PB Fintech Ltd. saw its share price drop after opening strong on Friday after the management raised concerns about the growth in new insurance core premium. The stock opened 4.33% higher but later declined to 1.64%.

Yashish Dhaiya, Co-Founder and CEO of PB Fintech Ltd., expressed dissatisfaction with the growth in the new insurance core premium.

"I'm talking about just the core insurance premium. Our compound annual growth rate for five years is 43%. The new insurance core premium for the quarter is up 21% year-on-year, and we don't feel very happy about that. However, if you exclude savings now for the last nine quarters, we have been between 35% to 45%," Dhaiya said.

The commentary came after PB Fintech Ltd. reported financial results for the fourth quarter of the financial year 2025. The company's consolidated net profit more than doubled, surpassing analysts' estimates. The net profit for the quarter ended March stood at Rs 171 crore, compared to Rs 71.5 crore in the same period last year. Analysts tracked by Bloomberg had a consensus estimate of Rs 134 crore.

Revenue increased by 17% to Rs 1,508 crore, up from Rs 1,292 crore, beating Bloomberg's estimate of Rs 1,472 crore. The company's Ebitda rose significantly to Rs 113 crore from Rs 28 crore, with the Ebitda margin expanding to 7.5% from 2.1%.

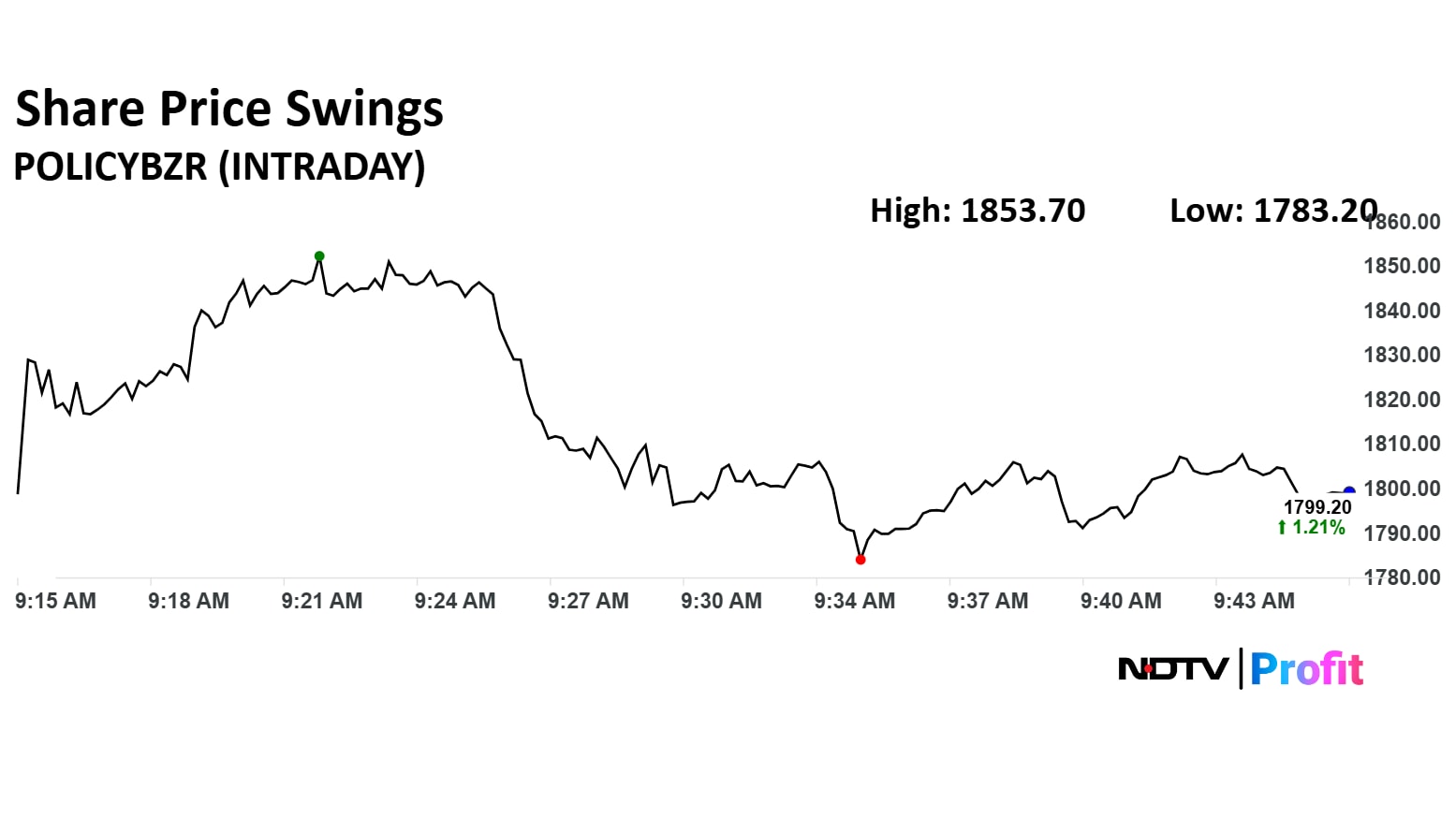

The scrip rose as much as 4.33% to Rs 1,854.70 apiece. It pared gains to trade 1.64% higher at Rs 1,086 apiece, as of 09:44 a.m. This compares to a 0.17% decline in the NSE Nifty 50 Index.

It has risen 35.02% in the last 12 months. Total traded volume so far in the day stood at 11 times its 30-day average. The relative strength index was at 64.

Out of 20 analysts tracking the company, nine maintain a 'buy' rating, three recommend a 'hold,' and eight suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 1.6%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.