Hello, and welcome to NDTV Profit's live coverage of Q3 results across India Inc.

More than 60 companies are scheduled to announce their results today. Major names include Zomato's parent company, Eternal, as well as Dr Reddys Laboratories Ltd., Thangamayil Jewellery Ltd., UTI Asset Management Company Ltd., Waaree Energies Ltd., PNB Housing Finance Ltd., and Tata Communications Ltd.

Stay tuned for all the latest updates and developments.

Canara HSBC Life Q3 Highlights:

Anant Raj Q3FY26, (Cons, YoY)

Oracle Financial Q3 Highlights (Cons, QoQ)

Epack Prefab Tech Q3 FY26 Highlights (Cons)

Waaree Energies Q3 FY26 Highlights (Cons, YoY)

Pnb Housing Finance Q3 FY26 Highlights (Cons, YoY)

KEI Industries Q3FY26 Highlights (Cons, YoY)

To Pay Interim Dividend Of Rs 4.5 per share

UTI AMC Q3 Highlights (Cons, QoQ)

HPCL Q3FY26 Highlights (Cons, QoQ)

Jindal Stainless Q3FY26 Highlights (Cons, QoQ)

DRL Q3FY26 Highlights (Cons, YoY)

Read More Here: Dr. Reddy's Lab Q3 Results

Tatva Chintan Q3 (Cons, YoY)

Bajaj Consumer Care Q3 (Cons, YoY)

The company announced a key management change along with their results and said that Deepinder Goyal will be stepping down as the CEO of Eternal.

For More Details Read: Deepinder Goyal Steps Down As Eternal Group CEO, Albinder Dhindsa To Succeed

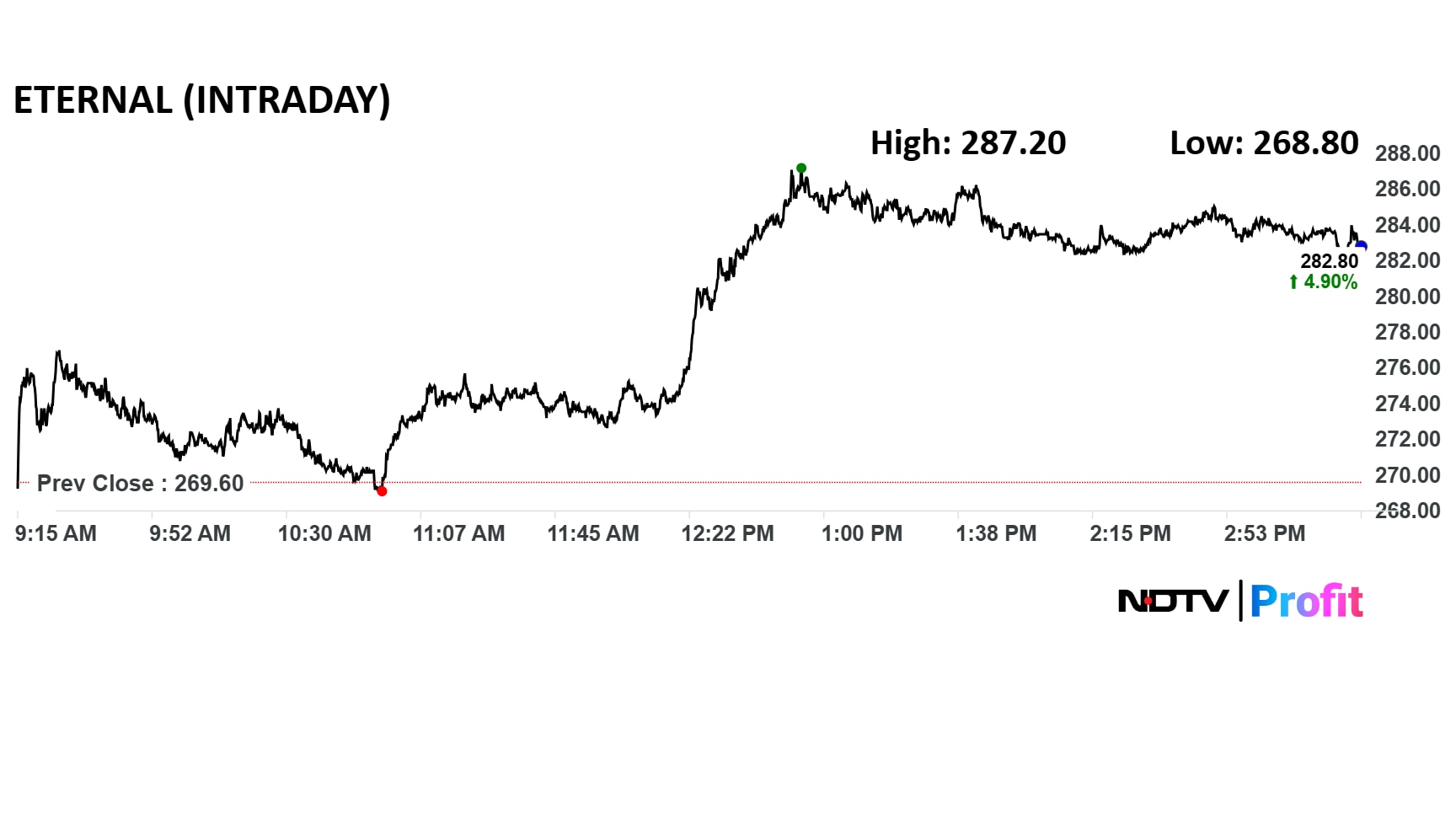

Eternal Q3 FY26 Highlights (Cons, YoY)

Hero MotoCorp's board to meet on Jan 29 to consider Q3 earnings.

Source: Exchange Filing

Dalmia Bharat Q3 Highlights (Consolidated, YoY)

For the all the updates on the Tata-Group company's financial performance in the December quarter, click this link.

Labour code impact of Rs 61 crore.

Tata Communications Q3 Highlights (Consolidated, QoQ)

InterGlobe Aviation Ltd., which operates IndiGo, is expected to report a soft performance in the December quarter, with profitability coming under pressure despite modest revenue growth. The third quarter is typically the strongest period for airlines, but was impacted by flight cancellations, weaker yields and currency headwinds.

Read the whole story to know the estimated earnings for India's biggest airlines.

Thangamayil Jewellery Q3 Highlights (Consolidated, YoY)

Shoppers' Stop shares have been on a downward spiral on Wednesday, with the stock notably hitting a four-year low in the early.

The company operates around 110 department stores, about 35% of which are located in North India. The company has a strong presence in New Delhi and Uttar Pradesh, two states which grappled with high pollution levels during the third quarter.

Given that much of Shoppers Stop's presence as a department store chain depends on customer entry, excessive winter pollution in Delhi and UP, which saw schools being shut, outdoor activity reduced, and people avoiding long commutes, can impact overall footfalls. On very bad AQI days, footfalls in malls can especially decrease in cities like Delhi.

Rajratan Global Q3 Highlights (Consolidated, YoY)

Supreme Industries Q3 Highlights (Consolidated, YoY)

Waaree Energies' consolidated Q3 estimates indicate robust year‑on‑year growth. Revenue is projected at Rs 6,397 crore compared with Rs 3,457 crore, an increase of 85%. EBITDA is expected to more than double to Rs 1,542 crore from Rs 722 crore, a gain of 114%. Margins are estimated to improve to 24% from 20.9%. Profit is projected at Rs 1,008 crore, up 104% from Rs 493 crore last year.

Dr Reddy's Laboratories' Q3 consolidated estimates signal a subdued year‑on‑year performance. Revenue is pegged at Rs 8,340 crore compared with Rs 8,360 crore. EBITDA is estimated to fall 22% to Rs 1,833 crore from Rs 2,344 crore. Margins are expected to contract to 22% from 28%. Profit is estimated at Rs 1,091 crore versus Rs 1,413 crore last year, down 23%.

Eternal's consolidated Q3 estimates indicate a strong year‑on‑year performance. The company is expected to post revenue of Rs 16,224 crore compared with Rs 5,405 crore in the same quarter last year, implying a surge of 200%. Estimated EBITDA stands at Rs 333 crore versus Rs 162 crore, reflecting growth of 106%. However, margins are projected to decline to 2.1% from 3%. Profit is estimated at Rs 115 crore compared with Rs 59 crore a year earlier, marking an increase of 95%.

Dr Reddy's Laboratories reported a 9.8% rise in consolidated revenues for Q2FY26, reaching Rs 8,805 crore compared to Rs 8,016 crore in Q2FY25. Ebitda stood at Rs 2,351 crore, slightly higher than Rs 2,280 crore a year ago, while Ebitda margins declined to 26.7% from 28.4%. Profit after tax attributable to equity holders increased 14% to Rs 1,437 crore, up from Rs 1,255 crore in the same quarter previous year.

In Q2FY26, consolidated revenue from operations jumped to Rs 13,590 crore, up sharply from Rs 4,799 crore in Q2FY25. However, profit for the period fell to Rs 65 crore, from Rs 176 crore a year ago. Consolidated adjusted Ebitda also declined 32% year-on-year, falling to Rs 224 crore from Rs 330 crore in the same quarter last year.

Meanwhile, the bourses are in for a toss on Wednesday as the Nifty slides below the psychological 25,000 level.

For all the latest updates, follow our sister live blog here.

KPI Green Q3 Highlights (Consolidated, YoY)

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.