Shares of Cholamandalam Financial Holdings Ltd., IIFL Finance Ltd., Muthoot Finance Ltd., Cholamandalam Investment and Finance Co. and Manappuram Finance Ltd. declined after the Reserve Bank of India announced it will issue comprehensive regulations on prudential norms for gold loans.

The announcement came during the first Monetary Policy Committee meeting of fiscal 2026, where Governor Sanjay Malhotra announced a 25 basis point cut in the repo rate.

The new gold loan framework aims to harmonise rules across regulated entities, while factoring in their differing risk profiles, the RBI said.

In addition, the central bank proposed fresh norms for non-fund based facilities to bring regulatory uniformity across lenders. It also plans to revise instructions related to partial credit enhancement, with the goal of broadening funding avenues for infrastructure projects.

The RBI further intends to enable securitisation of stressed assets through a market-based mechanism, extending beyond the current framework that applies only to standard assets. Separately, the co-lending model—currently restricted to priority sector loans—will now be expanded to cover all loans and all regulated entities.

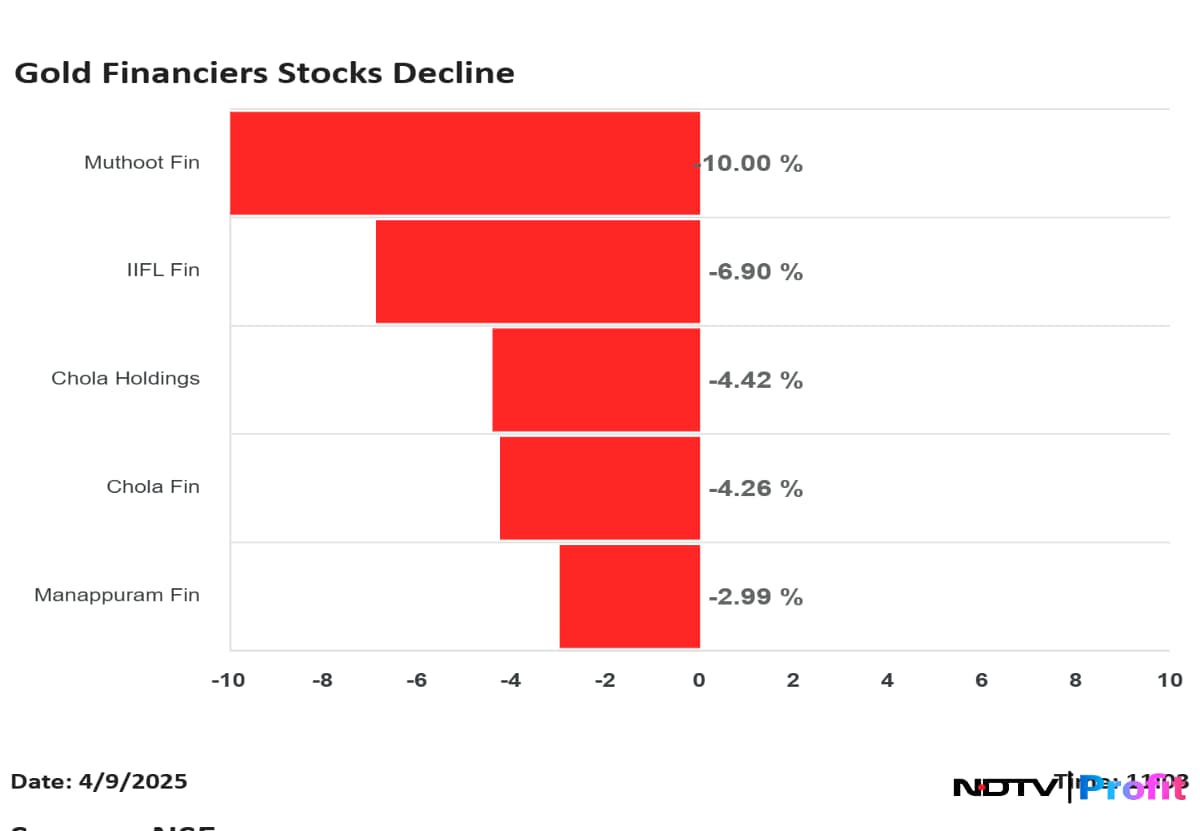

Gold Loan Financiers Shares Decline

Muthoot Finance declined as much as 8.61% to Rs 2,095.25.

IIFL Finance was down as much as 5.43% to Rs 315.45.

Cholamandalam Investment and Finance fell as much as 4.6% to Rs 1,396.05.

Cholamandalam Financial Holdings declined as much as 4.27% to Rs 1,645.

Manappuram Finance declined as much as 1.88% to Rs 224.75.

This is compared to an 0.57% decline in the benchmark Nifty 50 as of 10:50 a.m.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.