Shares of JSW Steel Ltd., NTPC Ltd. and Ashoka Buildcon Ltd. were in focus on Monday, after the companies announced their fourth quarter results.

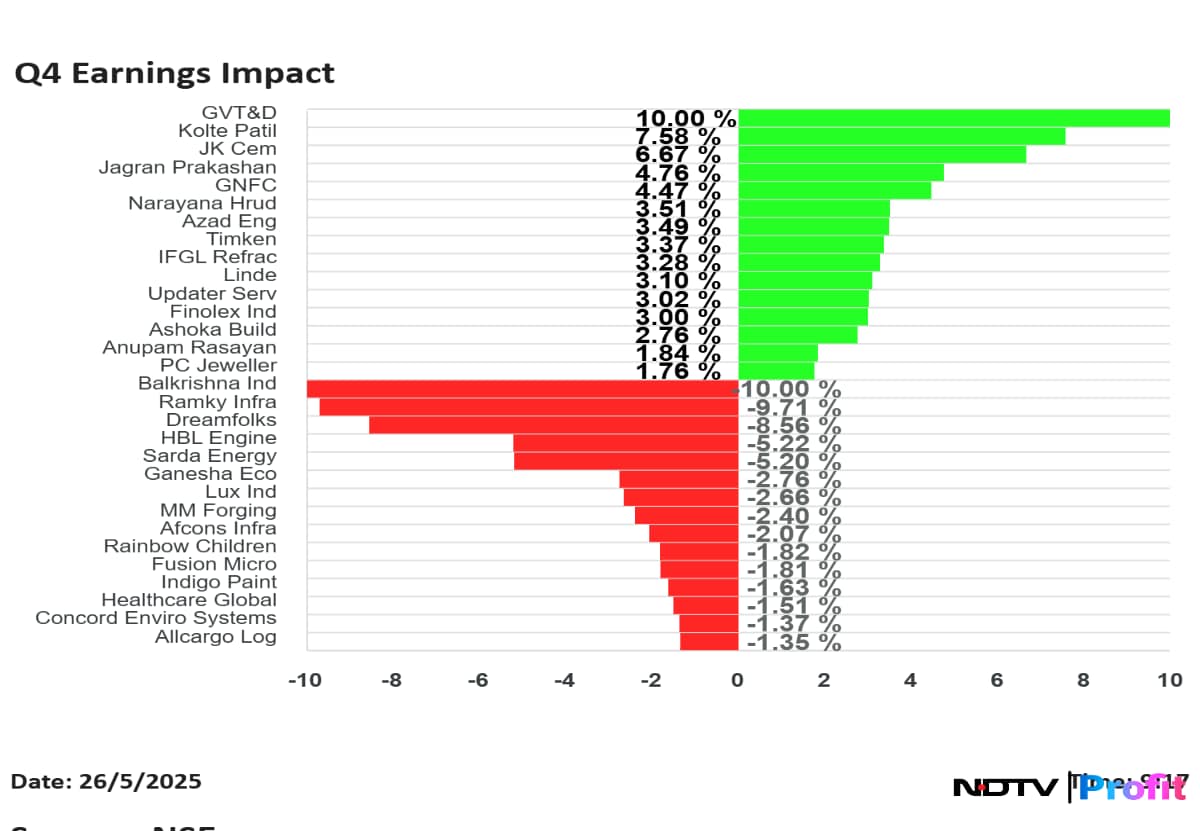

JK Cements Ltd. shares rose the most, while Dreamfolks Ltd. fell the most, among the companies that announced their results for quarter ended March.

JSW Steel Q4 Highlights (Consolidated, QoQ)

Share price rose 1.39% at Rs 1,022.50.

Revenue up 8.3% to Rs 44,819.00 crore versus Rs 41,378.00 crore (Bloomberg estimate: Rs 44,720 crore)

Ebitda up 14.3% to Rs 6,378 crore versus Rs 5,579 crore (Bloomberg estimate: Rs 6,548 crore)

Margin at 14.2% versus 13.5% (Bloomberg estimate: 14.6%)

Net profit up 109.6% to Rs 1,503 crore versus Rs 717 crore (Bloomberg estimate: Rs 1,608 crore)

Exceptional items at Rs 44 crore vs Rs 103 crore.

India capacity utilisation of 93% in Q4, 91% in FY25.

Consolidated crude steel production of 7.63 MT in Q4 (up 12% YoY), 27.79 MT in FY25 (up 5% YoY).

Consolidated steel sales of 7.49 MT in Q4 (up 11% YoY), 26.45 MT in FY25 (up 7% YoY).

Domestic sales up 30% YoY, while exports fell 58% YoY in Q4 FY25.

Domestic sales up 15% YoY, while Exports fell 39% YoY in FY25.

FY25 Guidance Achievement: Production 98% & Sales 98%.

Guidance of total consolidated volumes for FY26: Production 30.5 MT & Sales 29.2 MT.

Dreamfolks Services Q4 FY25 Results Highlights (Consolidated, YoY)

Share price down 17.16% at Rs 234.31.

Revenue up 11.7% at Rs 314.1 crore versus Rs 281.1 crore.

Ebitda down 19.1% at Rs 19.9 crore versus Rs 24.6 crore.

Margin at 6.3% versus 8.8%.

Net profit down 17.2% at Rs 14.9 crore versus Rs 18 crore.

Azad Engineering Q4 FY25 Results Highlights (Consolidated, YoY)

Share price rises 4.48% at Rs 1,873.90.

Revenue up 36.9% at Rs 126.9 crore versus Rs 92.7 crore.

Ebitda up 45.8% at Rs 45.5 crore versus Rs 31.2 crore.

Margin at 35.9% versus 33.7%.

Net profit up 69% at Rs 25.2 crore versus Rs 14.9 crore.

Balkrishna Industries Q4 FY25 Results Highlights (Standalone, YoY)

Share price falls 7.53% at Rs 2,460.

Revenue up 2.8% to Rs 2,746.6 crore versus Rs 2,673 crore (Bloomberg estimate: Rs 2716.5 crore).

Ebitda down 9.6% to Rs 602 crore versus Rs 665 crore (Bloomberg estimate: Rs 691 crore).

Margin at 21.9% versus 24.9% (Bloomberg estimate: 25.4%).

Net profit down 24.7% to Rs 362 crore versus Rs 481 crore (Bloomberg estimate: Rs 448.5 crore).

Glenmark Pharma Q4 FY25 Results Highlights (Consolidated, YoY)

Share price down 3.53% at Rs 1,370.

Revenue up 6.3% at Rs 3,256 crore versus Rs 3,063 crore (Bloomberg estimate: Rs 3,365 crore).

Ebitda up 11% at Rs 561 crore versus Rs 504 crore (Bloomberg estimate: Rs 598 crore).

Margin at 17.2% versus 16.5% (Bloomberg estimate: 17.8%).

Net profit at Rs 4.7 crore versus a loss of Rs 1,218 crore (Bloomberg estimate: Rs 344 crore).

Exceptional Item of Rs 373 crore vs 447 crore.

Loss in Q4FY24 due to higher tax expense of Rs 1,769 crore.

Reliance Infrastructure Q4 FY25 Results Highlights (Consolidated, YoY)

Share price falls 1.38% at Rs 301.25.

Revenue down 12.3% at Rs 4,108 crore versus Rs 4,686 crore.

Ebitda down 95.5% at Rs 14.3 crore versus Rs 317.3 crore.

Margin at 0.3% versus 6.8%.

Net profit at Rs 4,387 crore versus a loss of Rs 220.6 crore.

Note: Regulatory Income (net of deferred tax) of Rs 8,274 crore. Exceptional item of Rs 514 crore in Q4FY25 compared to Rs 220 crore in Q4FY24.

Anupam Rasayan Q4 FY25 Results Highlights (Consolidated, YoY)

Share price rises 4.74% at Rs 983.20.

Revenue up 24.7% at Rs 500 crore versus Rs 401 crore.

Ebitda up 55.8% at Rs 144.3 crore versus Rs 92.6 crore.

Margin at 28.9% versus 23.1%.

Net Profit up 44% at Rs 44.5 crore versus Rs 30.9 crore.

Performance supported by growth in pharma and polymer coupled with strong performance from Tanfac.

Q4 saw meaningful improvement with sales increasing both year-on-year and sequentially.

Linde India Q4 FY25 Results Highlights (Consolidated, YoY)

Share price rises 4.03% at Rs 7,338.50.

Revenue down 6.1% at Rs 591.8 crore versus Rs 630 crore.

Ebitda up 17.6% at Rs 209.8 crore versus Rs 178.4 crore.

Margin at 35.5% versus 28.3%.

Net profit up 12.3% at Rs 118.4 crore versus Rs 105.4 crore.

GE Vernova Q4 FY25 Results Highlights (YoY)

Share price rises 10% at Rs 2,073.60.

Revenue up 26% at Rs 1,153 crore versus Rs 913.6 crore.

Ebitda at Rs 252 crore versus Rs 110.9 crore.

Margin at 21.9% versus 12.1%.

Net Profit at Rs 186.4 crore versus Rs 66.2 crore.

Lux Industries Q4 FY25 Results Highlights (Consolidated, YoY)

Share price falls 3.41% at Rs 531.20.

Revenue up 15.6% at Rs 817.7 crore versus Rs 707.6 crore.

Ebitda up 1.4% at Rs 76.6 crore versus Rs 75.6 crore.

Margin at 9.4% versus 10.7%.

Net profit down 13.4% at Rs 48.1 crore versus Rs 55.5 crore.

Cello World Q4 Highlights (Consolidated, YoY)

Share price falls 1.03% at Rs 608.

Revenue up 14.9% to Rs 588.8 crore versus Rs 512.5 crore.

Ebitda up 1.4% to Rs 135.2 crore versus Rs 133.3 crore.

Margin at 23% versus 26%.

Net profit down 0.7% to Rs 88.2 crore versus Rs 88.8 crore.

Gujarat Narmada Valley Q4 Earnings (Consolidated, YoY)

Share price rises 4.95% at Rs 538.80.

Revenue down 2.6% at Rs 2,055 crore versus Rs 2,110 crore.

Ebitda up 65.5% at Rs 240 crore versus Rs 145 crore.

Margin at 11.7% versus 6.9%.

Net profit up 62.3% at Rs 211 crore versus Rs 130 crore.

To pay dividend of Rs 18 per share.

Ebitda uptick due to a 14%, 9%,10% downtick in employee expenses, other expenses and the cost of materials.

Afcons Infra Q4 Highlights (Consolidated, YoY)

Share price falls 2.64% at Rs 433.55.

Revenue down 11.4% to Rs 3,223 crore versus Rs 3,636 crore.

Ebitda down 17.3% to Rs 294 crore versus Rs 355 crore.

Margin at 9.1% versus 9.8%.

Net profit slips 23.4% to Rs 111 crore versus Rs 145 crore.

Dividend of Rs 2.5 per share declared.

Timken India Q4 Highlights (YoY)

Share price rises 6.16% at Rs 3,130.

Net profit up 32% at Rs 186.8 crore versus Rs 141.4 crore.

Revenue up 4.7% at Rs 939.8 crore versus Rs 897.8 crore.

Ebitda up 5.6% at Rs 209.7 crore versus Rs 198.7 crore.

Margin at 22.3% versus 22.1%.

Aditya Birla Fashion Q4 Highlights (Consolidated, YoY)

Share price rises 1.92% at Rs 90.25.

Revenue up 9.2% at Rs 1,719.5 crore versus Rs 1,575 crore.

Ebita At Rs 205 crore versus Rs 35 crore.

Margin at 12% versus 2.2%.

Net loss at Rs 161 crore versus loss of Rs 287 crore.

Narayana Hrudayalaya Q4 Highlights (Consolidated, YoY)

Share price rises 3.80% at Rs 1,789.90.

Revenue up 18.4% at Rs 1,475 crore versus Rs 1,246 crore.

Ebitda up 22.9% at Rs 357.7 crore versus Rs 291 crore.

Margin at 24.2% versus 23.4%.

Net profit up 3.4% at Rs 197.2 crore versus Rs 190.7 crore.

Final dividend of Rs 4.5/share declared.

Fusion Finance Q4FY25 Highlights (Standalone, YoY)

Share price falls 3.08% at Rs 170.71.

Total Income down 29.5% to Rs 476 crore versus Rs 675 crore

Net Loss of Rs 165 crore versus Profit of Rs 133 crore

AUM at Rs 8,980 crore versus Rs 11,476 crore in Q4FY24

NIM at 8.6% versus 11.6% in Q4FY24

GNPA at 7.9% versus 12.6% (QoQ)

NNPA at 0.3% versus 1.7% (QoQ)

IFGL Refractories Q4FY25 Highlights (Consolidated, YoY)

Share price rises 4.98% at Rs 525.

Revenue up 14% to Rs 448 crore versus Rs 394 crore

Ebitda down 5.7% to Rs 33 crore versus Rs 35 crore

Ebitda margin at 7.3% versus 8.8%

Net profit down 38% to Rs 8 crore versus Rs 13 crore (impacted by lower other income)

PC Jeweller Q4FY25 Highlights (Consolidated, YoY)

Share price rises 4.06% at Rs 13.60.

Revenue at Rs 699 crore versus Rs 48.5 crore

Ebitda at Rs 145 crore versus Loss of Rs 1.6 crore

Margin at 20.7%

Net Profit at Rs 94.8 crore versus Loss of Rs 122 crore

Healthcare Global Enterprises Q4FY25 Highlights (Consolidated, YoY)

Share price falls 1.94% at Rs 583.10.

Revenue up 18.2% to Rs 585 crore versus Rs 495 crore

Ebitda at Rs 106 crore versus Rs 92 crore

Ebitda margin at 18.11% versus 18.5%

Net profit down 71% to Rs 7 crore versus Rs 23 crore (due to exceptional gain last year and higher tax)

Concord Enviro Systems Q4FY25 Highlights (Consolidated, YoY)

Share price falls 1.56% at Rs 635.80.

Revenue up 3.5% to Rs 207 crore versus Rs 200 crore

Ebitda up to Rs 59 crore versus Rs 40 crore

Ebitda margin at 28.5% versus 20%

Net Profit up 68% to Rs 47 crore versus Rs 28 crore (margin expansion due to decreased material and other expenses)

Ramky Infra Q4FY25 Highlights (Consolidated, YoY)

Share price falls 10.61% at Rs 457.50.

Revenue down 16% to Rs 488 crore versus Rs 581 crore

Ebitda down 98% to Rs 1.8 crore versus Rs 95.5 crore

Ebitda margin at 0.37% versus 16.4%

Net loss at Rs 4.6 crore versus profit of Rs 57 crore (91% jump in other expenses impacted Ebitda)

MM Forgings Q4FY25 Highlights (Consolidated, YoY)

Share price falls 2.69% at Rs 363.60.

Revenue down 7% to Rs 370 crore versus Rs 397 crore

Ebitda down 6.5% to Rs 72 crore versus Rs 77 crore

Margin steady at 19.4%

Net Profit down 8.8% to Rs 33 crore versus Rs 36 crore

Updater Services Q4FY25 Highlights (Consolidated, YoY)

Share price rises 3.82% at Rs 342.25.

Revenue up 12.2% to Rs 709 crore versus Rs 631.7 crore

Ebitda down 11.2% to Rs 35.6 crore versus Rs 40 crore

Margin at 5% versus 6.3%

Net Profit up 33.3% to Rs 34.4 crore versus Rs 25.8 crore

Allcargo Logistics Q4FY25 Highlights (Consolidated, YoY)

Share price falls 1.61% at Rs 31.25.

Revenue up 18% to Rs 3,952 crore versus Rs 3,348 crore

Ebitda Loss at Rs 14.8 crore versus Loss of Rs 24 crore

Net Loss at Rs 12.6 crore versus Loss of Rs 5.6 crore

Jyoti CNC Automation Q4FY25 Highlights (Consolidated, YoY)

Share price rises 3.19% at Rs 1,277.90.

Revenue up 28% to Rs 576 crore versus Rs 450 crore

Ebitda up 32.8% to Rs 178 crore versus Rs 134 crore

Margin at 30.8% versus 29.7%

Net Profit up 9.4% to Rs 109 crore versus Rs 99.6 crore (higher tax impacted profits)

Finolex Industries Q4FY25 Highlights (Consolidated, YoY)

Share price rises 3.56% at Rs 216.39.

Revenue down 5.2% to Rs 1,172 crore versus Rs 1,235 crore

Ebitda down 18% to Rs 171.3 crore versus Rs 208.9 crore

Margin at 14.6% versus 16.9%

Net Profit down 0.2% to Rs 164.6 crore versus Rs 164.9 crore

To pay final dividend of Rs 2/share

Ashoka Buildcon Q4FY25 Highlights (Consolidated, YoY)

Share price rises 3.18% at Rs 217.90.

Revenue down 11.7% to Rs 2,694 crore versus Rs 3,052 crore

Ebitda up 22.3% to Rs 777.2 crore versus Rs 635 crore

Margin at 28.8% versus 20.8%

Net Profit up 73% to Rs 432.2 crore versus Rs 249.6 crore

Rainbow Children's Medicare Q4FY25 Highlights (Consolidated, YoY)

Share price falls 2.20% at Rs 1,322.60.

Revenue up 8.5% to Rs 370 crore versus Rs 341 crore

Ebitda up 8.8% to Rs 115 crore versus Rs 105 crore

Margin at 31% versus 30.8%

Net Profit up 10.6% to Rs 56.3 crore versus Rs 51 crore

To pay final dividend of Rs 3/share

Sharda Motor Industries Q4FY25 Highlights (Consolidated, YoY)

Share price falls 6.98% at Rs 436.65.

Revenue up 6.6% to Rs 750 crore versus Rs 703 crore

Ebitda up 1.2% to Rs 101 crore versus Rs 99.4 crore

Margin at 13.4% versus 14%

Net Profit down 5% to Rs 84 crore versus Rs 88 crore

To pay final dividend of Rs 32.5/share

JK Cement Q4FY25 Highlights (Consolidated, YoY)

Share price rises 10.50% at Rs 5,645.

Revenue up 15.3% to Rs 3,581 crore versus Rs 3,106 crore

Ebitda up 36.6% to Rs 765 crore versus Rs 560 crore

Margin at 21.4% versus 18%

Net Profit up 64% to Rs 360 crore versus Rs 220 crore

To pay dividend of Rs 15/share

HBL Engineering Q4FY25 Highlights (Consolidated, YoY)

Share price falls 5.83% at Rs 542.50.

Revenue down 22% to Rs 476 crore versus Rs 610 crore

Ebitda down 39.5% to Rs 79.5 crore versus Rs 131 crore

Margin at 16.7% versus 21.5%

Net Profit down 44.8% to Rs 45 crore versus Rs 81 crore

To pay dividend of Rs 1/share

NTPC Q4FY25 Highlights (Consolidated, YoY)

Share price rises 1.922% at Rs 351.20.

Revenue up 4.6% to Rs 49,834 crore versus Rs 47,628 crore

Ebitda up 4% to Rs 14,754 crore versus Rs 14,201 crore

Margin at 29.6% versus 29.8%

Net Profit up 23.4% to Rs 7,611 crore versus Rs 6,169 crore

To pay final dividend of Rs 3.35/share

Sarda Energy & Minerals Q4FY25 Highlights (Consolidated, YoY)

Share price falls 6.98% at Rs 436.65.

Revenue up 39.3% to Rs 1,239 crore versus Rs 889 crore

Ebitda up 77.6% to Rs 271 crore versus Rs 152 crore

Margin at 21.8% versus 17%

Net Profit up 14.7% to Rs 108 crore versus Rs 94.4 crore (higher interest and depreciation expenses impacted net profit)

To pay dividend of Rs 1.5/share

Hindware Home Q4FY25 Highlights (Consolidated, YoY)

Share price falls 3.20% at Rs 218.88.

Revenue up 9.5% to Rs 699 crore versus Rs 772 crore

Ebitda down 45.3% to Rs 41 crore versus Rs 75 crore

Margin at 5.8% versus 9.7%

Net Loss at Rs 31 crore versus Profit of Rs 2 crore

Ganesha Ecosphere Q4FY25 Highlights (Consolidated, YoY)

Share price falls 4.90% at Rs 1,491.40.

Revenue up 12.7% to Rs 344 crore versus Rs 306 crore

Ebitda down 17.9% to Rs 51 crore versus Rs 62 crore

Margin at 14.8% versus 20.4%

Net Profit up 10% to Rs 23.7 crore versus Rs 21.6 crore

To pay final dividend of Rs 3/share

Indigo Paints Q4FY25 Highlights (Consolidated, YoY)

Share price falls 2.79% at Rs 1,003.05.

Revenue up 0.7% to Rs 388 crore versus Rs 385 crore

Ebitda up 3.4% to Rs 87.3 crore versus Rs 84.5 crore

Margin at 22.5% versus 22%

Net Profit up 6% to Rs 56.8 crore versus Rs 53.6 crore

To pay final dividend of Rs 3.5/share

Jagran Prakashan Q4FY25 Highlights (Consolidated, YoY)

Share price rises 5.69% at Rs 79.70.

Revenue down 5.6% to Rs 481 crore versus Rs 510 crore

Ebitda Loss at Rs 66.2 crore versus Profit of Rs 25.3 crore

Net Loss at Rs 15.8 crore versus Profit of Rs 22.8 crore

To pay interim dividend of Rs 6/share

Kolte-Patil Developers Q4FY25 Highlights (Consolidated, YoY)

Share price rises 9.20% at Rs 425.

Revenue up 36.5% to Rs 719 crore versus Rs 526 crore

Ebitda at Rs 106 crore versus Loss of Rs 18 crore

Margin at 14.79%

Net Profit at Rs 65 crore versus Loss of Rs 27 crore

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.