Shares of PCBL Ltd. surged to a record high on Wednesday after it acquired Aquapharm Chemicals Pvt. for Rs 3,800 crore.

PCBL executed a share purchase agreement with ACPL and other shareholders for the acquisition of 2.12 lakh shares, representing 100% of the issued and paid-up share capital, through a mix of internal accruals and external funds raised by the company, according to an exchange filing.

"This acquisition of ACPL marks the company's foray into global specialty segments of water treatment chemicals and oil and gas chemicals, and it is the first milestone in achieving the vision of creating a multi-platform global specialty chemical business portfolio," the company said.

DAM Capital Advisors Ltd. and JM Financial Ltd. have maintained a 'buy' rating on the stock.

DAM has set a target price of Rs 293 apiece, implying an upside of 15%. The acquisition "will further reduce PCBL's tyre industry concentration" and help the company "reduce associated volatility," it said.

JM Financial views the acquisition as a "bargain deal for a world-leading differentiated chemicals player" and has kept the target price at Rs 290 apiece.

Stock Movement

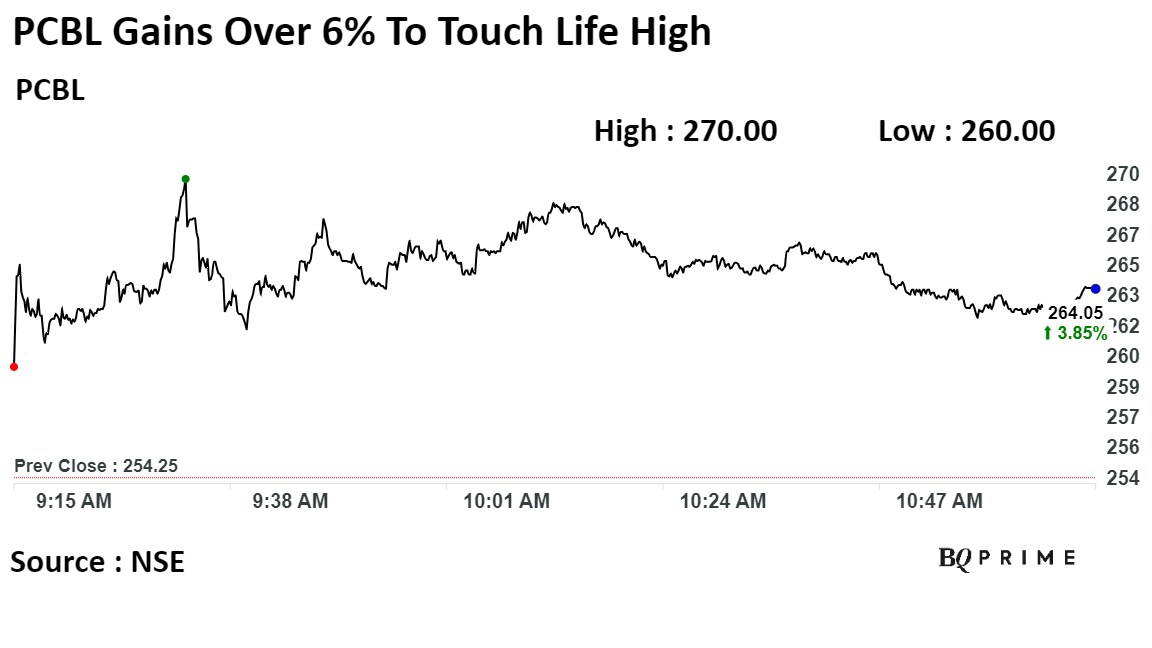

Shares of PCBL rose as much as 6.19% to a record high before paring gains to trade 3.74% higher at 11:00 a.m. This compares to a 0.56% advance in the NSE Nifty 50.

The stock has risen 102.89% on a year-to-date basis. Total traded volume so far in the day stood at 5 times its 30-day average. The relative strength index was at 75.

Of the 11 analysts tracking the company, 10 maintain a 'buy' rating, and one suggests a 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 100.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.