Shares of Multi Commodity Exchange Ltd., Lupin Ltd., Apollo Hospitals Ltd., were in focus on Friday, after the companies announced their fourth quarter results.

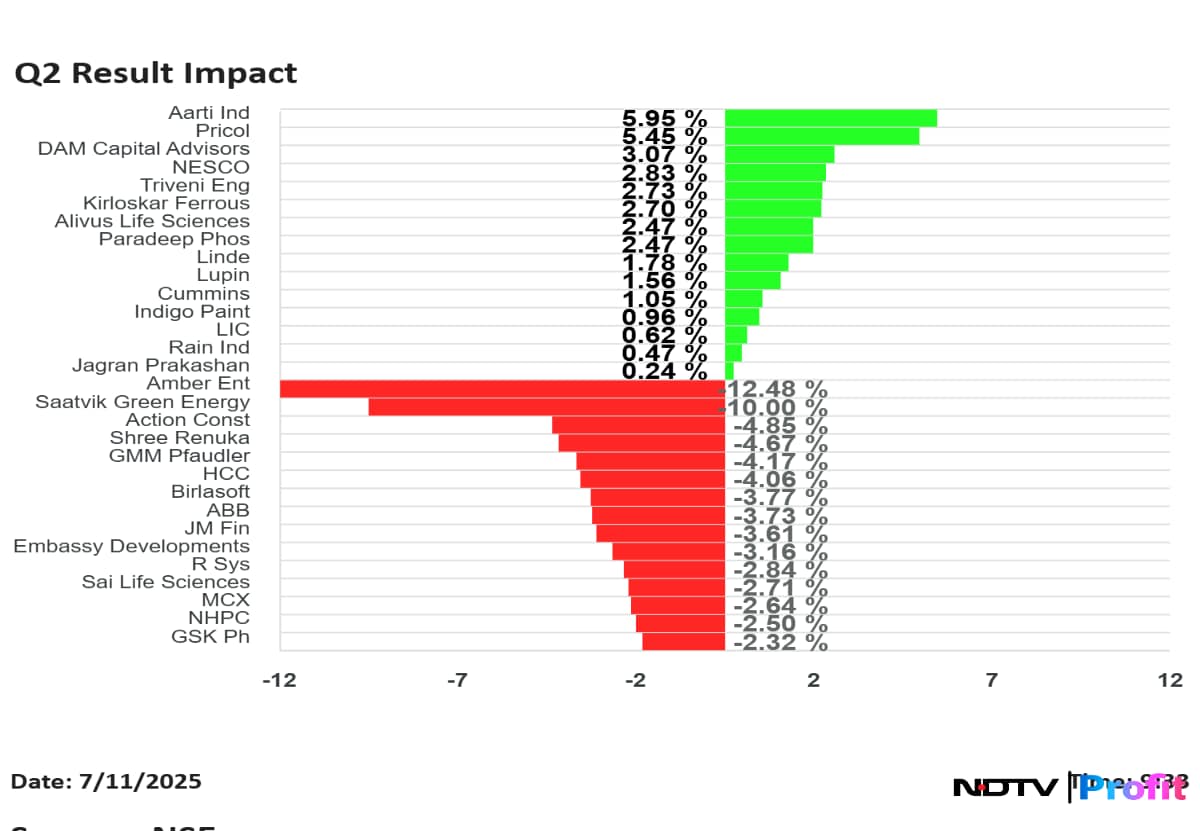

Pricol Ltd. shares rose the most, while Amber Enterprises Ltd. fell the most, among the companies that announced their results for the quarter ended September.

Ganesh Housing (Consolidated, YoY)

Revenue fell 26.6% to Rs 174 crore versus Rs 237 crore.

Ebitda was down 27% at Rs 148 crore versus Rs 203 crore.

Margin stood at 85% versus 85.4%.

Net Profit fell 30% to Rs 108 crore versus Rs 154 crore.

The company's shares fell 2.6% to Rs 804.10.

Bajaj Housing Finance (YoY)

Total Income rose 14.3% to Rs 2,755 crore versus Rs 2,410 crore.

Net Profit was up 17.8% at Rs 643 crore versus Rs 546 crore.

The company's shares rose 1.02% to Rs 110.50.

Goodyear India (YoY)

Revenue fell 12.6% to Rs 596 crore versus Rs 682 crore.

Ebitda was down 13.6% at Rs 26.9 crore versus Rs 31 crore.

Margin stood at 4.5% versus 4.6%.

Net Profit fell 17% to Rs 13 crore versus Rs 15.7 crore.

The company's shares fell 0.14% to Rs 980.05.

Crompton Greaves (Consolidated, YoY)

Revenue rose 1% to Rs 1,916 crore versus Rs 1,896 crore.

Ebitda was down 22.2% at Rs 158 crore versus Rs 204 crore.

Margin stood at 8.3% versus 10.7%.

Net Profit fell 43% to Rs 71.2 crore versus Rs 125 crore.

The company's shares fell 2.67% to Rs 271.10.

GMM Pfaudler (Consolidated, YoY)

Revenue rose 12% to Rs 902 crore versus Rs 805 crore.

Ebitda was up 30% at Rs 122 crore versus Rs 93.5 crore.

Margin improved to 13.5% versus 11.6%.

Net Profit jumped significantly to Rs 41.4 crore versus Rs 15.2 crore.

The company's shares fell 5.50% to Rs 1,211.

GSK Pharma (Consolidated, YoY)

Revenue fell 3.1% to Rs 980 crore versus Rs 1,011 crore.

Ebitda was up 4.4% at Rs 336 crore versus Rs 322 crore.

Margin improved to 34.3% versus 31.8%.

Net Profit rose 2% to Rs 257 crore versus Rs 253 crore.

The company's shares fell 1.50% to Rs 2,566.50.

Kirloskar Ferrous (Consolidated, QoQ)

Revenue rose 3.4% to Rs 1,755 crore versus Rs 1,698 crore.

Ebitda was down 1.1% at Rs 214 crore versus Rs 217 crore.

Margin stood at 12.2% versus 12.8%.

Net Profit fell 9.3% to Rs 86.3 crore versus Rs 95.1 crore.

The company's shares rose 1.84% to Rs 496.40.

Triveni Engineering (Consolidated, YoY)

Revenue rose 14.5% to Rs 1,707 crore versus Rs 1,491 crore.

Ebitda was up significantly at Rs 66.6 crore versus Rs 4.6 crore.

Margin stood at 3.9% versus 0.3%.

Net Profit swung to a profit of Rs 25.9 crore versus a loss of Rs 19.2 crore.

The company's shares rose 6.09% to Rs 379.

HCC (Consolidated, YoY)

Revenue fell 31.7% to Rs 961 crore versus Rs 1,407 crore.

Ebitda was down 39.1% at Rs 148 crore versus Rs 242 crore.

Margin stood at 15.4% versus 17.2%.

Net Profit fell 25.2% to Rs 47.8 crore versus Rs 63.9 crore.

The company's shares fell 4.06% to Rs 25.75.

Mankind Pharma (Consolidated, YoY)

Revenue rose 20.8% to Rs 3,697 crore versus Rs 3,061 crore.

Ebitda was up 8.8% at Rs 922 crore versus Rs 847 crore.

Margin stood at 24.9% versus 27.7%.

Net Profit fell 21.7% to Rs 512 crore versus Rs 654 crore.

The company's shares fell 2.62% to Rs 2,248.60.

NHPC (Consolidated, YoY)

Revenue rose 10.3% to Rs 3,365 crore versus Rs 3,052 crore.

Ebitda was up 12.3% at Rs 2,027 crore versus Rs 1,805 crore.

Margin improved to 60.2% versus 59.1%.

Net Profit rose 13.5% to Rs 1,021 crore versus Rs 900 crore.

The company's shares fell 2.78% to Rs 80.55.

Vishnu Chemicals (Consolidated, YoY)

Revenue rose 16.7% to Rs 401 crore versus Rs 344 crore.

Ebitda was up 28.6% at Rs 58.2 crore versus Rs 45.2 crore.

Margin improved to 14.5% versus 13.1%.

Net Profit jumped 43.9% to Rs 32.8 crore versus Rs 22.8 crore.

The company's shares fell 2.29% to Rs 491.

ABB India (YoY)

Revenue rose 13.7% to Rs 3,311 crore versus Rs 2,912 crore.

Ebitda was down 7.4% at Rs 500 crore versus Rs 540 crore.

Margin stood at 15.1% versus 18.6%.

Net Profit fell 7% to Rs 409 crore versus Rs 440 crore.

The company's shares fell 4.32% to Rs 5,002.

Action Construction (Consolidated, YoY)

Revenue fell 1.7% to Rs 744 crore versus Rs 757 crore.

Ebitda was up marginally by 0.4% at Rs 109 crore versus Rs 108.5 crore.

Net Profit fell 5% to Rs 90.1 crore versus Rs 94.8 crore.

The company's shares fell 5.32% to Rs 1,015.

LIC (Consolidated, YoY)

Net Premium Income rose 5.5% at Rs 1.27 Lakh crore versus Rs 1.2 Lakh crore.

Net Profit jumped 30.7% at Rs 10,099 crore versus Rs 7,729 crore.

Solvency Ratio stood at 2.13% versus 1.98%.

Persistency Ratios declined QoQ: 13th Month at 68.19% (vs 70.9%) and 61st Month at 55.12% (vs 58.31%).

The company's shares rose 2% to Rs 914.

Linde India (Consolidated, YoY)

Revenue rose 1.5% to Rs 644 crore versus Rs 634 crore.

Ebitda was up 57.8% at Rs 282 crore versus Rs 179 crore.

Margin improved significantly to 43.8% versus 28.2%.

Net Profit jumped 60.7% to Rs 171 crore versus Rs 106 crore.

The company's shares rose 4.48% to Rs 6,105.

Aarti Industries (YoY)

Revenue rose 29% to Rs 2,100 crore versus Rs 1,628 crore.

Ebitda was up 47.7% at Rs 291 crore versus Rs 197 crore.

Margin improved to 13.9% versus 12.1%.

Net Profit more than doubled to Rs 106 crore versus Rs 52 crore.

The company's shares rose 6.79% to Rs 417.

Indigo Paints (Consolidated, YoY)

Revenue rose 4.2% to Rs 312 crore versus Rs 300 crore.

Ebitda was up 12.1% at Rs 46.5 crore versus Rs 41.5 crore.

Margin improved to 14.9% versus 13.9%.

Net Profit rose 10.9% to Rs 25 crore versus Rs 22.7 crore.

The company's shares rose 1.94% to Rs 1,010.

Birlasoft (Consolidated, QoQ)

Revenue rose 3.4% to Rs 1,329 crore versus Rs 1,285 crore.

Ebit was up 40% at Rs 193 crore versus Rs 138 crore.

Margin improved to 14.5% versus 10.7%.

Net Profit rose 9.1% to Rs 116 crore versus Rs 106 crore.

Dividend: To pay interim dividend of Rs 2.5/share.

The company's shares fell 4.68% to Rs 355.50.

Amara Raja (Consolidated, YoY)

Revenue rose 6.7% to Rs 3,467 crore versus Rs 3,251 crore.

Ebitda was down 13.5% at Rs 374 crore versus Rs 433 crore.

Margin stood at 10.8% versus 13.3%.

Net Profit rose 17.4% to Rs 276 crore versus Rs 236 crore.

Dividend: To pay interim dividend of Rs 5.4/share.

The company's shares fell 1.55% to Rs 973.90.

JM Financial (Consolidated, YoY)

Total Income fell 6.9% to Rs 1,044 crore versus Rs 1,121 crore.

Net Profit fell 40.5% to Rs 270 crore versus Rs 454 crore.

Dividend: To pay interim dividend of Rs 1.5/share.

The company's shares fell 4.99% to Rs 153.85.

Pricol (Consolidated, YoY)

Revenue rose 50.5% to Rs 1,007 crore versus Rs 669 crore.

Ebitda was up 52.7% at Rs 118 crore versus Rs 77.3 crore.

Margin stood at 11.7% versus 11.6%.

Net Profit jumped 42% to Rs 64 crore versus Rs 45.1 crore.

Dividend: To pay interim dividend of Rs 2/share.

The company's shares rose 10.08% to Rs 570.

Jagran Prakashan (Consolidated, YoY)

Revenue rose 4.7% to Rs 467 crore versus Rs 447 crore.

Ebitda was down 1.4% at Rs 66.6 crore versus Rs 67.5 crore.

Margin stood at 14.2% versus 15.1%.

Net Profit rose 36.4% at Rs 58.6 crore versus Rs 43 crore.

The company's shares rose 2.33% to Rs 72.

Amber Enterprises (Consolidated, YoY)

Revenue fell 2.2% to Rs 1,647 crore versus Rs 1,685 crore.

Ebitda was down 19.8% at Rs 91.3 crore versus Rs 114 crore.

Margin stood at 5.5% versus 6.8%.

Net Profit jumped 71% at Rs 32.9 crore versus Rs 19.2 crore.

The company's shares fell 13.15% to Rs 6,780.

Apollo Hospitals (Consolidated, YoY)

Revenue rose 12.8% to Rs 6,303 crore versus Rs 5,589 crore.

Ebitda was up 15.4% at Rs 941 crore versus Rs 816 crore.

Margin improved slightly to 14.9% versus 14.6%.

Net Profit rose 26% at Rs 477 crore versus Rs 379 crore.

The company's shares rose 1.4% to Rs 7,891.

Aster DM (Consolidated, YoY)

Revenue rose 10.2% to Rs 1,197 crore versus Rs 1,086 crore.

Ebitda was up 13.7% at Rs 250 crore versus Rs 220 crore.

Margin improved to 20.9% versus 20.2%.

Net Profit rose 13.6% at Rs 110 crore versus Rs 96.8 crore.

The company's shares fell 1.45% to Rs 677.30.

Saatvik Green (Consolidated, YoY)

Revenue rose 61.6% to Rs 768 crore versus Rs 475 crore.

Ebitda was up 59.3% at Rs 108 crore versus Rs 68 crore.

Margin stood at 14.1% versus 14.3%.

Net Profit rose 35.9% at Rs 83.2 crore versus Rs 61.2 crore.

The company's shares fell 10% to Rs 484.

Lupin (Consolidated, YoY)

Revenue rose 24.2% to Rs 7,048 crore versus Rs 5,673 crore.

Ebitda was up 74.7% at Rs 2,341 crore versus Rs 1,340 crore.

Margin improved significantly to 33.2% versus 23.6%.

Net Profit soared 73.3% at Rs 1,478 crore versus Rs 853 crore.

The company's shares fell 1.92% to Rs 1,993.

Paradeep Phosphates (Consolidated, YoY)

Revenue rose 48.8% to Rs 6,872 crore versus Rs 4,619 crore.

Ebitda was up 29.5% at Rs 657 crore versus Rs 507 crore.

Margin stood at 9.6% versus 11%.

Net Profit rose 33.9% at Rs 342 crore versus Rs 255 crore.

Investment: Announced investment of Rs 2,450 Cr at Paradeep site and Rs 1,150 Cr at Mangalore site.

The company's shares fell 4.94% to Rs 171.90.

Protean eGov Tech (Consolidated, QoQ)

Revenue rose 18.8% to Rs 251 crore versus Rs 211 crore.

EBIT was up significantly at Rs 18.9 crore versus Rs 5.4 crore.

EBIT Margin improved to 7.6% versus 2.6%.

Net Profit was flat at Rs 23.8 crore.

The company's shares fell 2.38% to Rs 833.

Alivus Life (YoY)

Revenue rose 16% to Rs 588 crore versus Rs 507 crore.

Ebitda was up 33.4% at Rs 179 crore versus Rs 134 crore.

Margin improved to 30.5% versus 26.5%.

Net Profit rose 36.4% at Rs 130 crore versus Rs 95.3 crore.

The company's shares rose 4.66% to Rs 932.

Shree Renuka (Consolidated, YoY)

Revenue fell 5.6% to Rs 2,423 crore versus Rs 2,566 crore.

Ebitda swung to a loss of Rs 101 crore versus a profit of Rs 236 crore.

Net Loss widened to Rs 369 crore versus a loss of Rs 22.3 crore.

The company's shares fell 5.36% to Rs 27.36.

Cummins India (YoY)

Revenue rose 27.2% to Rs 3,170 crore versus Rs 2,492 crore.

Ebitda was up 44.4% at Rs 695 crore versus Rs 481 crore.

Margin improved to 21.9% versus 19.3%.

Net Profit rose 41.5% at Rs 638 crore versus Rs 451 crore.

The company's shares rose 2.83% to Rs 4,438.10.

DAM Capital (Consolidated, QoQ)

Total Revenue jumped to Rs 107 crore versus Rs 30.9 crore.

Investment Banking Revenue drove growth, rising to Rs 86.1 crore versus Rs 9.1 crore.

Stock Broking Revenue was down 3.9% at Rs 17.3 crore versus Rs 18 crore.

Net Profit soared to Rs 52.2 crore versus Rs 23 Lakh (Rs 0.23 crore).

The company's shares rose 8.33% to Rs 275.90.

Akzo Nobel (Consolidated, YoY)

Revenue fell 15% to Rs 835 crore versus Rs 982 crore.

Ebitda was down 24.4% at Rs 111 crore versus Rs 146 crore.

Margin stood at 13.3% versus 14.9%.

Net Profit jumped massively to Rs 1,683 crore versus Rs 97.9 crore (likely due to exceptional items).

The company's shares rose 1.01% to Rs 3,250.

Sai Life Sciences (Consolidated, YoY)

Revenue rose 35.9% to Rs 537 crore versus Rs 396 crore.

Ebitda was up 42.6% at Rs 146 crore versus Rs 102 crore.

Margin improved to 27.1% versus 25.8%.

Net Profit more than doubled to Rs 83.8 crore versus Rs 41.5 crore.

The company's shares fell 4.23% to Rs 883.25.

R Systems International (Consolidated, YoY)

Revenue rose 12.3% to Rs 499 crore versus Rs 444 crore.

Ebitda was up 5.9% at Rs 72.1 crore versus Rs 68.1 crore.

Margin stood at 14.5% versus 15.3%.

Net Profit fell 11.3% at Rs 35.3 crore versus Rs 39.8 crore.\

The company's shares fell 3.06% to Rs 405.15.

NESCO (Consolidated, YoY)

Revenue rose 24.5% to Rs 239 crore versus Rs 192 crore.

Ebitda was up 14% at Rs 136 crore versus Rs 120 crore.

Margin stood at 57% versus 62.2%.

Net Profit rose 11.2% at Rs 119 crore versus Rs 107 crore.

The company's shares rise 3.55% to Rs 1,289.

Rain Industries (Consolidated, YoY)

Revenue rose 13.8% to Rs 4,476 crore versus Rs 3,934 crore.

Ebitda was up significantly at Rs 627 crore versus Rs 216 crore.

Margin improved to 14% versus 5.5%.

Net Profit swung to a profit of Rs 106 crore versus a loss of Rs 179 crore.

The company's shares rise 3.49% to Rs 139.50.

MCX (Consolidated, QoQ)

Revenue rose 0.3% to Rs 374 crore versus Rs 373 crore.

Ebitda was up 0.8% at Rs 244 crore versus Rs 242 crore.

Margin stood at 65.1% versus 64.8%.

Net Profit fell 2.8% at Rs 197 crore versus Rs 203 crore.

The company's shares fell 4.76% to Rs 8,810.50.

Embassy Developments (Consolidated, YoY)

Revenue rose 3.72% to Rs 493.1 crore versus Rs 475.4 crore.

Ebitda swung to a loss of Rs 52.3 crore versus a profit of Rs 76.1 crore.

Net Loss widened to Rs 152.8 crore versus a loss of Rs 34.3 crore.

The company's shares fell 4% to Rs 86.49.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.