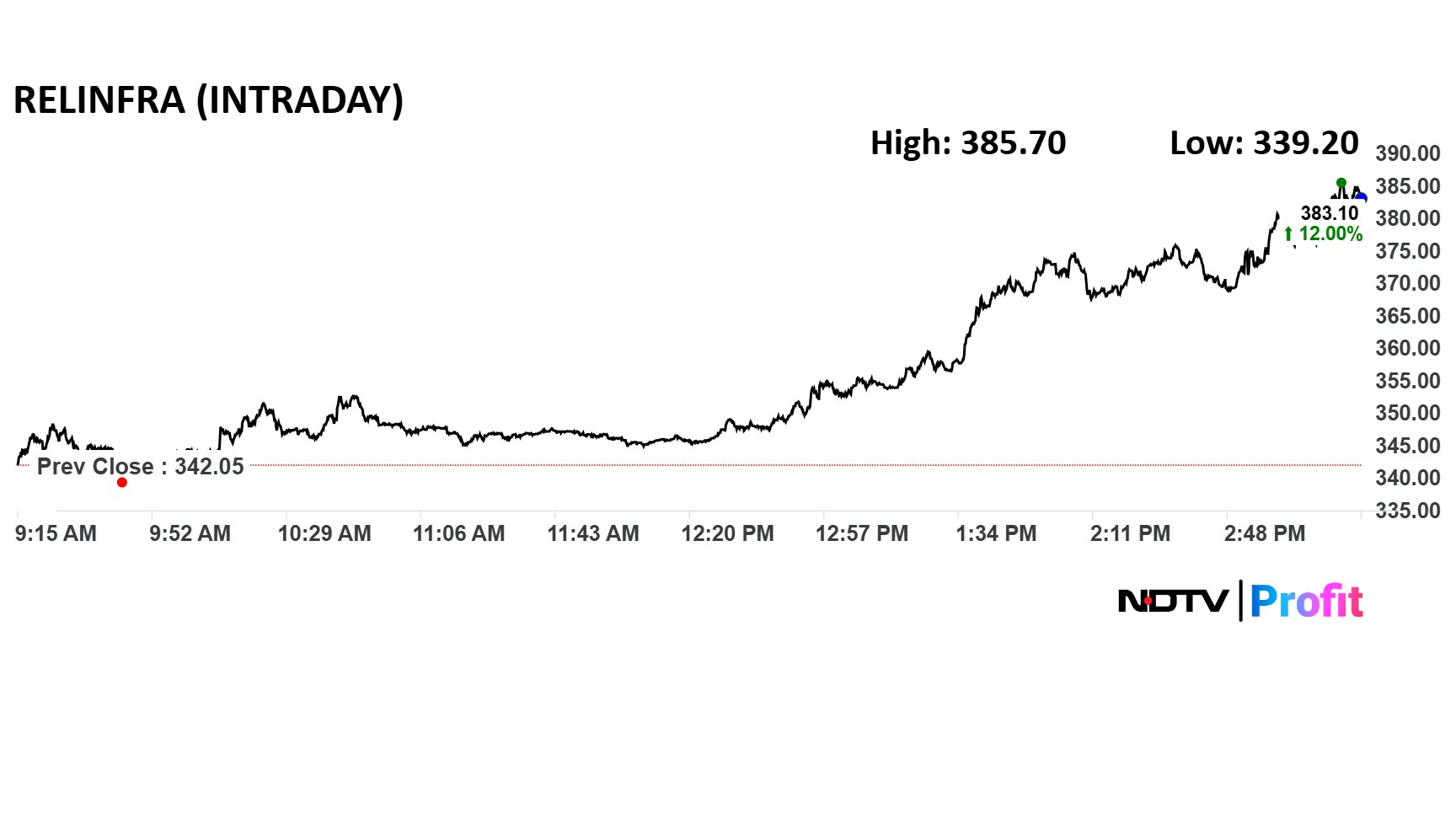

Reliance Infrastructure Ltd.'s stock jumped 13% on Wednesday after the National Company Law Appellate Tribunal suspended an order passed by the National Company Law Tribunal that admitted the company into the insolvency resolution process.

The Mumbai branch of the NCLT passed that order on May 30. The plea to admit Reliance Infra into insolvency was filed by the IDBI Trusteeship back in April 2022, alleging a default of Rs 88.68 crore, and an interest of 1.25% a month.

The default was on payment of 10 invoices raised between 2017 and 2018 by Dhursar Solar Power Pvt. for supplying solar energy to Reliance Infrastructure. IDBI Trusteeship, being the security trustee of DSPPL, sought payments against the invoices from Reliance Infrastructure.

Reliance Infrastructure on Monday argued that it has made the full payment of Rs 92.68 crore to Dhursar Solar Power towards claims of tariff, making the initiation of insolvency proceedings infructuous.

"The NCLT order has become infructuous as legally advised, upon full payment having already been made," the company said.

The Anil Ambani group company then appealed before the NCLAT for withdrawal of the order.

Reliance Infra shares hit a 52-week high of Rs 385.7 apiece after the announcement, before settling 11.3% higher at Rs 380.6 apiece. The benchmark NSE Nifty 50 ended 0.3% up. The stock has risen 144% in the last 12 months and 25% so far this year.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.