Good afternoon readers. The NSE Nifty 50 and BSE Sensex opened lower on Tuesday extending decline for the third day. The Nifty 50 opened 0.36% lower at 25,141 and Sensex opened 0.47% down at 81,794.65. The Nifty index was trading below the 200-DMA and had fallen below the 25,000 level. Sensex was also trading over 700 points lower. But Nifty and Sensex erased losses to trade in the green at 12:46 p.m.

All eyes will also be on US President Donald Trump in Davos later this evening. Watch this space for all the live updates.

That's all for today folks. But before I leave here are a few interesting stories to track:

IndiGo Q3 Preview: Weak Yields, Cancellations To Drag Profit To Four-Year Low

Jefferies Sees Upside In These Sectors With India-EU FTA 'Around The Corner'

Indian equities end volatile session in red, extending the fall for the third day. Nifty had fallen below the 25,000 levels but closed above 25,100.

Intraday, both Nifty and Sensex fell nearly 1.50%.

Nifty ends 75 points or 0.30% lower at 25,157.50.

Sensex ends 261.41 points or 0.32% lower at 81,919.06.

India and the European Union are close to finalising a long-awaited Free Trade Agreement, potentially ending negotiations that began nearly two decades ago, according to a strategy note by Jefferies. Talks were first initiated in 2007, stalled in 2013, and gained fresh momentum in 2022 as both sides sought a broad-based agreement while largely setting aside politically sensitive areas such as agriculture and dairy.

Jefferies said the contours of the proposed pact appear similar to the recently concluded India-UK FTA, with goods trade taking centre stage and services expected to remain a key area to watch.

India's Minister for Electronics and Information Technology, Ashwini Vaishnaw, on Wednesday issued a sharp counter to comments at the World Economic Forum in Davos, suggesting that India belongs to a "second grouping" of global artificial intelligence (AI) powers.

The remark was at a discussion in which political scientist Ian Bremmer referenced IMF Managing Director Kristalina Georgieva's characterisation of India as a secondary player in the AI race, alongside her view that countries outside the top tier must navigate alignments with the United States or China.

Responding to Bremmer, Vaishnaw insisted that India is "clearly in the first group" of AI nations. He detailed India's progress across what he described as the five layers of AI architecture: the application layer, model layer, chip layer, infrastructure layer, and energy layer. According to him, India is making 'very good progress' across all five layers.

Intra-Day Low 24920

200-DMA 25114

India's civil aviation sector is firmly in expansion mode, emerging as one of the fastest-growing aviation markets in the world. With airlines inducting aircraft at an unprecedented pace - IndiGo, for instance, has been adding nearly one aircraft every week. Speaking to NDTV on the broader trajectory of the sector, Civil Aviation Minister Ram Mohan Naidu said India is already the world's third-largest domestic aviation market and the fifth-largest overall.

"Very soon, we will be the third-largest international aviation market as well," he said, pointing to sustained double-digit growth in passenger traffic.

Yet, as the sector races ahead, regulators are grappling with the equally critical task of ensuring safety, workforce readiness and infrastructure keep pace.

Tata Communications Q3 Highlights (Consolidated, QoQ)

Thangamayil Jewellery Q3 Highlights (Consolidated, YoY)

The Union Government on Wednesday approved the continuation of support for the Atal Pension Yojana (APY) for old‑age income security for India's unorganised workforce up to the financial year 2030-31.

Under the renewed mandate, government assistance will focus on expanding outreach among unorganised workers, particularly through awareness drives and capacity‑building initiatives. It will also include gap funding to meet viability requirements, ensuring that the pension scheme remains robust and financially sustainable over the coming years.

The government hopes that this will secure a stable retirement income for millions of low‑income and unorganised sector workers who traditionally lack formal pension coverage.

InterGlobe Aviation Ltd., which operates IndiGo, is expected to report a soft performance in the December quarter, with profitability coming under pressure despite modest revenue growth. The third quarter is typically the strongest period for airlines, but was impacted by flight cancellations, weaker yields and currency headwinds.

On a year-on-year basis, consolidated revenue is seen rising 2.5% to Rs 22,674 crore compared with Rs 22,111 crore a year ago. This would mark the slowest revenue growth for IndiGo in the last 19 quarters, highlighting the impact of operational disruptions during the peak travel season.

India rupee falls to record low of 91.68 per dollar.

Supreme Industries Q3 Highlights (Consolidated, YoY)

The Nifty index was trading below the 200-DMA and had fallen below the 25,000 level. Sensex was also trading over 700 points lower. But Nifty and Sensex erased losses to trade flat at 12:41 p.m.

Shoppers' Stop shares have been on a downward spiral on Wednesday, with the stock notably hitting a four-year low in the early. This comes after tepid third-quarter earnings, where profit fell 69% to Rs 16.1 crore, although the numbers were impacted by one-time exceptional loss of Rs 17.69 crore.

This was coupled with flat revenue growth, gaining only 2.6% year-on-year to Rs 1,419 crore. This compares to a topline of Rs 1,379 crore that was achieved during the same period last year. Amid flat growth, the management, in its official Q3 note, has suggested that sales were impacted by pollution in North India.

Shares of Chemical-based multi-business entity SRF Ltd on Wednesday fell over 5% after the company reported a rise in consolidated net profit for Q3FY26. The stock was trading at Rs 2753.60 apiece on Wednesday.

SRF on Tuesday reported a 59.6% rise on a year-on-year basis in profit to Rs 433 crore for the third quarter ended December. The company's revenue in the third quarter grew by 6.3%, reaching Rs 3,173 crore as against Rs 3,491.31 crore in the year-ago period, SRF Ltd said in a regulatory filing.

Nifty saw some recovery and was back above the key 25,000 level after it fell below the 200-DMA. Sensex also saw some recover but as of 11:20 a.m. it was trading nearly 600 points lower.

India's benchmark indices fell nearly 1% extending decline for the third day amid negative global cues. Nifty fell below 25,000, while Sensex was down over 900 points. The broader segment of the market was also negative, with the Nifty Midcap 100 falling 1.96% and Smallcap 250 index slipped 1.95%.

Nifty fell below the 200-DMA on Wednesday and fell below the 25,000 mark for the first time since Oct. 6, 2025. The markets were in the oversold position as the weak breath in the market continues.

Volatility index VIX rose over 10% on Wednesday.

At 10:35 a.m. the Nifty index was trading below the 200-DMA for the first time since May 2025 and the index has fallen below the 25,100 level. Sensex was also trading nearly 500 points lower.

Amagi Media Ltd. listed on the National Stock Exchange on Wednesday at Rs 317 apiece, a discount of 12% over its issue price of Rs 361 apiece.

On the BSE as well, the stock was trading a 2.19% discount.

The shares of KPI Green were in focus on Wednesday after its third quarter profit surged 39%.

KPI Green Q3 Results Highlight (YoY)

Shares of CreditAccess Grameen surged sharply on Wednesday after the lender reported a strong set of third-quarter earnings for FY26 and received multiple analyst upgrades.

The stock climbed as much as 10.1% intraday to Rs 1,367.90, marking its biggest single-day gain since May 2025. This even as the benchmark Nifty 50 slipped 0.1% around mid-morning trade. Trading activity was robust, with volumes running at nearly 53 times the 30-day average.

The rally helped the stock snap a two-day losing streak. Year-to-date, CreditAccess Grameen shares are up about 5 per cent, outperforming the Nifty 50, which is down roughly 3.5%.

Shares of Persistent Systems Ltd. dipped to a one-month low on Wednesday, after the company took a hit to its bottom line in the December quarter.

Brokerages, however, remain constructive citing strong execution and deal momentum, with Investec and UBS both raising target prices, even as management signalled a sharper focus on growth over further margin gains.

Persistent Systems reported a mixed performance in the third quarter on a consolidated, sequential basis. Net profit declined 6.8% quarter-on-quarter to Rs 439 crore, compared with Rs 471 crore in the previous quarter, even as operating metrics improved. Revenue rose 5.5% QoQ to Rs 3,778 crore from Rs 3,581 crore, while EBIT increased 8.5% QoQ to Rs 632 crore from Rs 583 crore. Operating margins expanded to 16.7% from 16.3%, reflecting improved operating leverage. The company also announced an interim dividend of Rs 22 per share.

The shares of Shoppers Stop hit four-year low in response to a weak quarterly performance in the October-December period. The scrip fell as much as 12.39% to Rs 319.30 apiece on Wednesday, lowest level since Feb. 24, 2022. It pared gains to trade 4.01% lower at Rs 349.85 apiece, as of 9:51 a.m. This compares to a 0.16% decline in the NSE Nifty 50 Index.

It has fallen 44% in the last 12 months and 9.22% year-to-date. Total traded volume so far in the day stood at 6.79 times its 30-day average. The relative strength index was at 52.71.

The pressure in rupee continued as the local currency opened at 91.08 against the US Dollar, before weakening further to 91.22 levels, thus reaching an all-time low. This is the fourth time the rupee breached the 91 per dollar mark, as poor momentum continues.

Here, at NDTV Profit, we will take a look at five reasons why the rupee has continued to weaken against the US dollar.

Over 1.93 million shares of Kotak Mahindra Bank were traded via another block deal on Wednesday. The share of Kotak Mahindra Bank fell as much as 0.40% to Rs 422.10 apiece.

Over 1.68 million shares of HDFC Bank were traded via another block deal on Wednesday. The share of HDFC Bank fell as much as 0.67% to Rs 925 apiece.

Over 1.49 million shares of ICICI Bank were traded via another block deal on Wednesday. The share of ICICI Bank fell as much as 1.37% to Rs 1,357 apiece.

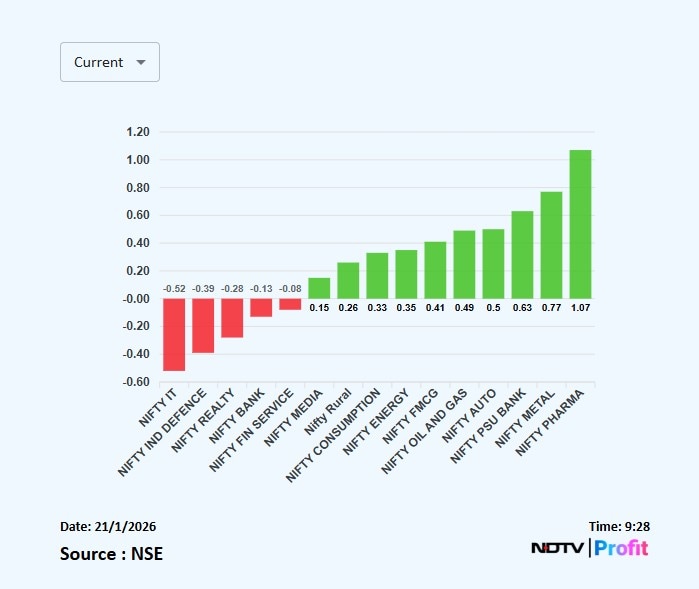

On NSE, 10 of the 15 sectors were in the green. Nifty Pharma and Nifty Metal lead the advance, while Nifty IT and Nifty Defence were among the red.

Broader markets were trading lower, with the NSE Midcap 150 trading 0.31% lower and NSE Smallcap was trading 0.38% higher.

ICICI Bank, HDFC Bank, Bharti Airtel, L&T and BEL weighed on the Nifty 50 index.

Eternal, Sun Pharma, ITC, M&M and Dr. Reddy's added to the Nifty 50 index.

The NSE Nifty 50 and BSE Sensex opened lower on Tuesday extending decline for the third day. The Nifty 50 opened 0.36% lower at 25,141 and Sensex opened 0.47% down at 81,794.65. However, minutes after open the Nifty was trading 0.06% lower and was above the 26,200 level and Sensex was also trading over 160 points lower.

Over 1.91 million shares of HDFC Bank were traded via another block deal on Tuesday.

Rupee Falls To Record Low Of 91.19/$

Rupee Hits Record Low Amid FII Outflow

At pre-open, the NSE Nifty 50 was trading 91.50 points or 0.36% lower at 25,141. The BSE Sensex was down 417 points at 81,763.26.

Strong execution and deal momentum kept brokerages constructive on Persistent Systems, Ltd. with Investec and UBS both raising target prices after the company delivered margin expansion and robust earnings, even as management signalled a sharper focus on growth over further margin gains.

Investec has reiterated its 'hold' rating on Persistent Systems, while raising its target price to Rs 6,665 from Rs 5,825, on the back of what it described as flawless execution during the quarter. The brokerage highlighted a 44 basis point quarter-on-quarter expansion in EBIT margin, a notable achievement given the 180 bps drag from compensation hikes. According to Investec, the improvement in margins underscores operational strength and also provides the company with enough headroom to reinvest in growth initiatives going forward.

Deal activity remained a key positive. Net new deal wins (ACV) came in at $256 million, which marginally exceeded the previous quarter's all-time high, signalling sustained demand and a healthy pipeline despite a challenging macro environment.

More than 60 companies are scheduled to announce their Q3FY26 results on Jan. 21. Major names include Zomato's parent company, Eternal, as well as Dr Reddys Laboratories Ltd., Thangamayil Jewellery Ltd., UTI Asset Management Company Ltd., Waaree Energies Ltd., PNB Housing Finance Ltd., and Tata Communications Ltd.

Following the exit of Everstone Capital as the promoter entity of Restaurant Brands Asia Ltd., the quick-service restaurant company that operates Burger King, has confirmed it will be acquired by Inspira Global. This effectively means Aayush Madhusudan Agrawal, a promoter of Inspira Global, will acquire a controlling stake in RBA.

The acquisition has been valued at around Rs 70 per share, representing a 10% premium from Tuesday's closing price. However, it must be noted that the deal will be executed inter alia through Lenexis Foodworks, which is the food and beverage arm of Inspira Global. The entity will now utilise that synergy to manage and operate Burger King outlets across the country. It also runs brands like Big Bowl and The Momo Co

Apart from acquiring the entire 11.26% shareholding of QSR Asia Pte. Ltd. for a figure of around Rs 460 crore, Inspira Global proposes to infuse around Rs 900 crore through a preferential allotment of equity shares and Rs ₹600 crore through the preferential allotment of warrants, with the transaction set to trigger an open offer for public shareholders, Restaurant Brands Asia confirmed in an exchange filing.

The IT major saw its standalone bottom-line swell 11% quarter-on-quarter to Rs 108 crore from Rs 97.5 crore. Revenue, however, slipped 3.7% to Rs 906 crore, compared Rs 940 crore in Q3 FY25.

Earnings before interest, taxes were largely unchanged at Rs 128 crore. Margins saw an expansion to 14.1% from 13.6%.

The company, while announcing the Rs 8-per-share interim dividend, said it has fixed Jan. 30 as the record to determine the shareholders eligible for the dividend payout. The amount will be paid on or after Feb. 17, it said.

Gold and silver prices have increased across major Indian cities on Wednesday, Jan. 21, 2026, as the precious metals felt the pressure of the worsening crisis over Greenland and a meltdown in Japanese government debt supported haven demand.

Today, gold is trading at Rs 151,230 while silver is at Rs 323,920, according to the India Bullions' website.

Silver rallied even more than gold levels with an Indian average at Rs 323,920. The white metal was trading at Rs 323,330 in Mumbai, according to Bullion's website.

Kotak Securities on CEAT

Maintain Reduce; Hike TP to Rs 3,480 from Rs 3,450.

India business remains resilient.

Camso performance continues to cap upside.

Standalone revenue and EBITDA beat estimates.

FY26–28 EPS estimates cut by 1–4%.

CLSA on CEAT

Maintain Outperform; Hike TP to Rs 4,640.

Strong growth offsets pressure on gross margins.

Commodity inflation and currency depreciation impacted margins.

EBITDA margin at 13.6% supported by operating leverage.

Analysts expect volatility to persist till clarity emerges on the US–Europe tariff standoff over Greenland.

"The index formed a sizable bearish candle, registering a lower high and a lower low, which underscores an extension of the ongoing decline and confirms the continuation of the corrective bias," said Bajaj Broking Research.

The key support for Nifty lies at 25,000 level, while on the upside, immediate resistance can be found at around 25,500 levels, it added.

Investec on United Spirits

Maintain Buy with TP of Rs 1,673.

Volume softness offset by strong product mix.

Gross margin expanded sharply.

Earnings growth expected to accelerate in Q4.

JPMorgan on United Spirits

Maintain Overweight with TP of Rs 1,650.

Revenue growth held up despite muted volumes.

Advertisement spends rose sharply, impacting EBITDA margins.

Investec

Maintain Hold; Hike TP to Rs 6,665 from Rs 5,825.

Execution remained strong.

EBIT margin expanded 44 bps QoQ despite compensation hikes.

Strong deal wins with net new ACV of $256 million.

UBS

Maintain Buy; Hike TP to Rs 7,490 from Rs 7,425.

Q3 performance remained robust.

EPS beat expectations after adjusting for labour code impact.

Management prioritises growth over further margin expansion.

Nifty Jan futures is down 1.28% to 25,268 at a premium of 36 points.

Nifty Options 2th Jan Expiry: Maximum Call open interest at 26,000 and Maximum Put open interest at 25,000.

Securities in ban period: SAIL, SAMMAANCAP

The US Dollar index is down 0.09% at 98.280.

Euro was up 0.04% at 1.1731.

Pound was up 0.13% at 1.3453.

Yen was down 0.15% at 157.92.

Asian stocks dropped 0.5% at the open after the S&P 500 posted its steepest loss since October. In a sign that stocks may be steadying, equity-index futures for the US rose 0.2% in early Asian trading. Amid the increased volatility, gold rose to a fresh record.

Good morning readers.

The GIFT Nifty was trading near 25,300 early on Wednesday. The futures contract based on the benchmark Nifty 50 rose 0.15% at 25,293 as of 6:46 a.m. indicating a flatish start for the Indian markets. This comes as Asian stocks retreated after a selloff on Wall Street.

In the previous session on Tuesday, the benchmark ended in red extending fall for the second day. The NSE Nifty 50 ended 353 points or 1.38% lower at 25,232.50, while the BSE Sensex closed 1,065.71 points or 1.28% lower at 82,180.47.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.